An acknowledgement receipt is a document sent to customers to sign as confirmation that they received services or goods in the desired condition. An acknowledgement receipt is a due diligence or follow-up document used to verify that goods were received as ordered, marking the successful completion of a transaction.

Keeping track of goods or parcels is essential for suppliers or sellers to ensure deliveries are made to the right person and are in good condition. Since the suppliers will sometimes use third parties to make deliveries, they use an acknowledgment receipt to confirm if the buyer received the goods according to their expectations. Fundamentally, an acknowledgment receipt is used by anybody who intends to verify receipt of goods, services, cash, or an item from another party.

An acknowledgment receipt is not a legal requirement but an official receipt of the goods and services provided in a transaction. As a result, it is not a requirement of the Internal Revenue Bureau.

However, its utilization in business is governed by the following laws that regulate the creation and issuance of receipts and invoices:

- The National Internal Revenue Code of 1997

- The Revenue Regulation No. 18-2012, Revenue Memorandum Order No. 12-2013

- The Revenue Memorandum Circular No. 64-2015

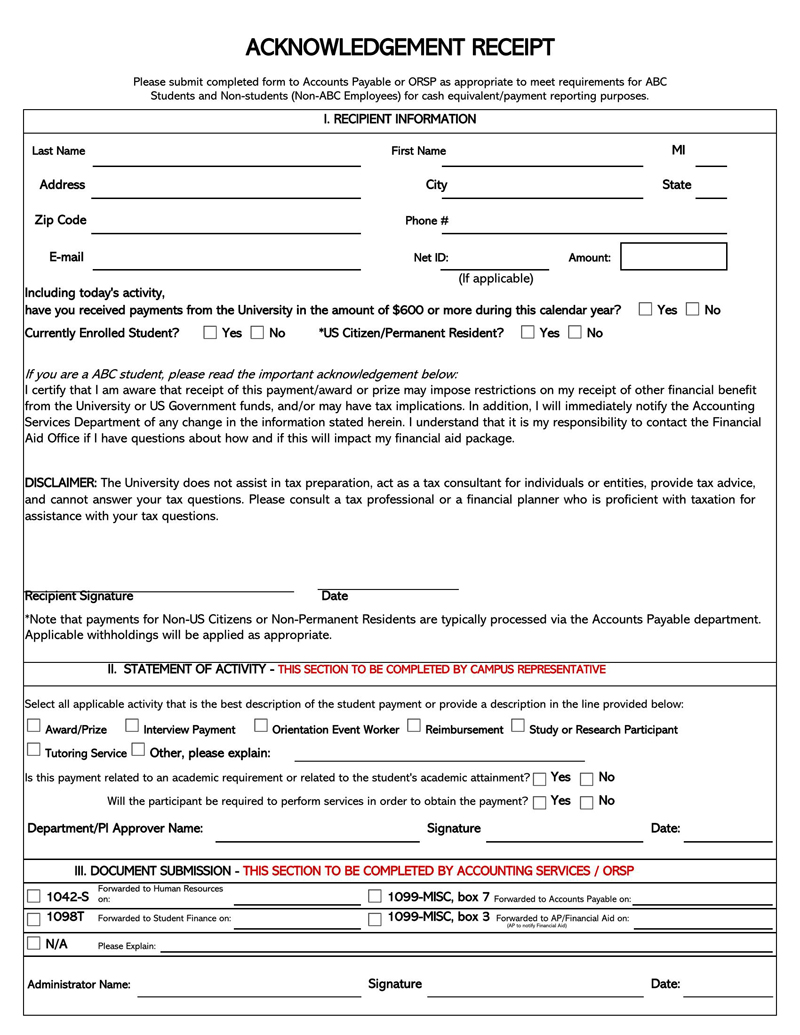

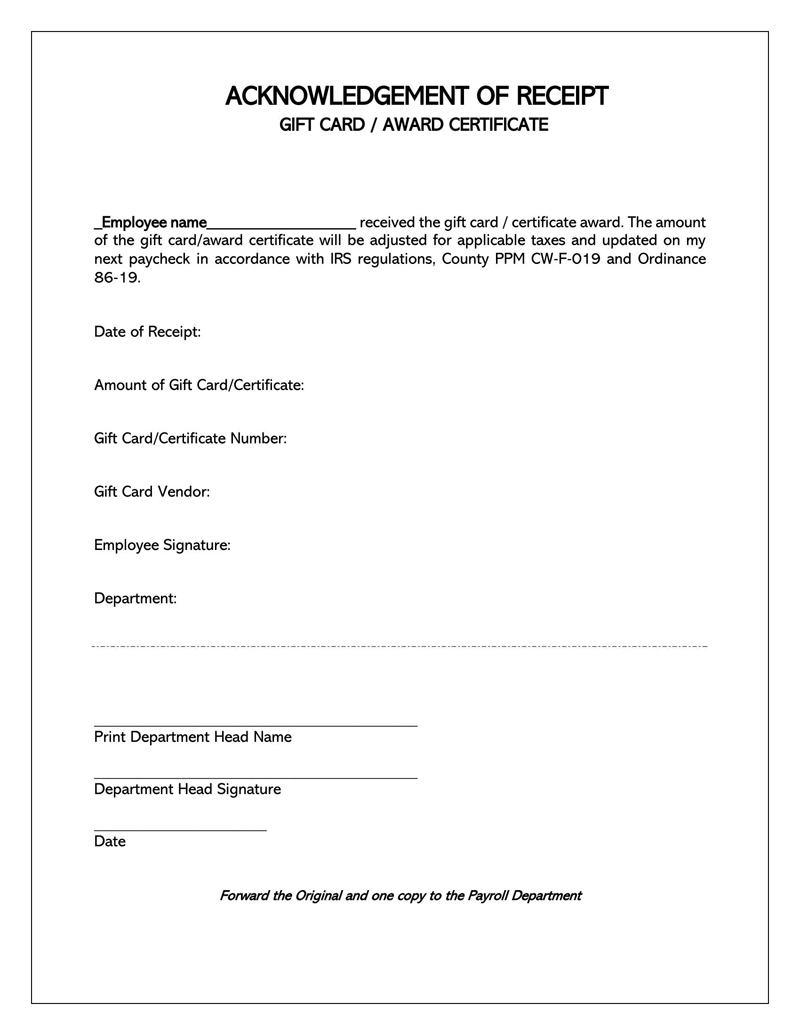

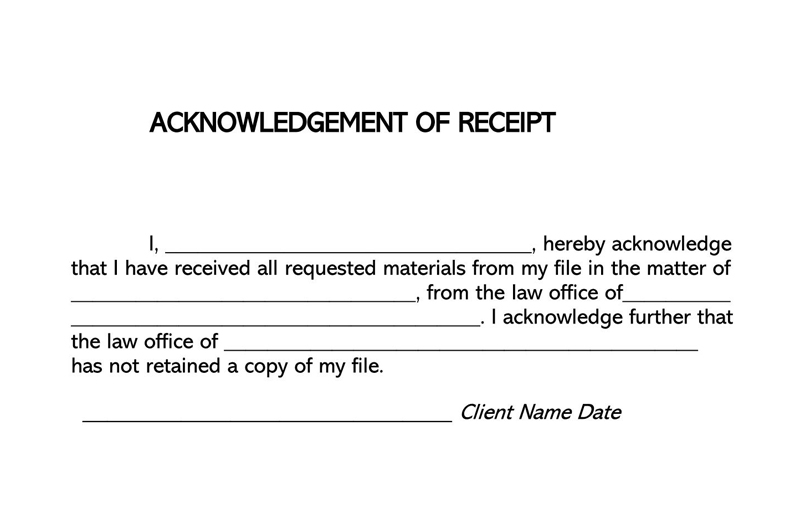

