A credit denial letter is an official notification written by lenders to inform an individual or business of the rejection of their loan request.

It is usually sent for applications for loans, mortgages, credit cards, and business credit lines. It also informs the applicant why their application was rejected.

Typically, lenders will deny loan requests if the applicants are not creditworthy, which can result from multiple factors such as incomplete documents, insufficient income, bankruptcy, poor credit score, etc. The letter also communicates the applicant’s credit score, the credit reporting agency used, and the process to obtain their credit report.

Lenders can use templates that include all the information required to produce the formal letters. It is important to note that lenders are expected to reassess their decision to decline an application should the applicant object to it. They should also cite legitimate reasons, such as errors and inaccuracies in the report. Review multiple samples of such letters to understand the different reasons a lender can use to legally deny credit to their clients.

The letter is a legal requirement under the ECOA and the Fair Credit Reporting Act. It provides information to the borrower, protects the lender’s reputation, and complies with legal requirements. Also, it is professional to be transparent about the decision-making process. Online templates are practical tools that can help lenders write such letters.

This article will discuss reasons to reject credit applications and how to write a letter notifying the applicant of such a decision by providing a sample. It also educates lenders on certain legal factors they should know before sending a letter of denial to a credit application.

Reasons for Denying a Credit Request

Letters to notify applicants of refusals of their credit requests serve a valuable purpose by providing individuals with insights into the factors considered by lenders when assessing creditworthiness. By exploring the common reasons for credit denial, we can understand the criteria that financial institutions use to evaluate applicants, empowering individuals to make informed decisions and take proactive steps toward improving their credit standing.

This section discusses the key factors that can influence a credit denial decision:

Credit score

A credit score is a measure or numerical ranking of creditworthiness. Using a standardized formula, you can calculate it from credit information such as length of credit history, payment patterns, credit utilization, and outstanding debt. The higher scores indicate a lower level of risk, making it more likely for such applicants to secure loans at favorable terms. On the other hand, the lower scores may result in credit denial or less favorable loan terms, as they suggest a higher risk of defaulting on payments.

Employment history

Employment status and history are criteria used to determine an applicant’s suitability for loans because they determine their capacity to pay back the loan. So, you need to consider whether an applicant is employed, how long they have been employed, and their current and previous jobs. Having a stable job and career may indicate that they have a reliable source of income and are less likely to default. However, if their employment situation is unstable, it raises concerns about their ability to fulfill financial obligations and is a legitimate basis for refusing their loan request.

Insufficient income

One crucial factor that lending institutions carefully scrutinize when assessing loan applications is the applicant’s income. For lenders, the ability of borrowers to repay their debts is of paramount importance to mitigate the risk of defaults. Therefore, income serves as a critical indicator of an individual’s capacity to meet their financial obligations. When an applicant’s income is deemed insufficient, it can be a compelling reason for denial.

Debt-to-income ratio

The debt-to-income ratio compares an individual’s monthly debt payments to their income. If the ratio is too high, it indicates that a significant portion of income is already allocated towards existing debts, and lenders may perceive the applicant as having a higher credit risk and reject the loan request.

Payment history

Payment history is a reliable criterion for determining an applicant’s eligibility for a loan. If an applicant has a history of late payments or defaults with a specific financial institution, it can significantly impact their chances of getting approved for new credit from that institution.

Unstable housing situation

Lenders might have a negative opinion of housing instability, such as frequent moves or a lack of a permanent address. It can be an indicator of financial uncertainty and affect an applicant’s creditworthiness.

Inaccurate information on a credit report

You can reject an application if the credit report results are inaccurate. The report will indicate the borrowing history, current and previous addresses, bank accounts, employment history, etc. Incorrect information, such as accounts that do not belong to the applicant or inaccurate payment records, can be particularly detrimental.

The accuracy and reliability of this information are of utmost importance in determining an applicant’s creditworthiness. Unfortunately, mistakes or inaccuracies in the reports can occur, and they have the potential to significantly impact an individual’s credit standing. From a lender’s perspective, such errors pose risks and can be a valid reason for credit denial.

Multiple loan applications

You can deny credit to individuals or businesses that have applied too many times in a short period. This will often indicate that the applicant is struggling financially and in desperate need of money, which poses a risk of inability to repay once approved.

