Receipts issued by the business facilitate maintenance of official transactional documentation or records within the business, used for reference purposes when filing taxes, conducting audits and doing stock taking. Receipts provide proof of purchase and are often used to solve disputes that may arise between the customers and the business in the case of returned faulty goods.

Payments receipts play an essential role in providing customers with information, helping with internal accounting, and the documentation of purchases.

Some of the vital functions of a payment receipt include:

- Useful during returns and exchanges: When a buyer gets a product that is defective or not the desired quality, they can return it if they have a payment receipt. Inside this receipt, relevant information about the return policy is included;

EXAMPLE

The number of days after purchase that goods can be returned to the seller.

- Information about the customer: Such receipts help to ensure smooth communication between the buyer and seller. This is made possible as it includes all the essential details on the purchase of goods or services from the seller, such as the number of products bought, taxes, date of purchase, and taxes. Therefore, it helps ensure there is no disagreement between the involved parties as all details are laid out.

- Internal accounting: Sellers keep copies of the payment receipts as these allow them to keep an accurate track of the sales as well as revenue. Thus, if an issue arises in the future, you can always refer to the receipt of payment to clarify matters.

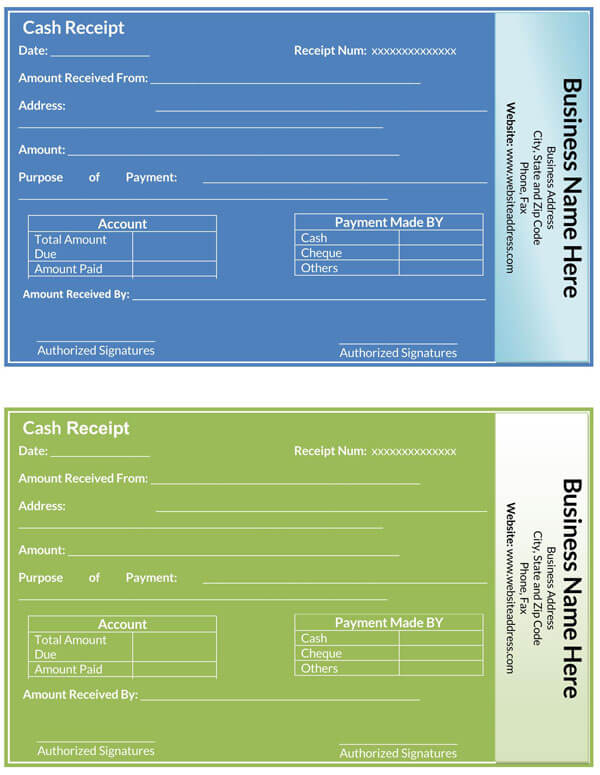

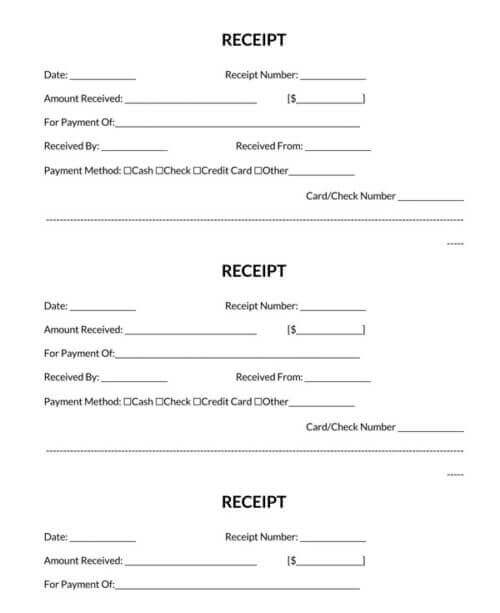

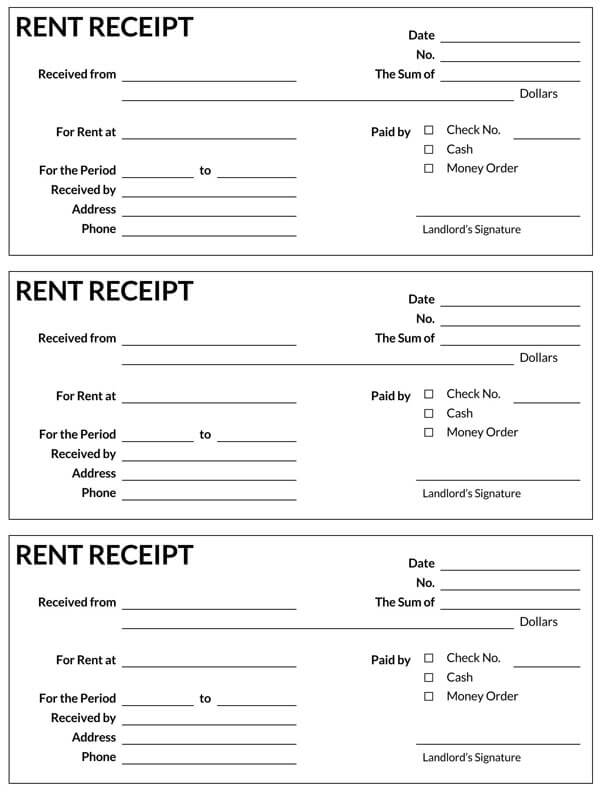

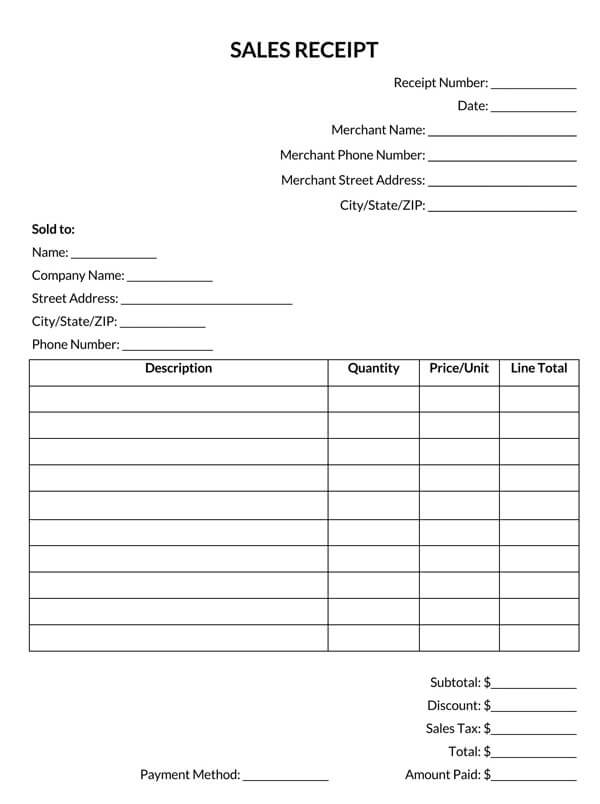

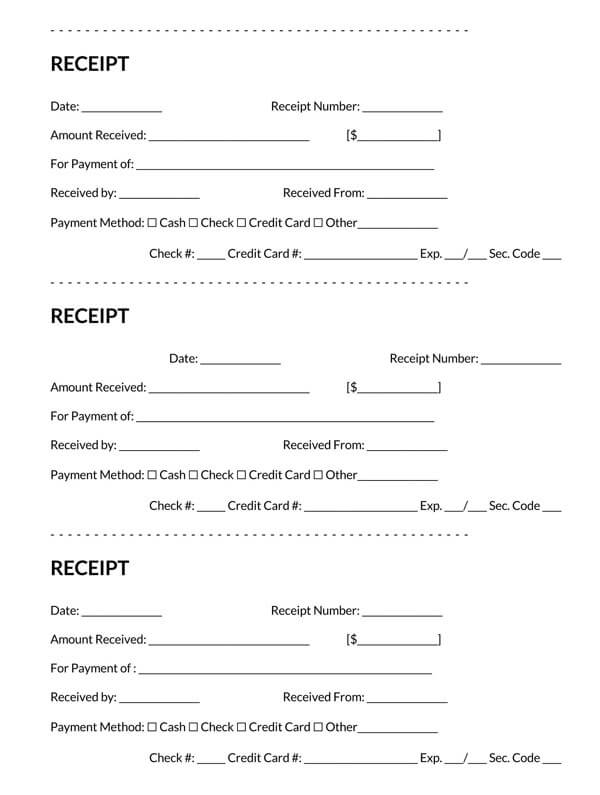

Free Payment Receipt Templates

How Long to Keep a Receipt

Businesses keep receipts as proof of sales made within a specified period for accounting purposes, and the records need to be up to date. A business should keep the records for as long as needed however, the IRS requires businesses to maintain their receipts for at least 3 years.

NOTE

It is important to note that in the eventuality that a business claims a loss for any particular tax year the receipts for that specific year should be kept for a minimum of 7 years.

The receipts can be stored digitally in different online applications for an indefinite period by scanning the physical document(s). Digitally stored receipts can later be used when the client wants to make a similar order but may have misplaced the original receipt.