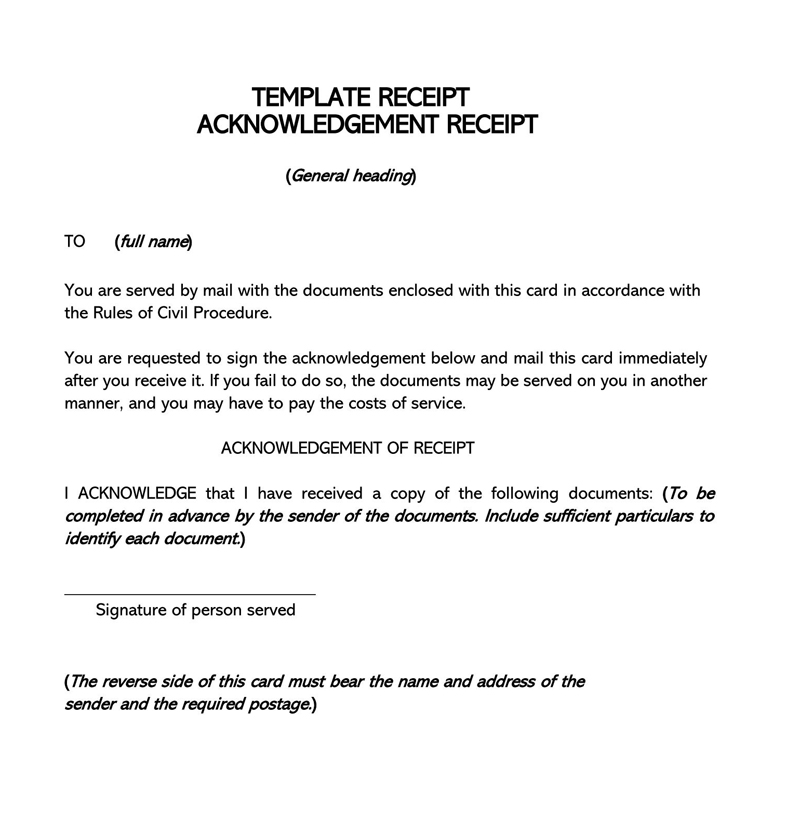

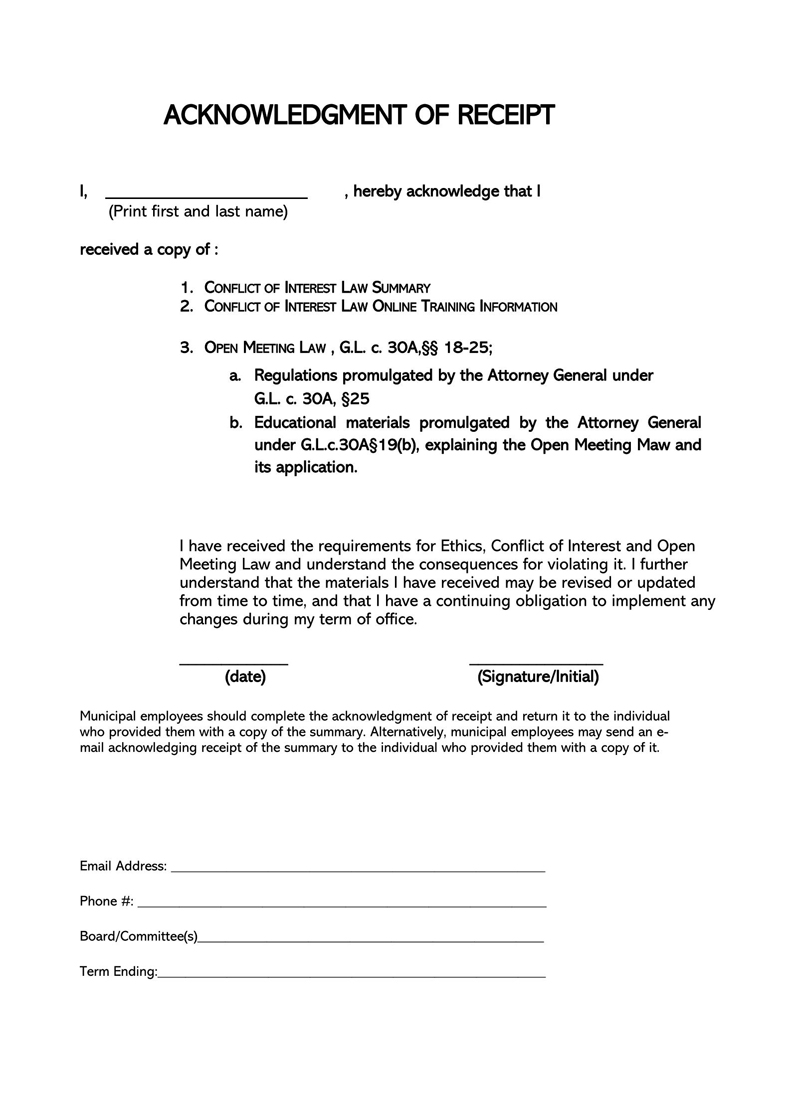

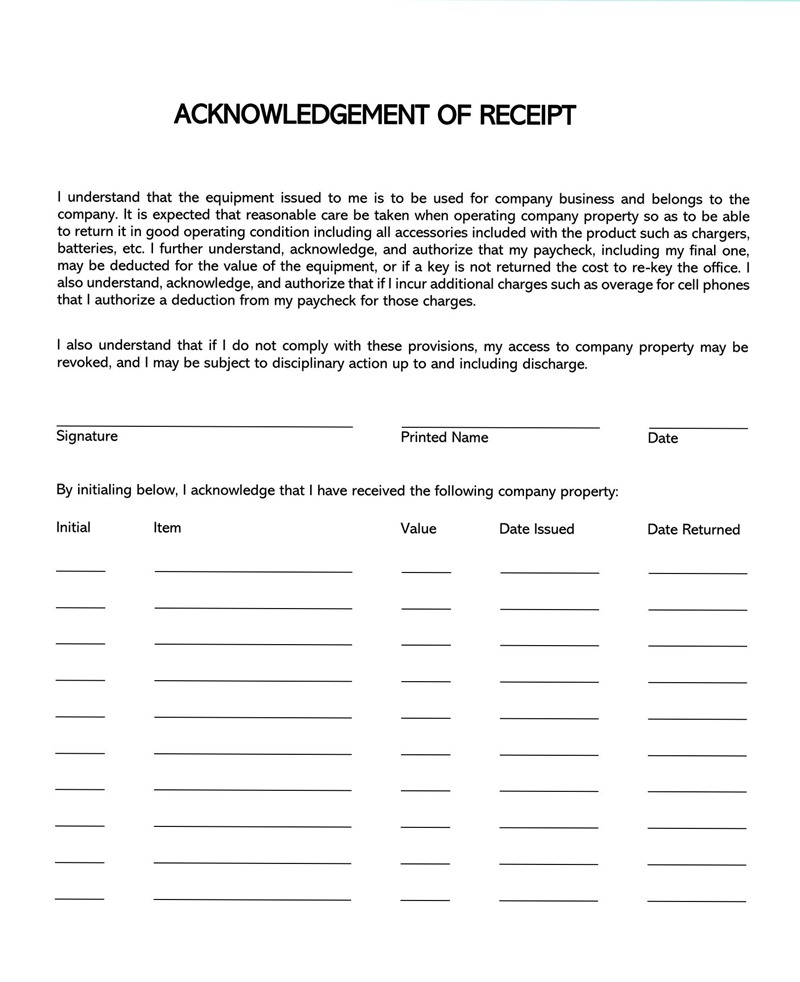

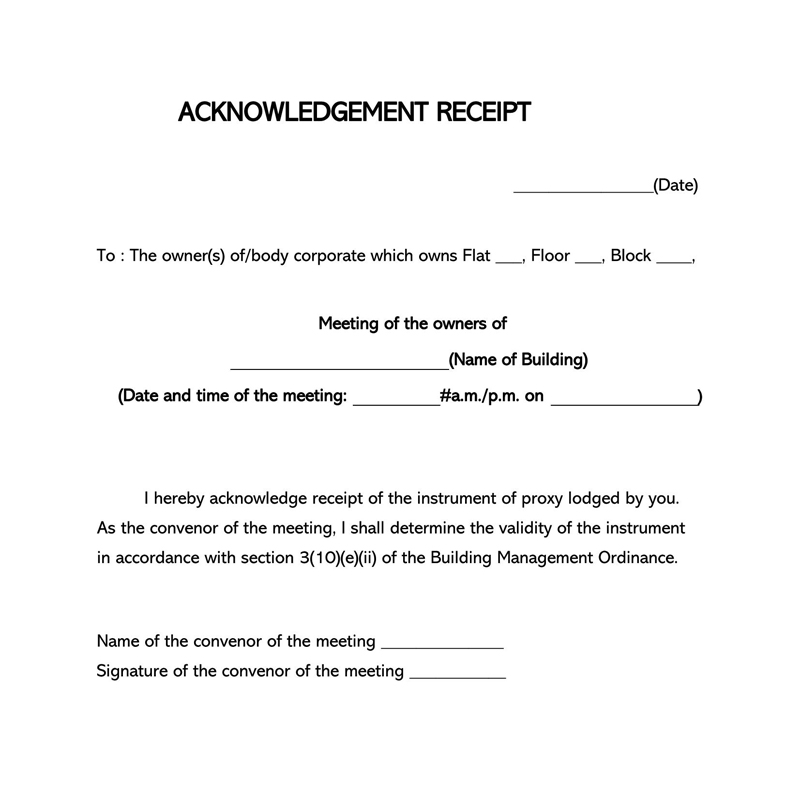

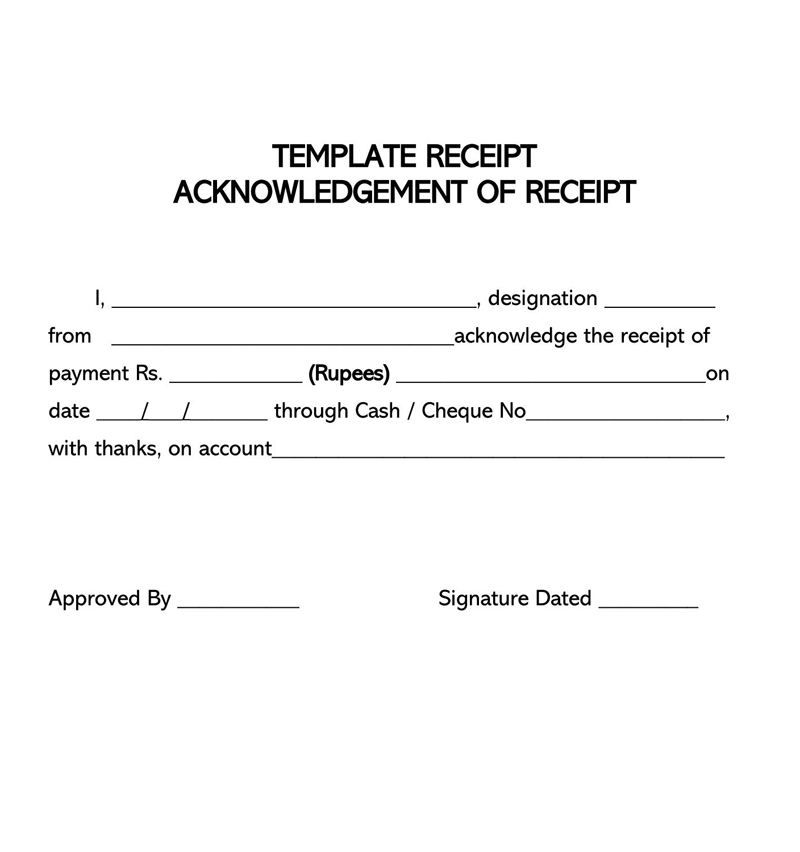

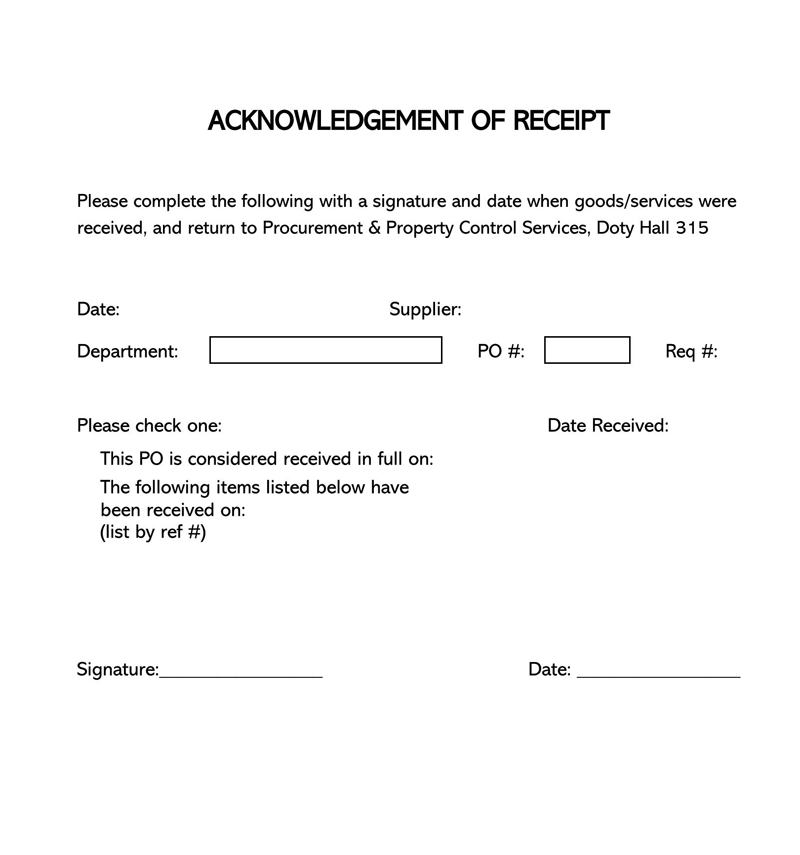

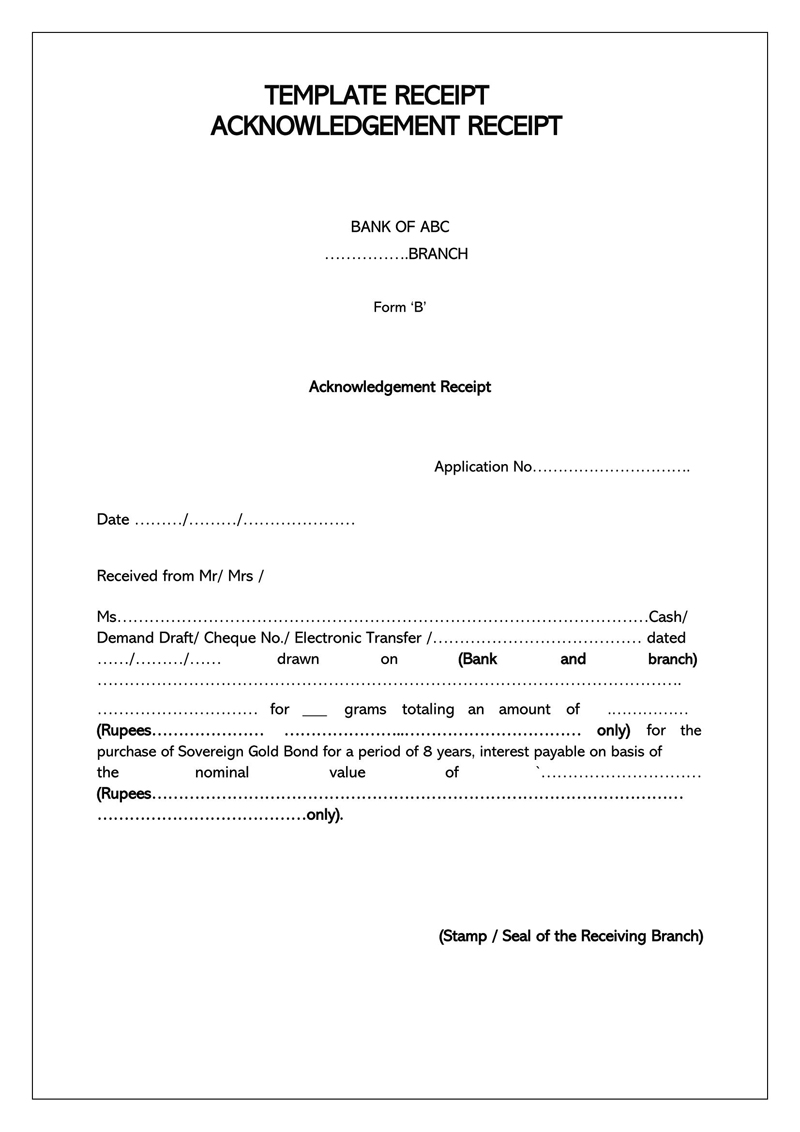

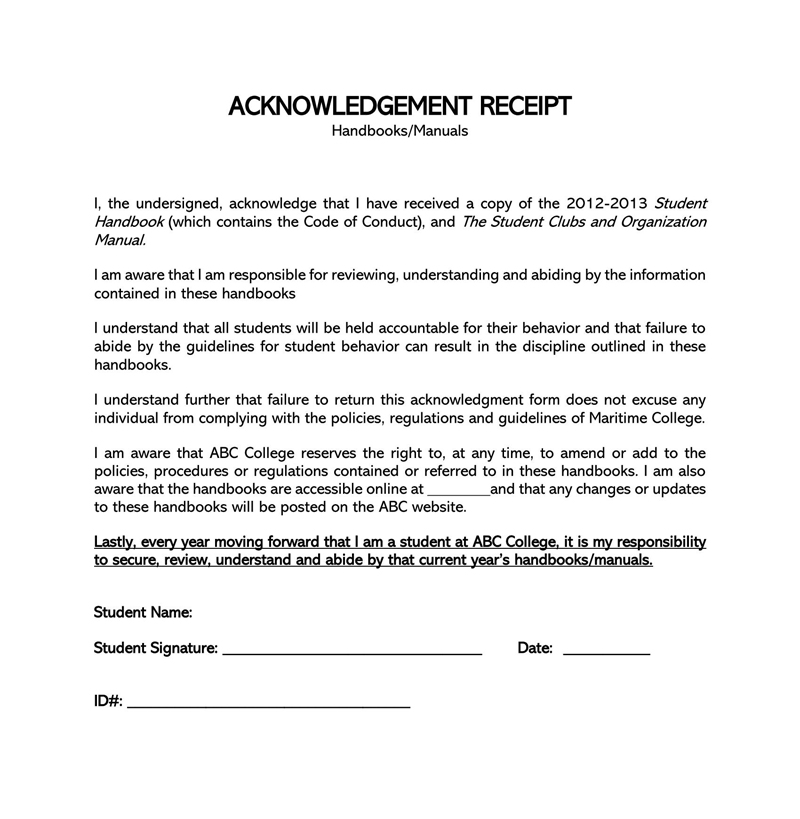

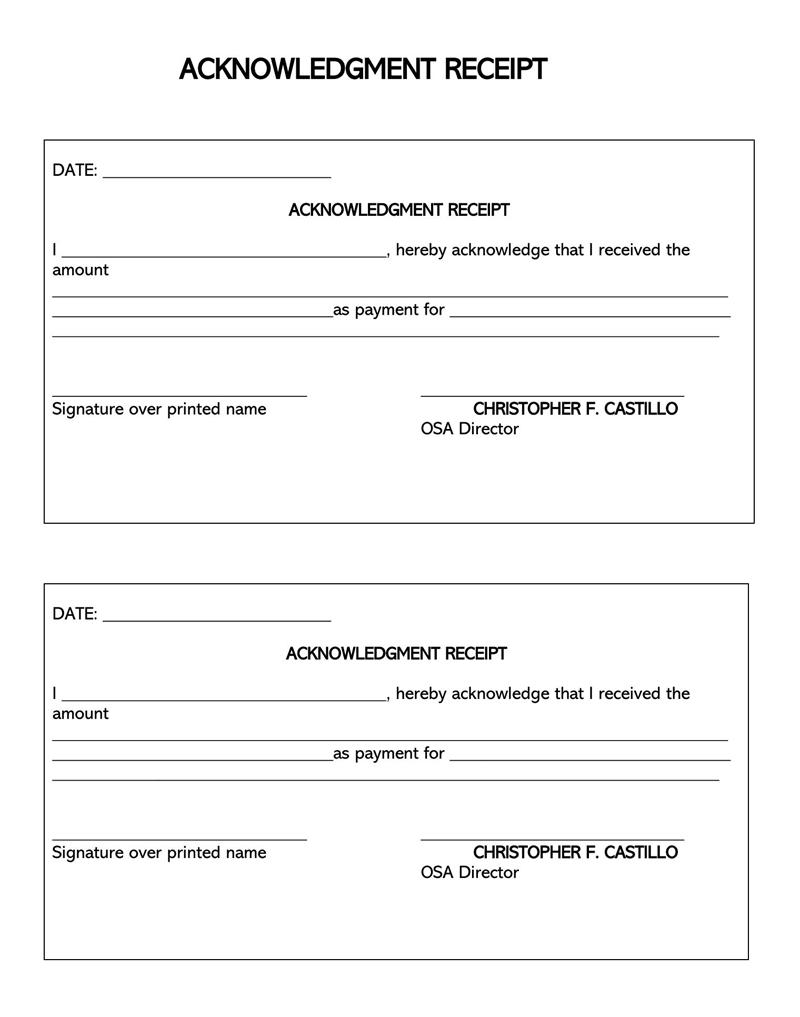

