Borrowing is one of the ways to meet people’s personal financial needs. Whether it’s a property you want to buy or start a project but have insufficient funds, the majority of people do borrow as an option. Borrowing isn’t a bad idea.

However, before making such a move, it’s essential that you consider a repayment plan for your borrowing. Otherwise, you’ll end up with huge loans. In some cases, you’ll find yourself struggling to resolve your outstanding debts. When confronted with such situations, sending a debt forgiveness letter can help.

Defining a Debt Forgiveness Letter

In its simple terms, a debt forgiveness letter, also known as a ‘cancel your debt’ letter, is written requesting your creditor to forgive your loan as you may not be able to pay everything off. This concept, however, is an undeniably appealing one that comes with strings attached and other consequences. Therefore, before considering requesting forgiveness from your creditor, always remain vigilant not to acquire enormous debts in the first place.

After receiving your letter, your creditor may weigh out certain options and decide whether to cancel the debt.

Depending on your reasons and the type of loan you owe, the creditor may grant you access to the following:

- Debt forgiveness for less than the full balance owed

- Full forgiveness of the debt.

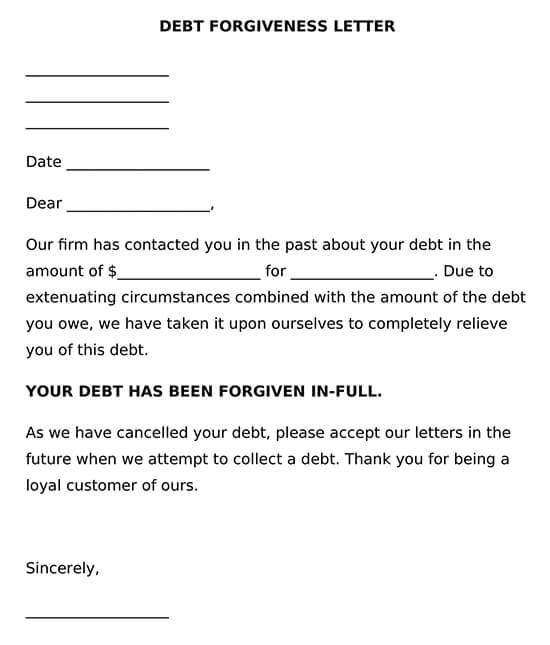

Free Templates

Possible Reasons Why You may Not Settle Debts as Expected

Sometimes, we may have the best intentions of paying our debts to creditors as originally planned.

However, this may be altered due to some reasons, as mentioned below:

- Decrease in income

- Unexpected life events

- Increased family medical bills

- Loss of spouse income

- Failure in business

- Divorce or death of a spouse

- Severe property damage from a natural disaster such as cyclone

- Being jailed for wrongdoing, among other reasons

It’s important to note that these reasons can be caused either by the lenders’ fault or beyond their control. Nonetheless, this doesn’t mean that debt forgiveness is their right. Rather, it solely depends on the creditor’s will. Therefore, the purpose of the letter is simply to convince the creditor that the lender is undergoing some personal financial difficulties that are incapacitating him/her from repayment.

How to Write a Well-convincing Debt Forgiveness Letter

Writing a letter is not just taking a walk in the park. You must articulate your issues in a well-convincing manner to win the trust of your creditor. Remember, as a lender, you are 100% responsible for repayment. Therefore, in order to get the much-needed relief, you must be sincere and convincing enough.

The following are some tips that will help you through:

- Use a polite and respectful tone: When drafting your letter, ensure your tone is polite and respectful without any sign of expectation or anger.

- Mention what is relevant: One thing that you wouldn’t want to do is use unnecessary information, such as that you have an addiction or have lost money in gambling or the lottery. Such information would only make your creditor angry. Therefore, make sure you stay relevant and direct.

- Prove your hardship: To win your creditor’s trust, you can provide evidence of your claims. For instance, you can attach proof of job loss, medical bills, divorce papers, or any other hardship that you are going through that is limiting your financial capability.

- Observe the time limits: Don’t wait till late to write your letter, as this would show your lack of seriousness and loan commitment. Therefore, ensure you notify your creditors of the issue early in time to help them come up with a decision.

