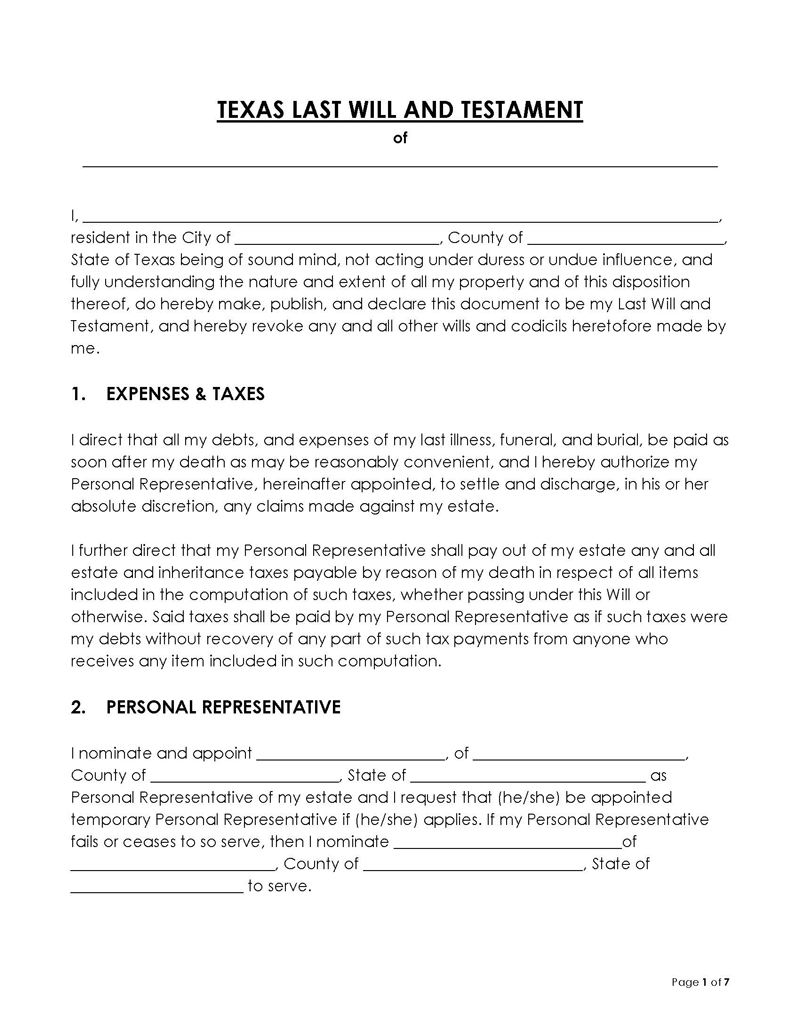

In Texas, a last will and testament is a legal document that expresses the testator’s (the will’s owner) wishes for how their assets will be distributed in the event of their passing. It is used to transfer the deceased’s possessions to the beneficiaries; it includes all of the deceased’s assets, such as land, finances, and insurance policies. Beneficiaries of the last wills may include spouses, children, relatives, charities, pets, and any other parties named in accordance with their last wishes.

Each state has its own set of laws governing last wills and testaments. For example, the State of Texas requires the testator to sign the will in the presence of two witnesses, aged 14 or older. These witnesses also have to append their signature as a testament to their presence at the time of execution of the will.

An official document is kept with the testator’s lawyer or a family member they can trust, and it can only be read in front of the lawyer and family members. Last wills and testaments can be amended as long as the testator is not under threat or compulsion to do so.

Free Forms

Importance of Last Will & Testament

A legal last will and testament helps put your final wishes in perspective. The state of Texas makes no requirements for the creation of a will. Without a will, family disputes may arise that would require years of legal proceedings to resolve. Therefore, documenting a will is one of the most vital things you can do for yourself and your family. Having a will protects your spouse and children legally and demonstrates how you want things to be handled after your demise.

Other advantages of having a legal Texas are as follows:

- You can appoint an executor to carry out everything you have written.

- You decide who will look after your minor children.

- Create a pet trust for your pets.

- You can decide to leave your property to organizations.

Associated Laws

The fundamental requirements of the laws relating to wills can be found in Texas Statutes: Estates Code, Title 2, Chapter 251, Fundamental Requirements and Provisions Relating to Wills. The definition of “will” in Texas law, as stated in Tex. Est. Code § 251.002 makes your will effective to dispose of any of your legally owned property at the time of your death. The law also allows your will to disinherit an heir.

According to Tex. Est. Code § 251.052, handwritten wills are not considered valid. Wills in digital formats, such as audio or video, are also not valid in Texas. A legally valid last will and testament is typed and printed on a computer or typewriter. Also, the witness law of the Texas State Last Will and Testament provided in Section 251.051 requires two witnesses, age 14 or older, to be present at the signing of the will.

