A loan receipt is simply a document signed by the lender and given to the borrower acknowledging payment done by the borrower in honor of the lending policy.

This receipt is used by private lenders and not lending institutions like the bank. Usually, banks and other lending institutions have their internal method of acknowledging the lending and the loan installment payment. These institutions also provide a document to the borrower showing the loan payment transaction.

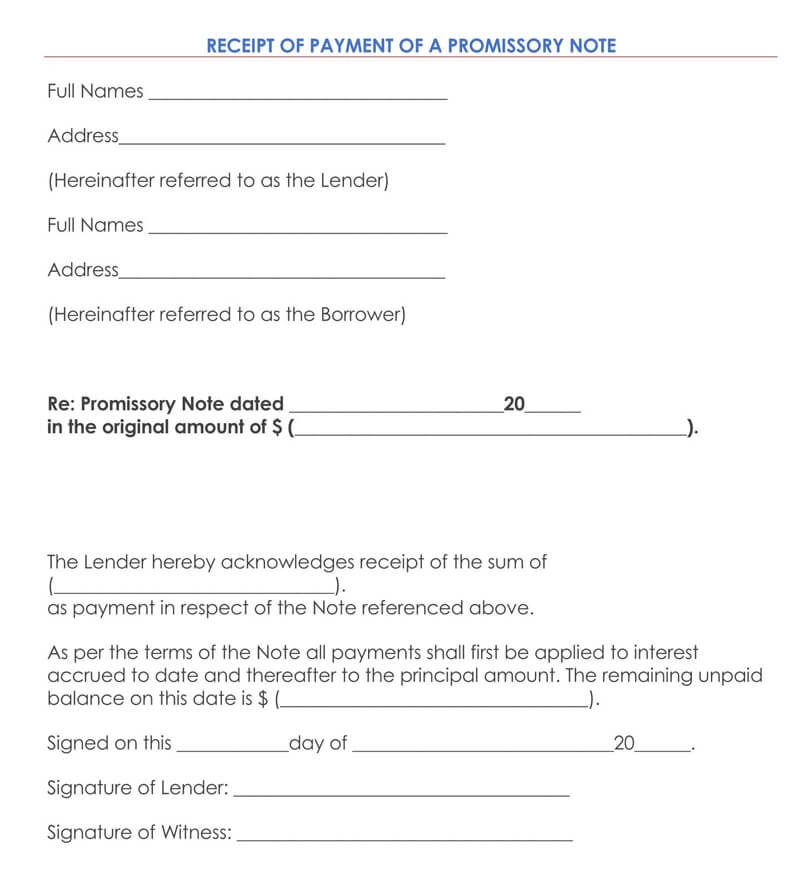

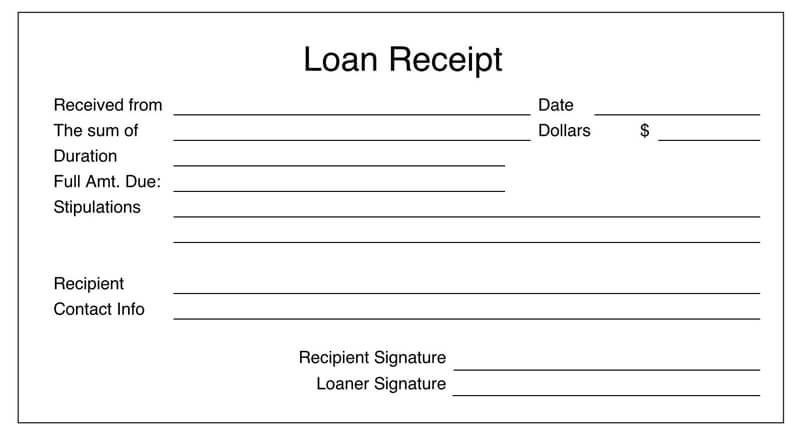

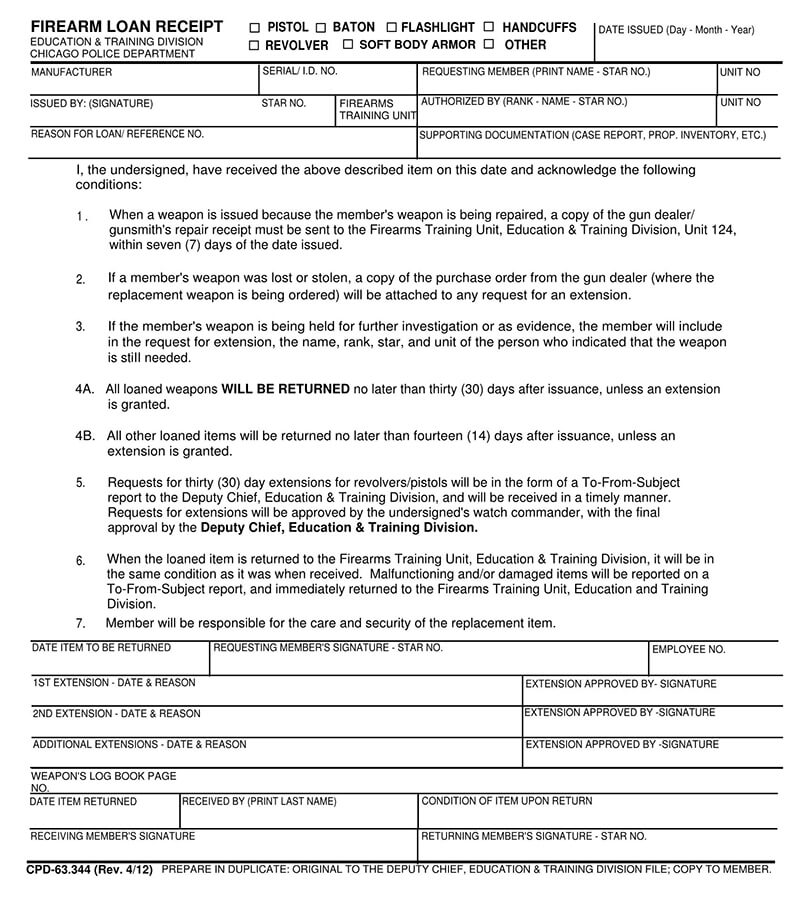

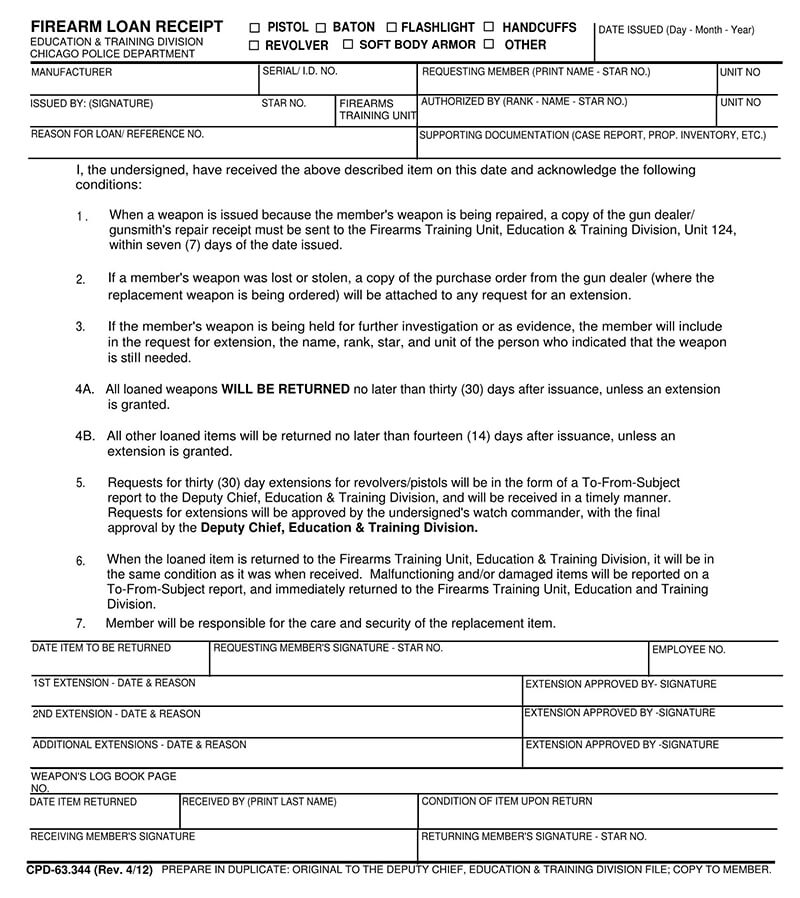

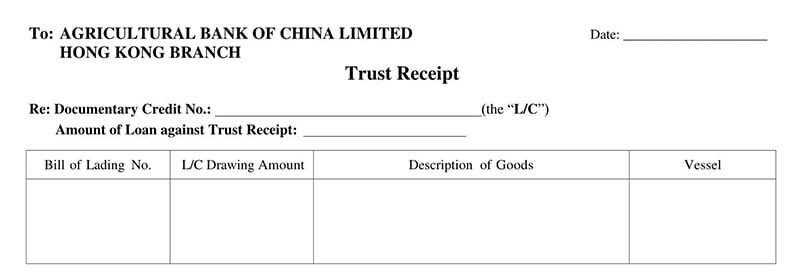

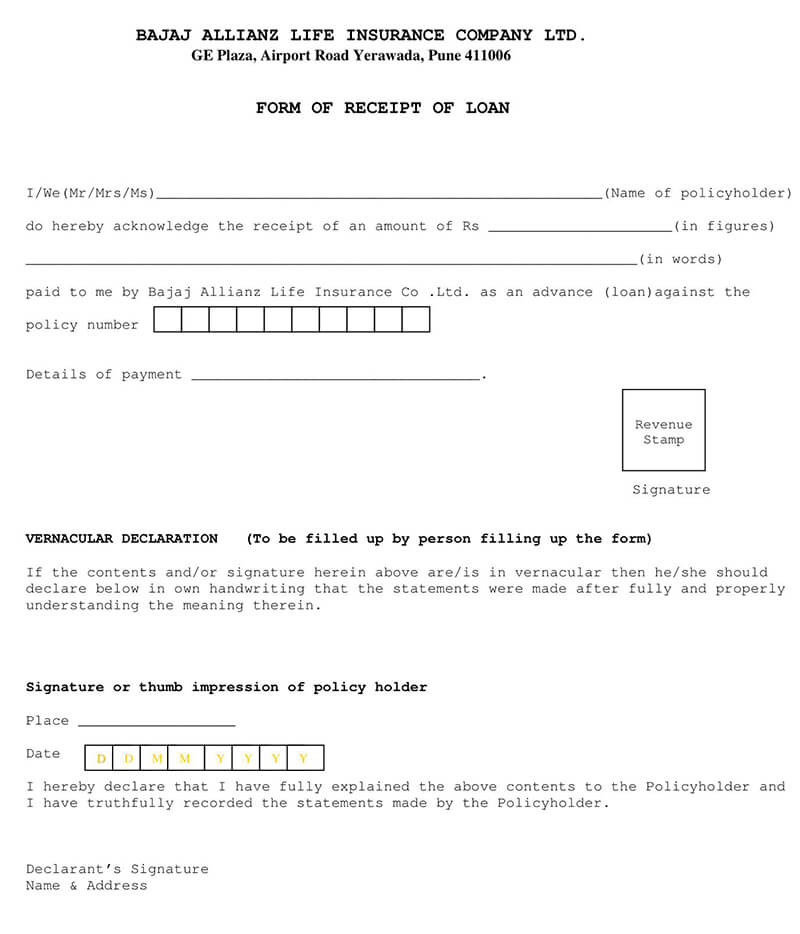

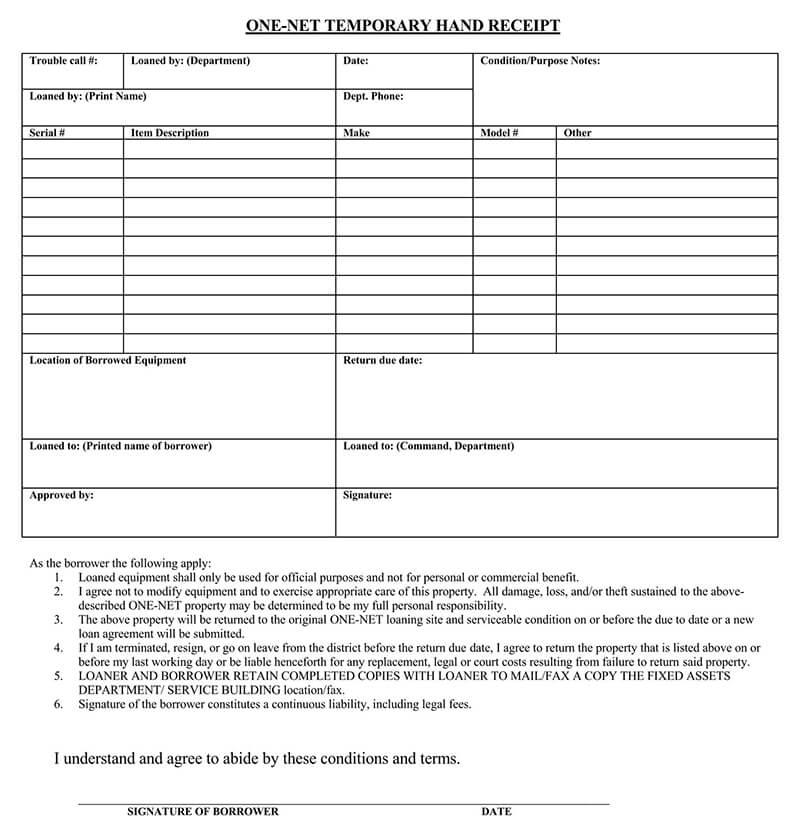

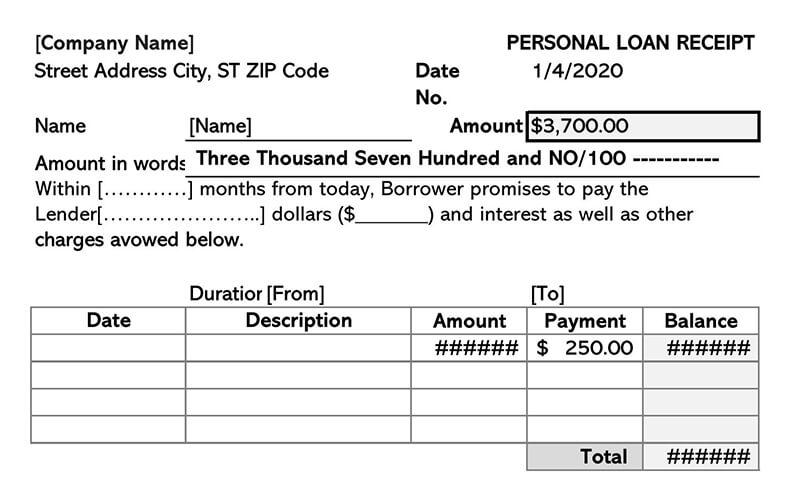

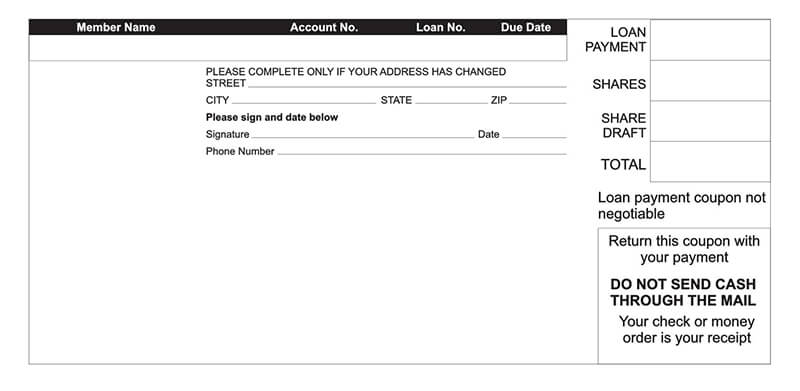

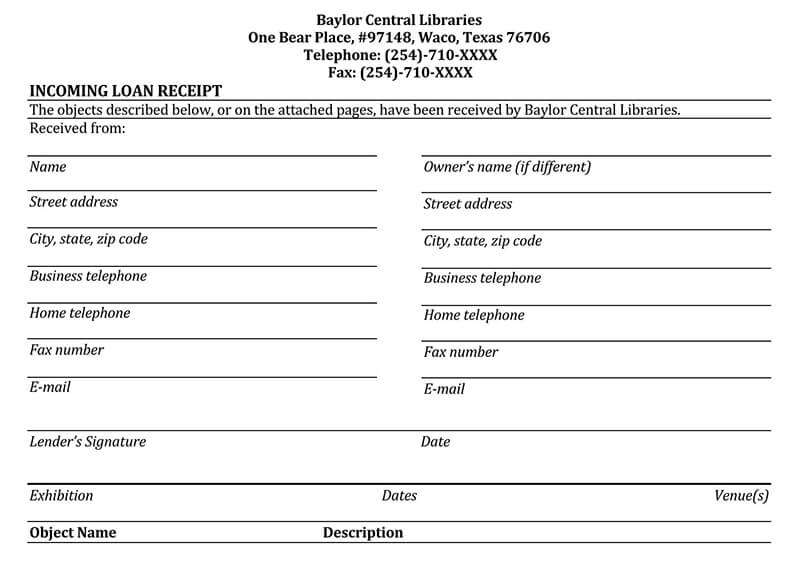

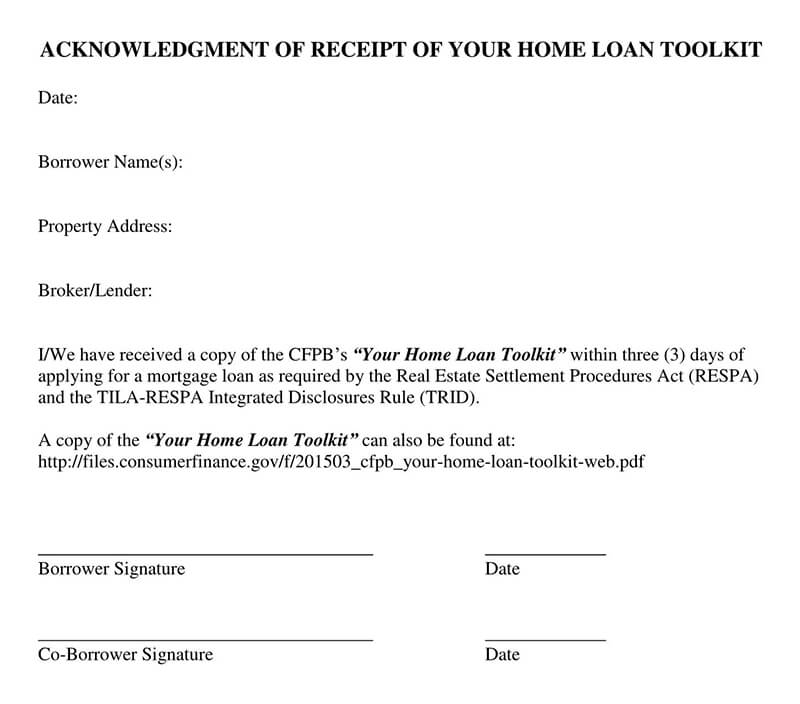

