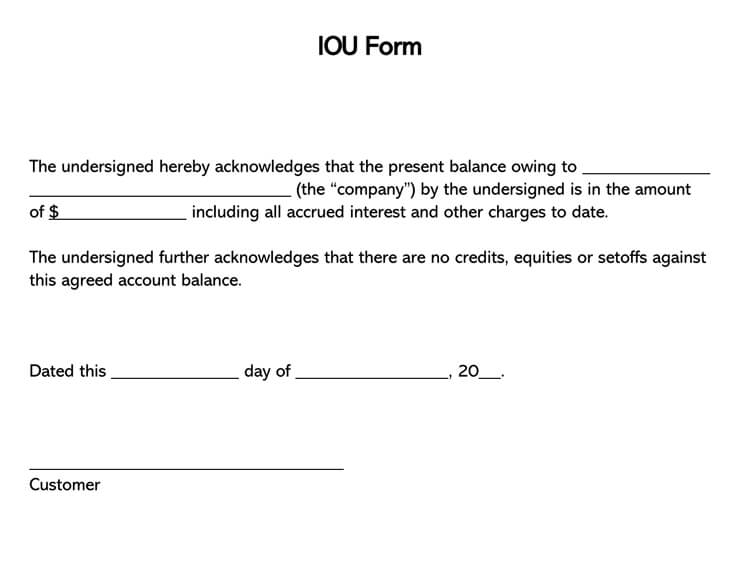

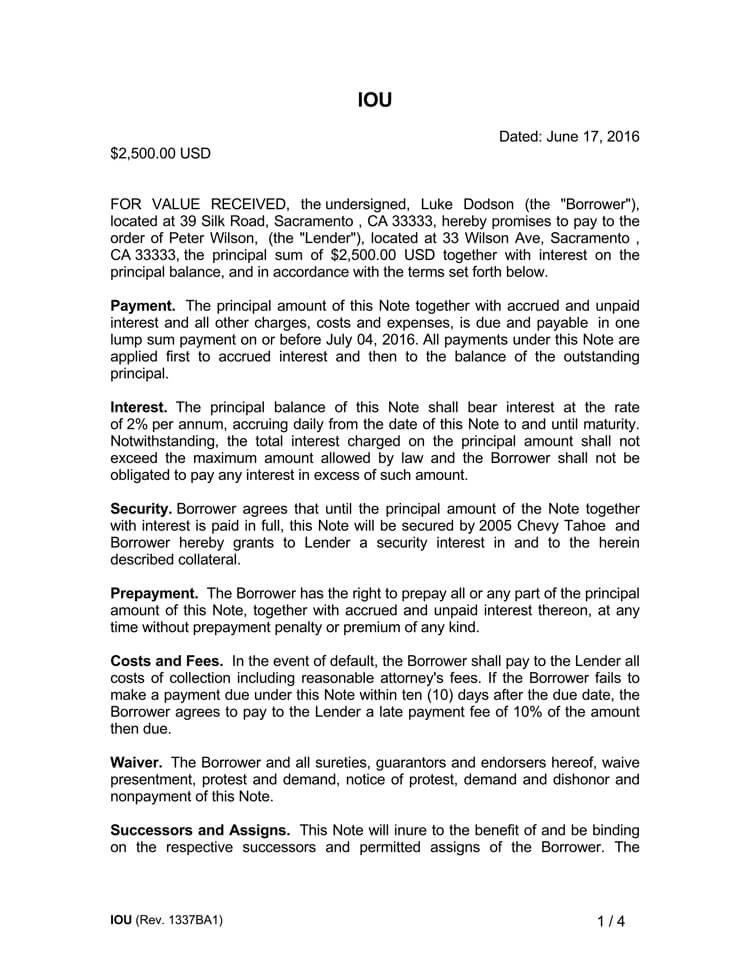

IOU is an abbreviation for I owe you. It is an informal document for debt acknowledgment. It is a non-negotiable instrument that is written and signed by a borrower and is addressed to the creditor. An IOU specifies the debtor, the amount owed, and the creditor.

Free IOU Forms

When Should You Sign an IOU?

An IOU usually happens between people with a common ground of trust. It can take place between business partners, friends, or family members. For instance, if you want to borrow money from a friend and you want to use a form of documentation that is not too formal, you can use an IOU document. Most of the tie, the document only includes the borrower’s signature.

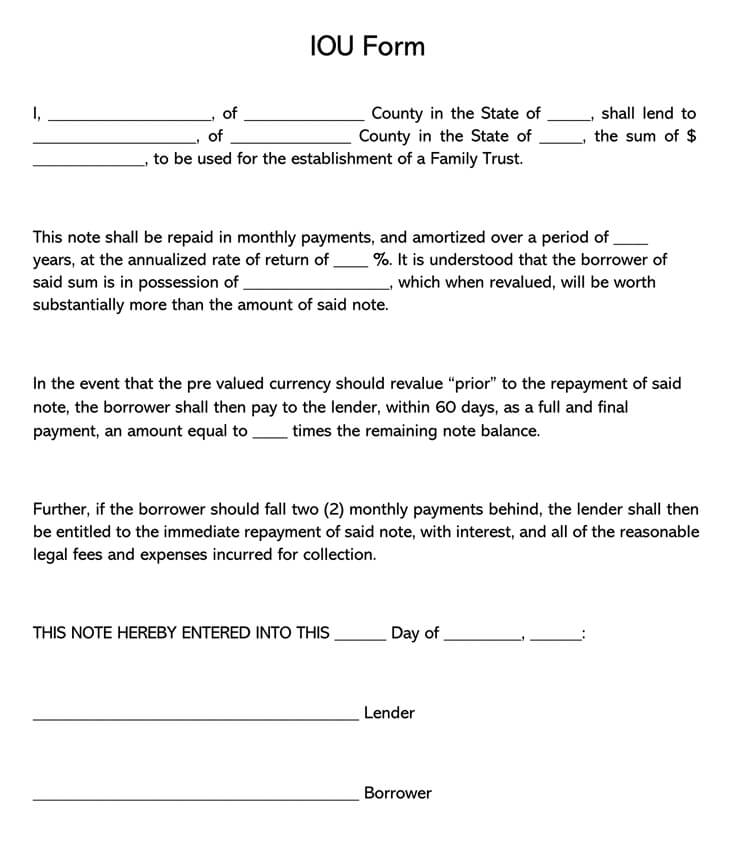

IOU is different from a promissory note and loan agreement since it doesn’t contain repayment terms; it’s non-negotiable and is the least formal among the three. A promissory note is used by people who want to secure a loan for business, medical expenses, special events, etc.

You should use it if you want to secure collateral, wish to charge interests on the loan, or want to be paid in installments. You should use a loan agreement if you need to borrow a substantial amount of money either for a business, buy a home, buy a car, or pay a student loan. It includes the consequences for defaulting and any late repayment charges.