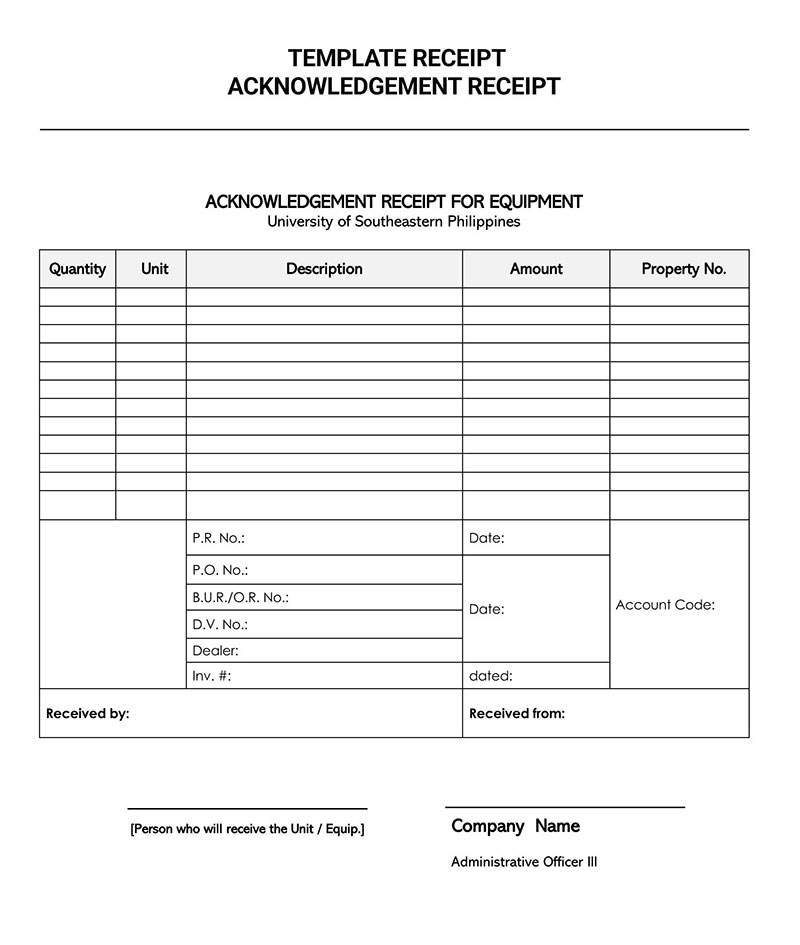

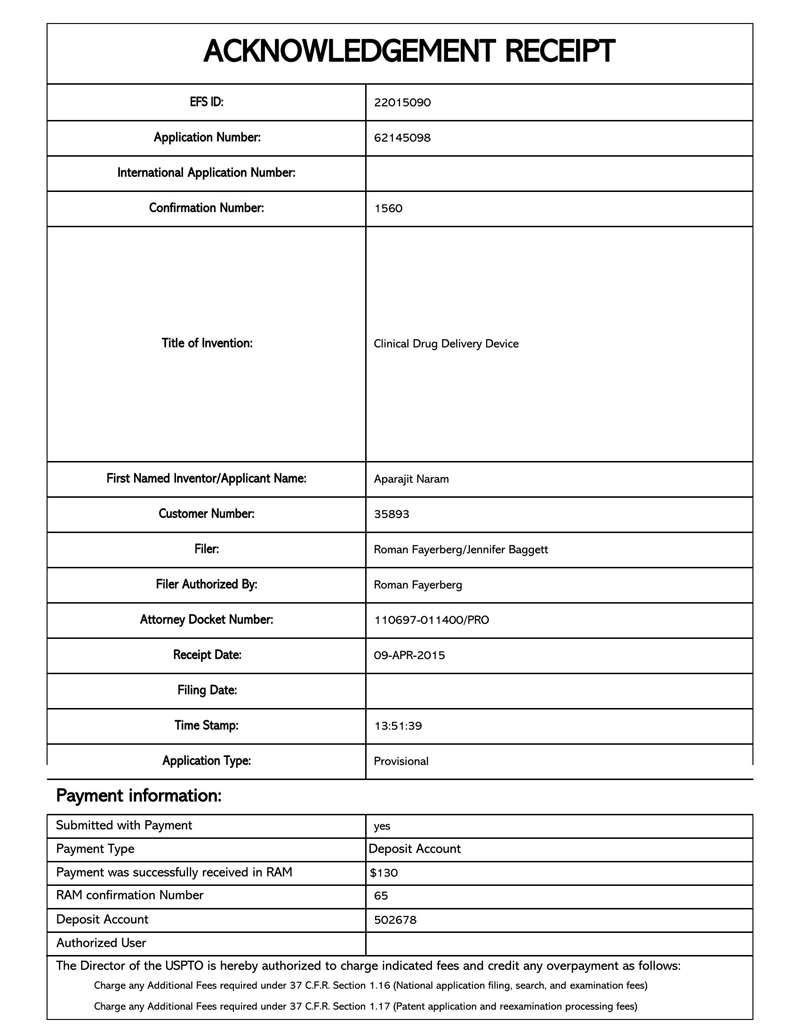

The use of templates like the ones provided in this article to prepare acknowledgment receipts is popular among sellers. In addition, this article willdiscuss the components of a standard acknowledgment receipt template and how to create a comprehensive receipt in a few steps.

