A Bank Authorization Letter is an official document written by an account holder to a bank manager to delegate authority or consent that their business partners or family members can conduct transactions in the account on their behalf.

Various reasons may prompt an account holder to write a bank authorization letter.

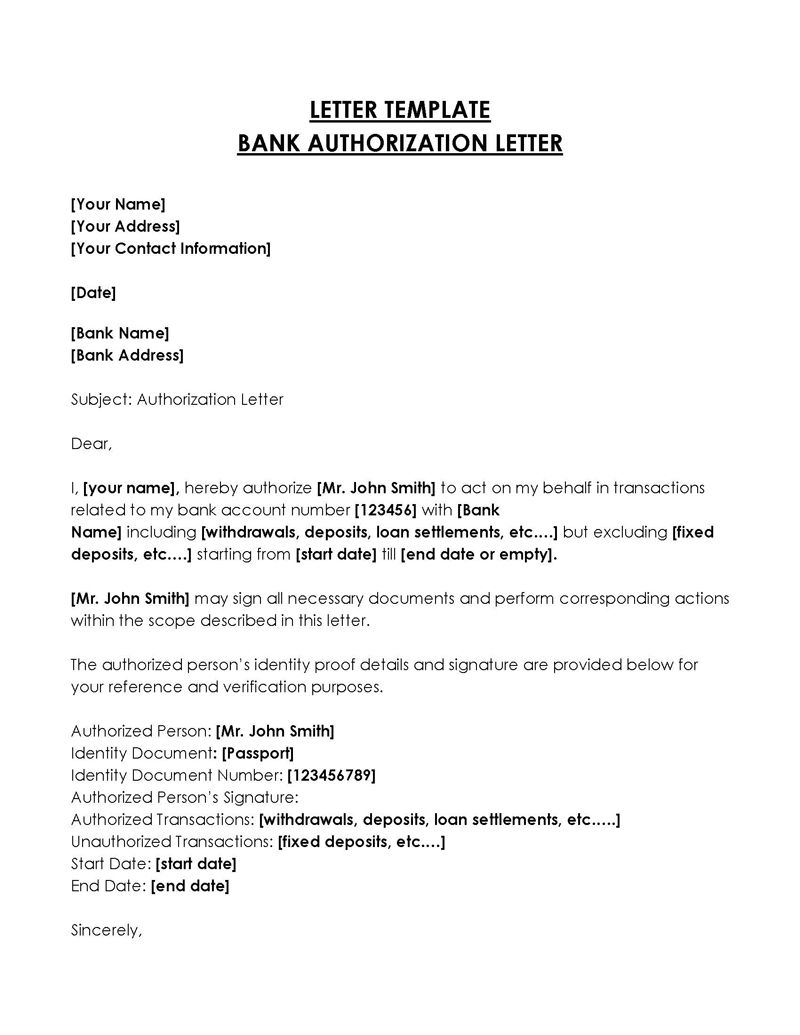

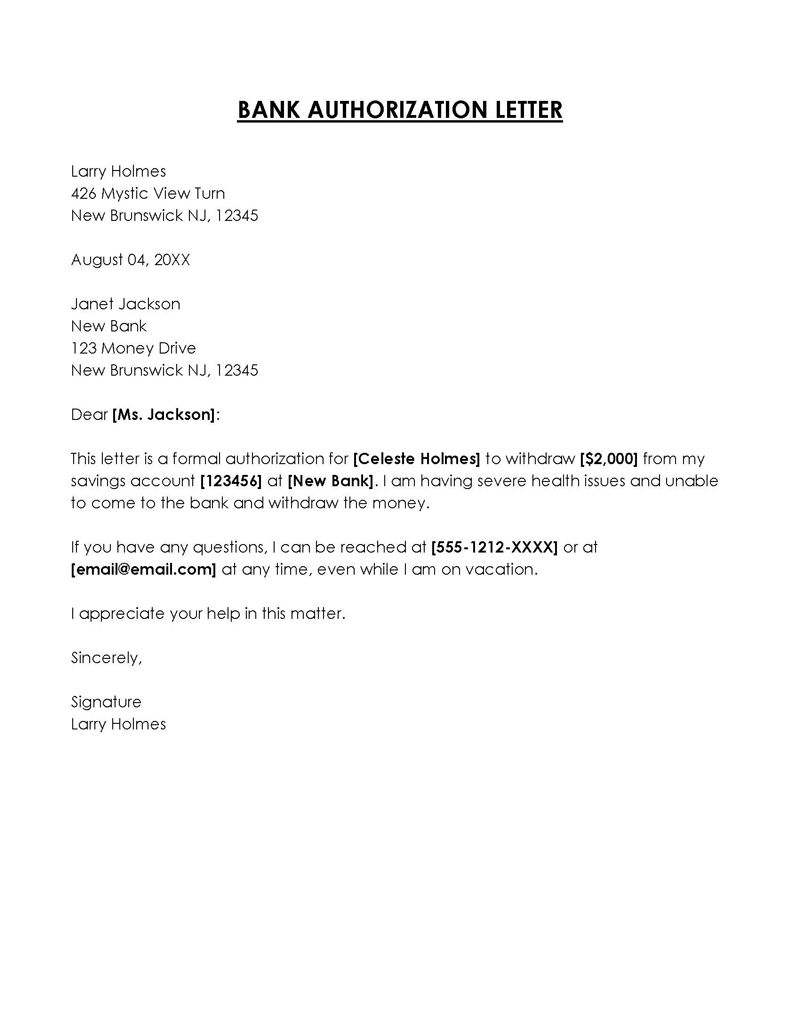

EXAMPLE

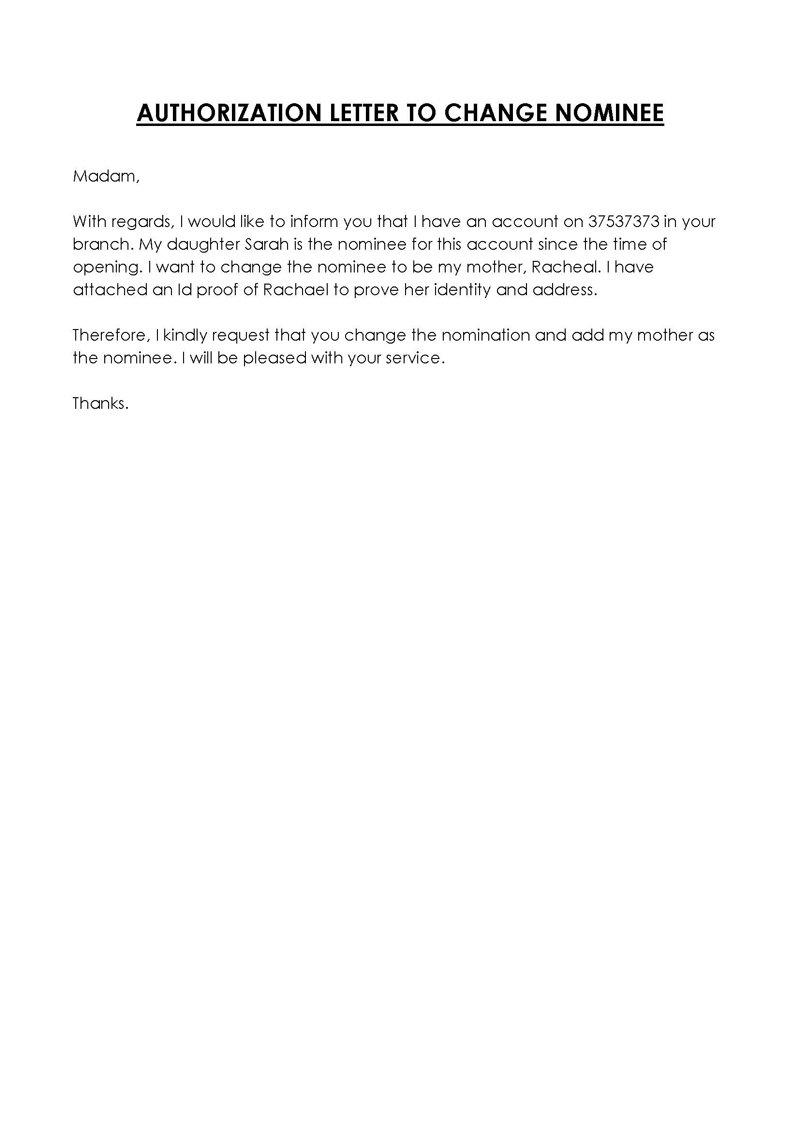

