An Office Space Lease Agreement is an agreement used to outline the terms and conditions of leasing office space to tenants. Office space refers to commercial space used for administrative operations of a business rather than retail or manufacturing use; making it more suited for accountants, consultants, attorneys, and such.

When leasing out office space, it is crucial to have an office space lease agreement in place. An office space lease agreement primarily puts the agreed-on lease terms in writing. In addition, renting out will ordinarily involve significant amounts of money, formalities, and legal issues. An office space lease agreement is a one-stop shop to account for all these aspects.

The following scenarios will more often than not necessitate landlords to use an office space lease agreement.

- Owners of commercial property that is to be leased to a tenant(s) for the first time require an office space lease agreement to give tenants directives on carrying out operations within the premises.

- Sometimes a landlord wants to convert their commercial property from an ongoing use to rental property. An office space lease agreement helps him, or her make the change worthwhile by allocating responsibilities of maintenance and operation of the premises to tenants, for example, through a triple net (NNN) office space lease agreement.

- Landlords may at times opt not to use a lease form to lease to direct his or her tenants on how leasehold improvements should be handled. An office space lease agreement can be used to this effect for commercial office property.

- An office space lease agreement is considered a significant financial document in that it defines what is to be paid as rent and breaks down other charges billed to the tenants. In addition, lease-based liabilities and responsibilities are stipulated in the office space lease agreement, thus protecting the landlords from unprecedented surprises.

Alternate names of an office space lease agreement are;

- Office Space Lease Agreement

- Commercial Office Space Lease

Free Agreement Templates

Types of Office Leases

Like other commercial property leases, office space leases typically have more money involved and are more complex than residential property leases. Despite having these common characteristics, office space lease agreements can differ from one lease to the other.

These differences due to flexibility of terms produce the following categories of office space lease agreements;

Co-working lease agreement

A co-working lease agreement is used by commercial property owners who rent out office space to multiple distinct businesses meaning tenants have to share the space, utilities, or certain services.

This type of leasing is convenient for multi-unit commercial office spaces. Office sub-leasing is more appealing to tenants looking for a flexible, short-term month-to-month lease where the tenants are considered “members” of the space and the landlord covers all operating expenses; therefore, landlords should be prepared to come up with terms that fit this scenario in the office space lease agreement. Remember, month-to-month leases can be terminated at any time with just a thirty (30) days’ notice.

Gross lease

Alternatively referred to as a full-service lease is one of the most commonly used commercial lease type for office space. It is known to be more appealing to most tenants. In a gross lease, the landlord charges his or her tenants a collective higher payment every month. Still, he bears the responsibility of paying for all office space-related expenses, including property insurance, property taxes, janitorial services, maintenance, and repairs. On the other hand, the tenant is expected to pay their utilities and services in a gross lease. Due to the fluctuation of the expenses, landlords will typically include an “escalation clause” to accommodate the difference, especially when it comes to insurance and taxes.

Modified gross lease

Modified gross leases offer a wider range of negotiations, especially for operating expenses. Tenants are expected to pay a fixed rent amount and contribute to the Common Area Maintenance (CAM) fees, office space property insurance, and property taxes. The landlord and the tenant agree on what each party will cover in a fair and balanced manner.

Triple net (NNN) lease

Operation and maintenance of a commercial property will typically involve the following expenses; property insurance, property taxes, and CAM expenses, normally referred to as the three “net” operating expenses. In a triple net (NNN) lease, the responsibility of the three “nets” is transferred to the tenant(s). In addition, other expenses such as janitorial services and utilities of the office space are also for the tenant to cover on top of the base rent.

How to Rent Out Office Space

Commercial property owners aim to have a good return of investment when renting out office property. It is also desirable if one can get compliant tenants.

To achieve these distinct and significant aspects of a lease, one can follow the steps to lease out the property mentioned below.

Find a tenant

The process of leasing out office space is initiated by finding potential tenants for the property. The recommended and most efficient way of finding tenants is online. There are numerous sites where landlords can list office spaces, and tenants can check out the listing and determine if they meet their needs. Finding tenants is in itself a process that involves the following;

Advertise office space

An efficient means of online marketing of office spaces is social media. One can post the ad on chat rooms and forums where people who would typically be interested in leasing commercial leases congregate. Landlords should consider trying the following online platforms;

- LoopNet – LoopNet is the most popular of these sites.

- Co-Star

- Square Foot

- Instant Offices

The ad should state the rental rate, square footage of the office space, location, and type of office space. One can also indicate the class of the office space; there are three classes of office space, that is, class A, Class B, and class C depending on the age or quality, design, furnishing of the office space.

