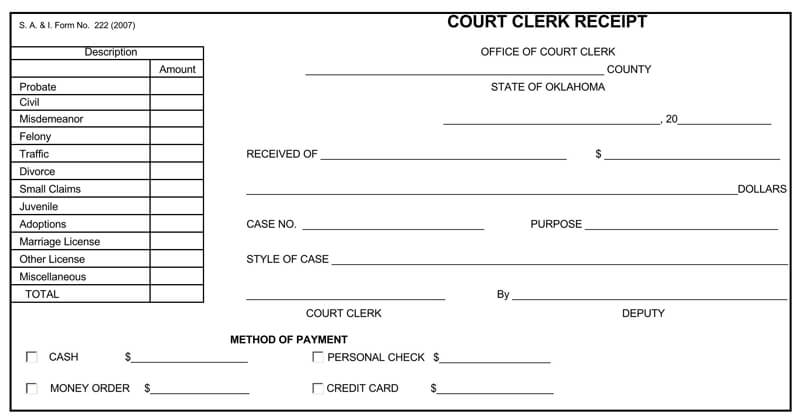

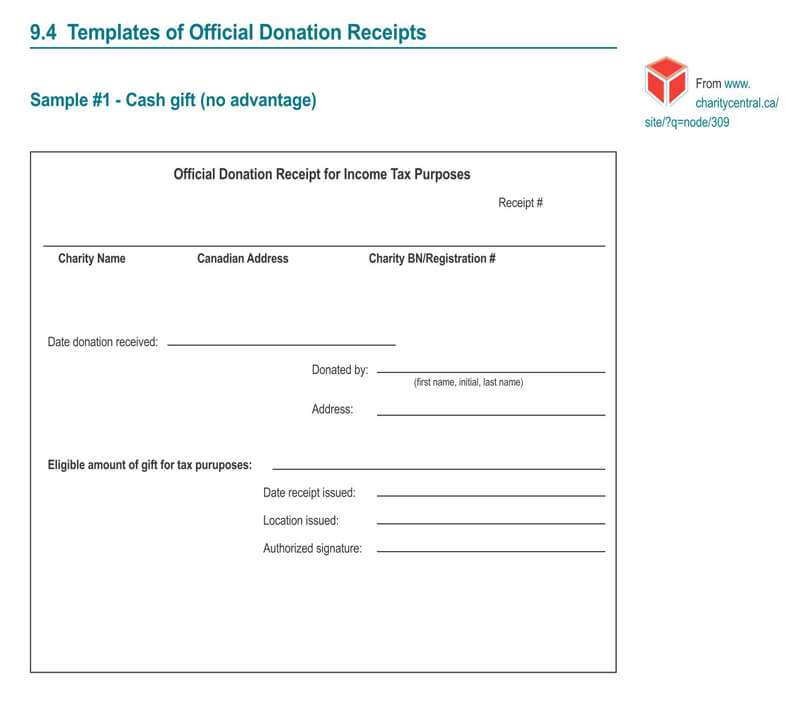

Official receipts are financial transactions documents that are used by firms for accounting and tax purposes. It is also a document given by a service provider or seller to a buyer as proof of transaction done.