The account holder must write the authorization letter for the bank when they want to provide a third party with their bank statements.

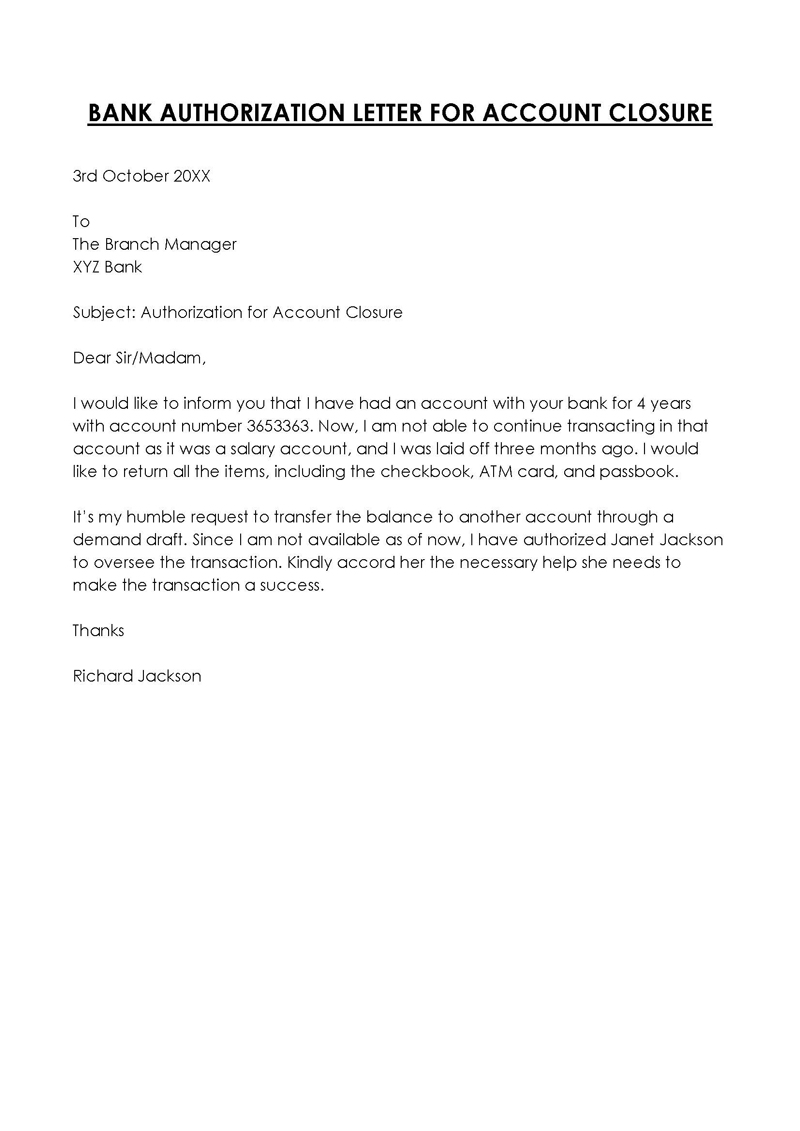

The bank statements summarize all financial transactions executed by the account holder and should, therefore, only be released to a credible person. This authorization letter may also be written if the account holder wishes to close their account. This enables the bank to start the closing process as stated by the third party acting on behalf of the account holder.

