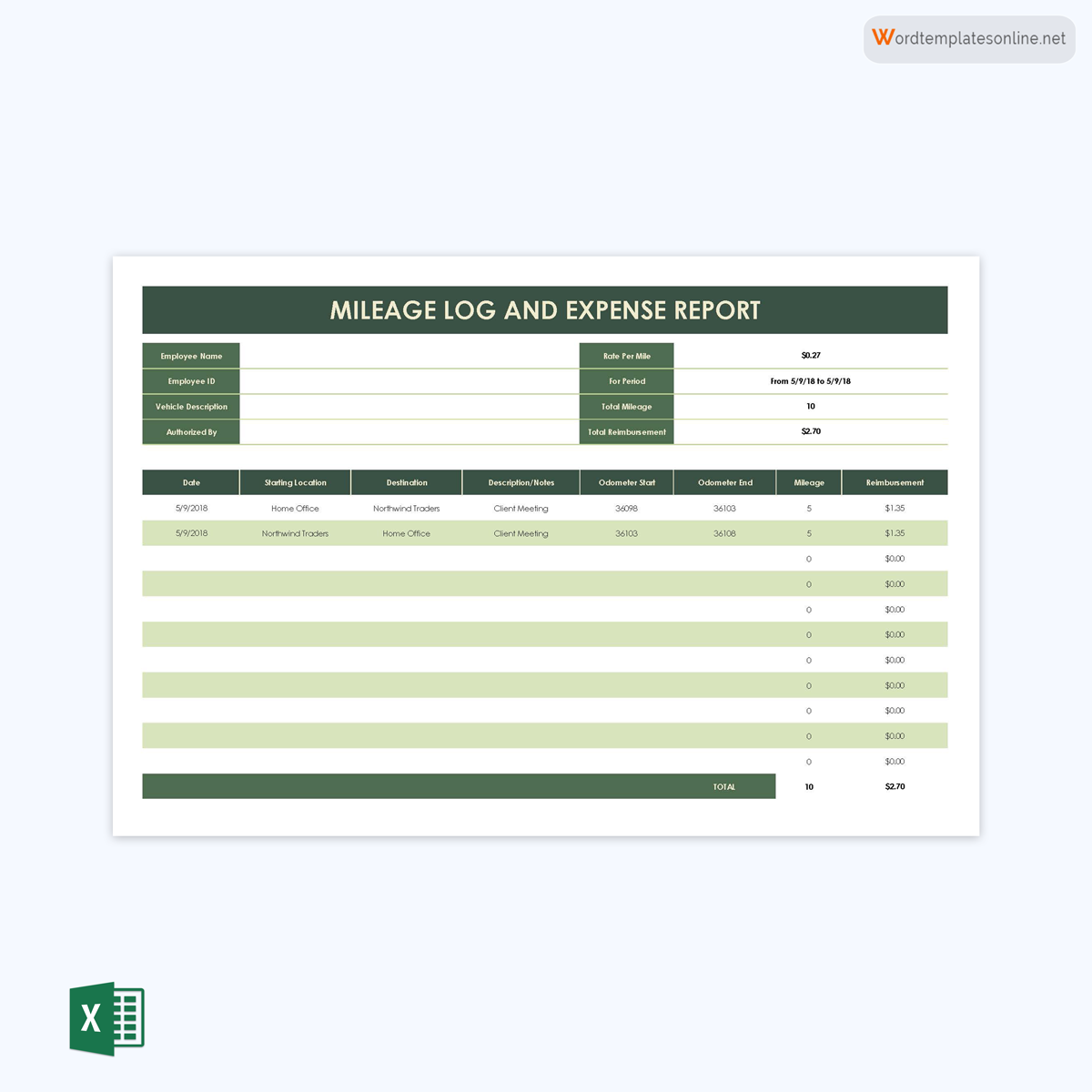

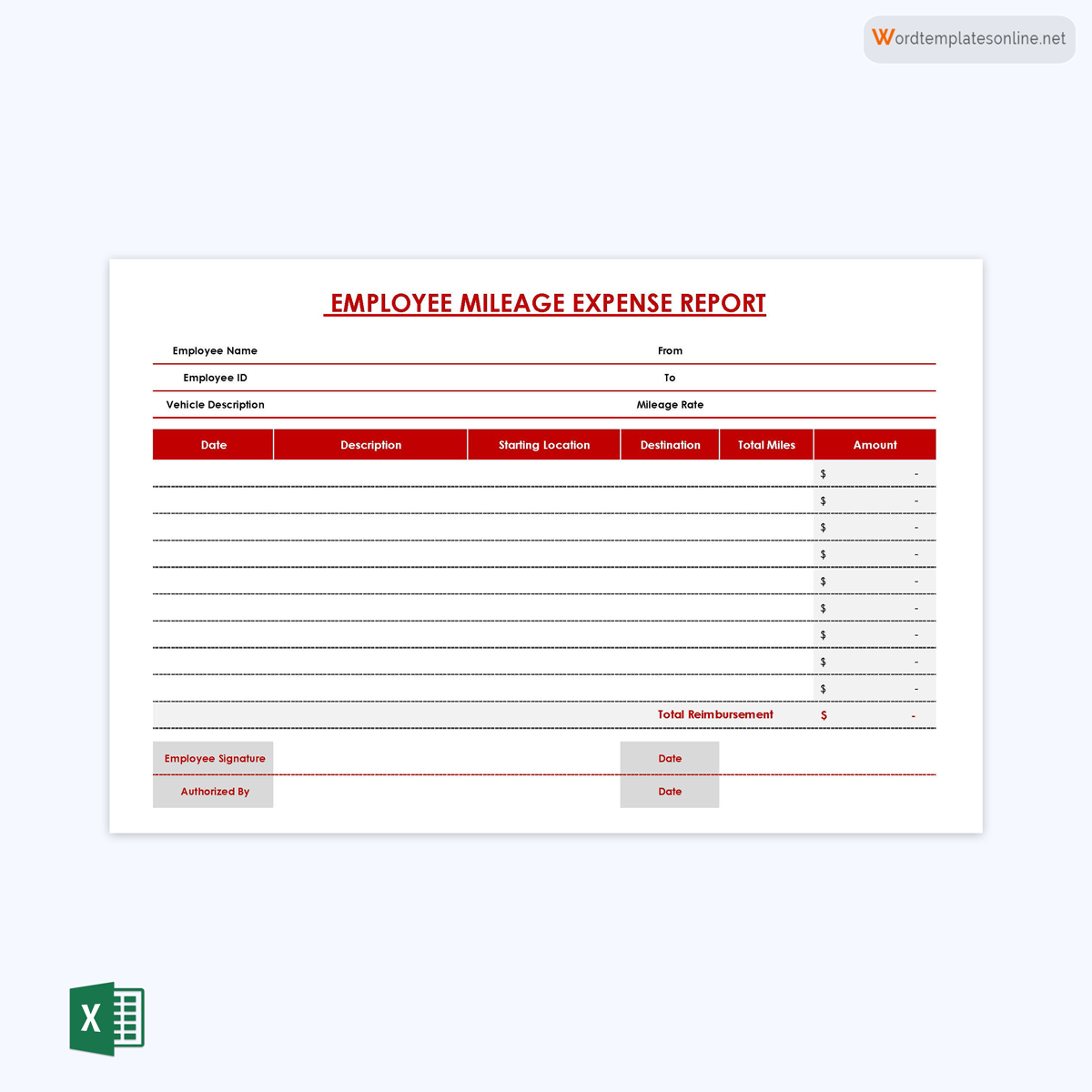

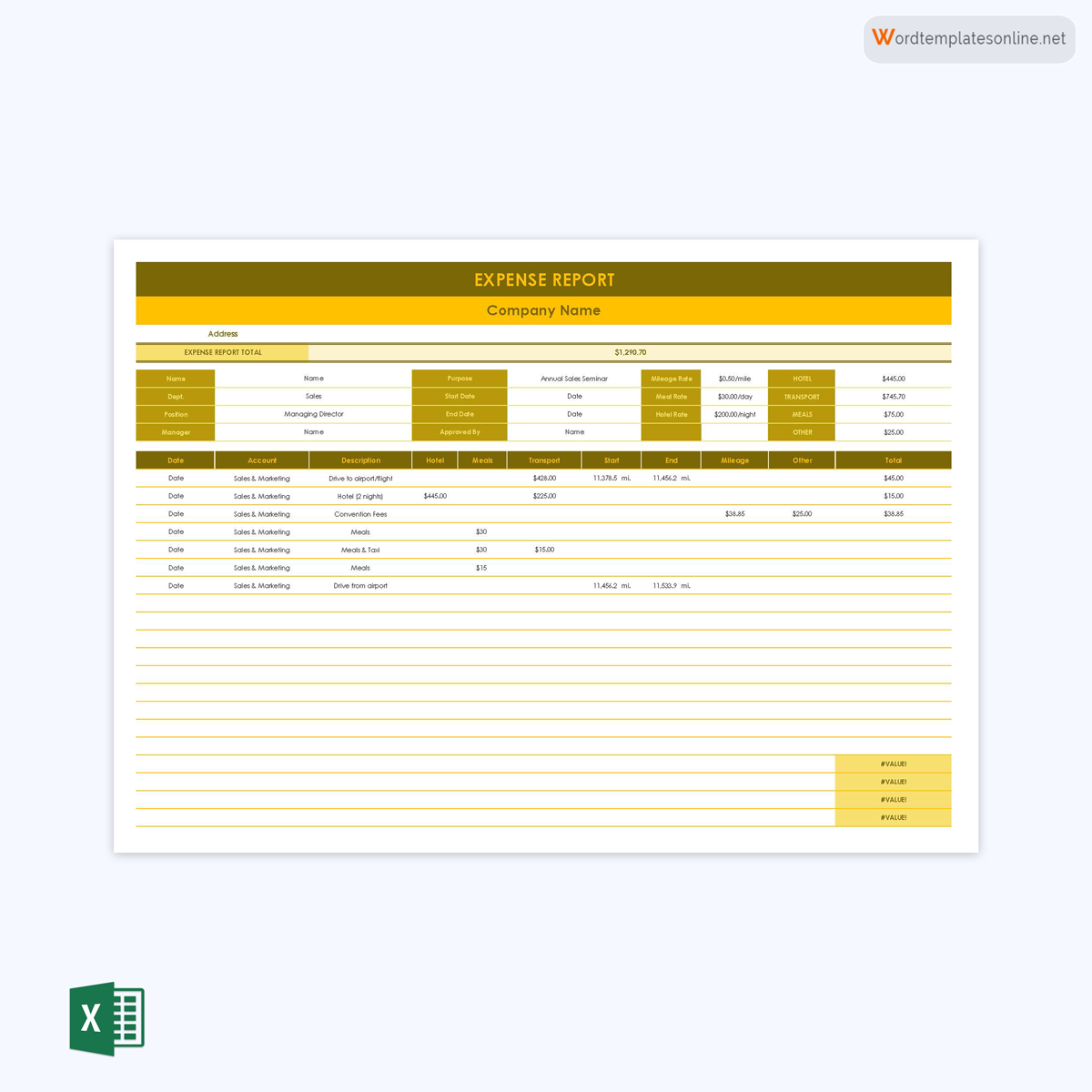

Using an automobile for business, medical, and charitable purposes can be costly, especially for individuals in professions where they have to travel a lot. In light of this, the IRS allows employees, small business owners, and companies to deduct mileage expenses from their taxes provided they meet set conditions to qualify for these deductions. One of these conditions is having an accurate expense report for mileage.

