In both personal and business matters, there may arise situations where one is unable to fulfill their financial obligations. In such circumstances, granting authorization to another individual to collect money on your behalf becomes essential. By doing so, you delegate the responsibility of handling financial transactions to a trusted party. To facilitate this process, it is imperative to issue a formal authorization letter or document indicating that the designated person is permitted to act on your behalf. This document should include vital information, such as the nature of your relationship with the authorized individual, the full names and addresses of both parties, and their respective signatures. Additionally, the letter must clearly state the date of authorization and specify the duration for which the authorization is valid.

Sample Letters

When You May Need an Authorization Letter to Collect Money?

There are various situations where you might find it necessary to authorize someone else to collect money on your behalf. These circumstances could arise due to reasons such as illness, heavy workload, vacation, travel, or any other valid reasons that prevent you from personally handling financial matters. When faced with such situations, it becomes crucial to delegate your responsibilities to a trustworthy individual, such as a family member, a close friend, or a reliable colleague.

Some specific instances that may require you to issue an authorization letter include:

Collecting money from another company

If you have the responsibility of collecting money from a company but are unable to do so, you can authorize someone else to perform this task on your behalf.

Collecting checks from a company or person

You can permit another individual to collect checks from a company or person if you are unable to do it yourself.

Operating your bank account on your behalf

In situations where you cannot manage your bank account, such as during illness or absence, you may authorize a trusted person, like your spouse, a junior staff member, or a colleague, to operate the account temporarily.

Important Note: Each bank has its own internal process for authorizing someone to access your bank account. The bank may require an authorization letter along with other necessary documents to complete this process. To ensure the accuracy of the procedure, it is advisable to contact your bank directly for further information.

