A commercial lease application form is a document issued by a commercial property landlord to be completed by a potential tenant before the parties enter into a commercial lease agreement. The form prompts the tenant to fill in key information such as name, tax return reports, a business’s revenue, and profit that the landlord uses to screen and review the business tenant’s suitability or creditworthiness.

The following names alternatively refer to a commercial lease application:

- Commercial Rental Application

- Commercial Property Application

- Business Lease Application

- Commercial Tenant Information Form

- Retail Lease Application

Free Forms

Types of Commercial Lease Agreements

When leasing a commercial property to business tenants, it is best to consider the suitable type of commercial lease to use in the situation. Different lease agreements will have different benefits and liabilities.

Below are explanations of how the mentioned commercial lease agreements differ to help landlords decide which one to use:

Gross lease

A gross or full-service lease assigns the landlord full responsibility for operating costs such as maintenance, real estate taxes, and insurance costs. The landlord is therefore expected to include these expenses when setting the base rent.

Download: Microsoft Word (.docx)

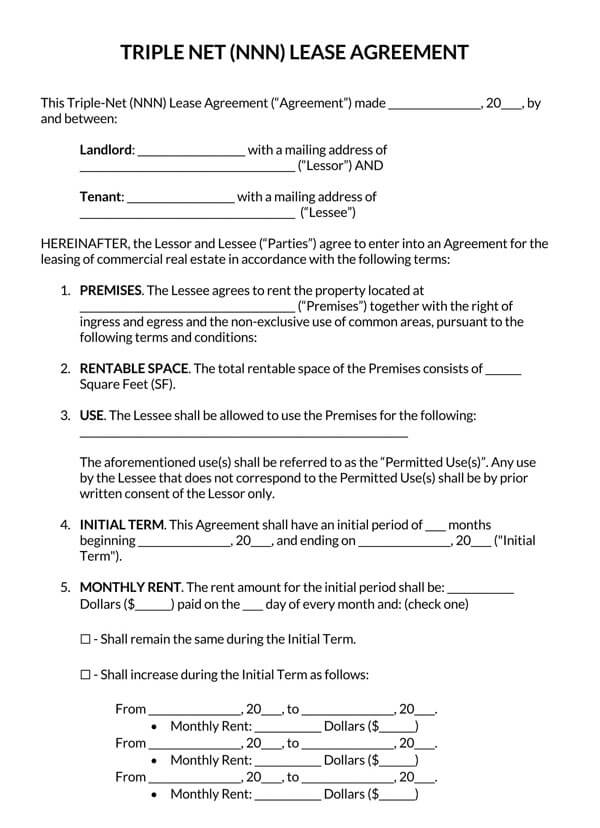

Net lease

A net lease stipulates that operating costs (maintenance, insurance, and real estate fees) are not to be included in the base rent; they are then divided proportionally depending on the agreement. The landlord does not take on sole responsibility to cover operating costs in a net lease. Depending on the number of expenses shared, the lease can be a triple, double or single net lease.

Download: Microsoft Word (.docx)