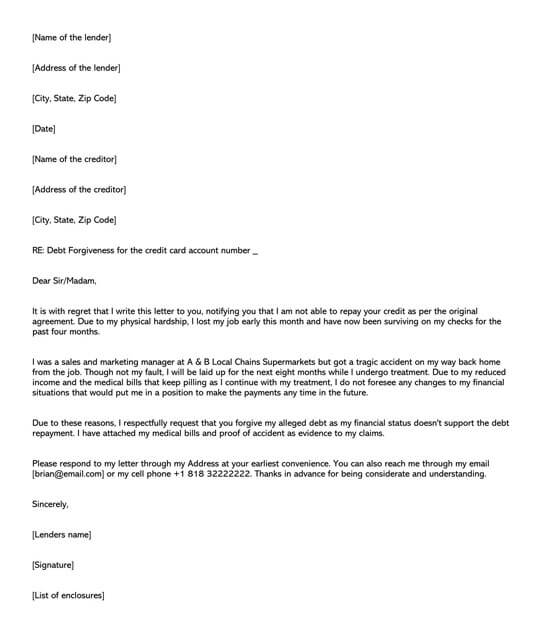

Sample Debt Forgiveness Letter

A free sample debt forgiveness letter is available below, serving as a reference point for individuals looking to write their letters seeking understanding and financial relief.

SAMPLE

Dear Ms. Smith,

I am writing to request your consideration for a debt forgiveness arrangement regarding my loan account #AB123456 with Anytown Bank.

Over the past few years, I have valued the financial services provided by Anytown Bank. Unfortunately, due to unexpected developments, my financial situation has drastically changed. In March 20XX, I was involved in a serious car accident, which resulted in extensive medical treatments and a prolonged period of unemployment. Consequently, my ability to meet the financial obligations of my loan has been significantly compromised.

As of today, my outstanding balance is $10,000. Despite my efforts to maintain payments, including using my savings and seeking temporary employment, I am no longer able to fulfill this commitment in full.

Therefore, I respectfully request a debt forgiveness arrangement. This action would allow me to manage my current financial burdens while acknowledging my commitment to Anytown Bank.

I am prepared to provide the necessary documentation, including medical records and unemployment verification, to substantiate my situation. I am hopeful for a solution that takes into consideration my present financial challenges.

Your assistance and understanding in this matter would be invaluable. I am open to discussing any alternative solutions you might propose. I look forward to your response and hope for a favorable outcome.

Thank you for your time and consideration.

Sincerely,

John Doe

Analysis

The provided sample debt forgiveness letter exemplifies a well-crafted and effective template for individuals seeking to communicate their financial hardships to a lender or creditor. One of its key strengths lies in its formal and professional tone, which establishes respect and seriousness in addressing a sensitive matter. The writer begins by respectfully addressing the loan officer, thereby personalizing the letter and demonstrating an awareness of proper business communication protocols.

The structure of the letter is clear and logical, beginning with an introduction of the purpose, followed by a detailed explanation of the circumstances, and concluding with a specific request and expression of willingness to cooperate. This organized approach ensures that the recipient can easily follow the writer’s train of thought and understand the situation.

The writer’s transparency about his financial difficulties, specifically citing the car accident and resulting challenges, adds a layer of authenticity to his request. By providing a specific account of the events that led to his financial distress, he creates a compelling narrative that invites empathy and understanding. This level of detail, combined with his willingness to provide supporting documentation, enhances the credibility of his request.

The letter also demonstrates a balanced approach to problem-solving. While the writer requests debt forgiveness, he also shows openness to alternative arrangements, like a reduced settlement amount or a longer-term payment plan. This flexibility indicates his commitment to finding a mutually beneficial solution, a quality that can be persuasive to creditors, who may be more inclined to negotiate under such circumstances.

In conclusion, the sample letter serves as a useful guide due to its professional tone, clear structure, detailed and credible explanation of circumstances, and balanced, solution-oriented approach. These attributes make it an effective example for individuals in similar situations seeking to communicate their financial hardships and negotiate debt forgiveness or other accommodations.