A last will and testament is an estate planning tool that allows a person to specify how their estate will be distributed to their beneficiaries after death.

An executor is designated in a will as the person in charge of seeing that the terms of the will are carried out. An executor is a personal representative who carries out the instructions of the testator or testatrix, also known as the will’s author. A will must also be dated and signed by the person drafting it.

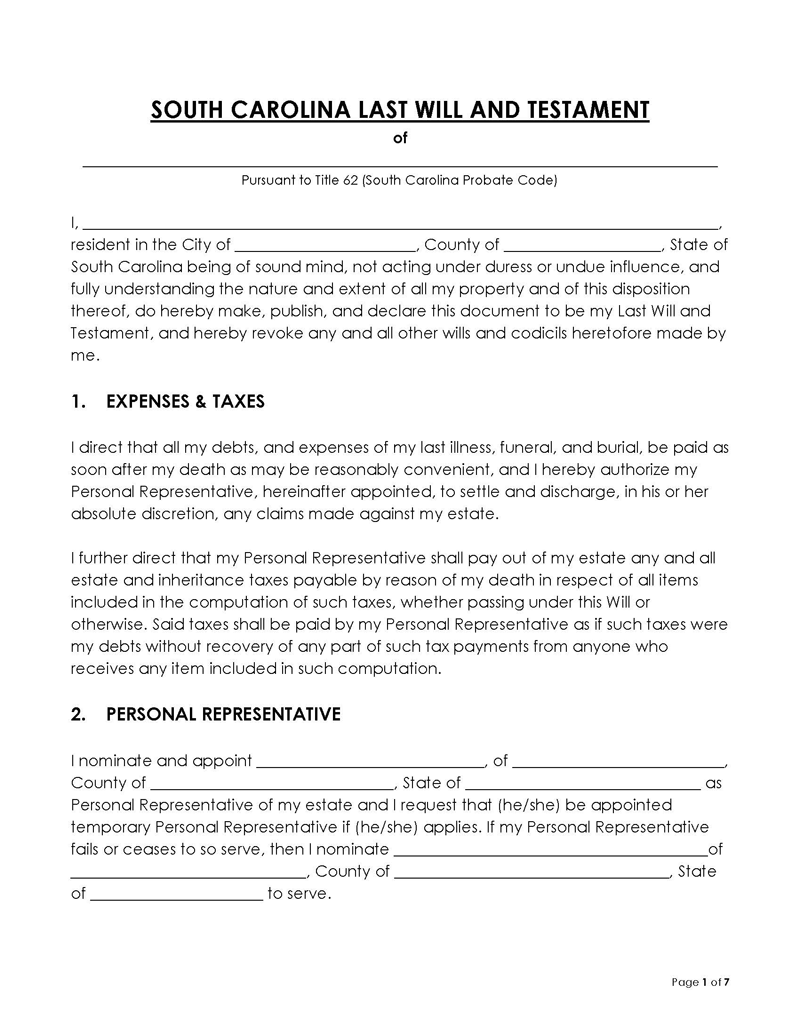

In South Carolina, as in every other state, a person’s last will and testament is needed to properly settle their affairs. Without a proper document detailing your wishes, the heirs or executors of your estate must rely largely on the state’s intestacy laws. In South Carolina, the last will is a legal document and can only be invalidated through the court under concrete evidence.

A will is a written document that outlines how you want your property to be divided and distributed after your death. Along with a comprehensive list of all the properties, it also specifies the terms and conditions under which the property will be distributed, including details on the kinds of assets that can be passed to a spouse, children, or other relatives.

When making this will, it is important to keep in mind certain requirements set forth by the state. For example, a will must be dated, signed, and witnessed in order to be valid – two or more people can witness your will. This article will offer information about how to create a legally binding South Carolina testament and last will.