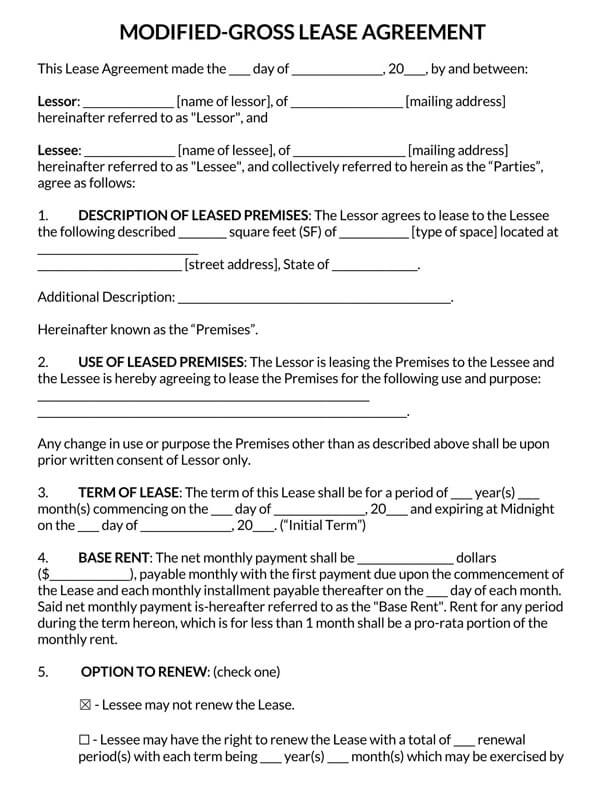

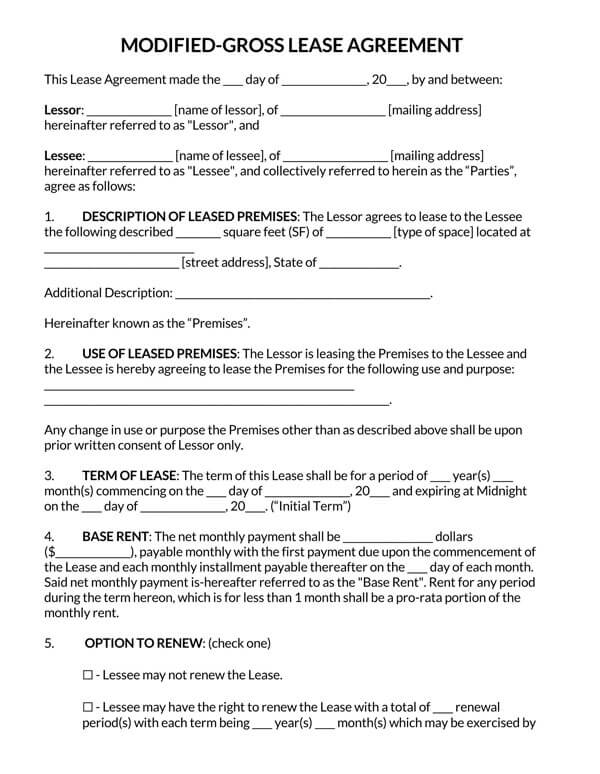

Modified gross lease

In a modified gross lease, no party takes up the full obligation of any of the building's operating expenses. The parties can therefore decide on how the operating costs should be shared. In some cases, it will depend on the square footage occupied by the tenant.

Download: Microsoft Word (.docx)

Percentage lease

In a percentage lease, the landlord is expected to receive the base rent and, in addition, a percentage of the business's gross revenue. At the same time, he or she assumes the obligation for operating costs. Usually, a seven percentage is acceptable.

Download: Microsoft Word (.docx)

Free Templates

Difference Between a Commercial and Residential Property

Leasing commercial property is different from leasing residential property in several ways. This article will highlight these differences to educate landlords who wish to transition from one type of leasing to the other.

Commercial property differs from residential property in the following ways:

Tenant protection

Commercial property is more lenient to landlords in that there are fewer consumer protections when leasing commercial property. The landlord is given more autonomy than with residential property, where consumer or housing laws prioritize the tenant’s well-being.

Duration of agreement and financial risks involved

Commercial property is usually leased for a longer duration than residential leases, which tend to be more short-term. Commercial property will normally be leased for a minimum of three years. As a result, commercial property of more stability, thus exposing the landlord to fewer risks than residential leases, which are relatively easy to break, posing a grave financial risk.

Negotiations

In leasing commercial property, commercial leases usually are more negotiable due to the complexities and formalities involved. This is in contrast to residential leases, which will usually be more straightforward.

Reasons to Use an Application Process

Safeguard the Income Stream

First and foremost, a landlord needs to use this form to safeguard the income stream. Landlords, like any other business person, primarily exist to make a profit. Anything that can compromise or threaten the profitability of his venture must hence be contained appropriately. This form provides a suitable hedge.

Minimize Defaults

As part of safeguarding the income stream, the landlord definitely wants to minimize defaults. This simply means seeing to it that the rental dues are remitted in a timely manner. Only by hosting a person with a sterling rental track record may this feat be realized.

Reduce Late Payments

After defaults, come risks of late payments. These are rental dues that are remitted but consistently outside the timeframes that are recommended. When rental dues are paid past the deadlines repeatedly, the end result might not always be desirable. That is why a landlord wants to host only a person who is more likely to pay the dues in time.

Avert unnecessary Legal Squabbles

With persistent defaults and late payments come the possibilities of legal squabbles. These issues are often referred to as the rental dispute tribunals for settlement. No sane landlord would want such an eventuality to befall him. That is why he desperately wants to put in place measures that may prevent the same from happening at all costs.

Guarantee Some Peace of Mind

The sum total of the benefits above boils down to one thing: the need to uphold the peace of mind at all times of operations. By using this form, the landlord has the long term benefit of guaranteeing some peace of mind to him. This is definitely a good thing as it lets the landlord enjoy his time and property.

How to Screen a Commercial Tenant

Screening is crucial in having a seamless leasing period. It provides the landlord assurances that the tenant makes enough to cover rent and other applicable fees, preventing conflicts during the lease term. With the significance of the screening process in mind, this article will look into the few steps used in screening business tenants in commercial leasing.

These steps include:

Obtain the rental application form

Firstly, receive the commercial lease application form from the prospective tenant. Ascertain that all the necessary information is provided. Then, at face value, determine whether the applicant is worth considering for the lease. If they do, proceed to the next steps.

Verify the provided information

Next, authenticate the information provided in the application form. Confirm with the Secretary of State if the business is registered in the respective state. If the business is not registered, it won’t be possible to conduct background and credit checks.

Perform a credit check

After verifying the legality of the business, it is time to determine its creditworthiness. Credit checks are necessary in order to determine the financial capability and ability of the prospective tenant to afford the rent. Two credit checks should be conducted.

