A pay-for-delete letter is a document that lets you ask a credit reporting agency to remove a negative credit listing from your credit report if you are inadmissible, have paid what you owe, have agreed to pay what you owe partially or entirely, or the credit dispute has been resolved.

Most people usually use this letter when they want a negative listing on a loan they owe, which cannot be disputed by the credit bureaus, to be removed from their credit reports.

Simply put, it is a negotiation tool that you can use to have an adverse credit listing removed from your credit report if the creditor consents to the deletion. When you use a pay-for-delete letter, it signifies to the creditor that you are ready to repay partially or fully what you owe in exchange for them removing the negative credit listing on your credit report.

If you want to write a pay-for-delete letter, this article will guide you on how it works, when to send it, what to do to have the debt collector remove your collection account, and how to write it correctly.

This article will also provide you with samples and tips to help make sure that your letter is as effective as possible.

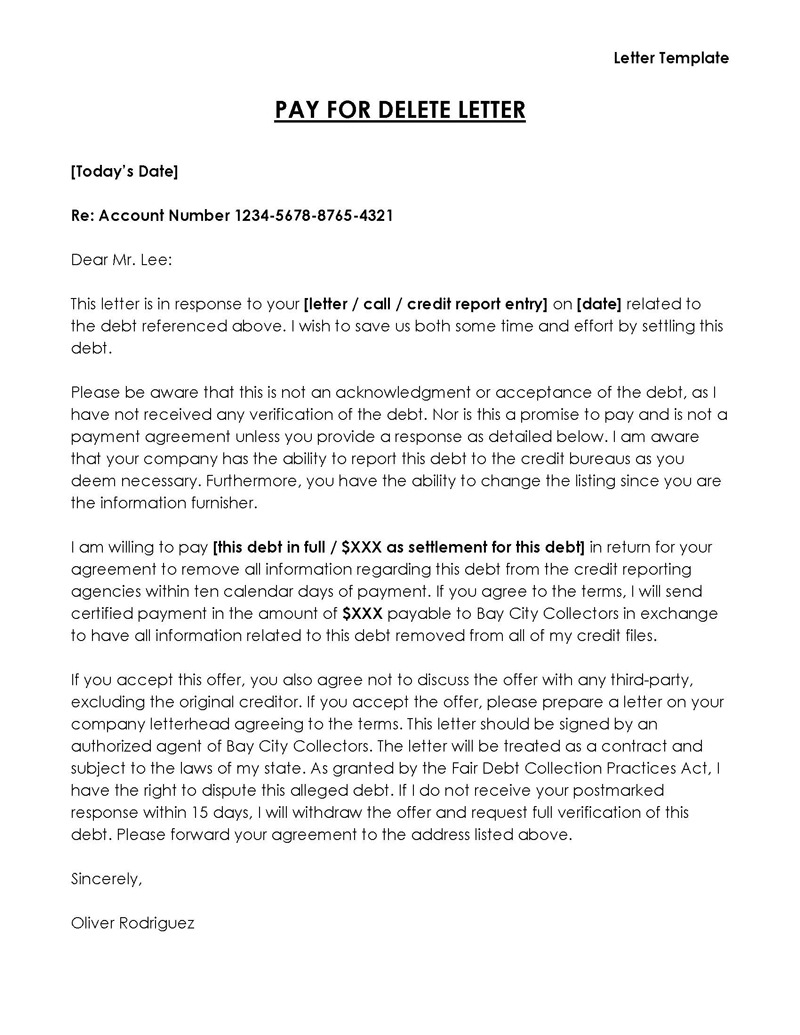

