Like it or not, you will, from time to time, contract debt either at the individual or the corporate level. To be able to contract the debt, you will have to give out collateral and work in cohorts with a couple of third parties. All these people and entities have to be informed of your progress insofar as servicing the debt is concerned.

After settling the debt has been settled, you have to draft and send out a debt release letter to the creditor and the third parties to notify them of the same. It is after this that the collateral that was held in lien is returned to you. We dedicate the article hereunder for that letter and every pertinent issue.

What is a Debt Release Letter?

A debt release letter is an official communique that a borrower drafts and sends out to a lender to notify him that he has completed paying the debt in full. The letter is also sent out to the third parties who were involved in the procurement of the debt or the associated transaction.

Its purpose is basically to announce to the stakeholders that there is no longer any financial obligation between the debtor and the creditor. It also asks the creditor to release the collateral that he holds in lien to the debtor. In many cases, the letter is drafted after the payment has already been concluded.

Debt Release Letter (Word Format)

- MS Word

Debt Release Email (Word Format)

- MS Word

How to Write the Debt Release Letter

To be able to write a good letter of debt release, there are issues you have to get right. In this section, we are going to highlight those issues and the steps you have to take to be able to arrive at the best possible letter:

Validate the Debt

You must first and foremost validate the debt to be sure that it is wholly paid up before commencing to draft the letter. This is to avoid the embarrassments that come along with drafting a letter about a purported release, yet the debt is, in fact, outstanding. Check out with the various financial institutions to see that they have indeed remitted the payments.

Check the statute of limitations

Each state and jurisdiction has its own rules and regulations that govern the repayments of debts. You have to check and be sure that you are well aware of the rules that exist in your state. Then, you have to structure and doctor your letter to line up with those very requirements.

Create a Header

Now get to the core of the business of letter writing. Start by creating a header that basically addresses the creditor and spells out the intent of the entire letter. Needless to say, this header has to exist at the very top of the letter.

Identify the Debt Obligation

Proceed to identify the specific debt obligation you have already settled. This entails you keying in the name of the creditor, the amount involved, any interests accrued, the date when the last installment was made, the account number to which the payments were made, and the addresses of both the creditor and the lender.

Request the Release of the Collateral and the Credit Listing

After furnishing the details of the date that you have already settled, go ahead now to ask the creditor to release the collateral that he had taken to advance the loan to you. Follow this by asking him to delist you from the credit reference bureaus wherein he most likely listed you.

Request an Official Response

Finish off the letter by requesting an official response from the creditor within a realistic timeframe. On the same note, ask the creditor also to reach out to you in case of the need to make any clarifications.

Proofread and edit

Having concluded drafting the body of the letter, you now have to proofread it in its entirety to see to it that it contains all the relevant pieces of information. Take advantage of the time slot also to weed out any grammatical errors from the letter before submitting it.

Sign and Date

Finish off drafting the letter by signing and dating. Being an official letter, you have to send it to the recipient through a registered mail. The object of this is to minimize unauthorized access and the damages that come along with the breach of trust.