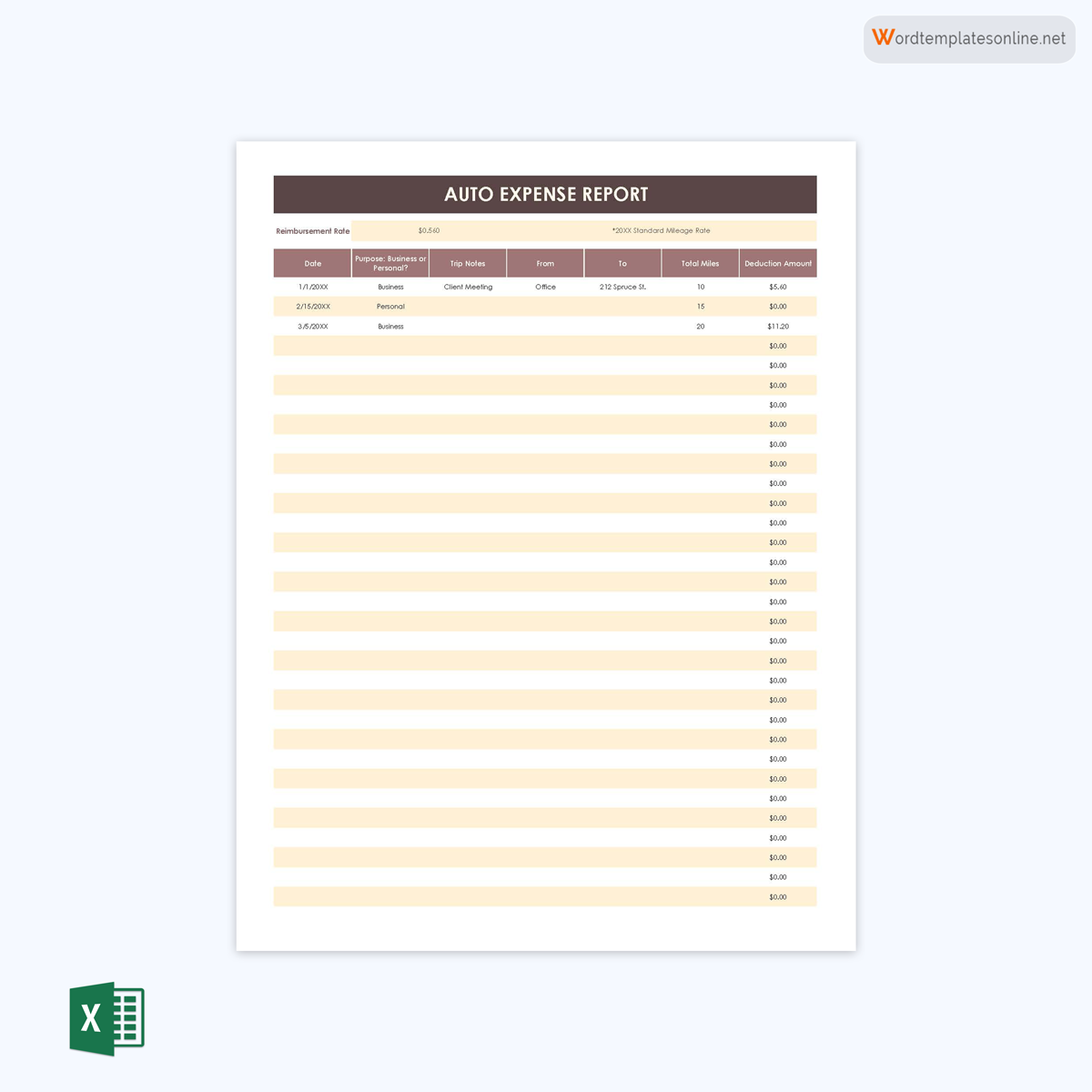

Therefore, anybody who intends to deduct mileage expenses from their taxes must track their mileage using this log. However, some companies offer mileage reimbursements to their employees. The reimbursement rate is usually a pre-established fee per mile given to employees per month.

Mileage Log Templates

IRS Requirements

The IRS requirements can be categorized into legal and record-keeping categories. Employer requirements can supplement these requirements. Either way, whether you’re an employee or self-employed, you should be aware of the requirements for claiming mileage deduction from taxes. The IRS requires any person filing for mileage deductible to be eligible and have adequate records.

The TJCA (Tax Cut and Jobs Act) 2017 stipulates that the following taxpayers are eligible for mileage deductions:

- Small-business owners (self-employed taxpayers) file either schedule C or Schedule F

- Self-employed workers such as contractors and drivers in the rideshare services industry

- Specific categories of employees such as reservists in the armed forces, fee-based government officials, and qualified performing artists

- Volunteer work taxpayers

- Physicians traveling for medical appointments

Note

Not all business mileage is deductible; the trips must meet specific criteria, for example, business trips from one work location to another work site or mileage trips to conduct official business-like meeting with customers/clients or business meetings. According to the IRS, this log must indicate the mileage per trip, date of trip, purpose, and trip destination. In addition, this report must also show the total business mileage for that year.

Which Mileage is Deductible?