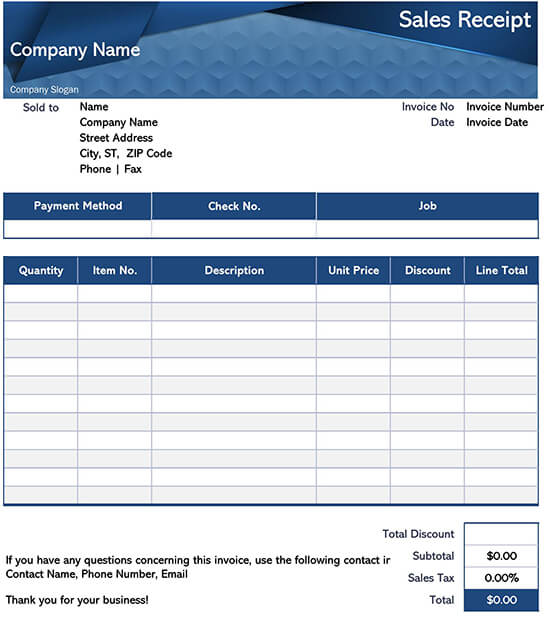

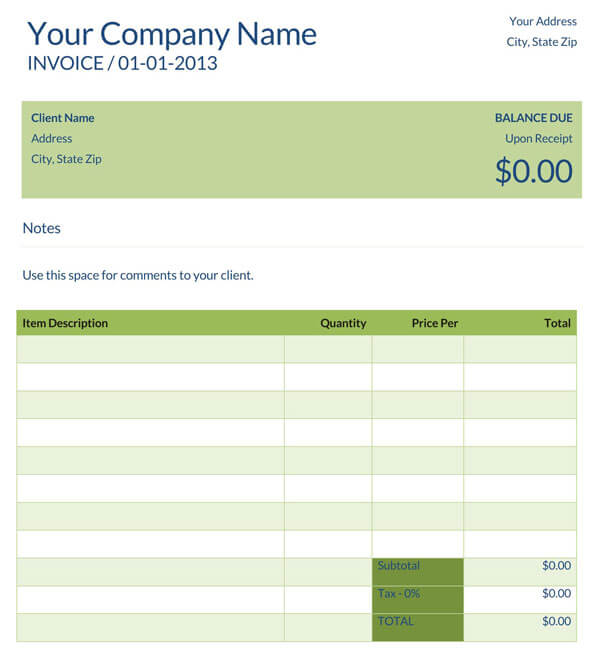

Receipt vs Invoice

A receipt is a document that shows the acknowledgment of transfer of goods or services between two parties such as the buyer and the seller indicating proof of payment by the buyer. Receipts are also issued for business-to-business transactions and the details captured in the receipt include a description of the services or goods sold and the amount.

Whereas an invoice is a form of document which lists down the different products and services that a business offers to various clientele and their amounts. It is also used as a polite reminder for asking for payment of the services rendered or goods delivered to the client. The invoice creates an obligation for the client to pay while providing clients with records that detail their expenses.

The main difference between an invoice and a receipt is that one is used to request payment while the latter is used to show proof of payment for goods and services sold by the business.

Differences between invoice and receipt

- An invoice shows a list of the amount that is due for payment, while the receipt shows the amount that has been paid for the goods or services sold by a business.

- An invoice is made to request for payment of goods and services while a receipt is issued as proof of payment for the goods sold.

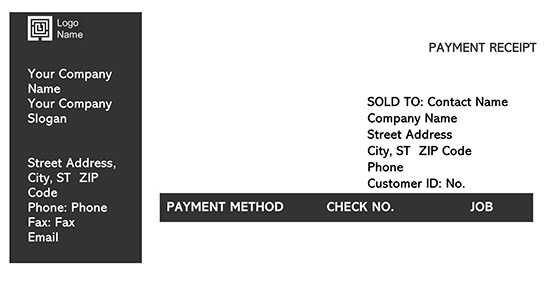

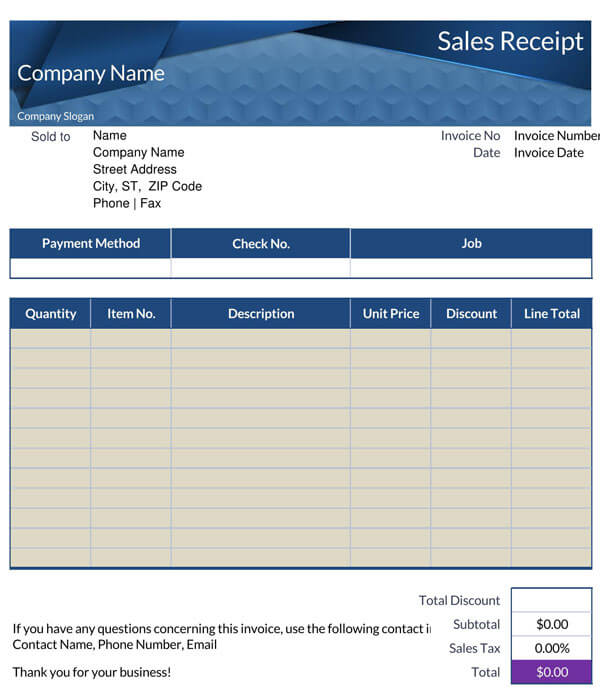

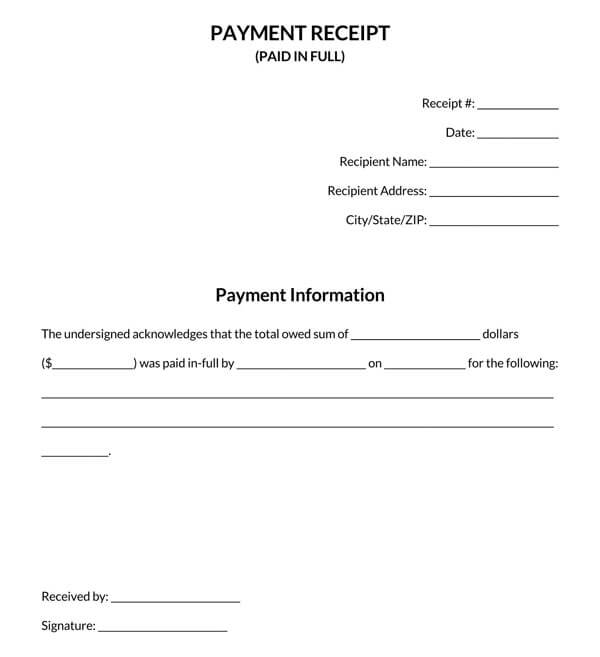

Payment Receipt vs Sales Receipt

There are distinguishing differences between the sales receipt and the payment receipt.

