Hotels and other rental properties have to ensure proper and accurate data keeping for each guest who stays on the premises and the transactions that the guests will conduct. One of the best documents to use for such a purpose is a hotel credit card authorization form.

What is a Hotel Credit Card Authorization Form?

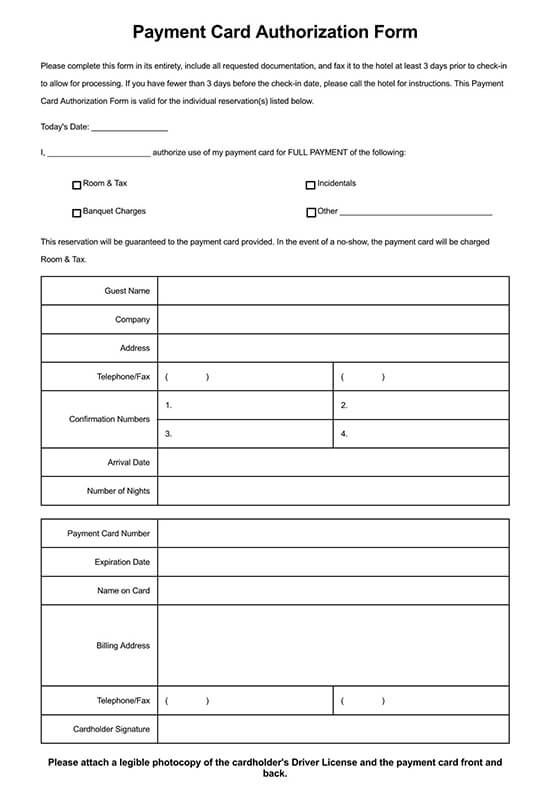

In its simplest definition, a hotel credit card authorization form is a type of document used by hotels for guests who prefer the option of paying for the hotel’s services and charges using their credit cards. The form’s primary purpose is to collect the necessary details concerning the guest and the right information about the credit card account where the payment is going to be billed by the hotel.

Without this form, the hotel management billing, the guest will not conduct the verification process, meaning the hotel cannot send, transact, or request payments from the guest’s credit firm.

Free Forms

Types of Hotel Credit Card Authorization Form

The forms come in different types, including:

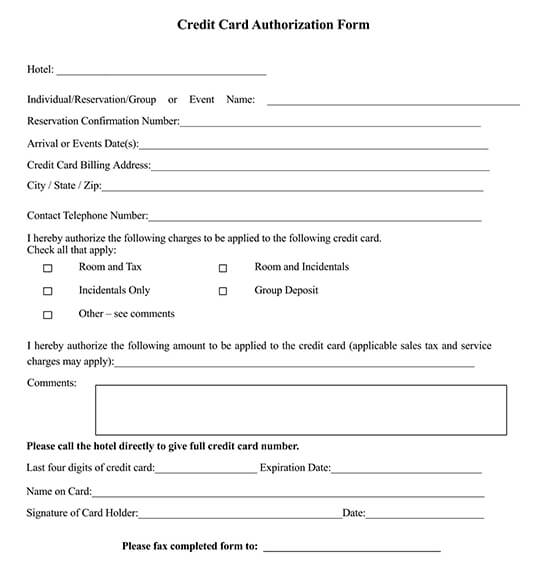

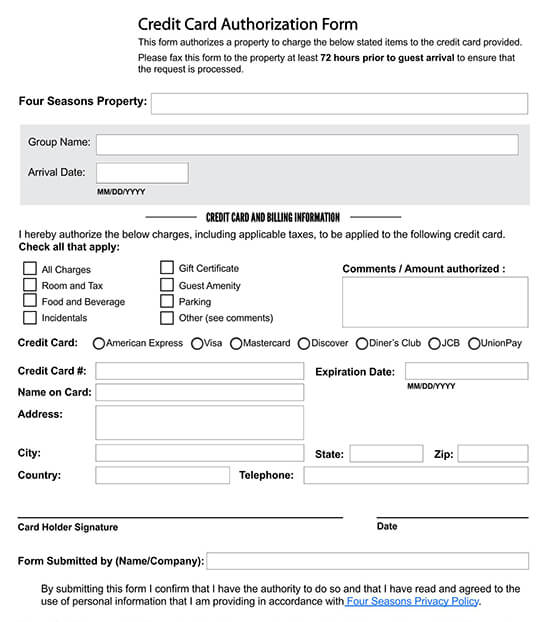

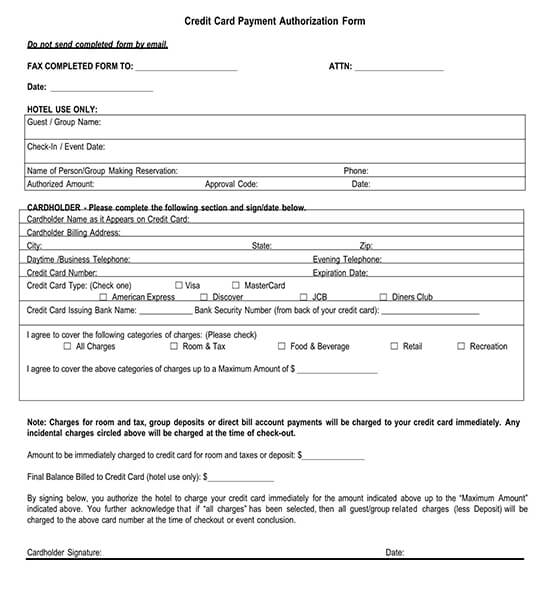

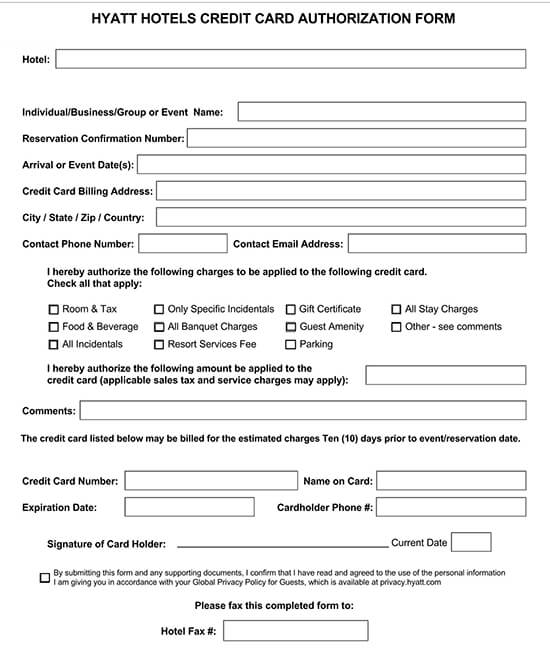

Hotel branch credit card authorization form

Hotels having more than a single branch have to prepare this kind of form for their guests. The form will include the specific hotel branch where the transaction will be authorized by the guest plus the guest’s event or business in the hotel, date of arrival, the confirmation number, and the credit card billing information, including the guest’s billing address.

Other details to be collected include the guest’s contact details, the hotel’s charges to be paid using the credit card, as well as the guest’s review comments concerning the transaction, and the hotel’s fax number.

