The W-4 form is an important form to be filled out accurately to provide an employer with the correct information regarding a new employee’s taxes.

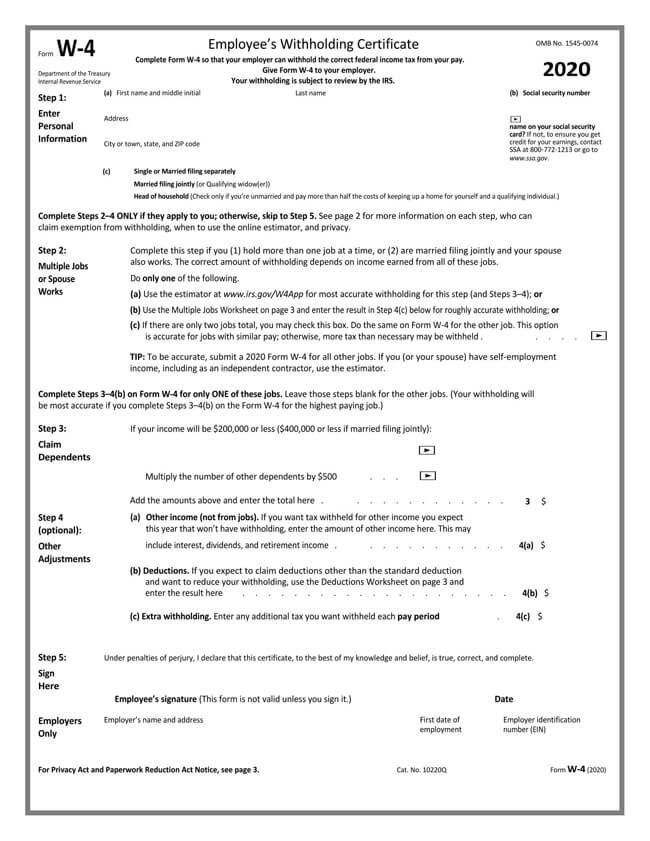

Since its overhaul in 2020, the W-4 form looks different, and a few significant changes have been affected. This article will provide all the essential information every new employee requires about the W-4 form and fill it out.

note

It is also known as the W-4 employee withholding certificate, this form is mandatory for all new employees hired as of Jan 1st, 2020.

Free Templates

Purpose of the W-4 Form

The purpose of a W-4 form is to inform an employer how much federal income tax to withhold from an employee’s paycheck. An employee is required to complete a new W-4 form every time they start a new job. An employee is obligated to request a new W-4 form when they start a new job if they neglect to provide one. If the employer does not have a W-4 form for their employee, the IRS requires the form to treat the employee as a single tax filer. This means that the employer must withhold the highest possible amount from the employee’s paycheck for taxes. The employee can only recover the amount overpaid in the next year when they file their tax return.

Income tax is meant to be paid as soon as the employee earns their income. The W-4 form exists solely to instruct the employer on how much tax to withhold from each paycheck. The employer is required to remit the amount withheld to the IRS on behalf of the employee at the end of the year, and the employer is also required to show the employee a W-2, among other things which shows the employee how much has been withheld for the year.