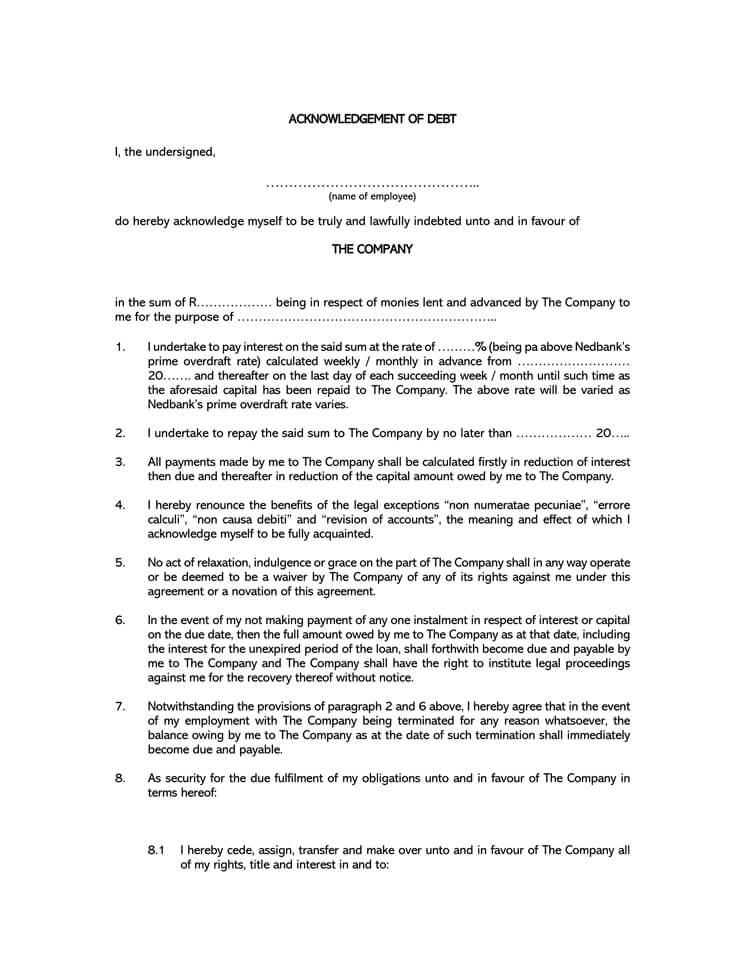

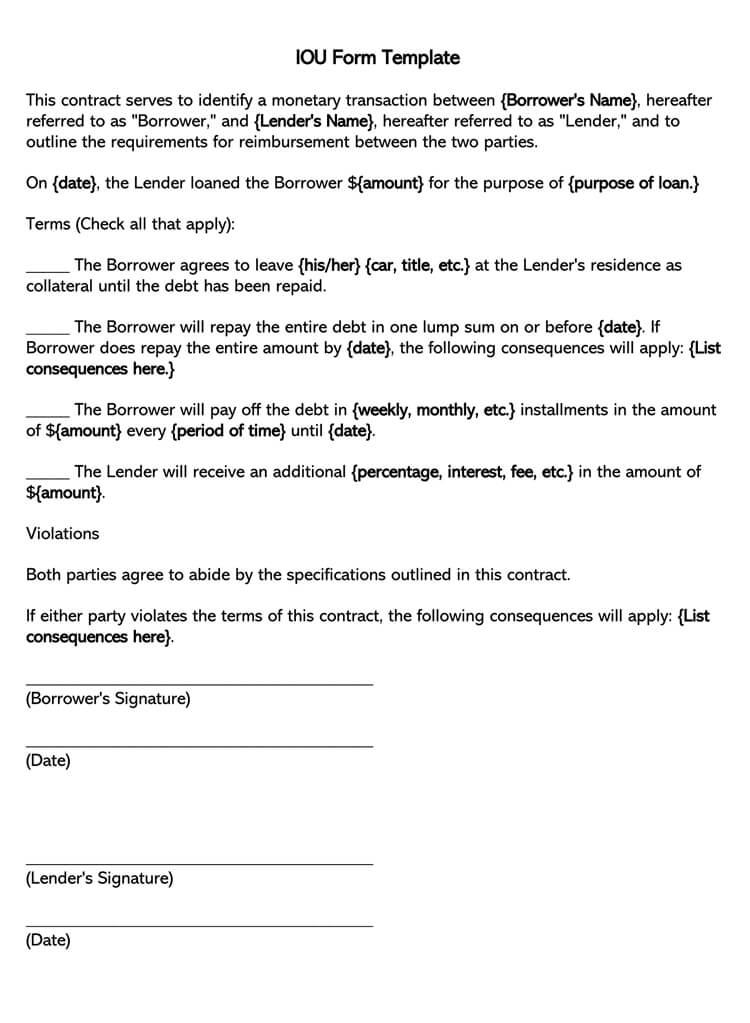

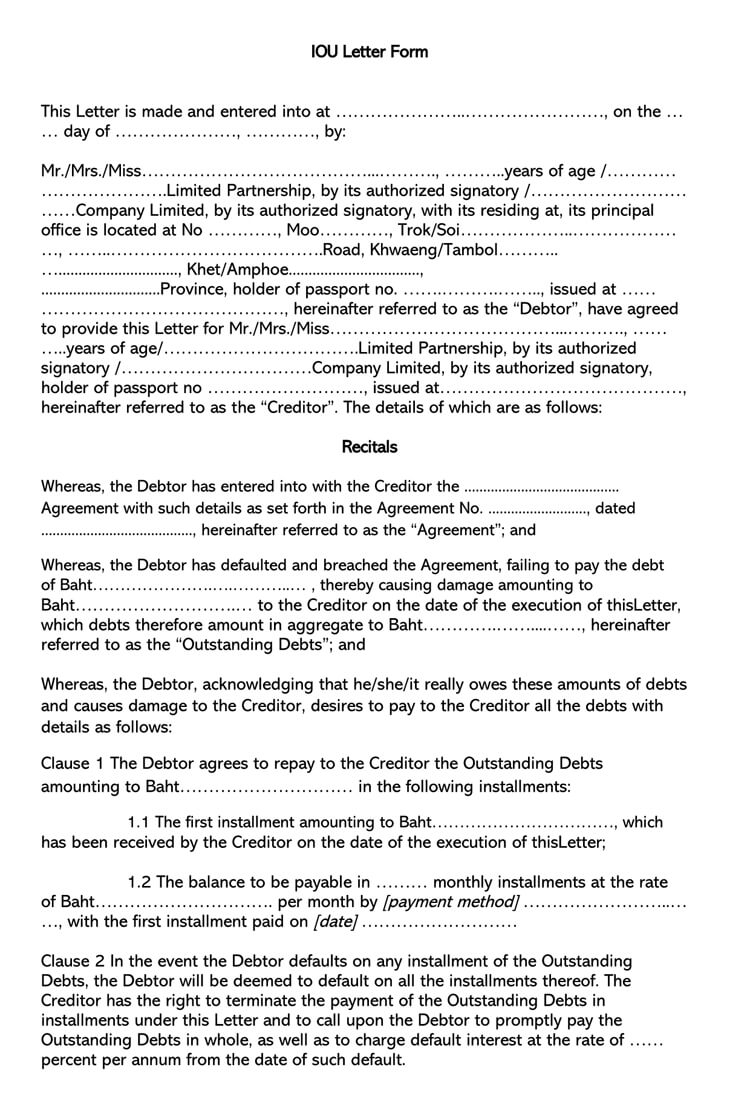

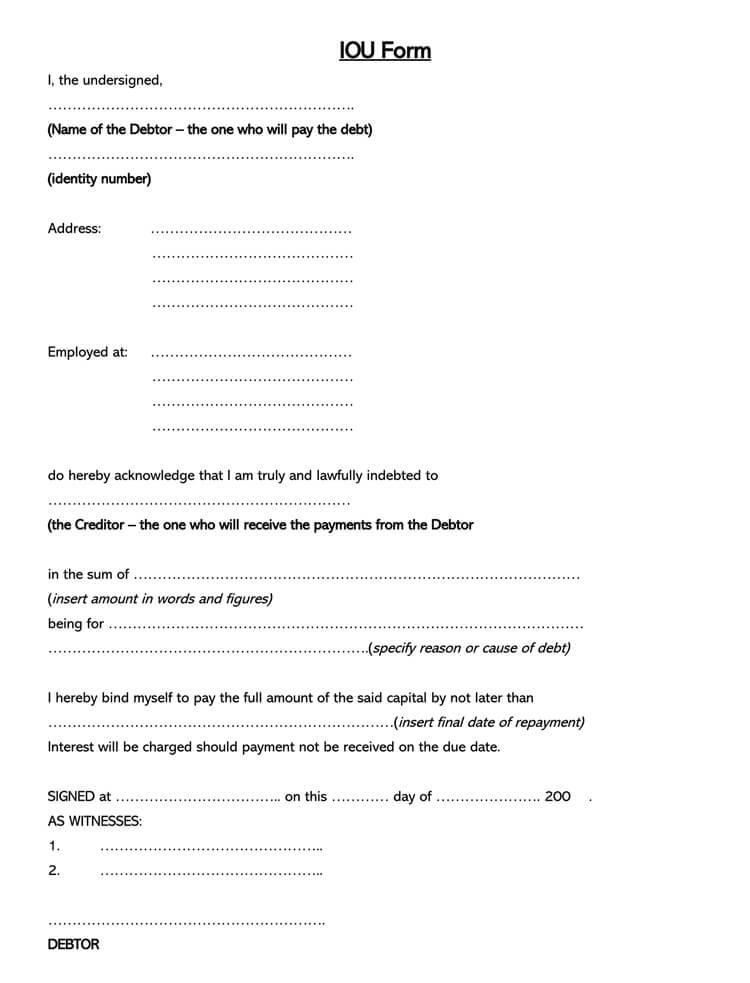

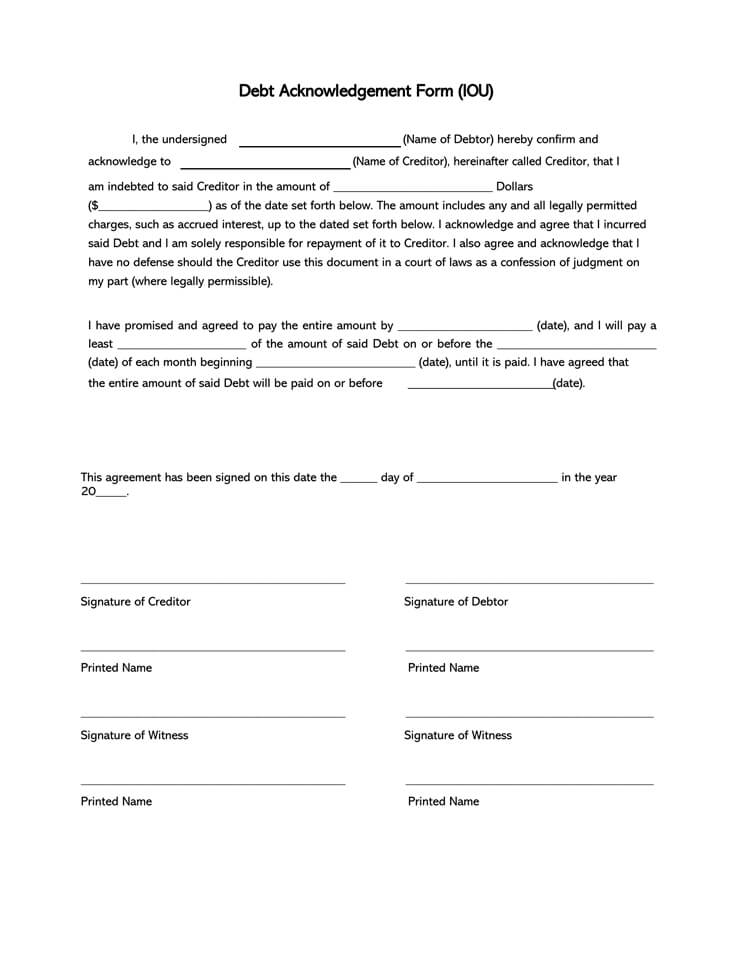

How to Write an IOU

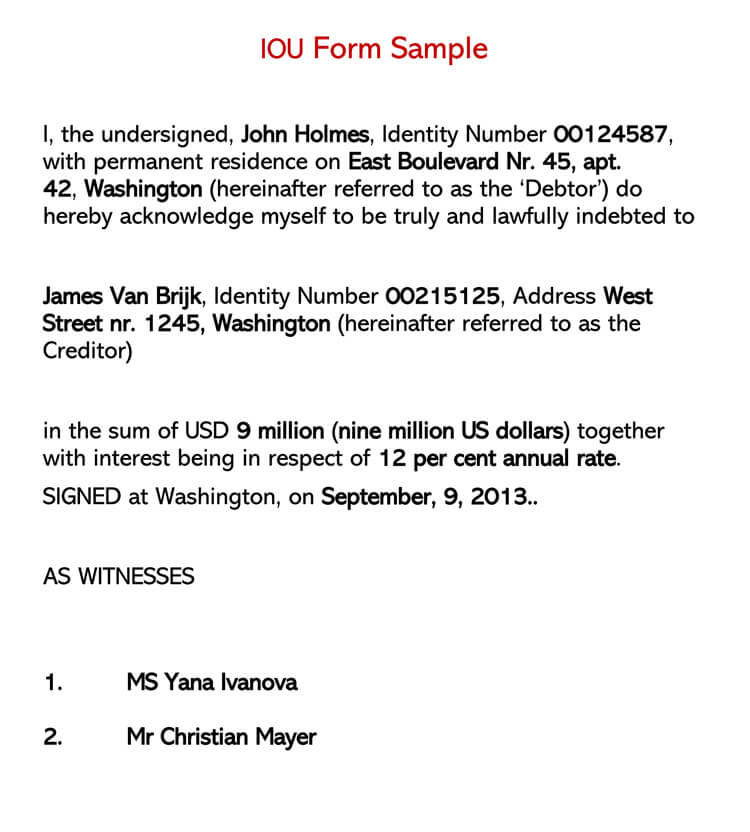

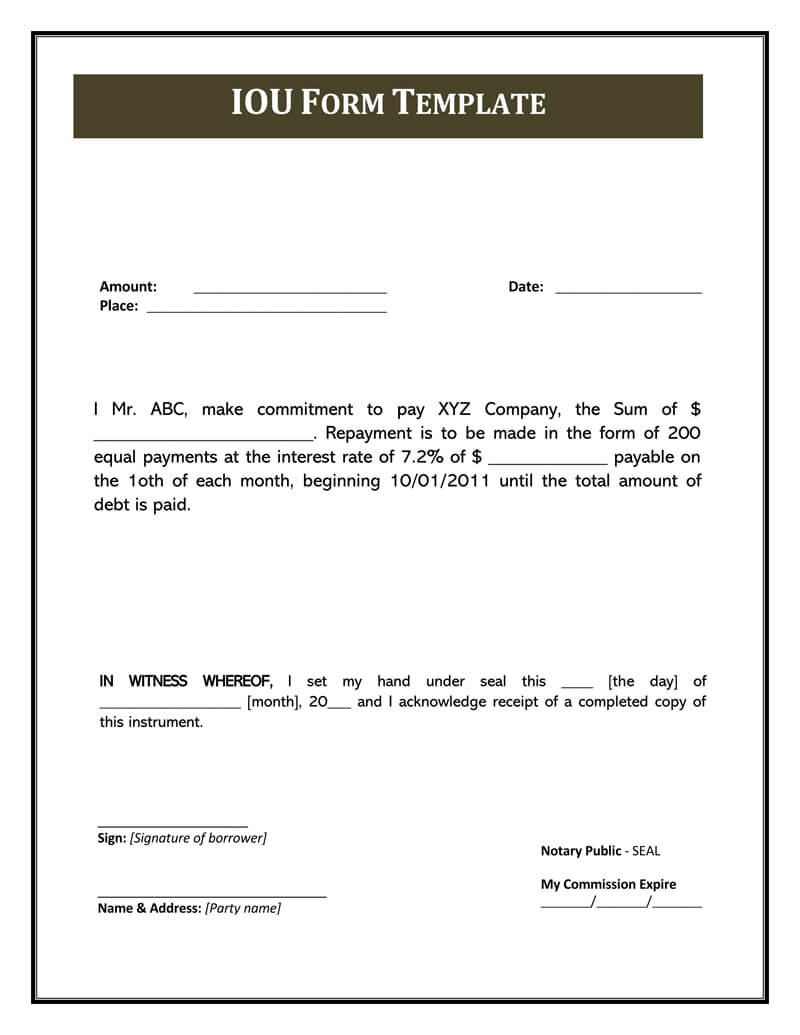

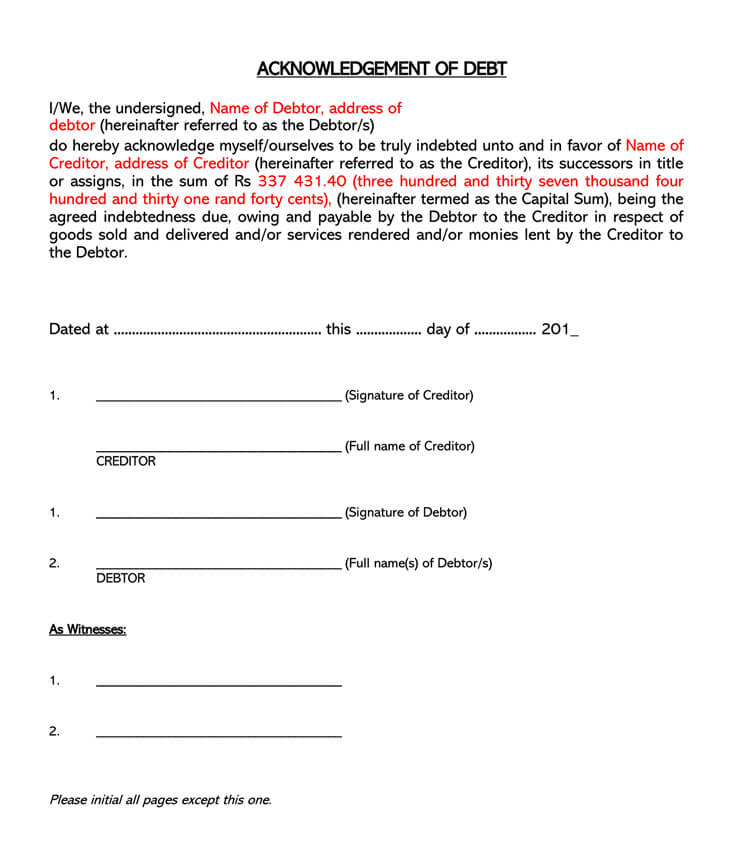

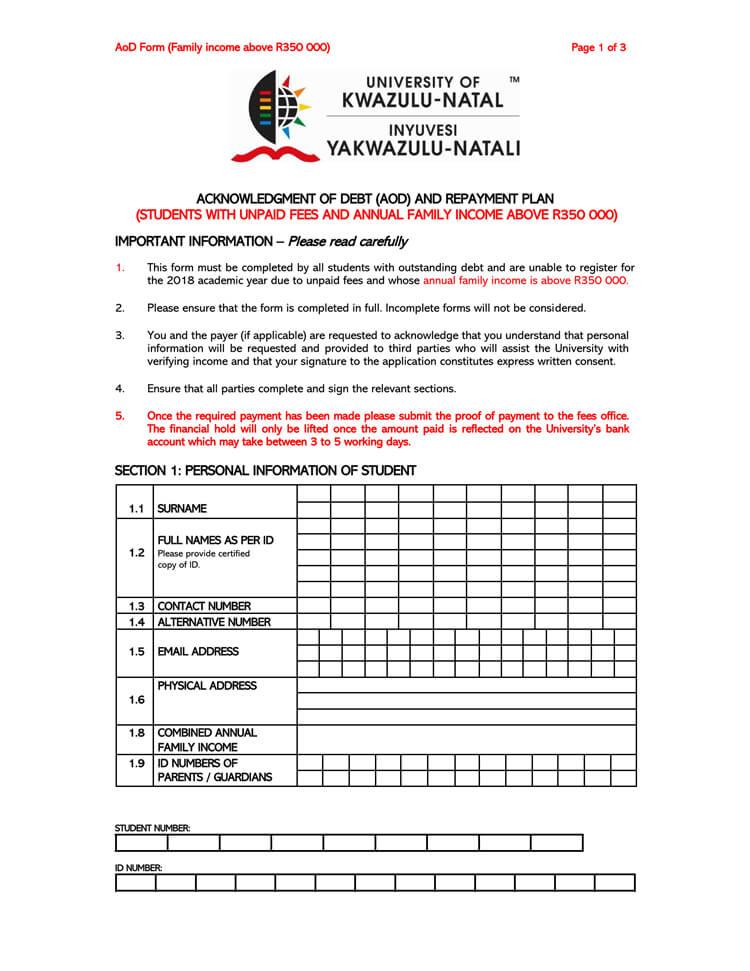

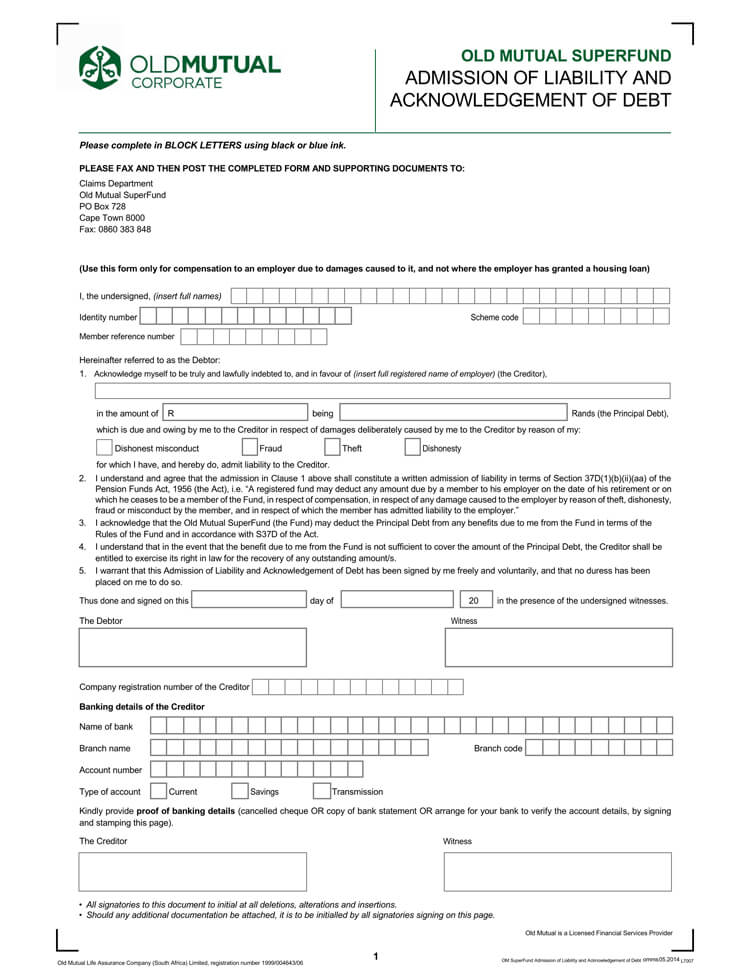

