When applying for a visa, enrolling in a mortgage scheme, or attempting to access certain privileges, you will have to verify that the bank account you have is active, legitimate, contains the right amount of funds and was not opened specifically for accessing that particular privilege.

This is where the bank account verification letter comes in. It is a letter that verifies that you indeed have an account with the bank, claim to have the necessary balance in that account, and are hence qualified to access the specific privilege that you are asking for.

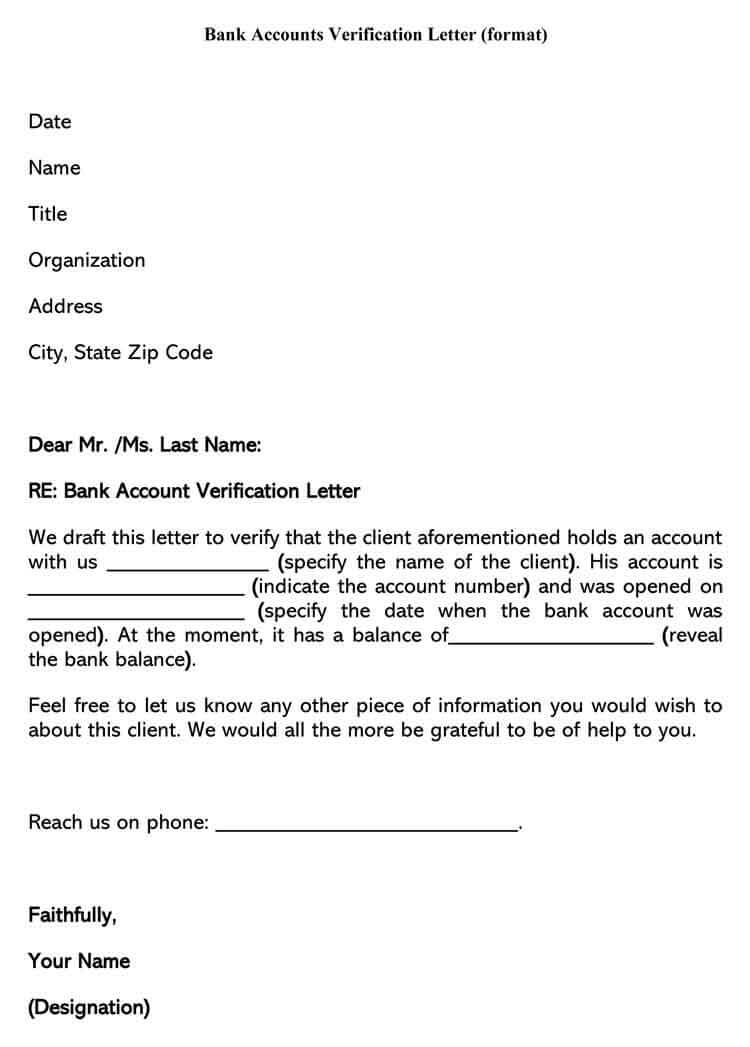

Free Templates

Purpose of the Bank Accounts Verification Letter

This letter serves two main purposes. These are:

Verify the availability of funds

It verifies the availability of funds, i.e., that the bank account in question indeed has the funds that it purports to contain. This piece of information is crucial in the sense that it is the one that is relied on to further deduce whether the applicant should be granted the privilege or not.

Confirm the veracity of the account details

Next, it confirms the veracity of the account details. That means it indicates the names of the account holders, when the account was opened, the account number, and the current balance. The letter also goes ahead to provide other details that the requester might want outside of these standards.

What to Include in a Bank Accounts Verification Letter

A typical bank account verification letter comprises the following pieces of information:

- Name of Requester – This is the person or entity that is seeking to have the account records of an applicant verified. It could be an individual, a corporate entity, or a consulate.

- Name and Address of the Bank Branch – It is the name of the bank plus the branch wherein the account holder has an account. These two uniquely identify the place where the client has had his money stashed.

- Name of the Account Holder – Now, this is the person whose financial records are presently being verified. The name has to be official, just as it would appear on various documents like passports and birth certificates.

