When you are a new customer with a lender, utility provider, or supplier, those service providers don’t necessarily know if you will pay your bills on time. As a result, it becomes risky for them to offer you anything on credit without requiring you to pay upfront). However a credit reference letter might help convince them to provide you with more favorable terms on the service or loan you require.

Examples and Templates

A credit reference letter serves as a formal document that provides information about your creditworthiness and financial history. It is typically requested to assess the creditworthiness of a potential borrower or tenant. When it comes to writing a credit reference letter, utilizing templates can offer several benefits.

What is a Credit Reference Letter?

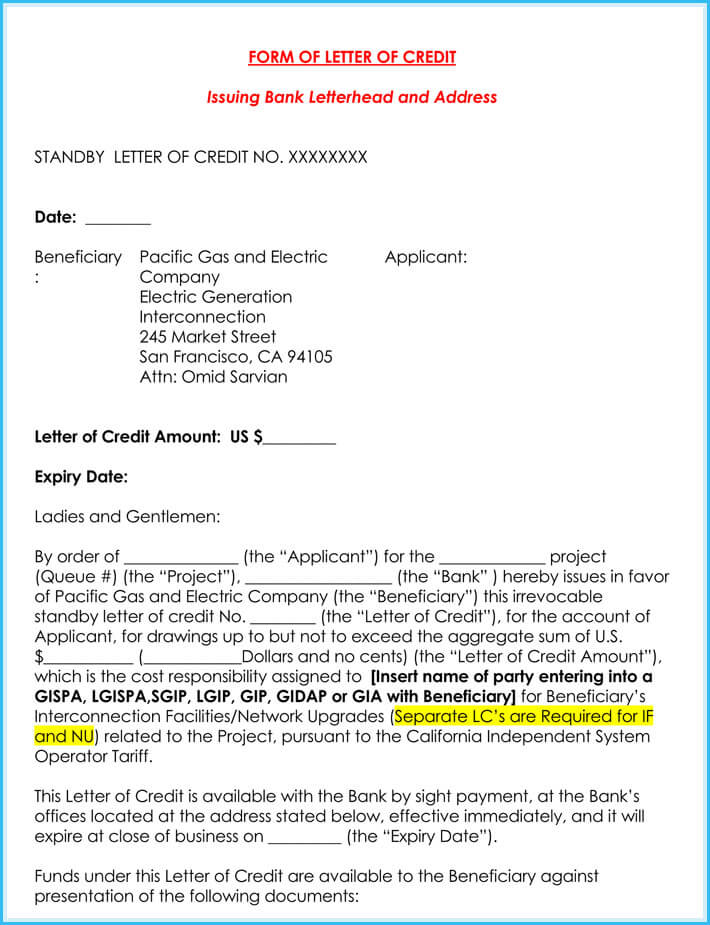

A credit reference letter is a document that verifies the creditworthiness of a potential borrower. It is a letter from a bank or any other financial organization with whom an individual or company has banked for a period that proves that the individual or company has a good credit record.

It is used to assure the third party that the individual or company ensures timely payment of financial obligations and that he/she should be trusted. The terms stipulated in the reference letter must be accepted and agreed to by the individual or company that has requested it.

