A loan rejection letter is a document that a credit provider issues to a loan applicant informing them of a rejection of the loan application. Every creditor has its own rules and regulations that govern loans. If you apply for a loan and you do not meet these requirements, the lender will reject your application. This letter outlines the reasons for the rejection. Before applying for a loan, make sure you are familiar with the set guidelines.

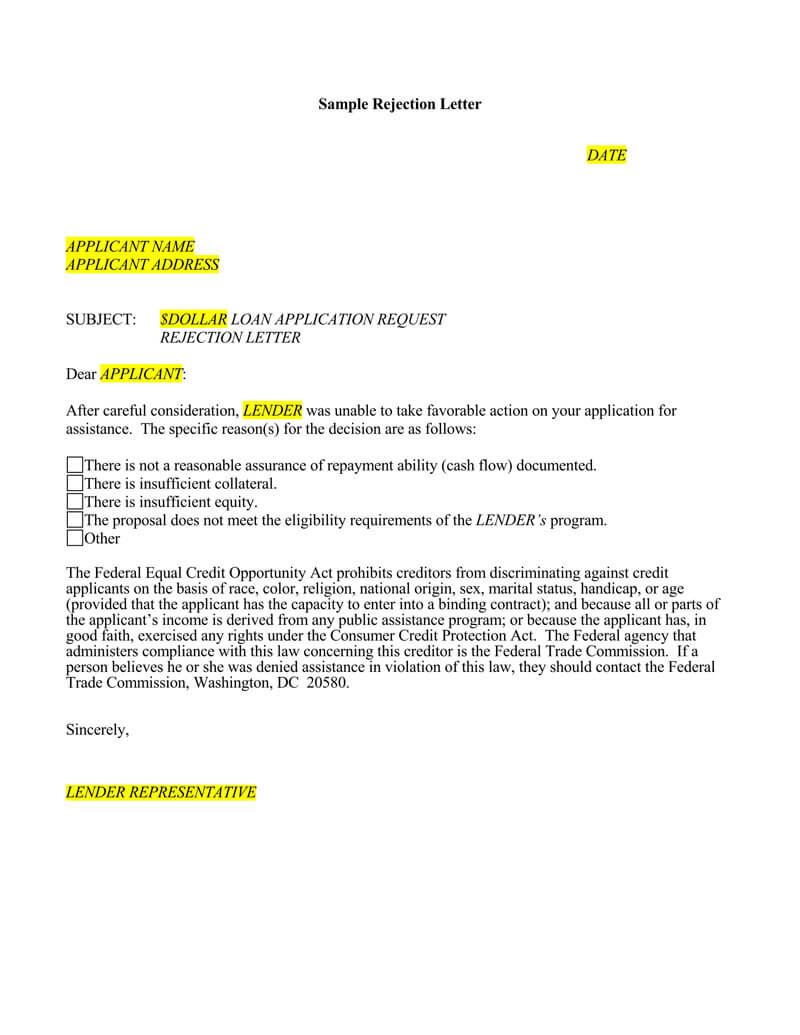

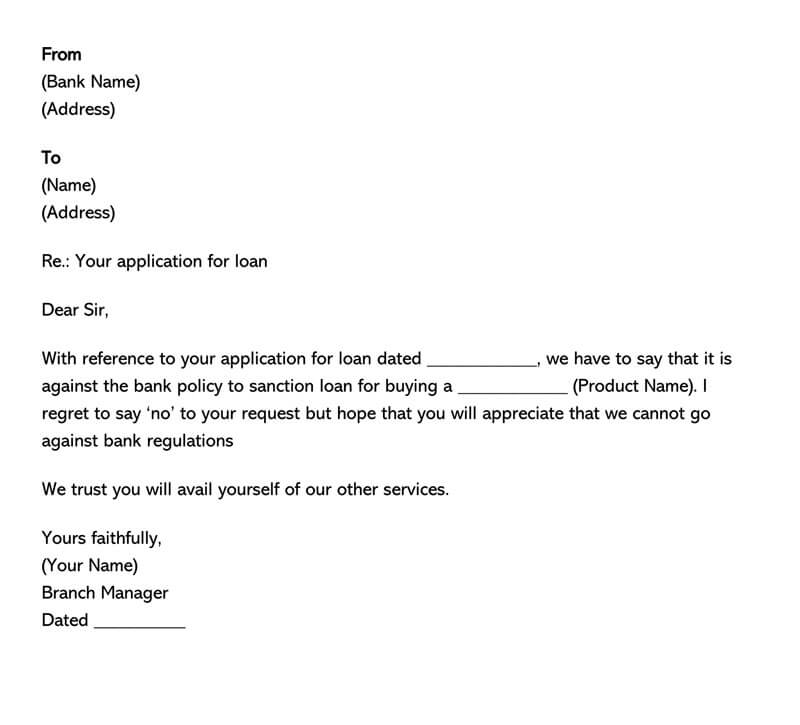

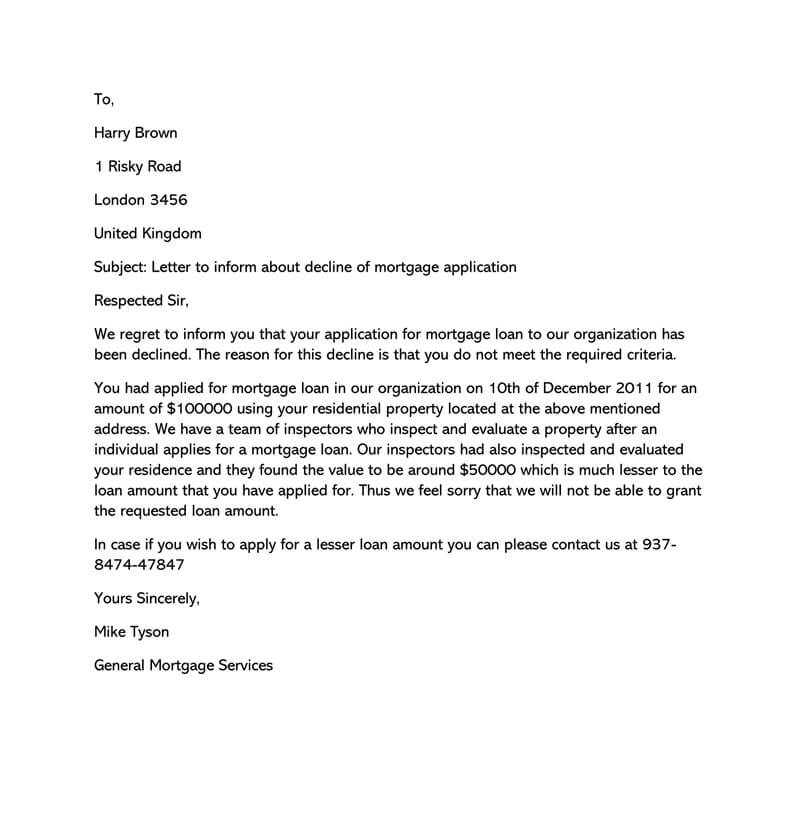

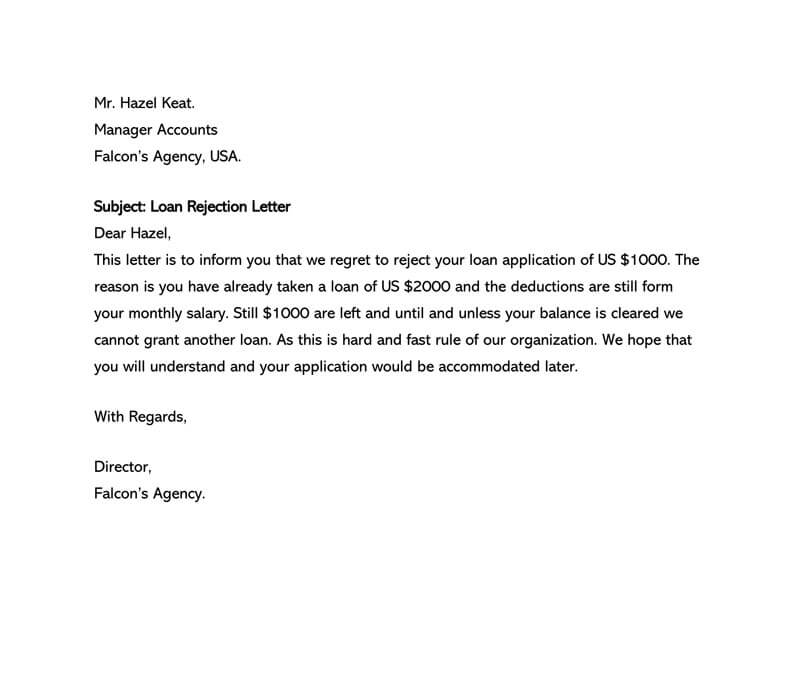

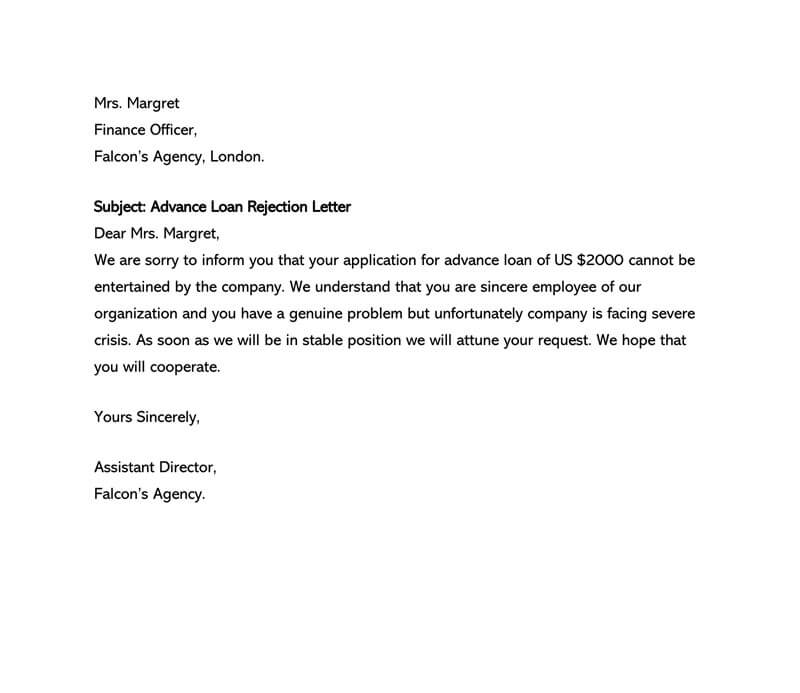

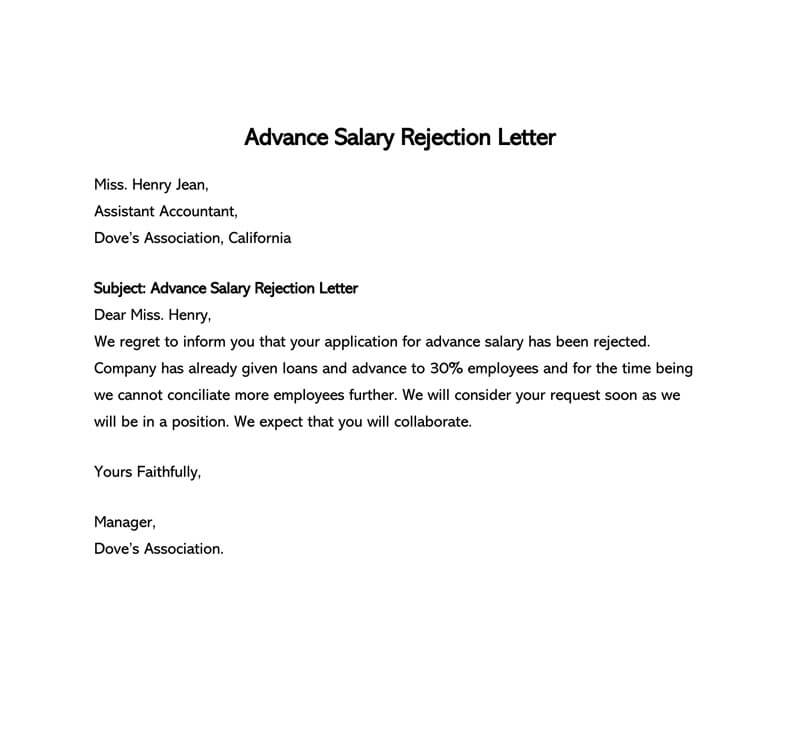

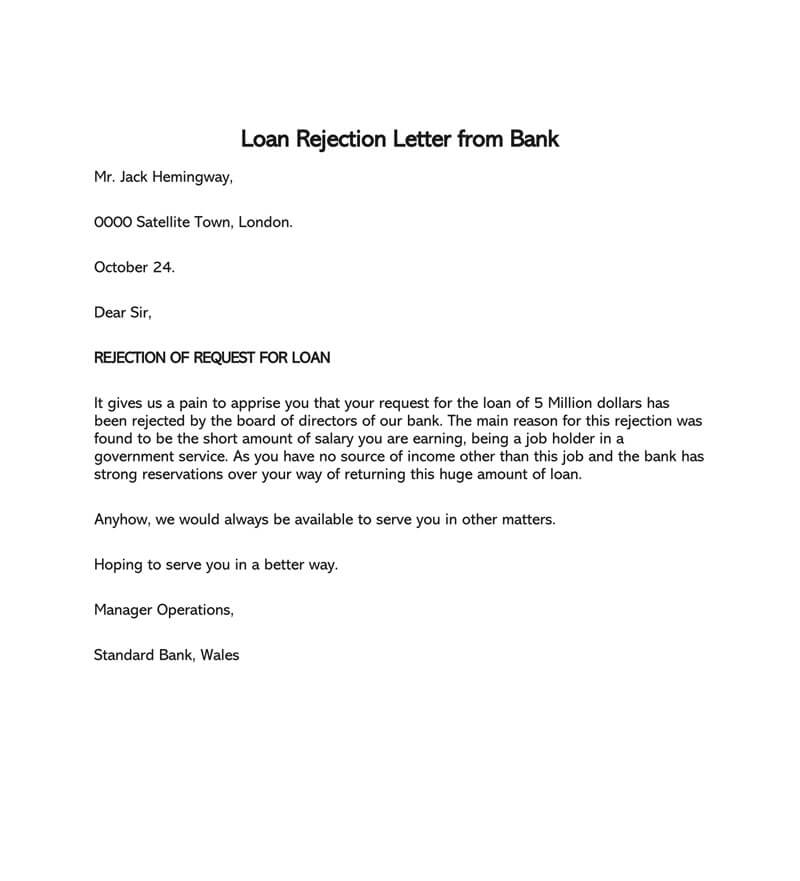

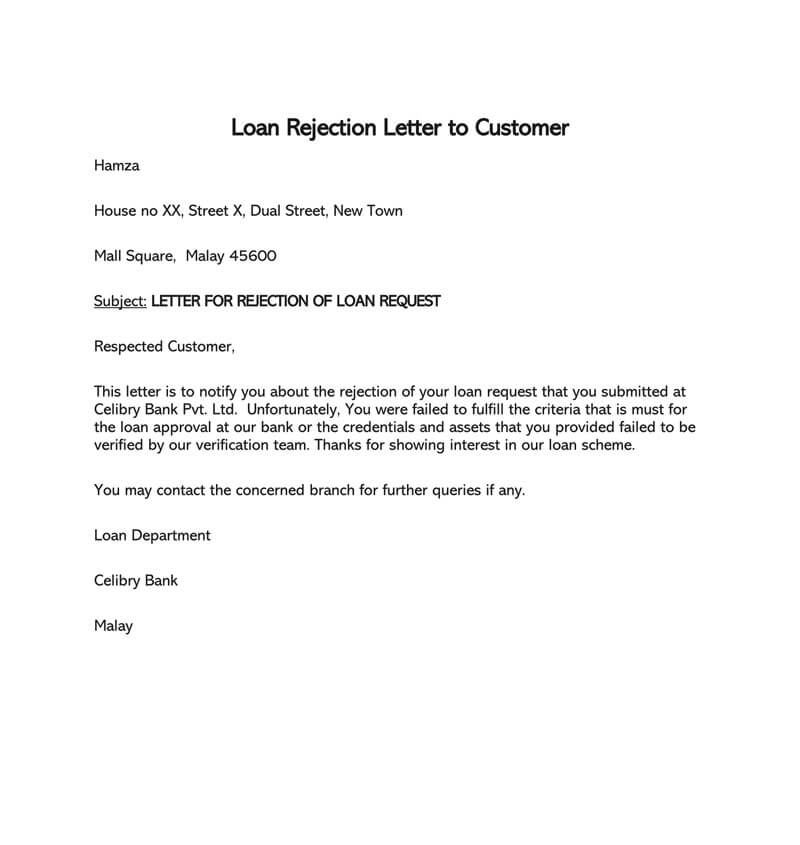

Samples and Templates

What should I Include In a Loan Rejection Letter?

When writing the letter, you must include reasons for declining the application. Additionally, you can advise the client on what to do to qualify for the loan. The lenders’ and recipients’ names and addresses must also be included in the letter. And finally, the letter must have the lender’s official signature.

Several reasons might motivate a financial institution to reject your loan.

They include:

Incomplete paperwork

As a credit provider appraises your loan application, they’ll check to ensure that all the required paperwork is complete. Some documents that accompany the application include bank account statements, personal/business tax returns, financial statements, personal/business credit reports, etc. If any of the stated documents are missing, your application will be rejected.

