The last will and testament is an estate planning document that specifies who will receive a decedent’s property upon death in Arizona. The person who makes the last will is known as the testator, and he or she is free to distribute their property to any relative or nonprofit organization of their choice. According to Arizona law, the last will must be written and signed in the presence of two witnesses.

The last will is essential for any estate plan. This document aids in streamlining and minimizing the cost of asset distribution after death. The person who makes a will must know his or her financial status and assets, and it is also important to organize these assets in an orderly fashion.

A person can guarantee that their assets are distributed according to their wishes after passing away by creating a will. In a last will or testament, beneficiaries frequently include spouses, children, parents, siblings, grandparents, etc., but a testator is also permitted to name third parties, such as trusts or charitable organizations. The last will includes both real and personal property. The will can also be used to name a guardian for your children or designate someone to manage any assets left behind for minors. If you do not have a last will, the state will determine who should inherit your assets and become the guardian of your children.

The significance and fundamental requirements of a valid last will in the State of Arizona are discussed in this article.

Free Template/Form

It is critical to use templates when creating a will and to plan ahead of time. A template helps to make sure that you do not miss out on any important information when making your will. This saves time and effort in creating a last will. The advantage of using a template is that it will allow you to make sure that your will is valid.

Significance of Using a Will in Arizona

The main benefit of having a will is that it gives the testator control over who will receive his or her property upon death and how much should be given to each beneficiary. A will allows an individual to say who they want to be the guardian of their children and what kind of upbringing they would like them to have. Last wills also give testators the option of designating a dependable executor to carry out their instructions. You can ensure that your pets are cared for even after you pass away in Arizona by setting up a trust for any pets you leave behind.

In Arizona, when someone passes away with a will, it significantly lessens family arguments over inheritance matters. It also helps avoid the lengthy probate process of intestacy, which can drag on for a long time and cost your heirs money. Additionally, you can avoid having your estate divided under intestacy laws that might not be in line with your preferences. Intestacy laws give priority to the surviving spouse and children, then parents, grandchildren, and siblings, with a progression toward more distant relatives. If there is no surviving relative, the state of Arizona repossesses the estate.

Do I Require Legal Counsel to Draft a Will in Arizona?

It is not essential to have an attorney when making a will. However, if you are unsure of what the content should be, are not familiar with the probate process in Arizona, or are dealing with a unique case such as a child with special needs, it would be best to obtain legal counsel to ensure that all your wishes are fulfilled. Furthermore, a will is one of the most essential documents in your estate plan, and having a professional draft is beneficial.

Conditions Required for an Arizona Will

Creating, signing, and executing a will in Arizona is relatively easy. However, before you begin writing this necessary legal document, it is critical to consider the following basic requirements:

Age and capacity of the testator

The testator must be over the age of 18. When making a will, testators should be of sound mind and not under the influence of drugs or alcohol, and they should sign it willingly to avoid any potential dispute over their decisions after death. Intoxication while drafting or executing the will can be grounds for invalidating that will.

Property distribution exceptions

Testators are not permitted to execute a will for property held in trust, property controlled by another person, property obtained through fraud or knowingly illegal acts, or property held in custody for the benefit of another.

EXAMPLE

Community property (inherited by the surviving spouse) and property under a joint tenancy (inherited by the surviving account holder). The surviving spouse or dependent descendants of the testator are also entitled to an $18,000 homestead allowance under Arizona law.

If there are multiple children, the allowance should be divided between them. Furthermore, the spouse OR children (if no surviving spouse) are entitled to $7,000 in personal property such as appliances, personal effects, automobiles, household furniture, and so on. This property goes entirely to the spouse or equally among the children. Furthermore, the surviving spouse’s spousal share is determined by the type of ownership (whether separate or community-owned) and the testator’s surviving family members.