Schedule an appointment

Once prospective tenants start to reach out, the next step is to have in-person interviews to better understand who they are and ask pertinent questions. Then, one can conduct meetings themselves or hire a real estate agent to represent them. This meeting can be held at the premises, where the landlord or agent shows the tenant(s) around and answers questions. In addition, information such as rental rates, square footage, and amenities should be reaffirmed and showcased, respectively.

Negotiate the terms

Next, the landlord and the potential tenant should negotiate on any negotiable aspects of the space. Keeping in mind that the tenant’s financial ability is one of the primary considerations, it is important to vet more at least two potential tenants for the same space. This way, one can settle on the one that is more beneficial financially and all other ways. Factors that one can use to argue their point during negotiation include; office space quality, location, size, and type of lease. The higher the degree of each of these qualities, the more leverage one has as a landlord.

Verify the tenant

The next step is to check the tenant’s suitability as a tenant. Landlords do not want inconveniences such as theft, assault, injury, disturbance, etc., within their premises, more so in shared office spaces. To avoid such, screening tenants becomes a very important step: conduct credit and background checks on businesses and their owners. Income returns filed with the IRS going back 2-3 years can be requested from individuals to understand their financial ability better.

Give access to premise

Once the tenant has been verified, and the terms are agreeable by both parties, and the office space lease agreement has been crafted. Both parties should sign before a notary public before the last step of handing over the keys takes place. Both parties should agree on the occupation date, and any built-to-suit requirements should be agreed on. A security deposit with one month’s rent is typically required. Access to common areas such as parking lots, mailboxes, etc., should be granted at this point. Any subscriptions or services the tenant is to cover can then be placed in the tenant’s name.

Writing an Office Lease Agreement

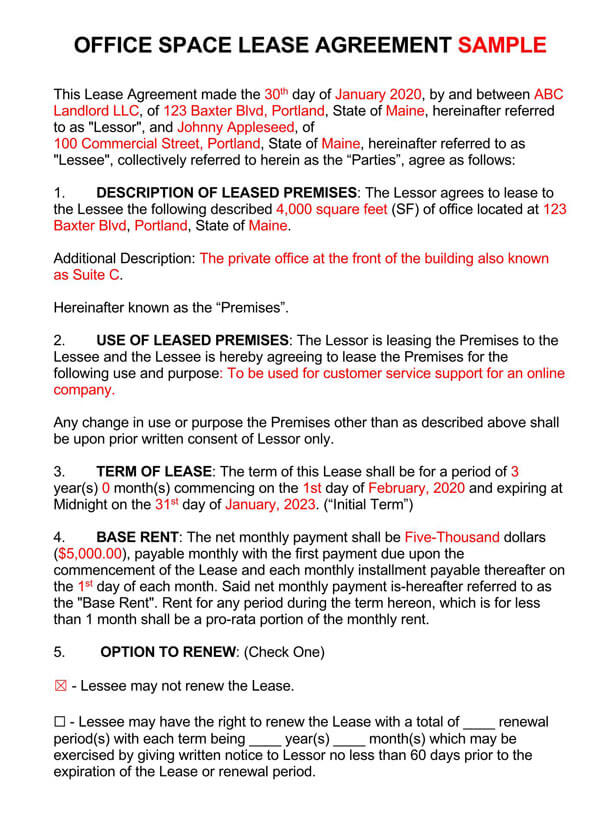

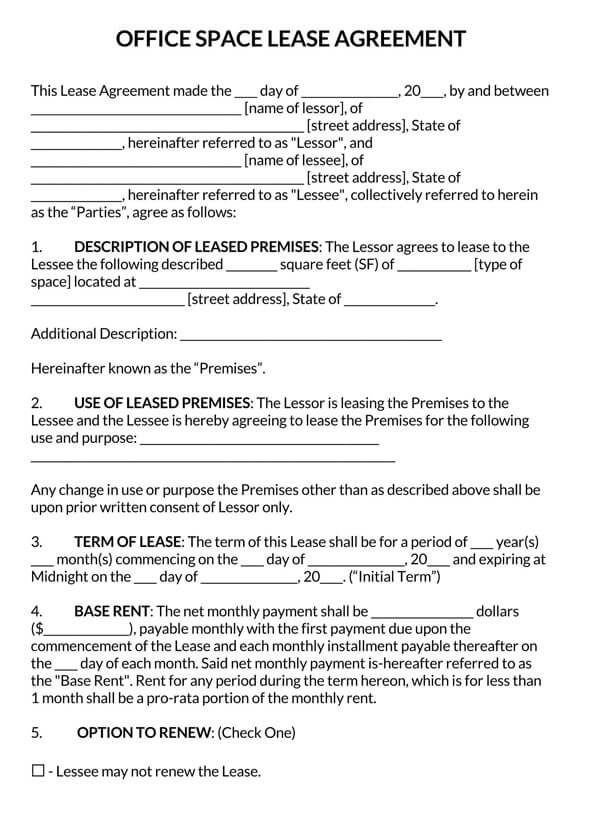

An office space lease agreement is as effective as it was written. Office space lease agreements will vary depending on the situation; however, there are certain aspects of an office space lease agreement that are common to most, if not all, office space lease agreements.

