An independent contractor agreement is a legal contract between an independent contractor and a client/business that outlines the terms of the working relationship between the two parties (client and independent contractor).

These agreements are used to protect both parties’ interests and ensure a clear understanding of the expectations and responsibilities of each party. Although agreements of independent contractors vary in content, some specific conditions and details should be included to make them legally binding. By including these conditions and details, this agreement can help to avoid misunderstandings and disputes between the involved parties.

What is an Independent Contractor?

An independent contractor is an individual hired by a client to perform a certain job or assist the client in whatever capacity they so desire. Clients should keep in mind that an independent contractor won’t be subject to any policy, and so, may work on their own schedule (unless explicitly stated in the agreement) and work in any atmosphere they desire, so long as they honor the commitments made to the client within the agreed-upon time frame.

Most often, independent contractors include, but are not limited to, the following services:

- Any freelance service, i.e., artist, writer, designer, photographer, video grapher, etc.

- Any consultancy-based gig, including, but not limited to, professional services, healthcare services, financial services, and much more.

note

Keep in mind that legal services are slightly different, and an advocate or lawyer won’t be considered an independent contractor within the boundaries of a 1099 agreement.

- Any one-time gig. This typically includes things like guest-speakers, performers, etc., as well as independent laborers that have been contracted to assist with a particular project.

How Do I Enlist an Independent Contractor?

Naturally, the first step of this process is to identify individuals with whom you would like to work. Once you have agreed to enlist their services in exchange for compensation, you can begin drafting a 1099 agreement to formalise the arrangement.

To make the arrangement formal and legally binding, follow these steps:

- Provide a w9 form to the contractor: A W9 form authorises the client to collect employment information and requires the independent contractor to provide their Social Security Number (SSN) and Employment Identification Number (EIN) directly to the IRS. These are used to verify employment status, as well as track tax-related information on behalf of the government. Keep in mind that, if a contractor does not have adequate work authorization, the client will not be able to legally hire them.

- Background Checks: This step, while not necessary, is highly recommended when clients are enlisting contractors for the first time. If the client doesn’t have a personal relationship with the contractor or has no mutual connections that can speak to the credibility of the contractor, a background check can be very useful – It will give the client a better idea of the work ethic and history of the contractor, while also disclosing any criminal offenses they may have committed.

- Draft the 1099 Form: Drafting the 1099 form is a very simple process. Some clients may require more (or less!) clauses than specified within the template, such as a non-disclosure clause, or an exclusivity clause. This is very important and gives the client a certain degree of legal protection in case of a breach, so we highly recommend having a legal professional around when drafting and adding additional clauses.

- Signing the forms: Once the drafting process is complete and you have had a legal authority verify the contents of the agreement, all you need to do is sign and date the document, as well as obtain the signature of the independent contractor.

If the monetary amount is less than $600, no contract will be required. If the amount is greater than $600, clients are required to obtain a copy of the 1099 form for taxation purposes. Also, keep in mind that the specifics and particulars of a contract will always have to be in accordance with state law. Naturally, laws vary from state to state, and so, the client and the contractor should be sure to draft the document within accordance to state law in the state in which the agreement is drafted and enforceable.

To help you out further, we’ve also compiled a template of an independent contractor agreement that may be used as-is, or modified to best suit your needs. Keep in mind that this only includes the body of the contract, and doesn’t include the signatory section, which usually lists the names of the parties contingent to the contract. It can be found below.

Agreement Templates: By Types

The fact that there are different types of independent contractor agreements implies that a unique type best fits particular business arrangements between a contractor and a client.

This article will discuss the different types of independent contractor agreements and explain the critical differences between them so that all parties (contractor and client) can better understand and gain helpful knowledge of independent contractor agreements. Then, keep reading for further details!

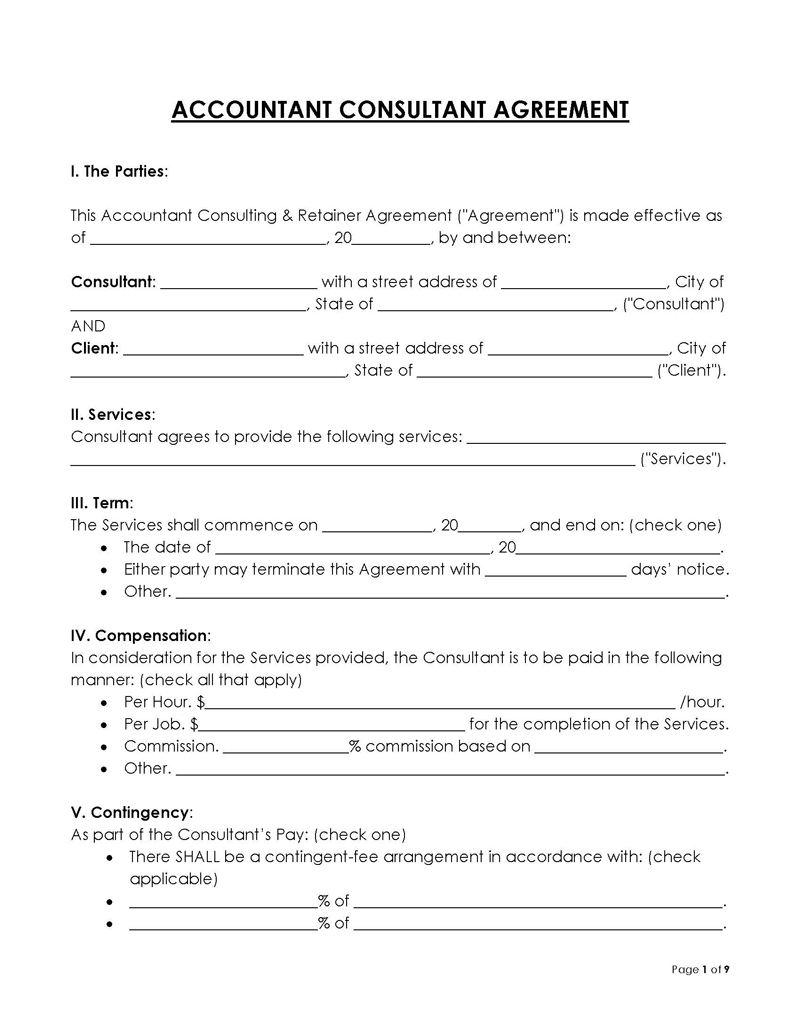

Accountant consultant agreement

An accounting consultant agreement is a legally binding document detailing the tax-related and financial-related services provided by an independent contractor (an accountant) for a client. In some parts of the US, an accountant is also called an accounting professional. Accountants are professionals who are licensed by the State to provide financial-related services to individuals and organisations. They are responsible for preparing and maintaining financial records, ensuring compliance with taxation laws under the State and Federal IRS (Internal Revenue Service) agencies, and advising on financial matters.

An accountant’s primary roles include financial reporting, tax planning, audit reports, and business and regulation overview. In addition, the standard accounting consulting services include financial forecasting, profitability analysis, advising on regulatory compliance issues, and other accounting consulting services.

Under an accounting consultant agreement, an accountant will agree to provide the services mentioned above in exchange for an agreed payment. An accountant or certified public accountant’s (CPA) wage depends on their experience and the pay the client plan to offer.

According to the U.S. Bureau of Labor Statistics, the accountant’s pay rate per year is $70,500, while the hourly rate is $33.89 per hour.

