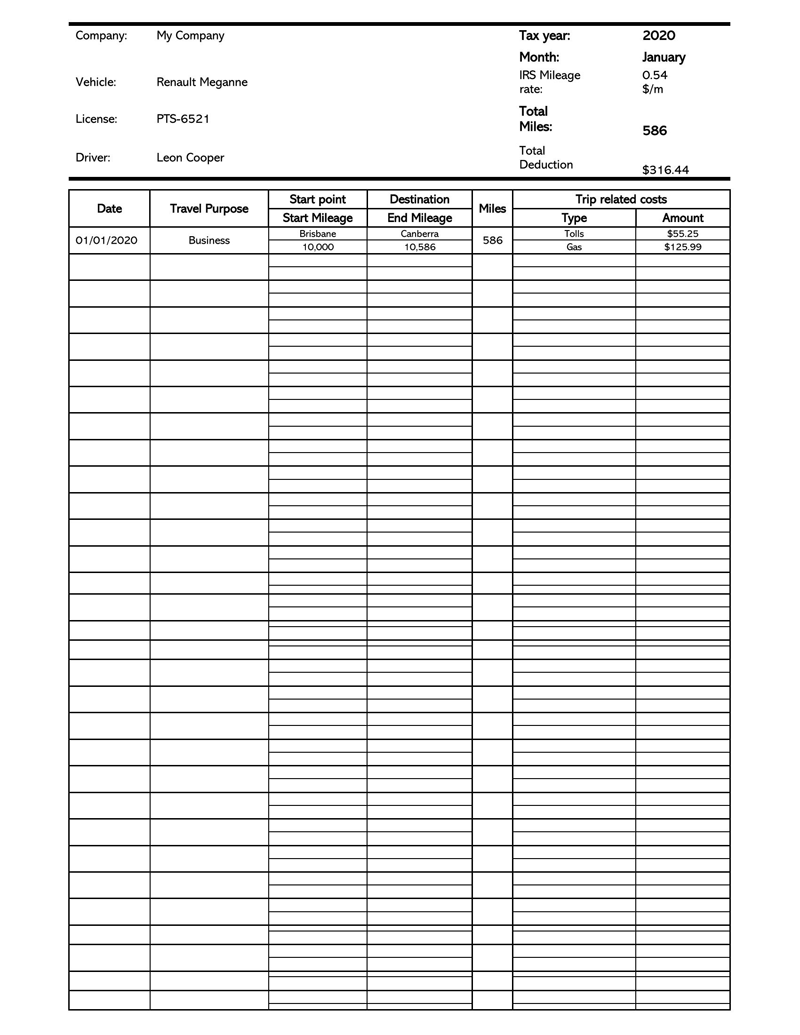

Whether you choose to claim your business auto expenses by submitting your total gas receipts or by claiming the IRS standard mileage rate, you will need to keep track of your mileage. You must be able to show which are business miles and which are strictly personal. But – if you can’t prove that the deduction is justified, you can’t deduct it, so you must record your business drives.

The Mileage Log or Logbook method of keeping track of mileage involves always recording the business trip at the time you take it within a logbook. On each occasion, you should include where you’re going and why, who you’re meeting, and the location’s address. In addition, you need to note when you began the drive and when you arrived at the destination.

You may think that using the receipt method negates the necessity to track your mileage. You’re mistaken – only bona fide business expenses are eligible, so you must have a means of differentiating them from the cost of operating your vehicle for personal use. While using software – whether an app or a spreadsheet – is probably advisable, keeping a logbook can be as simple as having a notepad (the paper kind!) and pen on hand and writing down the required business travel information as well.