When and Where a Credit Reference Letter is Required

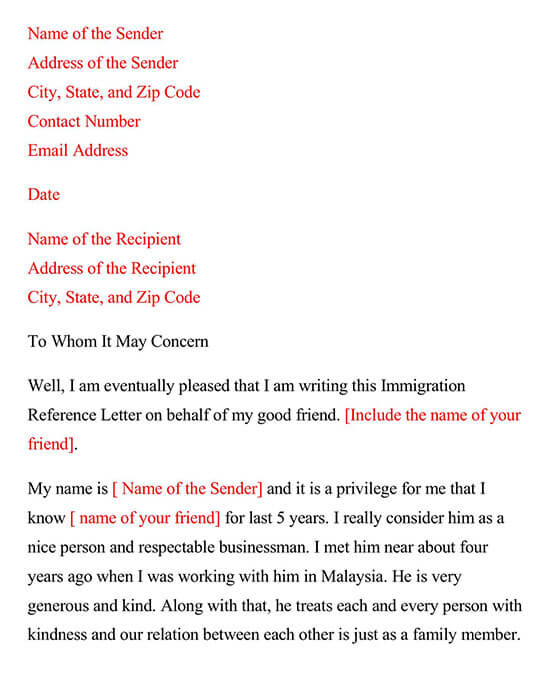

A credit reference letter is required when one is starting a business in a foreign country, he/she may request reference letters from banks with whom he/she has worked in the past to prove his/her creditworthiness. This helps build trust and confidence that the borrowed finances have a high chance of being repaid and on a good time.

The letter is also required when borrowing money from an individual, bank, or any other financial institution or investing company. It is also a requirement when you are new with a supplying company as failure to print one will require you to pay upfront cash for every single transaction.

Use our free Credit Reference Letter Samples and clear guide to have a clear illustration on how to write a reference letter that is appealing to your client.

What to Include

There are essential items that you must include in the letter; they include:

- Length/duration of the relationship: How long have you been their customer?

- Payment history: Do you often pay on time? Are you currently behind on your payments? Have you had any late payments during the last 12 months?

- Type of service: what products and/or services do you often buy from the reference provider?

- Terms of Credit: Does the agreement require that you make the payment within 30 days, for instance?

- Address of Service: Especially for utilities, the type of service and the address are important. Multiple addresses are not usually an issue, especially if you move several times while using the same provider.

- Total payment amounts: what’s the total amount you have paid over the duration of your relationship? This information helps the requesters gauge the size of your relationship.

- Late payments: Have you had any late payments in the past? If so, how many times?