Changes in W-4 Form

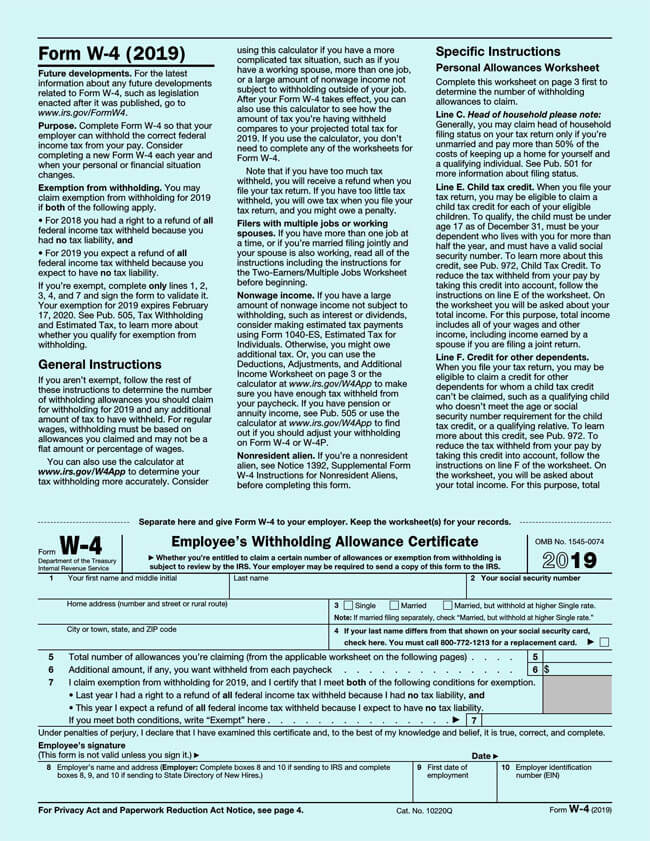

The W-4 form was revised in 2020, following the Tax Cuts and Jobs Act (TCJA) signed in December 2017, and with this effect, significant changes were made to the format of the W-4 form. Employees may need to re-examine the W-4 form previously filed and compare the information with the new W-4 form. Also, if the employee has a life change, it is always beneficial to update the W-4 form. For instance, the addition of a child. Divorce or marriage requires the employee to fill out and update the W-4 form.

Here are the changes made in the W-4 form in 2020:

Removal of allowances section

The removal of the allowances section is the most significant change made to the W-4 form. The employee is no longer required to calculate how many allowances they claim to increase or decrease their withholding. Instead, the new W-4 form requires the employee to indicate if they have more than one job, or if their spouse has a source of income and the number of dependents they have, and other sources of income apart from their jobs.

No need to provide multiple job worksheets

The employee is no longer required to turn in a multiple job worksheet, providing the employee with some privacy as to the number of jobs they have if they feel the need to keep this information from their employer.

Standard deduction doubled

Previously, the W-4 form loosely tied allowances to personal and dependent exceptions, which were cloned on the employee’s tax form. However, the new W-4 form has doubled the standard deduction as a result of the TCJA, eliminating personal and dependent exemptions.

More accessible filing process

The new format of the W-4 form was compiled to make the filing process easier for both the employee and the employer. It is less bulky and more comprehensive.

Five sections instead of 7

To make the filing process easier for both the employee and the employer, the new W-4 form has five sections instead of the previous seven sections.

How to Fill out a W-4 Form

The IRS website contains all pages of the new W-4 form. The new W-4 form is relatively straightforward.

Here are the basic requirements:

Basic personal information

If the employee is single or married to a spouse without a source of income and has no dependents, and only earned income from a single job, and not claiming tax credits or deductions other than the standard tax deduction, the process of filling out a W-4 form is very straightforward.

The new W-4 form only requires the employee to provide the following basic personal information:

- Name

- Address

- Social security number

- Filing status

- Signature

- Date

Multiple jobs or working spouse

The second step is for an employee that has more than one job or an employee whose filing status is married, filing jointly with their spouse that works. An employee with a working spouse or multiple jobs has a few options to choose from:

Option A: Use IRS’ online tax withholding estimator

The employee may use the IRS online tax withholding estimator and include the estimate in the W-4 form when applicable.

Option B: Multiple jobs worksheet

The employee may also fill out the multiple job worksheet provided on the third page of the W-4 form and enter the value, and the applicable space explained below. The employer must provide the W-4 form, which contains, on the third page, the space for the multiple jobs worksheet. The IRS only requires the W-4 worksheet to be completed and filed for the highest paying job to allow the employee to get the most accurate withholding.

The first thing the employee must differentiate when filling out the multiple job worksheet is whether they have two jobs, which include both the employee and their spouse, all three jobs, or more. If the employee and their spouse both have one job each, the employee must complete line 1 on the form. If, however, the employee has two jobs and their spouse does not work, the employee is also required to complete line 1 on the W-4 form.

The employee is required to use the graph provided on the fourth page of the W-4 form to fill in line 1 accurately. These graphs, separated by filing status, require the employee to select the correct graph based on how the employee files their taxes. The left column on the graph lists the dollar amount for the higher-earning spouse, and the top row lists the dollar amount for the lower-earning spouse.

For instance

An employee that is married and filing jointly.

If spouse X makes $80,000 annually and spouse Y makes $50,000 annually, spouse X would be required to select $8,420 the intersection of the $80,000 to $99,999.00 from the left-hand column as well as the $50,000 to $59,999 column to fill in line 1 on the multiple jobs worksheet.

If the employee has three or more jobs combined between them and their spouse, the employee would need to fill out the second part of the multiple jobs worksheet. First, the employee is required to fill in their highest paying job, followed by the second-highest paying job.

The employee should use the graphs on the front page of the W-4 form to figure out the amount to add to line-2 on the third page of the W-4 form. The step is like the example provided above, except the second-highest paying job is filled in as the lower-paying job.