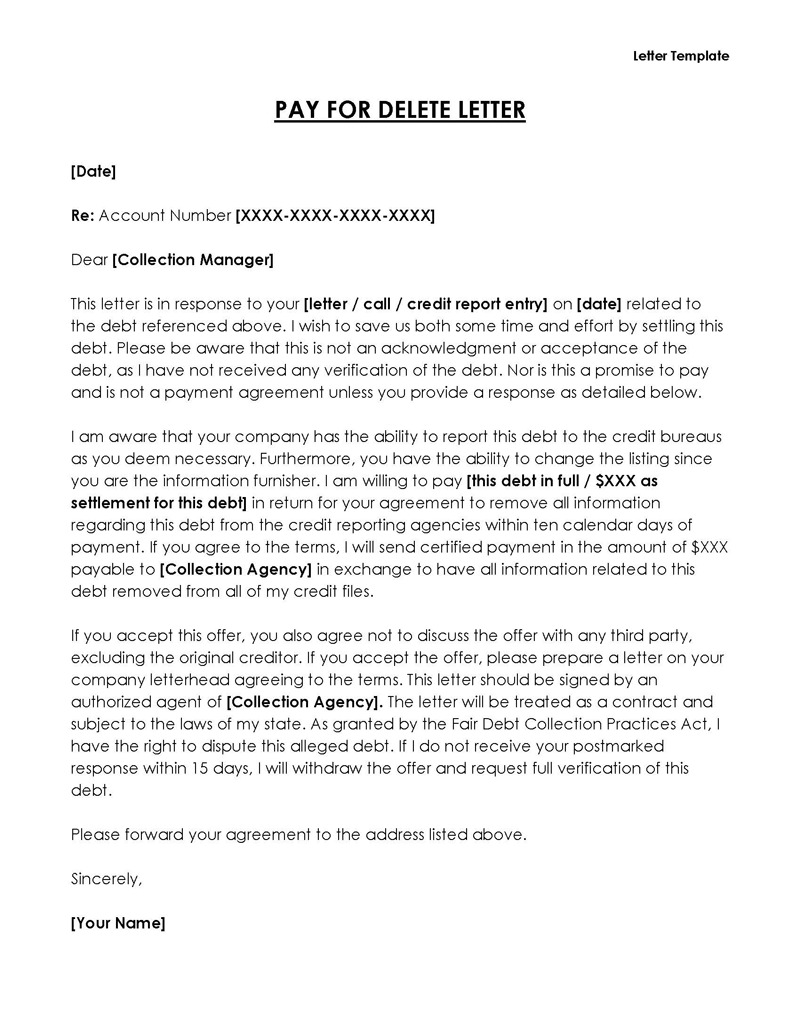

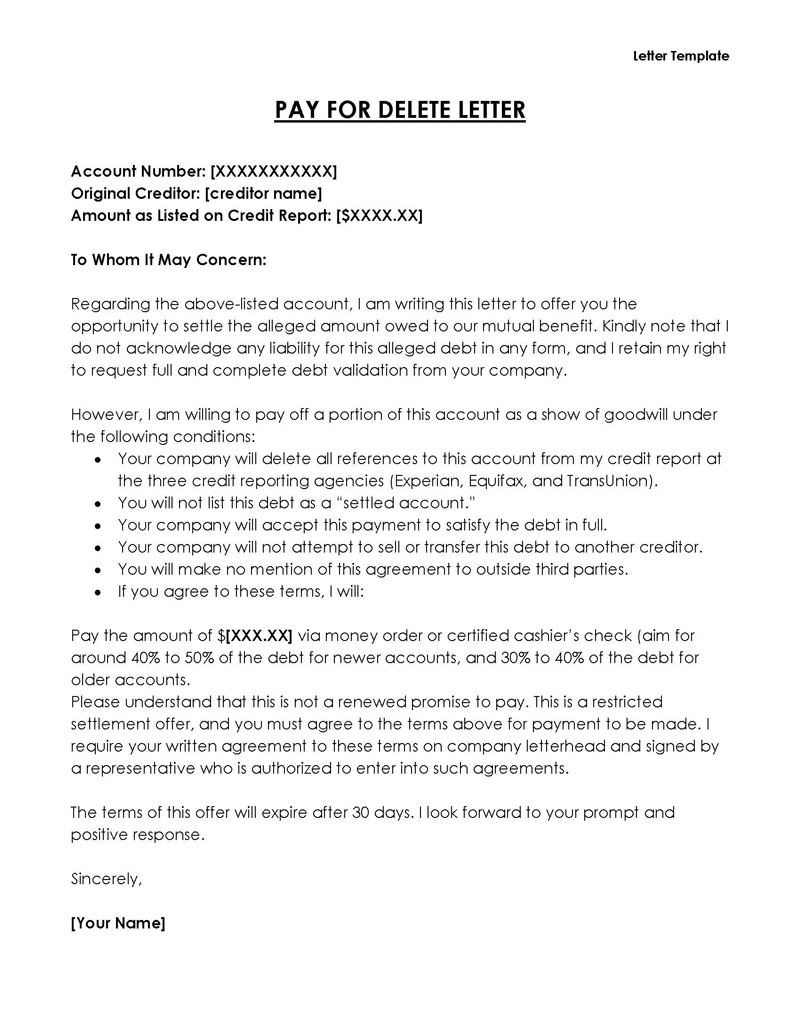

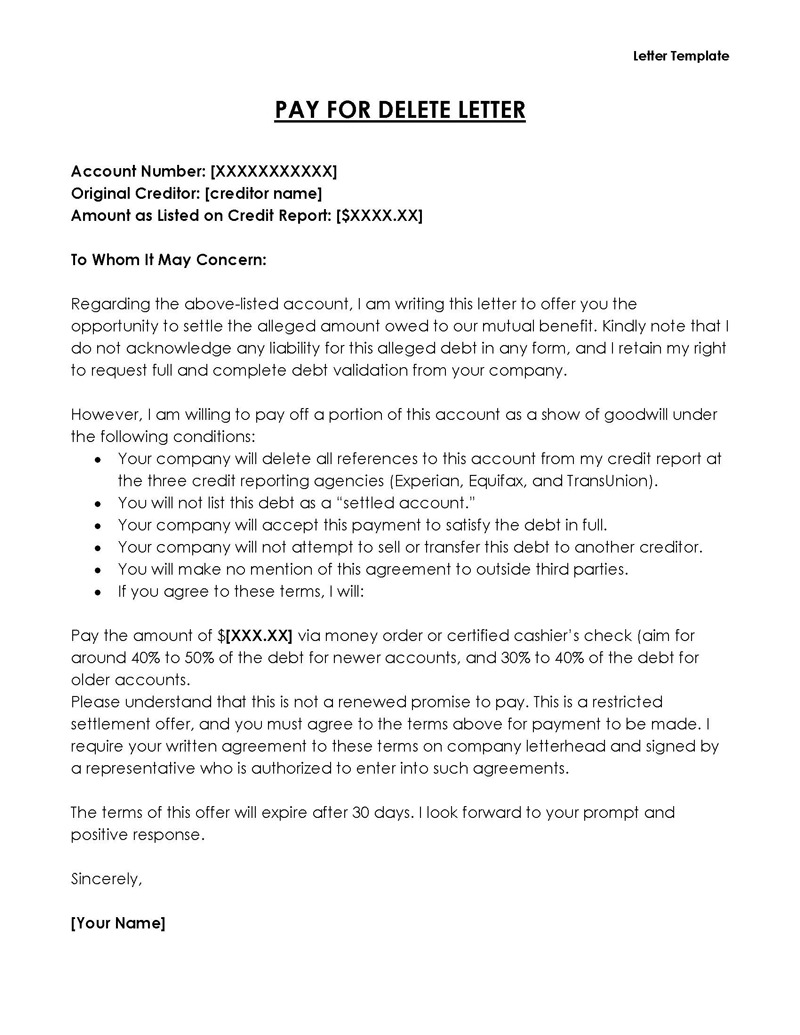

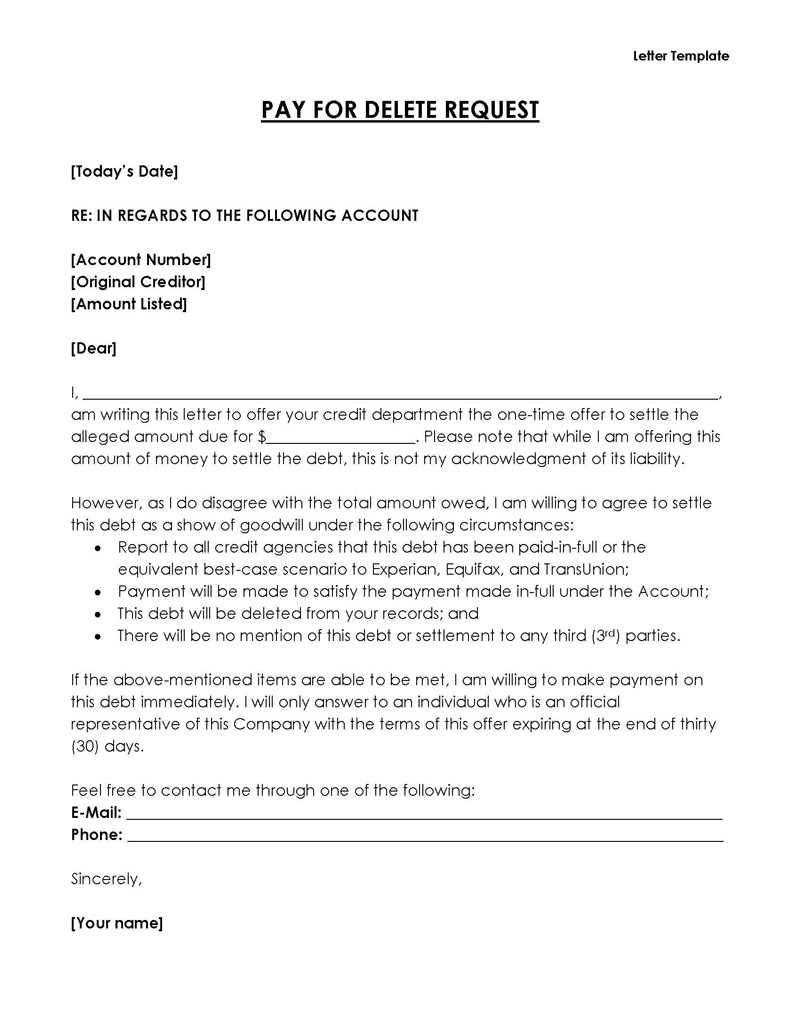

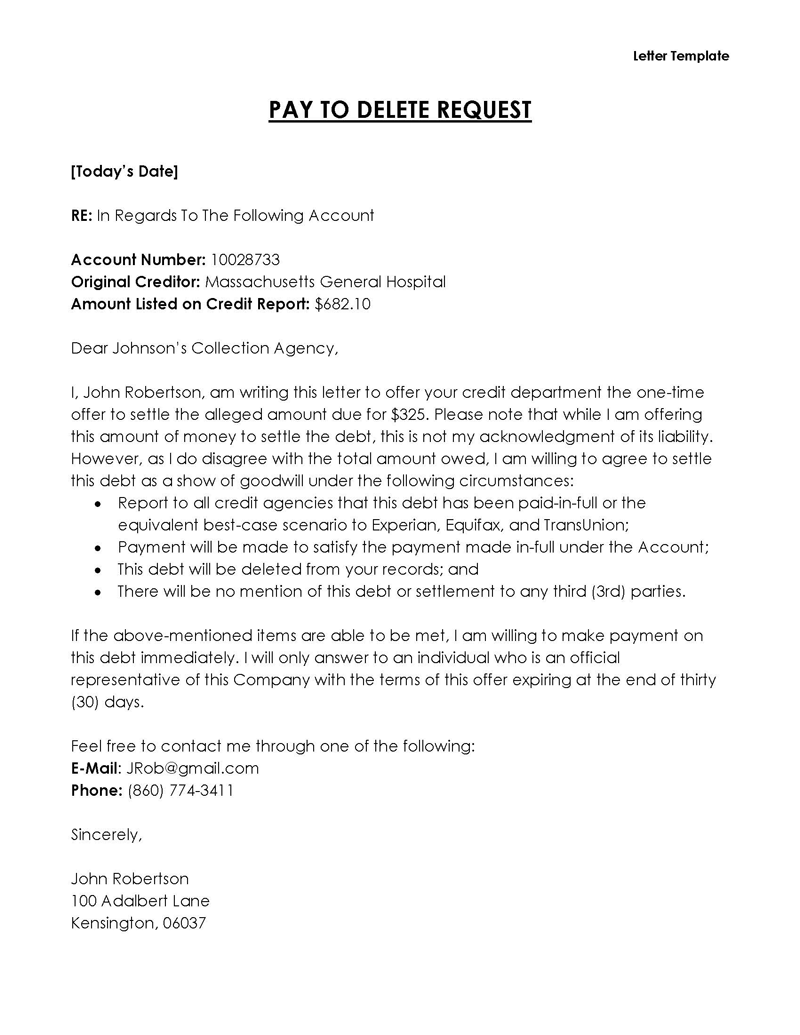

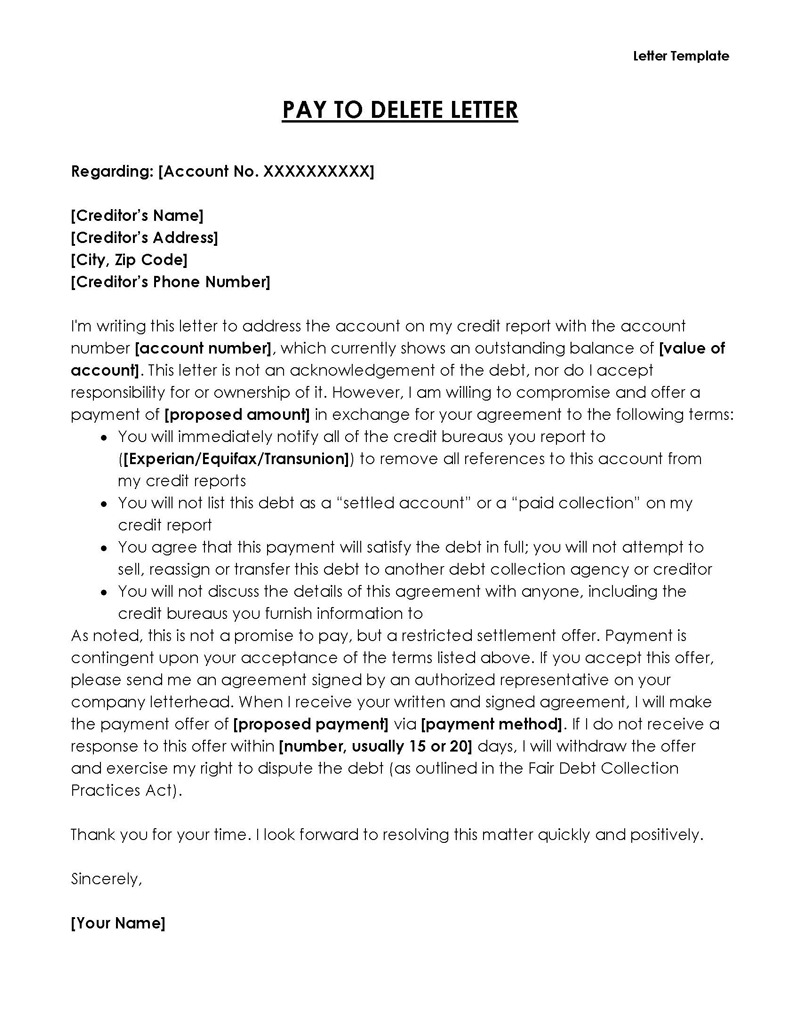

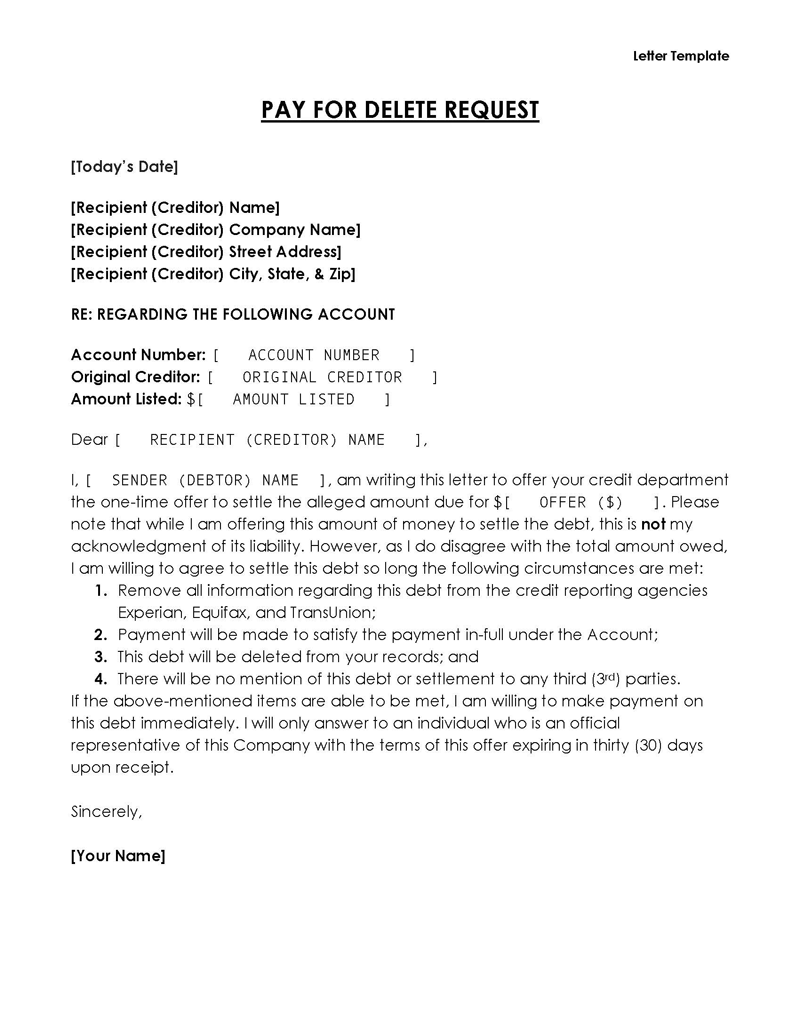

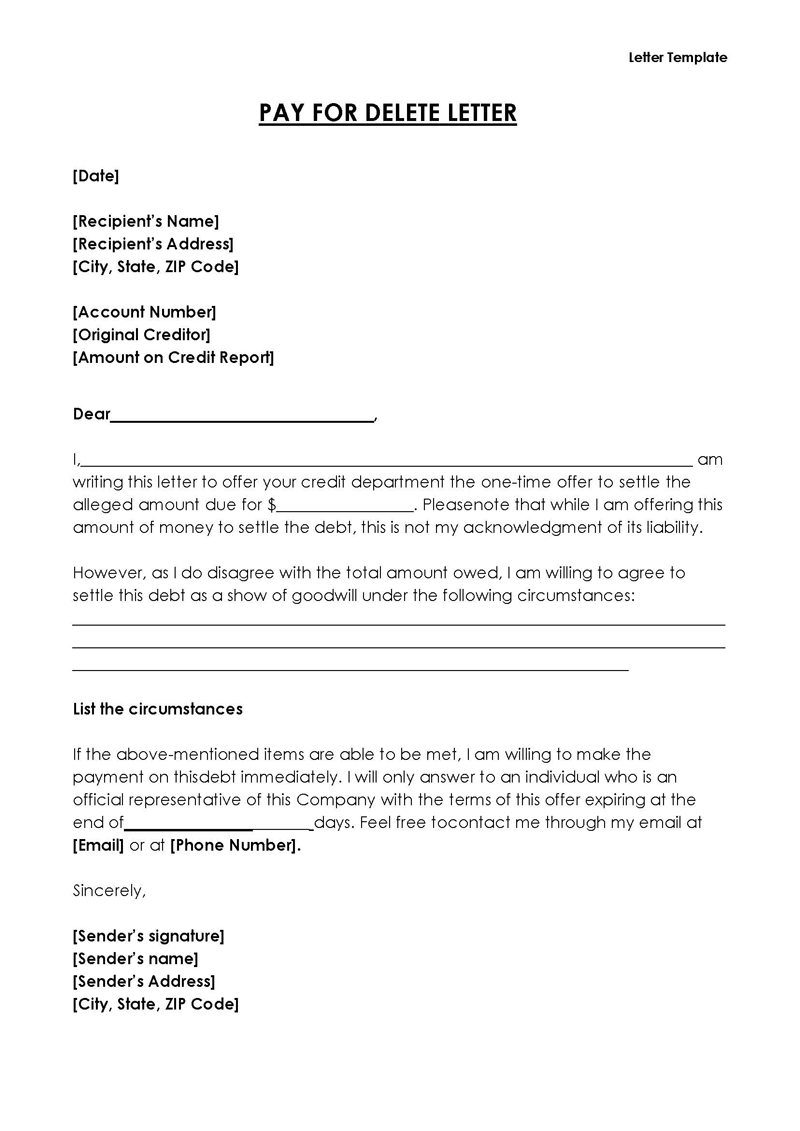

Pay for Delete Letter Templates

Dealing with negative items on your credit report can be daunting, but our collection of templates aims to simplify the process. Our templates are carefully crafted to help you draft a persuasive and professional letter that outlines your payment offer and requests the removal of the negative information from your credit report. By utilizing these templates, you can take a proactive step towards improving your credit score and financial well-being.

