A collection letter is an official notice provided to a customer notifying them of a past-due payment to a business.

It is a notice sent by a creditor seeking payment for an outstanding debt that contains instructions for the debtor. Instructions should include a stipulated 30 days from the date of the initial notice for the debtor to dispute the notice. This letter must be sent to the debtor’s home address or any other address pre-authorized by the debtor.

You must follow the correct step-by-step process and use formal language to provide official notice of a debt owed by your customers, notifying them that the debt is past due.

note

It is typically required to send four letters before one can hire a collection agency or record a bad debt expense.

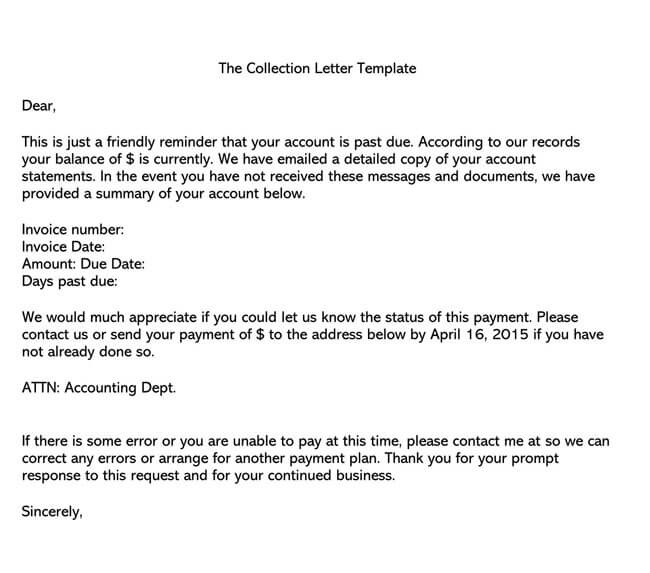

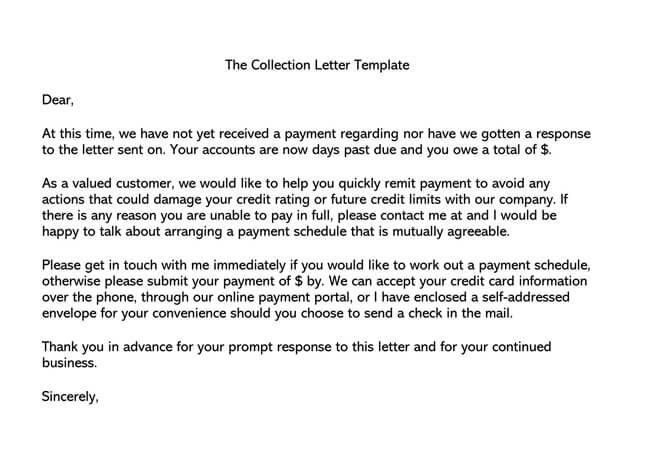

Free Downloads

Usage of Collection Letter

This letter is used to legally notify a debtor to pay up the amount owed and notify the debtor of the date by which they must repay the debt; otherwise, the creditor takes legal action. Also, it serves the purpose of being a record of notice, as the creditor is required to give four notices before hiring a collection agent or writing the debt off as a bad debt.

A collection letter must be sent to the approved residence of the customer or the home address of the customer. The debtor has 30 days within which they can dispute the validity of the collection letter. If, however, the debtor does not dispute the validity of this letter in 30 days, the letter remains valid.

Collection of debts under United States law is governed by 15 U.S. Code § 1692g.

Writing a Collection Letter

When writing a collection letter, it is important to note that the letter serves as a reference document for legal proceedings, and as such, it should be well-written, well-formatted, and well-worded. You need to include all the important elements and avoid all the pitfalls.

Things to be included

This letter must comply with fair debt collection practices by containing the following elements:

- The Debt amount ($)

- The name of the creditor

- A statement informing the debtor of their right to dispute the validity of the debt within 30 days, or else the debt will be assumed to be valid.