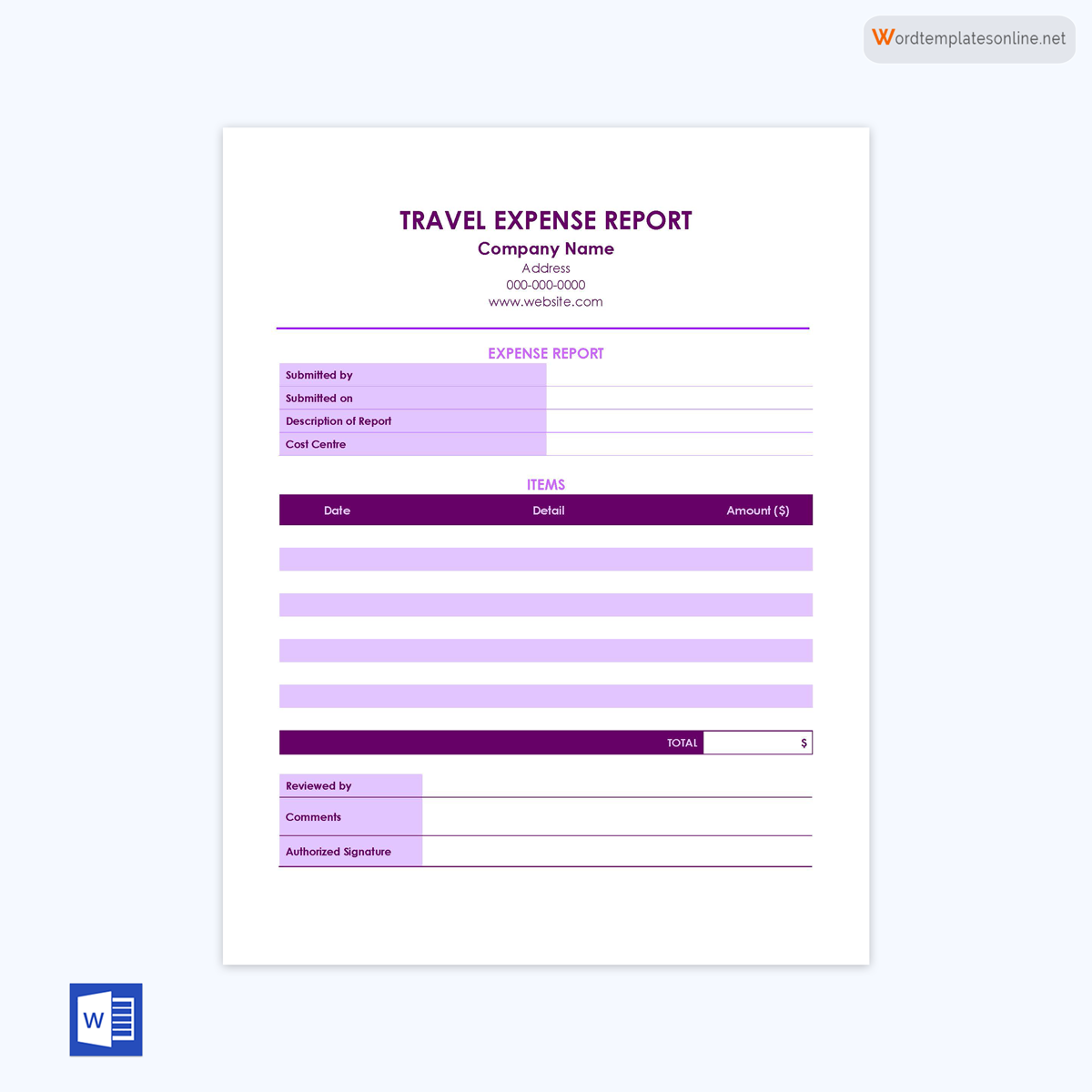

Taxpayers can deduct mileage expenses incurred for charitable travels, medical trips, and official business purposes such as trips to meet clients, in between offices, and to pick up work supplies, etc., even when they use personal vehicles. However, the deduction rates for all categories (business, charity, and medical trips) are reviewed constantly, and therefore you must confirm the applicable deduction rate when filing for taxes.

Note

You cannot claim deductions for mileage expenses for commuting from home to work. Also, employees cannot deduct mileage expenses that their employer is reimbursing them.

What Records Do You Need?

Not all the details about the business trip have to be recorded. The IRS priorities some details that individuals need to track, such as:

- Mileage for each deductible business use

- The total accumulated mileage for the fiscal year

- Time and date of mileage recording/trip

- Destination (to and from)

- The purpose of the trip

How to Calculate Mileage Reimbursement?

Calculating how much to claim as reimbursement is typically a straightforward multiplication process. You should note the total mileage recorded in the log and multiply it with the reimbursement rate. For example, for a tax return of 2021, where the reimbursement rate is 56 cents per mile, the total mileage of 1000 miles will equate to a total reimbursement amount of $560. This is $0.56 x 1000 = $560.