Next, the employee is required to add the wages from there to the highest jobs together. The employee should use the figure from the higher-paying job on the graph on the fourth page of the W-4 form by using the wages from the third job as a lower-paying job. The amount derived from the graph should be entered in line-2b on the third page of the W-4 form. Lines 2a and 2b should be added together to complete the 2c line.

Here is another instance

Suppose spouse X has two jobs making $15,000 and $50,000 annually, while Spouse Y has one job making $40,000 annually. Spouse A would be required to enter $3,570 to line 2a. This figure is derived from the intersection of the $50000 – $59,999 row from the left-hand column and the $40,000 – $49,999 column from the top row on the fourth page of the W-4 form. Combining $50000 and $40000 gives a total of $90,000 annually, and Spouse X would enter $3,260 on line 2c. This figure is derived from the intersection of the $80,000 to $99,999 row from the top left-hand column and the $10,000 – $19,999 $19,999from the top row.

The total of both derived amounts is $6,830 for line 2c. The employee is required to enter the number of pay periods in a year at the highest paying job online free of the multiple jobs worksheet.

For instance

Monthly pay occurs 12 times in a year, while biweekly pay occurs 26 times in a year. By dividing the annual amount on line 1 or line 2c by the number of pay periods, the derived figure should be entered on line 4 of the multiple jobs worksheet as well as line 4c of the W-4 form.

Option C: For two similar jobs

Option c is for employees that have a total of 2 jobs. The employee is required to check the box in option C and do the same on the W-4 form for the other job. This action is only advisable if both jobs have a similar pay otherwise more tax may be withheld than the necessary amount.

Add dependents

If the employee has dependents, they are required to fill out step 3 to determine their eligibility for the child tax credit and credit for other dependents. Single employees who make less than $20,0000 annually or employees married and filing jointly with an annual income less than $400,000 are eligible for the child tax credit.

- Children: The IRS has a complicated and technical definition of a dependent; however, the summary is a qualifying child who leaves with the employee and supports financially.

- Relatives: According to the IRS, a relative is a qualifying dependent if the relative leaves with the employee and the employee supports the relative financially.

The employee needs to multiply the number of qualifying children under the age of 17 by $2,000 as well as the number of other dependents by $500 and enter the total sum in dollars to line three.

Adjustments

The adjustments section is used to communicate to the IRS that the employee wants an additional amount withheld from their paycheck. Although it seems counter-intuitive, the information provided by the employee in the previous sessions might result in the employer withholding too little tax over the course of the year. If this happens, the employee will end up with a large tax bill and possibly underpayments penalties and interest. It is best for the employee to inform the employer to withhold extra tax from each payment to prevent this from happening.

This might be the situation if the employee receives significant income reported on form 1099. Form 1099 is used for dividends, interest, and self-employment income. No income tax should be withheld from the sources of income in this scenario. However, the employee may also need to use this section if they are still working but receive pension benefits from social security retirement benefits or a previous job.

The fourth step of a W-4 allows the employee to have an additional amount withheld by filling out one or more of the following three sections:

4a. Other income

If the employee expects to earn income from other sources that are not jobs and therefore not subject to withholding, such as dividends or retirement accounts, the employer should indicate that in this section.

4b. Itemized deductions

The employee should fill out this section if they are expected to claim deductions such as itemized deductions other than the standard deduction and the employee wants to reduce their withholding. A deductions worksheet is provided on the third page of the W-4 form for the employee to estimate their deductions.

4c. Refined withholdings

The refined withholdings section allows the employer to have any additional tax they want to be withheld from their pay each pay period which includes any amount from the multiple jobs worksheet filled in the previous stages as applicable to the employee.

Sign and date

While the employee signing and dating a W-4 form is the easiest step of the entire process, it is just as important as any other step explained above. The form specifies that the employee is signing and declaring under penalties of perjury, that they have examined the certificate, and to the best of their knowledge and belief, the information provided is correct, complete, and accurate. The employee has to sign their name below that statement where it says, “employee’s signature,” and then write out the date to the right. The W-4 form is not valid until this step is done by the employee.

Special Considerations while Filling

If an employee starts a job in the middle of the year without previous employment earlier that year, there is a tax wrinkle that can save the employee money. If the employee is employed no more than 245 days for the year, they are required to request in writing that their employee use the part-year method to compute the withholding. The basic withholding form is formatted to assume withholding for a full year of employment. Hence, if the employer fails to use the part-year method, the employee will have to wait until tax time to recover their money.