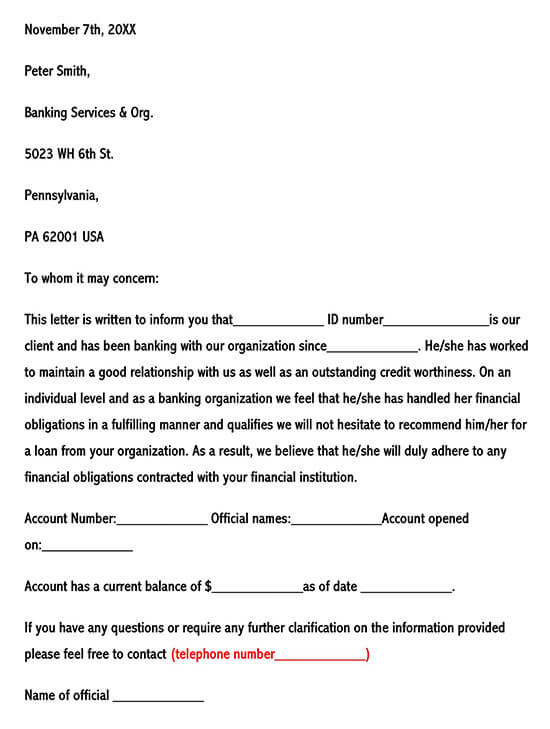

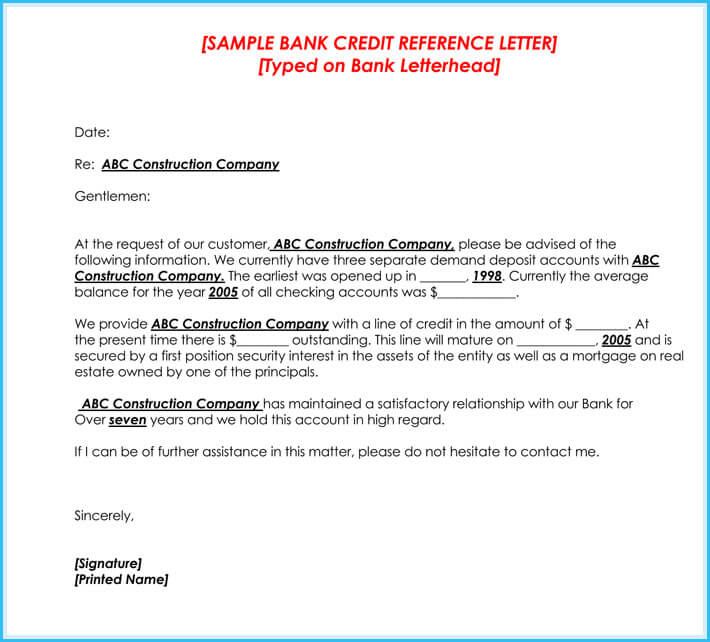

Credit Reference Letter Template

November 7th, 2017

Peter Smith,

Banking Services & Org.

5023 WH 6th St.

Pennsylvania,

PA 62001 USA

To whom it may concern:

This letter is written to inform you that____________ ID number______________is our client and has been banking with our organization since____________. He/she has worked to maintain a good relationship with us as well as outstanding creditworthiness. On an individual level and as a banking organization we feel that he/she has handled her financial obligations in a fulfilling manner and qualifies we will not hesitate to recommend him/her for a loan from your organization. As a result, we believe that he/she will duly adhere to any financial obligations contracted with your financial institution.

Account Number:____________ Official names:____________Account opened on:____________

Account has a current balance of $____________as of date ____________.

If you have any questions or require any further clarification on the information provided, please feel free to contact (telephone number____________)

Name of official ____________

Title of official ____________

Telephone or email____________

It is important to note that this letter must be written on the original bank’s letterhead and should be signed by the proper bank officials. If the language is in another language, it should be translated into English.

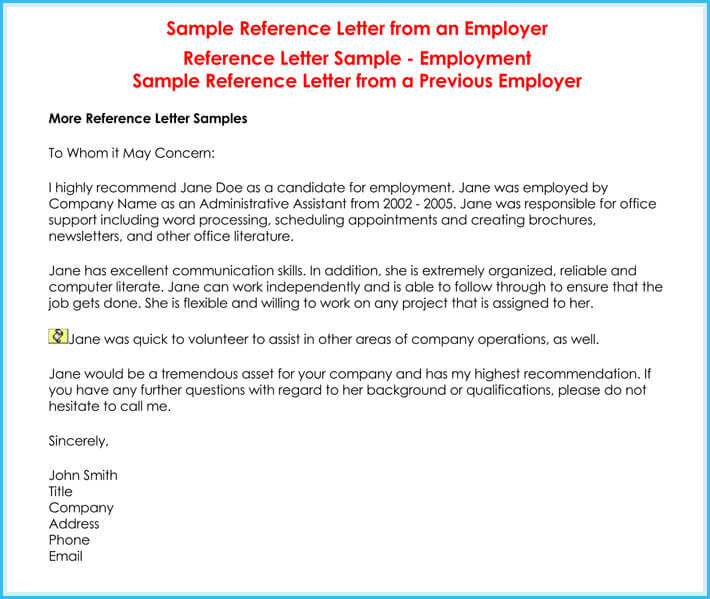

Sample Letter

This section includes a formal sample credit reference letter, thoughtfully composed to serve as a practical reference for those engaged in providing credit-related recommendations.

Sample

Dear Ms. Elizabeth Green,

I am writing to provide a credit reference for Mr. John A. Doe, who has applied for a personal loan through your esteemed institution, Green Financial Services. I have had the pleasure of knowing Mr. Doe in my professional capacity as the Senior Account Manager at Apex Bank Corporation for over seven years. During this period, Mr. Doe has demonstrated exceptional financial responsibility and integrity in managing his accounts and financial commitments.