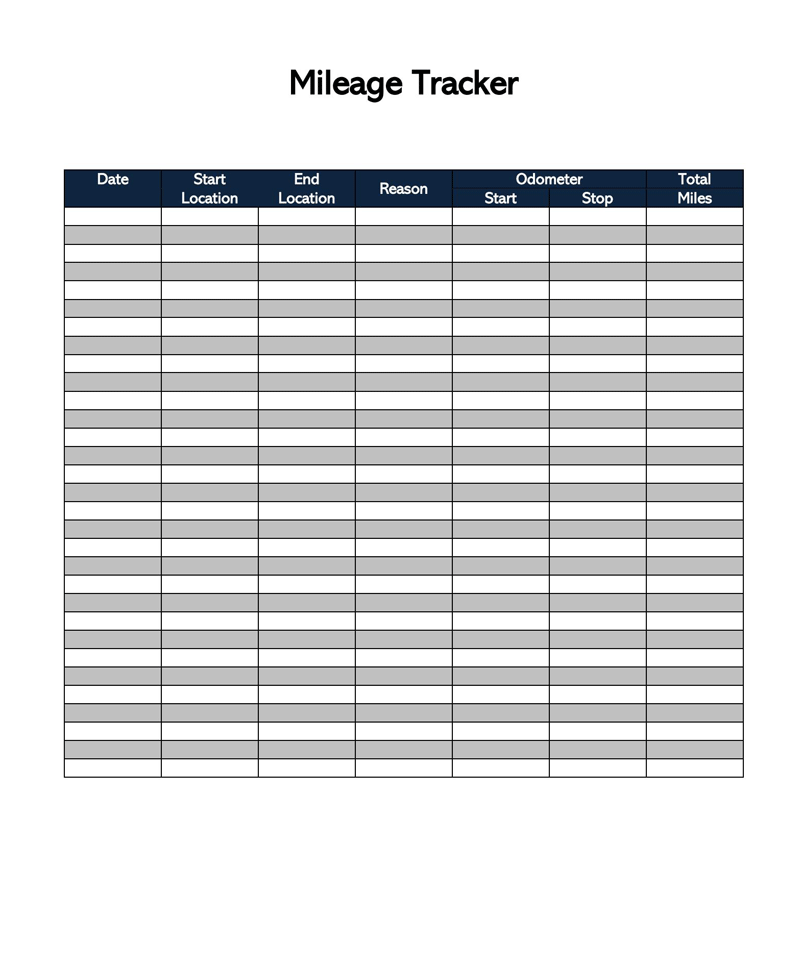

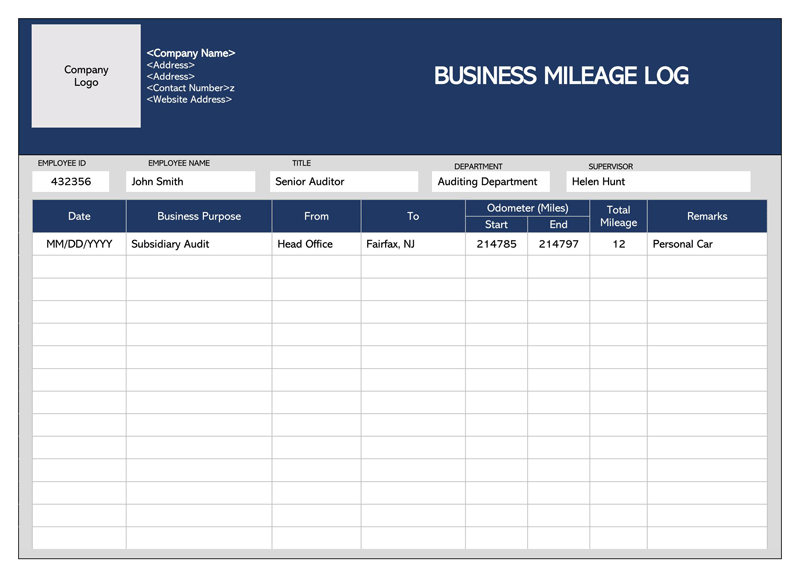

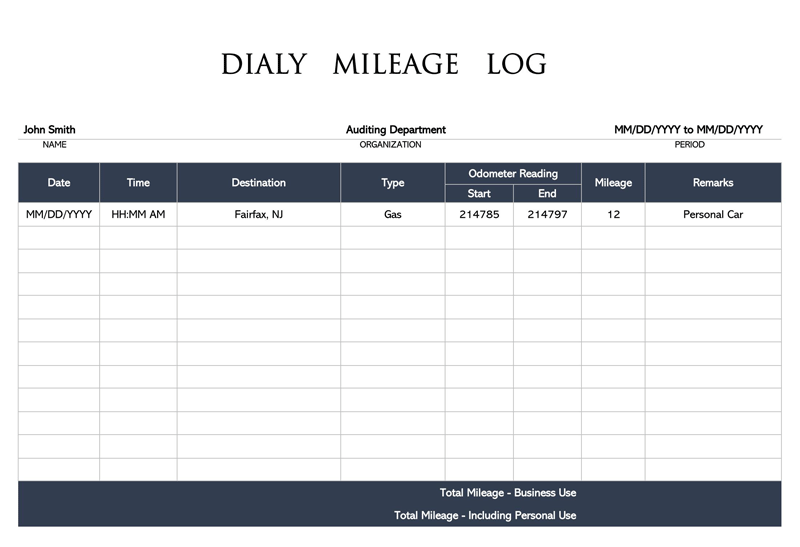

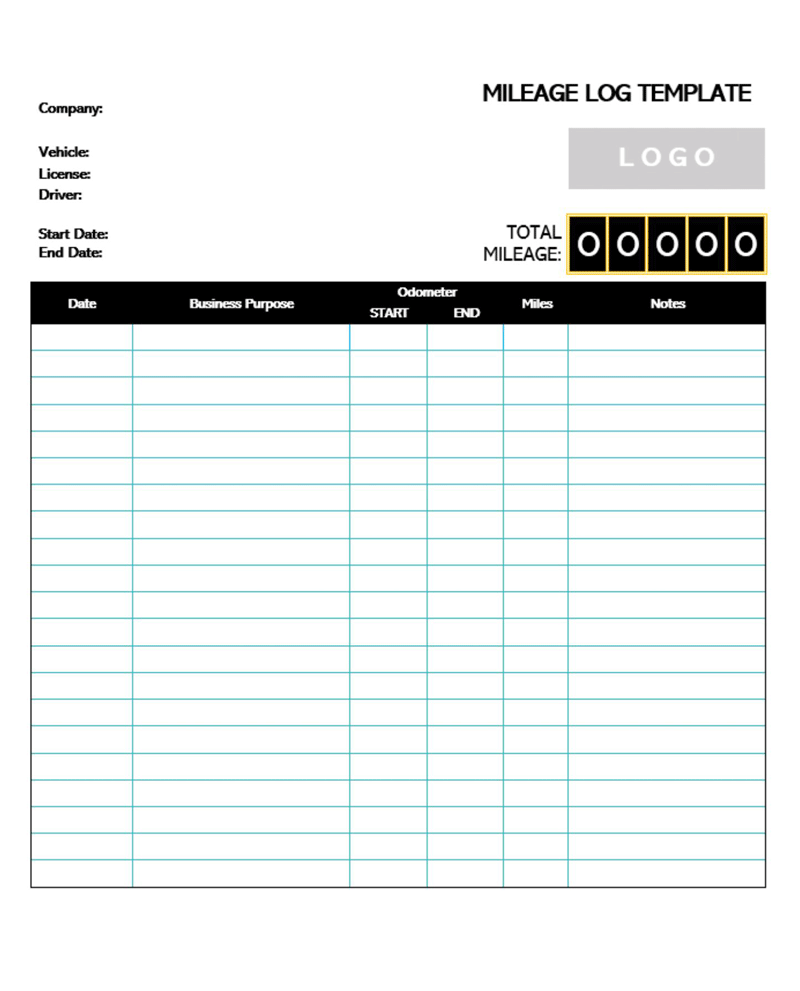

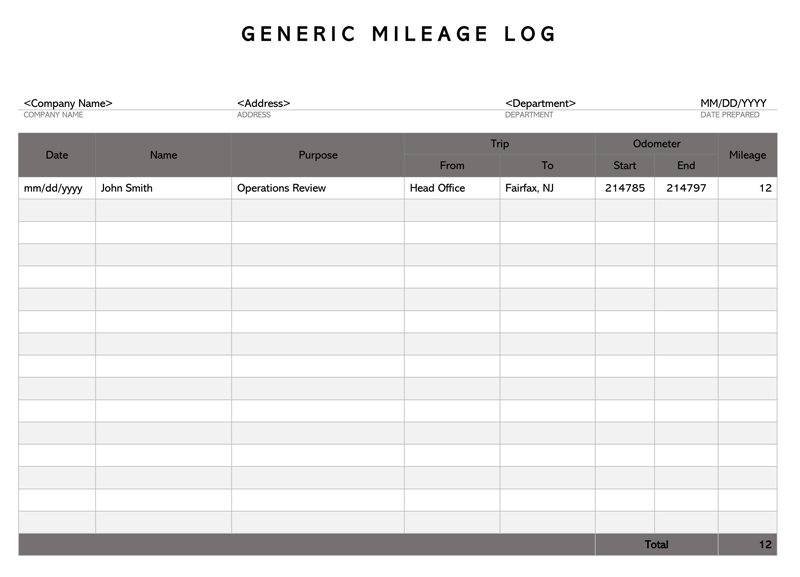

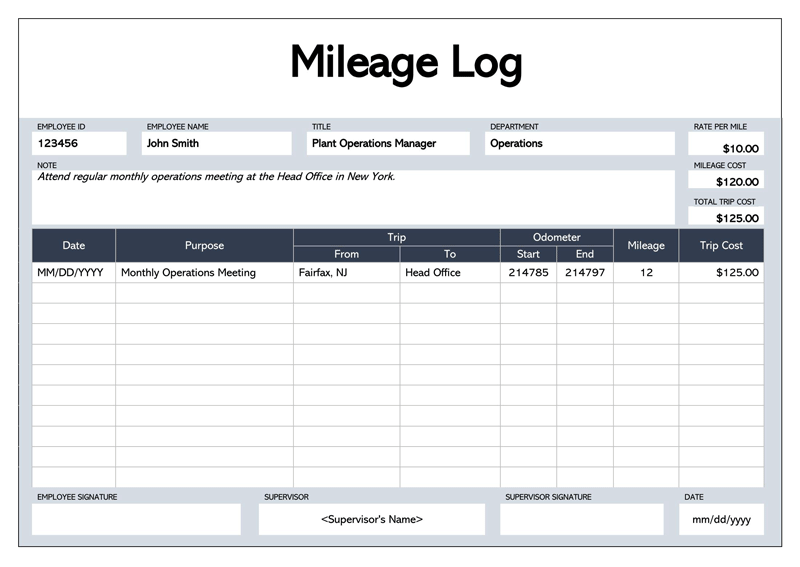

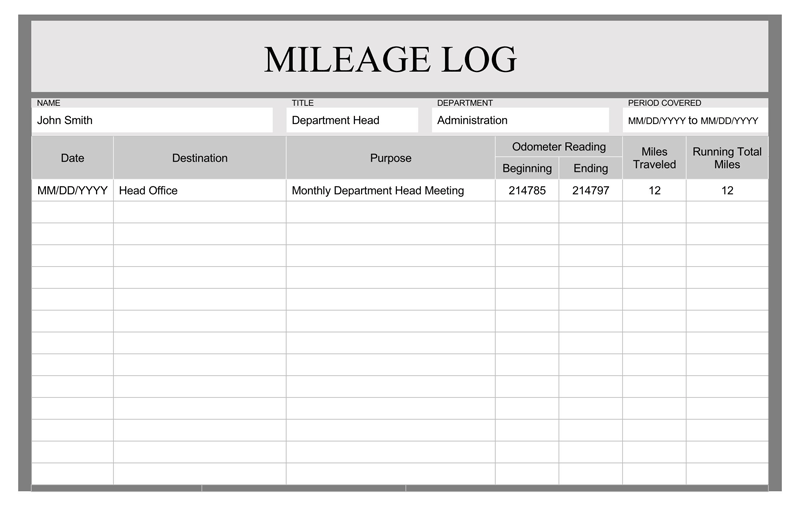

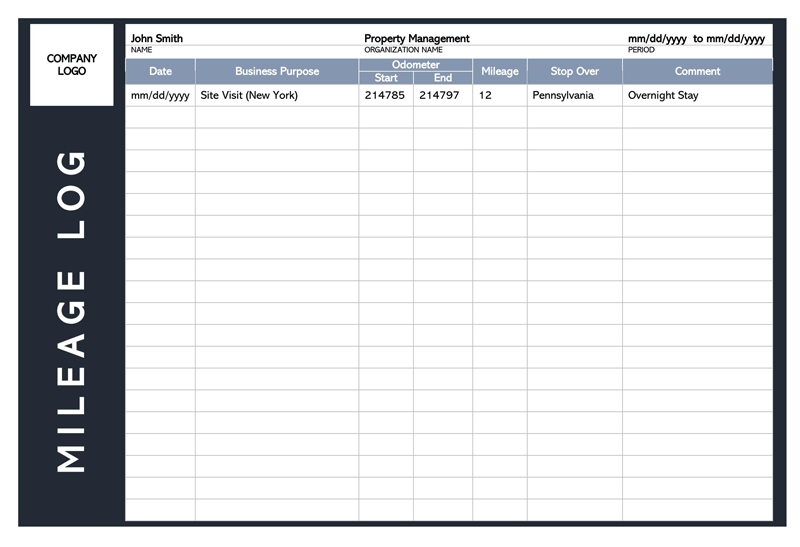

