At times in life, you may find you are unable to pay a bill that then goes to a debt collection agency. Once this has happened, you can enter into a payment agreement or offer a lump sum payment to clear the debt. This can be done using a settlement offer letter.

This form is used when the debtor and creditor want to agree to new terms. The letter is usually sent by the debtor to the creditor and may offer a lump sum that is not the full amount, but one that is agreeable to the creditor to accept and release the debtor from the burden of having to pay the full amount of the debt. Once a debt settlement offer letter has been accepted, the debtor and creditor can draw up a written agreement or receipt for their records.

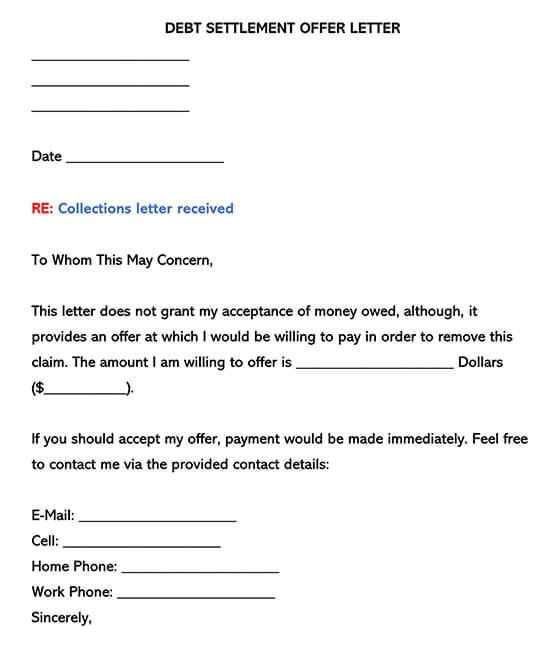

Sample Letters

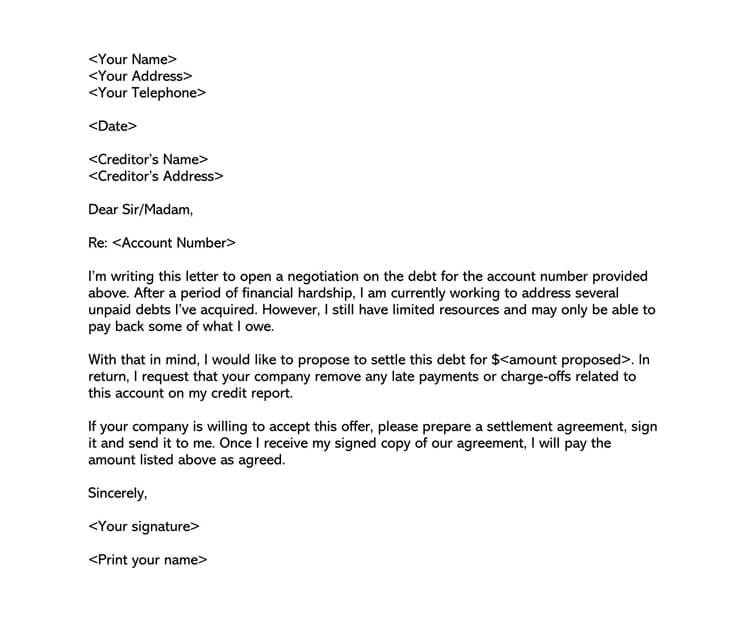

The following sample letter is offered as a resource to help you when seeking a thoughtful and professional approach to communicating your intent to settle a debt. It serves as a guide for expressing a genuine commitment to resolution.

sample

Re: Settlement Offer for Account No. 987654321

Dear Brighton Financial Services,

I am writing to you regarding my account with your company, specifically account number 987654321. Due to a recent medical emergency, which has significantly impacted my financial situation, I am currently unable to meet the full obligations of this debt. However, I am earnestly committed to resolving this matter and would like to propose a settlement offer.

I am able to offer a lump-sum payment of $2,000 as a full and final settlement for this account. This amount represents a 50% reduction from the total balance of $4,000. I believe this amount reflects my current financial capabilities while also acknowledging the importance of fulfilling my obligations to your company.

Should you agree to this settlement offer, I am prepared to make the payment by January 31, 20XX. The payment will be made via a bank transfer to an account you specify.