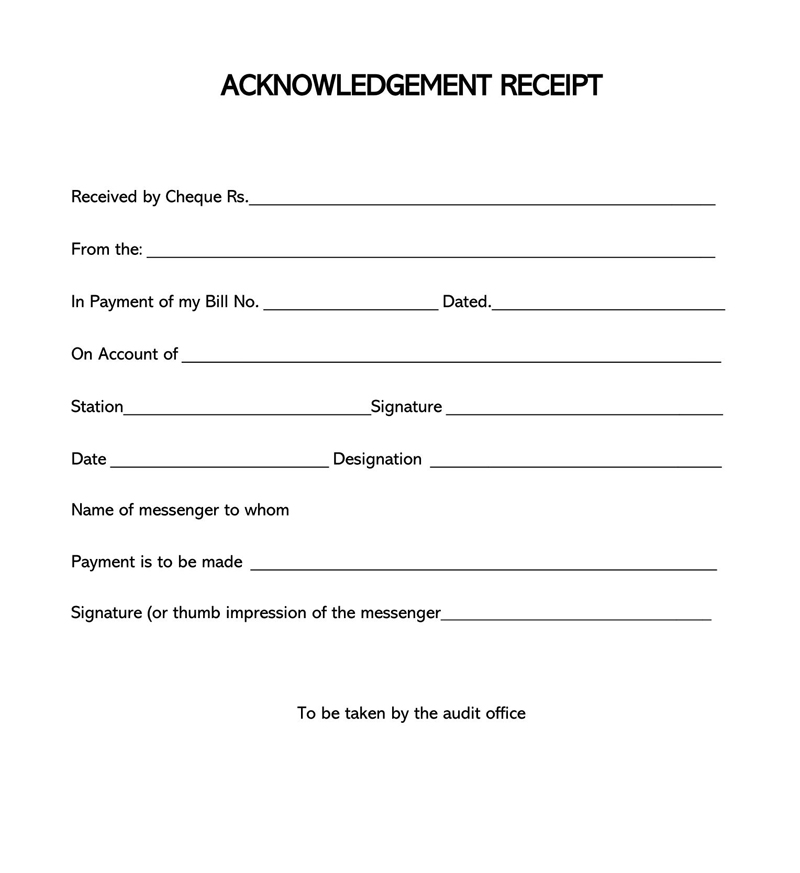

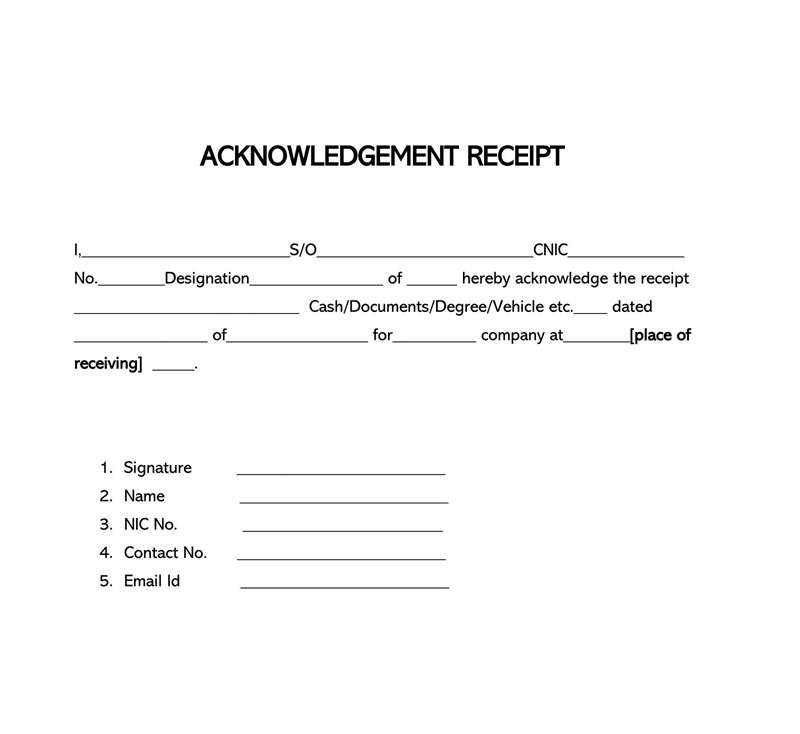

Free Receipt Templates

Components of an Acknowledgement Receipt

An acknowledgement receipt template will typically outline all the information needed to verify that an order was delivered to the customer’s satisfaction. You will only have to fill in the details specific to the order/services given each time you need an acknowledgement receipt.

Some of the details that should be in the document include:

Receipt title

A title ought to be provided declaring what type of document it is. Ordinarily, the document will be titled “Acknowledgment Receipt.”

Order number

The document should show the associated purchase order number of the goods or services being delivered to the buyer. The order number is unique to the transaction and is thus used for inventory.

Acknowledgement date

The acknowledgement receipt template should contain a section to input the date when the document was written. This date should be the exact date when the order was received.

Sender’s name and contact

Details about the sender should also be included. The sender can be an individual or business entity. The document should indicate their name and contact information, such as their phone number and address. A business logo can also be added.

Shipping details

The shipping company and the shipment details should also be included in the acknowledgement receipt. This information is categorized as shipping details. The shipping company’s name, address, contact information, and shipment order number should be clearly indicated.

Payment status and terms

An acknowledgement receipt should declare the payment status and terms of the order. This section declares if the order is paid for fully or partially.

List of items being ordered and quantity

A list of items delivered with a summarized description of each item should be provided. Details such as the type of goods and quantity delivered can be mentioned.

Unit price and price for the lot

The unit price of each listed item ought to be indicated in an acknowledgement receipt. The document should also state the total amount owed for the order.

Amount due

An acknowledgement receipt ought to indicate the total amount owed by the buyer. This includes the delivery fee and other applicable charges.

Total tax

Business transactions will typically be subject to tax. The document must therefore indicate how much of the money charged was as a result of the applicable tax, known as sales tax.

Acknowledgement statement

An acknowledgement statement should also be provided at the end of the receipt. The statement should declare two things; the order was received and that it was received as ordered in terms of quantity and condition.

Stamp or the electronic signature with date

An acknowledgement receipt should be signed by the person receiving the order. By affixing their signature with the date, the recipient confirms that the acknowledgement statement is true. The buyer can also use an official stamp or electronic signature instead, and the verification would still hold.

Instructions, if further action is required

