A credit report is a detailed account of your credit history. It will include a history of your borrowing habits and payments you have made. Credit bureaus are in charge of storing and updating these reports. A credit report can affect your finances in a negative way if you have missed a payment or have defaulted on a loan or credit card. Sometimes false claims are made on a credit report. If this happens to you, then you can file a credit report dispute to demand the removal of false information.

Free Templates

What is a Credit Dispute Letter?

A credit dispute letter is a formal communication that demands the removal of certain negative information from a credit report.

This information can be inaccurate or unverifiable. The letter is sent to all the credit bureaus and the original creditor.

What Should be Included?

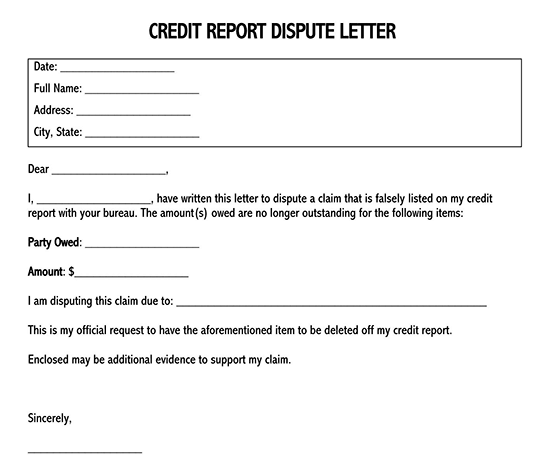

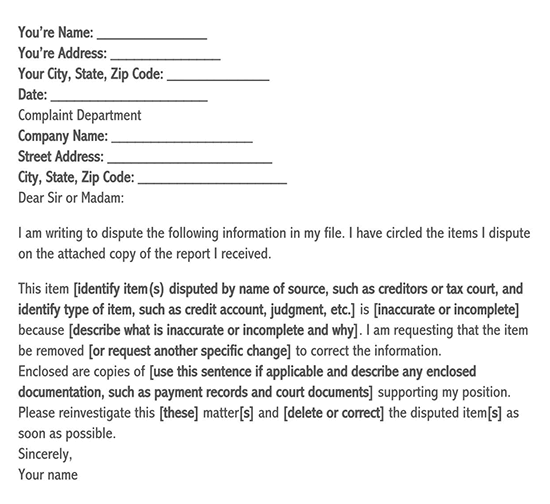

The first thing you will need to do before writing a credit report dispute letter is to find your credit report. This may be a difficult task because the credit bureaus keep files on just about everyone in the country that has been reported on. Once you have identified your credit report, you should provide information on any errors that you have found. Last but not least, your dispute letter should include a formal request to the credit bureaus to remove the error from your official report.

Providing credit bureaus with the information they need will help them make a quick decision on removing any false information from your report. Below are a few things that you should include in your credit report dispute letter:

- The current date.

- Your personal information, including your name, contact information, account number, and date of birth,

- The contact information for the credit bureaus.

- A description of the error in question. There is no need to go into deep detail.

- Documents that support your claim. These can include payment records, court documents, etc.

Template Credit Dispute Letter

[Your Name]

[Your Address]

[City, State, Zip Code]

[Phone Number]

[Email Address]

[Date]

[Credit Reporting Agency Name]

[Agency Address]

[City, State, Zip Code]

Dear [Credit Reporting Agency Name],

Subject: Dispute of Inaccuracies on Credit Report

I am writing to dispute certain information in my credit file identified as inaccurate. The details of the disputed information are as follows:

- Item 1: [Describe the item (e.g., account name and number) as it appears on your credit report, the date of the report, and explain why it is inaccurate.]

- Item 2: [If there are multiple items, repeat the format above for each disputed item.]

I have enclosed copies of documents that support my dispute (do not send original documents) such as [mention any supporting documents like payment records, court documents, identity theft reports, etc.]. Please find the attached documents that corroborate my claim:

1. [Document Name], indicating [brief description of what the document proves or supports].

2. [Document Name], showing [brief description of what the document proves or supports].

According to the provisions of the Fair Credit Reporting Act (FCRA), I request that the inaccurate information be removed or corrected at the earliest possible convenience. I understand that under the FCRA, you are required to process and complete the investigation within 30 days of receipt of this letter.

Please send me a written confirmation of receipt of this dispute letter and the resulting actions taken to address the inaccuracies on my credit report. I also request an updated copy of my credit report post-investigation.