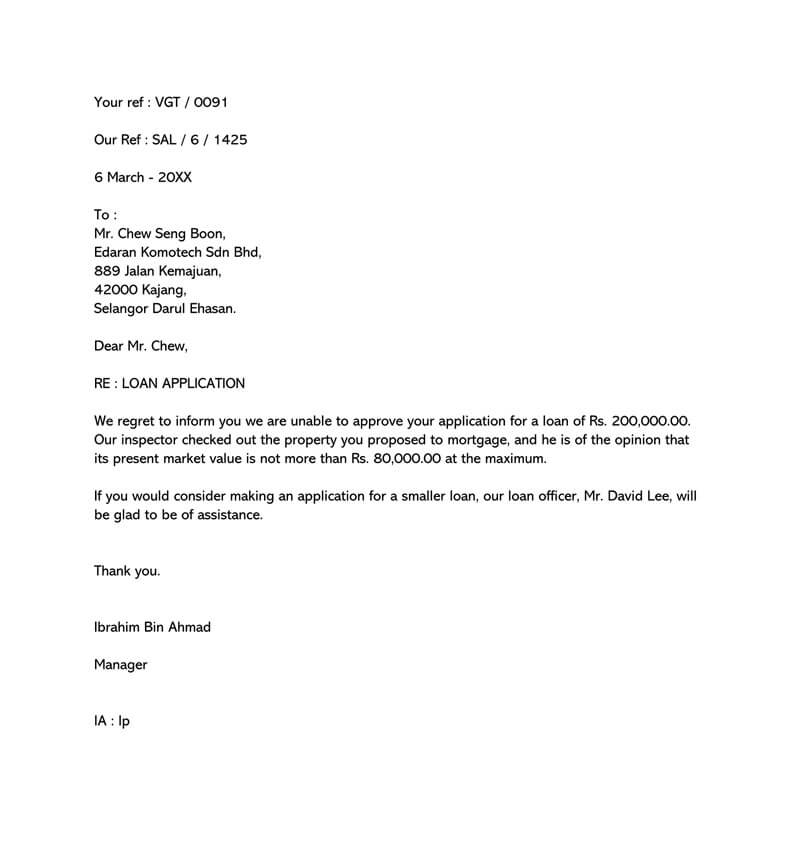

Lack of collateral

Traditional lenders require a loan applicant to submit a guarantee for the loan. In cases where you have not provided any collateral or it’s insufficient, your loan will be turned down. In this case, consider applying for an unsecured loan.

“Risky” investment

Lenders classify industries depending on the risk involved. If the credit provider views our investment as risky, they might reject the loan since your probability of repaying the loan is uncertain.

EXAMPLE

A lender might find it challenging to fund a gambling business.

Low credit score

Most applications face rejection due to a low credit score. If a lender rejects your loan due to a low credit score, then you have the option to make efforts to repair your score or look for alternatives. On the same token, if you have not been in business for a long period and you have not built a sufficient credit history.

Insufficient income

When applying for a loan, you must make sure your income is sufficient to repay the loan. Lenders will not approve your loan if they discover you can’t repay it. A solution to this problem could be borrowing a lower amount.

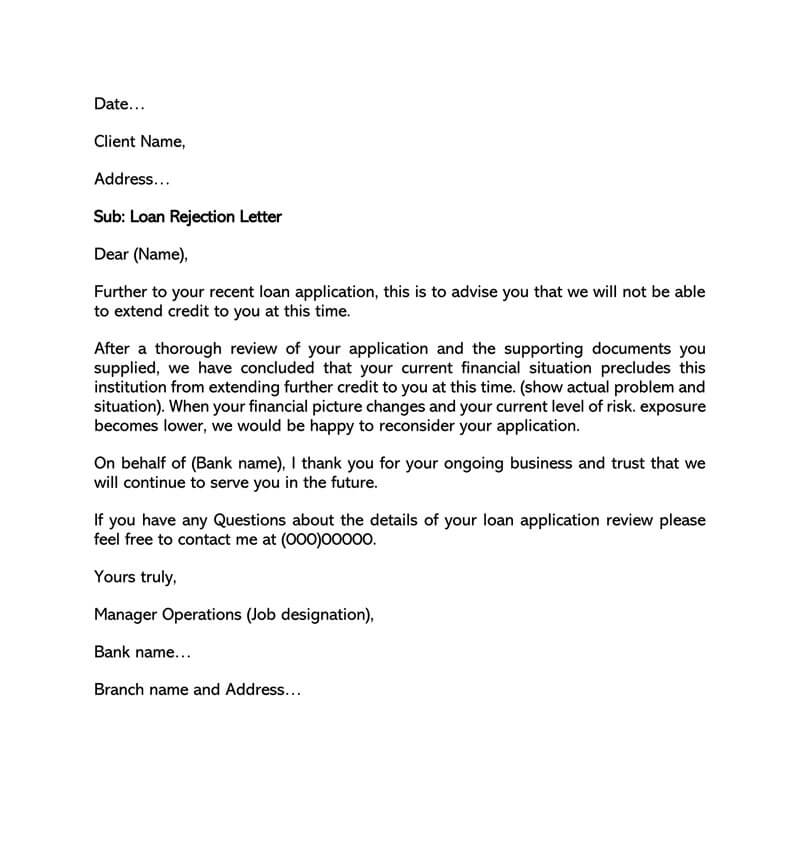

Loan rejection letter template

[Bank’s Letterhead]