Business check

Start with a business credit check. This is done by searching the business’s PAYDEX score to determine its credit score. First, obtain the business’s corporate number and employer ID from the state’s business bureau, which is used to get the PAYDEX score. High credit scores are desirable. Use the third-party services providers that conduct credit checks. Be aware that this service usually comes at a small fee.

Businesses that are known to lease commercial property include:

- Retail businesses

- Restaurants

- Medical clinic

- Shopping mall store or kiosk

- Offices or companies

- Childcare facilities

- Hotels or lodgings

- Factories or warehouses

Personal credit check

Next, conduct a credit check on the company owners. Utilize third-party credit check service providers. A credit score of an average of 700 is deemed suitable, but anything higher is desired.

Below are some of the most reliable sources alongside the amounts of money they demand, respectively:

- E-Renter.com – $32

- MyRental.com – $30

- RentPrep.com – $28

- ScreeningWorks.com – $30

Verify references

Lastly, verify the references provided in the commercial lease application form. Rental references are effective tools for determining a tenant’s rental history and suitability as a tenant. The form may also have credit references such as banks; contact the references to determine financial ability. If everything checks out, the screening process is completed, and the necessary steps can be taken.

Ask for a personal guarantee

If, after going through all the steps above you are not yet satisfied with the credibility of the potential tenant, you should demand a personal guarantee. This is basically a person that is well-known to the business and may also continue paying rent in the event of a default on the part of the principal tenant.