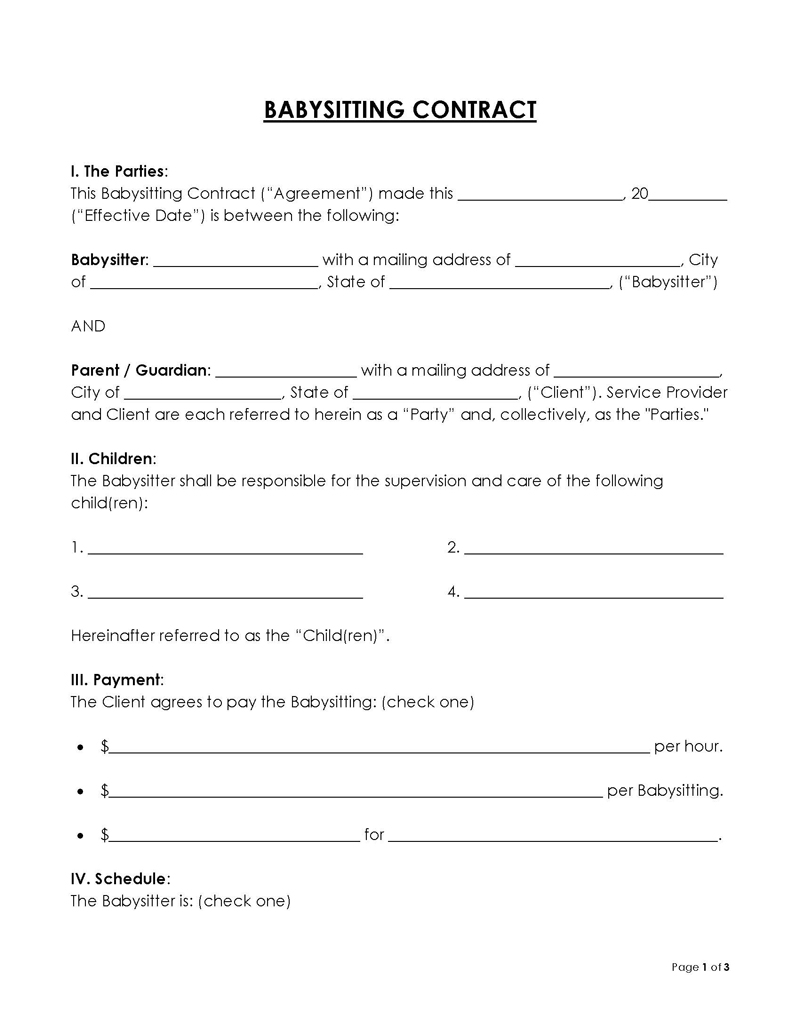

Babysitting contract

The babysitter contract is a legal agreement between a client (parent) and an independent contractor (babysitter) who will watch over the client’s children. The babysitter may be hired individually or weekly, with most babysitters being responsible for paying taxes themselves but earning compensation in return. Therefore, the contract must outline the specific responsibilities of the babysitter while caring for the client’s child (e.g., groceries/meal plans and medication allergies).

Also, the contract must include the following details:

- Compensation (hourly rate)

- Start date and time

- Termination procedures

- Transportation methods

- The babysitter’s emergency contacts

Both parties must agree upon all these to make the working relationship smoothly without any issues. In unique cases, the babysitting contract may be long-term. This arrangement benefits the client (parents) who may be absent for a while due to work trips, vacations, or are temporarily incapacitated.

According to sources like Care.com, SitterCity.com, Indeed.com, and others, a babysitter’s pay is about $15 – $18 per hour depending on factors such as experience, responsibilities, location, and babysitting type (short or long-term).

Bookkeeping service agreement

A bookkeeping service agreement is a legal agreement that outlines the terms of accounting services (on a one-time or monthly basis) to be rendered by an independent contractor (bookkeeper) for a client. In addition, the agreement shall include the following information:

- The entire identity of the bookkeeper and client

- The bookkeeping services that will be provided

- Agreed-upon compensation

- The signatures of the parties involved (client and bookkeeper)

The bookkeeper will have access to a client’s financial records, revenue details, receipts, and other personal financial information, making it essential for the client to choose an honest, experienced bookkeeper who can be trusted with personal financial information.

According to the U.S. Bureau of Labor Statistics, a bookkeeper’s pay rate per year is about $45,560 per year, while the hourly rate is $21.90 per hour depending on factors such as overall experience, professional certification, bookkeeping service type (part-time or full-time), location, and whether it is going to be a remote role or in-person role.

Caregiver agreement

A caregiver contract agreement is a document that can be used to outline the terms of an agreement between an independent contractor (caregiver/nurse) and a client (senior citizen who can’t live on their own anymore, patient, or guardian of the patient) concerning caregiving services in exchange for an agreed payment. The alternative names for the caregiver agreement are as follows:

- The eldercare agreement

- Agreement for personal care

- Agreement for eldercare

- Agreement for caregiving

The information in the caregiver contract agreement should outline the specific tasks expected of the caregiver, such as:

- Cooking nutritious meals

- Providing companionship

- Housekeeping duties

- Confidentiality clause

- Pay

- Work schedule

- Living arrangement (if it is a live-in caregiver)

The caregiver service agreement is supported by the federal model act called “The Caregiver Advise, Record, Enable (CARE) Act, which permits the use of family caregivers when patients are admitted to a hospital and educate them on how to care for their sick loved ones at home.

According to the U.S. Bureau of Labor Statistics, a caregiver’s average salary per year is about $29,430 per year, while the hourly rate is about $14.15 per hour depending on factors such as overall experience, schedule (part-time or full-time), and whether it is going to be a live-in caregiver.

Cleaning service agreement

A cleaning service agreement is a legal document detailing professional cleaning services. It provides terms of the agreement between the client and the hired independent contractor with their specific responsibilities regarding the indoor or outdoor cleanliness of a client’s property (residential and commercial). A cleaning service agreement must include the following details:

- Payment information

- The duration of the service

- Job location

- Schedule

- Description of the necessary cleaning equipment

- Signatures of the parties (client and cleaning company)

The cleaning service agreement is also known as:

- A maid service agreement

- Cleaning services contract

- Housekeeping agreement

- Residential cleaning services contract

- Janitorial services contract

Construction contract

The construction contract is a legal document that spells out the details of a construction project between a client and an independent contractor (sole contractor or construction company). A construction contract may include the information below:

- Contract budget

- Payments disbursement details

- Specific tasks involved

- Materials and labor

- Legal rights of the contractor

- Starting and completion dates

- Licensing and permits

- Dispute resolution

- Inspection

- Insurance

- Liquidated damage

These details will help keep the project managed smoothly while prioritizing the interest of all parties involved.

A construction contract agreement can also be referred to by other terms, which are:

- Construction agreement

- Construction contract

- Construction management agreement

- Service agreement for construction

- Contract for construction

- Construction contractor agreement

- Contractor agreement

Types of construction contracts

- Fixed Price — The contractor presents a budget for all the services to be provided and a total quote covering all materials and labor.

- Cost Plus — The client agrees to pay “at cost” for all the contractor’s expenses, including labor and materials. The contractor will profit by being paid a percentage or fixed fee agreed upon before work begins, with no profits going beyond this point unless otherwise specified in writing and signed off by both parties beforehand.

- Time and Material — The contractor buys materials, provides construction services at an agreed-upon rate, and pays all their staff. The profit is made when the contractor charges the client more than what will be used to complete the project.

- Unit Pricing — This is when the client demands to have the contract estimated per square foot ($/SF) or any other unit of measurement.