How Does Pay for Delete Letter Work?

Writing a pay-for-delete letter means that you essentially agree to pay your outstanding debts to have your collection account or judgment removed from your credit report, whether you owe the debt or not. It informs the collector that you have agreed to pay the outstanding debt in exchange for the credit reporting bureaus removing the harmful listings from your credit report.

If the creditor accepts your pay for delete request, they will send their acceptance to all three credit listing bureaus to have the negative listings cleared. At the same time, you proceed with making payments towards what you owe under arrangements made between you and your creditors.

When Should I Send it?

Since such letters are meant to help you repair your credit score, they should only be sent after you have exhausted all your other debt management solutions and the creditor has refused to remove the negative listing on your credit report.

It is recommended that you only send the pay-for-delete letter if:

If the debt is valid

If you cannot dispute the validity of the debt, then you can consider using this letter. To validate the debt, you should send a debt validation letter to the creditor or the collection agency. The creditor/collection agency is required by law to respond within thirty (30) days of the inquiry’s original creditor’s contact information. If they fail to respond within 30 days, you can use this as a ground to dispute their claim. If the creditor states that your debt is valid and you contest it, you can send a credit report dispute letter to the major credit listing bureaus to remove their negative listing on your credit report.

If the debt is not close to the seven-mark

The following criteria that your debt must meet before considering using the pay for delete letter are that it must be less than seven years old. This is because the credit reporting agency automatically removes harmful credit listings older than seven years from your credit report as per new credit reporting laws. Therefore, if your debt is close to seven years old, you can consider waiting for the credit reporting agency to remove your listing automatically.

3 Steps of Having Debt Collector Remove Your Collection Account

An adverse credit listing on your credit report can seriously affect your credit score. This is because it can impact your ability to get future credit and may discourage creditors from lending you money. Therefore, it is crucial to comprehend how to have a debt collector remove your debt because this will help improve your credit score.

Here are three key steps that you can use to have a debt collector remove your debt listing from your credit report:

Find out who the debt collector is

Debts are usually sold to collection agencies after the original creditor has written off your debt. Therefore, it is crucial to know who currently owns the debt. You should request this information from the original creditor or credit bureau and make an effort to contact the new debt collector.

In addition, you should write a letter to the new debt collector requesting to remove your debt listing from your credit report. If they fail to respond, you must write a letter to the credit reporting agency or the original creditor requesting the debt listing be removed from your credit report.

Write the pay-for-delete letter

After identifying the debt collector or original creditor, you should write a pay-for-delete letter to the collection agency. This letter should let them know you are willing to settle your debt in full to remove your negative listing from your credit report.

Here is how to write this letter:

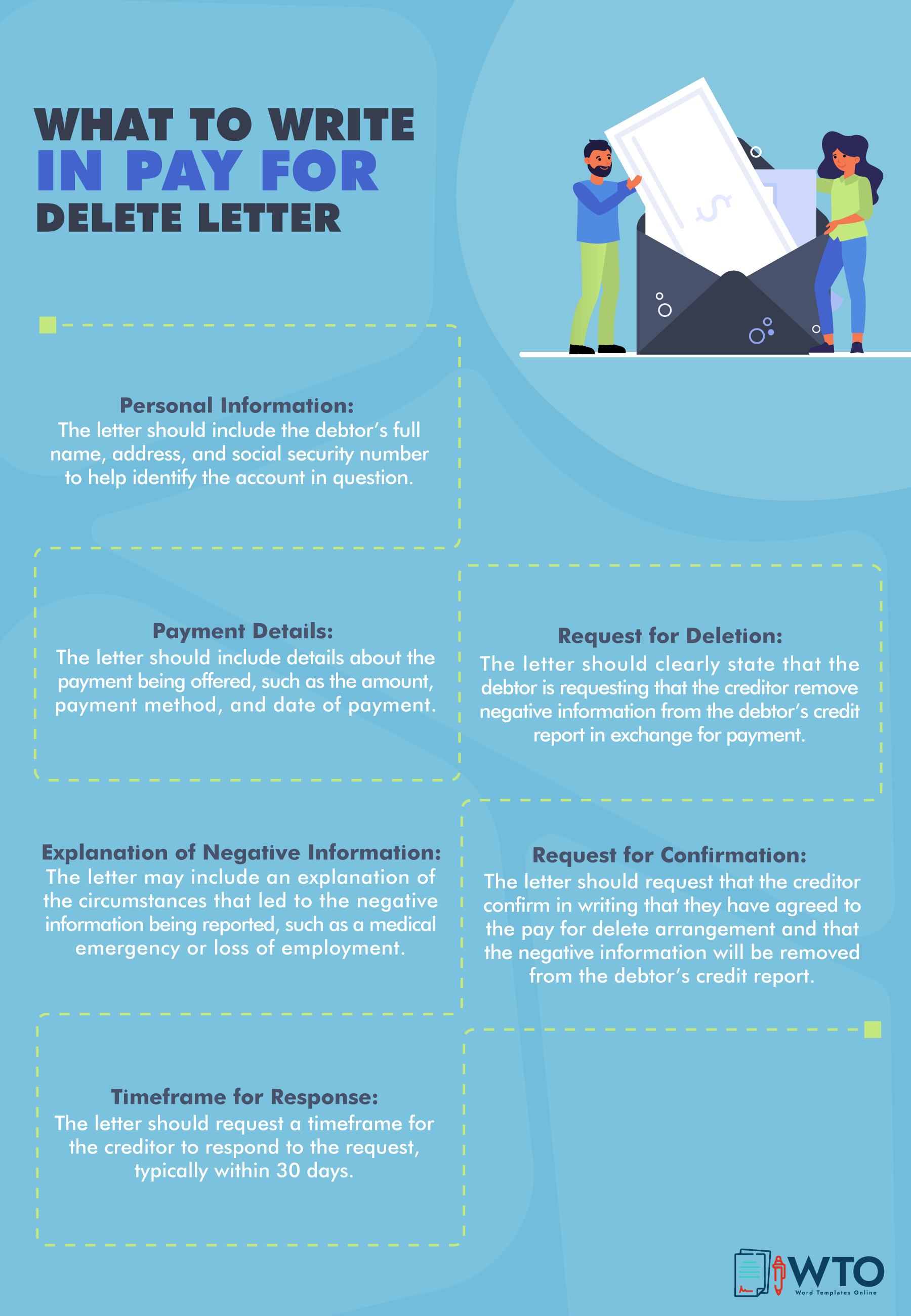

- Add preliminary information: The first thing that you need to do is add your personal information to the letter. This includes your name, address, and contact information, i.e., city, state, and zip code. You should also include the account number, the name of the original creditor, and the amount you have agreed to repay as per your agreement. In addition, you should also include the subject matter of the letter. This makes it easy for the collection agency or creditor to review your letter. For instance; you may write “RE: Pay for Delete Letter” or “Pay for Delete for Account______.’’

- Write the greetings: Like any other formal letter, the letter should also start with a greeting. In most cases, you can use standard salutations such as Dear Debt Collector or Dear Original Creditor. However, if you have had a previous relationship with the debt collector, you can use their first name to get their attention.

- Write the purpose of your writing: Your letter should let your debt collector know that you are willing to settle the debt in full or partial in exchange for their agreement to remove the negative listing from your credit report and settle your debt. When writing this part, describe your proposed terms to the debt collector.

- Provide your terms and conditions: In this section, provide the details of how you want to settle the debt. This includes the amount you are willing to pay in full or partial and your proposed payment schedule. If possible, try to offer them a lump sum amount and monthly minimum payments if they agree to remove your listing from your credit report.

- Provide additional contact details: It is generally best to send the pay for delete letter by mail and have it addressed to either the debt collector or the debt buyer. You should also include your contact details, such as your phone number and email address. These details will be necessary should they need you to propose any changes to their terms of settlement or if they need clarification on any information in your letter.

- Sign the letter: The final part of the letter is to provide a signature. This means you must write your name at the end of the letter and sign it. The signature will attest that you have verified all information and are willing to pay your debt in full or partial in exchange for their agreement to remove the negative listing from your credit report and any related lawsuits.

Pay the agreed amount (If the creditor agrees)

If the debt collector agrees to your letter, you should send them the agreed amount and ensure you get a signed agreement from them. This signed agreement should indicate that they accept your settlement terms and agree to remove your negative listing from your credit report. Make sure to keep the original, signed agreement and proof of the agreement for removing your negative listing from your credit report.

For your convenience, here is an infographic of what to write in the pay-for-delete letter.

Template for Pay-for-delete Letter

[Your Full Name]

[Your Address]

[City, State, Zip Code]

[Your Email Address]

[Your Phone Number]

[Date]

[Creditor or Collection Agency’s Name]

[Company’s Address]

[City, State, Zip Code]

Re: Account Number [Your Account Number]

Dear [Creditor or Collection Agency’s Name],

I am writing in regards to the above-mentioned account, which I understand is currently reported as [Status of the Account, e.g., “delinquent,” “charged-off”] on my credit report. I am eager to resolve this matter and am therefore proposing a pay for delete agreement to both satisfy the debt and have it removed from my credit file.

As I am in the process of [Reason for Wanting to Clear the Debt, e.g., “applying for a mortgage,” “improving my credit score”], it is in my best interest to have this account removed from my credit report. I believe this resolution is mutually beneficial, as it allows your company to collect a portion or the entirety of the amount due while helping me to improve my credit standing.

To this end, I am willing to offer a payment of [Proposed Payment Amount] as full settlement of this debt, provided that any and all reports of this account are completely removed from my credit report with all three major credit bureaus (Equifax, Experian, and TransUnion). This payment is not an acknowledgment of liability for the debt but rather a means to amicably resolve this issue.