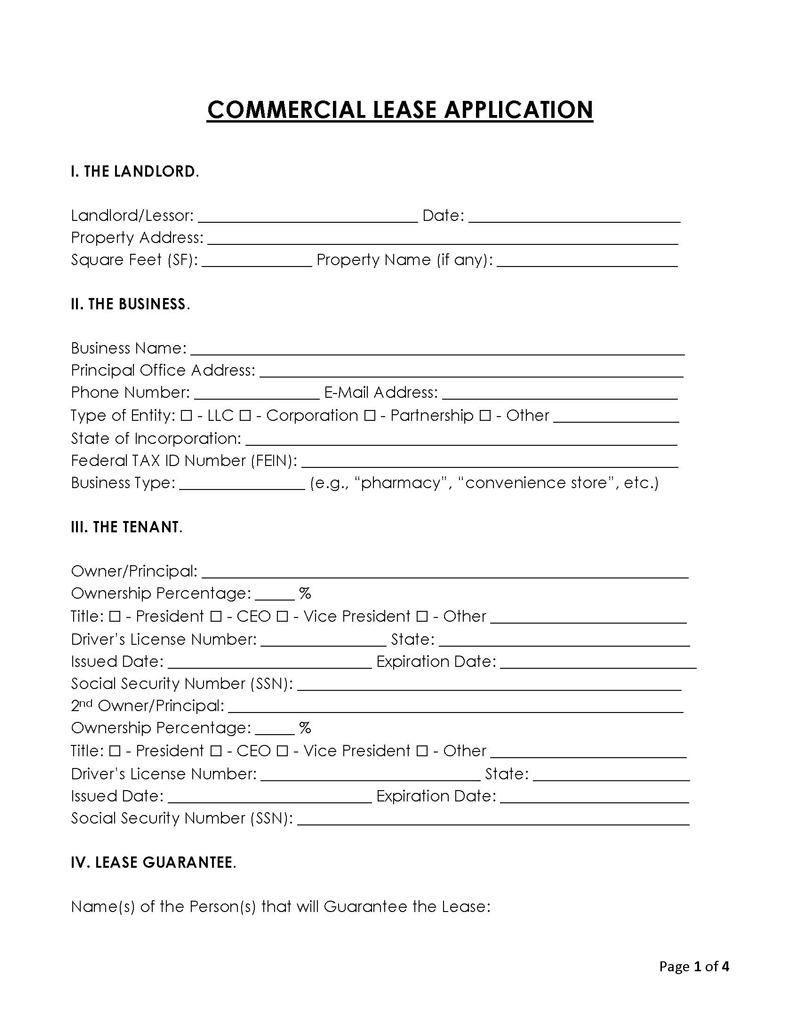

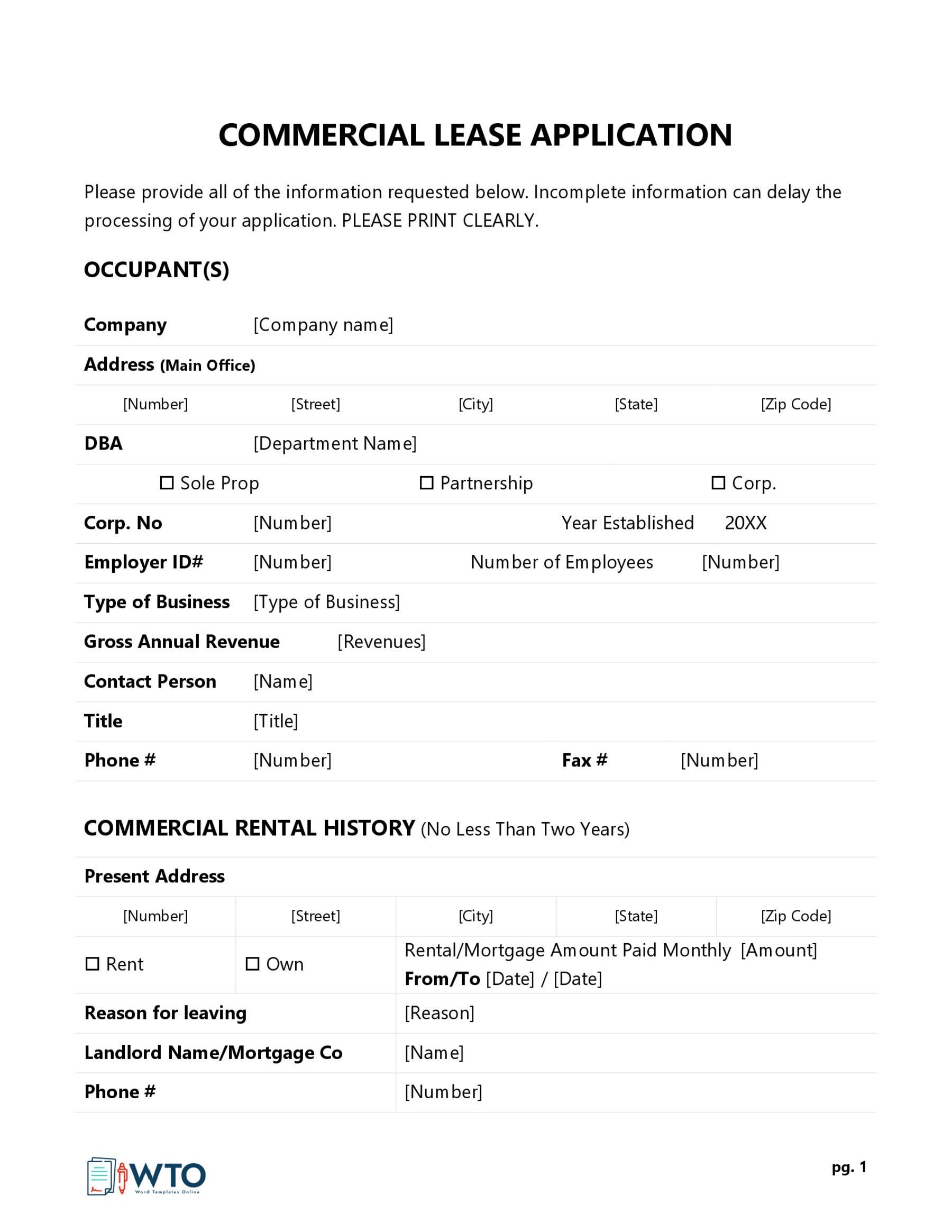

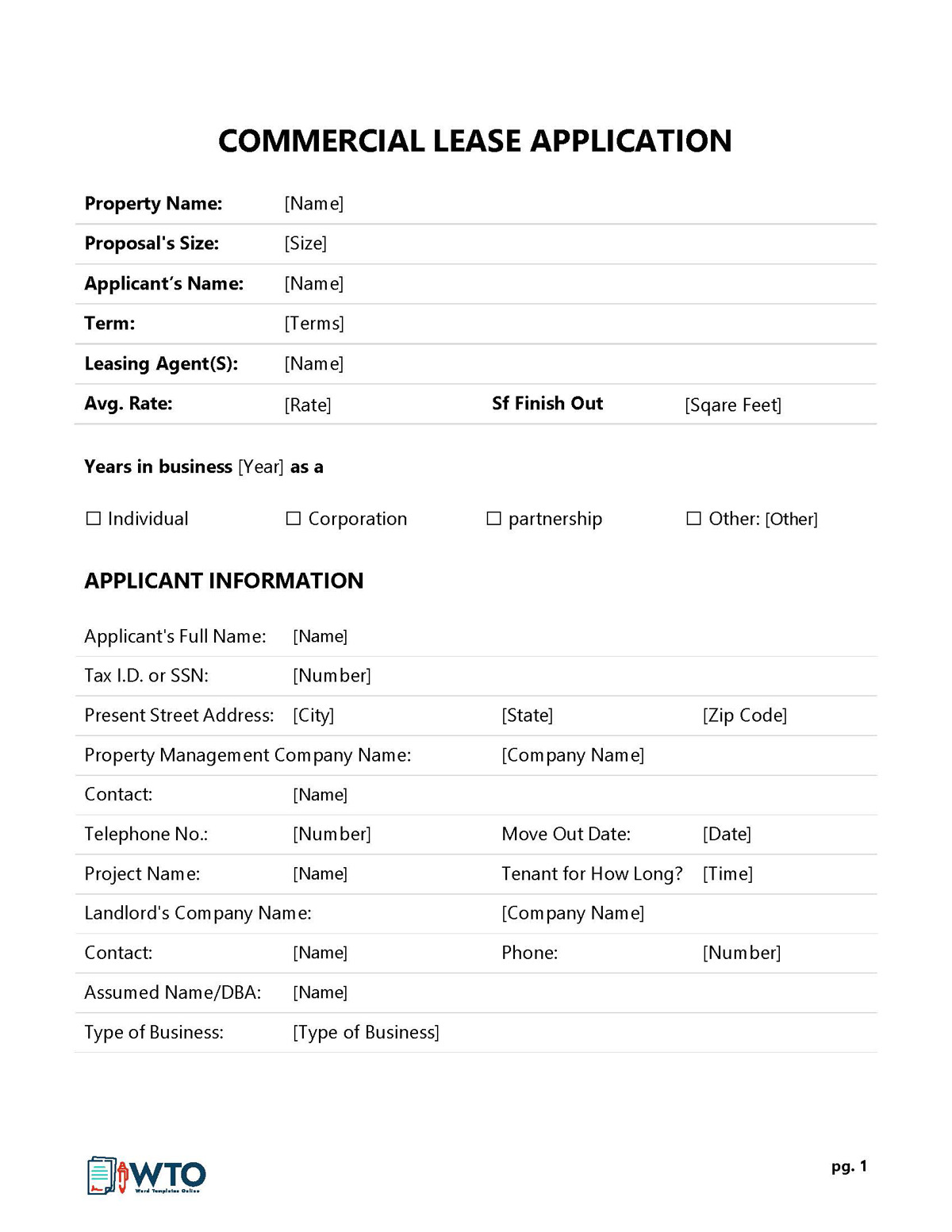

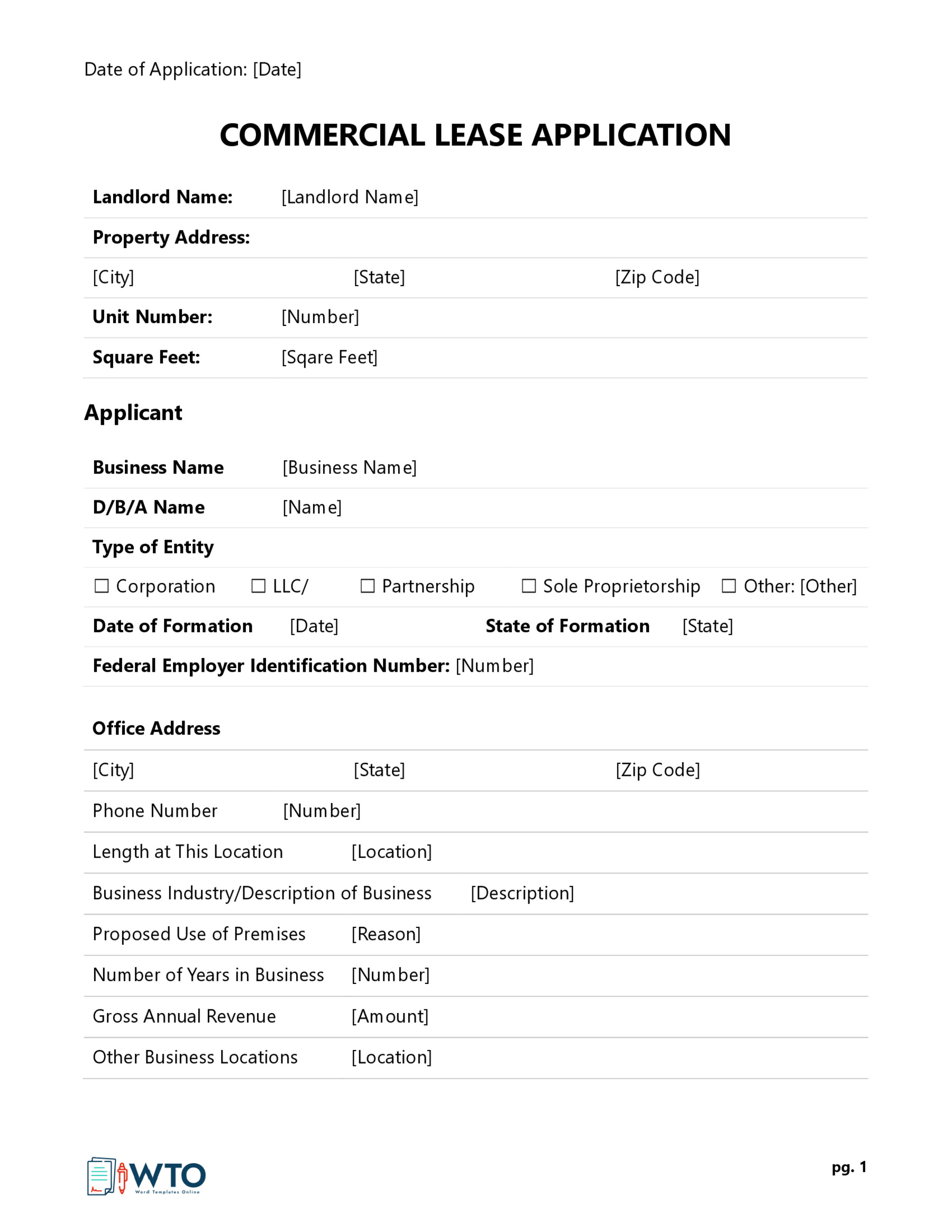

How to Write a Commercial Application Form

It is recommended that commercial lease application forms will usually be uniform among prospective applicants. This is important so that its contents can be used as criteria for selecting suitable tenants. The guide below indicates the different elements found in a standard commercial lease application form and the order in which the components should be written.

