With the world becoming more digital, it is no surprise that funds can be transferred without the need for any paperwork. Being able to receive payments quickly and without going to the bank is no longer a privilege. Therefore, many employers give their workers the option of a direct deposit of their payments.

While you have probably heard of the direct deposit authorization form, it is still possible if you do not know what it is or the necessary information to include in it. This article provides a guide to the direct deposit form and what you should include in it.

What is a Direct Deposit?

It is a digital method of depositing money directly into a person’s bank account.

Direct deposit, unlike checks, transfers funds directly over electronic networks to the payee’s account. The advantage of this deposit is that payments are processed quickly, saving time. However, before using this payment option, the payee must first complete an authorization form for a direct deposit. Also, for receiving payments other than salaries, like subsidies or disability payments, you will need to submit this form.

Alternative names

The direct deposit authorization form is also known by the following names:

- Employee direct deposit form

- Employee direct deposit authorization form

- Payroll direct deposit form

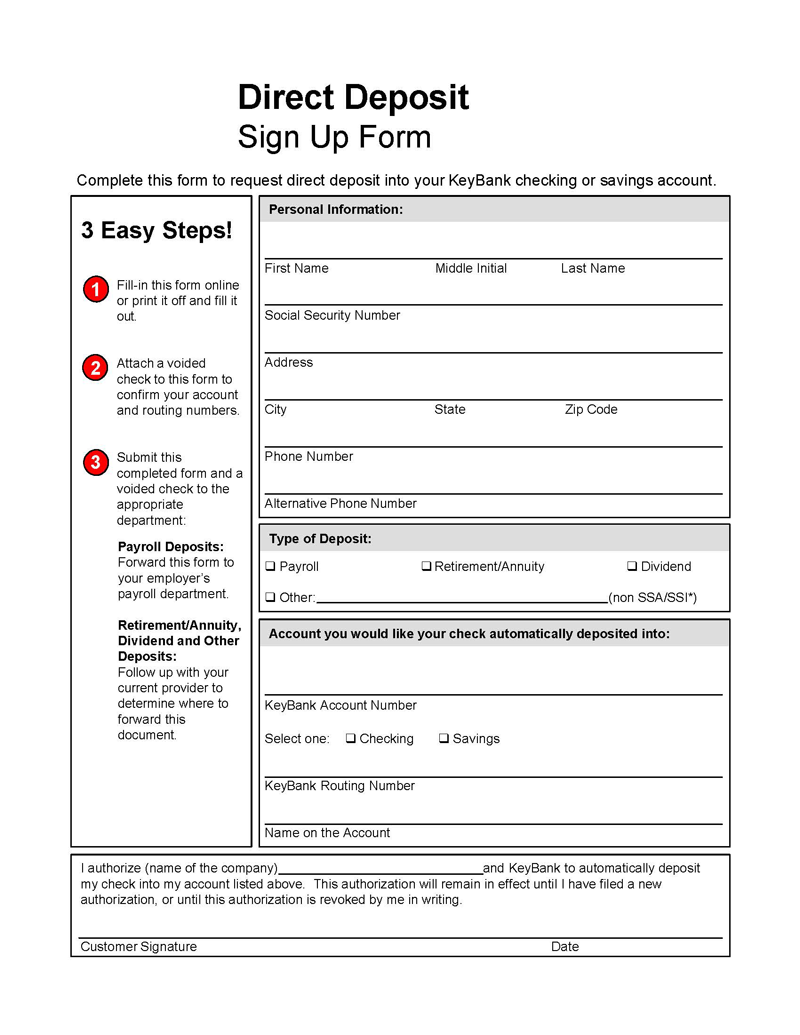

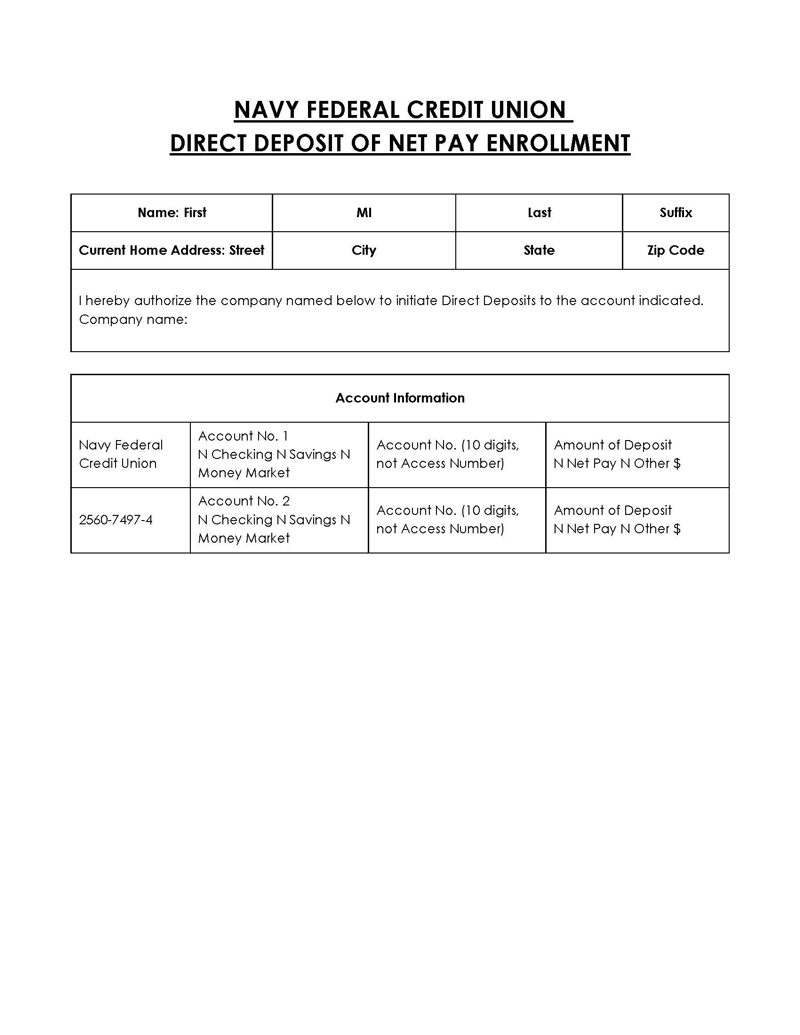

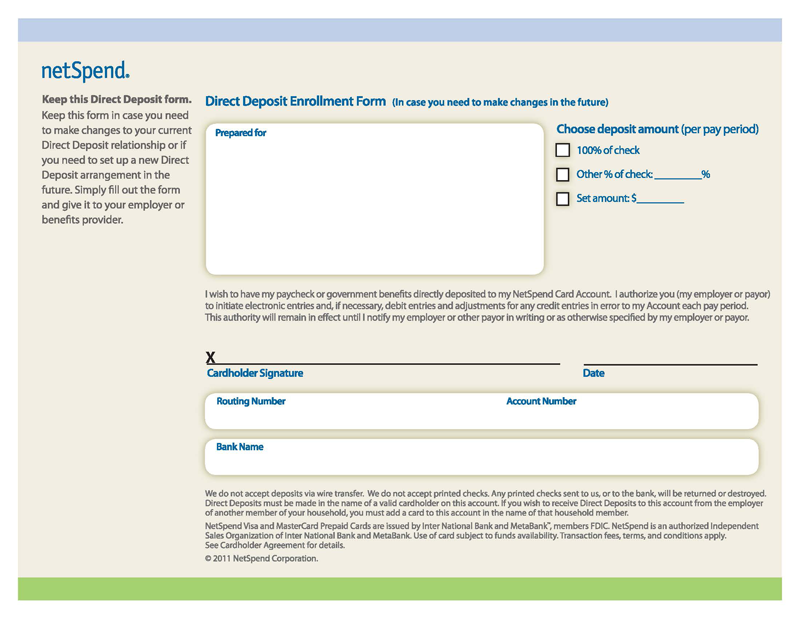

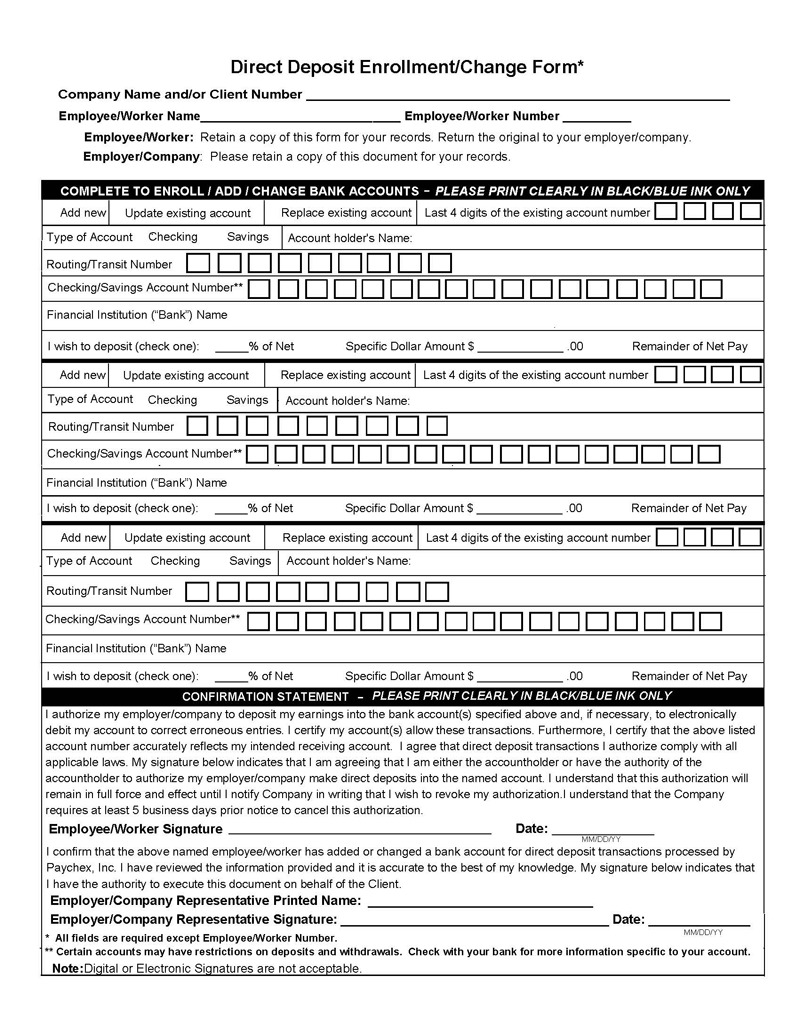

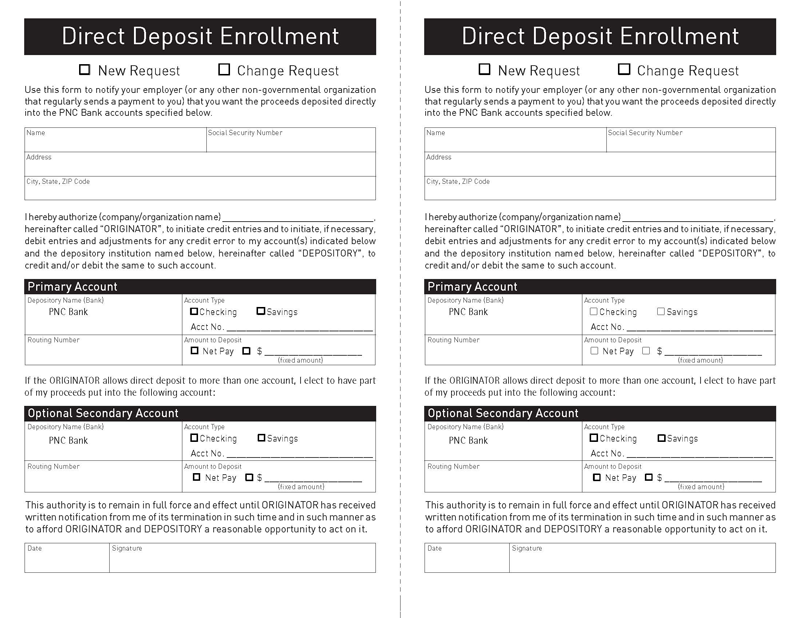

