In the state of Minnesota, when selling, buying, or registering a car, you will need a Bill of Sale for Motor Vehicle.

It is a document that acts as legal proof of the sale.

This can be useful if there are any issues regarding the vehicle, for example, if the seller got a ticket before the sale, the new owner can prove that they did not own the vehicle at the time of the ticket.

It is also required by the new owner when they register and title the vehicle in their name. Normally, the title of the vehicle is sufficient when registering the vehicle. However, should any important details be missing, it will be required by the Office of the Deputy Registrar. This is detailed in Statute 84.788 regarding the sale and registration of vehicles in Minnesota.

Free Templates

Other Requirements

Some other documents that you may need when registering a vehicle are a Power of Attorney and an Odometer Statement. The power of attorney is used when someone else is registering the vehicle on behalf of the new owner. The Odometer Disclosure Statement is a Federal form needed for any vehicle that is under 16,000 pounds and is under 10 years old. The Minnesota Registrar does not provide these forms.

Requirements For a Minnesota Motor Vehicle Bill of Sale

The Minnesota DMV does not provide its own bill of sale document. You can either use a template or create your own.

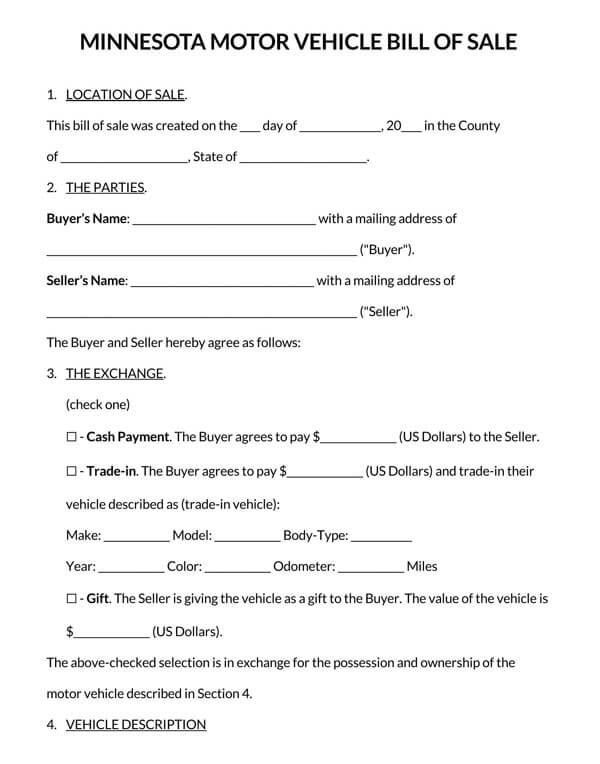

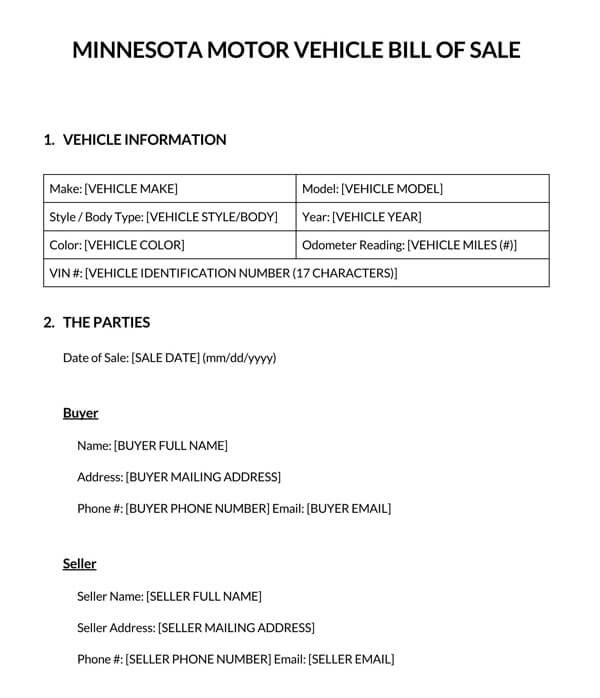

If creating your own document, you will need to have the following required information:

- The date of the sale of the vehicle

- The full name and mailing address of both the seller and the buyer

- A description of the vehicle, which must include the VIN, make, model, year, color, and body type

- The vehicle’s condition

- The amount that the vehicle was sold for

- Any other relevant details about the vehicle or the purchase agreement

- The signatures of both the seller and the buyer

Registering a Vehicle in Minnesota

If you are registering a vehicle for the first time, you have 30 days from the date of purchase to register and title it. New residents to Minnesota have 60 days from the time they have established residency to register their vehicle in the state. Registration can be done in person at your local DVS Deputy Registrar’s office or by mail by submitting Form PS2000.

Renewal of the vehicle’s registration is required yearly and can be done online through Minnesota’s Driver and Vehicle Services E-service page.

Alternatively, you can renew in person at your nearest DVS Deputy Registrar’s office, or by mail at:

DVS Renewal

P.O. Box 64587

St. Paul, MN 55164-0587

New vehicle owners cannot use the vehicle until it has been titled and registered with the Minnesota Driver and Vehicle Services.

Required Documents When Registering a Vehicle in Minnesota

When registering and titling a vehicle in Minnesota, the following documents are required:

- A current and valid Minnesota Driver’s License

- A bill of sale for motor vehicle in Minnesota

- Federal Odometer Disclosure form

- The vehicle’s Certificate of Title. If the Certificate of Title has been lost or damaged, you can request a duplicate with Form PS-2067A

- A completed Application for Registration and Title (Form PS-2000A)

- Funds to cover the appropriate Registration Fees

- Proof of insurance with a registered Minnesota vehicle insurance provider. The policy must have the following Minimum Requirements:

- At least $10,000 to cover any destruction of property

- At least $30,000 to cover bodily injury (per individual)

- At least $60,000 to cover bodily injury for more than 1 individual

- If you are registering the vehicle on behalf of the owner, you will need to complete a Vehicle Power of Attorney, which can be acquired from an attorney or template.

Private sellers of a motor vehicle in the state of Minnesota must also submit a Report of Sale, which can be done online. If the vehicle has no ownership record, a Statement of Facts (Form PS 2002-3) must be completed.

If there is a lien on the title of the vehicle that has been paid, you will need to complete a Release or Grant of Secured Interest (Form PS-2017).

Fees and Taxes

In the state of Minnesota, they use an “ad valorem” system for taxing vehicle registrations, which means taxes are determined in proportion to the amount the vehicle was sold for. Also taken into account is the vehicle’s age. For vehicles that are 10 years or more in age, the tax is generally $35.00. You can find out what your registration tax amount will be by calling the Motor Vehicle Registrar on 651-297-2126. Alternatively, you can visit one of their offices near you.

The fees charged to register a vehicle will vary depending on the vehicle type that you have. You can find out more on the Registration Tax Page. Taxes for vehicle registration follow Minnesota Statute 168.013.