These elements include:

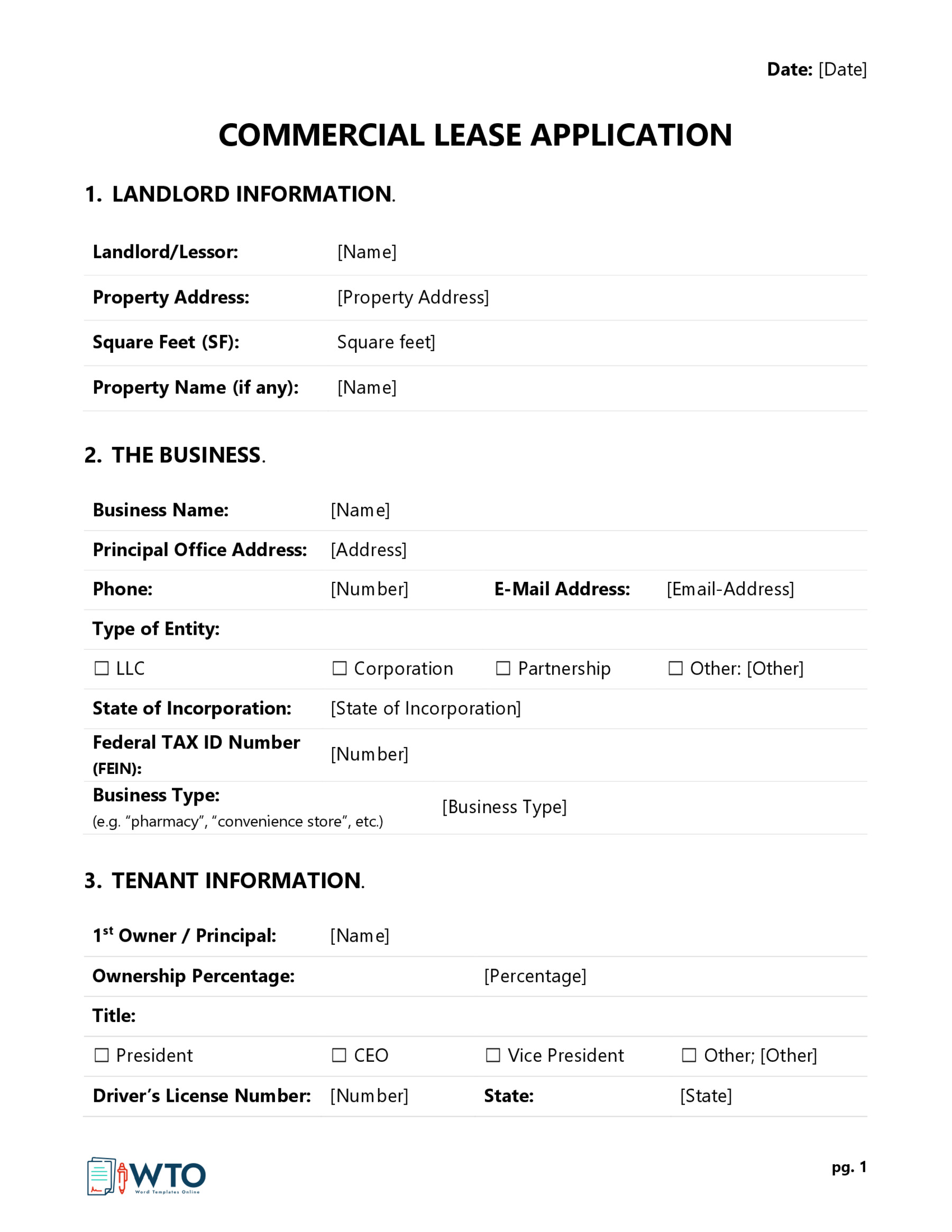

Name of the landlord

The form should start with the name of the landlord. The landlord will, in some cases, be referred to as the lessor. Provide his or her name, then add the effective date of the application form.

Property details

Then, it provides identification details of the commercial property.

The property details to be provided include:

- Property Location: The location is given by indicating the property’s physical address. The address should showcase the street address, city, state, and ZIP code. In addition, it can show the building number or unit number up for leasing.

- Number of square feet in the property: The form then indicates the size of the property being rented. This should be given in square footage.

- Property name: Next, indicate the name of the commercial property where the tenant is expected to rent.