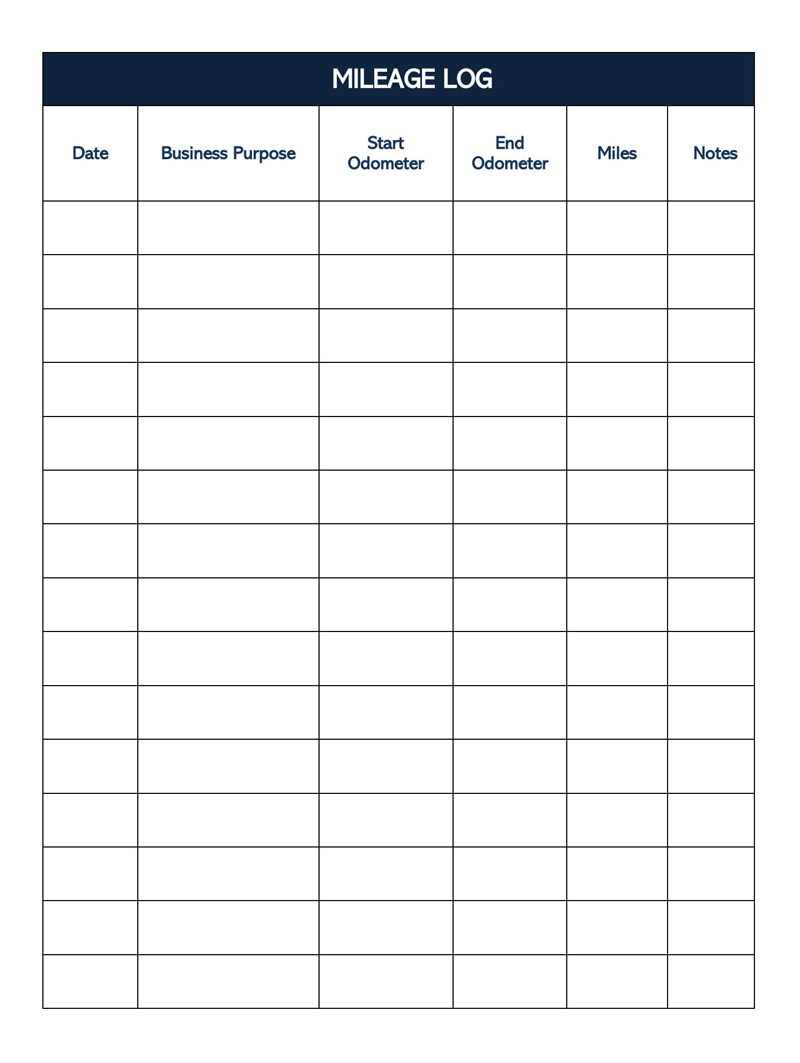

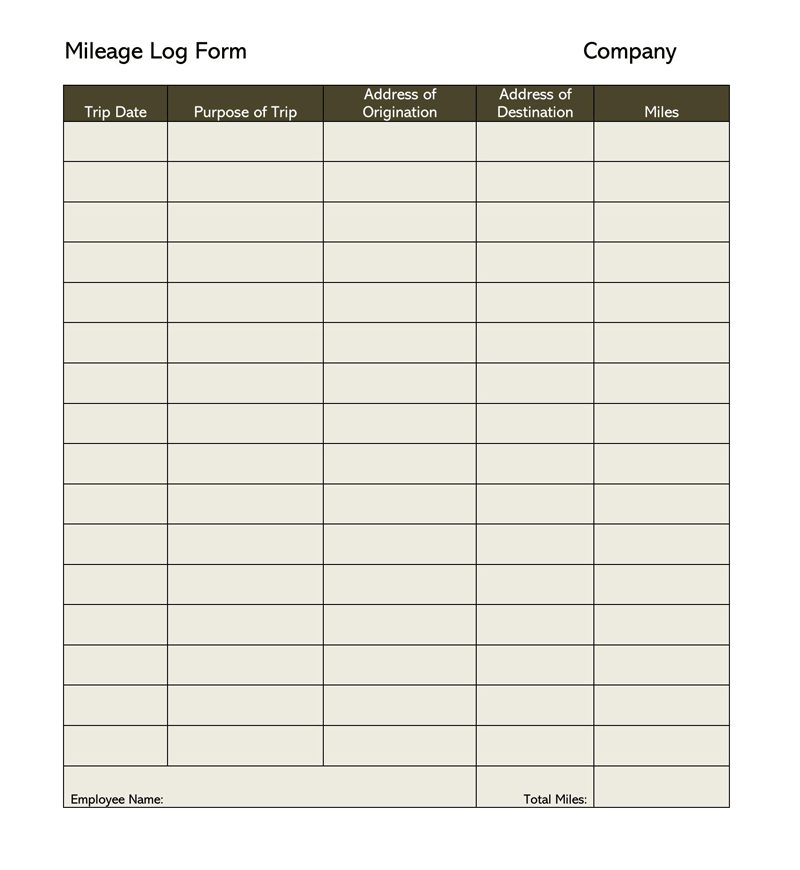

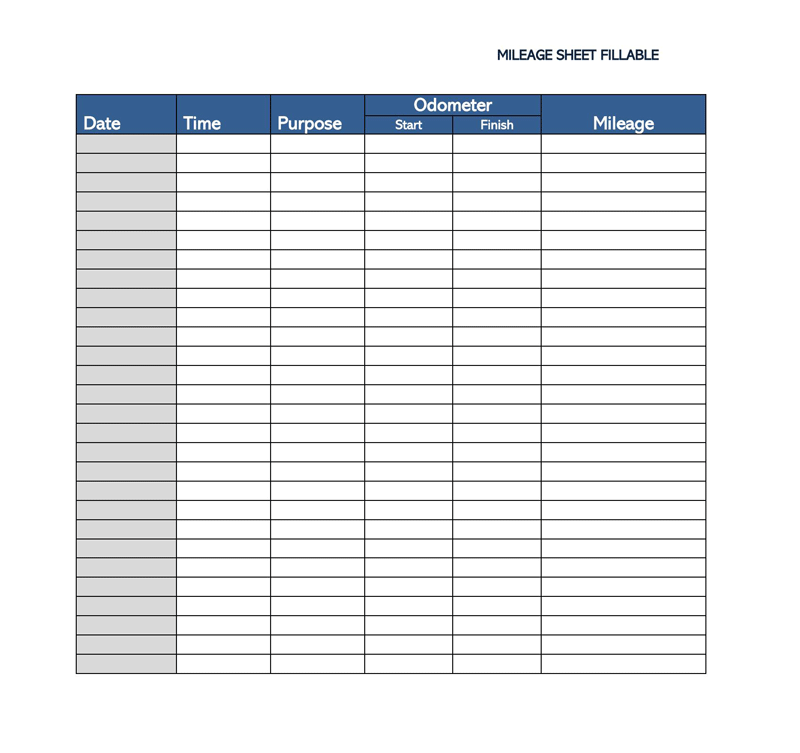

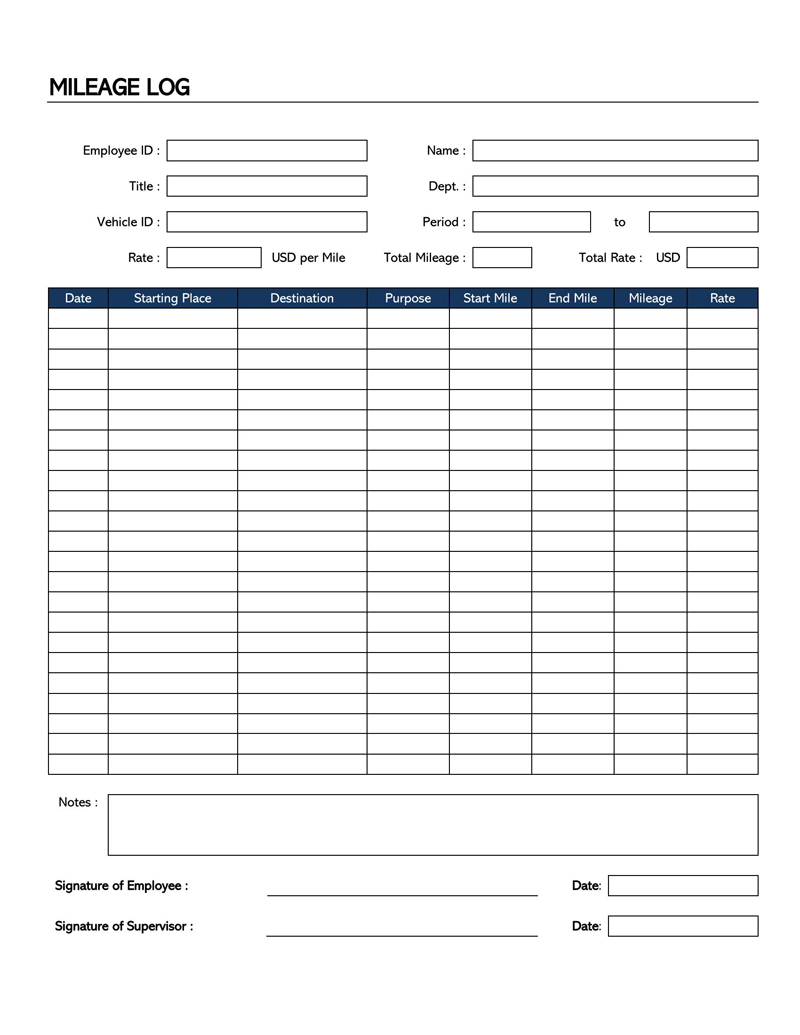

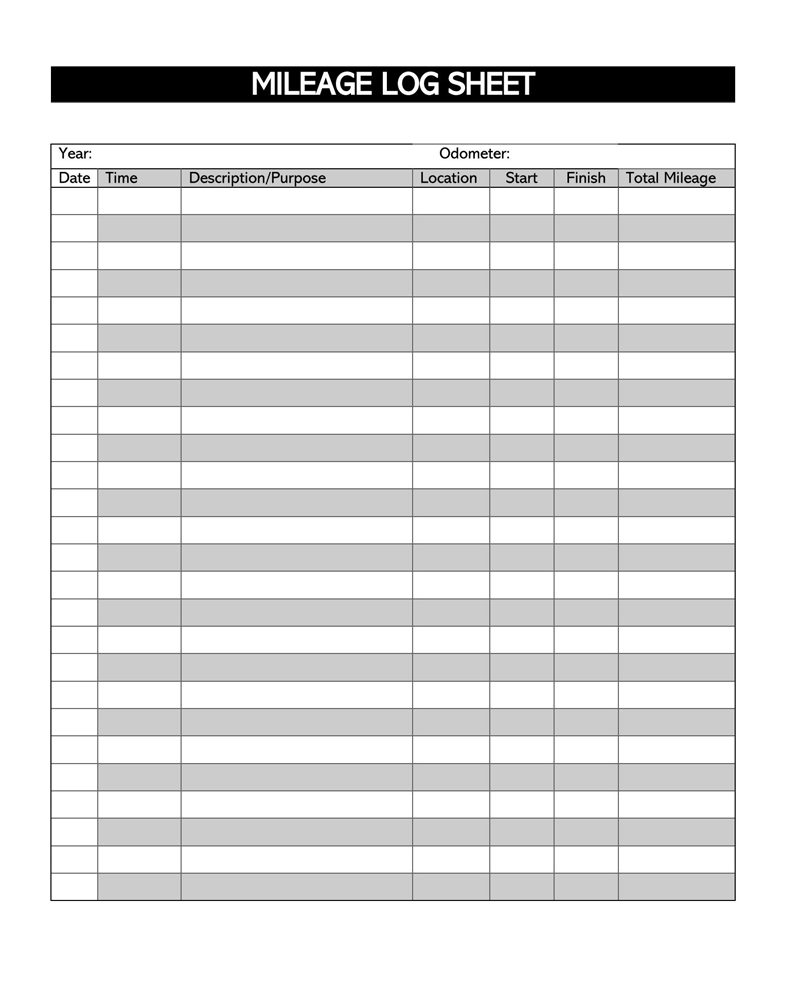

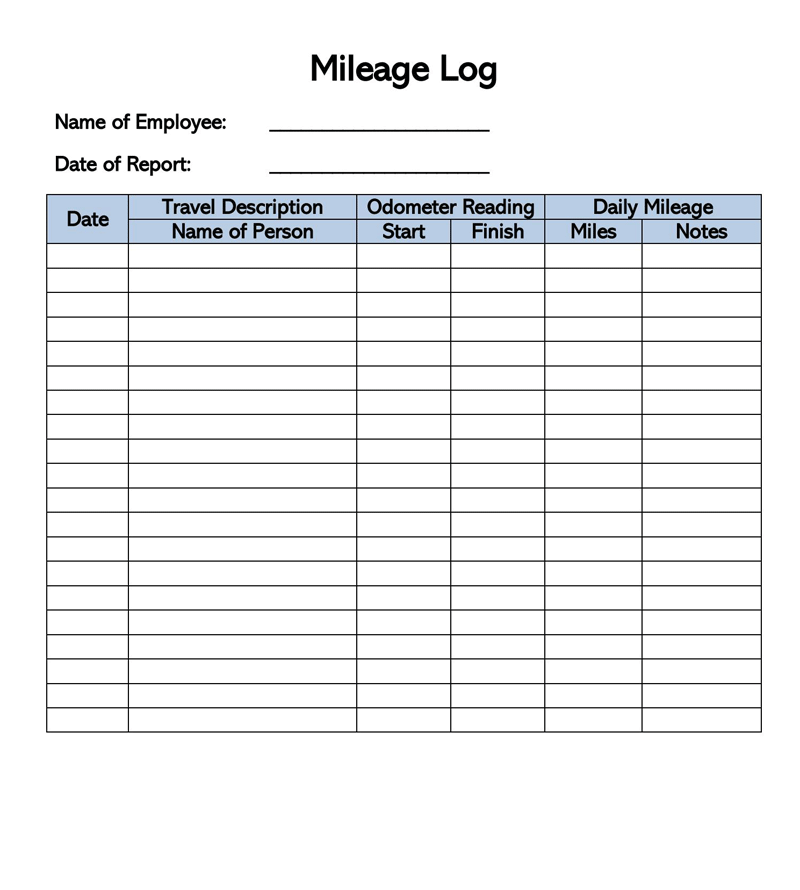

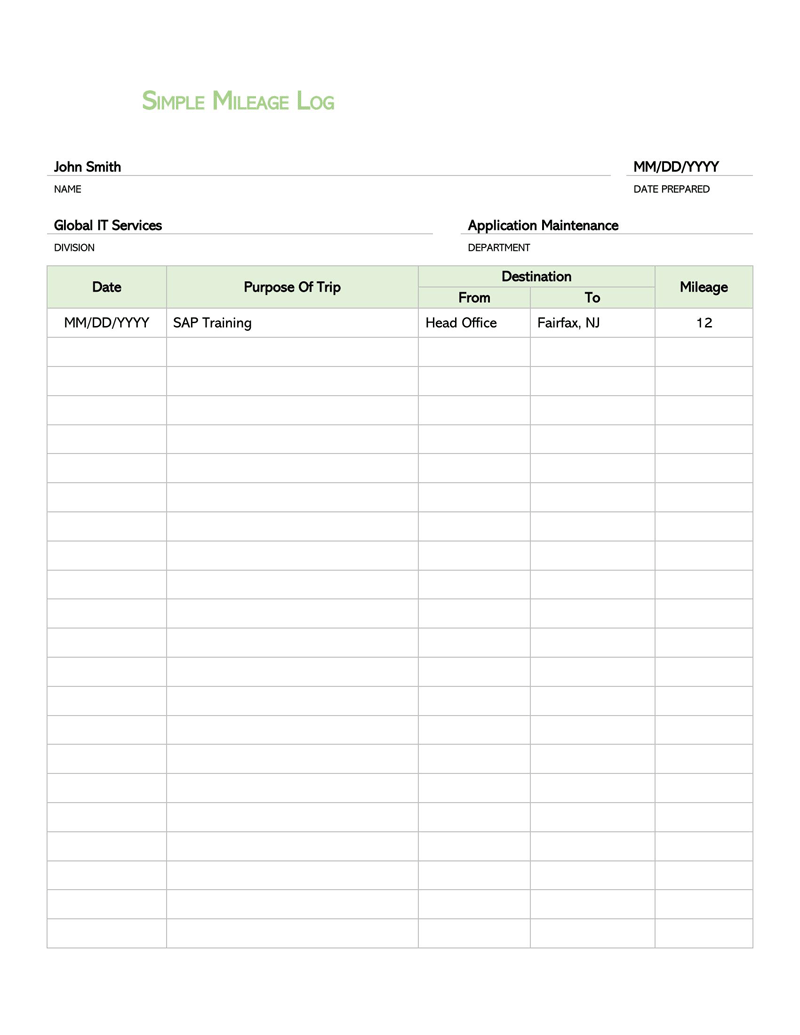

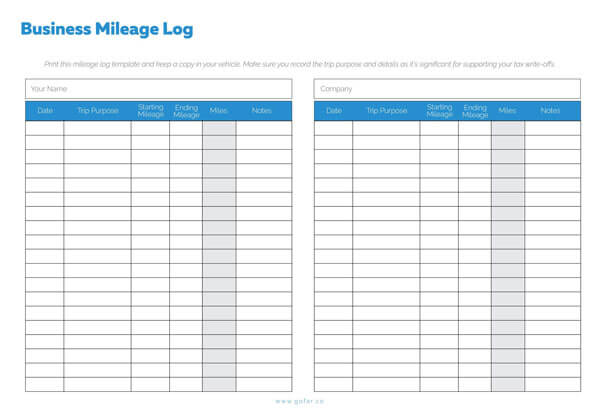

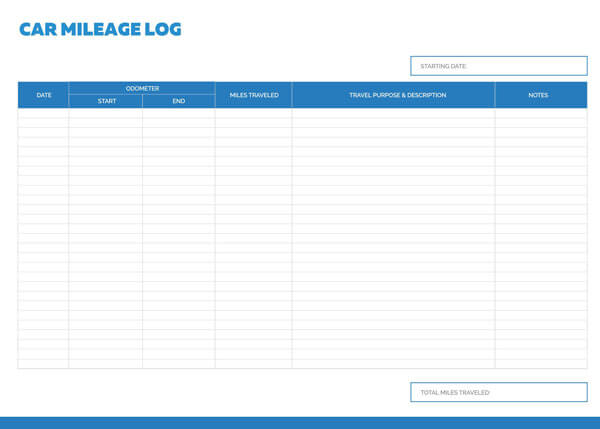