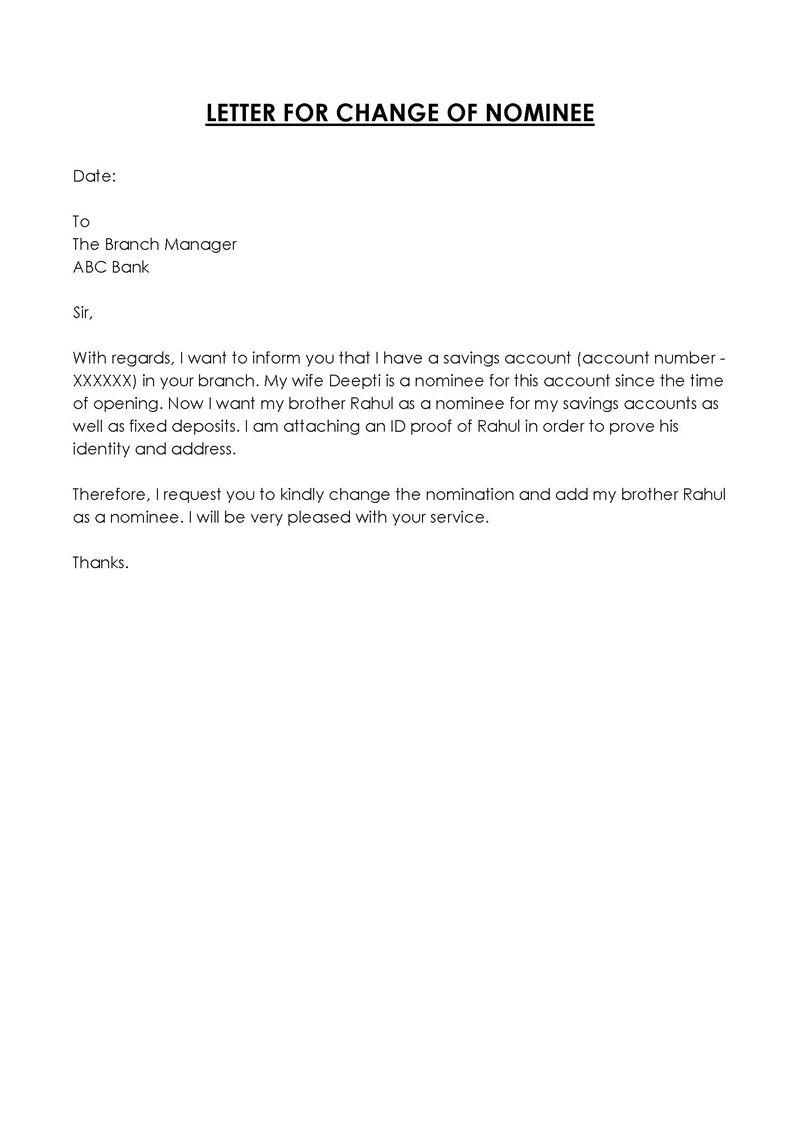

An account holder should also write a bank authorization letter if they wish to add or change nominees to their account. The authorised party will be permitted to add or change the nominee on behalf of the account holder. The letter can also be written if the account holder wants to change their bank branch. The letter should be sent to the current branch to instruct the manager to transfer the account on the account holder’s behalf. Finally, an account holder can also write the authorization letter to activate their frozen account. The authorized party will activate the frozen account on the account holder’s behalf.

Sample Letters

Below are carefully crafted sample authorization letters that offer you a convenient and time-saving solution, ensuring accuracy and professionalism in your communications with financial institutions. With the ease of adapting these samples to suit your specific needs, you can confidently authorize transactions, request account information, or delegate financial responsibilities, all while maintaining a formal and respectful approach.

Parties Involved in a Bank Authorization Process

When writing this authorization letter, the account holder must mention all involved parties. A party is an individual or entity involved in the bank authorization process. Stating the parties involved will help prevent misunderstandings and confusion.

The authorization letter should mention the following three parties:

The first party is the person or group that permits access to their account to someone else (third party). The person granting authority (account holder) must write and send the authorization letter to the financial institution/bank. In addition, the first party must explain the rights that the third party may exercise.

Second-party: financial institution

The second party is usually the bank or financial institution that is holding the first party’s account. The authorization letter is addressed to the second party. The second party receives the first party’s request to grant access to the bank account to the stated third party.

Third-party: the person receiving the authority

The third-party refers to the individual or group receiving authorization by the first party/account holder to conduct transactions on their behalf. The third party is answerable to the first party. The first party will be held responsible for the activities of the account by the bank. The third-party can only conduct the specific transactions authorised by the account holder.

How to Write a Bank Authorization Letter

The bank account holder must ensure that the authorization letter contains relevant information. The information contained in the authorization letter will ensure that the account holder can effectively communicate the authorization granted to the third party.

When writing a bank authorization letter, the account holder must include the following components:

Your name and address

First, the account holder must provide their name and address. This will ensure that the recipient can identify who the writer is. This will also provide the recipient with an address they can use to respond to the letter.

Date and time of authorization

Secondly, the specific date and time of authorization must be written to avoid future difficulties. It also ensures that the account holder is fully aware of when authorization was granted to the third party. It is also important that the writer ensures that the year is fully written to enhance clarity

EXAMPLE

2021, not 21.