How to Write a Letter to Notify Rejection of Credit Application

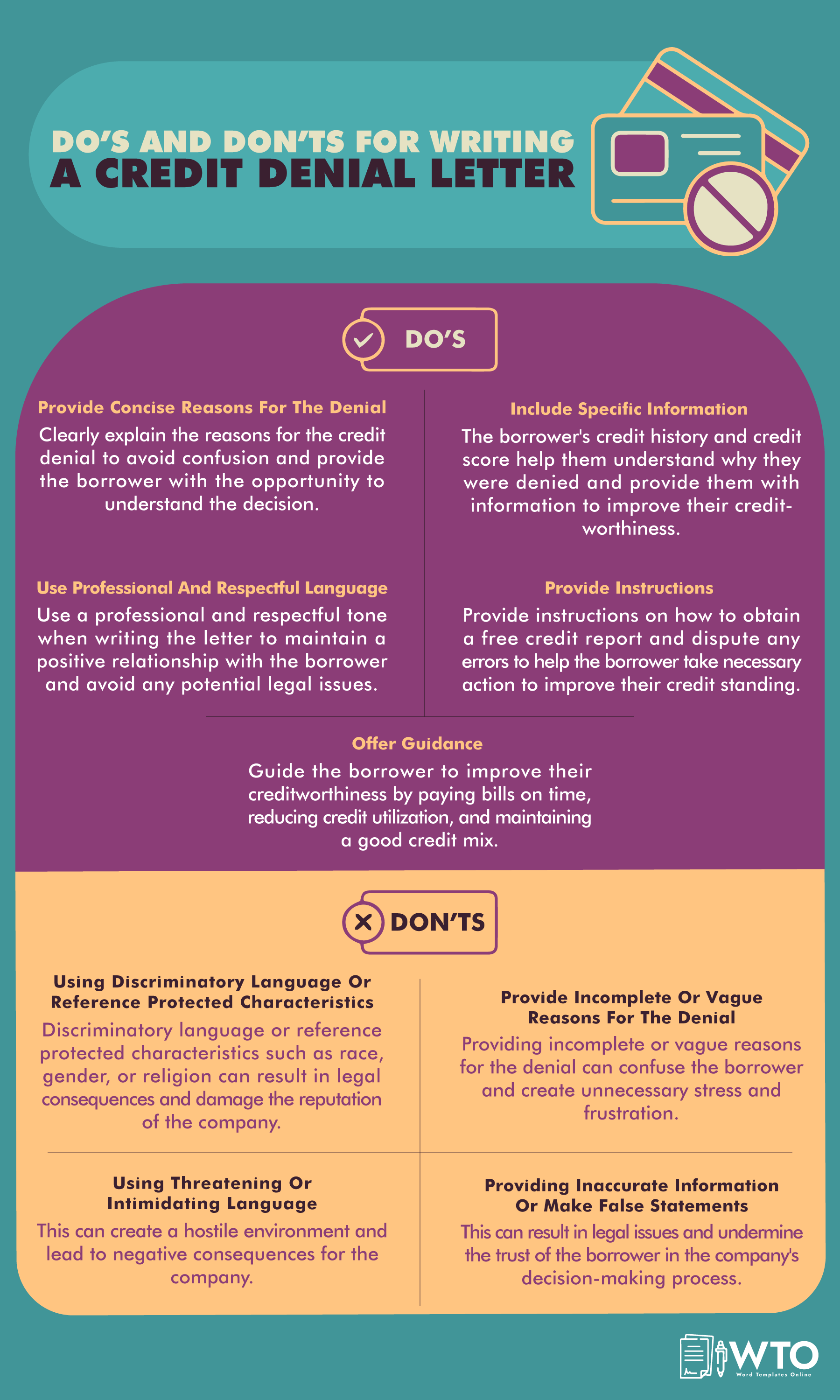

Most applicants will be distressed by the news, so it is critical to approach the rejection professionally. Your communication must be objective and clearly explain the situation. Using a template can be helpful in properly organizing information and ensuring the decision is effectively conveyed to the client.

The information required in a letter to formally notify applicants that they are ineligible for credit is presented below:

Specify the date

The first element on the letter is the date it was written or issued. The date is needed for reference and filing purposes. A proper format should be used,

EXAMPLE

March 24, 2023.