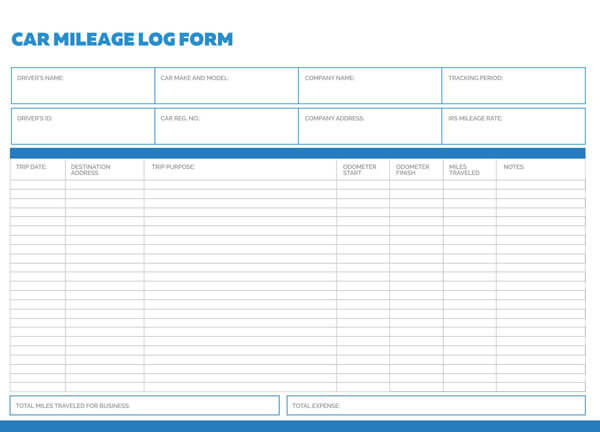

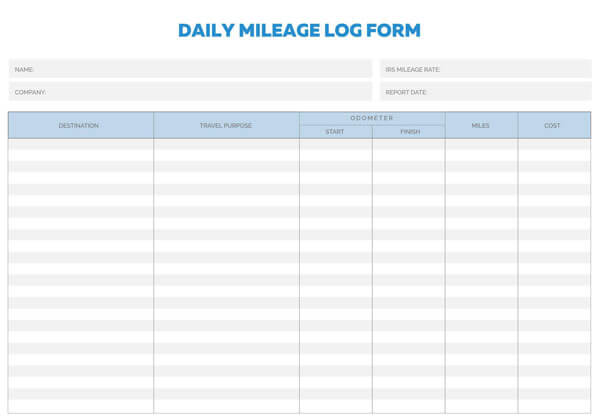

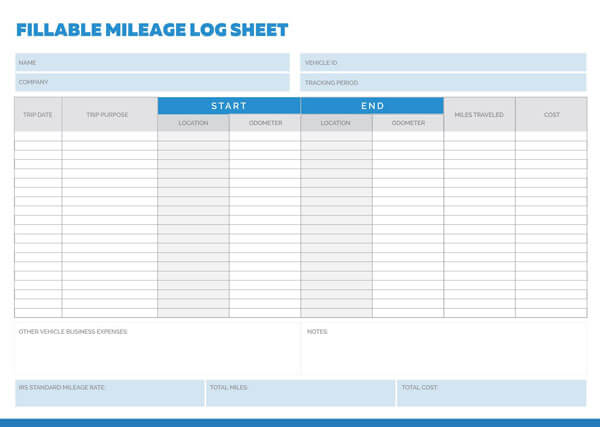

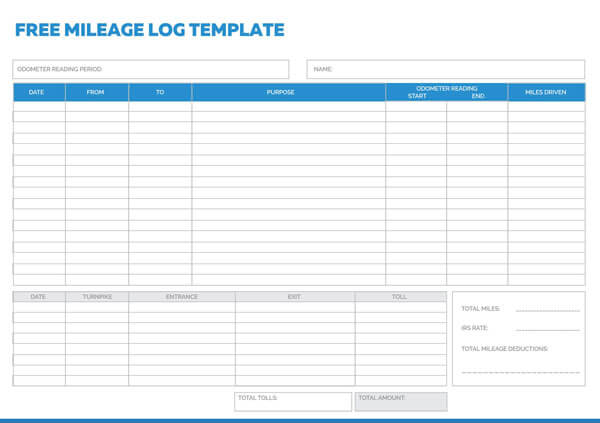

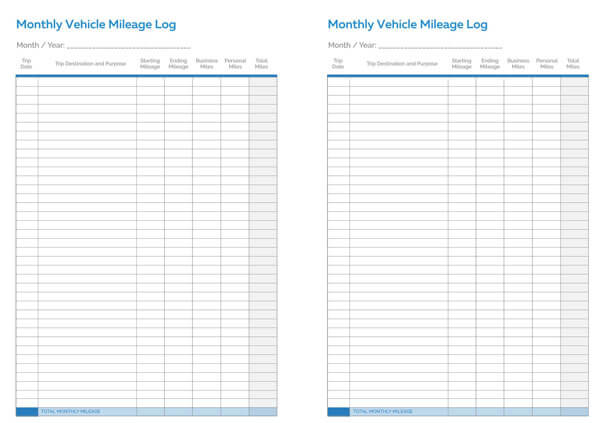

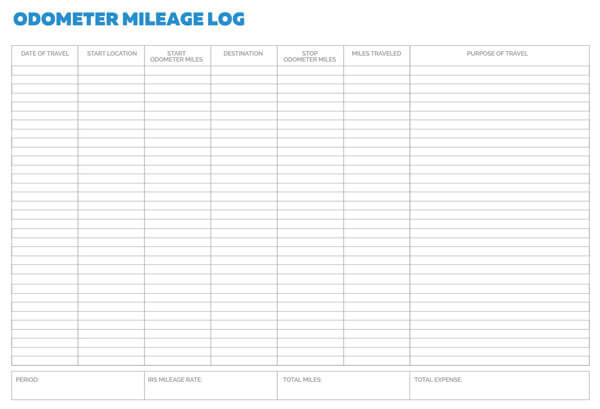

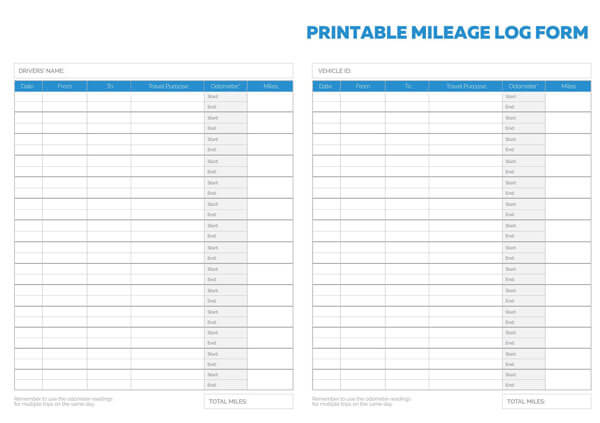

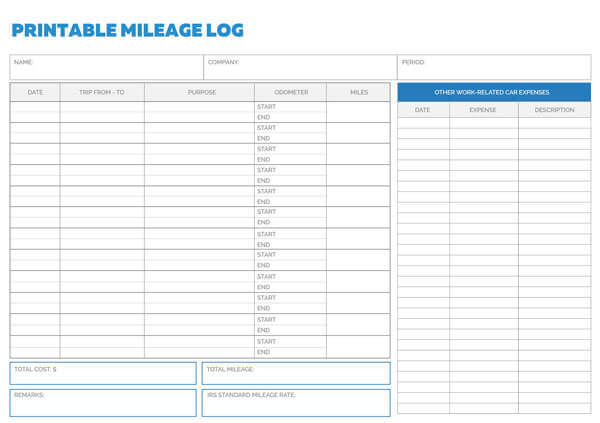