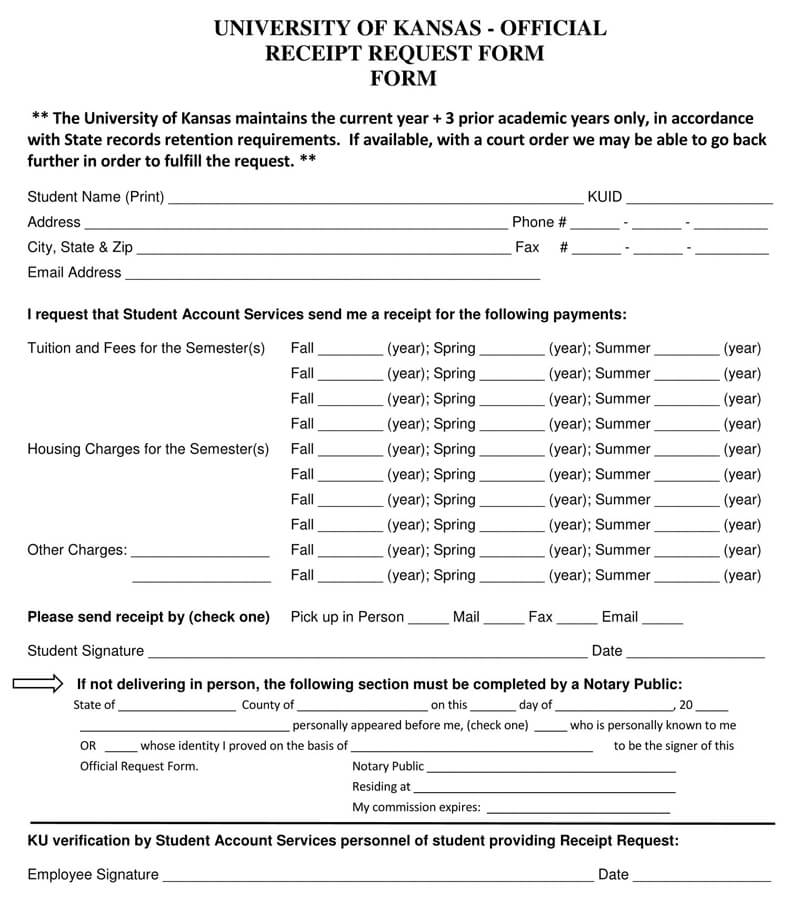

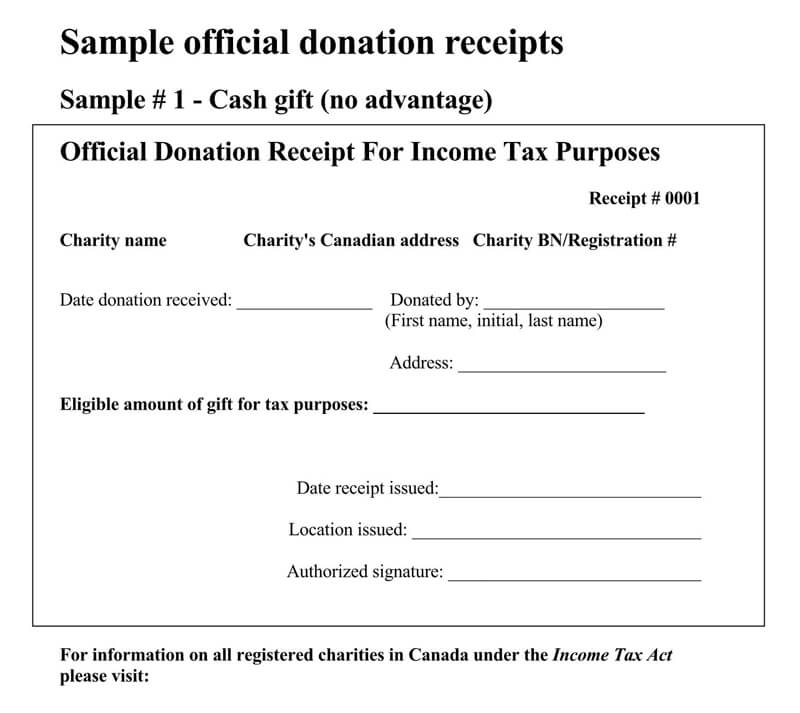

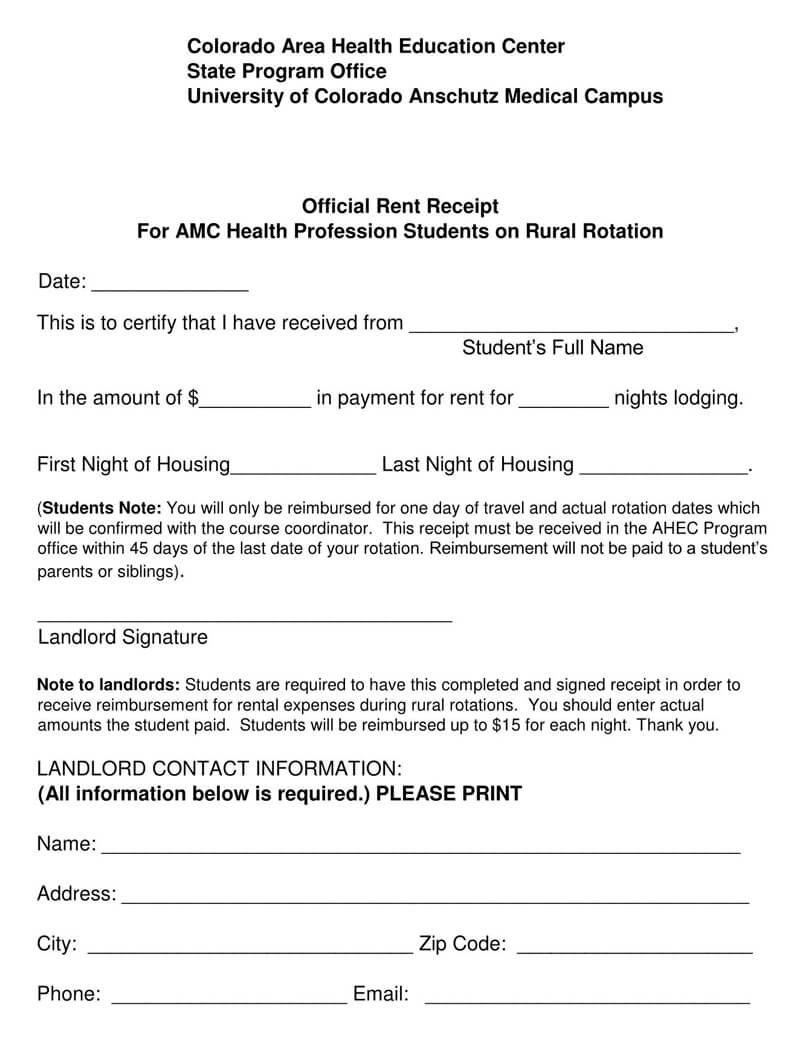

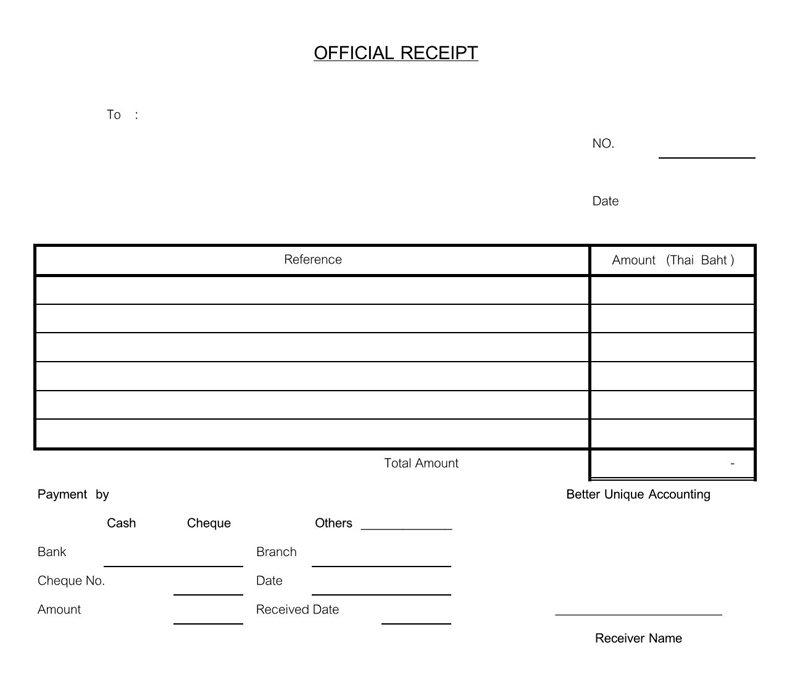

Official Receipt Templates

Invoice V.s Standard Receipt

An invoice is a document given by a seller to a buyer indicating the cost of goods and services that the seller had provided to the buyer. It is issued to ask for payment of the described goods or services.

A standard receipt is a document issued as proof of money transaction and is issued after payment has been made.