Include borrower’s information

Secondly, it must be clear to whom the letter is addressed, i.e., the applicant. Your letter must have the borrower’s name, mailing address, account number, and application ID.

For example, this information can be presented as follows:

EXAMPLE

Jack Geller

103 City Park Road,

New York City, NY 8007

Account No.: 1234 4567 7890

Application ID: JG009282NY

TIP

A subject line indicating the purpose of the letter can be included if you are sending an email. For example, RE: Credit Denial Letter for Application ID-2363. This should be followed by a formal greeting such as Dear Mr. Schumacher.

Mention the reason for the denial

Next, indicate the letter’s purpose for rejecting the application and provide a valid reason. You can begin by acknowledging the borrower’s interest in the opening statement before stating that their application is being rejected.

EXAMPLE

“Thank you for your inquiry about a credit card with B&G Platinum. We are honored by your interest in our company and our services. Unfortunately, we regret to notify you that your application was declined as your debt-to-income ratio is too high and a principal concern for our team.”

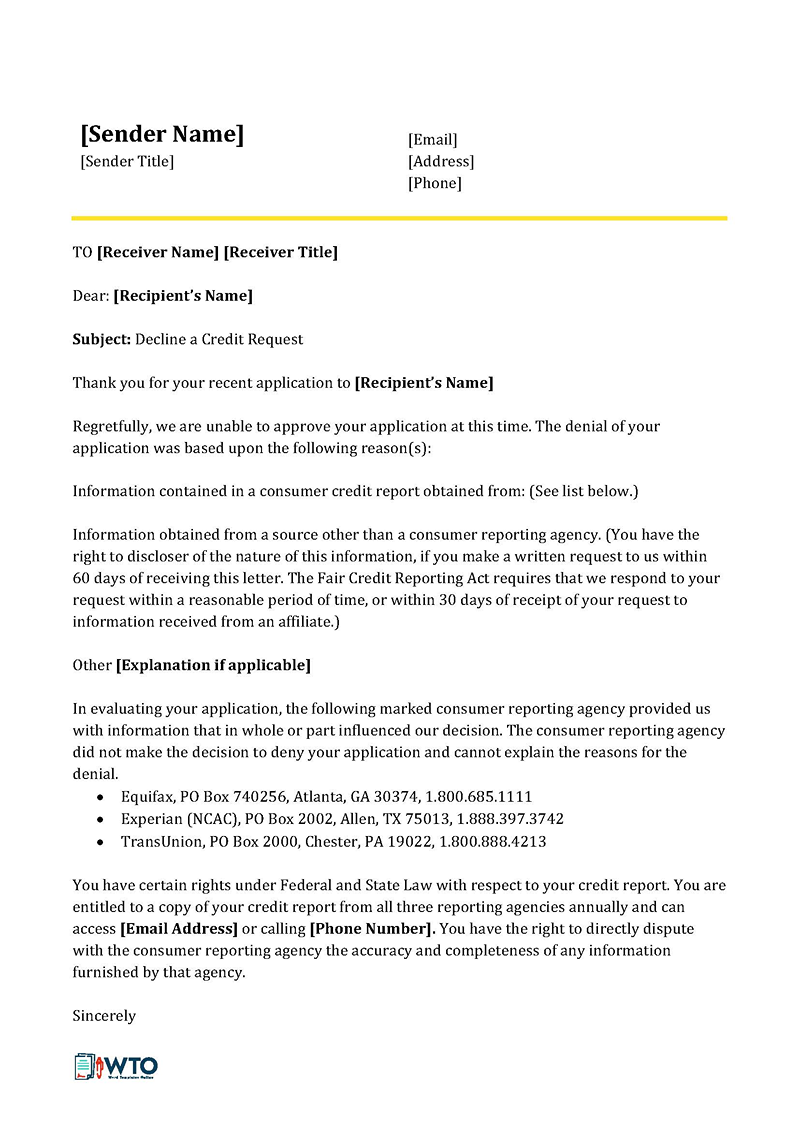

Provide credit reporting agency information

Lenders are usually obligated to inform applicants about the credit reporting agency (or agencies) they use to assess their creditworthiness. This section provides details of the agency’s name, contact information, and instructions on how to obtain a free copy of the report for further review. Note that while this information is necessary for a consumer credit application, it is not needed for a commercial application. This is because, in such situations, it is not a requirement of the FCRA.