In addition to the three primary requirements stated above, this letter should contain the following components:

- Include a copy of the invoice(s)- The invoices relevant to the indebted transactions should be included in the collection letter. If, however, there are multiple outstanding invoices, you may use a summarized statement containing details of all the invoices.

- Include a specific deadline- The creditor must include a specific date for the debtor to make all accounts current. The creditor should state in the sentence that payment must be made by June 12th at the latest. Do not phrase the deadline like this; Payment should be made within seven business days.

- Payment options- The creditor should include acceptable payment options through which the organization accepts payments from customers.

- Contact information- The creditor needs to include the company’s contact information, which includes mailing address, email address, and telephone number.

- Use a postage-paid envelope- Using a postage-paid envelope ensures that the debtor can pay promptly by simply dropping a check in the mail. This way, if the debtor is willing, they can pay it back instantly.

- Compliance with Fair Debt Collection Practices- According to the guidelines of Fair Debt Collection Practices, the collection letter must contain the debt amount as well as the name of the creditor and a statement informing the debtor of their right to dispute the validity of the debt within 30 days of receiving the collection letter, and forfeiture of this right means that the debt would be assumed to be valid.

Dos and Don’ts to Consider While Writing

If you need to write a collection letter to recover some debt, here are some recommendations you need to adhere to:

- Always keep it professional.

- Keep the contents of the letter short.

- Operate under the assumption that the debtor will pay.

- Attempt to contact the debtor via phone call before sending the letter.

- Send an email first before sending the letter.

- Always use the company’s letterhead.

Conversely, avoid doing the following:

- Never include harsh words in your letter.

- Never write a collection letter by hand.

- Never harass the debtor.

- Never send text messages to debtors

- Never communicate with debtors via social media links.

Types of Collection Letter

Debt collection letters are an essential tool used by creditors and collection agencies to remind individuals or businesses of overdue payments. These letters vary in tone and content based on the stage of the collection process and the severity of the debt situation.

Here’s a detailed overview of the different types of debt collection letters:

1. Friendly Reminder Letter: To gently remind the debtor of a missed payment. It includes details of the missed payment and a payment request.

2. Inquiry Letter: To inquire about a missed payment, considering there might be a valid reason. It seeks clarification on why the payment was missed and requests payment or a payment plan.

3. Demand Letter: To firmly demand payment of the overdue amount. It clearly states the amount owed, the deadline for payment, and the potential consequences of non-payment.

4. Final Notice Letter: To serve as a final warning before taking further action. It indicates that this is the final notice before legal or other collection actions are initiated.

5. Debt Settlement Letter: To offer a settlement for less than the total amount owed. It proposes a settlement amount and terms for the reduced payment.

6. Legal Action Letter: To inform the debtor of impending legal action. It details the legal actions to be taken if the debt is not settled.

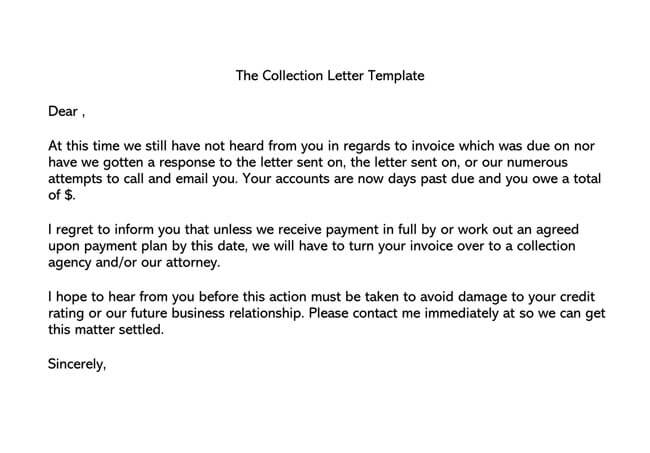

Template for Debt Collection Letter

[Your Company Letterhead]

[Date]

[Debtor’s Name]

[Debtor’s Address]

[City, State, Zip Code]

Subject: Regarding Your Account with [Your Company Name]

Dear [Debtor’s Name],

I hope this letter finds you well. We are writing to you regarding your account with [Your Company Name], specifically concerning [Invoice Number/Account Reference], dated [Invoice/Account Date], for the amount of [Amount Due].