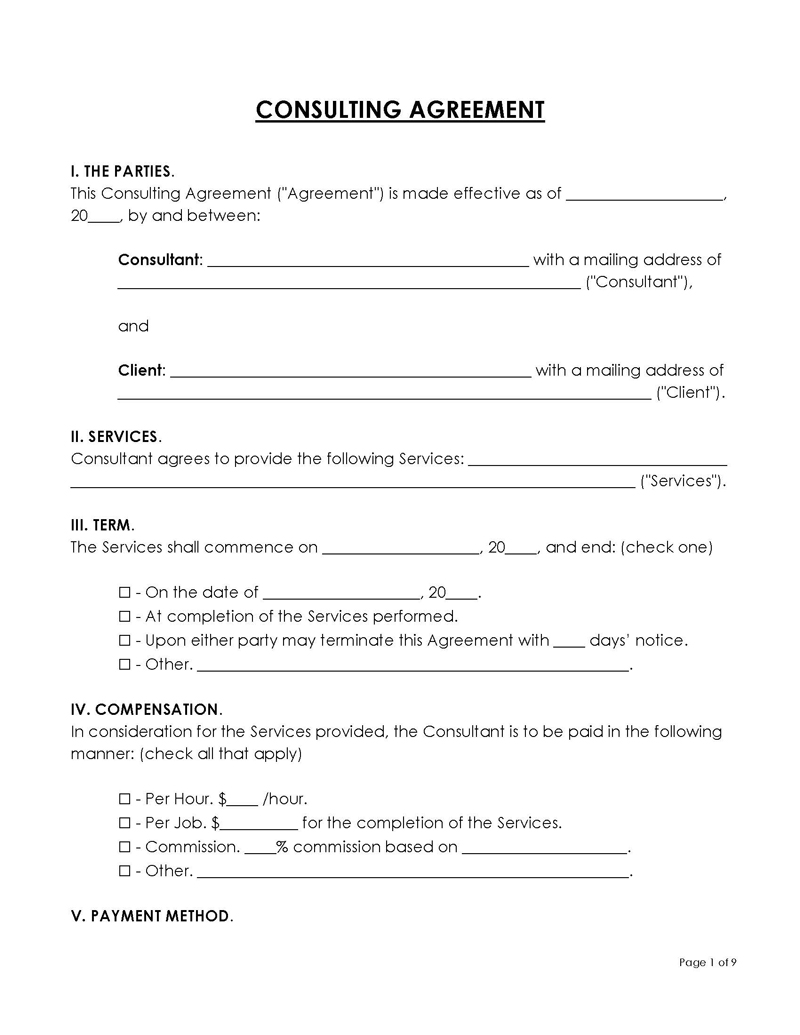

Consulting agreement

Consulting agreement is a document that outlines the terms of an agreement between an independent contractor (consultant) and a client. The consultant offers clients the expertise of their field in exchange for payment. This can be anything from advice, knowledge, or professional service.

A consultant is either paid per hour or project. Additionally, a retainer (a minimum amount paid immediately by the client to the consultant in advance) is applicable in most cases, which gives the consultant more security concerning the client’s commitment.

A consulting agreement must contain the following clauses:

- Confidentiality clause — Confidentiality clauses are a way to ensure that the consultant does not disclose any information about their client, especially information that, when shared with a third party, could cause irreparable harm and violation of trade secrets on behalf of either party.

- Non-compete clause — The con-compete clause guarantees that none of the parties (client and consultant) during or after the consulting agreement will compete in each other’s businesses. It is still generally recommended regardless of the laws in the State.

- Indemnification clause — An indemnification clause guarantees that the consultant agrees to provide their services while assuring them protection in case of any consequences during the agreement. Although, the agreement may or may not cover negligence or other liability caused by carelessness on behalf of the client.

- Termination clause — A termination clause is used in case either party wants out. The client or consultant must give each other notice within a specified period. The language should be simple, and if any other conditions are attached, such as payment for completed work, they must also appear in the clause so both parties will be on the same page.

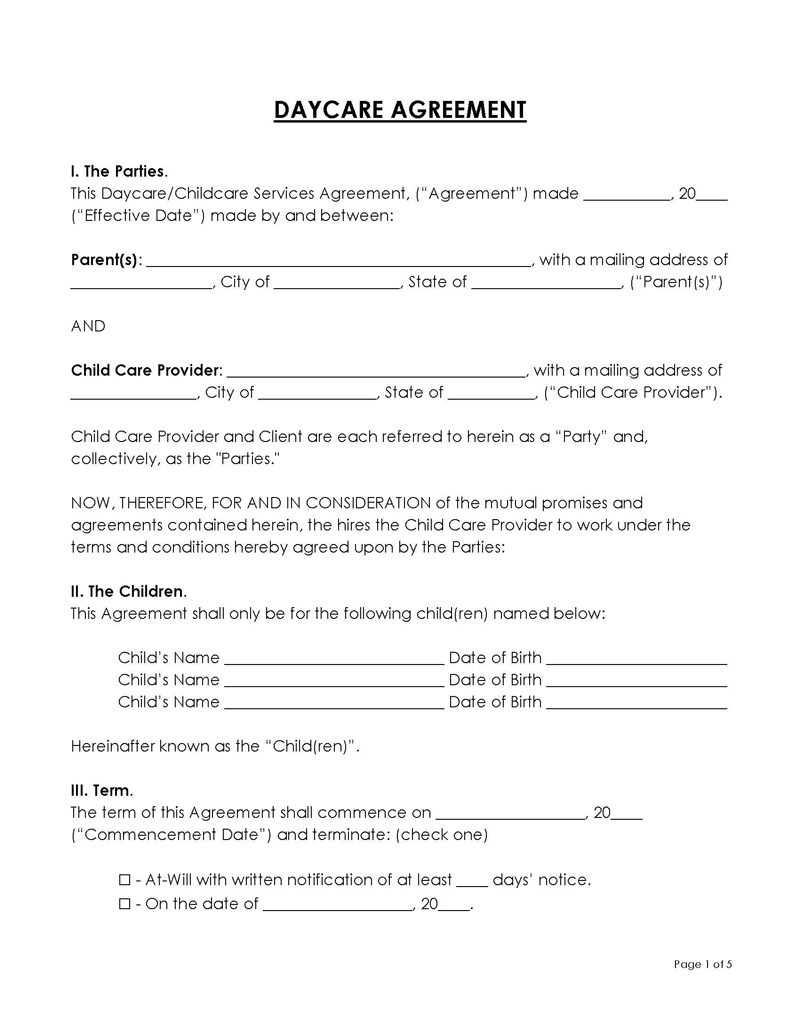

Daycare agreement

A daycare agreement is a document that outlines the terms of the agreement between a client (parent/guard) and an independent contractor (childcare service provider). Below are the relevant details in a daycare agreement:

- Payment arrangement

- Work hours

- Personal information of the child and parents/legal guardians

- Information about the childcare provider

- Termination procedure

The parties involved may seek the assistance of a legal counsel to create such an in-depth contract.

According to AmericanProgress.org, the average cost to provide center-based daycare for an infant in the United States is $1,230 per month. In a home-based daycare, the average cost is $800 per month — based on a 25 hours per week basis. Daycare is deductible, but the amount of tax deduction depends on the parents’ income.