- Account Number – The account number uniquely identifies one account from another. It specifies exactly where the client has an account to avoid any doubt.

- Date of Account Opening – When was the account opened? This piece of information describes when exactly the account in question was opened by furnishing the precise dates and times when that happened.

- Outstanding Balance – This refers to the amount of money that is present in that account. It is the one that is subsequently used to argue a case about the suitability of the applicant to the privileges sought by him.

Bank Accounts Verification Letter Template

[Bank’s Letterhead]

[Bank’s Address]

[City, State, ZIP]

[Date]

To Whom It May Concern,

Re: Verification of Banking Details for [Account Holder’s Full Name]

As the [Position, e.g., Branch Manager] of [Bank Name], I am writing to confirm the banking details of our client, [Account Holder’s Full Name], as per their request.

Account Information:

- Account Holder: [Full Name]

- Account Number: [Complete Account Number]

- Type of Account: [Checking/Savings/Other]

- Account Status: [Active/Inactive]

- Date Opened: [Date]

- Current Account Balance: [Amount]

This letter serves to affirm that [Account Holder’s Full Name] has been a client of [Bank Name] since [Account Opening Date]. The account is currently [Active/Inactive], and as of the date of this letter, the balance stands at [Current Account Balance].

This verification is provided at the request of our client for [Specify Purpose: e.g., loan application, financial verification, etc.].

Bank’s Contact Details for Further Verification:

- Branch: [Branch Name]

- Contact Person: [Contact Person’s Name]

- Position: [Position in Bank]

- Contact Number: [Phone Number]

- Email Address: [Email]

We assure you that the information provided herein is accurate and up-to-date to the best of our knowledge. Please feel free to reach out to us for any further clarifications or additional information.

This document is confidential and intended solely for the use of the individual or entity to whom it is addressed. Any unauthorized review, use, disclosure, or distribution is prohibited.

Yours faithfully,

[Signature of Bank Official]

[Name of Bank Official]

[Position]

[Contact Information]

[Bank’s Official Stamp or Seal]