[Date: Date of Letter Issuance]

[Applicant’s Information: Full Name, Address, City, State, Zip Code]

Dear [Applicant’s Name],

Subject: Loan Application Status – [Loan Type]

We are writing to you regarding your recent application for a [Loan Type] loan with [Bank Name]. After a detailed and thorough evaluation of your application, including an assessment of your financial documents and creditworthiness, we regret to inform you that we have decided not to proceed with your loan request at this time.

The decision to decline your application was based on several key factors, which we would like to share with you to provide clarity and assist in your future financial endeavors:

1. Credit Evaluation: Your credit score and history, obtained from [Credit Bureau Name], did not align with our minimum requirements for loan approval. Specific concerns include [List Specific Credit Concerns].

2. Debt-to-Income Ratio: Our analysis indicates that your current debt-to-income ratio is higher than our permissible threshold. This ratio is a crucial factor in assessing loan repayment capability.

3. Employment and Income Stability: We take into account the stability and continuity of your income. Based on the information provided, there were concerns regarding [List Specific Employment Concerns].

4. Collateral Evaluation (if applicable): For secured loans, the value and suitability of the collateral offered did not meet our required criteria.

5. Additional Factors (if applicable): [List Any Additional Factors].

We understand this might be disappointing news. However, we encourage you to address these areas, which could improve your chances of loan approval in the future. To assist you, we recommend the following steps:

- Credit Report Review: You are entitled to a free credit report from [Credit Reporting Agency Name]. Reviewing this report could help you identify and rectify any discrepancies or areas for improvement in your credit history.

- Financial Counseling: We offer financial counseling services to help our clients understand and improve their financial standing. Please feel free to contact our financial advisors at [Bank’s Financial Advisory Contact Information].

- Future Applications: After addressing the above concerns, we welcome you to reapply for a loan. Our team will be more than happy to guide you through the application process and provide any necessary assistance.

If you have any questions or need further clarification regarding our decision, please do not hesitate to contact our customer service team at [Bank’s Customer Service Contact Information]. We are committed to providing support and guidance to our valued customers.

Thank you for considering [Bank Name] for your financial needs. We hope to have the opportunity to assist you under more favorable circumstances in the future.

Sincerely,

[Your Name]

[Your Position]

[Bank Name]

[Bank’s Contact Information]

[Optional: Enclosures – Credit Report Information, Financial Counseling Brochures, Contact Details for Further Queries]