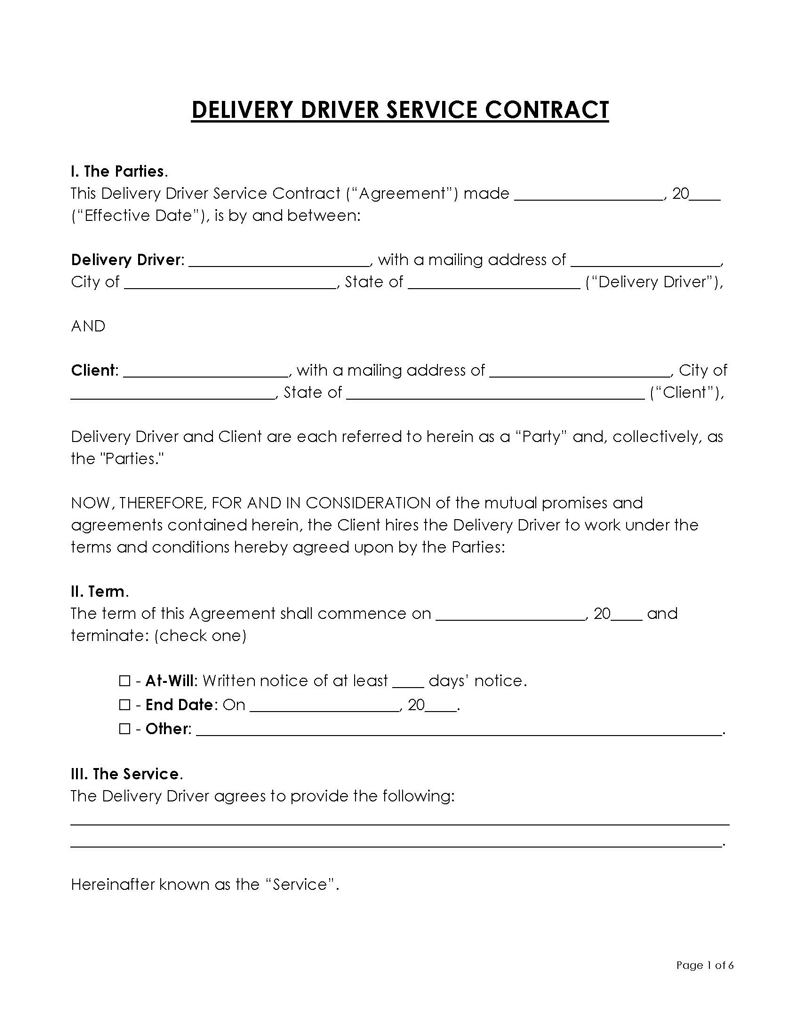

Delivery driver service contract

A delivery driver service contract is a document that outlines the conditions of the agreement between a client (a company that requires the means to deliver their good to customers) and an independent contractor (an individual whose job is to deliver goods to customers). This agreement is usually for short or medium-distance delivery drivers. Famous examples are pizza delivery and Grub hub. Whether a vehicle will be provided or the driver will make the vehicle available depends on the agreement between the contractor (driver) and the client (company).

According to the U.S. Bureau of Labor Statistics, the mean wage estimate for delivery drivers per year is $ 42,630, while the hourly rate is $ 20.50 per hour. Although, depending on the State, delivery drivers may not be paid an hourly wage but on a per delivery basis.

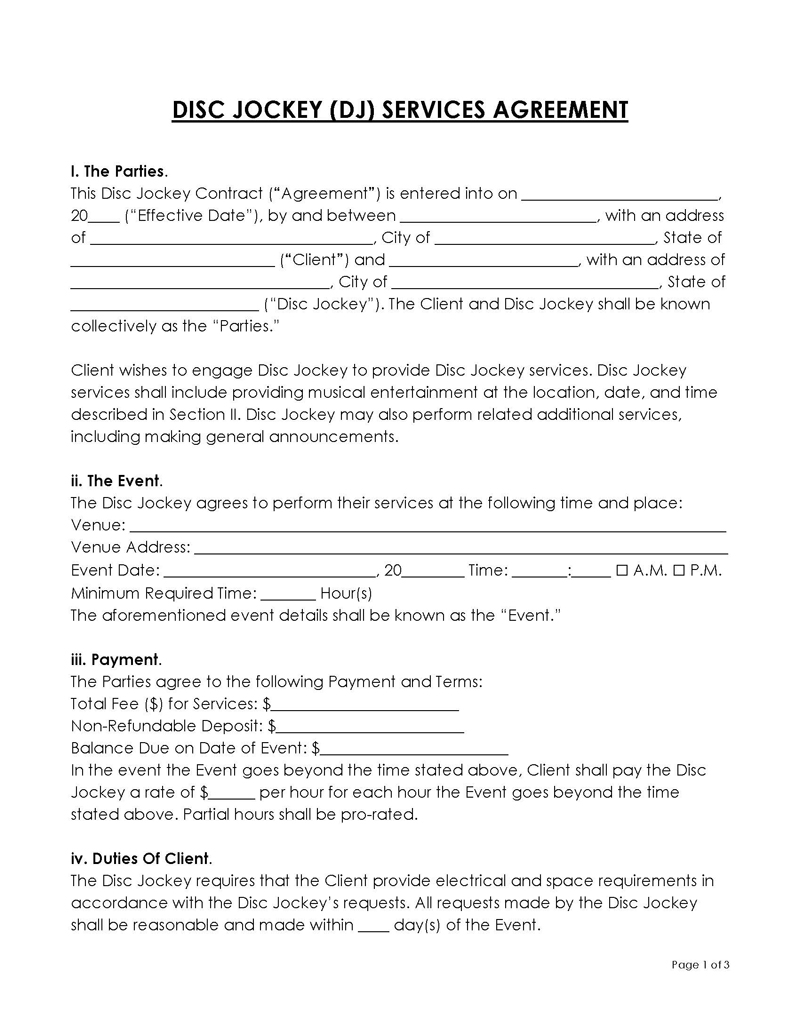

DJ disc jockey service agreement

The disc jockey services agreement is a contract that details the business arrangement between a client and an independent contractor (DJ) for a particular event. The pay may be per gig or hour, depending on the client’s choice. At the time of booking the service, non-refundable deposits will be made.

The following information should be in a disc jockey service agreement: DJ’s name, event date & time, termination clause, and duties of each party involved. A DJ’s pay ultimately depends on the location, event types, equipment required, and the number of hours. According to Thumbtack, DJs are paid about $450 to $550 per gig.

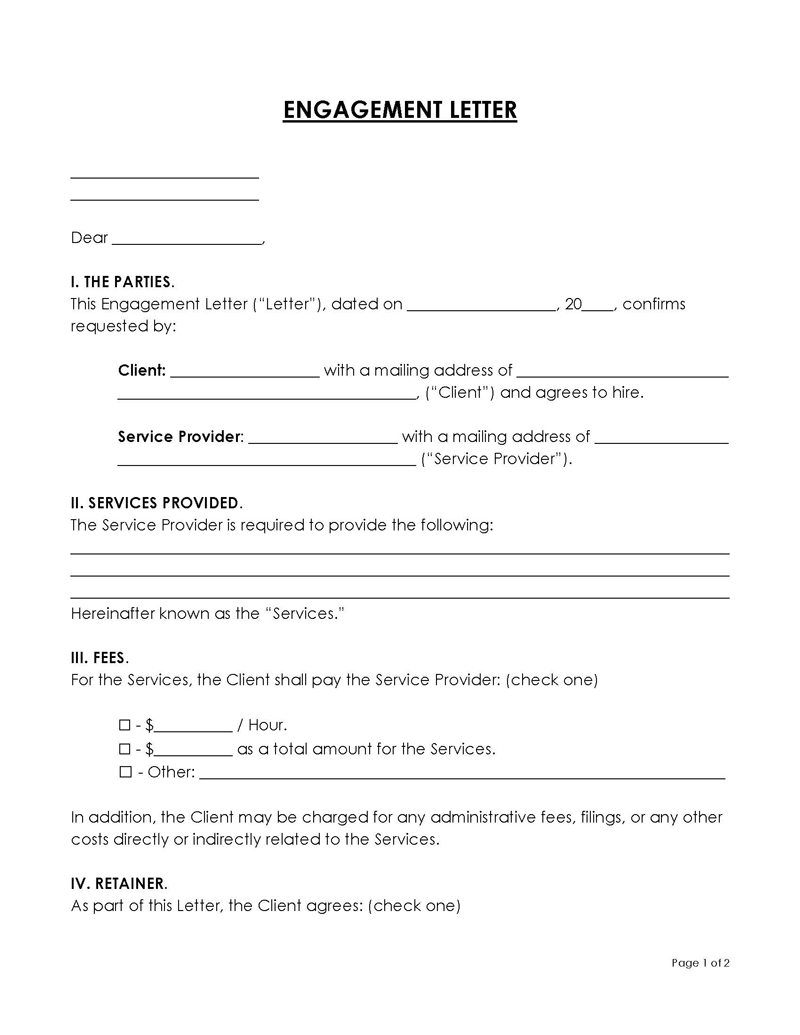

Engagement letter

An engagement letter is an agreement that details the expectations concerning the business relationship between a company and a client. Even though this agreement also outlines costs, services to be delivered, deadline, and compensation like other contract agreements, the format is less formal. It excludes all the legal jargon that will be found in other contractual agreements. Irrespective of the exclusion of legal jargon, an engagement letter is still a legally binding document that must meet the expectations of both parties involved.