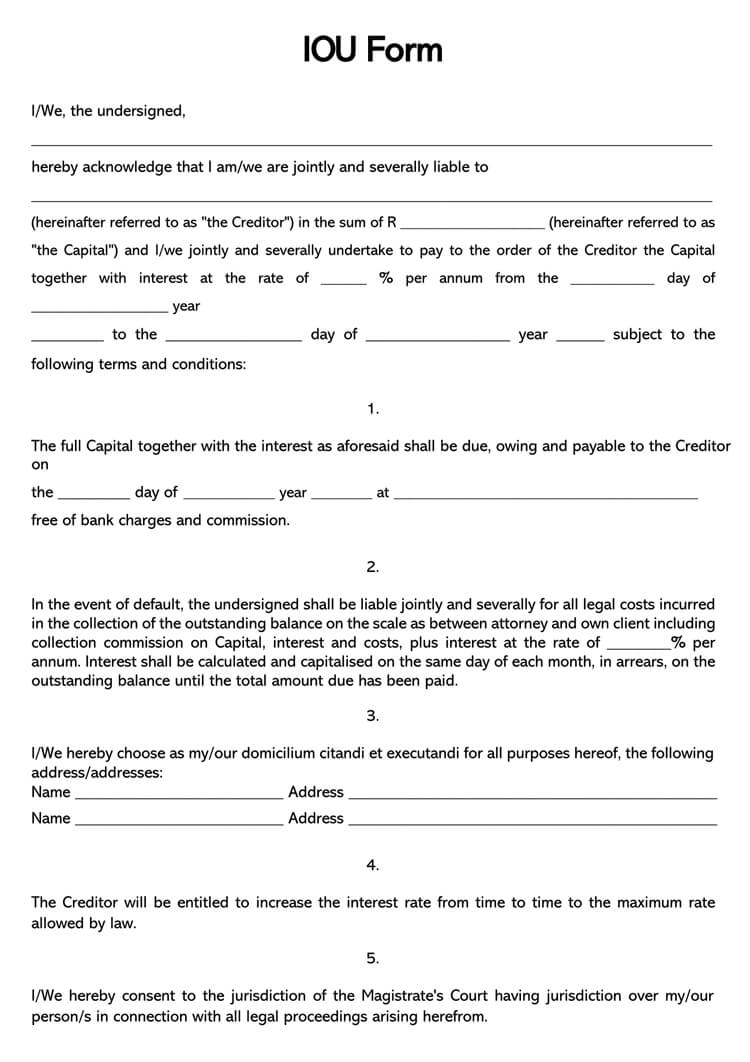

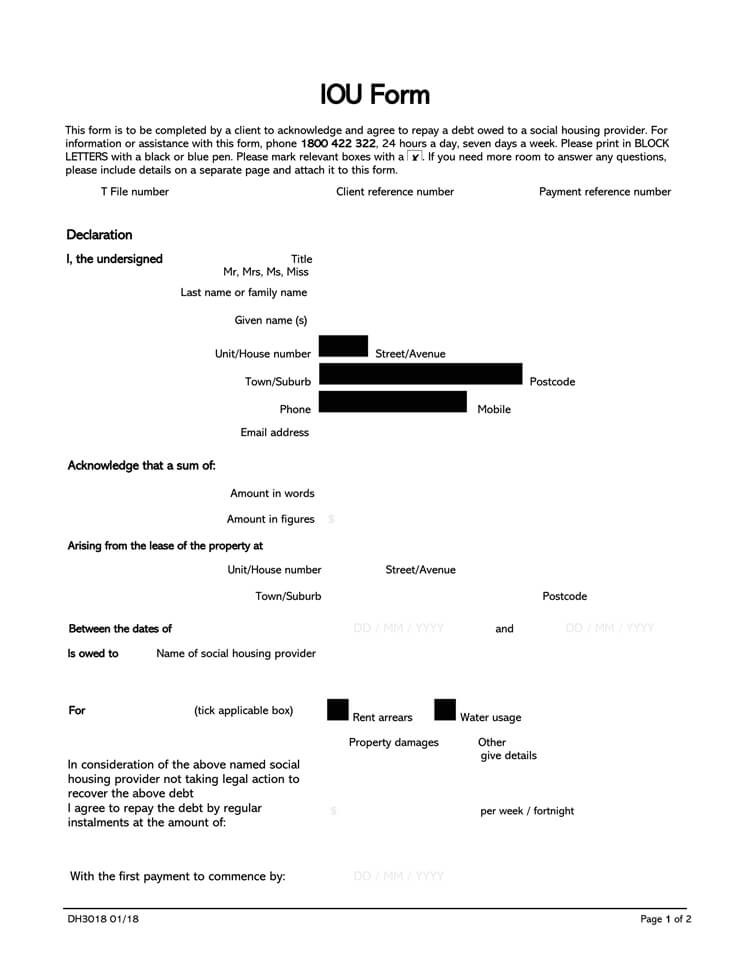

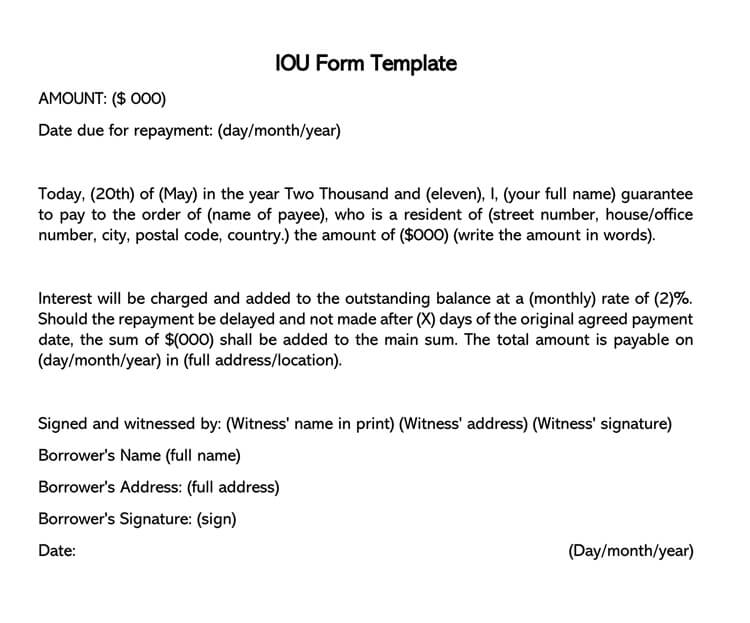

- State the important details: This includes the name of the debtor/borrower, followed by the lender/creditor then the loan amount.

- Repayment terms: This includes the due date for the repayment specifying when exactly the loans will be paid and should state if multiple payments will be made. You should also state if the loan