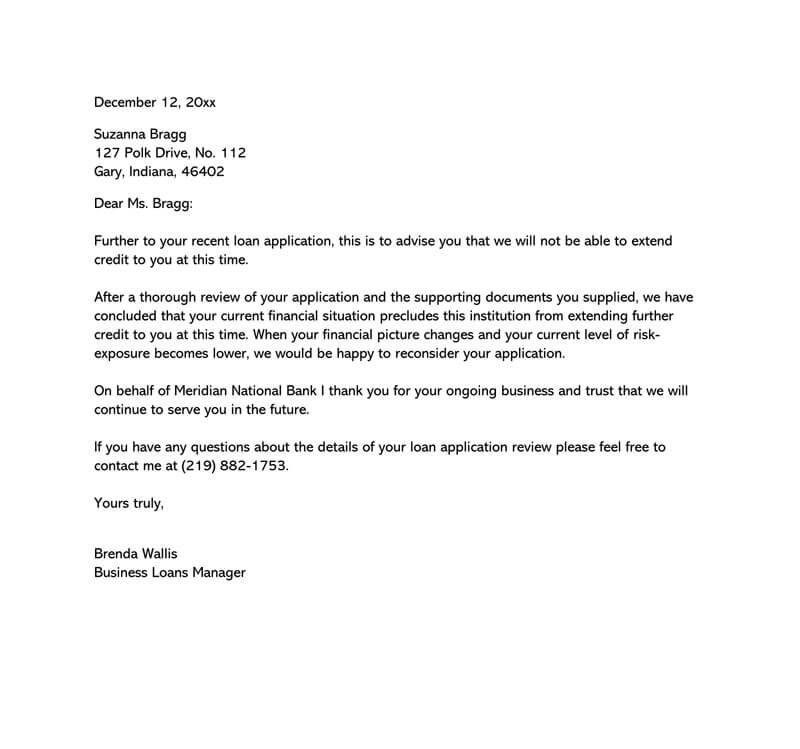

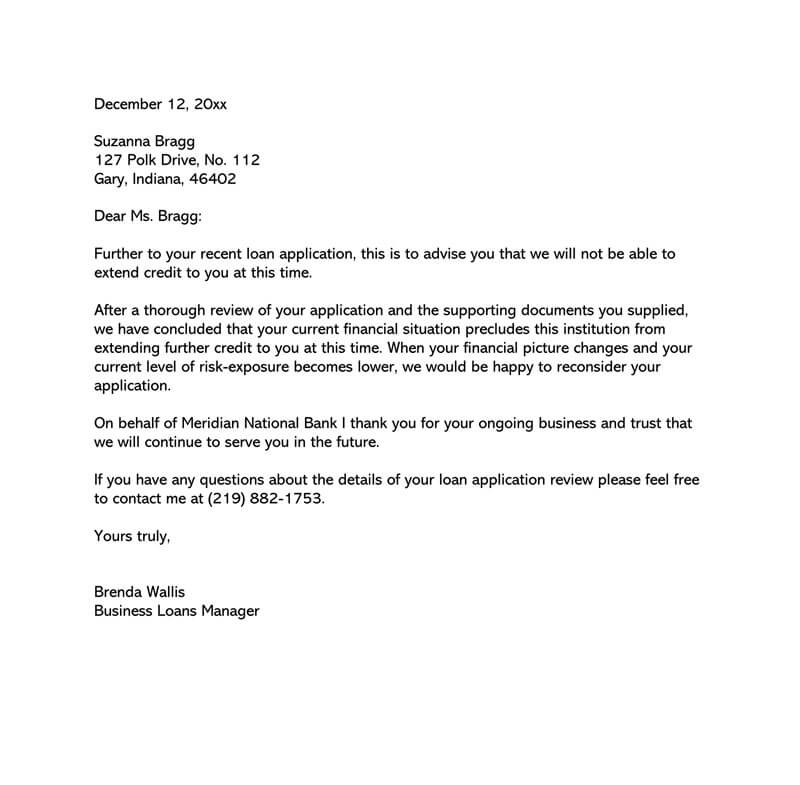

Sample Loan Rejection Letter

Dear Ms. Smith,

Subject: Car Loan Application Rejection

Thank you for your recent application for a car loan with Citywide Bank for the purchase of a car. We understand that acquiring a new vehicle is a significant step, and we appreciate your choice to consider Citywide Bank for your financing needs.

Upon careful evaluation of your application and financial information, we regret to inform you that we are unable to approve your loan request at this time. This decision was made following a thorough review of several key factors, specifically related to the loan for the car.

The main reasons for declining your car loan application are:

1. Credit Score: Our analysis found that your current credit score of 580 does not meet our minimum requirement of 650 for car loan approvals.

2. Debt-to-Income Ratio: Your existing debts, including mortgage and credit card debts, have resulted in a debt-to-income ratio of 45%, which exceeds our maximum allowable limit of 35% for car loans.

We believe in supporting our clients in making informed financial decisions. Therefore, we suggest the following steps to improve your eligibility in the future:

1. Credit Improvement: Regularly review your credit report for any discrepancies and work towards timely bill payments to enhance your credit score.

2. Debt Management: Consider strategies to lower your existing debts, such as debt consolidation or increased monthly payments, to improve your debt-to-income ratio.

We understand this decision may be disappointing. Once you have addressed these areas, we encourage you to reapply for a car loan. Citywide Bank also offers a range of other financial products that may suit your current needs, and our team would be happy to discuss these options with you.

Thank you for considering Citywide Bank for your car financing. We value your interest and are committed to assisting you in the future.

Sincerely,

John Doe

Loan Officer

Citywide Bank

Key Takeaways

The provided sample letter is a useful example of writing a similar loan rejection letter.

Here’s a brief analysis:

- The letter maintains a professional and respectful tone, which is crucial in sensitive communications like loan rejections. The format is clear, with the loan officer’s contact information, date, and applicant’s address.

- The letter clearly states the reasons for the loan rejection (credit score and debt-to-income ratio), which is important for transparency and helps the applicant understand what factors influenced the decision.

- Providing suggestions for improving credit scores and managing debt is helpful. This not only aids the applicant in potentially qualifying for future loans but also demonstrates the bank’s supportive approach.