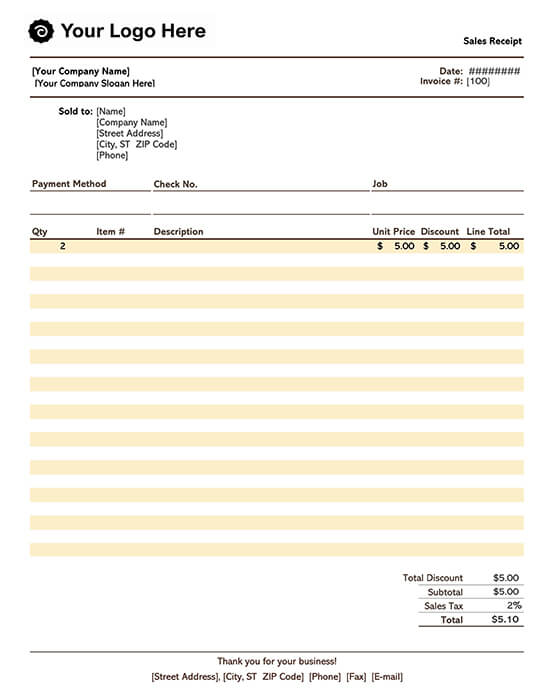

The receipt of payment is proof of payment by the buyer, whereas the sales receipt is a payment request by the seller if payment by the buyer is still due. Therefore, these receipts are more useful to the buyer to serve as proof that the seller received their payment.

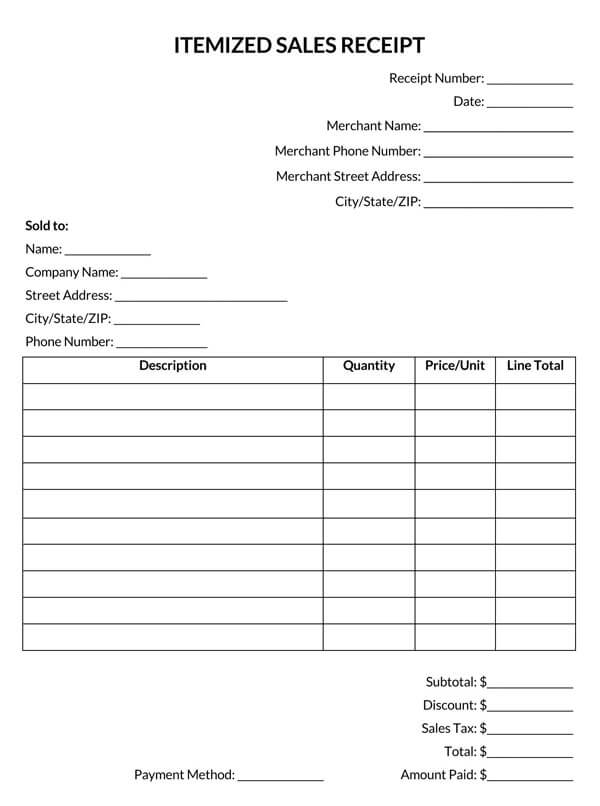

In contrast, the sales receipt is useful to the seller, hence used for accounting purposes. It usually contains crucial information, including the analysis of the taxes and costs involved plus relevant business information.

Furthermore, the sales receipt contains a unique receipt number as well as several other strict requirements.