will be repaid in installments and how many installments will that be. If the lender is charging any interests, it should also be stated in this section and the interest amount.

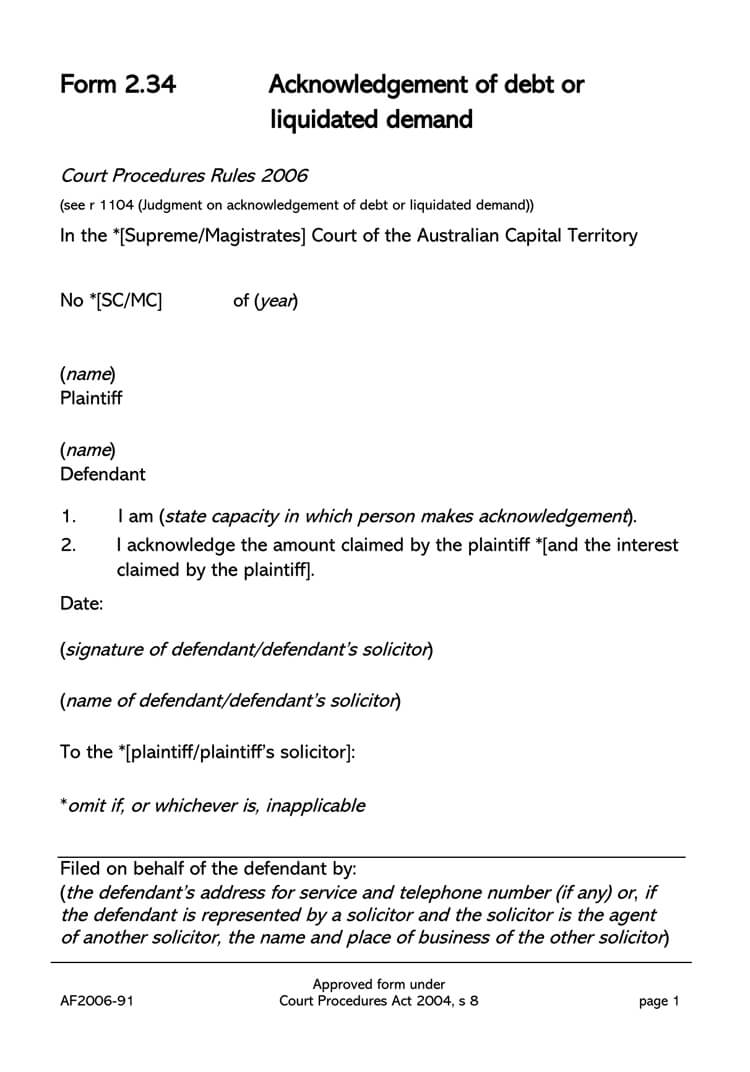

- Signatures: In most instances, only the borrower signs the document then states his/her legal name below it. However, for the document to be legally binding, it should contain both the name of the borrower and the lender.

