The last will and testament expresses a person’s (also known as a testator’s) final wishes for how their property and estate should be divided after their passing. The document is a legal document to specify how property will be distributed after the death of the testator.

It is a powerful testamentary tool in Florida law because it dictates how one’s possessions, assets, and estate will be distributed in the event of their death. In this testament and last will, an individual can choose to distribute assets amongst close relatives or, if in a more flexible environment, give some or all of his or her assets to a charity. It can also dictate many other practical details that govern distribution, such as who is responsible for funeral expenses, etc.

In Florida, a last will is valid once it has been signed, witnessed, and notarized by an official representative. It must be recorded with the probate court within ten days after the death. The term “last will and testament” may also refer to a clause in a will (or “codicil”) that revokes all prior wills made by that individual. Such a clause enables previous bequests to be effectively revoked as it is not uncommon for wealthy individuals to make multiple wills as circumstances and family dynamics change. This article educates people about instructions.

Free Template

Do You Require a Last Will and Testament in Florida?

It is necessary because it specifies your final wishes for how you want all of your assets to be distributed after you pass away. Assets include real estate, vehicles, personal belongings, bank accounts, benefits, etc. In such a document, you can clearly state what you want to happen to each asset, and in what manner, by specifying who will be entitled to inherit any particular asset or potentially receive other assets that have not yet been distributed.

A last will and testament also allow you, as the testator, to appoint trusted individuals to execute your directives. These individuals are referred to as executors. It also allows you to create long-term trusts for property left behind for minors. In such a case, you can appoint guardianship for the child(ren). You can create a trust for the care of any pets left behind upon your death as well. The pet’s expenses can be paid through the trust.

What happens when there is no will? The decedent’s assets will be distributed under Florida’s intestacy laws if there is no testament. This means that the decedent’s property goes to his or her closest relative. In most cases, a person’s assets are distributed equally to that person’s spouse and children. In the absence of a spouse and children, the property goes to the next available next of kin, whether it is parents, grandchildren, siblings, grandparents, aunts, uncles, or cousins, and in that order. According to intestacy law, the estate belongs to the state if no one is qualified to inherit it.

Associated Laws

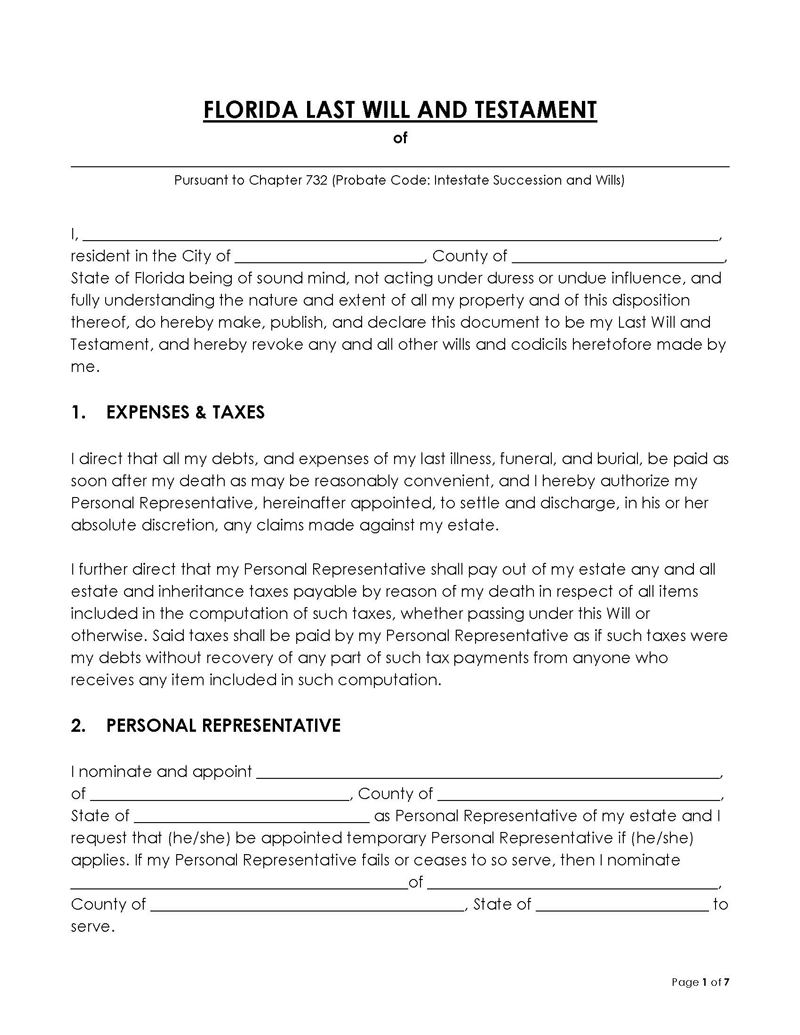

Various laws govern the establishment of wills. Common laws that govern a last will and testament can be found in Florida Statutes, Title XLII, Estates, and Trusts. Chapter 732, Probate Code, Intestate Succession, and Wills.

Key laws to look out for are:

- § 731.2: This law governs the definition of a legally valid last will and testament. The term “Will” is defined as “an instrument, inclusive of codicils, executed by an individual in the manner prescribed by this code, which disposes of the individual’s property on or after their demise and includes an instrument that merely appoints a personal representative or revises or revokes another will.