Basic Requirements

The courts of Texas will rule you fit for executing a last will if you meet the basic requirements of the law, which require you to meet the following conditions:

- You must be 18 years of age or older, except people already married and those who serve in the military, as stated in Tex. Est. Code § 251.001.

- You must be of sound mind to understand certain decisions.

- You understand what is a last will and testament and the effects of creating one.

- You understand the nature and extent of your assets and possessions.

- You can make decisions regarding your will and testament.

You must create your last will voluntarily, without coercion from anyone or anyone in a position of power over you.

Texas Will Executor Requirements

An executor is someone appointed to administer the will and testament of a deceased person. The executor’s primary objective is to carry out all the instructions written in the will. Depending on whether the testator is named an executor or not, the executor may also be chosen by the court.

A person must meet the following criteria to be approved as an executor in a Texas court:

- They must be at least 18 years old.

- They must be able to carry out the duties of an executor effectively.

- No records of conviction or felony attached to them.

- The court must have deemed them ‘suitable’ to be an executor.

It is recommended to choose an executor who is close to you and a resident of Texas. If you select an executor from outside Texas, the executor must name a resident agent (someone who resides in Texas and accepts legal documents on your behalf) and obtain the court’s permission before appointing the resident agent.

Signing Requirements

Section 251.051 of the Texas Estates Code considers a last will and testament valid if the testator signs it in the presence of at least two credible witnesses, who will also sign it to verify its authenticity. The Texas Estates Code requires both witnesses to be at least 14 years old. A witness is said to be credible if they are not a beneficiary of your last will.

Is it Necessary to have my Last Will and Testament Notarized?

No, your last will and testament are still valid if it is not notarized. Although Texas’s law allows you to make a “self-proving” will (a will that allows you to make certain adjustments to prove its validity without presenting it in probate court), you will be required to go to a notary to do that.

According to Section 251.104 of the Texas Estate Code, making a self-proving last will and testament requires you and your witnesses to go to the notary to sign an affidavit that proves your identity and that you are mentally sound to sign the will. Furthermore, Section 251.103 of the Texas Estate Code allows you to make these changes at any time during your (as the testator) and your witnesses’ lifetimes.

It must also be presented in written form and documented on paper. It could be written by hand or typed on a computer. The document is deemed invalid if it is presented in any other format, including a digital one.

Are Holographic Wills Legally Accepted in Texas?

Holographic wills, or handwritten wills, are legal in the State of Texas (Tex. Est. Code § 251.107). A holographic will must be entirely written in your handwriting and signed by you in order to be accepted. A holographic will does not require witnesses to prove its validity. However, if you feel the validity of your last will and testament could be threatened, having witnesses sign it is always a good option.

Estate attorneys typically do not advise creating a holographic will because it may be difficult to prove its validity in court and is prone to errors.

Can I make my Last Will and Testament Digital or Electronic?

A few states have legalized “digital wills,” which are wills that are documented and signed digitally and never available in paper format. Other states across the country are considering making electronic wills legal in the future. The wills made in accordance with the laws of other states are recognized by Section 251.053 of the Texas Estate Code.

How to Revoke or Change a Will in Texas

Revocability of a will in Texas is based on the jurisdiction of the legal document that binds it. You are free to nullify or change your will during your lifetime as long as you have not committed to a contract, such as a joint will, that forbids you from making any changes.

You can revoke your will in the following ways:

- Intentionally destroying it by shredding, burning, tearing, or disposing of it.

- Have someone destroy it in your presence.

- Create a new will under Tex. Est. Code § 253.002. It is important that you clearly state the purpose of this will, which is to nullify your previous will and deem every item therein invalid.

The law of Texas nullifies any provisions of your last will and testament that name your spouse or a relative of theirs who is not a close relative as a beneficiary or executor if you divorce or the court finds that your marriage is invalid. The exception to this rule is if you state specifically in writing that your will should not be affected even after divorce (Tex. Est. Code § 123.001.)

Creating a new will that revokes the older one is always a good option, but if you have very few changes to make to the will, you could sign a codicil, which is used to make provisions for change in the original will.

The Intestacy and Probate Laws of Texas

An individual who dies without leaving a will leaves the State of Texas no choice but to enact the intestacy law. This puts the Texas probate court in charge of how your assets are distributed to your survivors, which may include your spouse and minor children.

In Texas, if you die without a will, below is an order of succession on how your property will be distributed in accordance with the Texas Estates Code:

- If you are married but have no children, siblings, or parents, your spouse automatically inherits your estate.