Below is the step-by-step process of writing an office space lease agreement.

Summary

The first item to be written in an office space lease agreement is a summary that introduces the agreement and involved parties.

The summary should indicate the following;

Date – There should be a date that shows exactly when the office space lease agreement was created. This is referred to as the effective date. The effective date must include the day, month, and year.

Lessor’s Details – The lessor is the landlord. Information that can be used to identify the landlord should then be provided. This includes his or her official full name and mailing address.

Lessee’s Details – The lessee is the tenant. The name and their mailing address should be provided next. Mailing addresses should give the street address, city, zip code, and state of residence or operation of the business.

Lease information for the premises

Next, the office space lease agreements should state important office space details and the lease in general as follows.

Description of leased premises – A description of the office space should first be provided stating its size (in square footage), type, and location (mailing address). Any additional details that can be used to describe the space can be included in this section.

Use of leased premises – The following item to be written is the use of the office space. The use should include all the operations tenants are allowed to carry out within the office space.

Term of lease – Subsequently, the length of the period in which the tenant intends to lease the office space should be clarified. How is the lease term defined? It is defined by stating the starting and ending date of the lease. Dates should be given as day, month, and year.

Base rent – Next, have the base rent for occupation and use of the office space declared. It should be clear how much the tenant will be paying as base rent by indicating the exact figures in the appropriate monetary unit. The due date of every month must also appear in this section.

Option to renew – Sometimes, it might be necessary or professional courtesy to renew a tenant’s lease after the expiration date. The landlord must declare if this option to renew will be available to the tenant. In cases where tenants can renew, the office space lease agreement should show how many renewal terms each tenant is allowed and the length of the renewed term. Other terms of renewal, such as whether rental rates will increase and by what percentage or how much, must be stated here.

Required financial definitions

The next step in crafting an office space lease agreement is declaring additional expenses tenants are expected to pay on top of the base rent. At this point, ensure that the financial responsibilities of the tenants are clear. This is achieved by stating whether the lease is Gross, Modified Gross, or Triple Net (NNN). These types of leases are already discussed earlier in the article.

Predetermined expenses should be declared by stating them in figures and appropriate monetary units.

Security deposit – Ordinarily, a security deposit must be paid. The office space lease agreement must state how much is to be paid and its due date at this point.

Leasehold improvements – Some tenants will request that certain alterations or improvements be done on the office space before they can take occupation. These leasehold modifications must be listed, and the party responsible for their expenses is declared in this section.

Terms governing default payments should also be included together with the applicable ramifications. Typically an interest rate of the amount due or late fees will be imposed. The number of days tenants are awarded for delaying payment should also appear in this section.

Miscellaneous terms and governing laws

More often than not, a landlord will always have additional terms and laws that require to be addressed for the smooth execution of the lease.

These terms are outlined below:

Signs – Businesses will commonly need to put up signs for advertising. Display of signs must be done in an orderly fashion to be effective. Tenants should be obligated by the office space lease agreement to request a permit to place signs, and declaring this in the agreement is an effective way to achieve this.

Governing laws – Office space lease agreements are governed by state laws, and as a result, it is important to indicate the state whose jurisdiction governs the agreement at hand.

Notices – In most cases, issuing notices will happen at one point or the other during the lease term. Outline how notices shall be issued by providing the addresses of the landlord and the tenant to which the said notices will be sent.

Signatures

Like other legally binding agreements, state signing requirements must appear on the office space lease agreement for it to serve that purpose.

Binding effect – Firstly, there must be a declaration of the binding effect of the office space lease agreement between the landlord and the tenant. This should be followed by providing the date when the agreement was signed.

Handwritten signature – The landlord’s signatures and the tenant should then appear next together with their names. Typically the tenant precedes the landlord in signing.

Notary acknowledgment – Lastly, an office space lease agreement should be notarized. The notary public’s signature, name, and county or state represented must appear at this point. This information appears in acknowledgment of the notary public.

eSignature – eSignatures can be included in the agreement. These are digital signatures that electronically record whether an individual signed a document.

Frequently Asked Questions (FAQs)

No. Either party must communicate their wish to renew the lease, or the other party chooses to agree or decline.

The availability of things other than the basic cubicles, reception areas, public restrooms, and space for offices will vary from one lease to the other. Providing them as the landlord is an incentive for tenants, but it is not required by the standard practice of commercial office leasing.

This depends on the aspect of the lease at hand. Depending on the negotiations and type of lease, the obligation of insurance for different things will often be interchanged from one lease to the other.