In exchange for this payment, I request that you report this account as “settled in full” to all credit bureaus and provide me with a letter confirming the settlement and that no further payments are required.

Please respond to this letter with your decision. Should you need to contact me, I can be reached at:

Phone: 312-555-1234

Mobile: 312-555-5678

Email: laura.smith@email.com

Thank you for considering this offer. I look forward to your positive response and resolving this matter amicably.

Sincerely,

Laura Smith

Analysis

The presented letter exemplifies well-structured and effective communication for someone navigating a situation requiring negotiation or resolution. It adheres to a standard format, encompassing a formal header, salutation, body, and closing. This organizational clarity ensures that the recipient can easily follow the content of the letter, contributing to its overall effectiveness.

Furthermore, the letter achieves a personal touch by customizing the address to the recipient and referencing a specific account number. This attention to detail demonstrates a sincere effort to address the matter at hand. The inclusion of a brief but sufficient explanation of the sender’s financial hardship, attributed to a recent medical emergency, adds a human element to the communication. This not only provides context for the proposed settlement but also establishes a basis for understanding and empathy.

The letter’s strength lies in its specificity and transparency. It proposes a clear settlement offer. The inclusion of a proposed payment timeline, payment method details, and a request for specific documentation further enhances the clarity and completeness of the proposal. The professional and respectful tone maintained throughout the letter contributes to the likelihood of a positive response from the recipient, fostering an environment conducive to resolving the matter amicably.