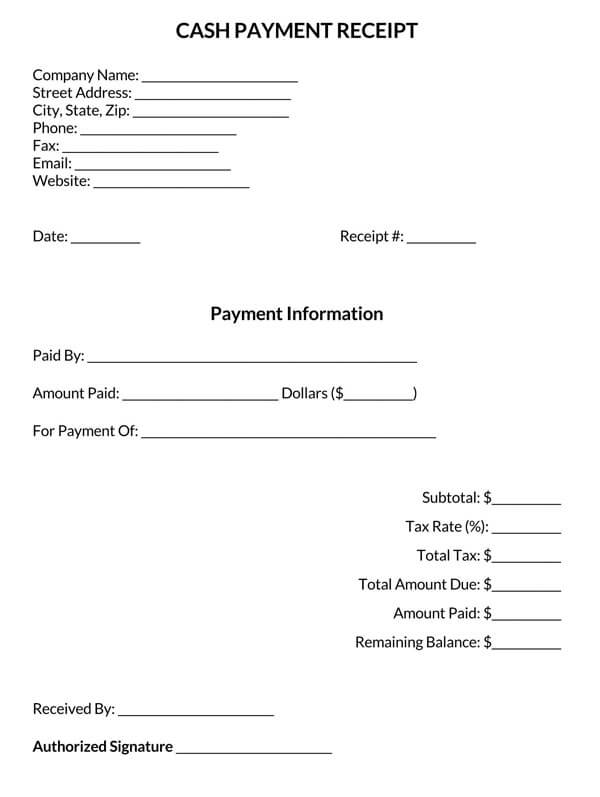

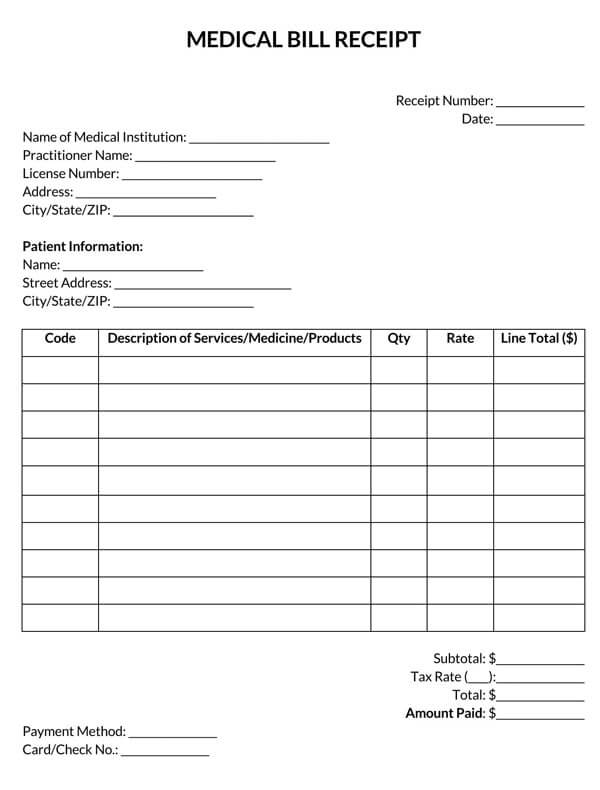

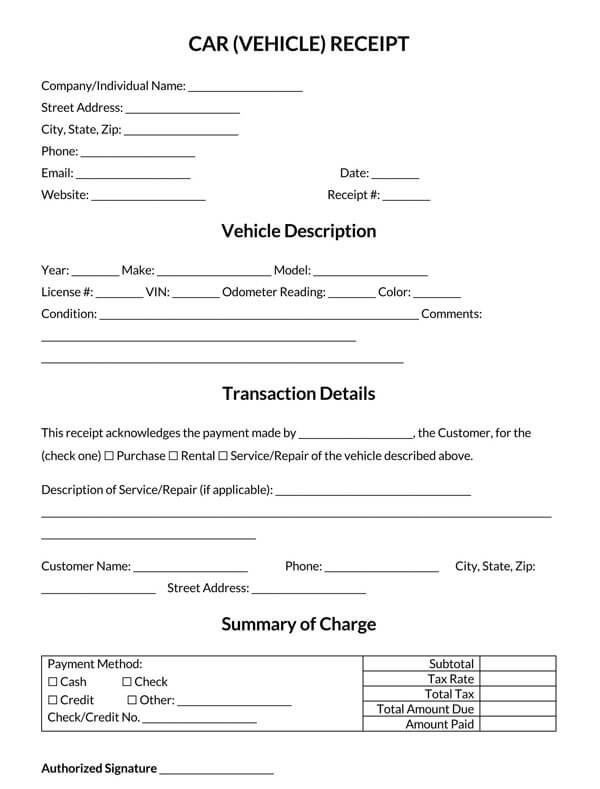

Information on a Payment Receipt (Basic Contents)

Information in the receipt indicates details that show the description of the items purchased by the buyer.

Such information includes:

Date of payment

The date of payment is meant to show the day that the goods or services were sold to a buyer. The date on a receipt can be used to keep track of the particular period that certain items were sold. The information can be used when solving discrepancies on faulty goods returned within the warranty period, the date on the receipt showing when the item was bought informs whether the item is returned within the specified warranty period.

Receipt number

This is a number that is generated once full payment for goods and services sold is made. The number can be a sequence that consists of the date in which sales were made and the specific time that the receipt was issued.

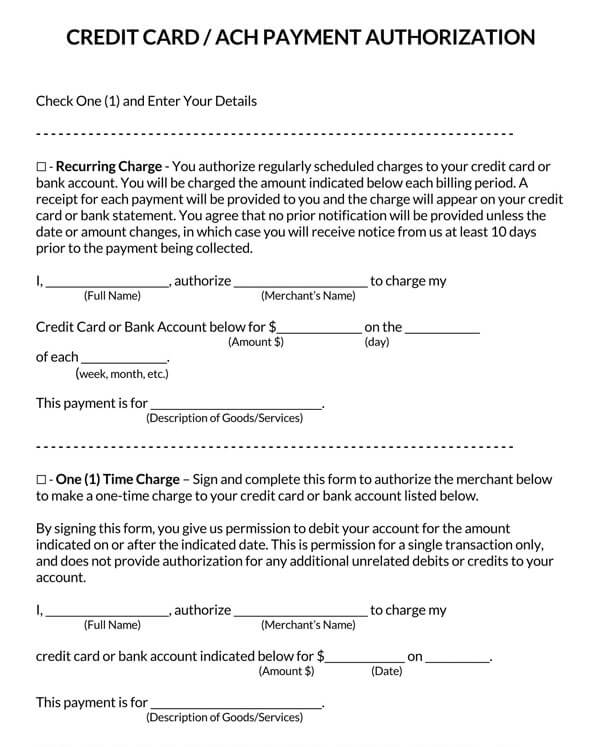

Credit card details

The credit card details displayed on the receipt show the date and time a transaction was made, it also includes part of the account number of the seller, the reference number, and the amount that was charged in that particular transaction.