In case there are instructions, notes, or any other information that ought to be provided in the document, it can be included as deemed necessary for the transaction.

How to Create a Flawless Acknowledgement Receipt

When creating acknowledgement receipts, it is essential to capture all the necessary information. The specifics of this document will vary from one transaction to another; however, the components of the document will more or less be the same. Consequently, acknowledgement receipt templates can be created using the same steps regardless of their application.

Below are a few special considerations that can help you create an effective acknowledgement receipt.

Use a company letterhead

To outline your information as the seller’s information, using a predesigned company letterhead is an effective method of achieving this. Ensure the letterhead contains the business name, contact information and place it at the top of the document. The contact information should be written in a font that is 2-3 points smaller than the business name.

Clearly mention all details

Write down all the details regarding the order and transaction carefully. The acknowledgement receipt template should have sections to input the seller’s details, the purchase order number, shipping information, payment status and terms, itemized list of goods, unit price and the total value of goods, amount owed, sales tax, acknowledgement statement, signature and any other information. This creates flexibility as the template can be used for different transactions multiple times.

Keep the original and send a copy

Next, print out at least two copies of the document. The buyer should sign the documents at the time of receipt. The seller should keep the original copy of the acknowledgement receipt and give a copy to the buyer.

Write a formal receipt

The acknowledgement receipt template should be written using a formal or professional tone and language. The document is filed as an official document in a company’s records and must, therefore, be prepared like one.

Be timely

Ensuring the buyer signs the acknowledgement receipt upon receiving the order is a good practice. Timely issuance of the acknowledgement receipt ensures the transaction is finalized faster, and the document is filed on time.

Proofread

Always proofread the document before sending it to the buyer. Ensure that all details have been captured correctly, from names, addresses, type of goods, order number to amount owed. Also, ensure there are no typos, spelling, or grammatical errors.

Frequently Asked Questions

Yes. Sellers can issue acknowledgement receipts via email, and they would still hold the same value as paper receipts.

No. Acknowledgement receipts are not legally binding, but they are legally viable as evidence should issues arise between the seller and the buyer.

The Bureau of Internal Revenue does not necessarily require sellers to issue an acknowledgement receipt. However, when creating the document, it is important to ensure applicable laws of creating and using receipts and invoices such as the Revenue Regulation No. 18-2012 and National Internal Revenue Code of 1997 are complied with.