An authorization letter for collecting a checkbook indicates that you have granted permission to another individual to collect a checkbook on your behalf. The authorized person should have this letter when picking up the checkbook. It’s important to note that the letter is valid for a single collection and does not grant any additional permissions. The person collecting the checkbook assumes full responsibility for completing the necessary tasks. This article provides a straightforward guide for account holders to draft an authorization letter for checkbook pickup.

An authorization letter to collect a checkbook allows another person to retrieve the checkbook on behalf of the account owner, especially when the owner cannot be present. Typically, this letter is sent to the bank or financial institution from where the checkbook is to be collected.

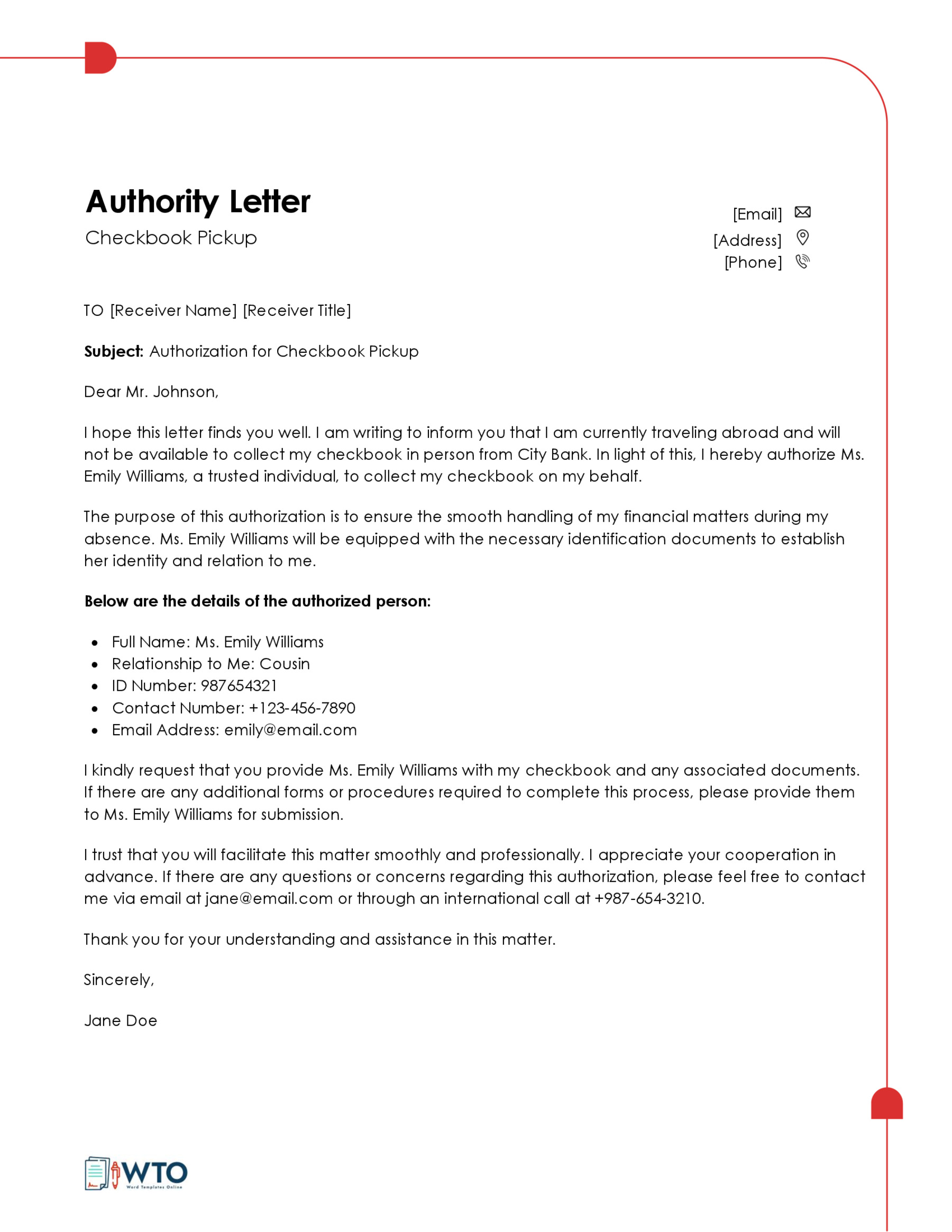

Sample Letters

Parties Involved in an Authorization Letter

An authorization letter to collect a checkbook involves the following parties:

Account owner

The account owner is the individual who writes the authorization letter to allow checkbook collection from the bank. The letter should include the account owner’s full name and address, and specify the type of account held with the bank.

Bank manager or relevant bank official

The bank manager represents the financial institution in matters of checkbook collection. Their primary role is to ensure that the authorized person presents all required documents for a successful process. The bank manager will also authenticate the authorization letter and verify its legitimacy. Finally, they are responsible for ensuring that the checkbook is handed over to the right person.

Authorized representative

This is an individual authorized to collect the checkbook on behalf of the account owner. The authorized representative must provide documentation to prove their identity and address. They should diligently follow the required procedures for checkbook collection to prevent any unnecessary delays or complications. Additionally, it’s the representative’s responsibility to ensure the safe and timely delivery of the checkbook to the owner.

How to Write an Authorization Letter for Checkbook Pickup

An authorization letter for checkbook collection is a significant official document that requires careful and appropriate composition. It should be concise and to the point.