Here are a few special considerations on filling out a W-4 Form:

- An employee is not required to fill out a new W-4 form if they already have one on file with their employer.

- The employee does not have to fill out a new Form W-4 every year. However, if the employee changes jobs or is interested in adjusting their withholdings in their existing job, they may be required to fill out the new W-4 form. Filling out the new W-4 form is an excellent opportunity for the employee to review their withholdings.

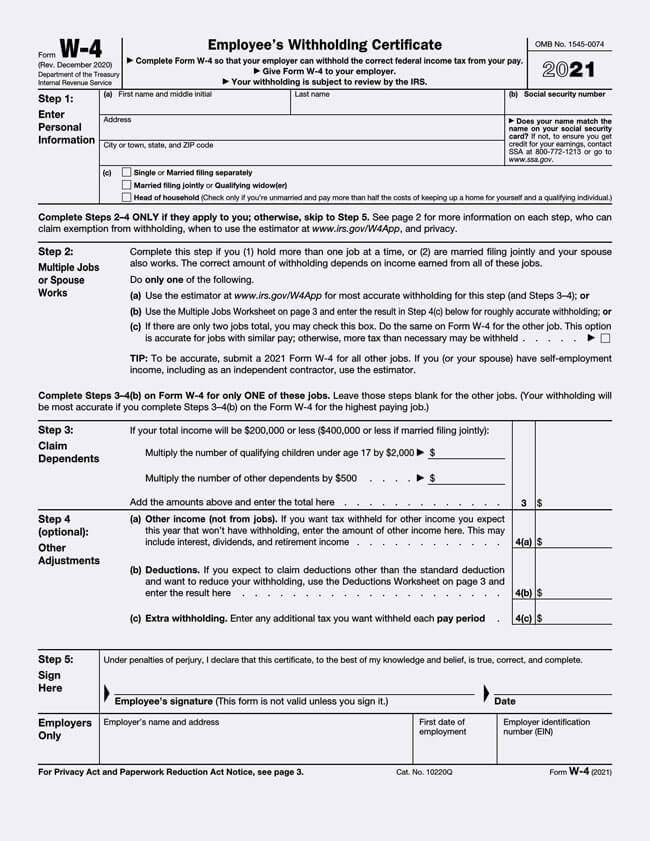

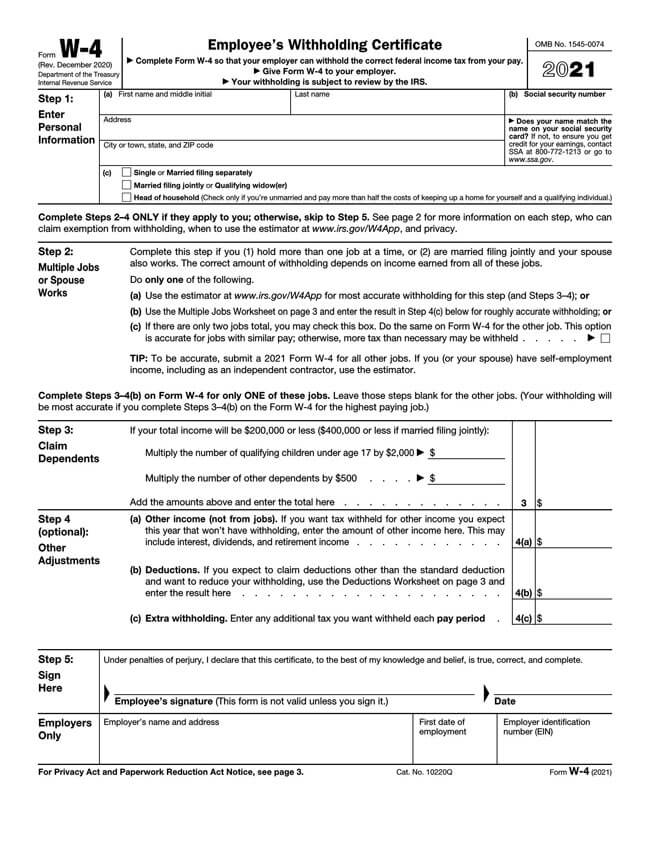

- The new 2021 form W-4 does not require the employee to choose a number of allowances.

- The question of how many allowances on the W-4 was removed in 2019; instead, the employee is required to provide a particular dollar estimate for the payroll system to use.

If the employee is single and have multiple jobs or married and filing jointly with both spouses working, the employee must keep the following in mind:

- The employee is required to have a W-4 on file for each job.