As of [Date], we have noted that this amount remains outstanding. We understand that there may be various reasons for this delay, and we are committed to working with you to resolve this matter.

[Select the Appropriate Paragraph Based on the Scenario]

1. Friendly Reminder: We would like to gently remind you that this payment was due on [Due Date]. If you have already made this payment, please accept our thanks and disregard this notice.

2. Inquiry for Information: If there are any issues or concerns regarding this payment, or if you require assistance or clarification, please do not hesitate to contact us.

3. Demand for Payment: As this payment is now significantly overdue, we must insist on prompt settlement of this amount. Please arrange for payment by [New Due Date].

4. Final Notice: This serves as a final notice before we take further action. Failure to settle this debt by [Final Deadline] will necessitate additional measures.

5. Settlement Offer: We understand that you may be facing financial difficulties. As such, we are open to discussing a possible settlement or payment plan that could be mutually beneficial.

6. Legal Action Warning: Please be advised that continued non-payment will leave us no choice but to initiate legal proceedings to recover the debt.

[End with a Concluding Statement]

We value our relationship and are eager to resolve this matter in a manner that is fair and satisfactory for both parties. Please contact us at [Your Contact Information] at your earliest convenience to discuss this matter further.

Thank you for your prompt attention to this important issue. We look forward to hearing from you soon.

Sincerely,

[Your Name]

[Your Position]

[Your Company Name]

[Your Contact Information]

Sample Debt Collection Letters

Sample Letter Friendly Reminder Debt Collection

Subject: Gentle Reminder: Invoice 12345 Overdue

Dear John Doe,

I hope this message finds you well. We are writing to remind you about the payment for invoice #12345, which was issued on January 15, 20XX. According to our records, the amount of $500.00 was due on February 15, 20XX, and we have yet to receive this payment.

We understand that managing finances can sometimes be challenging, and oversights can occur. Therefore, we kindly ask you to review your records regarding this matter. If you have already processed this payment, please accept our sincere thanks and disregard this reminder.

Do you need any further details or a copy of the invoice? We are more than happy to provide any additional information that might assist you.

Are there any issues or concerns we can address? Your satisfaction is important to us, and we are here to help in any way we can.

Our aim is to ensure that all transactions are smooth and hassle-free. We value your relationship with our company and look forward to continuing our business partnership.

Warm regards,

Jane Smith

Accounts Receivable

ABC Widgets Inc.

Sample Inquiry Letter Debt Collection

Subject: Inquiry on Unsettled Invoice 12346

Dear John Doe,

I hope this letter finds you in good health and spirits. We are reaching out to you concerning the status of invoice #12346, which was issued on January 20, 20XX, for the amount of $750.00. According to our records, this invoice was due for payment on February 20, 20XX, and as of today, we have not received the outstanding amount.

We understand that there could be several reasons for this delay, and it is not our intention to cause any inconvenience. We have noticed a recent deviation from your usual timely payments, which has led us to verify that everything is in order. Your track record of timely payments has been impressive.

Is there any issue with the invoice itself? If there are any discrepancies or errors, please let us know so we can rectify them immediately.

Are you facing any temporary financial challenges? If so, we are more than willing to discuss possible payment arrangements that could ease your current situation.

Do you require any additional information or clarification regarding this invoice? We are here to provide any assistance you might need.

Our goal is to maintain a positive and cooperative relationship with you, and we are committed to finding a solution that works for both parties. Your feedback and response to this inquiry will be greatly appreciated and will help us understand your situation better.