Independent contractors/businesses such as attorneys, auditors, accountants, and consultants commonly use engagement letters, even if their clients are individuals or large corporations.

Retainers are a significant part of engagement letters. Retainers signify the client has shown commitment to excellence and security while also trusting that they have paid for quality service.

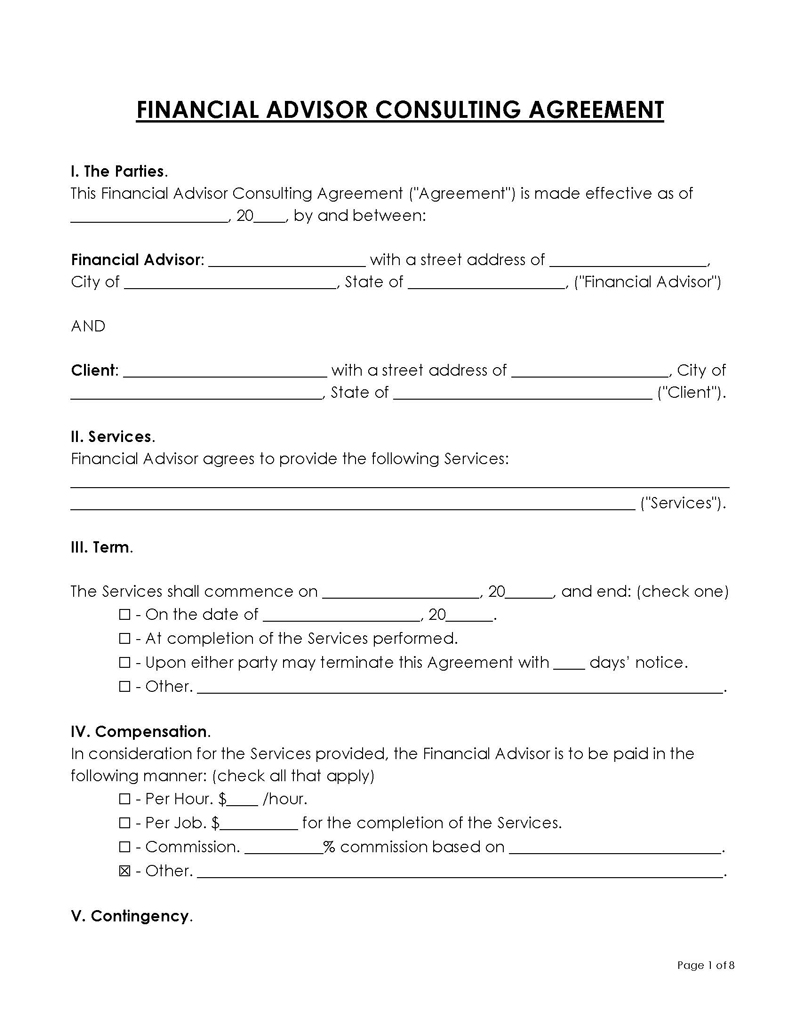

Financial advisor consulting agreement

A financial advisor consulting agreement is a document that contains the privileges and permissions a client has bestowed to an independent contractor (an advisor) to validate a legal consulting agreement. An advisor’s service to individuals and companies varies on various levels.

The responsibilities of an advisor to an individual include investment guidance, tax planning, and monthly budget planning.

In contrast, an advisor’s responsibilities towards organizations include assisting with risk management decisions, representing the company in an official capacity, creating and presenting a financial plan (retirement, education, expenses, investments, taxes, etc.), and creating a plan to increase profitability by streamlining the business model. An advisor may or may not be a licensed individual.

According to the U.S. Bureau of Labor Statistics, the average salary of a financial advisor/consultant per year is $94,170 per year, while the hourly rate is $45.27 per hour.

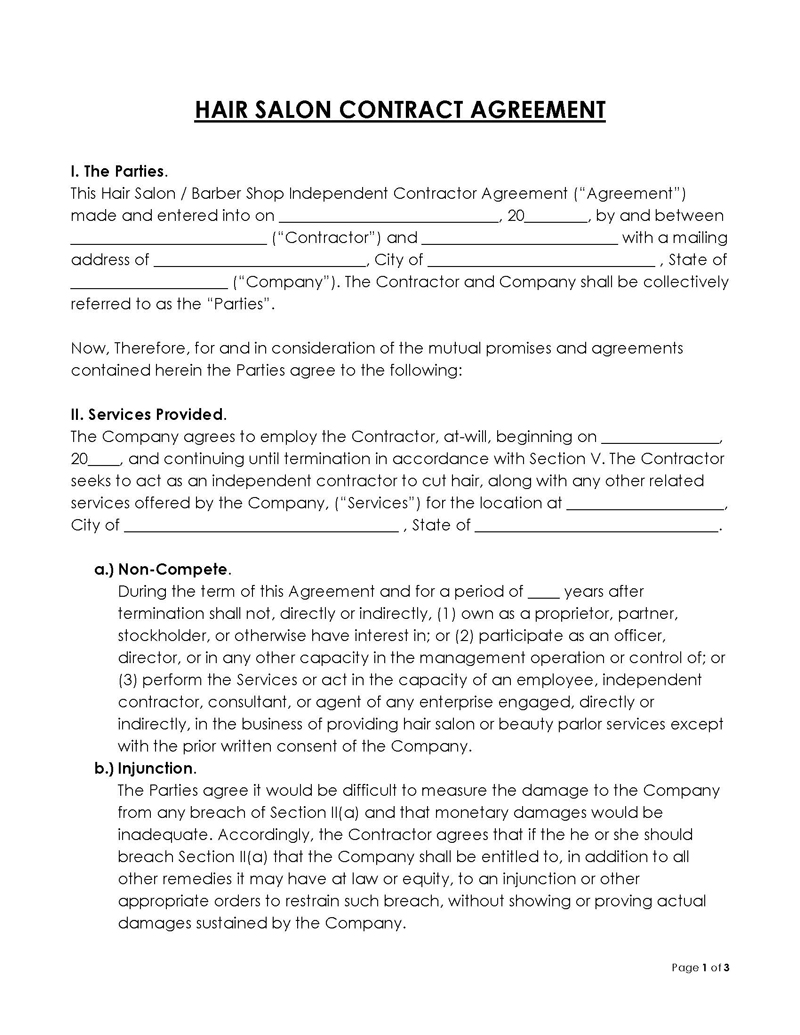

Hair salon contract agreement

The hair salon independent contract agreement is a document that details the business arrangement between a hair stylist or barber and a salon company. As independent contract workers, the hair stylist and barber are responsible for obtaining clients themselves while being given equipment by the salon company to work with. In addition, they return a certain percentage (%) of sales generated back to the salon company. In a case where the salon company is only charging the hair stylist or barber the rent for booths /chairs use, the agreement used is called the salon (booth) rental agreement.