Format of Mileage Log according to IRS

The IRS has not restricted taxpayers from presenting different formats of a log used for deductions. This means you can present the expense report in the following formats:

- Handwritten records such as paper, diary, account book (IRS log template)

- Digital spreadsheet log used for mileage

- Word Document

- CSV file

- Microsoft’s Excel (Xlsx) file

The IRS accepts its different formats. However, it is recommended that an easy-to-process format be used. As a result, electronic logs are recommended, which are easy to prepare via an application and easy to generate in different formats.

Note

When preparing a report for calculating mileage expenses for your employer, always inquire about the format to simplify processing.

How to Claim for Mileage Deduction for Taxes?

The report for expenses must be accurate to the core due to the legalities associated with tax returns. Therefore, it is advisable to plan before claiming deductions. This means tracking must be done from the beginning of the year. However, even if you begin tracking in between the year, it is acceptable as long as you begin tracking soon as you start making business-related trips.

Below are steps you can follow in your tracking process:

Ensure that you are eligible

The first step is to ensure that you are eligible to claim deduction. Refer to the IRS criteria for deductions eligibility, as mentioned earlier in this article.

Specify the method of calculation

Secondly, decide on the calculation method you would like to use to calculate the reimbursement. For example, there are two methods of calculating mileage for tax returns – standard mileage expenses method or actual costs method.

The standard technique is the most common method, which includes multiplying the total mileage with a standard rate. The standardized rate covers the driving costs, including gas, tolls, parking, repairs/maintenance, and depreciation.