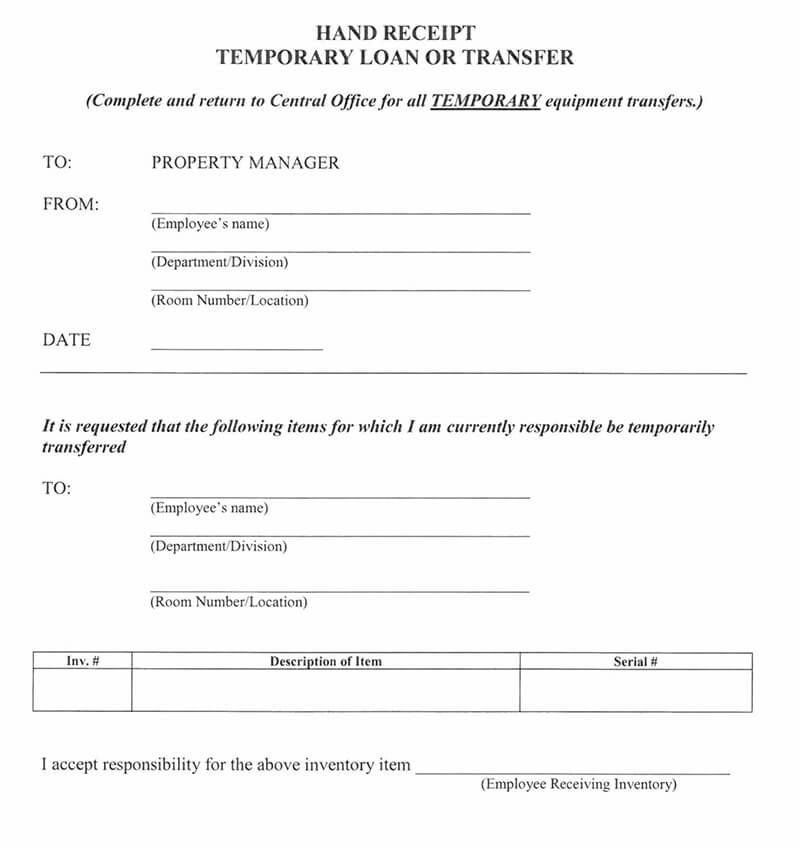

Loan Receipt Templates

What a Personal Loan Receipt Includes?

Just like any other type of receipt, a standard loan receipt has its basic contents to acknowledge and act as a proof of payment made. The following are the contents of a loan receipt:

- Lender’s detail: It consists of the name of the lender, address, and contact.

- Borrower Details: It consists of the name of the borrower, address, and contact.

- Date: This receipt consists of two dates. The first date is the date the money was borrowed, and the second date is the date the installment was paid or received.

- Amount: It is a must part of this receipt. The amount paid must be indicated on the receipt.

- Balance: The loan balance is also indicated on this receipt.

- Lenders signature: The lender’s signature is a must of a receipt. This acknowledges that the lender has received the payment.

- Witness signature: This is also a part of a receipt. A witness signature acts as a third-party proof that money was paid and received. In case of future disputes or disagreements, the witness can be consulted.

- Original loan amount: The initial loan amount must also be included in this receipt.

- Payment history: The loan payment history to the current date is also indicated on a receipt.

Tip for Using a Loan Receipt

There is always a high chance of misunderstanding and disagreement with this kind of loan. Bearing in mind that this loan was not processed through a legitimate channel. It is always good to use the receipt to keep track of the loan repayment by both parties.

Also, you should involve an extra party to act as a witness to prove the lender gave that money to the borrower under the agreed terms and conditions. It is also good to involve the witness when paying the loan installments. The receipt should consist of the witness signature and the thumbprints for all parties involved on the receipt.