- The witness: The witness section is optional but to be on the safe side of the law; you need to have a witness just in case the issue goes to court, and you need someone to prove that the transaction took place.

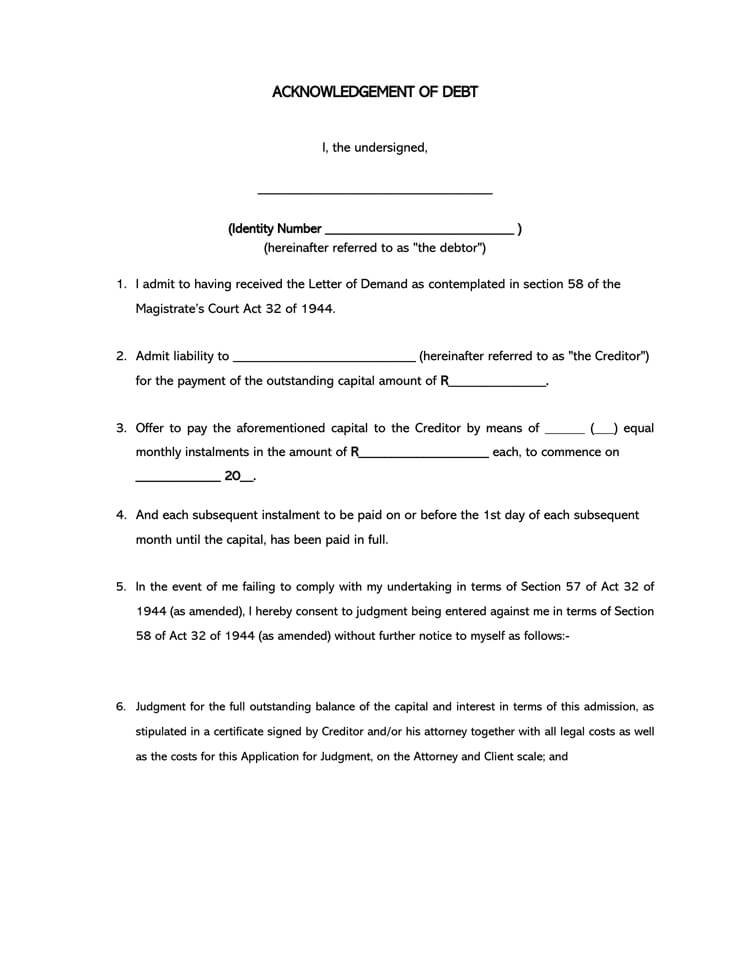

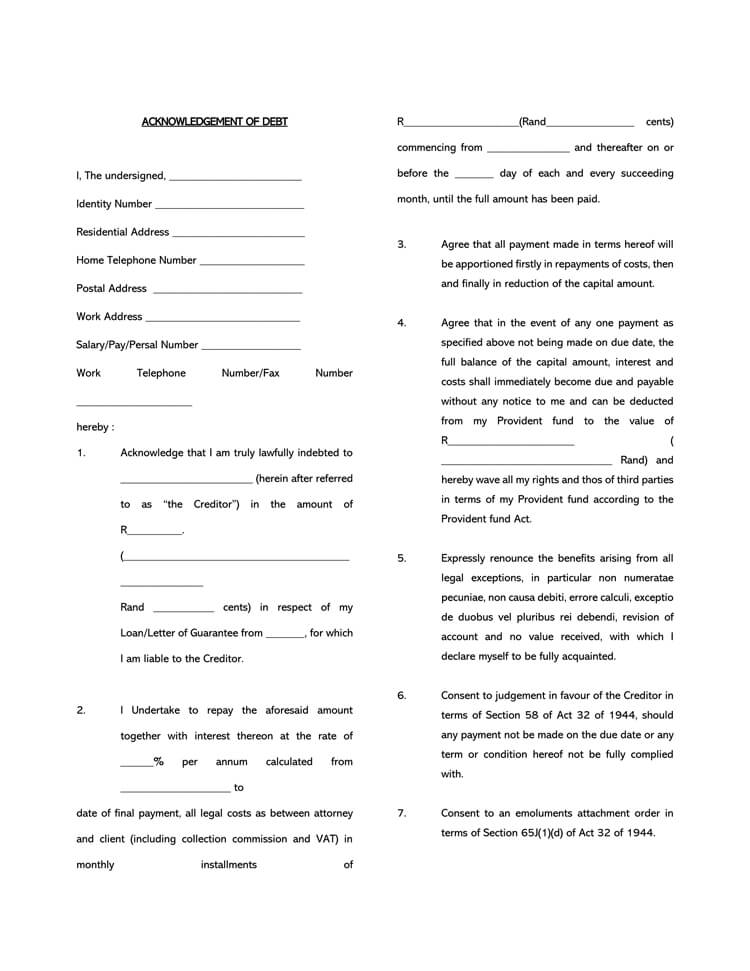

Is an IOU Legal?

An IOU acts like a documentary evidence of debt. The fact that it’s signed by the borrower himself even makes it more of evidence. So, as far as there are no lawyers or witnesses involved in the document, one should not think that it has no legal value. It can, however, be difficult to enforce in court if it lacks a witness signature. So, if you’re lending a huge amount of money or any item of huge value, it is safe to have a witness.

Some of the legal implications of an IOU include:

- If your IOU is legally-binding, this can help you should you get audited by the IRS. Therefore, you have to make sure that the IOU has the correct format and contains all relevant information.

- If you have any doubts about an IOU, make sure to consult with your lawyer. Your lawyer should be able to properly explain to you all of the legal aspects of the IOU and offer better suggestions about any legal actions you may take in case you encounter an issue.

- You have to know the difference between an IOU and a promissory note. It is often difficult to enforce an IOU in court, particularly if you made it as a formal agreement. On the contrary, promissory notes include more information, such as the legal steps that the borrower needs to take to pay back the loan. It also includes the consequences should the borrower fail to follow the steps. Hence, the reason why it is typically recommended to have your IOU signed so you can use it in court if necessary.