Sum amount received

Receipts show the amount of money that was paid to the business from the sale of goods and services. The amount received helps the business and its owners to keep records that help them to calculate the revenues they have generated. The business can also use the information to mitigate future losses which may affect the business.

Payment method

The mode of payment used to pay for goods and services by different customers helps a business to keep track of and to know the major methods used by their customers. The business can add a mode of payment at the request of their clients; such a method can include online payment systems such as PayPal. This ensures that the business does not in any way lose revenue due to the lack of a particular payment method.

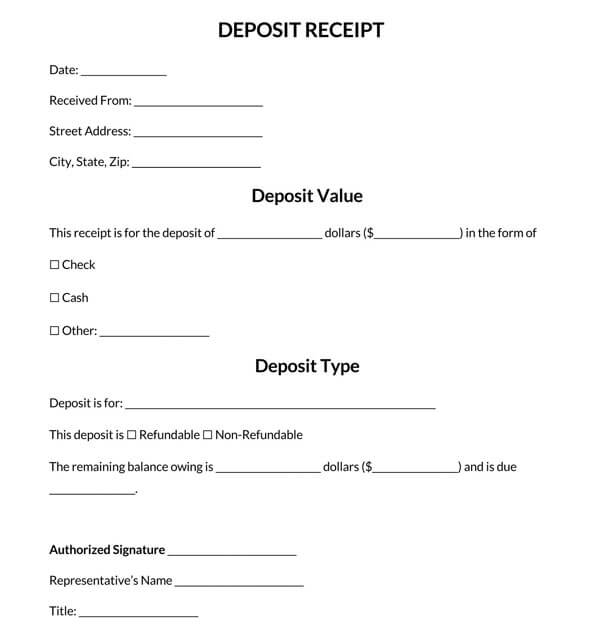

Remaining amount due

The remaining amount due is normally used in situations where the invoice is applicable and, in such situations, the business can use this to track payments that may be pending. The business can use the information to fast-track payments of goods and services offered to customers and other organizations that are yet to complete payments or clients who have made partial payments to the business.

Seller’s details

This section covers the information which is concerning the seller such as the physical address of the seller and the contact information. This can be used by the customer, organization, or the business which uses or purchases goods or services from a particular seller. The customer can use the seller’s details to contact the seller to inquire about goods and the quantity that is available at the moment without having to physically visit the business premises.

