Sometimes, recouping a debt is not always worth the effort. It may harm the delicate relationships between you and the debtor or may imperil any future business ventures. Under that circumstance, only forgiving the debt seems to be the logical way forward. You have to draft a letter to that effect.

This is called the ‘debt forgiveness letter,’ and it endeavors to inform the debtor that he is no longer obliged to repay the earlier debt he contracted. The letter also goes by the name ‘cancel your debt.’ Apart from notifying the debtor that he is no longer under any obligation to repay the debt, this letter also frees the collateral.

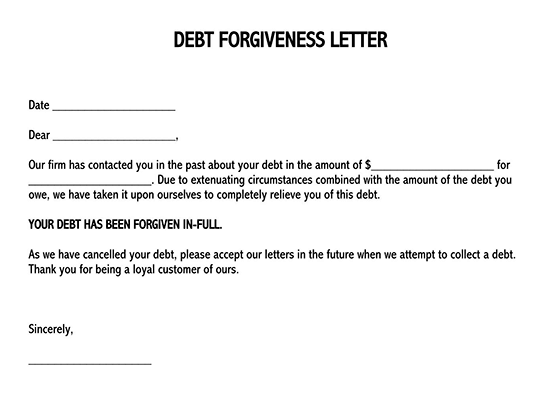

Free Templates

Common Reasons and Causes to Draft this Letter

This letter is mainly drafted in response to the emergence of financial hardships.

Common causes of these financial hardships include:

Severe damage to property

If and when your property experiences severe damages, the income that arises from it may be compromised. This may impact on your ability to repay a debt.

Jail terms

Obviously, you cannot service a loan while at the same time, serve a jail term. If you are convicted, you will find a nice excuse not to repay your debt.

Military deployment and duty

Some military duties require that you detach yourself from your home country or active employment. This again interferes with your ability to service existing debt.

Work relocation

Other than military engagements, some work relocation activities may demand that you detach yourself from your normal places of residence. These, too, impact your ability to service a debt adversely.

Divorce or death in the family

When partners divorce or when a partner dies, there is bound to be a loss of income that used to be brought in by the departed partner. This may also warrant dent forgiveness or the inability to keep servicing a debt obligation.

Failed business ventures

If a debt was contracted principally to start a business, its repayment will rely heavily on the success of the business venture. The ability to repay the debt may yet again be compromised if the business fails to take off.

Reduced working hours

To be able to repay any debt, the borrower has to work to raise the money. Most employments are pegged on the number of hours worked. A reduction in the same may definitely impact the ability to repay severely.

Loss of spousal income

Some debts are contracted jointly as a couple. Their repayments hence depend on the contributions that each party rakes in. A loss of spousal income from one party thus has a bearing on the ability to repay that debt.

Personal or family medical bills

Life is never smooth and linear. Some circumstances may arise unexpectedly that impact on the ability of the borrower to repay the debt. Their existence may also impact the ability to repay a debt adversely.

Loss of personal income

This is perhaps the single most significant cause of debt defaults. The loss of your own income will no doubt impact your ability to honor your debt obligations severely.

ps

Though these circumstances are understandable and justifiable, the creditor is still under no obligation to honor a debt forgiveness request. The borrower is still obliged to honor his commitment. As such, this letter merely convinces or requests the creditor to consider forgiving the debt.

What Should be Included?

It is worth noting that the letter assumes many shapes and forms, depending mainly on the exact circumstances that underlie its drafting. Notwithstanding these variations, several steps and contents must exist in each letter.

We look at these here below:

Reason(s) of the possible defaults

The letter has to contain the reason or reasons for the possible defaults. We have already explained the main reasons that may warrant debt forgiveness above. You only have to be honest with yourself here by not feigning reasons. Doing that may land you in trouble in the future.

Borrower’s present financial status

Next, you should also indicate your present financial status. Here, indicate just how much money you have as well as the ones you have already lost in the process. That is necessary, as it will give your lender as accurate a picture as possible about you. Be ready to back those facts with proof.

Present repayment capacity

It is not always a given that you will receive 100% financial debt relief. Thus, you, too, should be ready and willing to make some payments, albeit in part. State this detail in the letter as well. Let your lender know just how much of the debt you may be willing to repay.