In his dealings with Apex Bank Corporation, Mr. Doe maintains a premium savings account and a platinum credit card. His financial records with us are exemplary, characterized by consistent on-time payments and a commendable credit utilization rate. In the past seven years, there have been no instances of overdrafts, late payments, or any irregular activities in his accounts. His diligent financial management is further highlighted by his proactive approach to savings, maintaining an average balance well above our premium account requirements.

Based on our longstanding banking relationship, I can confidently vouch for Mr. John A. Doe’s credibility and trustworthiness in financial matters. He has consistently shown a high level of fiscal discipline and a clear understanding of his financial obligations. His excellent track record with Apex Bank Corporation reflects his ability to manage and fulfill financial commitments responsibly. Therefore, I wholeheartedly recommend Mr. Doe for the personal loan he seeks from Green Financial Services.

Yours sincerely,

Henry S. Clarkson

Senior Account Manager

Apex Bank Corporation

123 Finance Street, Business City, BC 45678

Phone: (123) 456-7890

Email: h.clarkson@apexbank.com

Analysis

The provided sample credit reference letter serves as an excellent guide for individuals seeking to compose similar letters due to its clear structure, formal tone, and inclusion of essential elements that lend credibility and effectiveness to its purpose.

Firstly, the letter follows a clear and professional structure, which is crucial in formal communication. It opens with a direct address to the recipient, establishing a personalized connection. This is followed by an introduction stating the purpose of the letter – providing a credit reference for an individual. Such clarity in communication ensures the intent of the letter is immediately clear to the recipient.

Secondly, the body of the letter is well-organized and informative, which is key in a reference letter. It details the duration and nature of the relationship between the writer and the individual in question, thereby establishing the writer’s authority to comment on the individual’s financial behavior. This detail is important as it gives weight to the writer’s observations and recommendations. Furthermore, specific examples of the individual’s financial behavior, such as consistent on-time payments and maintaining a healthy account balance, are highlighted. These concrete examples provide a clear picture of the individual’s financial responsibility, making the letter both credible and persuasive.

Finally, the letter concludes with a strong endorsement of the individual’s financial trustworthiness and a personal recommendation. This not only reinforces the positive assessment provided in the body of the letter but also adds a human touch to the endorsement, making it more impactful. The writer’s signature, position, and contact information are included at the end, which is essential for verification purposes and adds a level of professionalism.

Overall, the letter serves as a useful example due to its clear structure, detailed and specific content, and formal yet personalized tone. It successfully balances providing factual information with a personal endorsement, making it a useful guide for anyone looking to write an effective credit reference letter.

Main Elements to Cover in Credit Reference Letter

- The legal name of the business and its owner’s name.

- Date and length of time the business has been in operation.

- Bank name and account number.

- Borrowed finance repayment history

- Bank contacts, email, and phone number.

- Business address and contacts.

- Billing address.

- A declaration that the information provided is correct and true.

- Authorization to free contact references to confirm that the information provided is correct.

Who Can Write You a Reference Letter?

The person or organization to issue you with a reference letter is normally determined by the lender or service provider. You may, however, need to use the same type of reference:

for instance

An electricity company may need you to provide them with a letter from your previous electricity provider.

Some of the most common sources of use include:

- Utilities like sewer, gas, electricity, and trash

- Lenders (home loans, auto loans, and more)

- Communication service providers such as the internet, phone, cable, and satellite

- Suppliers to your business

- Gyms and other monthly subscriptions

- Leasing companies and landlords

The letter normally sticks to the requested information without any additional commentary. Do not expect the letter writers to give you positive reviews, like,

for instance

Saying that you’re a great person and that you’ve been a valuable partner.

Most people offering reference letters are normally hesitant to say more than they need to. If, for instance, they say that “you can’t go wrong” by extending credit, they risk misleading somebody- with potential consequences. If you are writing a letter for somebody, make sure that you provide accurate information and avoid statements and any predictions that you can’t back up with facts.