Transaction details

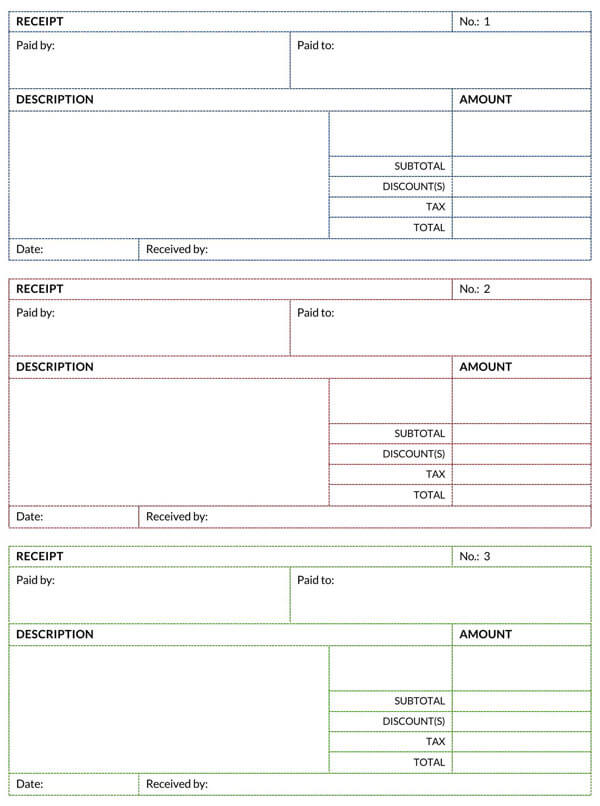

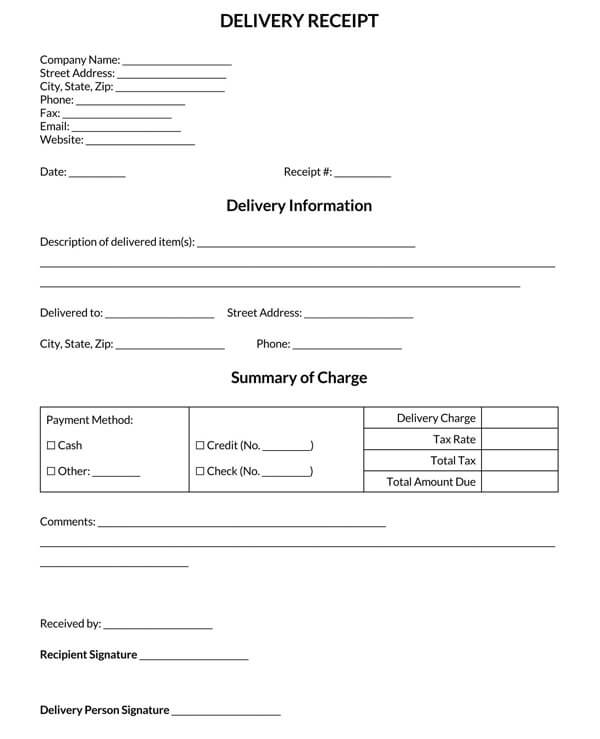

Transaction details display specific information that describe items bought or sold and payment methods used, including the date the transaction took place.

Transaction details include:

- The thing purchased as highlighted in the transaction details of a receipt relates to details of the commodities that have been purchased by a customer. This information is crucial to the business as it ensures that the business is in a position to keep track of the rate at which specific commodities are purchased and provide proof of the specific item bought by a customer in case of a return.

- Quantity purchased information on a receipt helps the business owners when it comes to stock taking. The business can know the quantity that should be increased and also by the specific margin. They can use this information to track the spending habits of their clientele and in the long run, they will determine the popular brands that are frequently purchased and do away with those that are less popular.

- Received by: this section in a receipt is used to highlight the person to whom the receipt is made to in this case the customer or organization which made the purchase. The business can use information in this section to identify the goods which customers purchase and also use this information to create better service delivery tailored to fit that customer.

- Received from: this part is used to show the person or the business which made the receipt it acknowledges that goods were dispatched and payment for the same has been received by the business. The transaction, therefore, is deemed to be complete in some instances this can be used to identify the specific employee in the business who made the sale, and this can thus be used in calculating the commissions for that particular employee.

Logo (optional)

A company or business can choose to include their logo in the receipts they issue, which is part of brand marketing that can be helpful to customers and other organizations which receive receipts from different businesses. The business logo in this context can assist the customer to quickly identify which business organization the receipt came from without having to go through the items listed in the receipt.

Original invoice number

The original invoice number is unique to a particular invoice and is used by businesses to keep track of the sales made and the amount that was in that invoice. The invoice number can also be used by the business to document payments and track the payments that are yet to be received.

The number is useful in keeping track of taxes paid by the business for accounting purposes and ensures that the invoice is a legal document since it is not considered legal without the original invoice number.

Scanning a Receipt

Scanning is the process that a business undertakes to convert a physical receipt to a digital file or image. The process uses optical recognition software to process the physical receipt with the help of the following devices.

Mobile apps

Several mobile applications exist and are used to scan receipts from businesses. The primary role or reason for scanning receipts is to keep track and analyze the different receipts. The mobile apps also assist businesses and customers in generating expense reports and creating and customizing files, such as PDF, stored in apps such as Google Drive for future reference.

Physical scanner

Physical scanners are used by businesses to scan documents using devices such as scanners, which convert the receipts into digital formats such as pdf. The documents can then be transferred to email or other necessary formats.