Format of a Receipt

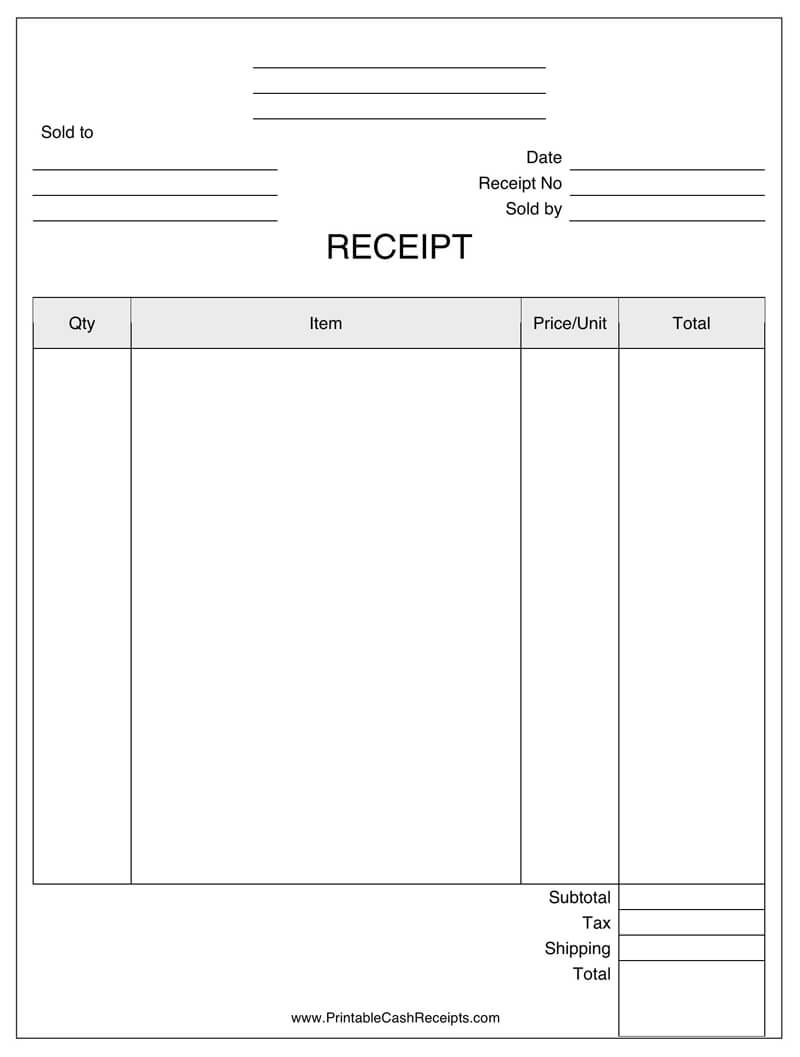

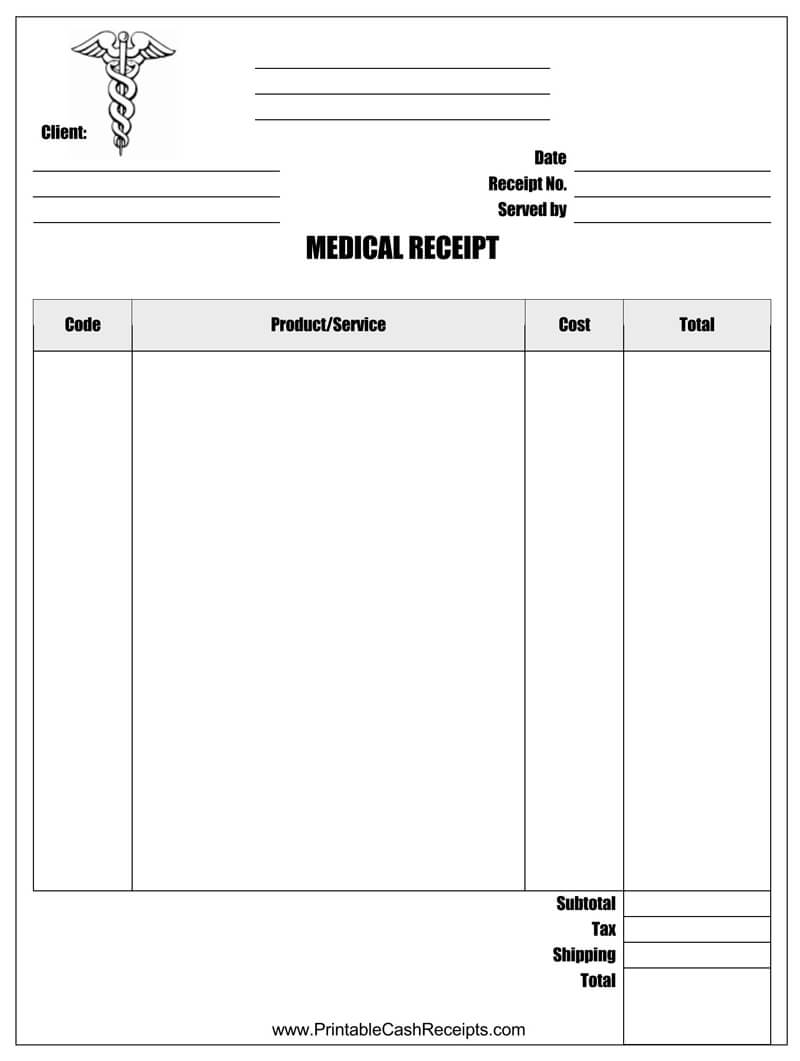

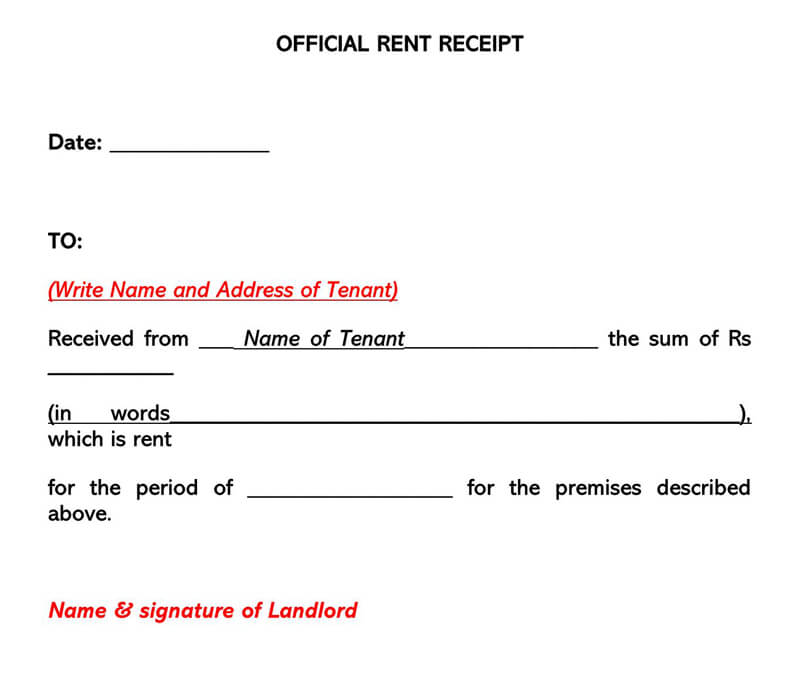

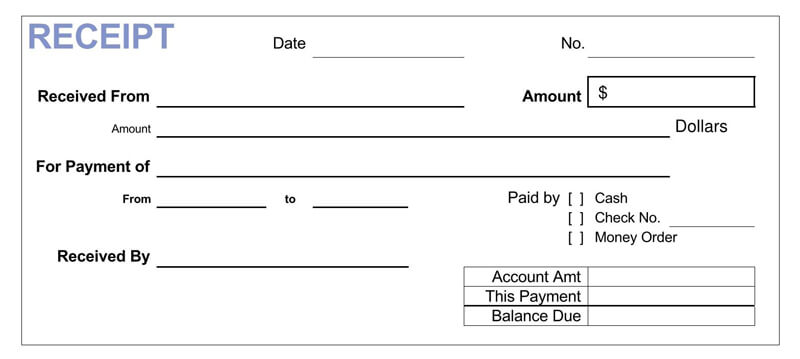

There are many different standard receipt templates with different formats and sections. But there are basic and common receipt sections that must appear in a standard receipt:

- Receipt: The word receipt is always written on the top right, center, or left part of this document with uppercase letters. This helps in the easy identification of a receipt.

- Company details: This is the section of official receipt that takes the second part in most standard receipts. They can be indicated on the side or in the middle of the receipt. They include the company name, address, city, email, and phone number. Another thing that might be included in this part is the company/business logo. This is usually indicated on the top or adjacent to the details.

- Date and receipt number: It is a piece of essential information on a receipt. Each receipt has a unique receipt number. The date is used to record the day the transaction was made. The two of them are used to trace a given transaction easily.

- Customer’s details: It is another primary part of a standard receipt. It includes the name of the customer, address, email, and phone number.

- Item billing box: This is the most important part of any standard receipt template. The itemized billing box is mostly laid in rows and columns; The first column is the product description. The second column is the quality part. The third is the unit price while the last column is the total column. Below the last row on the total side of the billing box is the subtotal of all the items, then followed by a discount row, then the subtotal less discount. Another row that might be added is the tax rate and the tax payable. Finally the total amount payable for the goods or services provided.

- Signature: This is the second last of most standard receipts. It includes the signature of the seller and the buyer. This marks the acceptance of the transaction by both parties.

- Added information: This is the last part of almost all receipts. This includes important details and conditions that are not covered in the receipt. For instance, the mode of payment, goods once sold cannot be re-accepted.

Benefits of Using a Receipt

- Record keeping: Receipts are used for record-keeping by both the seller and the buyer. It shows proof of a money transaction.

- Easy preparation of a financial statement: Receipts ease the work of making financial statements at the end of the day, month, or even end of a financial year.

- Easy preparation of tax returns: To prepare an accurate tax return statement, one will need to have all transaction receipts. Receipts also act as support items during tax returns.