Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. When you make a charitable donation, it’s your responsibility to make sure to obtain the donation receipt, or you may not receive one. However, all organizations must follow the rules found in the IRS publication 1771, so if you feel it necessary, you can view their rules and regulations for non-profits there, which is helpful if you are concerned whether the organization is a real non-profit or some shady organization looking to scam good people.

Finally, the donation receipt can either be an email, a letter, a form, or a postcard sent to the donor. Furthermore, all donations above $250 must be acknowledged by a donation receipt.

Why Are Donation Receipts Important?

Each year hundreds of people are scammed out of their money by organizations claiming to be charities. Donation receipts are the only way that a charitable, non-profit organization and the donor can keep evidence of their transaction. Both parties are required to use donation receipts to prove that they’ve either donated cash or non-cash items or received the donation. The IRS will require proof of every charitable transaction, and the donation receipt is that proof.

If the IRS qualifies the organization receiving the donation as having tax-exempt status, the donation receipt is then used to claim a deduction on the donors’ income tax return. All donors who are looking for a solid charity to donate to should choose their charity with caution if you’re looking for a deduction, as you want to get the best return for your dollar as possible.

A donation receipt is always necessary if the donor requests one, no matter the amount or value. They are also required when one individual donation adds up to $250 or more. Finally, if the individual who made a donation received goods and or services in exchange for any donation over $75.

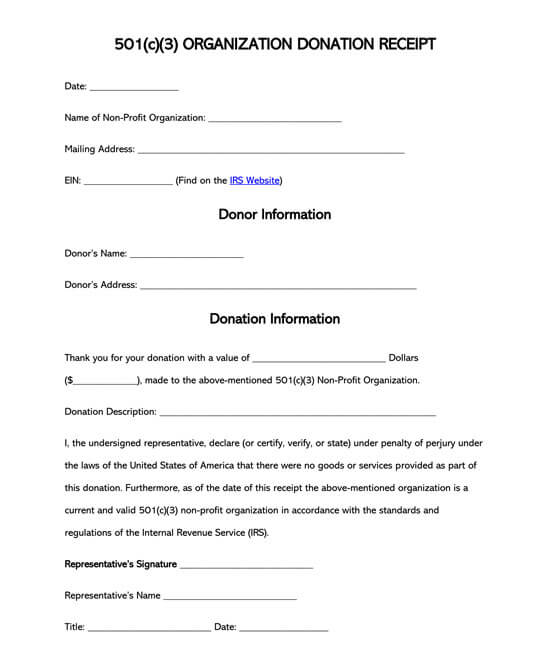

The IRS is very particular as to what organizations receive tax-exempt status. As tax laws can change, if you are in doubt, please check with the organization or IRS directly. The section which deals with charitable donations and exemption requirements is the 501(c)(3). Charitable organizations are those who do not benefit the private interests of any individual or shareholder. If you’re looking for information regarding how to start up a non-profit, then please visit the IRS page which goes over tax structures for non-profits.

What Should Be Included on a Donation Receipt?

Donation receipts are necessary when it comes to both the giver and receivers accounting and record keeping. If you donate but do not obtain and keep a receipt, you cannot claim the donation. If you are non-profit and do not keep proper records, you can be fined $10.00 per donation and $5,000 per charity event. Just having the receipt is not enough. The receipt must also have the proper information on it.

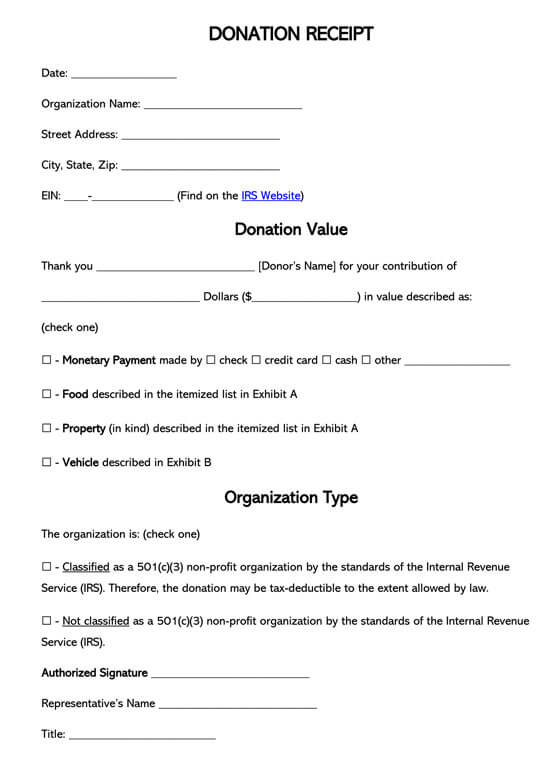

The IRS does not have any formal rules as to what should be included on the donation receipt but it really should include the following:

- The donor’s name and contact information

- The organization’s name, tax ID and contact information

- Date of the donation

- Method of payment

- The donation amount

- If the property is involved a detailed description of the property is necessary

- If stocks are donated, provide the company donating the stocks and the number of shares involved

- Any required signatures

- A statement establishing if goods/services were donated in return for a gift.

- Religious institutions must provide a statement stating that “intangible religious benefits” were given but have no “monetary value for tax purposes.”

- An estimate of the value of the goods/services given if applicable

Example of a Written Acknowledgment of a Donation

Again, there are no hard and fast rules when composing a donation receipt. Some organizations will use a well-organized template. Others will send it as a simple statement via postcard, email or letter.

example

Mr. Chesterton, thank you so much for your cash donation of $500.00 that our organization, Katy’s Kitties, received from you on Friday, January 17, 2020. We appreciate your care and concern. Also, no goods or services were provided in exchange for this donation.

Notice the statement has the name of both the donor and charity, as well as the amount, the method of payment, date, and finally, a note stating that the donation did not involve an exchange of goods or services. Examine your donation receipt when you receive it. If it does not contain the information you’ll need to make a deduction, then contact the charity, discuss the matter and have them send you a new, amended donation receipt.

Vehicle Donations

If you’re considering donating your vehicle to a charity or other non-monetary contributions, then there may be additional considerations. For instance, if the vehicle is worth more than $500, the non-profit must give you a detailed donation receipt, known as Form 1098-C Contributions of Motor Vehicles, Boats and Airplanes.

To get a good idea of what you can expect, check out the American Cancer Society’s Cars for a Cure program, where you’ll get a better idea of what to expect. Fortunately, the IRS has provided both donors and charities with a comprehensive guide when it comes to donating a vehicle.

What Should a Vehicle Donation Receipt Include?

- The donor’s name and tax ID number

- The vehicle ID number

- Date of the donation

Also, one of the following, as taken from form 1098-C:

A statement that the charity provided no goods or services in return for the donation, if that was the case, a description and good faith estimate of the value of goods or services, if any, that the charity provided in return for the donation, or, a statement that goods or services provided by the charity consisted entirely of intangible religious benefits if that was the case.

Donation (Non-Profit) Receipt Templates

Simple Donation Receipt

501(c)(3) Donation Receipt Template

note

Need more donation receipts? Check out 45+ free donation receipt templates.

Donation Receipt FAQs

Yes. For instance, the Humane Society of the United States, at the time of this writing, will not automatically send you a donation receipt for any one-time donation amount under $75.00 unless specifically requested by you. They require you to call their membership department to issue a receipt in such cases. However, members who automatically donate each month with a registered email will receive one.

Yes. You must deduct your donation the year you donate. Even if you send a check in 2019 that will not be cashed until 2020, the donation is still to be included in your 2019 tax return. If it is not a cash donation, it must be deducted the year you donated the non-cash deduction.

Then they are probably trying to scam you out of your money. Sadly, scammers are out there and will do their best to prey on your sensibilities. Whether they are posing as a rep for a recognized charity or simply making one up, it’s important to protect yourself. If you are leery, it’s always better to go to a charity directly and donate from there.

Yes. If the item is valued to be over $5000, it will need an appraisal before it can be claimed on their taxes.

Final Thoughts

In summary, if your donation is not tax-deductible, there is no reason to keep the donation receipt. However, if you receive a donation receipt from a charity and wish to use it for tax purposes, then make certain that the charity is listed as a non-profit, and place it with your other tax records. The receipt should also have the date of the donation and the amount, along with the charities’ name and contact information. Since you cannot claim a deduction on your taxes without a donation receipt, you must store it in a safe place. If the receipt is sent to you in the form of an email, make both a print and digital copy. Finally, before you accept it, have yourself or your accountant examine it to ensure that it contains the information necessary for the deduction to be legal.