For example, this section can be written as follows:

EXAMPLE

“After a thorough search, we determined that your total debt is above $150,000. When compared to your assets, this amount indicates that you have a credit score of 450, which is lower than the 650 required for eligible candidates.”

Specify the adverse action reasons

The letter should include a section detailing the specific adverse action reasons, which are the key factors that contributed to the denial decision.

To comply with regulatory requirements, for example:

EXAMPLE

“The decision was based specifically on the key adverse action reasons that influenced our decision: a poor credit history and insufficient income.”

Right to obtain a free report

Lenders typically highlight the recipient’s right to access a free copy of their report within a specified timeframe. This provision allows individuals to review the report for inaccuracies or discrepancies that may have impacted the credit decision.

EXAMPLE

“We understand that credit denial can be disappointing, and we encourage you to review your credit report, which you can obtain free of charge from [credit reporting agency’s name], to ensure its accuracy and address any areas that may require improvement.”

Your contact information

The letter for denial should be concluded by providing your contact information, including your name and contact details such as phone number, email address, and mailing address. This information is meant to facilitate future correspondence if the borrower has questions about the denial or future applications.

EXAMPLE

Charles MajorsJenkins Micro-Finance CompanyDownhill AvenueAugusta, Maine 00328Charlesm200@email.com (0288) 3630-8999

Free Templates

To simplify the writing process, you can use the free downloadable templates for these letters provided in this article. They can be customized to suit your needs and preferences. Also, they are professionally designed to create legible and presentable letters that protect a financial institution’s reputation.

Credit Denial Letter Template

[Your Company Name]

[Your Company Address Line 1]

[Address Line 2]

[City, State, Zip Code]

[Phone Number]

[Email Address]

[Today’s Date]

[Applicant’s Name]

[Applicant’s Address Line 1]

[Address Line 2]

[City, State, Zip Code]

Dear [Applicant’s Name],

Thank you for your interest in [Credit Product/Service, e.g., credit card, loan, etc.] with [Your Company Name]. We appreciate the opportunity to review your application. After careful consideration, we regret to inform you that we are unable to approve your request at this time.

The decision to decline your application was based on the following reason(s):

- [Reason for denial, e.g., credit score below our minimum requirement, insufficient income, employment history, etc.]

- [Any additional reason(s)]

In accordance with the Fair Credit Reporting Act, you have the right to a free copy of the credit report used in our decision-making process. To obtain your report, please contact the credit reporting agency listed below within 60 days of receiving this notice:

Credit Reporting Agency Information:

[Agency Name]

[Agency Address]

[Agency Phone Number]

[Agency Website]

Furthermore, you have the right to dispute the accuracy or completeness of any information in your credit report. If you have any questions or believe this decision is based on incorrect information, please do not hesitate to contact us at [Your Phone Number] or [Your Email Address].

We understand that this may be disappointing news, and we encourage you to review your credit report and financial situation. Improving certain factors may increase your eligibility for [Credit Product/Service] in the future. For any questions about improving your creditworthiness or to discuss potential options moving forward, please feel free to reach out to our customer service team.

Thank you again for considering [Your Company Name] for your financial needs. We hope to have the opportunity to serve you under different circumstances in the future.

Sincerely,

[Your Name]

[Your Title]

[Your Company Name]

Sample Credit Denial Letter

Dear Mr. Doe,

Thank you for applying for the Sunset Credit Card with Sunset Bank. We value your interest in our products and services and appreciate the opportunity to review your application.

After a thorough review of your application and credit information, we regret to inform you that we are unable to approve your request for credit at this time. The decision is based on the following primary reason(s):

- Credit Score Below Minimum Requirement: Your current credit score of 620 falls below our minimum requirement for the Sunset Credit Card, which is set at 650. Our decision was influenced by the credit report obtained from Equifax, one of the leading credit reporting agencies.

- High Utilization of Existing Credit Lines: Our review also noted a high utilization rate on your existing credit lines, which is another factor in our decision-making process.