Recipient’s name and address

Thirdly the bank name and address must be provided in the authorization letter. This will ensure that the appropriate bank branch receives the letter. The recipient’s name, who is often the bank manager, should also be written in the salutation. If the account holder is not sure of the recipient’s name, they can use the generic term ‘To Whom It May Concern’ to help avoid confusion.

Your bank account details

Next, the account holder should provide their bank details in the introductory sentence of the authorization letter. This will help show that they are an account holder with the bank. It will also help the bank manager identify the account holder’s bank account.

State your reason for authorization

The account holder should follow up by providing a reason for the authorization. The main reasons often provided can range from medical problems, legal bindings to financial issues. The account holder should ensure that the reason provided is detailed and specific.

Authorized transactions

The bank authorization letter should then contain the transactions the account holder has authorized the third party to make. The account holder should ensure that they write the exact explicit responsibilities granted to the third party. The responsibilities stated can include withdrawals, deposits, loan settlements, etc. This will ensure that the bank can inform the account holder if the third party performs any transactions they have not been authorized to conduct.

Unauthorized transactions (fixed deposits, etc.)

The account holder must also ensure that the authorization letter states all unauthorized transactions that the third party cannot conduct. These can be stated as restricted transactions, which may include fixed deposits etc. This ensures that the third party cannot act beyond the rights granted by the first party.

Start date and end date

The account holder should not neglect to include the permission period the third party has been granted in the letter. This should be indicated in the form of a start date and end date. This will ensure that the bank can halt any transaction made after the lapsing of the period stated by the account holder.

Closing

Finally, the account holder should conclude the authorization letter by politely requesting the bank manager to carry out the activities stipulated in the bank account authorization letter.

The account holder must also ensure that they provide the following information in the conclusion:

- Contact information: The account holder should provide their contact information to ensure that the bank manager can contact them for any questions or clarification that need to be made and also if any issues regarding the authorization process arise.

- Your name: The account holder’s name must also be included when signing off. This will help ensure that the bank manager remembers who the account holder is. It also ensures that the account holder adheres to the formal format of the letter.

- Signatures: The authorization letter should be presented to a notary where that signing can be witnessed. This will ensure that a certified notary public authenticates the letter. It will also help prove that the account holder made a sound decision to authorize access to their account to a third party.