Should you require any additional information or documentation to facilitate the resolution of this dispute, please do not hesitate to contact me at [Your Phone Number] or via email at [Your Email Address].

Thank you for your prompt attention to this matter. I look forward to your swift response and the resolution of these inaccuracies.

Sincerely,

[Your Name]

[Enclosures: List of documents you are including]

Sample Letter

Dear TransUnion,

Subject: Dispute of Inaccuracies on Credit Report

I am writing to formally dispute inaccuracies found in my credit report, which I obtained from your agency on January 15, 20XX. After reviewing my report, I have identified discrepancies that are negatively impacting my credit score and request your immediate action to investigate and rectify these errors.

Disputed Items:

- Item 1: Credit Card Account XYZ1234 (ABC Bank)

Reported Delinquency Date: January 20XX

Dispute: I am disputing this delinquency notice as inaccurate. I have always maintained timely payments on this account. Enclosed are bank statements from December 20XX through February 20XX, clearly showing payments made before the due dates.

- Item 2: Collection Account 789654 (Medical Bill)

Reported Amount Owed: $500

Dispute: This collection account is incorrect and should not be on my credit report. I was never treated at St. Elizabeth Hospital and have no knowledge of this debt. I suspect this is a case of mistaken identity or a billing error. Attached is a letter from St. Elizabeth Hospital confirming that there is no record of me owing such a debt.

Supporting Documents Enclosed:

- Bank Statements (Dec 20XX – Feb 20XX): Showing proof of timely payments for account XYZ1234.

- Letter from St. Elizabeth Hospital: Confirming no debt owed by me for the mentioned medical bill.

In accordance with the Fair Credit Reporting Act (FCRA), I request that these inaccuracies be investigated and corrected promptly. The presence of these incorrect entries is not only misleading but also damaging to my financial reputation and creditworthiness.

Please send me a written confirmation that this dispute has been received, along with the outcome of your investigation, and an updated copy of my credit report once these inaccuracies have been resolved. Should you require further information or additional documentation to assist in your investigation, please contact me at the phone number or email address provided above.

I appreciate your attention to this matter and expect a response within the statutory timeframe of 30 days as mandated by the FCRA.

Thank you for your prompt assistance.

Sincerely,

Jordan Lee

[Enclosures: Bank Statements (Dec 20XX – Feb 20XX)]

[Letter from St. Elizabeth Hospital]

Analysis

Here we will analyze the above given samples to understand the effective approach of the writer on writing this letter. This dispute letter effectively addresses inaccuracies identified in the credit report obtained from TransUnion. It starts with a clear subject line and a concise introduction, stating the purpose of the letter upfront. The body of the letter is organized into two sections, each addressing a specific disputed item, providing details of the discrepancy, and offering supporting evidence.

In the first item, the writer disputes a delinquency notice on a credit card account by providing evidence of timely payments through enclosed bank statements. For the second item, a collection account for a medical bill, the writer challenges the validity of the debt and provides a letter from the hospital confirming the absence of any outstanding debt.

The writer appropriately references the Fair Credit Reporting Act (FCRA) and requests a prompt investigation and correction of the inaccuracies. The letter concludes with a polite request for confirmation of receipt, updates on the investigation outcome, and a new credit report once the issues are resolved.

Overall, this letter is effective because it clearly outlines the disputed items, provides supporting documentation, adheres to relevant regulations, and requests timely resolution, ensuring a thorough investigation of the discrepancies.

Standard Practice to Send a Credit Report Dispute Letter

Before sending out your credit dispute letter, make sure to make a copy for your records. In the letter, make sure to include all documents that may help support your claim. For example, you may want to send in a copy of a cashed check that proves you made a payment on time.

You also may want to make a copy of your bank statement to help add additional support to your dispute. The more information you can provide, the easier it will be for the credit bureaus to decide in your favor. Additionally, it may help speed up the investigation and removal process. Remember, never send in your original document. Instead, make copies of them to include in your credit dispute letter.

Once you have sent in your credit report dispute letter, typically, the credit bureaus will have 30 days to respond. This period was set by the Fair Credit Reporting Act and is designed to protect people from false reporting. During the 30 days, the credit bureaus will investigate your claim and get back to you in writing. It is a good idea to send your credit report dispute letter by certified mail. This will provide you with proof of when you sent in the letter. For even more protection, you may want to send the letter with a return receipt request. This will require someone at the credit bureau to sign the receipt that will be returned to you via the mail system. Doing so will provide you with proof that your letter has gotten in the right hands.