- By inviting the applicant to reapply in the future or consider other financial products, the letter helps maintain a positive relationship with the applicant.

- The closing remarks are polite and encourage future engagement, which is key to maintaining good customer relations.

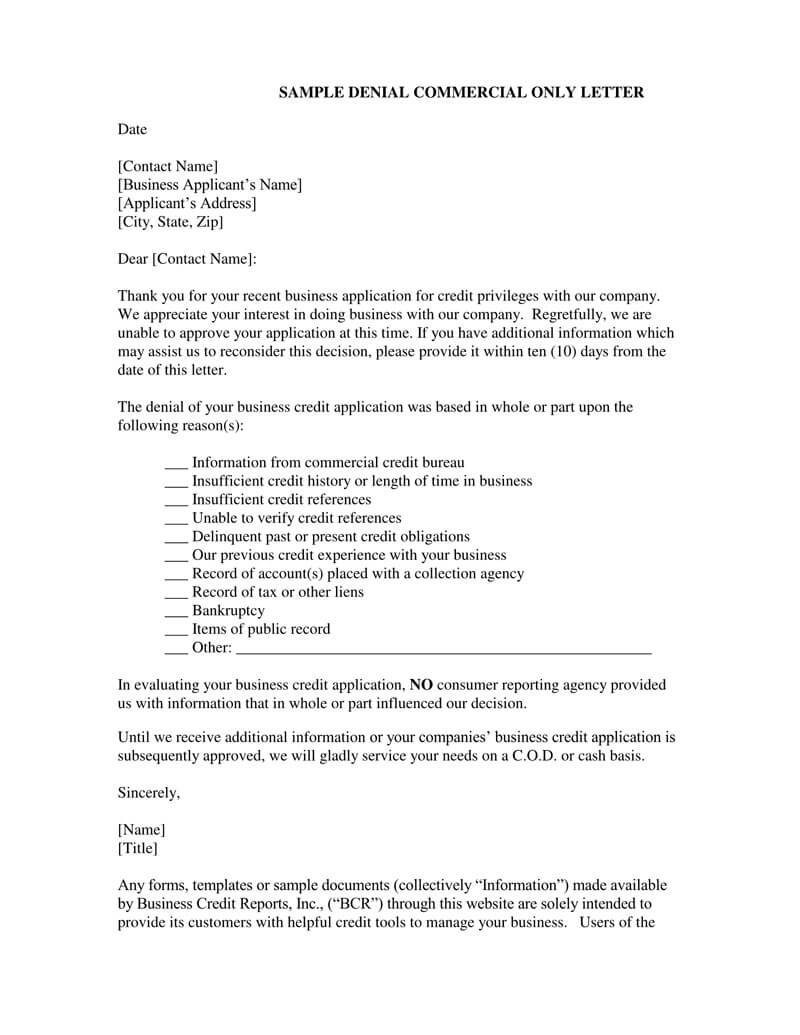

Types of Loan Rejection Letters

Personal loan rejection letter

This letter is one received if they had applied for a personal loan from a credit provider and failed to secure the loan. The letter gives reasons for declining the application. Personal loans are the best option to cater to emergencies. The appraisal process for these loans is more stringent. They offer more flexibility in how you can use the money. Poor credit score, inability to repay, and errors in the application are the main reasons for the rejection of personal loans.

Business loan rejection letter

This letter is a response to an individual who had applied for a business loan. It’s a rejection of the application. Most lenders reject business loans because of limited collateral, a lack of a solid business plan, excess debts, inadequate cash flow, a poor credit score, and if the business is still young. The lender will specify why they have rejected the application.

Customer loan rejection letter

If one is a customer of a lending institution, let’s say a bank, and they apply for a loan, if the lender declines the loan, they’ll issue a letter to the client rejecting the loan—the letter is referred to as the customer loan rejection letter. The lender must express their regrets for rejecting the loan to maintain customer relations. The letter must embrace a polite tone since you’re addressing your customer.

Home/mortgage loan rejection letter

When you apply for a mortgage and your application is rejected, the financier will issue a mortgage loan rejection letter explaining why you did not qualify for the loan. Credit providers mainly reject mortgage loans due to insufficient income, poor documentation, a small down payment, issues with the property, and a poor credit history. Before applying for a home loan, consider going through a checklist to know what is required of you.

A loan rejection letter from a bank

This letter from a bank is a formal communication a bank sends to a loan applicant to inform them that they are not eligible for a loan. The letter might offer suggestions of what you can do to qualify for the loan. If you receive this letter from your bank, you can revert to a personal loan since most personal loans are unsecured but attract a higher interest rate.