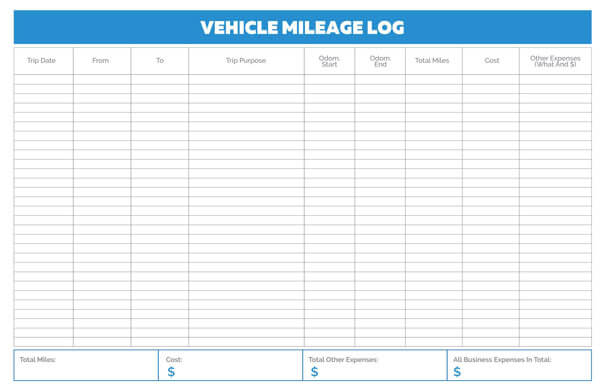

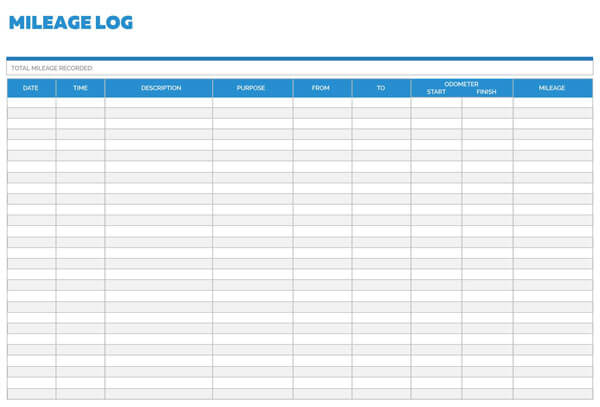

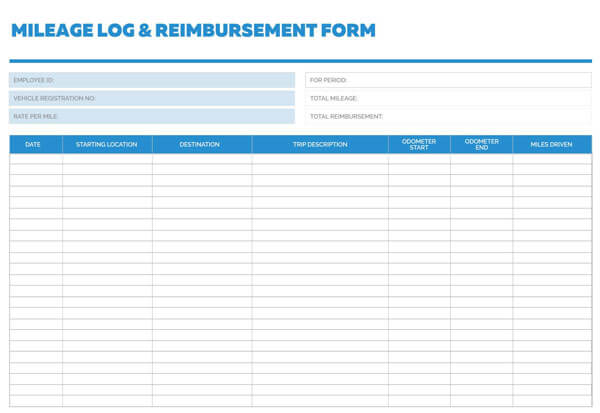

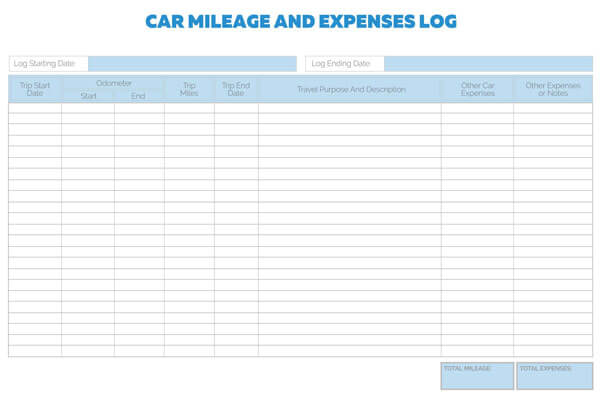

There are still several simple paper mileage logs available in this digital age that will enable you to maintain a detailed record of your business mileage. They allow you to complete the date and time, odometer readings, and total mileage, along with the reason for the journey, location, and even a place for notes. This provides the information required for an employee to complete Form 2016 or for people filing under 1099 status who have very little need to make business trips and, consequently, do not require anything more intricate.