Details of business

The next section should identify the business tenant.

The following information should appear in the application form:

- Full name of the business entity: The official name of the business should be provided. The name specifies the business intending to rent the space.

- Principal office address: The business name should then be followed by the principal address of the business. This will typically be the business’s headquarters.

- Phone number and email address: Contact information of the business should then be supplied. Different contact details can be provided, such as phone number, email address, etc.

- Corporate number and employer ID: Next, the form outlines the business’s corporate number and employer ID.

- Type of entity: The form ought to indicate the type of company renting the premises. Examples of types of entities are LLC, corporation, sole-proprietorship, partnership, etc.

- Year established: The year when the company was founded should also be indicated. This helps determine if the business is a start-up or an already established entity.

- State of incorporation: The state where the company was registered should be declared in the form. This ascertains the jurisdiction governing the prospective tenant.

- FEIN: The Federal Tax ID Number should then be supplied. All tax liable businesses will have this number which is used for credit checks.

- Business type: The next item is the use of the property or business type. This is the type of business the tenant will be undertaking on the property.

For example:

A restaurant, a consultancy office, etc.

- The number of employees: The form should then declare the number of employees under the company.

- Tenants details: The next section of the commercial lease application form prompts the tenant to supply the person appointed by the business to represent it on the lease – typically the owner. This can be more than one person. These are the people who make decisions on behalf of the business. The following information about the tenant should be provided.

- Principals’ name: The principal’s names, SSN, birthdates, and mailing addresses should be supplied. This information is used to conduct personal credit checks.

- Ownership percentage: The form should then show the percentage owned by each named principal.

- Title: The respective title of the named principal should then be specified. Some of the positions credible for leasing property for a business are CEO, president, vice-president, etc.

- Driver’s license number: Additional information like the principal’s driving license number can be added.

- State: The form then declares the state where the principal’s driving license is valid. The name of the state indicates the jurisdiction applicable.

- Issued and expiration dates: Next, the driving license issuance and expiration dates should be written down.

- SSN: The last item under the tenant section is their social security number. This information is used for credit checks.

Personal guarantee

The application form indicates the individuals selected to offer a personal guarantee if the business defaults on rent payments. There can be more than one personal guarantor. Their name(s) should be clearly stated in the application.

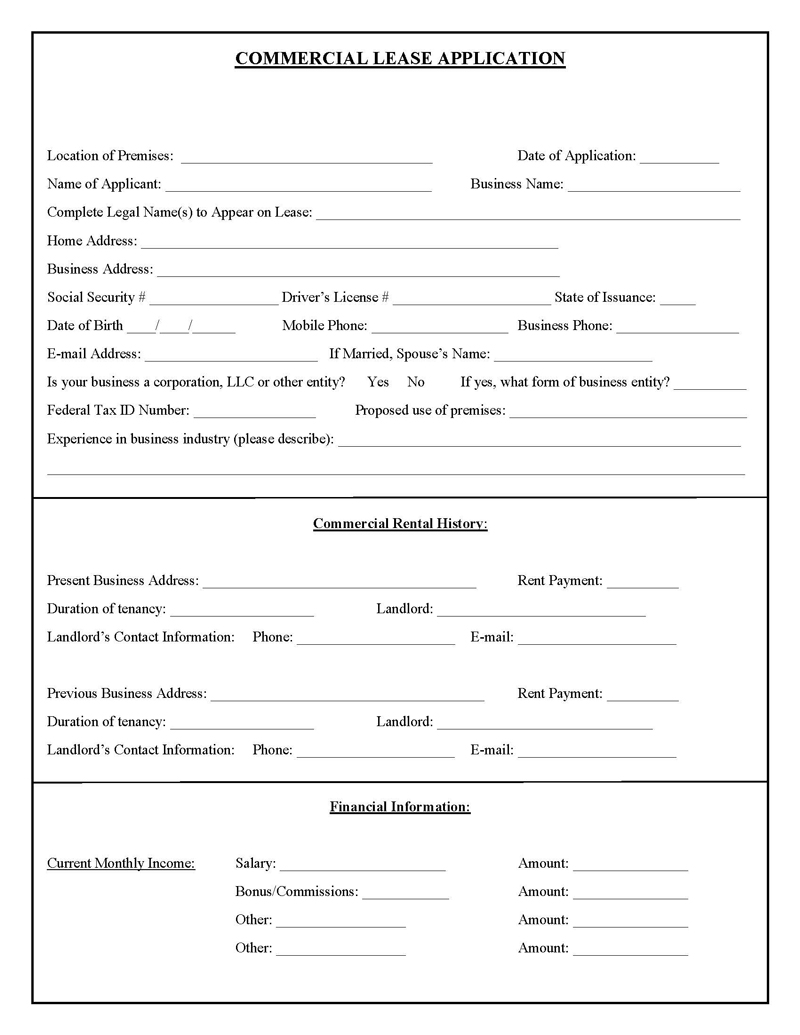

Commercial rental history

The next step is to obtain the tenant’s rental history. This section should contain information about whether the prospective tenant is currently renting; if so, the business’s address, the rent amount, and the landlord’s name should be stated. If they own the space, it should be indicated. Contact information such as the phone number and mailing address of the landlord should be provided. If the applicant had previously rented another commercial property, similar information about the previous rental property and landlord should be given.