The hair salon contract agreement and salon (booth) rental agreement include the following details:

- Date of the agreement

- Name and address of the lessor (salon company)

- Name and address of lessee(hair stylist or barber)

- Size of the space

- Fixed rental amount

- Equipment and personal property provided by the lessor (salon company)

- Real estate taxes

- State of governing law

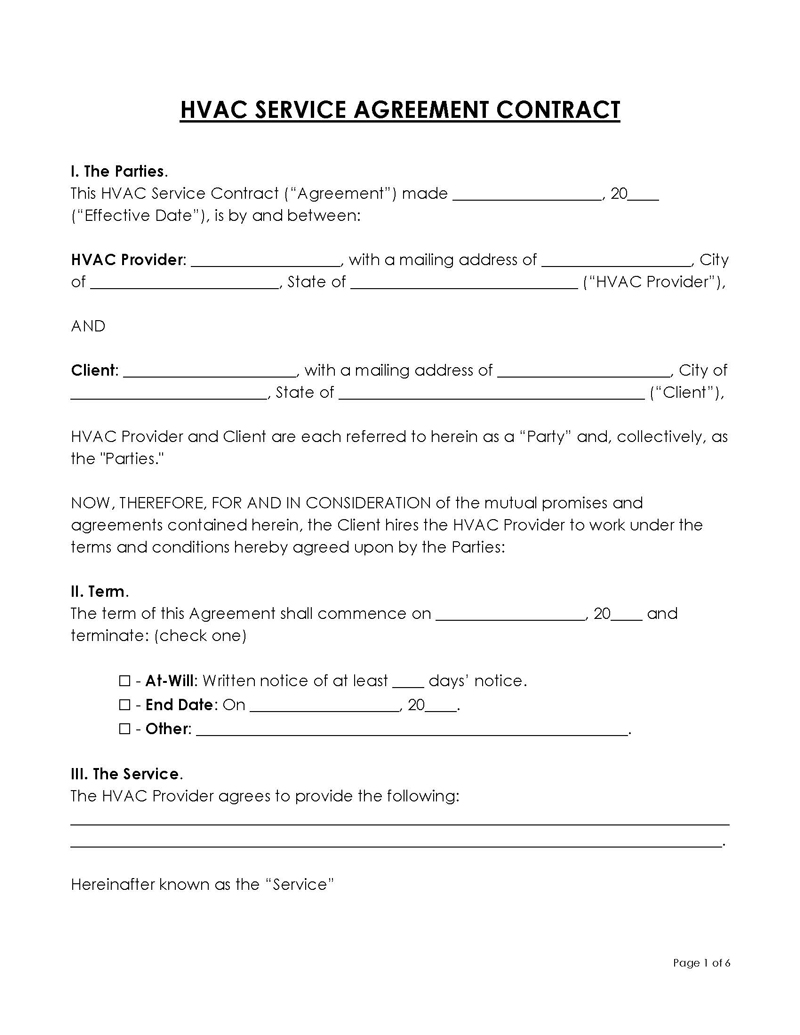

HVAC service agreement contract

An HVAC service agreement contract is a document that outlines the terms of the agreement between a client and an independent contractor (HVAC technician or HVAC service provider) concerning the client’s HVAC system maintenance and repair purposes. HVAC means Heating, Ventilation, and Air Conditioning. This HVAC service agreement contract includes a monthly retainer fee which guarantees constant routines test of the client’s HVAC system.

An HVAC technician’s responsibilities include installing, cleaning (changing filters), repairing, and testing an indoor climate system for a residential or commercial property.

According to the U.S. Bureau of Labor Statistics, the average pay of an HVAC technician per year is $48,630 per year, while the hourly rate is $23.38 per hour.

Lawn care service contract

lawn care service contract is a document that outlines the terms of the agreement between a client (commercial or residential property owners) and a contractor (landscaper). Some typical responsibilities of a landscaper included in a lawn care service contract include hedging, applying fertilizer, spraying pesticides, mowing, removing weeds from walkways, watering plants, and clipping. Lawn care contracts are an excellent way for clients to ensure their lawn stays healthy, thriving, and beautiful. The client may choose between regular mowing services at weekly or monthly rates depending on their preference while benefiting other maintenance requests.

According to the U.S. Bureau of Labor Statistics, the hourly rate of lawn care is $ 16.94 per hour, and the annual rate is $ 35,240. The square foot rate of lawn care is $4-$12/SF (source: HomeGuide). A monthly retainer is often included in the lawn care service contract, especially in the southern regions of the United States, where there is active sunlight throughout the year.

Legal service retainer agreement

A legal services retainer agreement is a document that states the conditions of legal service to be rendered by an independent contractor (attorney) for a preset number of hours. Legal services retainer agreements are perfect for clients who want to ensure they have constant access to their attorney and frequent update on their legal matters. In addition, the attorney usually offers their services at discount rates if the agreement is made to maintain continuous monthly payments, which also helps the client save money in the long run.

According to the U.S. Bureau of Labor Statistics, an attorney makes about $127,990 annually, while the hourly rate is $61.54 per hour.

Marketing consulting agreement

A marketing consulting agreement is a document that outlines the terms of the agreement between an independent contractor (marketing consultant or marketing consulting firm) and a client (the organization that has hired their service to assist). Marketing consultants use their expertise in marketing to help clients (companies) define the best ways of presenting themselves (companies) and expand on potential consumers. Marketing consultants are essential for any business looking to expand its customer base. They can develop strategies that will make it easy enough so anyone can buy what their client is selling. The contract becomes legally binding once the parties involved have signed the contract.

According to ZipRecruiter, marketing consultants make about $52,464 annually, while the hourly rate is $14 to $29.

Below are the primary sections a marketing consulting agreement must contain:

- Services and compensation

- Confidentiality

- Term of termination

- Limitation of liability

- Reports

- No solicitation

- Arbitration and equitable relief

- Ownership

- Return of company materials

- Consultant obligations

- Services and compensation

- Return of company materials

Massage therapist contractor agreement

A massage therapist contractor agreement is a document that outlines the terms of an agreement between an independent contractor (massage therapist) and a client (the company where they will be providing services). This protocol ensures that the therapist and the client’s interests are protected, especially regarding liability and confidentiality. The contract usually includes essential details such as the party that would be providing equipment (massage oils, therapy table, towels, and sheets) needed for work and the party that would be responsible for maintenance of the workspace.

Below are the different types of massage therapists:

- Hot Stone

- Deep Tissue

- Pregnancy (Prenatal)

- Aromatherapy

- Reflexology

- Shiatsu

- Trigger Point

- Sports

- Swedish

- Thai

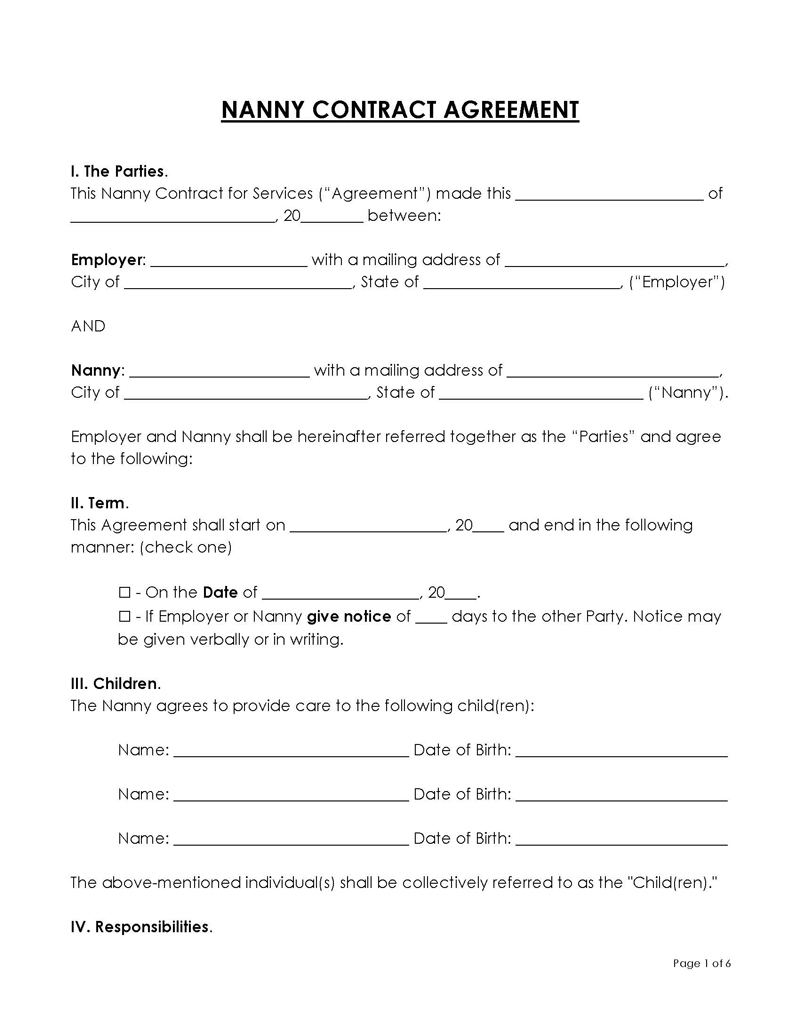

Nanny contract agreement

A nanny contract agreement is a document that outlines the terms of an agreement between an independent contractor (nanny) and a client (parent or legal guardian of the child). A nanny contract is commonly an at-will arrangement. The nanny’s service is to take care of the client’s children in exchange for payment either as a 1099 independent contractor or employed employee. Depending on the client, this could be part-time or full-time. The payment method for a nanny is usually hourly, including reimbursements such as travel costs and compensation for extra hours.