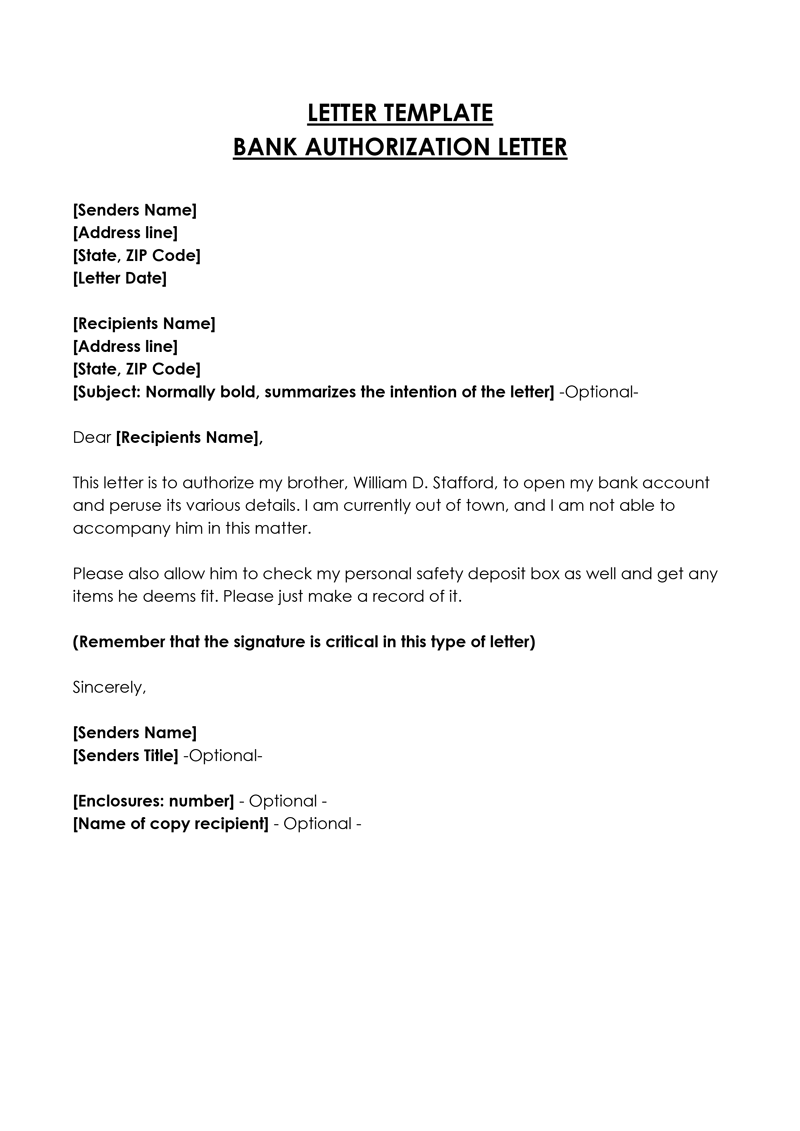

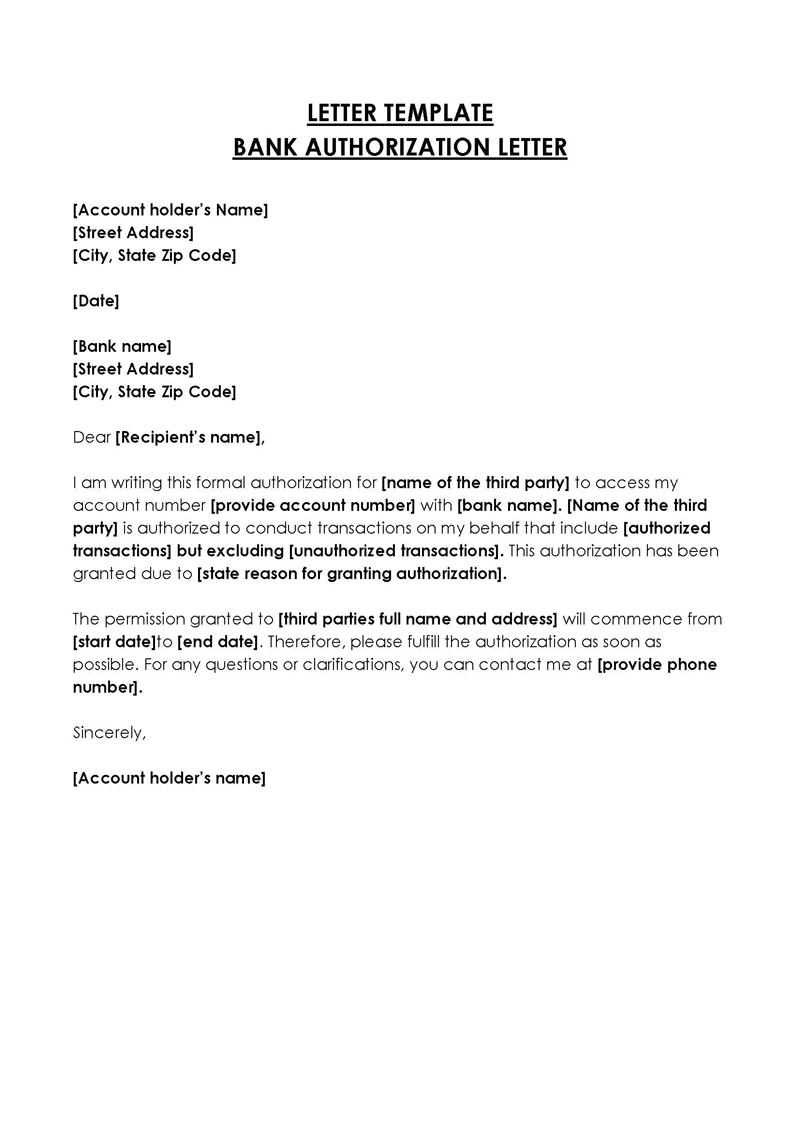

template

[Account holder’s Name]

[Street Address]

[City, State Zip Code]

[Date ]

[Bank name]

[Street Address]

[City, State Zip Code]

Dear [Recipient’s name],

I am writing this formal authorization for [name of the third party] to access my account number[provide account number] with [bank name].[Name of the third party] is authorized to conduct transactions on my behalf that include[authorized transactions] but excluding [unauthorized transactions]. This authorization has been granted due to[state reason for granting authorization].

The permission granted to [third parties full name and address] will commence from[start date]to [end date]. Therefore, please fulfill the authorization as soon as possible. For any questions or clarifications, you can contact me at[provide phone number].

Sincerely

[Account holder’s name]