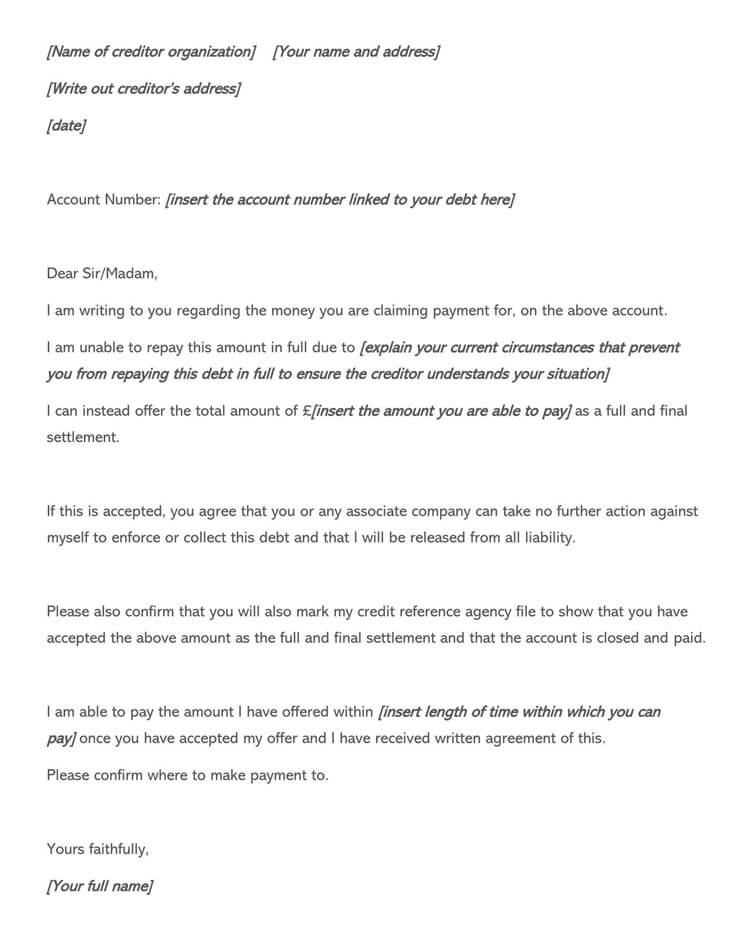

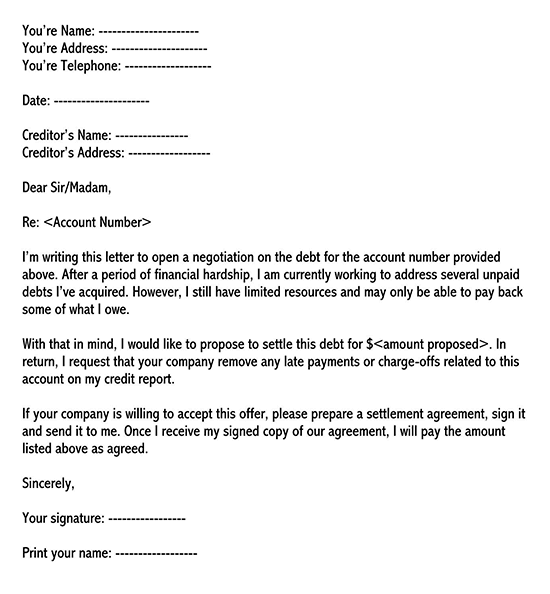

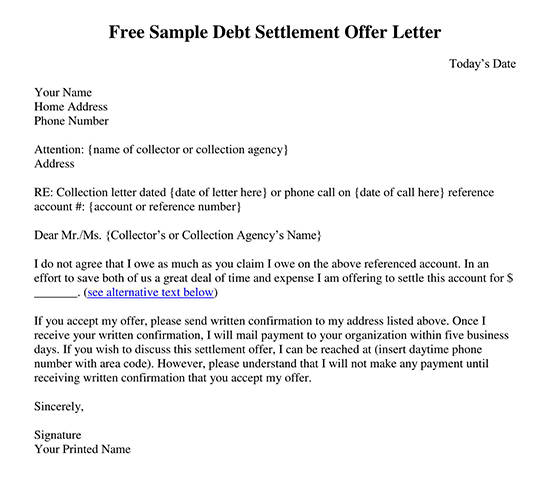

Free Template

Here’s a template for a debt settlement offer letter that includes all the necessary components:

template

[Your Full Name]

[Your Address]

[City, State, ZIP Code]

[Date]

[Creditor’s Name or Company]

[Creditor’s Address]

[City, State, ZIP Code]

Re: Settlement Offer for Account No. [Your Account Number]

Dear [Creditor’s Name or Company Representative],

I am writing to you regarding my account with your company, specifically account number [Your Account Number]. Due to [brief explanation of your financial hardship, e.g., job loss, medical emergency], I am currently unable to meet the full obligations of this debt. However, I am committed to resolving this matter and would like to propose a settlement offer.

I am able to offer a lump-sum payment of [Amount] as a full and final settlement for this account. This amount represents a [percentage] reduction from the total balance of [Total Balance]. I believe this amount reflects my current financial capabilities while also acknowledging the importance of fulfilling my obligations to your company.

Should you agree to this settlement offer, I am prepared to make the payment by [date of payment, e.g., within 30 days of receiving written confirmation]. The payment will be made [method of payment, e.g., via bank transfer, check, etc.].

In exchange for this payment, I request that you report this account as “settled in full” to all credit bureaus and provide me with a letter confirming the settlement and that no further payments are required.

Please respond to this letter with your decision. Should you need to contact me, I can be reached at:

Phone: [Your Phone Number]

Mobile: [Your Mobile Number]

Email: [Your Email Address]

Thank you for considering this offer. I look forward to your positive response and resolving this matter amicably.

Sincerely,

[Your Signature (if sending a hard copy)]

[Your Printed Name]

How to Write a Debt Settlement Offer Letter

When you send a debt settlement offer letter to a creditor, it’s important that you explain to them how you plan to settle the outstanding amount, along with any payment amounts and scheduled dates. This should be done using a formal tone, and you should also include what you are expecting from your creditor.

There are some key details that all such letters should have:

- The full name used for the credit account

- Your full address

- Your account numbers or a reference number from the creditor

This information is what your creditor will need to pull up all the relevant details of your account with them.

Make sure your letter has:

- Header: This should include your full name and address, as well as the date that the letter was written.

- Body: This is where you will explain the details of your settlement offer (amount, dates of payments you will make, and how they will be made) and what you are expecting from your creditor.

- Contact: Your contact details, including a current phone, mobile, and e-mail address.

- Closing: This is where you will sign the letter

Make sure that your creditor has accepted your offer and does so in writing before you make any payments to them. Be sure to keep this confirmation in a safe place because it is your proof of the agreement should a dispute arise.

note

Not repaying it in full will show up on your credit report as a partially settled debt, not a fully settled one. This can have an impact on your credit score and your chances of obtaining credit in the future.