Below are the key details to include in the letter:

Header

The header is the opening section of the letter and should incorporate the following information:

Sender’s name, address, and contact details

The authorization letter to collect the checkbook must include the full name of the account owner (sender). Additionally, the sender’s current address and contact details should be provided. These contact details will facilitate communication and notifications from the bank.

For example,

[Sender’s name]

[Sender’s address]

[Sender’s contact details]

Date

Next, specify the exact date the letter was sent to the bank. The date should be written in full and not abbreviated. It indicates when the letter was dispatched to the bank.

For example,

December 23, 202x

Recipient’s name, address, and contact details

After the date, include comprehensive details of the recipient bank. Mention the bank’s name, physical address, and contact information. This clarifies the intended recipient of the letter.

For example,

[Recipient’s name]

[Address]

[Contact details]

Subject of the letter

An authorization letter to collect a checkbook should feature a subject line that accurately conveys the letter’s purpose. The subject line should be brief, informative, and placed before the salutation. Write the subject in uppercase.

For example,

Subject: Letter of Authorization for Checkbook Collection

Professional greetings

A professional letter mandates a proper greeting. Greetings are among the initial elements the recipient will notice, setting the tone for the letter. They also establish a confident and professional demeanor throughout the communication.

For instance,

Dear Sir or Madam,

Body of letter

The body of the authorization letter comprises the following segments:

Introductory statement

In an authorization letter, the introductory statement serves to introduce yourself and clarify the letter’s purpose. Explicitly state the intention of authorizing someone else to collect the checkbook on your behalf.

For example,

“I, Jason Max, permit Carol Racheal to collect a checkbook delivered on June 10, 2018, on my behalf.”

Duties assigned to the representative

Detail the responsibilities assigned to the representative. Ensure that the representative’s information provided in the letter matches the details indicated within. Specify the actions the representative is empowered to undertake. For instance, the sender might authorize the representative to sign necessary documents for process completion or withdraw funds.

Time duration for the authorization

Clearly state the start and end dates during which the authorization is valid. Within this period, the representative is authorized to perform designated duties. If exact dates are uncertain, consider granting a 30-day duration for task completion.

For example,

“Carol Racheal is authorized to act on my behalf from June 13, 20xx, to June 18, 20xx.”

Reason for the authorization

Explain the underlying reasons necessitating representation through the authorization letter. Clearly communicate to the representative why they have been chosen and what tasks are expected during the authorized period. This could encompass instances where the account owner is occupied with work, unwell, or traveling.

Restrictions for the representative

The authorization letter to collect the checkbook should indicate both permitted and prohibited actions for the representative. The sender should clearly state what is authorized and not authorized in the letter. As the account owner, specific actions may be restricted for security purposes.

Examples of restrictions include:

- Prohibiting the representative from withdrawing or using funds to ensure financial security.

- Explicitly forbidding any unlawful use of the checkbook.

Reference to the attached documents

Lastly, provide relevant documents to facilitate a smooth process. Mention any relevant bank documents that will be needed to collect the checkbook and refer to the attached documents.

For example,

“You can see the attached documents: a copy of my original identity card and a copy of the ID card of my representative.”

Additionally, provide any relevant bank documents that will be needed to collect the checkbook.

Conclusion

Concluding the authorization letter is crucial to reinforce the importance of the enclosed information and instructions. The conclusion serves as a reminder that all outlined directions should be adhered to diligently. It includes the following:

Appreciation and sign-off

Wrap up the letter by expressing appreciation and reiterating the significance of complying with the instructions provided. For instance:

“I appreciate your prompt attention to this matter and thank you for your cooperation. Please ensure that all directives detailed in this letter are carried out accordingly.”

Signatures and notary witness

You can end the letter with phrases like “yours sincerely.” Then, add signatures of all the relevant parties to authenticate the content and commitments within the letter. Include the signatures of:

- Account owner or sender

- Authorized representative

If needed, for added legal validity, consider involving a notary public or a witness by appending their signature.

By concluding with clear appreciation, compliance emphasis, and authorized signatures, the authorization letter attains a comprehensive and legitimate closure.

Free Templates

Tips for Writing an Effective Authorization Letter for Checkbook Pickup

Drafting an authorization letter for checkbook collection demands clarity and accessibility. Employ the following crucial tips to facilitate a smooth writing process:

Be precise and brief

An effective authorization letter for checkbook collection should be precise and to the point. Focus solely on relevant details, avoiding unnecessary information. The risk of misinterpretation is higher when a letter is full of irrelevant details. Therefore, keeping the authorization letter short and precise is necessary.

Type the letter

Always ensure that the authorization letter is typewritten. Handwritten letters are perceived as unprofessional and might fail to meet the expectations of all parties involved. Additionally, handwritten content can be challenging to decipher and comprehend.

Double-check for accuracy

Thoroughly review the authorization letter for spelling and grammatical mistakes. Ensure that all details, such as names, dates, and addresses, are correct. Mistakes could lead to confusion and potential complications.

Use clear formatting

Employ clear formatting techniques, such as headings and bullet points, to enhance readability. Organizing the content logically makes it easier for the reader to follow the information.

Frequently Asked Questions

The purpose of such an authorization letter is to grant someone else the authority to collect your checkbook on your behalf. This is particularly useful when you are unable to collect the checkbook personally. It allows a designated individual to carry out this task for you.

Authorization is the process of giving someone else the ability to access and utilize resources, either for their own benefit or to act on your behalf. It establishes legal permission for certain actions to be taken.

For the authorization to be effective, you will need to write a formal letter to your bank. The letter should indicate that you have authorized the person mentioned in the letter to collect the checkbook on your behalf. Complete personal details about yourself, the recipient, and the third party should also be included in the letter.