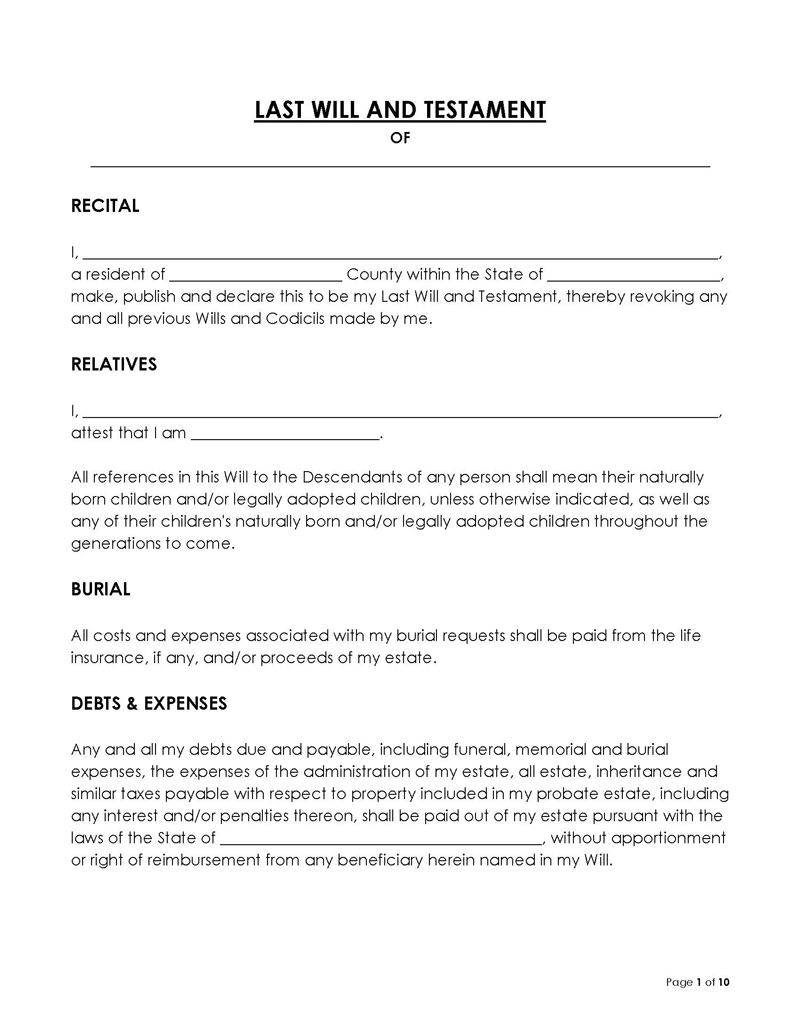

Free Templates/Forms

Why Do You Need a Will in South Carolina

It is confronting to think about death, but an estate plan can be an important document to have to plan for the distribution of assets in the event of death. In South Carolina, this will is used to legally outline how your estate should be handled after death, ensuring that your wishes on who should receive what property or other assets are protected. Without legal protection, your possessions will be distributed as dictated by intestate succession laws. Intestate succession laws may not always align with your wishes, distributing your estate to people you did not intend.

Through a last will, you can name an estate executor. A will’s executor ensures that the terms of your instructions are carried out exactly after your passing.

In South Carolina, the last will also allows you to name a guardian for your children (if they are under the age of majority). It can therefore be a vital document for new parents and parents with children under the age of 18. A trust can be established in the will for any pet to ensure that their expenses are covered after the testator’s death.

Last wills and testaments allow testators to name anyone they want as a beneficiary. This means you can name individuals as well as organizations in your will. With a valid las will in place, the probate process of any estate is simplified, reducing frustrations and expenses for the inheritors.

What Happens When You Do Not have a Will

Without a last will, South Carolina intestate succession laws will determine the distribution of property upon death. According to the laws governing intestate succession, your heirs are automatically entitled to all of your assets. Property under intestate is distributed in the following order: your spouse or domestic partner is first in line, followed by children. If there is no living domestic partner or spouse, the property is equally divided among all children. If there is no surviving spouse or children, the property will be passed down to the parents.

If there are no surviving parents, then their descendants inherit the property. If no such heirs exist, then your property is passed onto the state. Also, the court appoints a guardian for any minors left behind (if any). This can lead to a very complex and confusing situation for the family members.A testament and last will provide the opportunity to distribute the property in an organized manner and according to one’s wishes. You get to dictate the shares each beneficiary receives and the order of priority in the will. Giving the assets to a trust for the benefit of your heirs is possible with a last will. Additionally, last wills can be used to plan for the death of the second account holder in joint tenancy ownership.

Writing a Will in South Carolina: A Step-by-Step Detailed Guide

Before writing this will, one should make an inventory of all the assets and properties that one owns. Once you have determined that you need this will in South Carolina, the process is relatively straightforward.

So here are some simple steps on how to get started creating your own will:

Step 1: Determine eligibility as a testator

The very first step is to determine whether you meet all the requirements to be in South Carolina. Under South Carolina law, a person is eligible to write such will if they are of legal age (which is at least 18 years old) and have a sound mind – S.C. Code Ann. § 62-2-501. A minor is not permitted to write his/her own will in South Carolina.

Step 2: Identify the assets or property to dispose

The next step in making a last will involves making a list of your property and assets. This includes all the cash and other properties you own, including electronic devices (computers, cellular phones, tablets, etc.), furniture and appliances, clothing, jewellery, plates, and other household items. This list should also include vehicles you own and any real estate properties (houses, apartments, etc.). Other assets not mentioned may also need to be included in your will. You can ensure that the list contains all pertinent assets and property you own by hiring an experienced attorney.