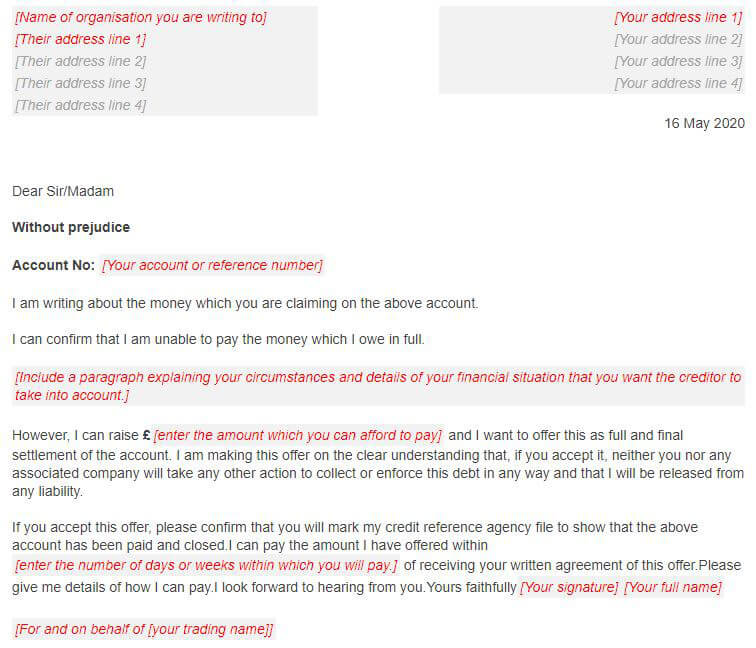

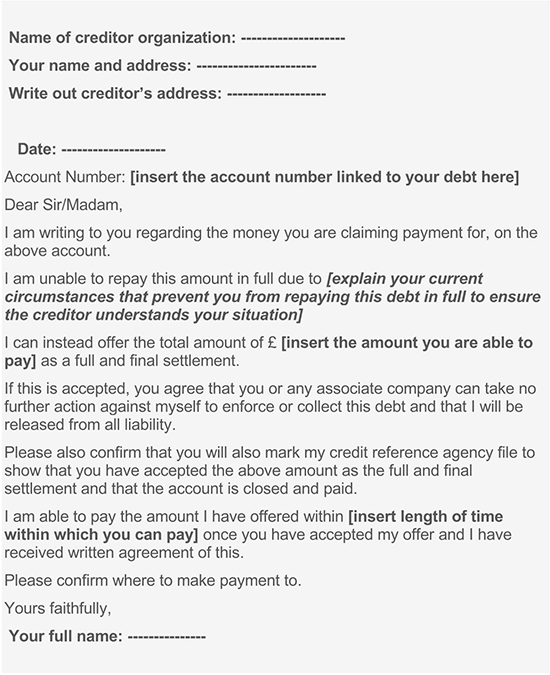

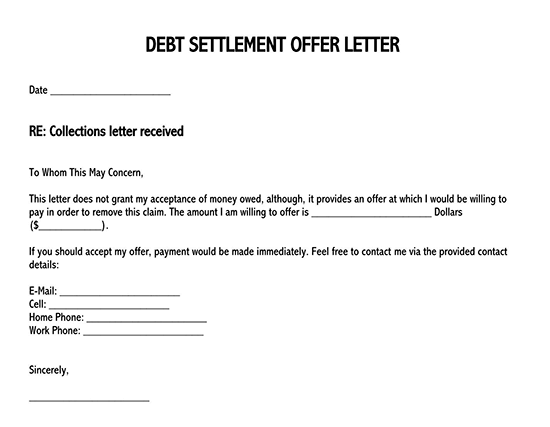

Free Downloads

Law Around Debt Settlement Offers

One main question people ask is whether a creditor can try to claim the balance of a debt that was partially paid and accepted as releasing the debtor from it. When a creditor agrees to do so, they are considered estoppel from being able to claim the remainder. Estoppel occurs when a debtor has relied on the creditor’s release agreement, making it unjustified for them to go back on that agreement. This is why it is important to have a written copy of an offer of acceptance from the creditor as proof, to stop them from trying to come back and claim the balance afterward.

Frequently Asked Questions

Typically, an offer of 30% of the debt’s outstanding balance should be made to a creditor for them to even consider it. They will normally come back with a counteroffer of 50%.

Negative marks on your credit report, such as a partial debt settlement, can stay on your report for 7 years.