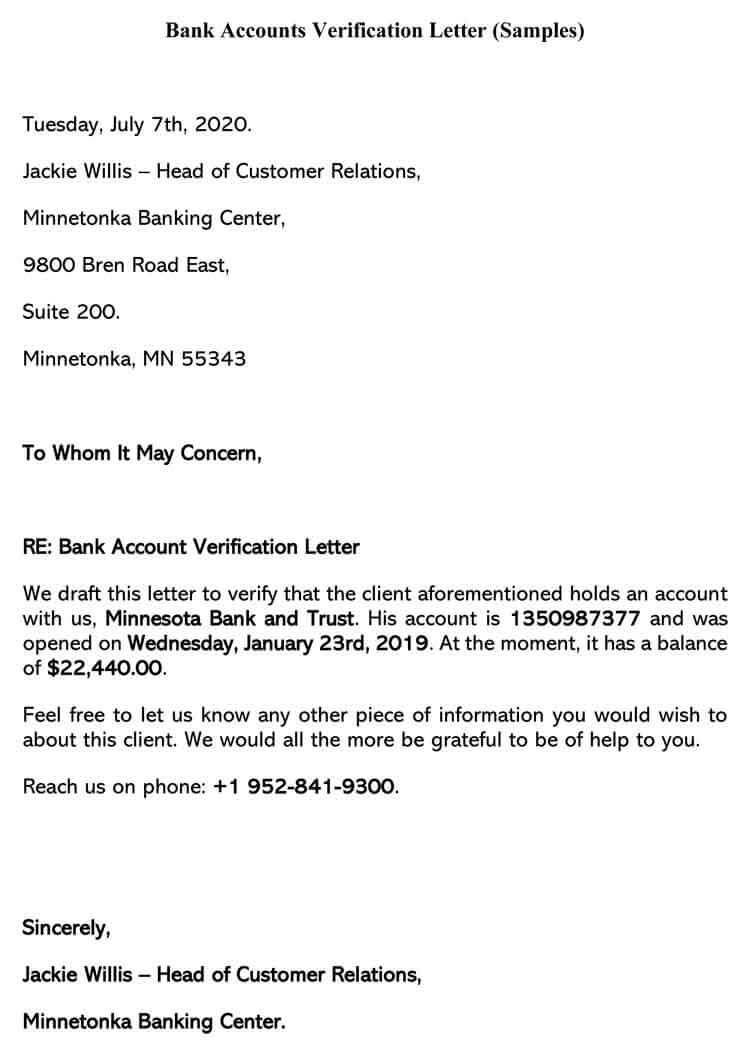

Bank Accounts Verification Letter Sample

To Whom It May Concern,

Re: Verification of Bank Account – John Doe

I am writing in my capacity as the Branch Manager of First National Bank, New York Branch, to confirm the banking details of our client, Mr. John Doe.

Account Information:

- Account Holder: John Doe

- Account Number: 000123456789

- Type of Account: Checking

- Account Status: Active

- Date Opened: March 10, 20XX

- Current Account Balance: $5,250.00

This letter is to certify that Mr. John Doe has been a valued client of First National Bank since March 10, 20XX. His account is in good standing and currently active, with the balance as stated above.

This verification is provided upon the request of Mr. Doe for the purpose of his mortgage application with XYZ Mortgage Company.

Bank’s contact details for further verification are:

- Branch: New York Branch

- Contact Person: Jane Smith, Branch Manager

- Contact Number: (123) 456-7890

- Email Address: jsmith@firstnational.com

We confirm that the information provided in this letter is accurate and current as of the date of this letter. Please do not hesitate to contact us should you require any further information or clarification.

This document is confidential and intended for the specified use of verifying Mr. Doe’s bank account details for his mortgage application. Any other use of this information is strictly prohibited.

Yours sincerely,

[Signature]

Jane Smith

Branch Manager

First National Bank, New York Branch

Phone: (123) 456-7890

Email: jsmith@firstnational.com

[Bank’s Official Stamp]

Things to Keep in Mind

There are things you have to keep in mind when drafting a letter of this kind. These are:

- Confidentiality: You have to see to it that you maintain strict confidentiality when drafting such a letter. Never fall into the temptation of leaking the client details to third parties or the general public. Financial transactions are guarded by strict laws that are way too punitive even to contemplate breaking.

- Accuracy: The pieces of information you provide have to be accurate and verifiable. Lying to the relevant state authorities will only serve to make your life more difficult. You do not want to land in such trouble at all, do you?

- Wholesomeness: Also, ensure that the information you provide is wholesome. Wholesome here infers that you have to provide the information that the requester asked for over and above the standard details that a letter of this kind is ordinarily supposed to contain.

- Timeliness: You have to work within strict timelines. This is informed by the fact that financial records are volatile and change now and then. Any slight delay might alter the records and subsequently compromise the accuracy of the pieces of information you include in the letter.

- Professional Tone: As with any other official letter, this one too has to bear a professional tone. Avoid using unofficial terms and words that may water down the meaning and seriousness that the letter is naturally supposed to bear. That will boost its seriousness, too.

Frequently Asked Questions

We now take a look at some of the questions that are consistently asked with regard to this letter here below:

It all depends on your bank. Generally, though, you will be required to approach the customer service officer and argue your case there. You will receive the necessary directions and guidelines, which you will eventually follow to get your way.

Yet again, this all depends on your bank. On the whole, though, most banks take roughly 3 working days, give or take, to process the letter. It is therefore imperative yet again that you confirm this piece of information with your bank beforehand.

It need not necessarily be notarized, not unless the requester demands that it be. Only the official seal of the bank, the company letter, and the relevant signatures and stamps are needed to grant the letter the official character it is supposed to have.

Conclusion

In conclusion, this article serves as a comprehensive guide for banks seeking to enhance the efficacy and professionalism of their bank account verification letters. By offering templates, sample letters, and valuable tips, the content empowers you to articulate information clearly, concisely, and in compliance with industry standards. The provided resources not only streamline the letter-writing process but also contribute to the creation of documents that instill confidence in clients, partners, and regulatory bodies alike. As the financial landscape continues to evolve, the article underscores the ongoing significance of accurate and well-crafted verification letters, positioning banks to meet the demands of a dynamic and interconnected global economy with transparency and credibility.