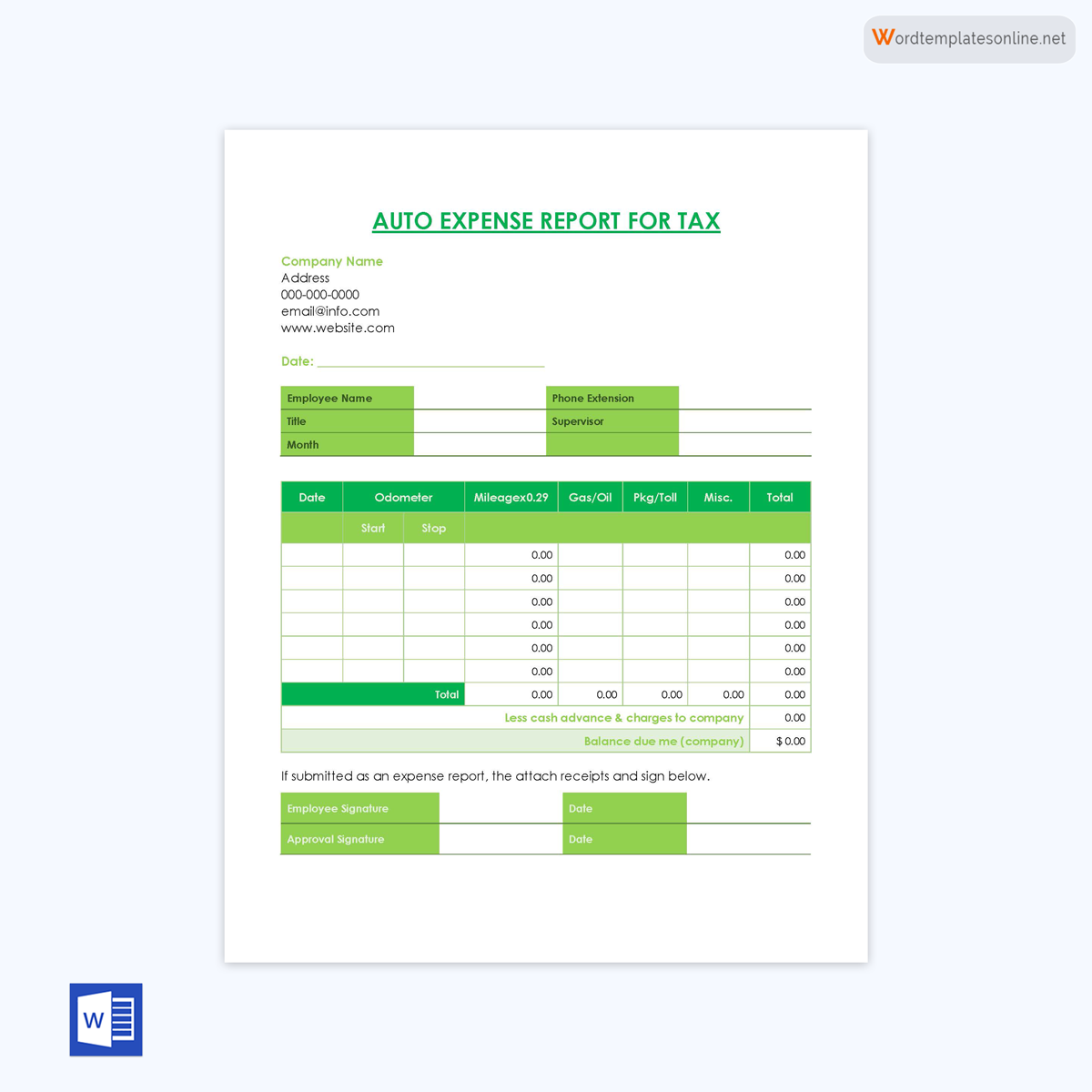

The actual vehicle costs method requires you to track all the driving costs yourself, such as license fees, insurance, roadside assistance plans, car washing, and other over and above the costs covered under standard rates. This may require you to seek professional tax assistance.

Record reading from your odometer at the start of the year

Then, record the vehicle’s odometer reading at the beginning of the year. Note this figure on Form 2106 as the IRS will want to know the total mileage the vehicle covered within the year. Note that, if the car is not new, say it was bought in between the year, the records can still be taken; the only difference will be the odometer readings should start from the first day the car was deployed and not the beginning of the year.

Maintain driving log

Next, document all the details for the business trips made all year round. This will include odometer readings at the beginning of each trip, starting destination, date of the trip, purpose, the final destination, and the odometer reading at the end of the trips. Subtract the initial odometer reading from the final reading to record the total mileage for each trip. Repeat for each business-related trip within the year.

Record of receipts

Also, keep all receipts for the expenses and other driving costs such as maintenance, tolls, parking, and insurance payments. These documents are vital for taxpayers who choose the actual costs method. Ensure each receipt has the necessary information such as date, the amount paid, and details of the associated service.

Record mileage for tax year

Next, when filing your returns, record the total mileage you want to claim for deduction on Form 2106, Line 12. Then calculate the amount to be deducted depending on the method of calculation.

Retain the documents

Lastly, create separate documents for every year and keep the documents used to claim the deduction in a safe place. The deduction documents should be kept for at least three years.

Frequently Asked Questions

Taxpayers don’t need to record their odometer readings for each trip they make. However, they must record the odometer readings at the beginning and end of each year or when they start using a new car within the year.

The IRS has not set rules governing how anyone tracks their mileage. However, the individual must record the mileage for business trips if they are to claim for deductions from their taxes.

You are not required to track mileage covered for personal errands. However, recording them is a good idea so that it becomes easy to differentiate the percentage mileage used for business and personal purposes. Tracking all trips is recommended.

The general rule under IRS stipulations is to keep all documents that support the mileage reimbursement for three years at least. This is three years from the final date of filing the returns.

Yes. It is a good idea to keep copies of your records. Copying your records makes it easier to verify driving costs if you are requested to do so. Using a digital mileage log is an easy way of keeping these records hustle-free.

Employers use a per-mile or car allowance reimbursement system to calculate how much they can reimburse their employees for driving costs. This typically involves setting an agreed-on per mile fee multiplied by the mileage to give the total reimbursable amount.

A mileage reimbursement rate is a standardized amount that organizations can multiply an employee’s business-related mileage with to give the total amount of reimbursement the employee is entitled to. For example, the 2021 mileage reimbursement rate is 56 cents.

The amount you should be reimbursed is dependent on the mileage covered for business-related errands. Note that your employer is not required to reimburse you for mileage; however, most companies reimburse their employees as an employee retention strategy.

No laws dictate how and if companies should reimburse their employees who use their vehicles for business purposes. Therefore, employers may or may not choose to reimburse their employees without breaking any law.

Not. If your employer reimburses you for mileage in a given year, you should not claim a mileage deduction for the same.

A gasoline log is used to record the amount of fuel a vehicle uses for a given duration, whereas a log is used to track the distance travelled by a vehicle for a given period. The latter is typically used for tax purposes. Gasoline logs are used for budgeting and accounting purposes.