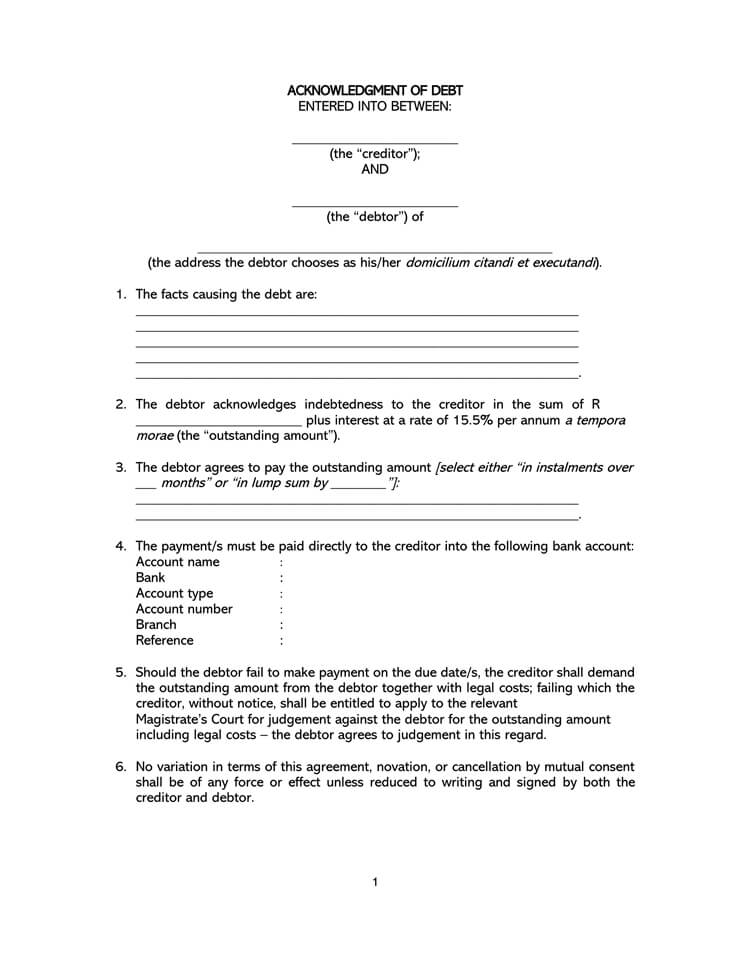

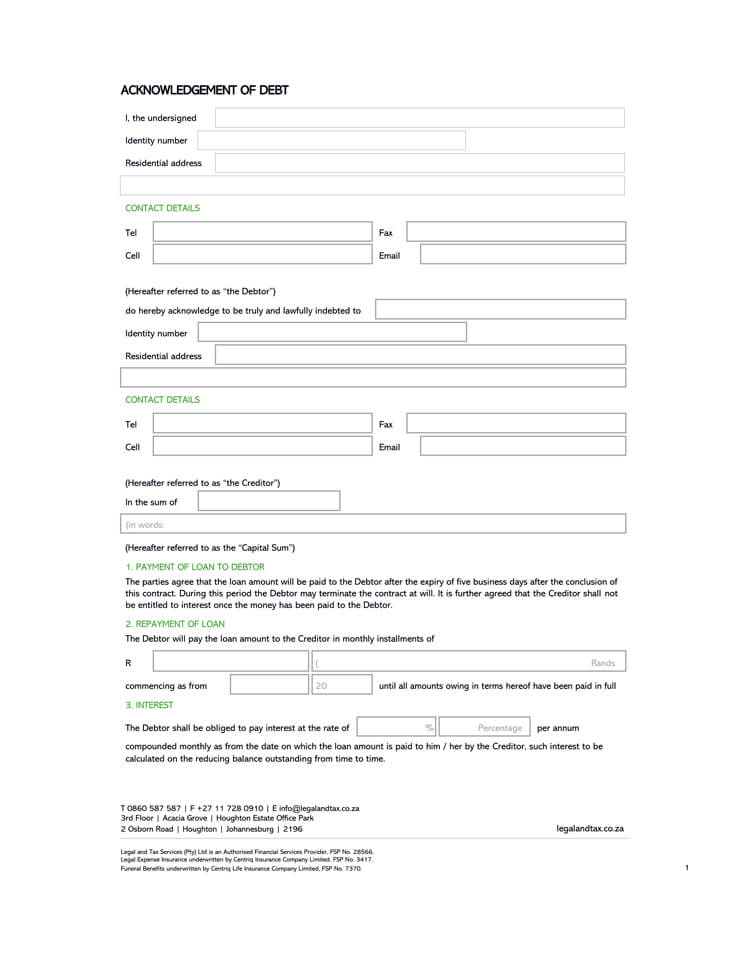

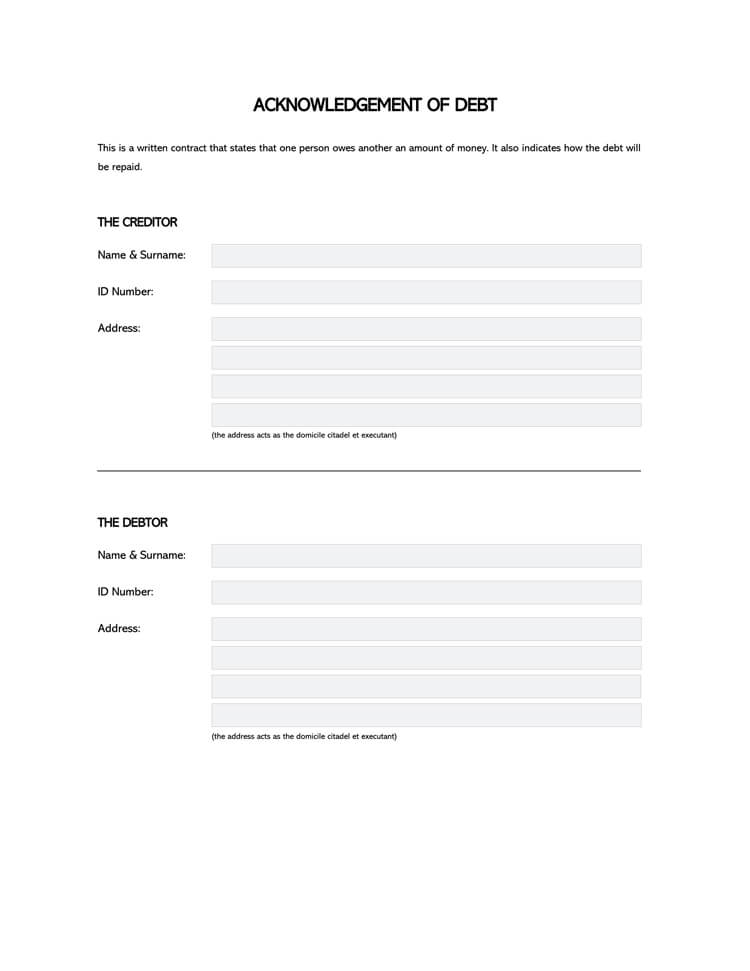

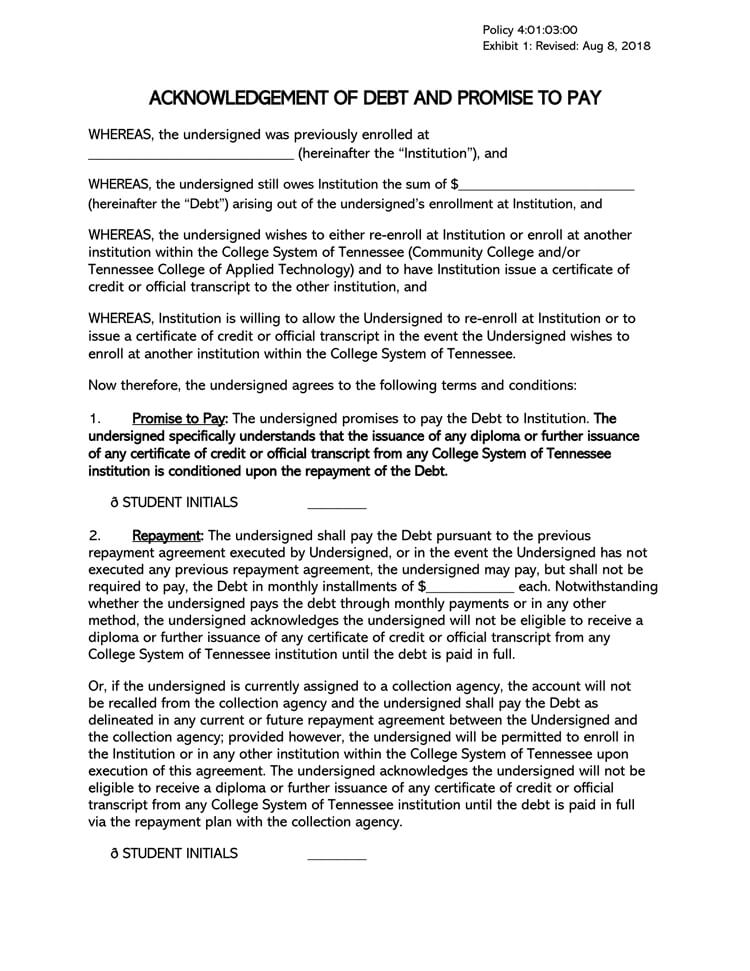

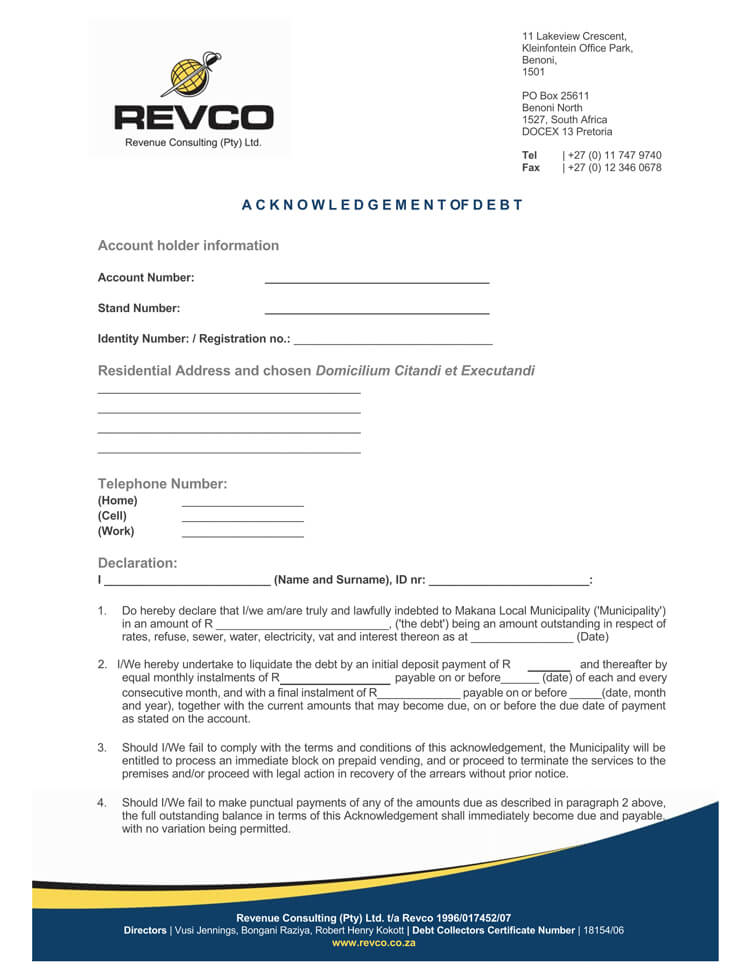