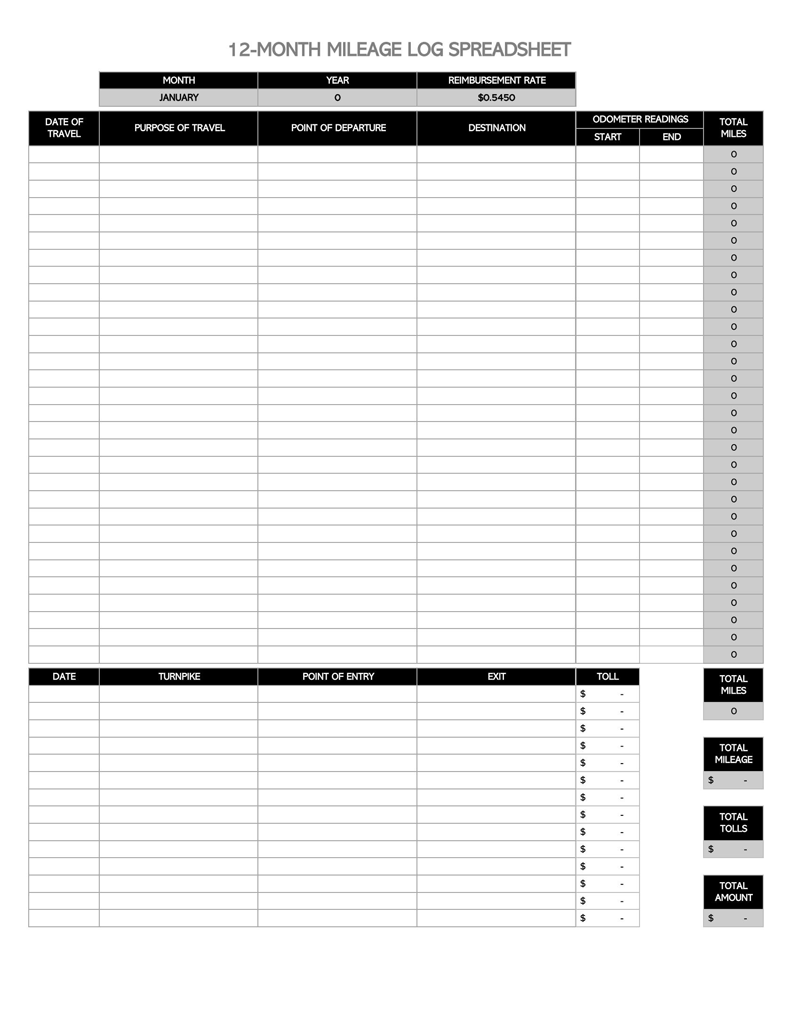

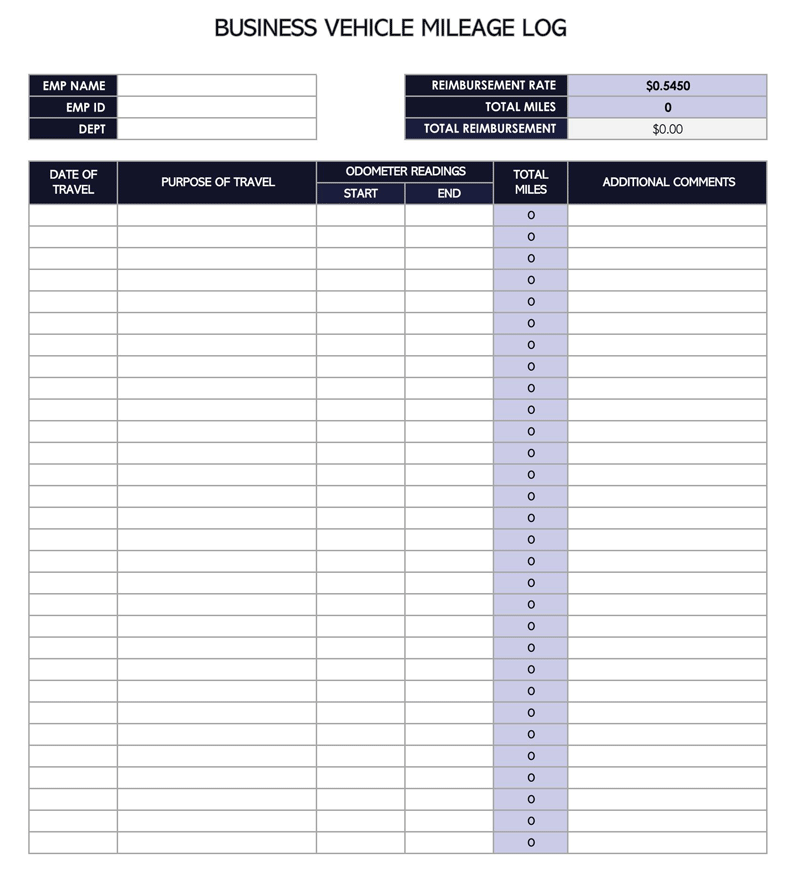

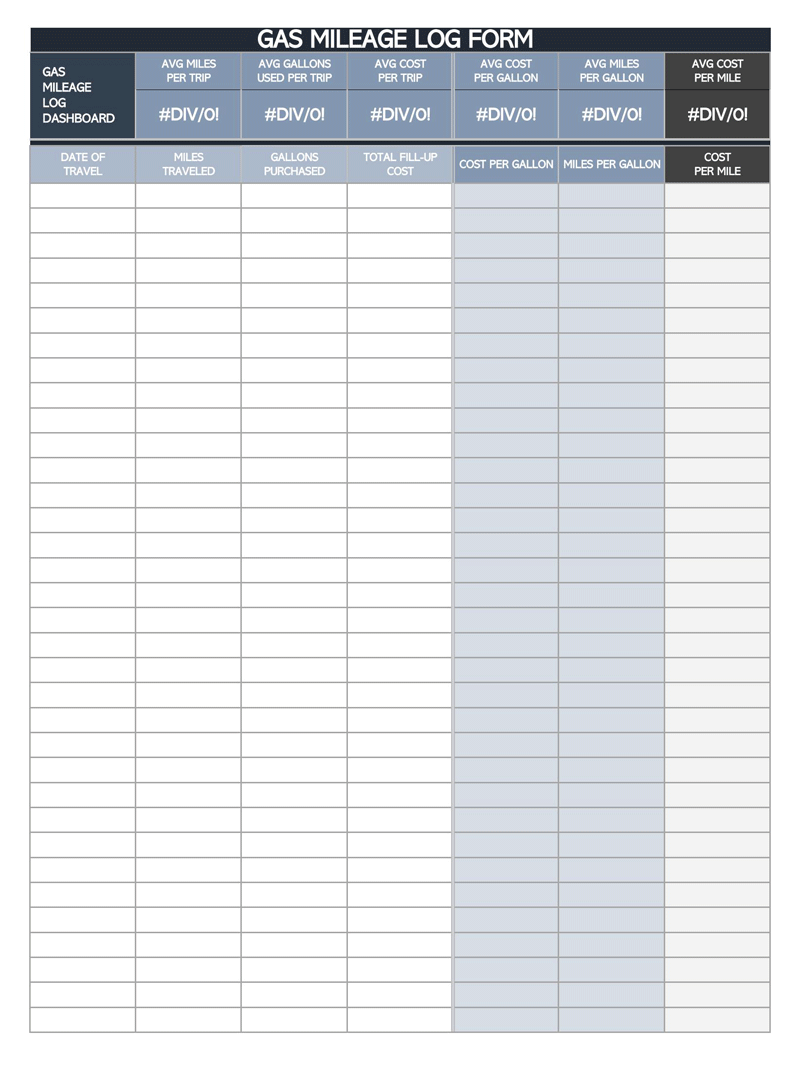

A Mileage Log Template can come in the form of a printed sheet or as a digital spreadsheet. There are many places on the internet where printable log templates can be downloaded.

Printable templates are developed to meet IRS regulations and have all the relevant spaces for you to complete to record odometer readings, destination, etc. They are most useful for employees claiming expenses for making irregular business-related trips. Deducting the cost of frequent business travel is more conveniently supported by using software, whether in a mileage log template incorporated into a spreadsheet program such as Excel or a stand-alone application.

The IRS is likely to disqualify your deduction if no apparent difference is recorded between business and personal use. Both printable downloaded mileage log templates and digital spreadsheets provide spaces for you to record your mileage each time you take a business trip.

These include:

- Date of the trip

- Time

- Description

- Purpose

- Starting point

- Destination

- Odometer start reading

- Odometer end reading

- Related Costs

Free Templates

The Purpose & Importance of Using a Mileage Log

The IRS insists on meticulously kept records to support any business deduction, especially providing firm evidence of business-related automobile expenses. You absolutely must record the odometer reading at the start and end of the journey and ensure that the difference is the total mileage being claimed. The purpose of the trip, start location, destination, and the current date are all required, and the log must be written up at the time of the trip. An IRS audit will quickly reveal whether you have met all the requirements for your claim and will equally quickly result in it being disallowed if you have not.

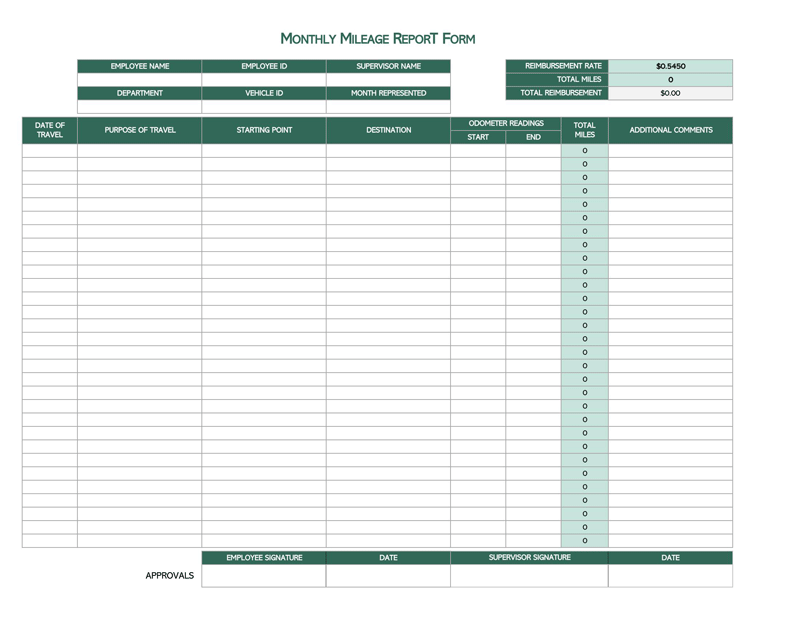

In addition to supporting your business automobile travel expenses, you’ll find that a mileage log template has other uses if you are an employee claiming a deduction on Form 2016. It provides an easy way of referencing times and dates when you made trips or met with clients or vendors. It can be used to support direct reimbursement from your employer. Notably, it can be referred to in order to confirm the length of time a specific trip took and, consequently, how long you need for travel when planning a future trip to the same location.

The consistently completed template proves especially useful for business owners, contractors, and freelancers operating their businesses and can, consequently, incorporate the information with their accounting procedures. Easy access to checking on the time spent on travel may be needed to bill clients, estimate costs when planning a project, or quote a job, and most of all, it contributes to much-needed efficiency when completing tax returns.