- The employee should fill out steps 2-4 on the W-4 for the highest paying job and leave the steps blank on the W-4 for the other jobs.

- If the employee is married and filing jointly with both partners earning about the same amount, the employee can check a check box indicating as much. However, it is essential that both spouses do that on each of their W-4 forms.

If the employee is exempt from withholding, they should indicate by writing “exempt” in the space below step 4 (c).

The employee still needs to complete steps 1 and 5. Furthermore, they will need to submit a new W-4 every year if they plan to continue claiming exemption from withholding.

On the new 2021 W-4, the employee can select the head of household filing status.

If an employee files at the head of household and has not updated the W-4 for a few years, it is advisable that the employee files the new 2021 W-4 if they want the amount of taxes withheld from their pay to be more accurate with their tax liability.

If the employee does not want to reveal to their employer that they have a second job or a second source of income from non-job sources.

The employee has a few options:

- The employee should instruct the employer to withhold an extra amount of tax from their paycheck on line 4(c).

- The employee may not factor the extra income into the W-4; instead, the employee may directly take out the tax from their paycheck. The employee may send estimated quarterly tax payments to the IRS instead.

What Should I Put on my W-4 Form?

For an employee unsure of what they should include on their W-4 form, here is a general strategy they can use:

- If the employee got an excessive tax bill when they filed, the employee might use form W-4 to increase their withholding. Doing this will help the employee or less or even nothing the next time they file.

- An employee that got a large refund the previous year has only needlessly lived on less of their paycheck while providing a free loan to the government. The employee may consider using the W-4 form to reduce their withholding.

Tips on Filling a W-4 Form

There are a few tips, keeping in mind while filling out the W-4 form could prove to be beneficial for you.

These include:

- Be strategic: The employee needs to be strategic when filling out the W-4 form to protect themselves from possible excessive income withholding or prosecution as a result of underpaid taxes.

- Make adjustments in the form: The employee must make the required adjustments in the W-4 form in the spaces explicitly provided for adjustments to get a more accurate withholding.

- Tax exemption: The amount of wages is subject to graduated withholding, which may be reduced by the personal exemption amount. The current personal tax exemption amount there is and can be confirmed on the IRS website.

Need for a New W-4

Typically, employers do not send form W-4 to the IRS. In general, after using Form W-4 to determine the employee’s withholding, the company files it. The employee only has to fill out the new W-4 form if they start a new job in 2021 or beyond or if they want to make changes to how much pay is withheld from their wages.

Here are some situations when an employee might need to change the information on their form W-4:

After getting married or divorced

If an employee’s marital status changes either from married to divorced or from single to married, their household income and expenditure also change significantly. Hence the employee should fill out a new Form W-4 and indicate these changes to get a more accurate withholding.

Having a child

If an employee has a child or more, the IRS regards the addition of a child to an employee’s household to be a significant life change that affects their expenditure significantly, and as such, this information should be included in a new W-4 form to get the necessary deductions and accurate taxes.

Starting a second job

The IRS regards an additional job as an additional source of income that is liable to taxes, and as such, the employee is required to indicate in the W-4 form that they have started a new job in addition to the job they already have.

Withheld too much or too little the previous year

If in the previous year the employer withholds too much or too little from the employee’s wages, the employee should fill out a new W-4 form to get a more accurate withholding, especially if the employer withheld too little and resulted in penalties in the previous year.

Difference between a W-2 and W-4

The W-2 and W-4 forms are similar only in the letter contained in their names. Unlike a W-4, the W-2 form is filled by the employer for all employees. The employer is required to file the W-2 form with the IRS as opposed to keeping and filing the W-4 form internally. The W-2 form shows the employee’s annual earnings from wages and tips. In addition, the W-2 form States the amount withheld for the year for social security local and federal income taxes as well as Medicare.

We have put together well-researched and comprehensive templates to aid your W-4 filing process and help you get the most accurate withholdings. Download our free and customized templates now to accurately file your details and prevent excessive or inadequate withholdings.

Frequently Asked Questions

When an employee is submitted W-4, they can expect the information to go into effect quite quickly. However, the exact period of time before the employee’s paycheck reflects the changes depends quite significantly on the payroll system in the organization. The employee may enquire about this period when they turn in the W-4 form.

The new W-4 form can be downloaded from the IRS website. We also have a comprehensive template and customizable templates to help make filling out a W-4 form faster.

Instruction to help fill the W-4 form is available on our website, as well as free templates for customizable and straightforward W-4 forms.