In accordance with the Fair Credit Reporting Act, you are entitled to a free copy of your credit report from Equifax, used in our decision-making process, if you request it within 60 days of receiving this letter. To obtain your report, please contact:

Equifax

P.O. Box 740241

Atlanta, GA 30374-0241

Phone: 1-800-685-1111

Website: www.equifax.com

You also have the right to dispute any inaccuracies in the information provided by the credit reporting agency.

We encourage you to review your credit report and address the factors that have affected our decision. Improving your credit score and lowering your credit utilization may enhance your eligibility for credit in the future.

Please understand that this decision does not diminish the value we place on your interest in our services. We would be happy to review another application from you in the future, should your financial situation change.

If you have any questions or require further clarification, please do not hesitate to contact our customer service team at (555) 890-1234 or via email at service@sunsetbank.com.

Thank you again for considering Sunset Bank for your credit needs. We hope to have the opportunity to serve you in the future.

Sincerely,

Lisa Smith

Credit Manager

Sunset Bank

Key Takeaways

This rejection letter from Sunset Bank regarding the credit card application is a well-structured and considerate communication. Here’s why it’s effective:

Gratitude and Politeness: The letter starts with a courteous tone, expressing gratitude for the applicant’s interest in the bank’s services, which sets a positive tone despite the disappointing news.

Clear Explanation: It provides a clear explanation for the decision, citing specific reasons such as the credit score falling below the minimum requirement and high utilization of existing credit lines. This transparency helps the applicant understand the basis of the decision.

Reference to Rights: By mentioning the Fair Credit Reporting Act, it informs the applicant of their rights to access their credit report and dispute any inaccuracies, demonstrating the bank’s commitment to regulatory compliance and consumer rights.

Encouragement for Improvement: Despite the rejection, the letter encourages the applicant to take steps to improve their creditworthiness, indicating a willingness to consider future applications if their financial situation improves. This supportive approach maintains a positive relationship with the applicant.

Openness to Future Applications: It leaves the door open for future interactions by expressing a willingness to consider another application in the future, fostering goodwill and preserving the possibility of a future relationship with the bank.

Clear Contact Information: The letter provides clear contact information for the bank’s customer service team, allowing the applicant to seek further clarification or assistance if needed, which enhances accessibility and customer support.

Closing Appreciation: It ends with a sincere expression of appreciation for the applicant’s consideration of the bank’s services, reinforcing the bank’s commitment to customer service and leaving a positive final impression.

In summary, this rejection letter effectively communicates the decision while maintaining professionalism, transparency, and a customer-centric approach, which are crucial for preserving the bank’s reputation and fostering goodwill with the applicant.

Legal Requirements for Credit Denial Letters

As previously stated, it is legally necessary for you to notify the applicant in writing of the reasons for the application’s denial.

These include:

- Fair Credit Reporting Act (FCRA): FCRA mandates you to notify applicants of any information, such as credit scores and reports, used as a basis for credit refusal. Also, it gives the applicant the right to reevaluate the credit report and appeal the decision if any inaccuracies are identified. According to the FCRA, borrowers should request the credit report within 60 days of being notified of the refusal.

- Equal Credit Opportunity Act (ECOA): ECOA prohibits discriminating against applicants based on race, gender, age, religion, marital status, or receipt of public assistance.

- Truth in Lending Act (TILA): TILA promotes transparency in lending. It requires the lenders to disclose the terms, credit terms, costs, and fees to consumers. Even though TILA regulations may not directly control credit refusal, lenders are nevertheless required to abide by other TILA provisions when providing credit to customers.

- State-Specific Regulations: Each state may have additional laws or regulations that govern the content and delivery of credit refusal letters. Lenders must familiarize themselves with state-specific requirements to ensure compliance.

Conclusion

You can deny credit applications as long as you have valid and lawful reasons. However, you must issue a letter to explain with clarity the reasons for the refusal. Compliance with legal requirements, such as the Fair Credit Reporting Act and Equal Credit Opportunity Act, is crucial to avoid legal issues and maintain ethical lending practices. By understanding the importance of effective communication and adherence to regulations, lenders can ensure fair treatment of applicants while protecting their institution’s reputation. The most common reasons for credit denial are a high debt-to-income ratio, a poor credit score, and a poor payment history. You can use templates to save time and effort when writing this type of letter. Consider reviewing sample letters of this type to learn the proper format and language to use when writing one.