Credit reference

Prospective tenants must provide third parties that can be contacted to verify the information they provide in the commercial lease application form. Therefore, the form should outline the references by name and indicate their address, valid phone numbers, and email addresses. Credit references can be a financial lender, credit card, or loan establishment. References are contacted later to verify the applicant’s creditworthiness.

Current monthly revenue

Next, the form should have a section where the applicant declares their business finances.

The following information ought to be presented in the form:

- Gross revenue: The form should outline the business’s annual gross revenue. Knowing the company’s finances can help in sorting out applicants.

- Total expenses: Total expenses of the previous fiscal year of the business should also be declared. Knowing how much a business spends can show its commitment to settling debts which is a desirable trait in tenants.

Current assets

Assets are essential in determining a business’s financial status. The application form should prompt the applicant to declare their existing assets in monetary value.

They include all of the following:

- Cash on hand and in banks: Cash on hand and in deposit accounts represents liquid money the business has and can be readily accessed. The higher the amount, the more suitable an applicant is.

- Savings account: The applicant is expected to state the amount they have in their savings account. A business with a good saving habit shows preparedness and sound financial status.

- Retirement accounts: The amount of money kept in the company’s retirement accounts should be stated as it contributes to its valuation.

- Accounts receivable: Accounts receivable are any monies owed to the business. They represent the business’s accessible funds. The total accounts receivable should be declared.

- Insurance cash surrender: Insurance cash surrender refers to the money an insurance provider awards the business (the policyholder) if the business decides to cancel the policy or contract. The total amount the business can claim as insurance cash surrender should be evident in the application form.

- Stocks and bonds: The form should state the value of the company’s total stocks and bonds. This amount makes up part of a company’s wealth.

- Real estate: The tenant should be prompted to declare any real estate property the company owns. Real estate presents assets that can be liquidated and contribute to a company’s valuation.

- Vehicles: The form should outline the total value of vehicles the company owns as they are part of its assets.

- Other personal property: Any other personal property that establishes the company’s financial status should be declared. Again, the total value should be written down in this section.

- Total assets: Finally, the total value of the current assets should be clearly indicated.

Current liabilities

The next section should address the business’s liabilities. The value of the liabilities should be declared in monetary terms.

Some of the common liabilities associated with businesses are:

- Accounts payable: Accounts payable are any debts the business owes to its suppliers and other business. The exact amount owed should be stated.

- Notes payable to banks: The form should show any amount the business owes to banks or other credit-building institutions.

- Auto payments: Auto payments are any periodic payments the company is obligated to. Examples are annual taxes, annual utilities, and such.

- Other installment accounts: The form should also declare any accounts the company is obligated to make deposits to on an installment basis.

- Loans on life insurance: Most companies will have loans on life insurance. The applicant should be prompted to declare the business is liable to pay to life insurance agencies.

- Mortgages on real estate: The commercial lease application then declares any mortgage loan obligations the business has. The total value of the mortgage owed should be stated.

- Unpaid taxes: The form then outlines any business taxes due. Unpaid taxes are liabilities that influence a company’s financial status.

- Other liabilities: The form then prompts applicants to declare other liabilities. The liability should be stated, and its total value should be written down.

- Total liabilities: The total value of the business’s current liabilities ought to be declared.

Banking information

The following section on the commercial lease application form is the bank details. The form should prompt the applicant to declare their bank that can be used as banking references. The form should have the bank’s name, contact information, address, account number, and type of account. This information is used to verify the business’s assets and liabilities information. Since businesses can work with more than one bank, there should be room for at least two banks.

Credit check authorization

The next item on the application form is an authorization statement that allows one to undertake the required credit and background checks on the business and its owners. The statement should clearly indicate the names of the party giving the authorization (business/company) and the party is authorized. In addition, it should authorize third-party service providers to provide the information needed for the screening process.

Consent

Lastly, the application form should conclude by providing the tenant’s name, signature, and date of signing. By signing the document, the tenant gives consent to the credit checks and certifies that the information given in the commercial lease application form is true and accurate.

Final Thoughts

An application form is an essential tool when screening prospective tenants for a commercial lease. It is a source of information that landlords use to determine an applicant’s suitability. The screening process in commercial leasing is more intense than in residential leasing due to the legalities involved. The major types of leases in commercial leasing are gross lease, net lease, modified gross lease, and percentage lease.

Landlords should choose a type of lease that befits them before commencing the screening process. This way, they know what to look for in a prospective tenant. A commercial lease application form will typically outline the landlord’s details, business information, owner’s details, commercial rental history, credit references, business assets and liabilities, banking information, credit check authorization, and formal consent.