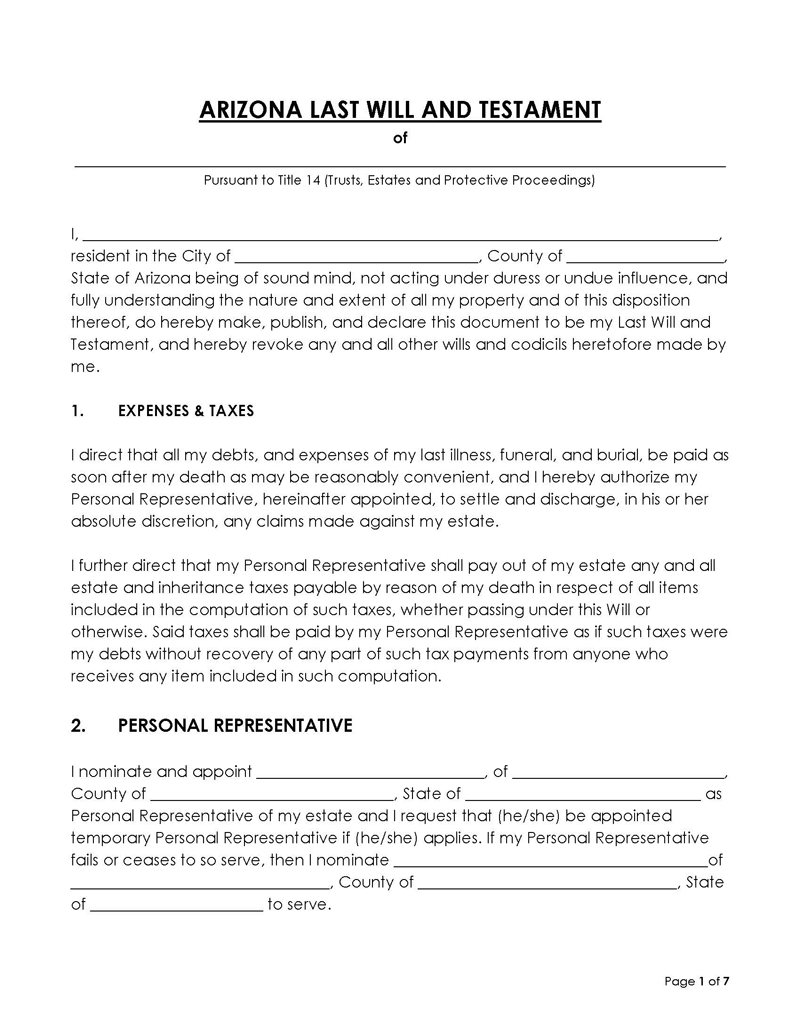

State laws

The laws of Arizona govern how the assets you leave behind are distributed after your death. These laws are provided in Title 14 – Trusts, Estates, and Protective Proceedings. (§ 14-1201(70) dictates that a legally valid will in Arizona has to conform to the definition of a “will” provided in the law. The laws state that the term “will” refers to all written text, codicil, and testamentary text that expressly appoints an executor, revokes or revises an existing will, appoints a guardian, or explicitly excludes or denies an individual or class from succeeding to the property of a descendent passing by intestacy. These rules are frequently updated, and any changes should be reviewed during the will-writing process to ensure compliance with state laws.

If you have an old will with null directives, you can destroy it and create a new one. However, to avoid this situation, always include a provision in the will that states that all prior wills are null and void.

Beneficiaries

The testator’s will should name the person or persons who will inherit his or her estate. A beneficiary can be established by naming them or by allocating assets to a group of beneficiaries. Testators can select anyone they wish as a beneficiary. The beneficiary of a will can be any individual or group. According to Arizona law, beneficiaries should be named who can be identified by the testator’s relationship with them. These assets are typically given to the surviving spouse of a married person; in the absence of a surviving spouse, they are given to the person’s heirs. The property can be sold, with the proceeds going to each beneficiary per their respective percentages, or it can be divided into specific portions and given to different beneficiaries, or it can be given away entirely.