- § 732.502: The will has to be signed by the testator in the presence of two witnesses. The two (2) witnesses must also sign the document in the testator’s presence.

Basic Requirements

Making a testament is a significant act that requires careful planning and preparation. The fact that it was drafted by the testator poses certain risks. For example, suppose someone is a poor writer and drafts a poorly worded will. In that case, many potential problems may arise in the future when inheritance disputes become complicated for a variety of reasons.

Therefore, when making a last will, the following basic requirements should be considered:

Restrictions on property distribution

The state of Florida has restrictions as to the types of assets that can be distributed through a last will and testament. Property owned jointly through joint tenancy with a right of survivorship, for example, cannot be included because it automatically passes to the survivorship.

Also, typically, the surviving spouse should inherit the family homestead, and the remainder is distributed to the descendants. Lastly, spouses cannot disinherit each other. A spouse can claim “an elective share” in the will.

Executor and testator requirements

You, as the testator, must be eighteen years of age or older, a Florida resident, and in a sound mental state. You must be mentally capable of comprehending the practical implications of the testament, the nature and extent of the estate being distributed, and their relationship with the beneficiaries. You must also be the sole owner of the property with no shared interests. A person who is not legally competent to sign a contract cannot sign a will in Florida.

An executor is a person in charge of carrying out your will by distributing your assets according to your final wishes. The executor is chosen by the testator. The executor should be 18 years or older, and they must have the mental capacity to carry out the duties assigned to them. If you do not name an executor, the court will appoint one after the will is filed. Additionally, they ought not to have a criminal record, be residents of Florida, and be related to you by marriage, blood, or adoption if non-residents.

Signing requirements

The will must be signed in accordance with (§ 732.502). They need not be family members but can have a professional relationship with you. Therefore, it is best to have the witnesses be “disinterested” parties – meaning they are not entitled to any portion of the estate. Witnesses must attest that you signed freely and voluntarily, without coercion or persuasion. Signatories to a Florida will are in each other’s presence. In Florida, electronic wills are permitted, and thus the document can be signed remotely.

The will can also be notarized to make it self-proving; however, it is not mandatory. A self-proved last will does not require witnesses’ testimony, thus simplifying the probate process. However, you and the witnesses must sign a self-proving affidavit, which must be notarized.

Writing

In Florida, the last will should be in writing. It can also be handwritten or oral, provided it is witnessed. The document must include your proper identification, such as your name, address, age, and occupation. In Florida, digital or electronic wills are accepted; however, they must meet all applicable requirements to be valid.

How to Formally Revoke or Change a Will in Florida

The revocation process is triggered by different reasons, such as a change of mind or a change in family structure (divorce, the birth of a newborn, the death of a beneficiary, etc.). There are various ways to revoke a will in Florida, including burning, scattering, and intentionally cancelling the will. You can also revoke the will by executing a new will or codicil and following the necessary formalities.

The simplest way to incorporate changes in the will is by revoking it and creating a new one. Codicils are used for minor changes. When a marriage is annulled or divorced, Florida law nullifies any provision in the last will and testament that names the spouse as a beneficiary. This stipulation is applicable only if the will does not explicitly state that changes in the marital structure should not affect provisions of the will – Fla. Stat. Ann. § 732.507.

Florida’s Laws of Intestacy and Probate

If you, as the testator, do not provide an executor, the court can assign one from a list of potential candidates. The first step is to file the will with the court, which must be done within 10 days after death. The court validates the will. The judge examines whether it complies with all legal requirements, including signatures, witnesses, and notary endorsement (if there were any). The next step is for your assets to be gathered together and appraised. Any debts or other obligations must be paid in full before any assets are distributed to beneficiaries.

When there is no will, the distribution of assets becomes much more difficult because it depends on intestacy laws. If there is no will, intestate succession applies, and then it will indicate the inheritance. All assets are gathered together and then taken to a probate court, where an individual or entity is appointed to carry out the estate’s legal responsibilities.

The beneficiaries under intestate laws are as follows; the spouse and descendants get each half of the estate; if there is no spouse, the property goes to the children, and if there are no children, then the parents inherit the estate. If there are no parents, the siblings follow, then the extended family, and so forth. If there are no surviving relatives, the estate goes to the state of Florida.

Florida is not a community property state – meaning any property acquired during the marriage is not considered to belong to both spouses equally. Florida follows the principle of equitable distribution, meaning property earned during marriage goes to the person who earned it. However, even if they were not mentioned in the will, spouses are still entitled to the property under elective share, which typically grants the spouse 30% of the property.

Frequently Asked Questions

No, Florida does not have the jurisdiction to tax someone’s assets after they die or inherit them through a last will and testament. However, it is important to consult federal tax laws as they may be applicable. For example, property worth $12.06 (unmarried) and $24.12 million (married couples) is taxable. The government does not levy an inheritance tax.

No, you do not need a lawyer to make your testament. However, you need to get the legal assistance of a lawyer when it comes to the probate of your will in Florida. The lawyer must ensure that the will is valid and legal. They also help with drawing up the document and reviewing all documents related to the estate.

Yes, Florida recognizes digital and electronic wills. However, the guidelines regarding electronic wills are a bit complex as the concept is still novel. It is thus advisable to make the will conventionally.