Proof of hardship

We have already stated and explained above that you will have to back your claims or allegations with hard facts. This entails furnishing foolproof evidence of the existence of issues that may prevent you from repaying your debt in full or on time. They include medical records and bank statements, among others.

Any other viable alternative(s)

In the unlikely event that you are not granted the full debt relief you request, what alternatives may you be willing to explore?

for instance

Are you willing to extend to repayment period, accept reduced rates of interest, or repay a portion of the debt instead of the 100% waiver? State those alternatives also for the consideration of your creditor.

The Tone of the Letter

Considering that this is a formal letter and it dares to invoke the mercy of the lender, the tone has to be polite and respectful. You should never show any signs of anger or wrath, even if you are. Then,

remember

The letter is a mere request. You are not entitled to any debt relief at all. Use words and approaches that capture and convey those vividly.

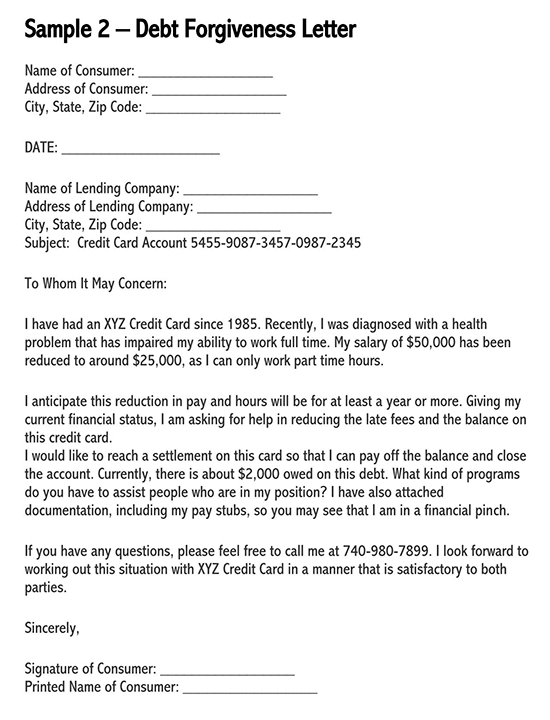

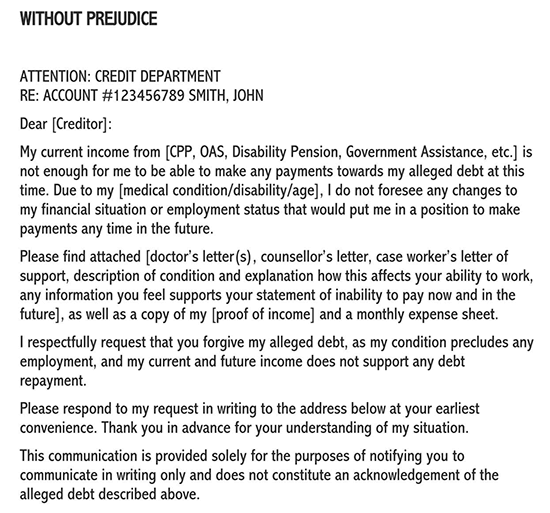

Sample Letters

Presented below are two exemplary debt forgiveness letters, offering you a tangible starting point and guidance when expressing your request for financial assistance.

Traditional Format – Debt Forgiveness Letter

Dear Mr.Jonathan,

I trust this letter finds you well. I am reaching out to discuss my current financial situation and the possibility of debt forgiveness concerning my loan with XYZ Bank, account number 987654321. I want to provide you with a comprehensive overview of my circumstances.

The primary reason for my financial hardship is an unexpected natural disaster that devastated my community. My home, along with many others, was severely damaged, and I lost nearly all my possessions. The expenses related to rebuilding my life have created an overwhelming financial burden, making it incredibly challenging for me to meet my financial obligations, including my loan repayments.

I have attached copies of insurance claims, repair bills, and bank statements for the past six months to illustrate my current financial status. These documents clearly show the extensive costs associated with recovery and the resulting strain on my income.

While my intention is to honor my debt, my current financial situation necessitates a modified repayment plan that is more sustainable. I propose a reduced monthly payment plan to pay $200 less per month for the next 12 months to ensure that I can continue making payments.

Attached, you will find the relevant insurance claims, repair bills, and bank statements as evidence of the hardships I am facing due to the natural disaster.