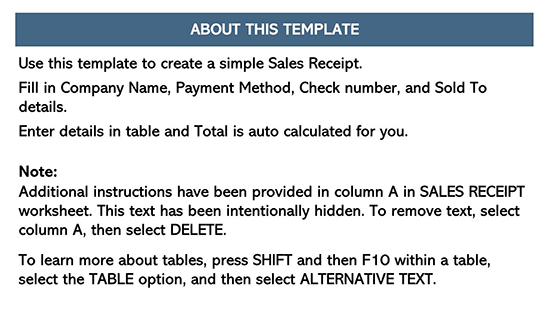

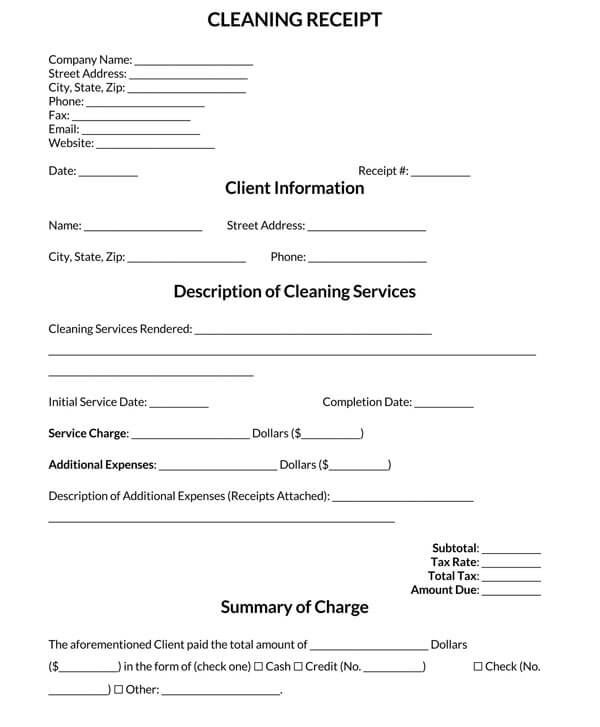

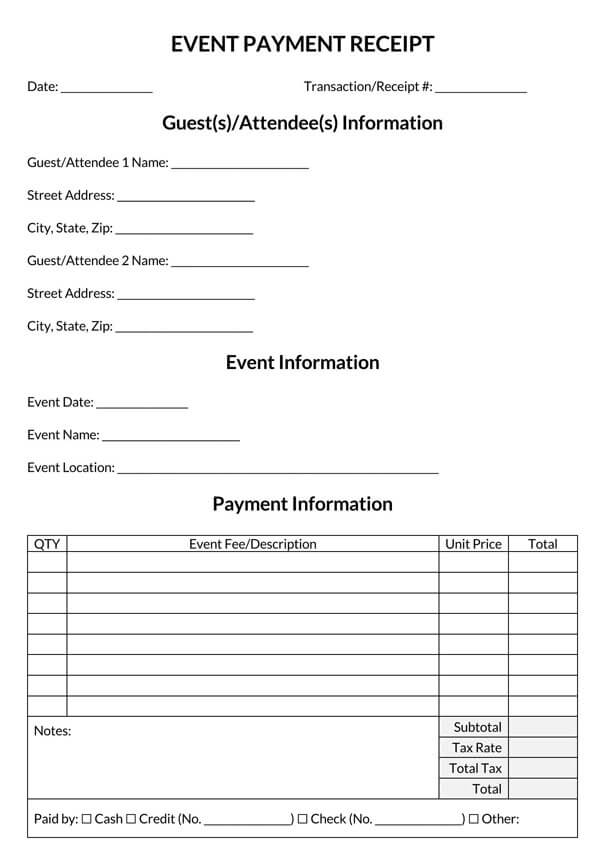

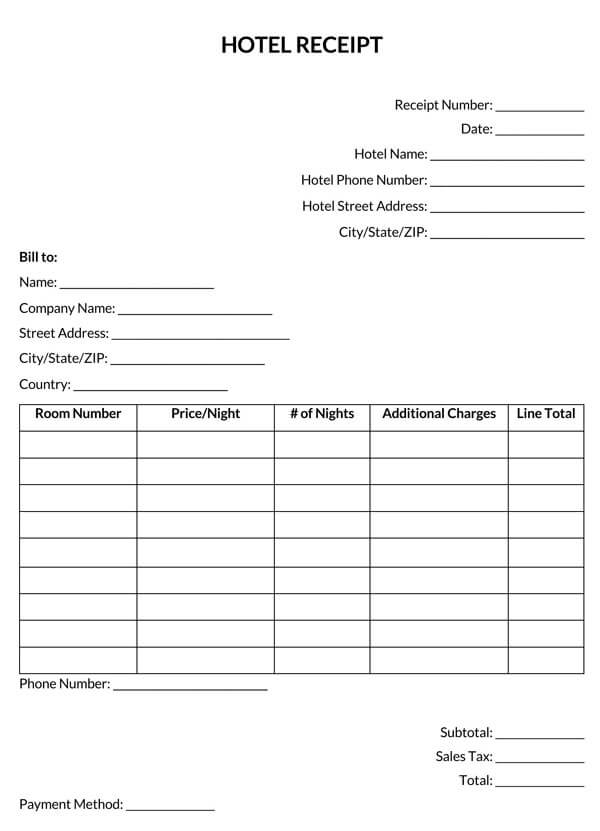

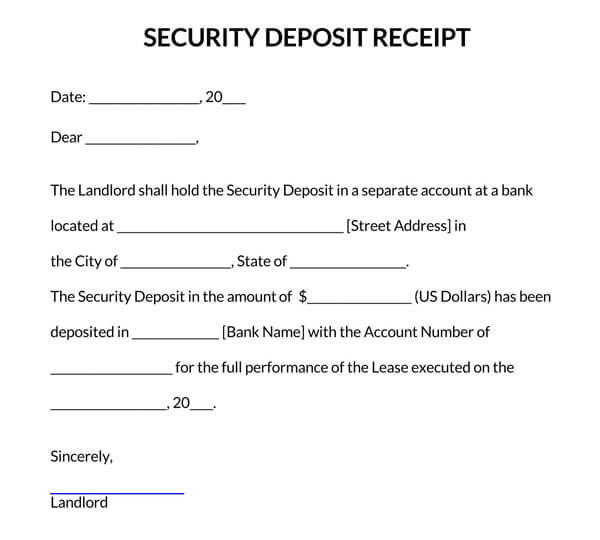

Free Payment Receipt Templates: By Type

Whether you need a receipt for a cash payment, credit card transaction, or online payment, we’ve got you covered. The templates are designed to provide a clear and professional record of every payment received, ensuring accuracy and transparency in your financial transactions. Choose the template that matches your payment method, download it for free, and customize it to suit your specific needs.

Conclusion

Receipts form an integral part of the business since they help in record-keeping by the businesses. The receipts assist the business owners in keeping meticulous and crisp records of the sales they have made during a particular period. Receipt records help inform the business about the amount of taxes that should be paid at the end of the year.