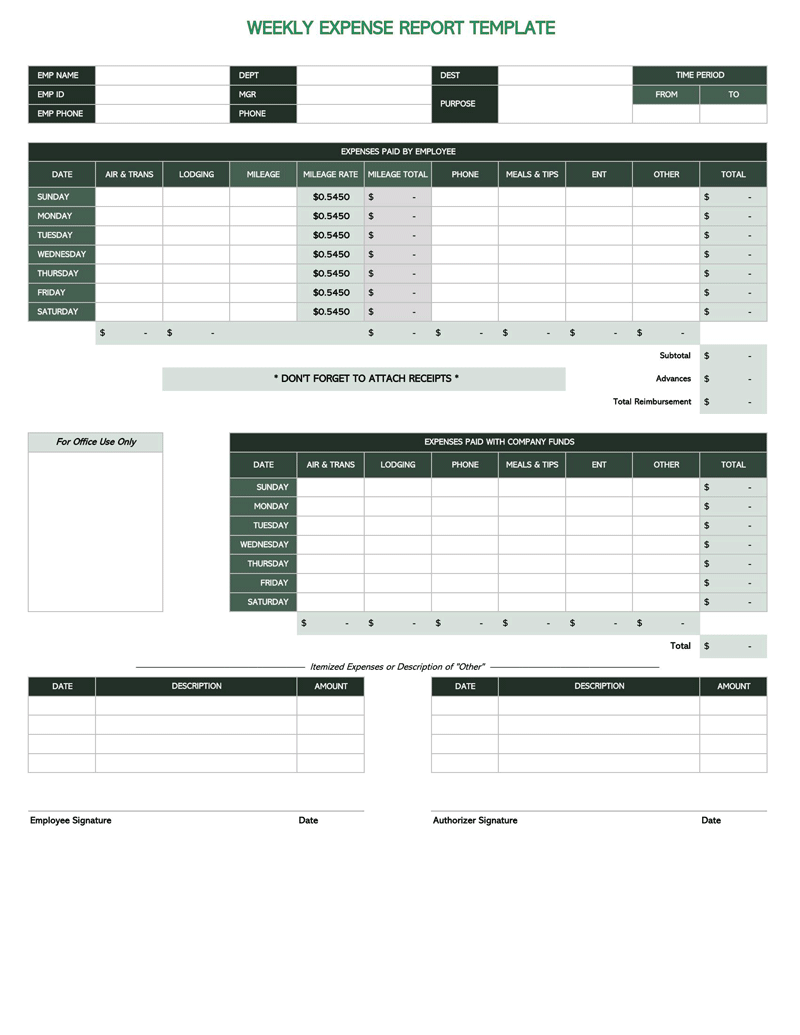

Whether you are a business owner or an employee, using your automobile for business is often a prerequisite for your job. Fortunately, the cost is allowed as a tax deduction from any earned income. However, in taking the possibly quite considerable deduction, you need to keep meticulous records to support your claim.

Both long and short business-related trips in your car are tax-deductible – from driving out to various branch offices, plants, and warehouses to making a drive to the bank, to purchase office supplies, or to meet with clients. Then, there’s picking up or dropping out-of-town clients at the airport, driving yourself to the airport for a business trip, and a dozen more reasons for using your car and the gas you purchase.

Basic Types of Logging

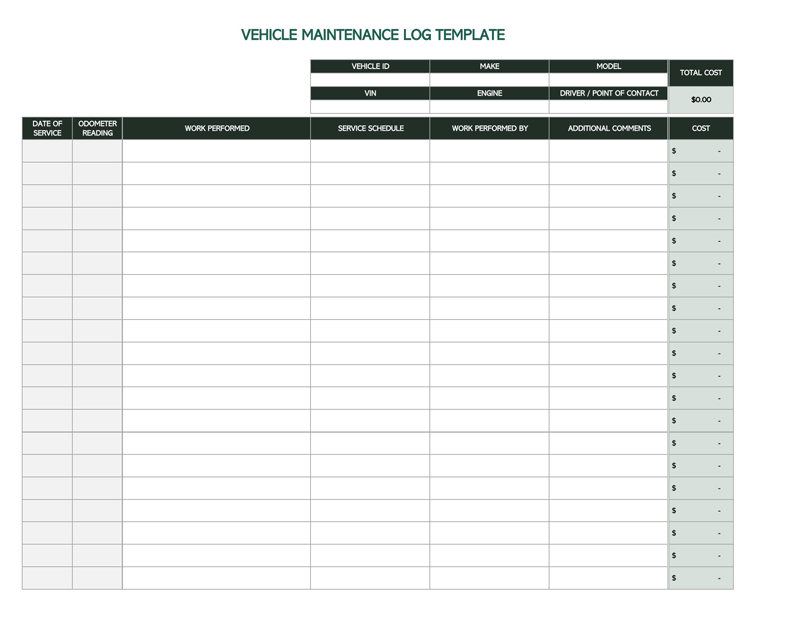

There are two acceptable types of methods of logging the business automobile expenses you plan to get reimbursed from your income. You can record the miles you travel and the gas you buy or record your mileage to claim your expenditure using the IRS standard rate in a mileage log for instance. A combination schedule will ensure that you have everything required to hand in to support your claim.

EXAMPLE

If you claim the actual gas expenditure, you need to keep all your receipts, including maintenance costs and insurance. Likewise, proof of a mileage claim needs evidence to support vehicle costs.

Mileage tracker apps provide the easiest way of automatically tracking mileage to meet IRS requirements for business owners and employees.

MileIQ is an app that quickly sets up and runs in the background on your phone so that, like a mileage logbook, it’s available as soon as you set off on your business trip. Unlike a logbook, however, it is intelligent software that has a range of capabilities. It can recognize the regular trips you make and provide you with the ability to flag the locations involved and the routes taken. You can set your work hours so that miles are tracked during these periods. It can save you hours of record-keeping labor.

Swiping right and left respectively for business and personal travel is incredibly convenient and accessibility from your computer makes the application especially ideal for employees claiming business travel expenses while using software to file their taxes. In addition, incorporating the information into desktop business software provides a reliable means to having supportable deductions for business owners, contractors, and freelancers who are claiming additional business deductions.

How to Log Mileage for Taxes

Best taken in steps, you should carefully ensure that you are eligible to claim a use of automobile deduction, then decide how you will calculate your expenses, how you will record and retain them – e.g., what sort of mileage log or logbook template or app to use. Finally, whatever means you decide upon your records, you need to ensure that you comply with IRS requirements. This applies whether you are an employee or a self-employed person.

Assess your eligibility

The first step in claiming automobile expenses against your income is to ensure that the types of expenses you consider business-related are indeed eligible.

The expense must meet one of the IRS definitions of what constitutes a business drive:

- Meeting clients for coffee, lunch, or dinner

- Trip to and from the airport for business travel, including parking costs

- Car expense regarding income generated from a sideline

- Visits to customers’ and vendors’ locations

- Errands and purchasing of supplies

- Commuting to temporary short-term business locations

- You have 1099 status – i.e., you are an independent contractor or a freelancer

- You have documentation, regardless of your status, to support your claim. This should include the fact that you have a home office claiming mileage for driving home from undertaking a project at a client-designated location.

Select method of calculation

There are two basic methods of calculating your automobile expense that meets IRS requirements when claiming a tax deduction. First, you must keep records that are both timely and accurate. This includes keeping a daily log of the purpose, the destination, and the miles traveled, supported by the odometer readings at the start and end of the trip.

Calculate your mileage log deduction by using either:

- Actual expense

- The standard IRS mileage rate (2021 – 56 cents per mile)

Whether you calculate the deduction by gas expenditure or using the IRS sanctioned mileage rate, ensure that your records are made each time you take a business trip and that you keep them to support your claim.

Ensure that you record your odometer reading at the beginning of the tax year. If you are an employee, it will be required for completion of Form 2106 and, if you are a business owner, contractor, or freelancer, it will be needed to support the applicable business expense claim form.

Maintain your driving log for all trips if you are claiming the standard IRS mileage rate. This is best done by systematically keeping a mileage log template.

Record your odometer reading at the end of the year – again, this is required on Form 2106.

By the same token, your mileage – in its entirety – will be required when you complete the IRS-prescribed forms.

The IRS requires that you keep your records for a minimum of five years. Therefore, you need to ensure that all your paper and or digital records are kept in a safe place.

And you can choose whichever of the two earlier methods of logging you use:

- IRS standard mileage rate

- Gas, insurance, and maintenance receipts

More Mileage Log Templates (PDF)

Frequently Asked Questions

The IRS requires that you supply a record of your mileage, date, purpose, and destination of every business-related trip. Additionally, you must record your odometer reading at the beginning and the end of the tax year relating to your claim.

Self-employed workers can deduct mileage expenses from their income, and, as an employee, you can deduct mileage, but you will need to complete Form 2016. Sometimes both situations apply.

Any mileage you put on your vehicle when undertaking business-related travel can be claimed whether you are an employee or a self-employed person with 1099 status. Business automobile expense includes driving between offices, warehouses, plants, etc., meeting clients for business or entertainment purposes, banking, picking up supplies, and other errands. Note well: commuting expenses cannot be claimed other than when you must regularly travel to a temporary location by your employer.

You need to keep a consistent record each time you drive for a business purpose. This can be in the form of a mileage logbook, on a mileage log template, or on a mileage log app.

You can keep and record gasoline receipts and maintain a mileage log, or you can take the standard cents to miles IRS mileage deduction according to the mileage total shown on your mileage log.

The IRS does not stipulate any specific mileage log but accepts any properly kept mileage logbook, mileage log template, or records on a mileage log app. A digital form of the logbook is preferably less likely to get inadvertently destroyed than paper records in this day and age.