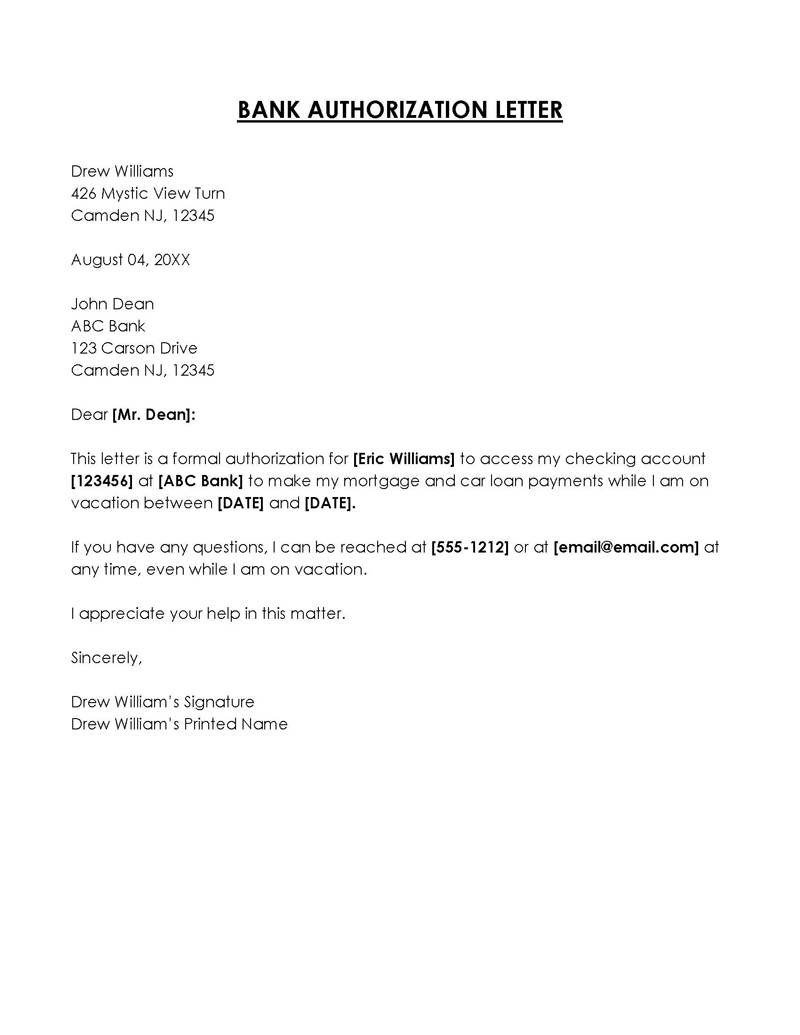

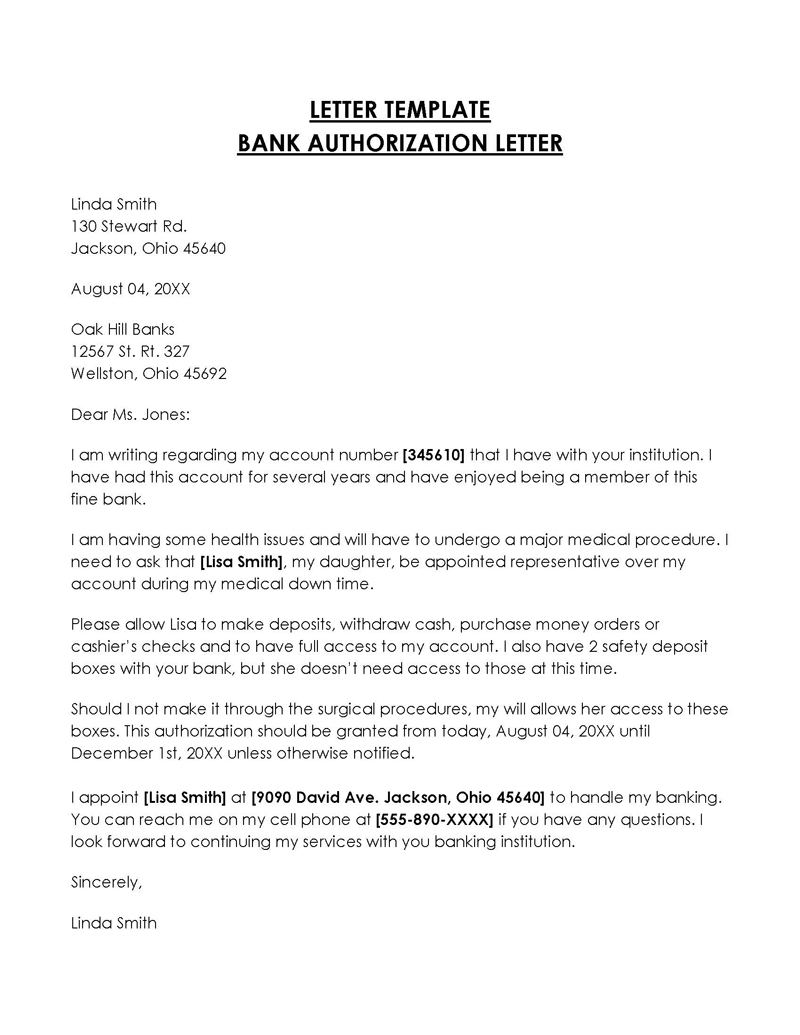

Bank Authorization Letter Samples

The importance of formal communication in banking transactions cannot be overstated. Here, we present illustrative sample authorization letters, serving as a guide to articulate requests and permissions with the required level of formality.

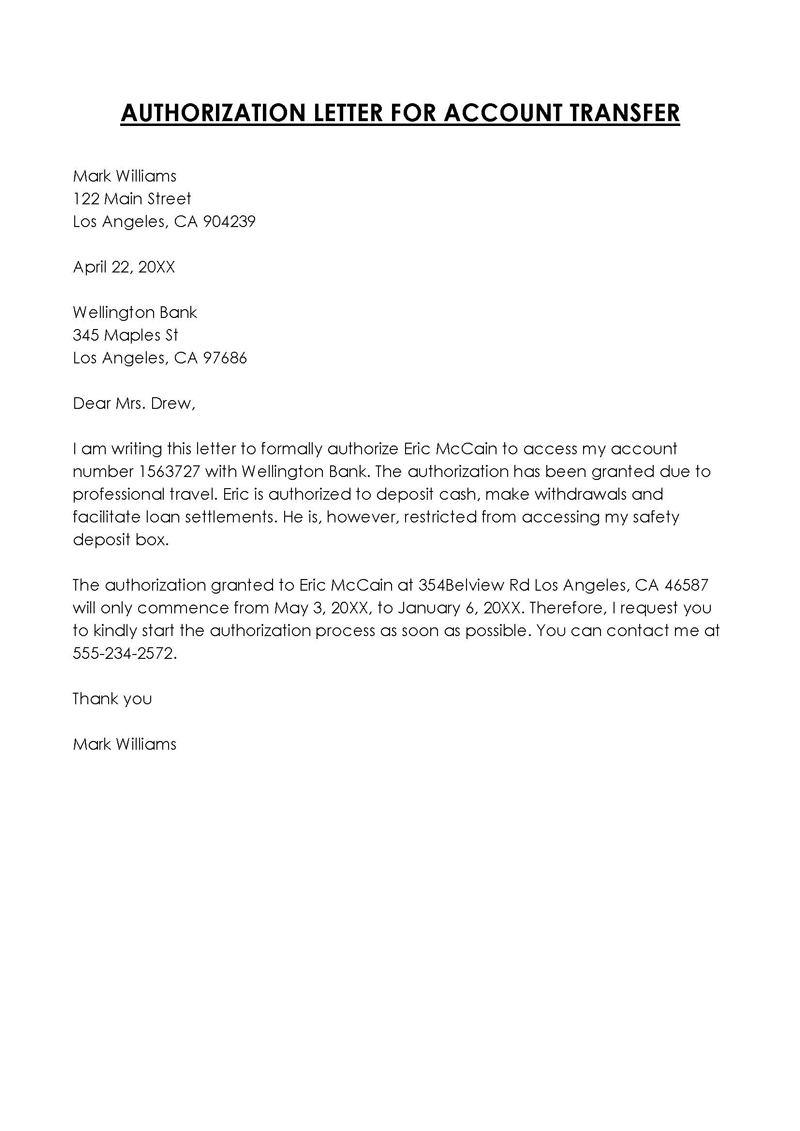

Authorization Letter for Account Transfer

Dear Bank Manager,

I, John Doe, holder of the account number 123456789, hereby authorize Jane Smith, bearing ID proof (Passport No. AB1234567), to act on my behalf in transferring my account to your Downtown Branch. This authorization includes handling all related paperwork and formalities needed for the successful transfer. Please ensure all communications regarding this process are directed to Ms. Smith.