Your prompt response to this inquiry will help us understand your situation better and find a suitable solution. We are here to support you in resolving this matter.

Best regards,

Jane Smith

Customer Service

ABC Widgets Inc.

Sample Demand Letter Debt Collection

Subject: Immediate Action Required: Overdue Invoice 12347

Dear John Doe,

I am writing to you with an important matter regarding your overdue payment for invoice #12347. As per our records, the invoice, dated January 25, 20XX, for the amount of $1,000.00, was due on February 25, 20XX. It has come to our attention that this payment is now 30 days overdue.

We have sent previous reminders regarding this matter, and it is imperative that this issue is addressed immediately to avoid further complications.

We require the full payment of $1,000.00 to be made by, March 7, 20XX.

Please be aware that failure to comply with this demand may result in additional charges, interest, or potential legal action to recover the debt.

We understand that unforeseen circumstances can affect financial commitments. However, it is crucial that we receive communication from you regarding this payment. If there are extenuating circumstances preventing you from fulfilling this obligation, please contact us immediately to discuss potential arrangements.

This is a serious matter that requires your urgent attention. We prefer to resolve this amicably and without further action. Please ensure that payment is made by the specified deadline or contact us to discuss your situation.

Thank you for your prompt response to this matter. We look forward to settling this issue promptly and continuing our business relationship.

Sincerely,

Jane Smith

Finance Director

ABC Widgets Inc.

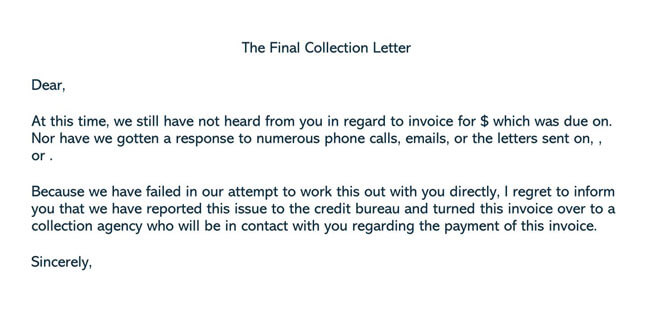

Sample Final Notice Letter Debt Collection

Subject: Final Notice: Urgent Payment Required for Invoice 12348

Dear John Doe,

Despite our previous communications, we have not received your payment for invoice 12348, totaling $1,250.00, which is now 45 days overdue.

This is your final notice. If we do not receive the payment by March 10, 20XX, we will be forced to initiate legal proceedings to recover the debt.

This is a critical matter that requires your immediate attention. We urge you to settle this debt to avoid any further action, which we would like to prevent if possible.

Regards,

Jane Smith

Legal Department

ABC Widgets Inc.

Sample Debt Settlement Letter

Subject: Settlement Offer for Your Overdue Account

Dear John Doe,

We understand that you may be facing financial challenges and are currently unable to pay the full amount of $1,500.00 for invoice 12349. As such, we are willing to accept a one-time settlement payment of $1,000.00 to close this account.

This offer is valid until March 15, 20XX. Please confirm your agreement to this settlement by replying to this email or calling our office.

We hope this settlement offer demonstrates our willingness to work with you during this challenging time. Please contact us to confirm your acceptance of this offer or to discuss alternative arrangements.

Kind regards,

Jane Smith

Debt Resolution Specialist

ABC Widgets Inc.

Sample Legal Action Letter Debt Collection

Subject: Final Warning: Legal Action Pending for Invoice 12350

Dear John Doe,

This letter serves as a final notice regarding the outstanding payment for invoice #12350, dated February 1, 20XX, amounting to $2,000.00. Despite our previous correspondences and reminders, we regret to inform you that this payment remains unsettled as of the current date.

The total amount of $2,000.00 is now 90 days overdue. We require this payment to be made in full by March 20, 20XX.

If we do not receive the payment by the specified deadline, we will have no alternative but to initiate legal proceedings against you to recover the debt.