A nanny contract agreement should include the following:

- Nanny’s schedule

- Transportation

- Duties

- Pay and benefits

- Maximum hours per week

- Forbidden acts

- Termination procedure

The duties that will be included in a nanny contract agreement include meal preparation, housekeeping duties, and everyday care. Because children are involved in this arrangement, it is a common practice for clients (parents/guardians) to speak to the nanny’s references and carry out background checks on the nanny for security reasons. According to (source: Page 25 – 2017 INA Salary and Benefits Survey). The average pay for nanny service per hour is $19.14/hr, depending on the experience.

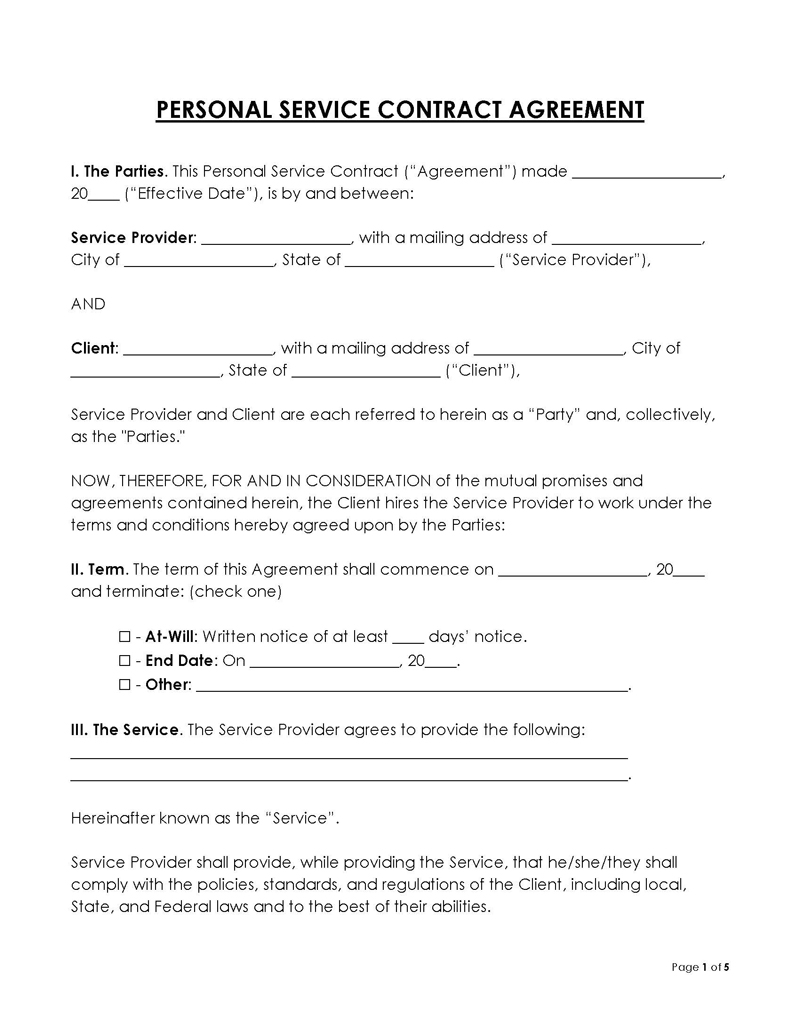

Personal service contract agreement

A personal service contract agreement is a document that outlines the terms of an agreement between an independent contractor (personal service provider such as personal shoppers, personal chefs, personal assistants, private drivers, and dog carer/walkers) and a client.

Forms of personal service contractors’ agreement:

- Non-government contractor arrangement is when the personal service provider’s work is related to the client’s private life or business but is not an employee or contractor to the client.

- Government contractors’ arrangement — a personal service agency that solely provides a personal service for government agencies.

On the other hand, individuals who offer clients personal services may merge to form a corporate entity called a personal service corporation or a professional service corporation. Examples of such corporate entities are law firms, construction firms, accounting firms, and veterinary clinics.

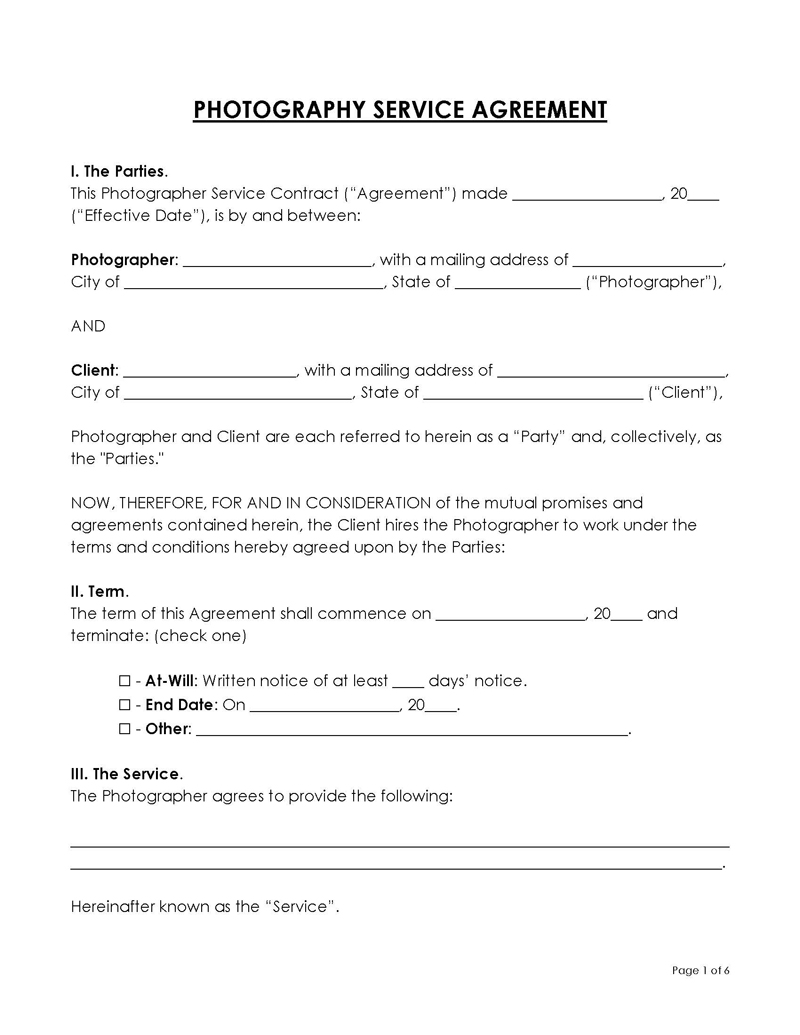

Photography service agreement

A photography service agreement is a document that outlines the terms of an agreement between an independent contractor (a photographer for personal or commercial photoshoot service) and a client. This is a straightforward contractor agreement with basic details such as party location, party size, service hours, and the expected number of pictures. This contract ensures that all the necessary photography services are covered. In addition, it defines who owns any intellectual property or other assets. It also includes standard payment terms guaranteed to be met with deadlines for both parties involved.