I kindly request that we agree upon this pay for delete arrangement in writing before I proceed with any payment. Please provide a written agreement stating that if I fulfill my end of the agreement by paying the agreed-upon amount, your company will remove all information related to this debt from my credit report and cease any further collection efforts.

I hope to receive a positive response to my proposal, allowing us to swiftly resolve this matter to our mutual satisfaction. Please contact me at [Your Phone Number] or via email at [Your Email Address] to confirm acceptance of this offer or to discuss any adjustments.

Thank you for your attention to this matter. I look forward to your prompt response.

Sincerely,

[Your Signature, if sending by mail]

[Your Typed Name]

Sample Letter

In this dedicated section, we aim to provide you with a valuable resource to address credit discrepancies through the provision of a complimentary sample pay-for-delete letter.

Sample 01

Dear Mr. Jonathan Swift,

I hope this letter finds you in good health and spirits. My name is Elizabeth Harmon, and I am the Collections Manager at Greenfield Financial Solutions. I am writing to you regarding a matter concerning your account with us, specifically account number XF-3487J, which currently has an outstanding balance.

Our records show that a total amount of $3,500 remains unpaid on this account, which was originally due on March 15, 20XX. We understand that unforeseen circumstances can sometimes lead to financial difficulties, and we are always willing to find workable solutions for our valued clients.

To this end, I would like to propose a pay-for-delete arrangement. Under this agreement, you would make a one-time payment of $2,000, which is less than the total amount due. In exchange, upon receipt of this payment, Greenfield Financial Solutions will erase the record of this debt from your credit report. This action aims to alleviate any negative impact on your credit score and offer a path towards financial recovery.

To accept this offer, please respond to this letter by December 20, 20XX. Upon receiving your confirmation, we will provide you with the necessary details to complete the transaction. Once the agreed payment is received, we will promptly initiate the process to remove the debt record from your credit history. Please be aware that this offer is limited and represents a unique opportunity to settle your account in a favorable manner.

We appreciate your attention to this important matter and hope for a positive and prompt resolution. Should you have any questions or require further information, feel free to contact me at (555) 123-4567 or via email at e.harmon@greenfieldfs.com.

Warm regards,

Elizabeth Harmon

Collections Manager

Greenfield Financial Solutions

Things to Keep in Mind

Before paying off your debt or writing a pay-for-delete letter, it is vital to keep the following in mind:

Make sure it is your debt

First, you should ensure that you are only paying off your debt. This means that you should not do anything if it is not your debt until you have verified the debt’s validity. The best way to verify the debt is to contact the original creditor or collector and ask for a copy of all documents relating to your account.

Wait until the credit reporting time limit

Harmful credit listings are automatically removed from your credit report after seven years. After this time, the negative listing will no longer affect your credit score, and you do not need to pay for its removal. However, suppose you have defaulted on the debt for a longer period, i.e., five to six years. In that case, you may decide to wait for the duration to end to have your credit report automatically cleared of any harmful listings.

Make sure you can pay the amount

Once you have decided to pay off your debt and send the letter, it is crucial to ensure that you can pay the amount into the account. To do this, you should contact the original creditor and ask them if they can reduce the interest rate or waive it altogether in exchange for your payment.

Use certified mail

Always use certified mail with a return receipt request when sending your letter. Then, the debt collector or buyer can verify that they received your letter. This will also ensure they do not make false claims about the letter being lost or not received.

Keep a copy for yourself

You must keep a copy of the letter on record, whether it is on original, signed paper or a digital copy. This should prove that you settled your debt in full or made payments as agreed with the collector. Also, keep any correspondence with the collector or debt buyer, including any agreements made between you and the original creditor or debt buyer.

Tip for you

There are several other tools (such as a credit dispute letter or debt validation letter) other than a pay-for-delete letter that you can use to repair your credit score. These tools can help establish proof of your ability to pay credit-related debts and can help improve your chances of successful negotiations with debt collectors.

Frequently Asked Questions

If the debt collection agency rejects your letter, there are a few things that you can do, including; paying the total amount that you owe them, settling your account for less than the amount due, waiting until the debt is sold off to another debt collector, or waiting until the debt is automatically removed from your credit report by the credit listing bureaus.

The statute of limitations is the period within which the original creditor or collector has to pursue legal action to collect your debt before they are legally obliged to report it as a debt collection. The statute of limitations usually differs by state and type of debt but usually ranges from 3 to 10 years. Some debts will also have different statutes that may impact what happens if you do not make payments.

To find out which debt collector has your debt, if the original creditor or collector has sold the debt, you can contact the creditor or debt collection agency and ask them for a copy of the account’s credit report. You can also obtain a free copy of your credit report from the major credit listing bureaus and find out which collection agency has reported your debt as past due payment.

A successful pay-for-delete letter can increase your credit score by up to 100 points. Making a successful negotiation or settlement with a debt collector can also help enhance your credit score because it means that you have the financial ability to pay your debts in full.