I trust that Jane Smith will carry out these actions with diligence and responsibility. Should any additional documentation be required, please contact me at (555) 123-4567. This authorization remains valid until December 31, 20XX, unless revoked earlier.

Thank you for your assistance in this matter.

Sincerely,

John Doe

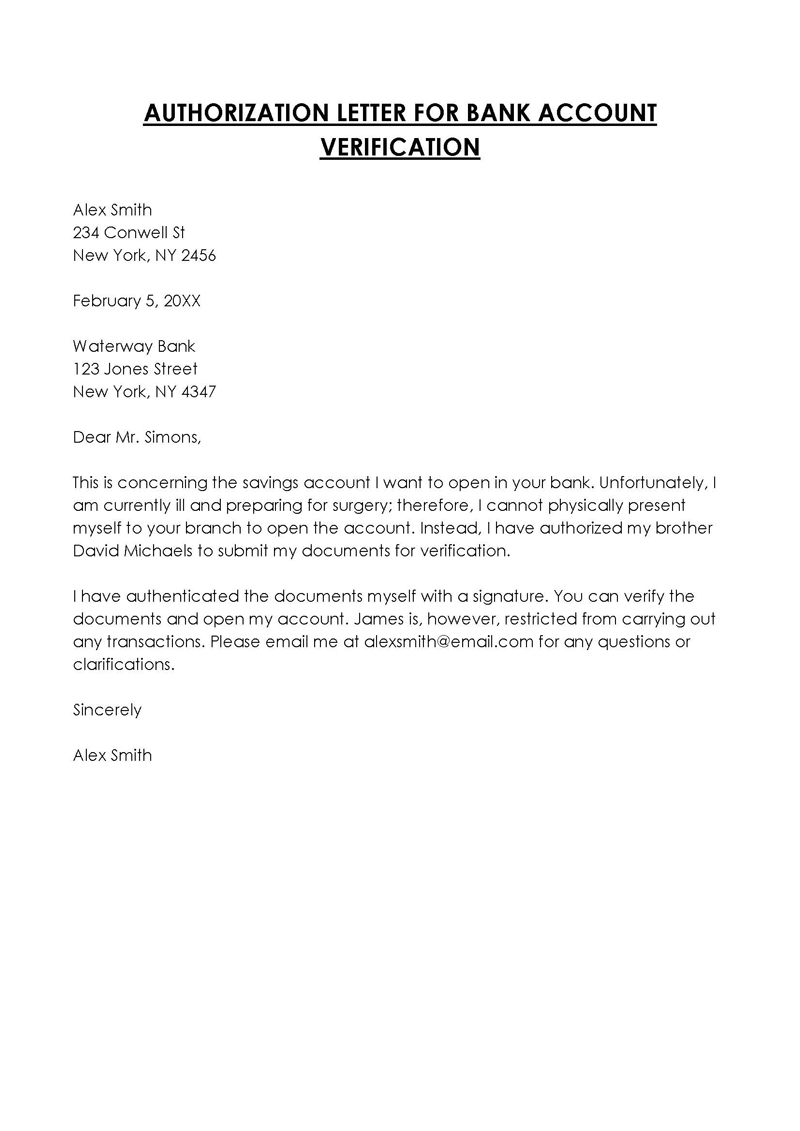

Authorization Letter for Bank Account Verification

To Whom It May Concern,

I, Emily Johnson, with the account number 987654321, hereby grant permission to Michael Brown, holding ID (Driver’s License No. CD7891011), to verify my bank account on my behalf. This authorization includes accessing account details, statements, and any related documentation necessary for verification purposes.

I assure you that Michael Brown is trustworthy and has my complete confidence to carry out this task. In case of any queries, I can be reached at (555) 987-6543. This authorization is valid until June 30, 20XX, unless I state otherwise.

I appreciate your cooperation in facilitating this verification process.