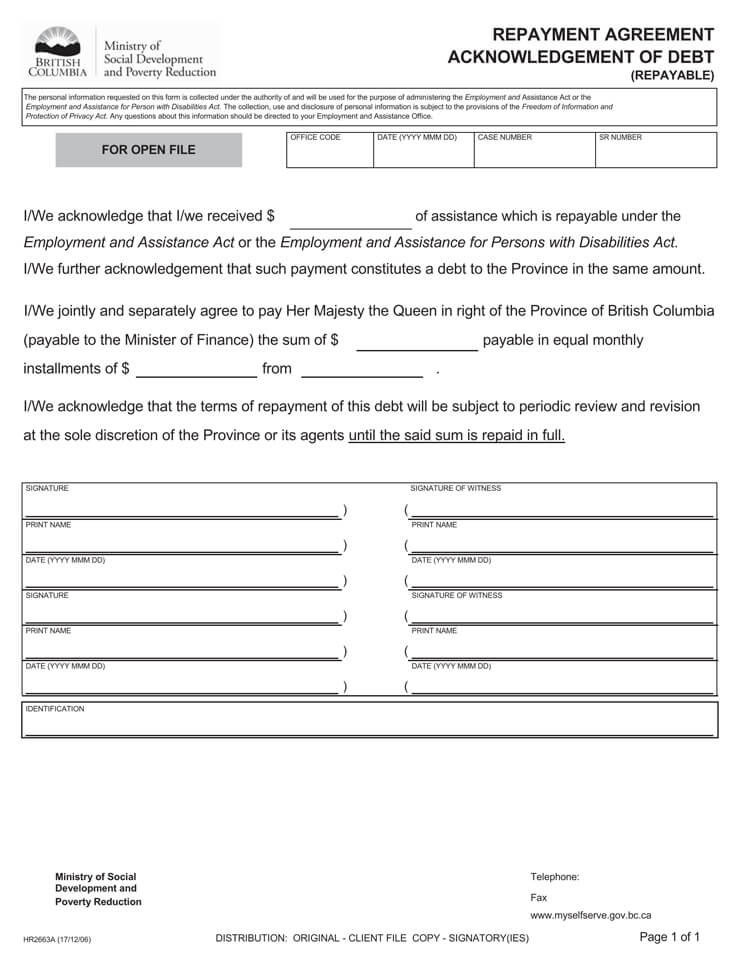

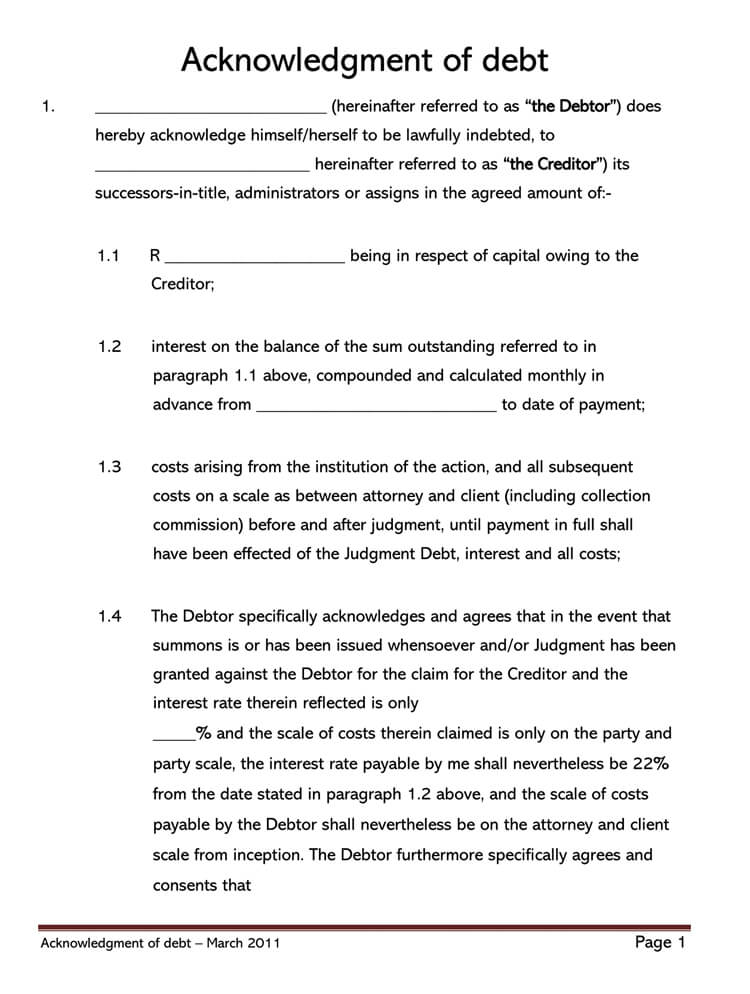

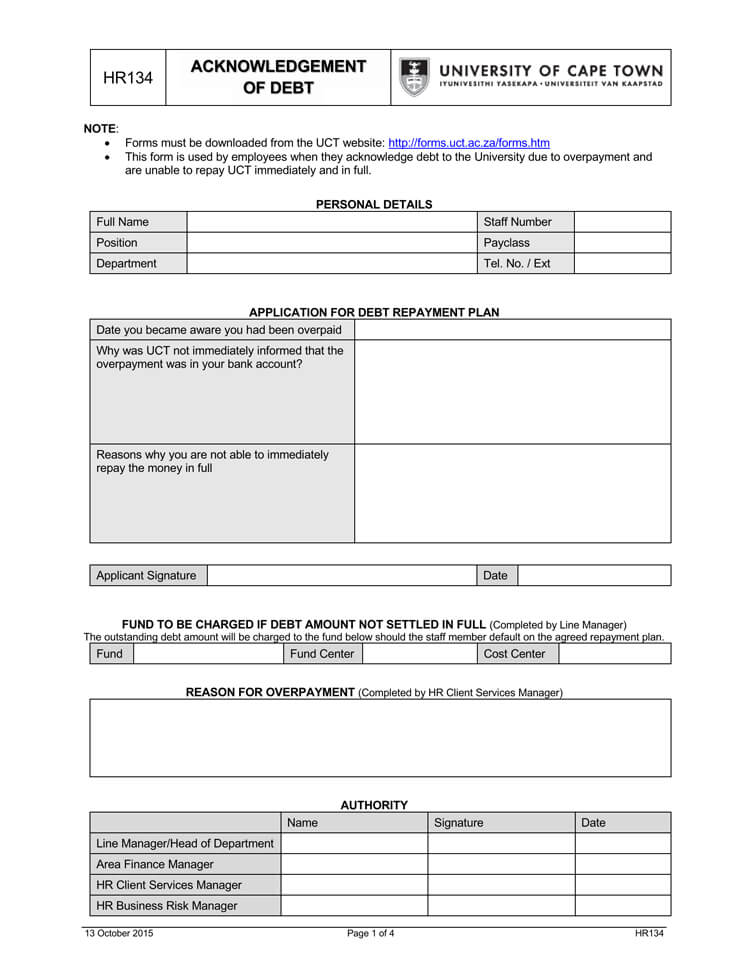

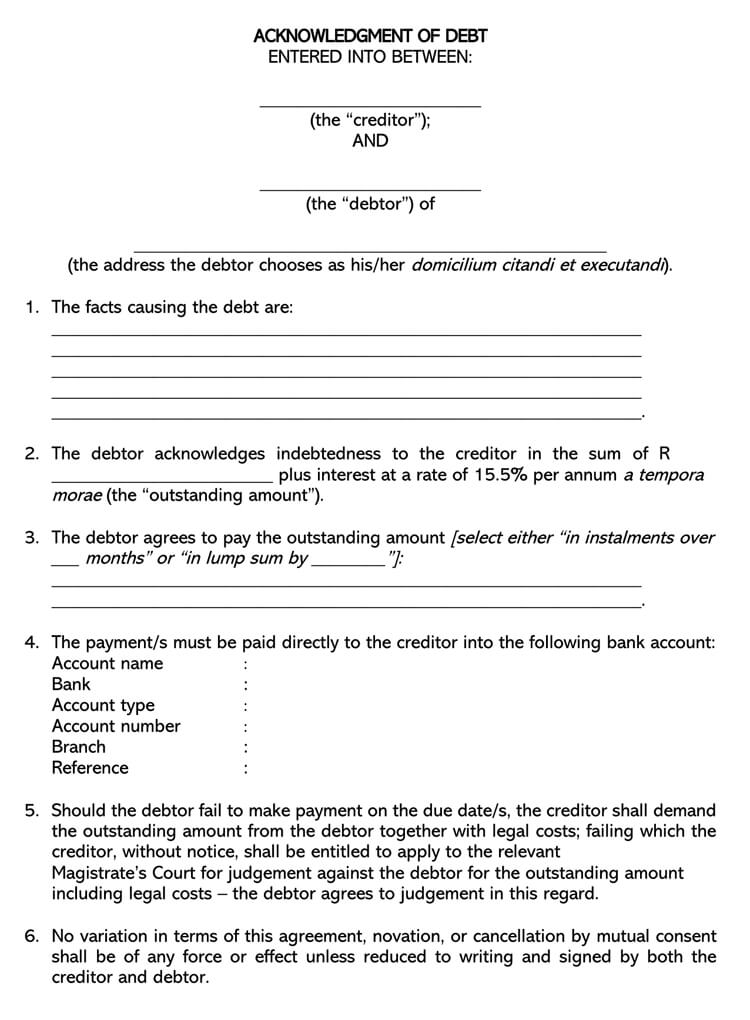

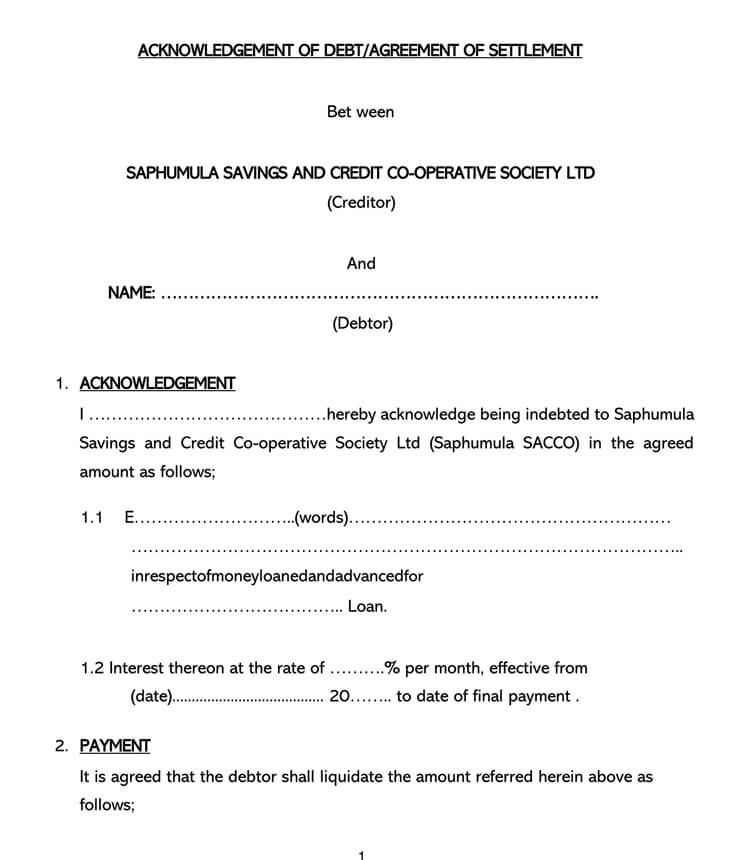