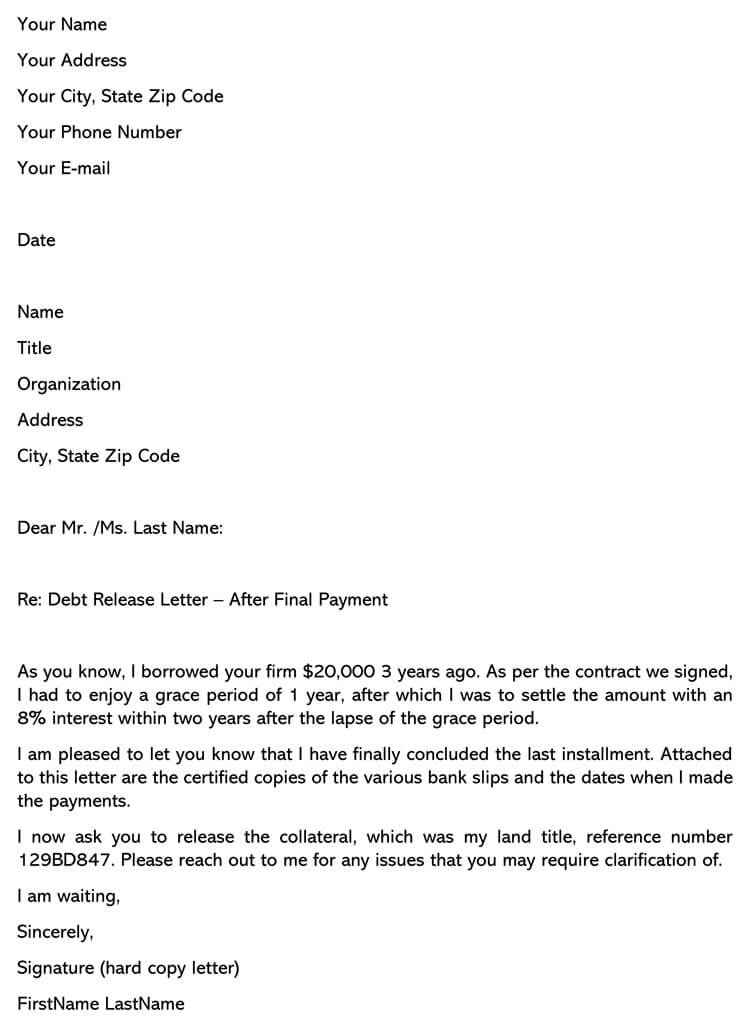

Sample Debt Release Letter

Your Name

Your Address

Your City, State Zip Code

Your Phone Number

Your E-mail

Date

Name

Title

Organization

Address

City, State Zip Code

Dear Mr. /Ms. Last Name:

Re: Debt Release Letter – After Final Payment

As you know, I borrowed your firm $20,000 3 years ago. As per the contract we signed, I had to enjoy a grace period of 1 year, after which I was to settle the amount with an 8% interest within two years after the lapse of the grace period.

I am pleased to let you know that I have finally concluded the last installment. Attached to this letter are the certified copies of the various bank slips and the dates when I made the payments.

I now ask you to release the collateral, which was my land title, reference number 129BD847. Please reach out to me for any issues that you may require clarification of.

I am waiting,

Sincerely,

Signature (hard copy letter)

FirstName LastName

Debt Release Email Example

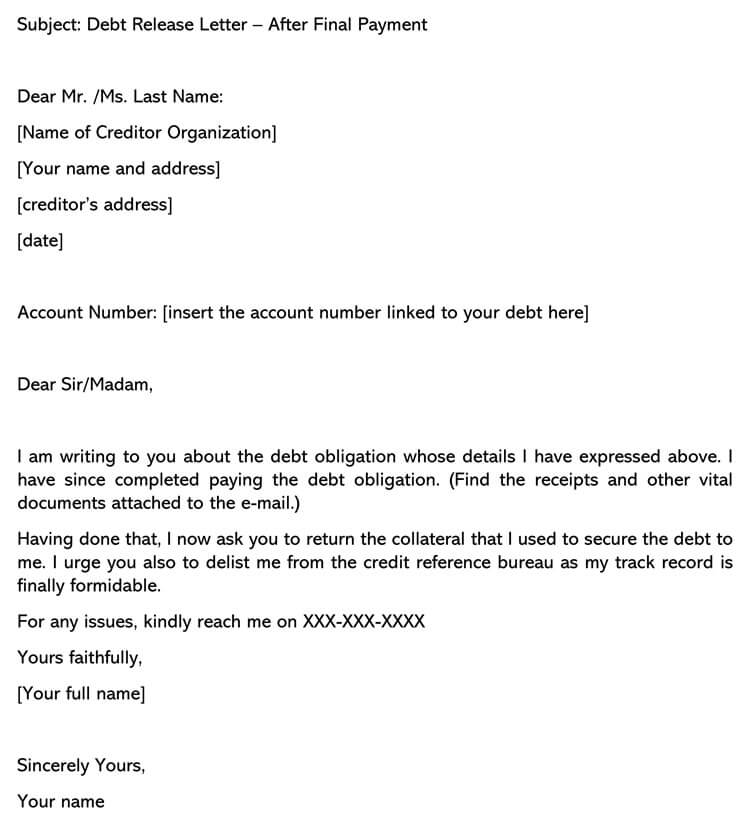

Subject: Debt Release Letter – After Final Payment

Dear Mr. /Ms. Last Name:

[Name of Creditor Organization]

[Your name and address]

[creditor’s address]

[date]

Account Number: [insert the account number linked to your debt here]

Dear Sir/Madam,

I am writing to you with regard to the debt obligation whose details I have expressed above. I have since completed paying the debt obligation. (Find the receipts and other vital documents attached to the e-mail.)

Having done that, I now ask you to return the collateral that I used to secure the debt to me. I urge you to also delist me from the credit reference bureau as my track record is finally awesome.

For any issues, kindly reach me on XXX-XXX-XXXX

Yours faithfully,

[Your full name]

Sincerely Yours,

Your name

Conclusion

We have belabored just about every issue you need to get started out in drafting such a letter. Having done our part, we now leave it to you to carry on from where we have left. That can only mean you are putting the relevant strategies in place to make use of the information to draft your own letter.