Best Regards,

Emily Johnson

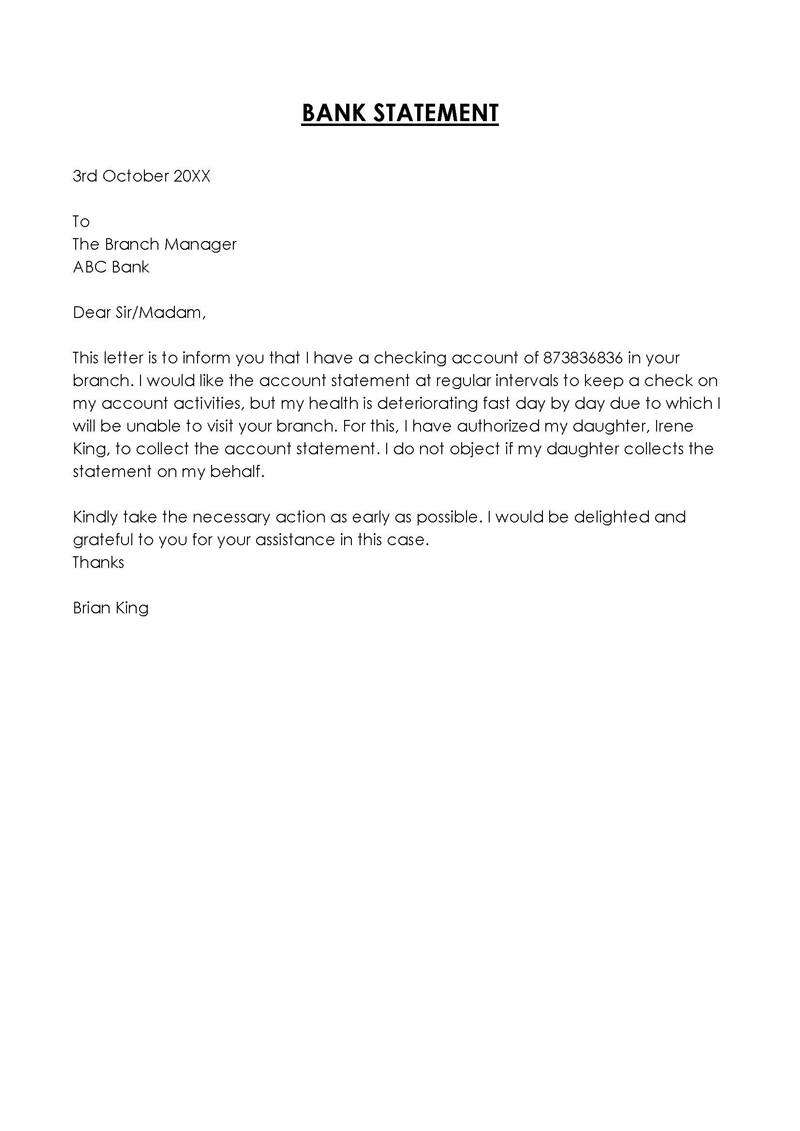

Authorization Letter for Bank Statement

Dear Bank Manager,

I, Alice Green, am the holder of account number 1122334455. I am writing to authorize David Wilson, who will present their ID proof (State ID No. EF1234567), to collect my bank statements. They are permitted to receive statements dating back to January 20XX, if necessary.

I fully trust David Wilson to handle this sensitive information with the utmost confidentiality and care. Should you require any further information, please feel free to contact me at (555) 678-9101. This authorization is effective until September 30, 20XX.

Thank you for your assistance in this matter.

Kind Regards,

Alice Green

Bank Authorization Letter for Account Closure

To the Manager of ABC Bank,

I, Robert Lee, holding the account number 5566778899, hereby authorize Lisa Martin, with ID (Social Security No. 123-45-6789), to close my bank account on my behalf. This includes signing any documents required for the closure and completing all necessary formalities.

I have entrusted Lisa Martin with this responsibility and request that all procedures be completed as per my authorization. For any clarifications, please contact me at (555) 321-0987. This authorization is valid until March 31, 20XX, unless otherwise notified.

Thank you for your attention to this matter.

Sincerely,

Robert Lee

Authorization Letter for Operating Bank Account

Dear Bank ABC,

I, Laura Thompson, the account holder of 9988776655, hereby authorize Kevin White, bearing identification (Voter ID No. GH1234567), to operate my bank account in my absence. This includes conducting transactions, making deposits, and handling any related banking activities.

I assure you that Kevin White has my full trust to manage these activities responsibly. Please contact me for any further verification at (555) 456-7890. This authorization is in effect until November 30, 20XX, unless I revoke it earlier.

Your cooperation in this regard is highly appreciated.

Yours Faithfully,

Laura Thompson

Analysis

The authorization letters serve as useful samples for readers due to their clear structure, precise language, and attention to necessary details. Each letter begins by addressing the relevant authority, which establishes the recipient and context of the communication. The introduction of each letter succinctly states the purpose, with the writer’s name, account number, and the nature of the authorization mentioned, thereby avoiding any ambiguity. This clarity is essential in formal communications, especially in banking contexts where precision is paramount.

The middle paragraph in each letter introduces the authorized person, including their name and specific identification details, which is a crucial security measure. This inclusion not only legitimizes the authorization but also provides the bank with the necessary information to verify the identity of the authorized individual. The specification of the authorization’s scope and duration, along with any specific instructions or limitations, demonstrates a thorough understanding of the process and preemptively addresses potential queries.

Finally, the closing paragraph reiterates the writer’s contact information, offering an avenue for further communication, and ends with a formal sign-off, including the writer’s full name. This structure ensures that each letter is comprehensive yet concise, providing all necessary information in a professional and accessible manner. The consistent format across different types of authorization also aids in reader comprehension, making these letters a useful guide for drafting similar documents in the future.

Tips for Writing a Bank Authorization Letter

A well-drafted authorization letter for the bank should be effectively drafted to ensure information is appropriately conveyed to the bank manager.

It is therefore critical that the account holder consider the following tips when drafting an authorization letter for a bank:

The tone of the letter

The bank authorization letter is regarded as a business letter. Therefore, using the appropriate tone is essential, as it reflects the relationship between the account holder and the bank manager. The appropriate tone in the authorization letter can be achieved through thoughtful, direct, and respectful use of words and sentences.

Keep the letter precise and short

The account holder should ensure that the information provided in the authorization letter is short and precise. This will help save the bank manager’s time, who is likely busy. It will also reduce the chances of misunderstandings, which often result from lengthy letters.

Keep the letter formal

As a formal document, the bank authorization document should be typed and not hand-written. A hand-written letter can be illegible, resulting in difficulty in understanding the information written by the account holder; therefore, banks do not accept a hand-written authorization letter. The account should also ensure that the letter is correctly formatted with no spelling or grammatical errors.

Be clear when specifying the duties

There should be clarity in the specified duties of the third party. The specificity of the duties authorized and unauthorized by the account holder will enable the bank to discern what the third party can and cannot do. It also helps ensure that the bank can secure the first party’s account.

Final Thoughts

A well-written bank authorization letter should effectively communicate an account holder’s authorization to have their account handled by a third party. The account holder should ensure that the letter is short, direct, and clear to avoid misunderstandings with the bank. The letter should contain authorized and unauthorized transactions, the account holder’s account details, and a reason for the authorization to ensure that adequate information is provided to the bank.