Should full debt forgiveness be unattainable, I am open to exploring alternative solutions that are equitable for both parties. These alternatives may encompass extending the repayment period, reducing the interest rate, or making partial payments towards the outstanding balance. My goal is to find a solution that benefits both myself and the lender.

I kindly request your understanding and consideration of my situation. I believe that, working together, we can discover a mutually beneficial resolution that enables me to honor my debt while managing my current financial challenges. I am prepared to provide any additional information or documentation you may require to facilitate this process.

Thank you for your attention to this matter. I eagerly anticipate your response and the opportunity to discuss potential solutions.

Sincerely,

John Anderson

[Contact Information]

Email Format- Debt Forgiveness Letter

Subject: Request for Debt Forgiveness – Account Number 987654321

Dear Ms. Turner,

I hope this message finds you well. I am writing to discuss my current financial circumstances and explore the possibility of debt forgiveness regarding my outstanding loan with XYZ Bank, account number 987654321. I want to provide you with insight into my situation and the challenges I am currently facing.

My financial hardship stems from a unique set of circumstances. I recently experienced a sudden and unexpected career change that significantly impacted my income. This shift has made it exceptionally challenging for me to meet my financial obligations, including my loan repayments.

I have attached electronic copies of the termination notice, updated income statements, and bank statements for the past six months to demonstrate my current financial status. These documents clearly show the change in my income and the resulting strain on my ability to make timely payments.

While I remain committed to repaying my debt, my current financial situation necessitates a modified repayment plan that aligns with my new income level. I propose a reduced monthly payment plan with terms that include paying $200 less per month for the next 12 months to ensure consistent payments.

The attached termination notice, updated income statements, and bank statements provide concrete evidence of the financial challenges I am facing due to the career change.

In the event that full debt forgiveness is not possible, I am open to exploring alternative solutions that are fair and reasonable for both parties. These alternatives may encompass extending the repayment period, adjusting the interest rate, or making partial payments toward the outstanding balance. I am committed to finding a resolution that works for both sides.

I kindly request your understanding and consideration of my situation. I believe that, through collaboration, we can identify a mutually beneficial solution that allows me to fulfill my debt obligations while navigating my current financial circumstances. If you require any additional information or documentation, please feel free to let me know, and I will provide it promptly.

Thank you for your attention to this matter. I look forward to your response and the opportunity to discuss potential solutions.

Sincerely,

James Walker

[Contact Information]

Analysis

Both sample debt forgiveness letters serve as comprehensive guides for individuals seeking to draft similar requests. They share a common structure, beginning with a polite and professional tone, followed by a clear identification of the loan account and an honest explanation of the financial hardship. What sets them apart as comprehensive guides is their inclusion of crucial supporting documentation such as insurance claims, bank statements, and termination notices, which substantiate the claims made in the letters. This use of evidence adds credibility to the requests, making them more persuasive.

Moreover, the letters propose a modified repayment plan. This demonstrates the writers’ commitment to repaying their debts while taking into account their financial constraints. Additionally, they express a willingness to explore alternative solutions if full debt forgiveness is not feasible, which shows a cooperative attitude and a desire to find a fair resolution for both parties.

Both letters effectively convey a sense of urgency and anticipation for a response, underscoring the importance of open communication in resolving the debt issue. In conclusion, these sample letters provide a comprehensive framework for crafting a well-structured, respectful, and persuasive debt forgiveness request.

Frequently Asked Questions

Not necessarily! If it happens normally or under debt forgiveness programs, it is unlikely to affect your credit score. Nonetheless, if it happens in the event of bankruptcy, it may adversely affect your credit score considerably. You, therefore, have to tread this path wisely.

Yes, you may! However, there are certain risks involved in the process. Some creditors will note it and use it against you if you decide to ask them for another debt. Others may choose to list you in the credit reference bureaus.

No less than 30% of the debt would be suitable. Be willing to negotiate with your creditor, though. This also requires that you seek alternative pathways to settle the debt in case you are asked to repay a higher percentage.

Conclusion

You at least know how to go about seeking debt forgiveness. The critical pieces of information we have furnished above are no doubt well able to guide you through the process from scratch through to the finish. All you have to do is read them carefully and adhere to each step faithfully.