A photography service agreement can be referred to as other terms such as:

- A contract for photography services

- Photography contract

- Photographer contract

- Wedding photography services

- Photographer’s contract

Photographers can charge varying rates for their services, depending on the type of photography desired and whether any post-event editing will be needed. However, a skilled professional usually require an upfront retainer equal to half (50%) of the fee.

According to the U.S. Bureau of Labor Statistics, a photographer earns about $18.73 per hour, while the annual rate is $38,950.

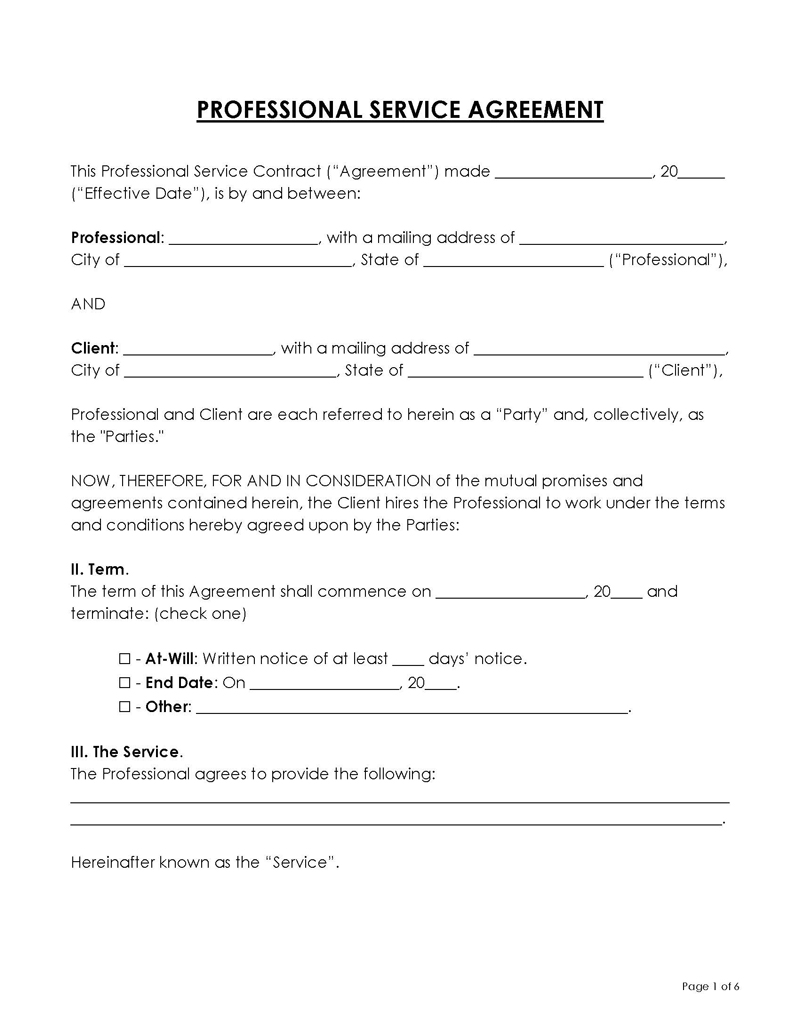

Professional service agreement

A professional service agreement is a document that outlines the terms of an agreement between an independent contractor (a professional service provider such as a plumber, electrician, painter, and plumber) and a client. In addition, these individuals must have acquired a license or certificate from a municipality, State office, federal agency, or any government-recognized association to be authorized and referred to as professionals.

Public relation consultant agreement

A public relations consultant agreement is a legally binding document that outlines the terms of a business arrangement between an independent contractor (a public relations consultant) and a client (such as a company, a hiring organization, or a music artist). A public relations consultant works with a company’s PR team to establish and promote a good client image to the public, the media, customers, and employees.

The conditions of a public relations consultant agreement must include the pay for the services, the termination clause, and all other explanations concerning all consultant’s responsibilities towards the client. The agreement becomes legally binding once the two parties (client and consultant) sign the document.

According to ZipRecruiter, a public relations consultant’s pay is about $55,800 per year and $27 per hour depending on factors such as their expertise level (bachelor’s degree and more), client’s company size, and business niche.

Real estate agent independent contractor agreement

A real estate agent independent contractor agreement is a legally binding document that outlines the terms of an agreement between a client (real estate company) and a salesperson (“agent”), detailing the responsibilities of the salesperson and how expenses and commissions will be divided between the parties involved (real estate company and a salesperson). Whether for residential or commercial real estate purposes, it will be stated in the agreement if the real estate company will make provisions for office space and other needed equipment or not. If the agreement includes that the real estate company would provide office space, it will be in exchange for a portion of the salesperson commissions.

In this agreement, there is a practice called “Taking a Draw”, which means that the real estate company will have to pay the salesperson their commission in advance.

The following are the essential details that must be included in a real estate agent independent contractor agreement:

- Agreement effective date and termination date

- The real estate company’s obligations

- Commission and pay arrangement

- The salesperson’s qualifications

- The salesperson’s expectations

- The salesperson’s obligations

- The salesperson’s mailing address

Sales consultant agreement

A sales consultant agreement is a document that outlines the terms of an agreement between an independent contractor (self-employed sales consultant) and a client. A sales consultant agreement shall cover the interest of both parties involved (a sales consultant and a client). The sales consultant’s job is to work with the clients/company’s sales associates to successfully promote the company’s product while also improving the company’s sales platform, client base, and market potential.

The following are the crucial details that must be reflected in a sales consultant terms agreement:

- Services provided

- Compensation

- The period during which the contract is effective

- Other additional provisions such as the payment of a retainer

The two clauses that are usually included in a sales consultant agreement are:

- Non-compete clauses

- Non-solicitation clauses

Both clauses ensure that the sales consultant will not compete with the client’s business and attempt to solicit the client’s customers during and after the agreement. Other sections in a sales consultant agreement include the associated liabilities and responsibilities of both the client and the consultant.

A consultant’s pay depends on their job position (Junior or Senior Sales Consultant), job experience, and amassed portfolio. According to PayScale.com, a sales consultant’s pay is about $50,173 per year and $12.27 per hour.

Snow removal contract

A snow removal contract agreement is a document that outlines the terms of an agreement between an independent contractor (whose job is to get rid of snow and ice on a property) and a client. The contractor’s service can either be for commercial or residential property offered in exchange for an agreed payment as stated in the snow removal contractor agreement. Usually, the payment plan is fixed after each job, irrespective of the snowfall. The stipulated work time can either be immediately after a snowstorm or only when the client requests the contractor’s service.

Another critical aspect of the contract agreement is a concept known as “snow event”, which is the quantity of snow that makes snow removal by a service provider needed. The parties will negotiate on what they will consider a snow event — the standard practice is to consider the occurrence of 2 or more snowfalls as a “snow event.”

Other sections that must be included in the snow removal contract agreement are:

- Both parties’ names (contractor and client)

- Term

- Service description: parking lots, driveways, sidewalks, rooftops

- Property description

- Payment amount ($)

- Retainer

- Instructions

Templates (US)

Streamline the contracting process and protect your interests by utilizing our customizable templates:

Frequently Asked Questions

The article above works as a complete guide to writing an independent contractor agreement. It is a fairly simple process, which is legally binding. Simply have the independent contractor fill in a 1099 agreement, list all the terms of the contract such as monetary compensation, the time frame within which the work is to be completed, and the contract is applicable, additional clauses and stipulations and sign and date the agreement.

The contractual agreement should include the terms and conditions of the contract, such as pay, time frame, the process in case of breach (if needed), and any other additional clauses, such as an NDA or an exclusivity clause.

This largely varies from state to state. In general, however, independent contractors are different from employees in the sense that they are free to work in their place of choice, as well as according to their own hours or schedule (unless explicitly stated and agreed upon). Moreover, independent contractors’ only obligation is to complete the work within the agreed-upon time frame, meaning they are exempt from any company policy. They also have the right to pursue legal claims in case of breach of the contract.