- If you have children but are not married, your children will inherit your property equally among them. Texas law defines your children as your descendants by blood or adoption. Any other form of parenting between you and a child contrary to these (such as step-children or foster children) is not legally accepted to be called “Child(ren)” and is not entitled to your property.

- If you are married with children belonging to you and your spouse then your spouse inherits all community property and 33% of your personal property and your children inherit the remaining property.

- If you are married and have children with someone other than your spouse then your spouse inherits half of the community property and ⅓ of your personal assets and your children inherit the other half of the community property and the other ⅔ of your assets.

- If you are not married and have no children or immediate family, your property will be shared among your living extended family, uncles, cousins, aunts, and grandparents.

- If there are no records of any living relatives by blood or marriage, the assets you leave behind will be inherited by the State of Texas.

Texas will Probate Procedures

A decedent’s assets are gathered, any outstanding debts are settled, and any remaining assets are distributed to the beneficiaries of the decedent’s estate during the probate process, which is a court-supervised process. While the probate court grants a hearing, the executor must prepare an appraisal of your property, and this should be done within 90 days of the hearing.

The executor’s other duties include paying off debts, notifying creditors, and submitting the decedent’s tax return.

The steps involved in administering probate in Texas are listed below:

- A family member or executor brings a written application to probate your will. Texas grants a window of 4 years from the deceased’s death to apply for probate.

- Once the application has been validated, the probate hearing is done before the probate judge.

- The judge confirms the deceased’s death, verifies the validity of their will, and confirms the individual serving as the executor is eligible.

- The executor identifies the deceased’s estate, informs beneficiaries and creditors of their passing, and resolves any outstanding disputes.

- Once all debts have been settled, the executor distributes the remaining assets to the beneficiaries according to the deceased’s wishes. In the event that the deceased passes without a will, their assets are distributed according to the statutory intestate laws of the State of Texas.

Probate Types

The two major types of probate are independent probate and court-supervised probate:

Independent probate

Independent probate, also referred to as “informal” probate, is a legal procedure that places the executor in charge of administering the estate—distributing assets, paying off debts, etc.—without the involvement of the court. Independent probate is often selected as it is quick and requires fewer formalities than court-supervised probate.

Court-supervised probate

Formal probate also referred to as court-supervised probate, is typically handled by a judge and may involve multiple hearings. One might file for court-supervised probate for various reasons, such as when the terms stated in the will are not clear enough if there are interlineations and deletions in the handwritten will, or for supervised demonstration. The court-supervised probate comes in handy once there are complications with the assets of the deceased. One can also define the type of probate administration they want for their estate.

Texas’s Disinheritance Laws

Texas law gives you the option to disinherit an heir, which prevents them from having a legitimate claim to your property after your passing. However, because the law typically guards against surviving spouses being disinherited without their consent, your legally married spouse is exempt from this rule.

Since Texas is a community property state, almost all assets accumulated during a marriage are guaranteed to belong to both spouses and must be split equally in the event of a death or divorce. Regardless of what the decedent left in their will, the surviving spouse is entitled to at least half of the community property in the event of their death.

However, not all property is shared equally even after getting married in a community property state like Texas, which is why it is important to understand the distinctions between separate property and community property.

Separate property

Separate property is a class of property that legally belongs to only one spouse. Personal property may include the following:

- An inheritance received while wedded.

- Debts or assets acquired before marriage.

- Gifts and property acquired by one spouse in an agreement that excludes the name of the other.

Unless there are claims that state otherwise, you are free to give your separate property to any person you choose.

The law of Texas defines “community property” as all assets and earnings acquired during the marriage. Community property takes no account of whose name is on the property or whose account was used to purchase it; the property legally belongs to the couple as long as it was acquired within the marriage.

EXAMPLE

Examples of community property include the following:

- A house or any other real estate acquired during the marriage.

- Salaries, wages, and every other form of income during the marriage.

- Unemployment compensations and payments for lost wages.

Both parties are entitled to half of the community property as a couple. Then, each party is free to leave their respective half of the property to whomever they so choose.

In general, regardless of whether they reside in a community property state, people prefer to leave the majority of their assets to their spouse. Consider speaking with an estate lawyer before making any decisions if you feel the need to leave a sizable portion of your assets to someone other than your spouse.

Final Thoughts

It is important to be thorough when drafting a last will and testament. It is important to start making arrangements for a will as soon as you come of age. Wills are not just for the wealthy. There is never a bad time to make a will as a working person, whether you are single or married, as long as you have reached the legal age of majority and are capable of taking care of yourself.

You can always amend the previous will, as mentioned above, as you continue to grow and acquire more property. The State of Texas has the right to apply the intestate law to any property left behind if you pass away without having a will.