Without a will, intestacy laws take precedence. They dictate that if there is a surviving spouse with whom the testator shared children, then the spouse should inherit the estate in its entirety. If there are descendants or children and no spouse, the entire estate should be distributed to them. The estate should, however, be shared if there is a surviving spouse and any children that are not shared with the spouse left behind.

Executor

In Arizona, the last will or testament can be used to appoint an executor of the estate. An executor is someone named by a person who has made a will and has been entrusted with carrying out their instructions after death. The executor is usually named in a specific part of the will (called an “executor’s clause”). An executor usually has three duties: appraise the estate, pay off debts and taxes, and distribute the property to its beneficiaries. An inventory of the assets may be created by the personal representative, who is in charge of examining the decedent’s possessions and determining their current market value. The court will be required to name an executor on behalf of the decedent if they have failed to do so.

Witnesses and signature

According to Arizona law ( 14-2502), the testator must sign the last will in the presence of two witnesses. Each witness must be present simultaneously, and both must sign in front of the testator. After this, it is best if each witness should also write his or her name on a separate line of the will after he or she has signed it. Each witness must sign at least once on each page of a will to prevent it from being challenged later on in court. Signing should be done within a reasonable timeframe after witnessing the document.

Furthermore, neither the witnesses nor the testator should be related to one another by blood, marriage, or adoption. Unless the last will is self-roved (notarized), they must also be disinterested parties (not beneficiaries of the will); however, it is still not advised. In Arizona, handwritten last wills do not have to be witnessed, but their contents must be in the testator’s handwriting. Ariz. Rev. Stat. Ann. § 14-2503.

Writing

A will has to be written in a language that is both clear and simple. The will should specify the terms of the disposition of assets and property. The will can be written in hard copy, digitally (an electronic will), or handwritten or holographically. Arizona accepts all of them.

Probate and registering the will

An executor of a will in Arizona may be required to file with a probate court. The executor must file this document within six months of the testator’s death, as specified in § 14-2602. Once the will is validated, it can be executed. The state of Arizona offers both a formal and informal approach to the probate process. The formal approach is typically meant for wills that are contested. However, both approaches do require the will to be validated in court.

A probate court determines the title and distribution of an estate (probate is the formal process by which the will is executed). Probate can last from six months to several years. Probates are expensive, take time, and require specialized legal knowledge. The probate process can be time-consuming and expensive, so planning is important. The will ought to be filed with the county in which the testator resided.

How a Will in Arizona Can Be Properly Revoked or Modified

Revocation of a will is generally easy in Arizona. When a new will is made and replaces the old one, the former one is revoked. Ariz. Rev. Stat. Ann. § 14-2507.

The procedure for revoking a last will in Arizona is as follows:

- You must create a new will.

- The new will must clearly state that it revokes all previous wills or testaments ever made earlier.

- The new will should be signed in front of the same witnesses as the old will.

It can also be revoked by burning, tearing up, canceling, or destroying the old.

The testator can also change the will by adding a codicil (an amendment) and following the state-mandated formalities. The best course of action, however, is to simply revoke the current will and draft a new one.

note

In the event of divorce, marriage annulment, or appointing a beneficiary or relative as a personal representative or executor, any gift they were to receive through the will is revoked. This is only if the last will in Arizona does not explicitly state otherwise. Ariz. Rev. Stat. Ann. § 14-2804.

Final Thoughts

A last will is an instrument that ensures that a person’s desires and wishes are carried out after death. Additionally, it safeguards their assets in the event of an accident or significant change in the circumstances. A will is created to make sure the distribution of assets is done in a manner that is preferred by the individual.

These wills are crucial in the context of inheritance because, in the absence of a will, state law (intestacy) determines who receives the property of the deceased based on their relative relationships in proportion. The act of creating a will is essential for all residents of Arizona. A knowledgeable attorney can assist you with the creation process, ensure that your wishes are carried out, and help you avoid going through judicial probate.