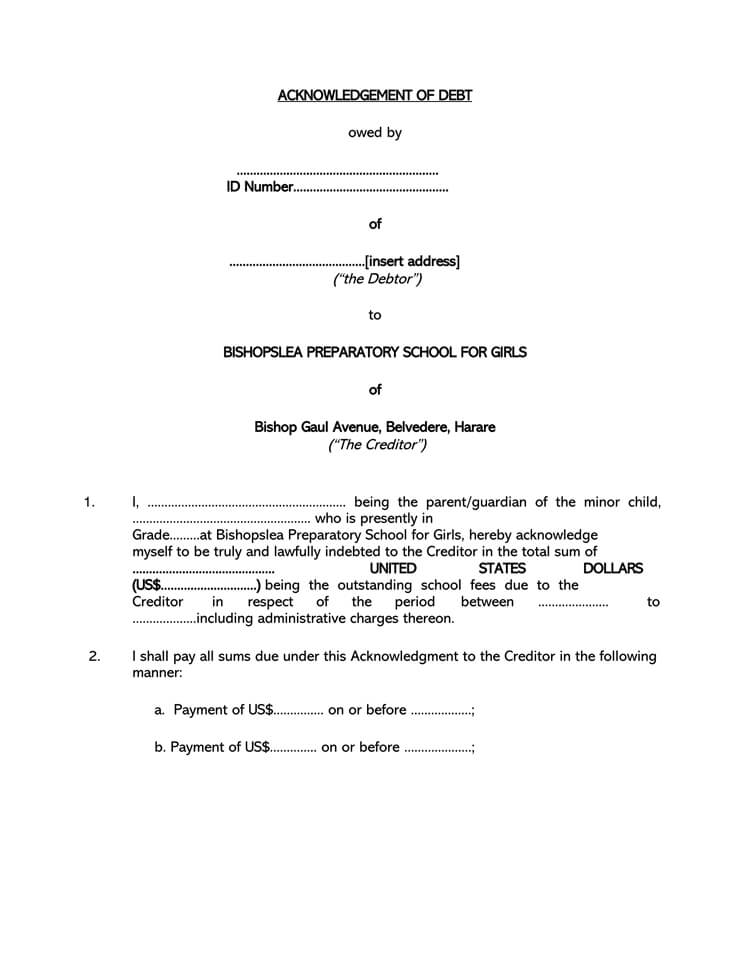

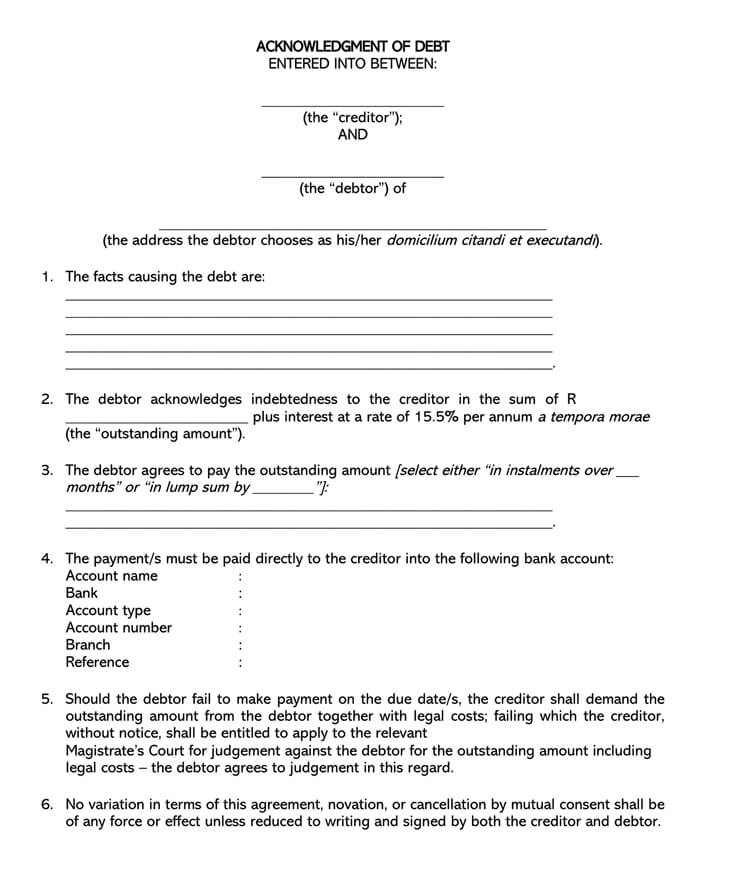

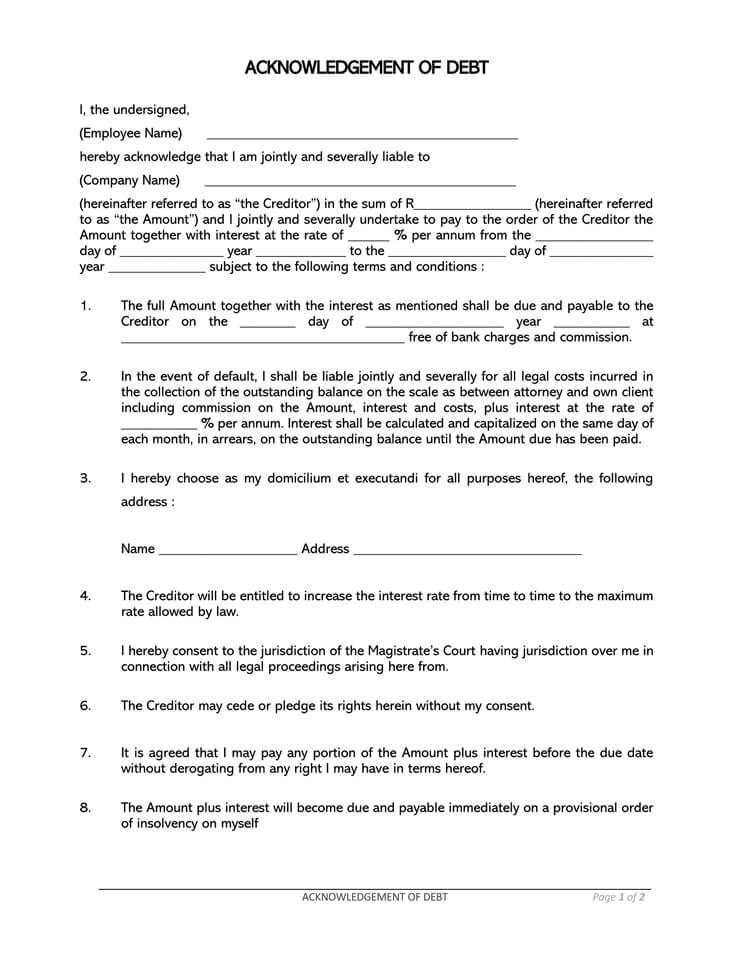

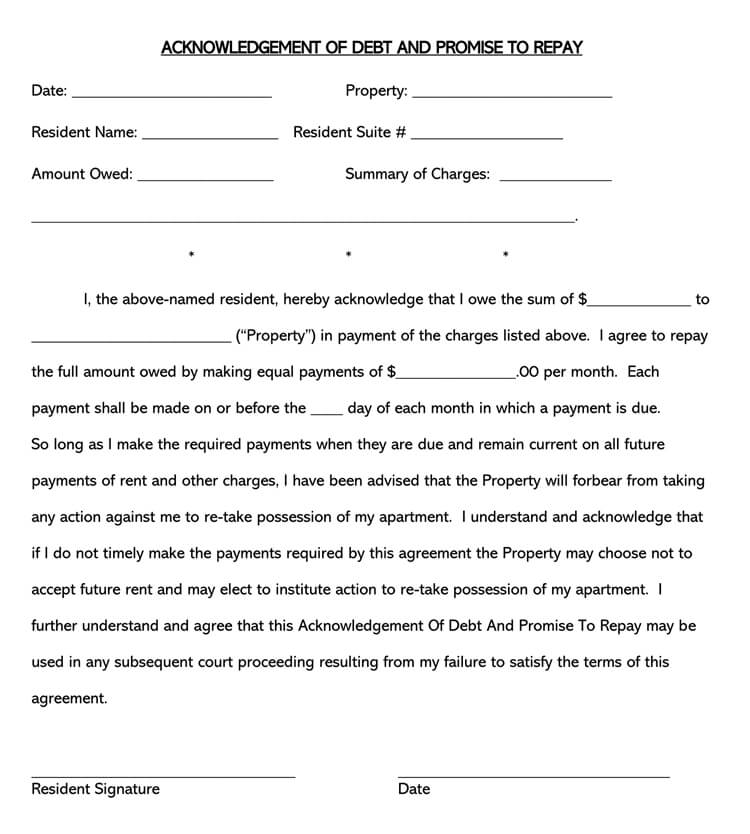

Free Acknowledgment of Debt Forms