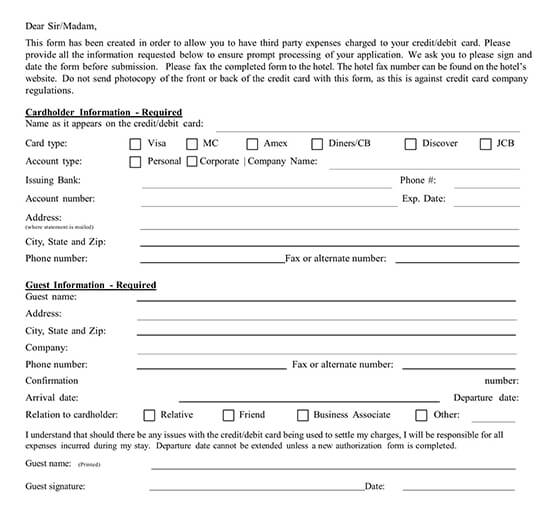

Hotel credit card assumption and authorization of liability form

Disposing your details to another party is always a risky undertaking since there is the possibility of your information being disclosed and used for the wrong purpose. Some hotels will include liability assumption rules or statements in the form. This helps the guest to understand that the hotel will not be liable for the risks associated with disclosing personal information.

note

The primary use for the form is to ensure that the right charges are billed to your credit card after staying in the hotel. The payment authorization will only include goods or services described in the form and is valid for one-time use.

Do Credit Card Authorization Forms Help Prevent Chargeback Abuse?

Chargebacks are used in protecting consumers from any unauthorized transaction. But it can also cause a significant effect on any business. A credit card authorization form is, therefore, a sure way of preventing chargeback abuse. Having a signed form from the cardholder will give you the right permission to charge the card for all the services rendered. This means that you stand a higher chance of winning the case once the cardholder issues a chargeback.

When Should I Use an Authorization Form?

Credit authorizations forms are useful for recurring transactions. The form serves two purposes:

- It mitigates customer risks for being charged when they should not have been charged.

- It saves time

If you have a hotel or restaurant that usually offers lunch to local offices every week, having an authorization form will ensure you charge the card every time the office calls for deliveries. However, recurring billing is not the only situation whereby an authorization form will come in handy. It can also be used in taking deposits for future purchases of services and goods.

It can also be used in putting on hold a card until a piece of equipment is returned for those operating a business that involves renting expensive equipment.

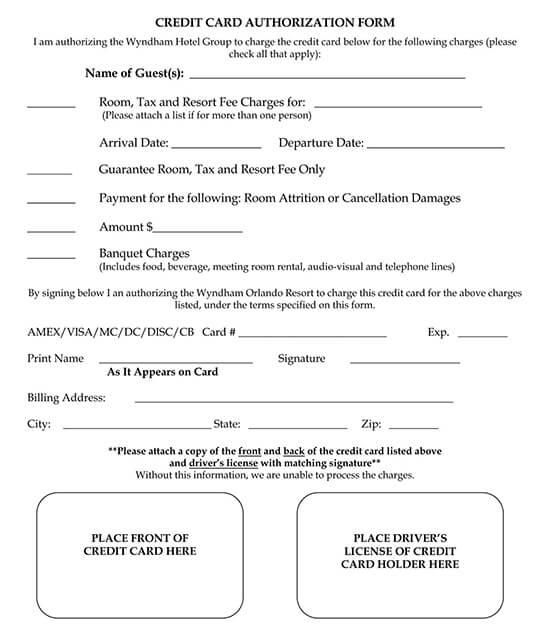

Contents of a Hotel Credit Card Authorization Form

Credit card authorization form typically contains:

- The information of the credit card holder

- Card number

- Card type

- Expiration date

- Merchant’s commerce information

- The billing address of the cardholder

- Language permitting the merchant to change customer’s card on file

- Signature and name of a cardholder

- Date

note

The credit card authorization form is a suitable practice for merchants. However, there is no legal obligation required. But it is essential to consult your lawyer on when he or she would suggest using it.

The Benefits of Credit Card Authorization Form

The authorization form comes with lots of benefits, including:

- It reduces fraudulent chargeback occurrences, thus allowing merchants to process the payments safely.

- It allows merchants to check the availability of a product before proceeding with the buying process.

- It enhances customer experience, immediately there is trouble with an order, having your customer funds available within a few days help mitigate customer frustrations, thus providing better experiences.

The forms play an essential role for both customers and sellers. However, to make the most of the form, it is vital to understand the required application better. This will help in eliminating any problem that may arise due to improper credit card authorization.