Step 3: List the beneficiaries

Then, you should list the beneficiaries of your will. It is a good idea to list people and organizations you wish to receive your possessions. This can be done in a specific order of priority. For example, listing your spouse as the first beneficiary and then following it up with the share you would like your children to inherit.

Step 4: Appoint an executor

You should also appoint an executor to ensure the will is carried out and completed in accordance with your wishes. This is the person you designated to carry out your last will and testament in South Carolina. To appoint an executor, you must include the information about your executor in the will itself. This can be done by writing down the person’s name, address, and phone number in the body of the document.

Step 5: Appoint a guardian for minor(s) (if any)

If you have children under the age of majority, you need to appoint a guardian for them. This can be done in the will itself or in a separate document. Under South Carolina law, the guardian is responsible for all decisions made pertaining to the minor’s welfare and education and for managing any property you leave behind for the benefit of the minor.

Step 7: Write the will

The next step is to write the legal document itself. Make a careful and detailed will that includes your instructions and any additional information you want to include. It is recommended that you have several legal experts review the document to make sure it is appropriately worded. Ask them if anything seems off or unclear. The last will must satisfy the definition provided under state laws – (Section 62-1-201(53)).

Any codicil or testamentary instrument that appoints an executor or revokes or revises an existing will is included in the definition of a will. The last will can be printed on plain paper and signed, or it can be handwritten for a more personalised effect. However, under S.C. Code Ann. § 62-2-505, South Carolina permits valid last wills created in accordance with other states’ requirements and therefore can accept digital wills from other states. In South Carolina, last wills and testaments must be in hard copy, not electronic (audio, video, or other digital file formats).

Step 6: Signing the document and notarize it (optional)

Lastly, your will must be signed by you to be considered valid under (Title 62 (South Carolina Probate Code).) You should sign your last will in the presence of two or more witnesses and have both witnesses also sign at the same time – (Section 62-2-502). The witnesses should initial every page of the will, though it is not mandatory. It is advisable to use “disinterested” parties as witnesses, as “interested” witnesses risk losing their gift under the will (S.C. Code Ann. § 62-2-504).

Witnesses must also be willing to testify on your behalf regarding their ability to recall and comprehend everything said during the procedure. In this way, you can be confident that the contents of your will accurately reflect your wishes and intentions, even if the will is ever contested in court.

You can notarize a last will and testament in South Carolina, even though it is not a legal requirement. This is considered “self-proving” the will. A self-proved will expedite the probate process and reduce the likelihood that the last will, will be challenged. You should notarize the will according to S.C. Code Ann. § 62-2-503 guidelines – that is, visit a notary public with your witnesses and sign an affidavit that declares each signatory was aware of the contents and provisions of the will.

How to Revoke or Change a Will

There are a number of ways to revoke or change a last will in South Carolina. The first way is to revoke an existing last will by writing an entirely new one. The second method is by adding a codicil – which is legal terminology for an addition or amendment to a will. The codicil may be written in addition to the existing last will or as a separate document within the body of the will. Codicils are recommended when making minor changes only. Major changes call for the complete revocation of the last will. Alternatively, you can physically destroy the will by burning, tearing, obliterating, or canceling the will and creating a new one that lists the revised wishes and intentions. You can also appoint someone to destroy the will in your presence. Any revocations should be done appropriately in accordance with state laws.

South Carolina laws (S.C. Code Ann. § 62-2-504) state that your old will automatically gets revoked if a new will distributes property in an existing will. The law assumes you intended to supplement the existing will if the new will distributes a portion of the estate described in the old will. Executors should follow these guidelines, and in cases of ambiguities in directives, they ought to follow the new will.

S.C. Code Ann. § 62-2-507 states that if a testator divorces a spouse or has their marriage annulled, then the laws of South Carolina consequentially revoke any provision in the last will that awards the spouse right to the property under the contract of marriage. However, this law is not applicable if the testator remarries the spouse or includes provisions in the will, divorce judgment, or any property division agreement that specifically state that the last will should not be affected by the divorce.

Final Thoughts

A last will and testament is a legal contract. You should always view it as a crucial document with very real implications for your beneficiaries, family, and estate. The information presented above can assist in the preparation of a last will in ensuring that all affairs are in order in the event of the testator’s death.

If you wish to give away property in your lifetime, refrain from executing a will, as this would defeat the objective of having one in the first place. Having a last will ,will also help the executor fulfill his or her duties and obligations. Remember that a legally valid will must be witnessed and properly signed.