Free Templates

Basic Components of an Authorization Letter to Collect Money

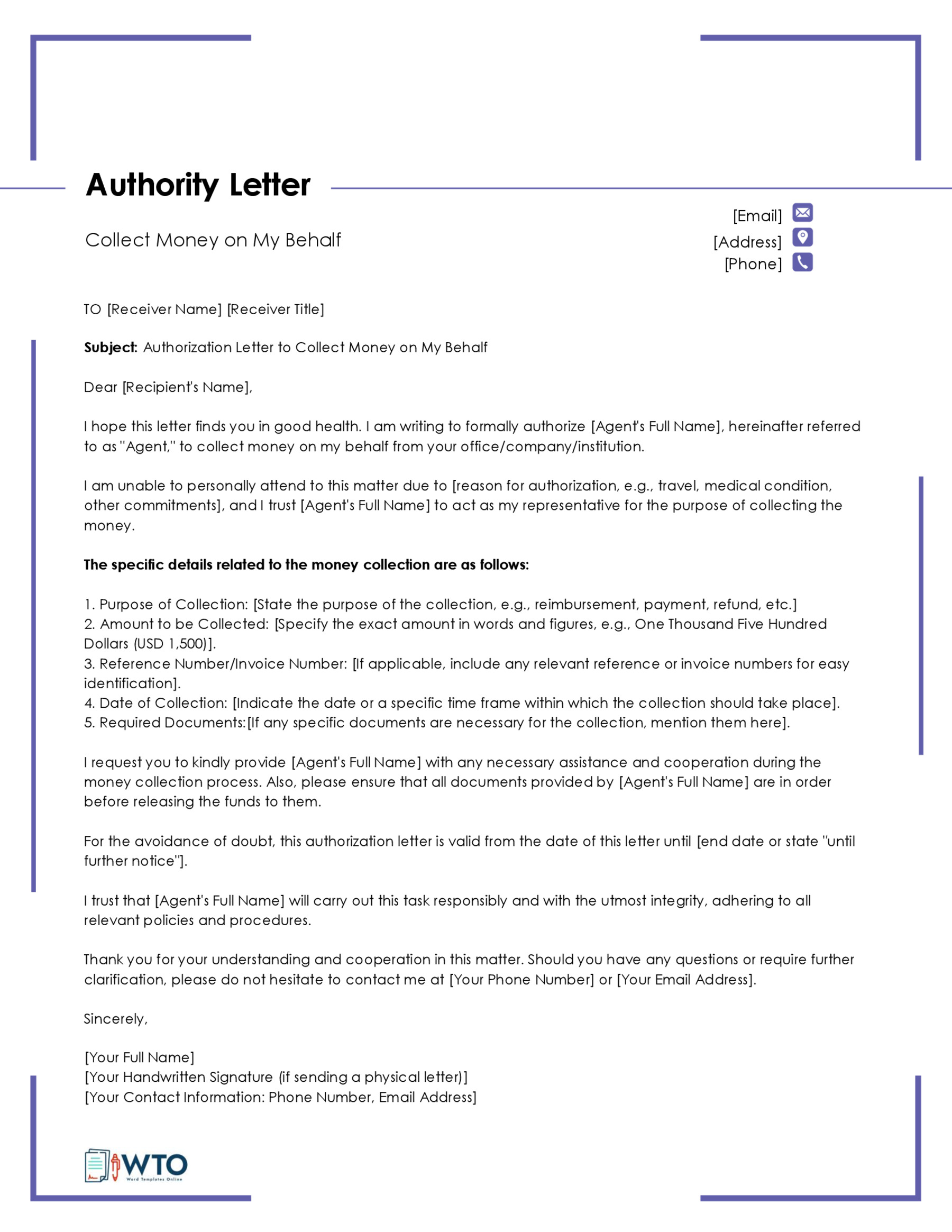

An authorization letter to collect money on my behalf should contain the following essential components:

Your information

Begin the authorization letter by providing your details, including your full name, address, contact information, and any other relevant identification details. This information is essential as it identifies you as the Principal and establishes your authority.

Date

Next, include the date of writing the letter. This helps in record-keeping and establishes the timeline for the authorization.

Recipient’s information

Following the date, provide the recipient’s details, including their full name (or company name if applicable), designation, address, and any other relevant contact information.

Subject

Include a clear and concise subject line that specifies the purpose of the authorization. For instance, you can write “Authorization to Collect Money on Your Behalf,” “Authorization to Collect Checks on Your Behalf,” or “Authorization Letter to Claim Money.”

Salutation

Use an appropriate and respectful salutation in the letter. Common salutations include “Dear Sir,” “Dear Mr./Ms./[Name],” “Dear Madam,” or “To Whom It May Concern” if you are not familiar with the recipient.

Reason for authorization

You should clearly state the reasons why you are unable to collect the money personally. Whether it’s due to illness, travel, or any other valid reasons, providing a brief explanation will help the recipient understand the context of the authorization.

Authorization details

Clearly state the full name of the agent who you are authorizing to collect money on your behalf. Express your approval for the designated individual or entity to act as your representative in financial matters. Additionally, provide the agent’s Social Security Number (SSN), passport number, or any relevant identification details to verify their identity. Furthermore, emphasize your relationship with the authorized agent (e.g., friend, family member, or colleague).

Period of authorization

Specify the exact dates or the duration for which the authorization will be valid. This ensures that the recipient knows the timeframe during which the authorized agent can act on your behalf.

Date of collection

If the authorized agent is expected to collect money or checks on a specific date, mention it clearly for proper coordination.

Additional information

You may include any other relevant information or specific instructions you want the recipient to be aware of. For example, you can request the recipient to notify you via SMS or email immediately after the authorized agent completes the collection.

Contact details

Provide both your and the agent’s complete contact information, including addresses, phone numbers, and email addresses. This information aids in verification and facilitates communication.

Letter closing

Conclude the letter with a polite and appreciative closing, such as “Thank you for your cooperation.”

Signature

Include your handwritten signature at the end of the letter, as it validates the authorization. If applicable, include a company stamp to add further authenticity, especially when representing a business or organization.

Related: Sample Authorization Letters for Bank

4 Key Precautions to Consider

When granting authorization for someone to collect money on your behalf, it is essential to exercise caution and avoid potential pitfalls. Here are some precautions to keep in mind:

Trustworthiness

Ensure that you only authorize someone you have complete trust in. Entrusting financial matters to a reliable and responsible individual is crucial to avoid any mishandling of funds.

Authorized checks

Limit the authorization to collect only checks that bear your name or your company’s name. This prevents any unauthorized or fraudulent collection attempts on your behalf.

Letterhead (if applicable)

If you are representing a company or organization, it is advisable to use the official company letterhead for the authorization letter. This adds legitimacy and professionalism to the document.

Valid company stamp (if applicable)

If your company or organization uses a company stamp for official documents, consider including it in the authorization letter. The company stamp further validates the authenticity of the letter and your authorization.

Final Thoughts

The Authorization Letter to Collect Money on My Behalf serves as a crucial document that grants explicit permission to trusted individuals to handle financial matters on behalf of the authorizer. By authorizing someone else to collect money, the authorizer enables the designated person to act as their representative in financial transactions that they may not be able to attend to personally. With the authorizer’s signature validating the letter’s authenticity, this formal document empowers individuals to delegate financial responsibilities while maintaining control and accountability. Overall, an authorization letter is a vital tool for handling financial matters responsibly and ensuring that trusted representatives can act in the authorizer’s best interests.