Please be aware that this action may result in additional legal costs and fees for which you may be liable.

We would like to avoid taking such measures and strongly urge you to settle this debt promptly. Our preference is to resolve this matter amicably and without the need for legal intervention.

This is a critical issue that demands your immediate attention. We hope to receive the outstanding payment by the specified deadline to avoid legal proceedings. Please contact us immediately to discuss any concerns or payment arrangements.

Thank you for your prompt response to this urgent matter.

Yours sincerely,

Jane Smith

Chief Financial Officer

ABC Widgets Inc.

Tips to Avoid Payment Collection Issues

Many businesses have clients who have trouble making payments. There are a few precautionary measures you can put in place to avoid a situation where issues arise when collecting payments from customers.

Here are a few tips to help you:

Review A/R aging report

The accounts receivable report is one of the high-priority financial reports that all businesses should review often. It contains the details of all unpaid customer invoices, including the date of the invoice, the amount due, the invoice due date, and the number of days past due.

Offer early discount payment terms

Offering customers an incentive to pay their invoices early encourages them to pay their invoices promptly. You may place early payment discounts anywhere between 1% and 5%. Require customers to repay their accounts within 10 days of the invoice date. A lot of customers would like to save some money by sending in their payments early.

Request deposits upfront

Although this may seem awkward initially, if you ask your customers to deposit before receiving services, you will not be the only one. If, for example, a customer orders a producer, they are required to pay for the product in full (including shipping) before they receive it. Legal and accounting firms also require their clients to pay a retainer before they provide their services.

If any of the following conditions apply to you, you should consider requesting a deposit:

- Brand-new client

- The high value of projects. (the amount depends on the type of business.)

- Projects that stretch beyond 30 days.

Be proactive

Following up on payments on time is a common, useful practice that many businesses overlook. Many business owners find it difficult to ask for a payment, so they put it off for too long. However, this is not a good practice, as early notification helps you remind the client to make the payment before it becomes past due.

Run a business credit check

You may decide to run a credit check to analyze your client’s business credit profile. You may also view their payment history with trade partners. If you have access to how well your client has met their payment obligations in the past, you can easily decipher whether you will get paid on time.

Hire a collection agency

After the creditor has carried out multiple attempts to collect on a delinquent account to no avail, the creditor should consider hiring a collection agency. It is important to note that the creditor will not receive the full amount owed upon hiring a collection agency. Typically, collection agencies charge between 25 and 45 percent of the total amount to be recovered. Hiring a collection agency may not be worth the expenses, depending on the total amount owed.

Writing accounts off as bad debt

The creditor, after multiple attempts to collect on a delinquent account (via telephone calls, and letters), may decide to cut their losses and elect not to hire a collection agency. If the total amount owed minus the collection agency’s charge is not worth it, the creditor should write the account off as a bad debt. By doing this, the creditor can at least claim a tax deduction for the amount owed.

Frequently Asked Questions

Many entrepreneurs find themselves asking this question. The short answer is that it depends. Typically, if the customer makes the payment before you have to involve an outside collection agency, you may consider doing business with them in the future. However, you should include the condition that you will require an upfront deposit. If the customer is not willing to pay a deposit upfront, it is best to cut ties with them. If the customer only paid the debt after an external collection agency was involved, you should seriously consider closing their account.

Like any other business decision, you need to scrutinize the collection agency. You should verify the agency’s legitimacy, confirm if they use skip tracing, ensure they have insurance, and compare fees with their competitors.

The best practices include using invoicing software and communicating with customers before their accounts become past due.

Key Takeaways

Writing a collection letter is a delicate process that requires a lot of consideration and requires the business owner to follow guidelines. In addition to serving as a business communication with clients with which you may continue to do business upon repayment, the collection letters may also be used as legal documents should the need arise. As a result, collection letters should be well written and contain all necessary elements and relevant details. If done properly, the collection process will be a smooth and hassle-free process without having to close the account of a client.