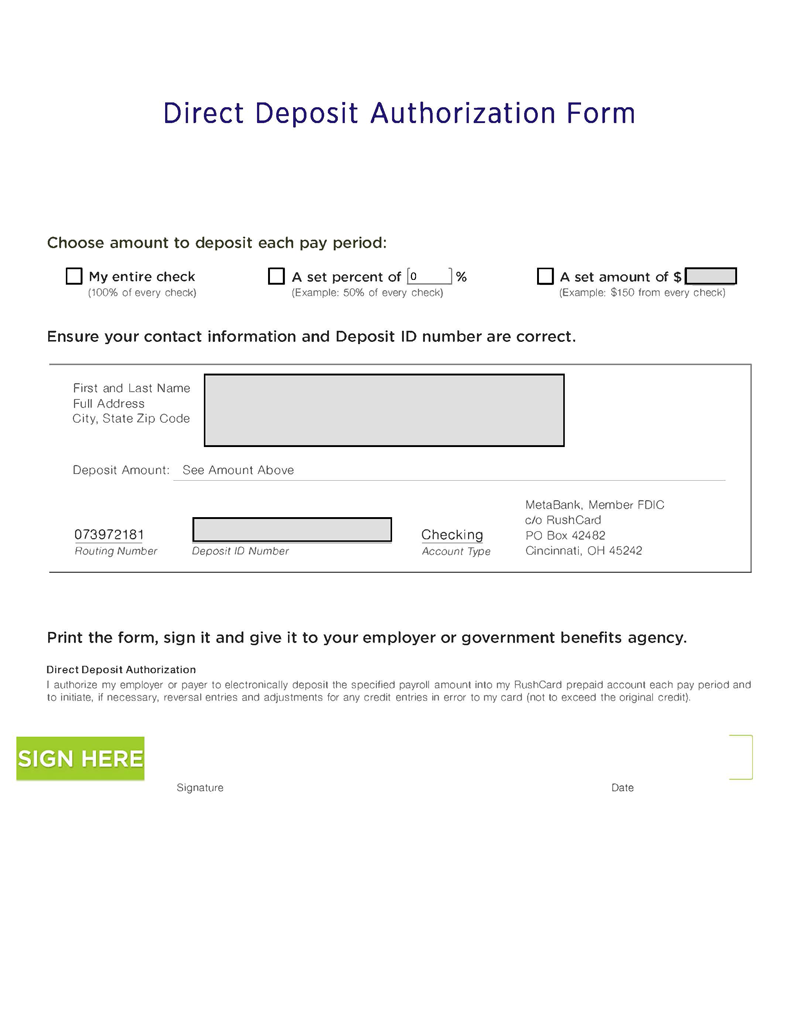

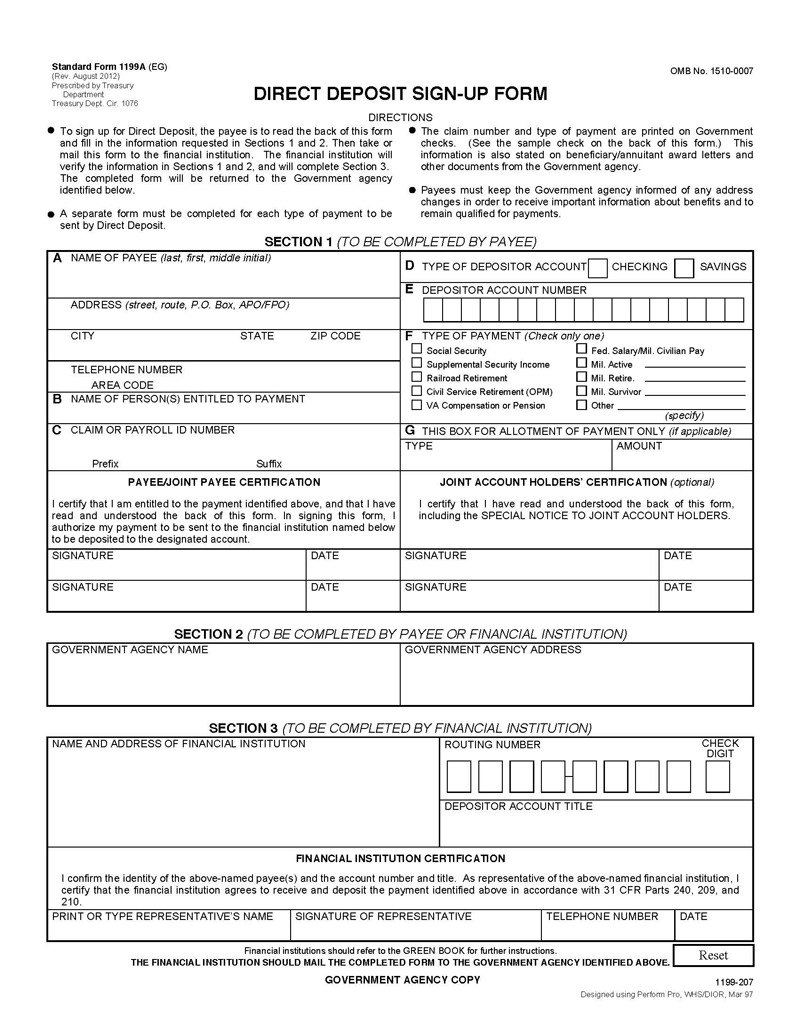

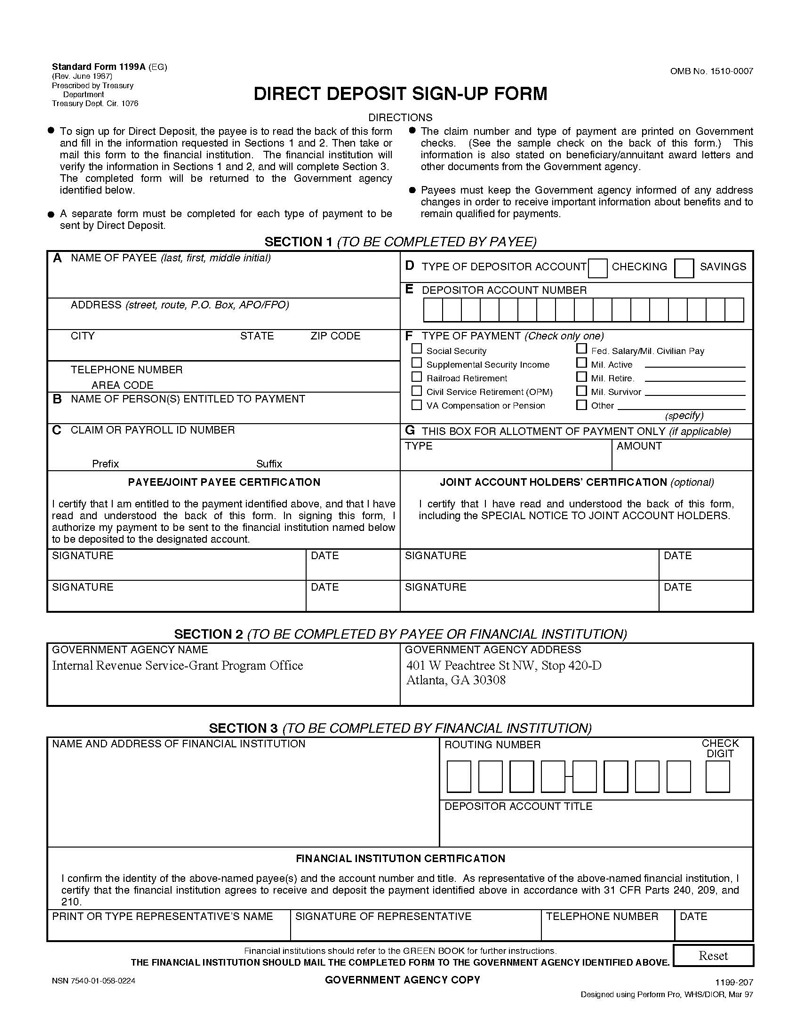

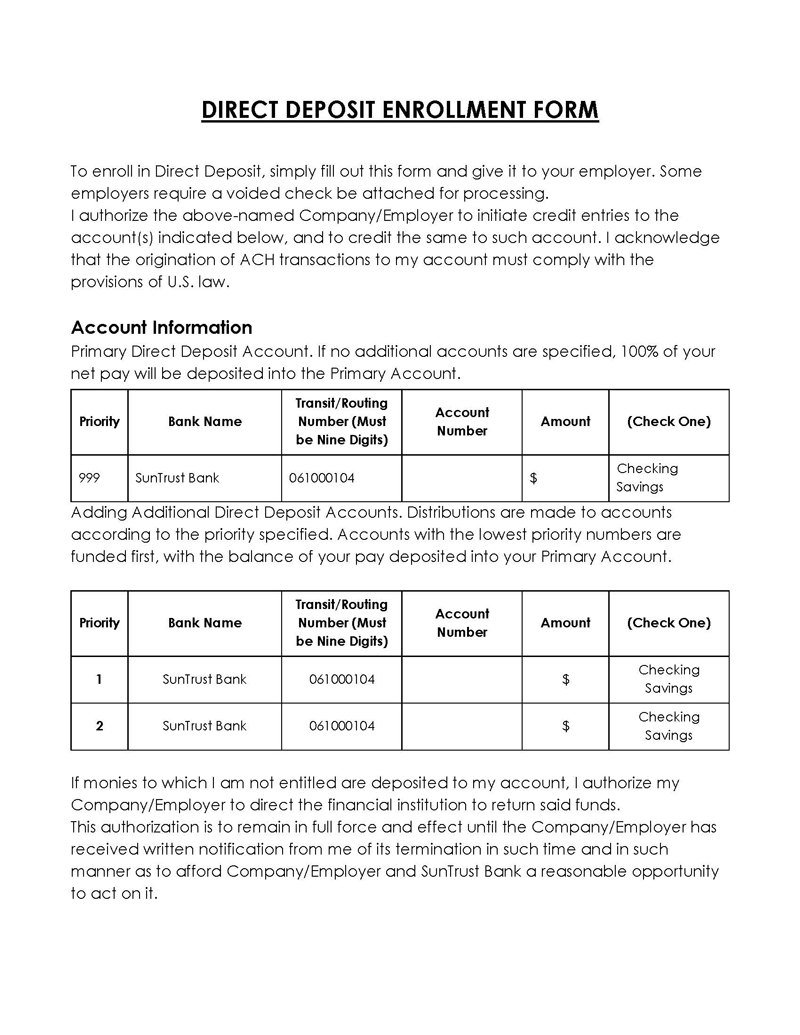

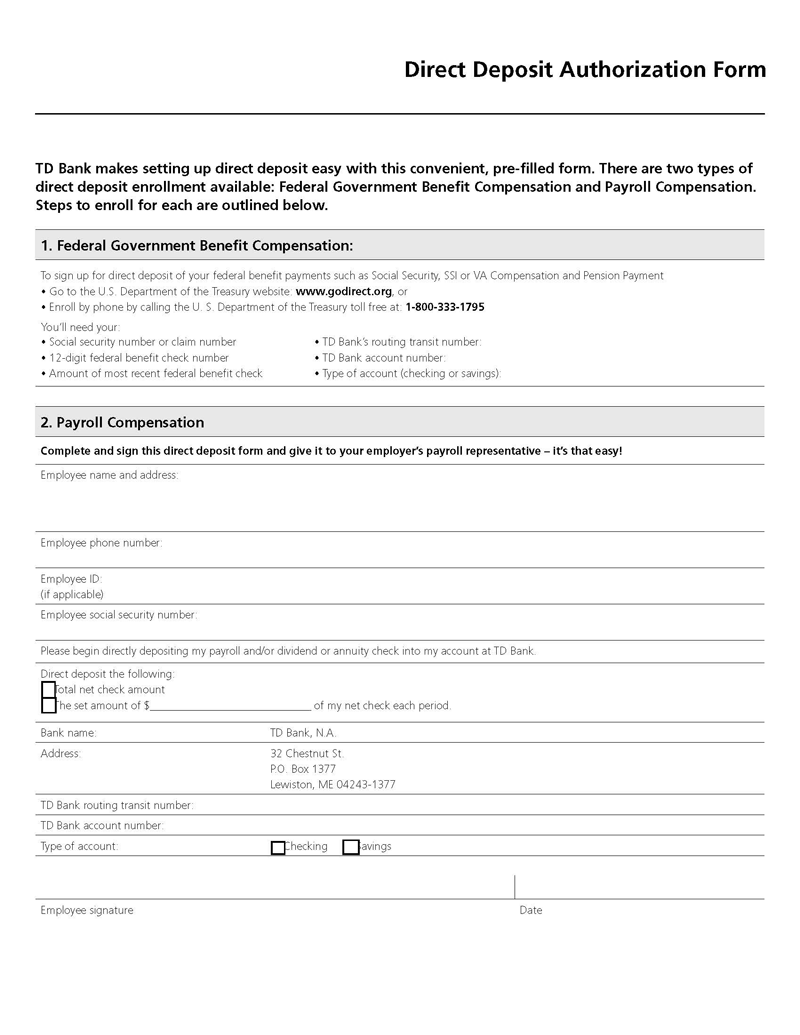

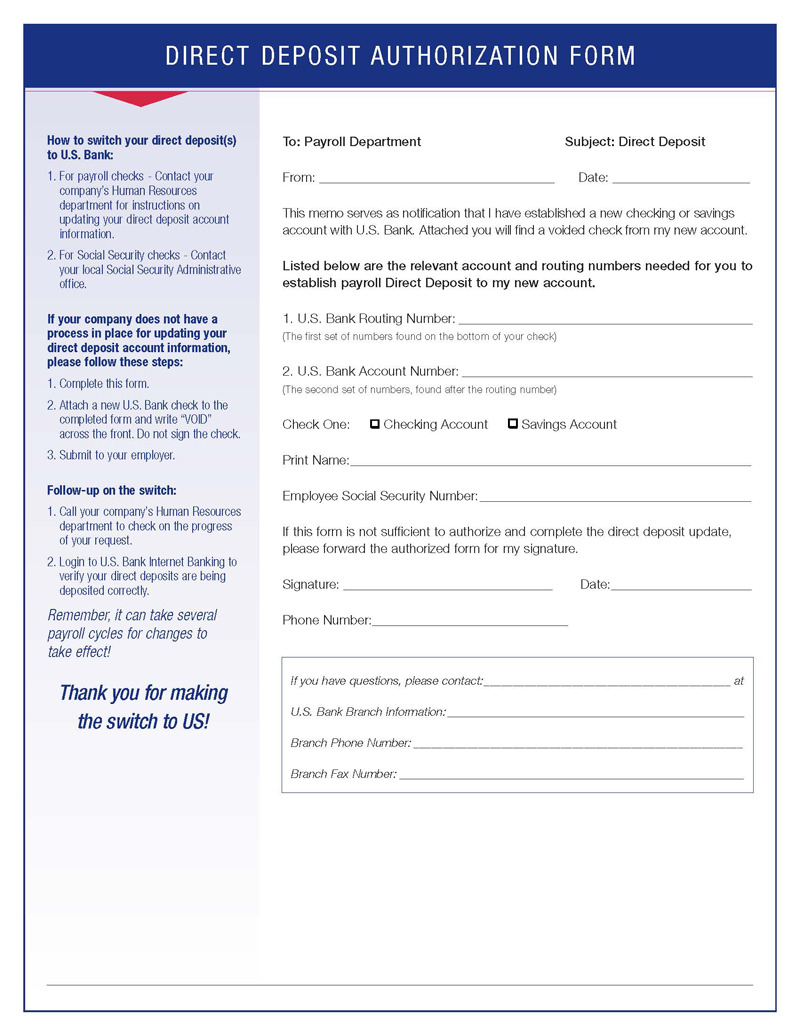

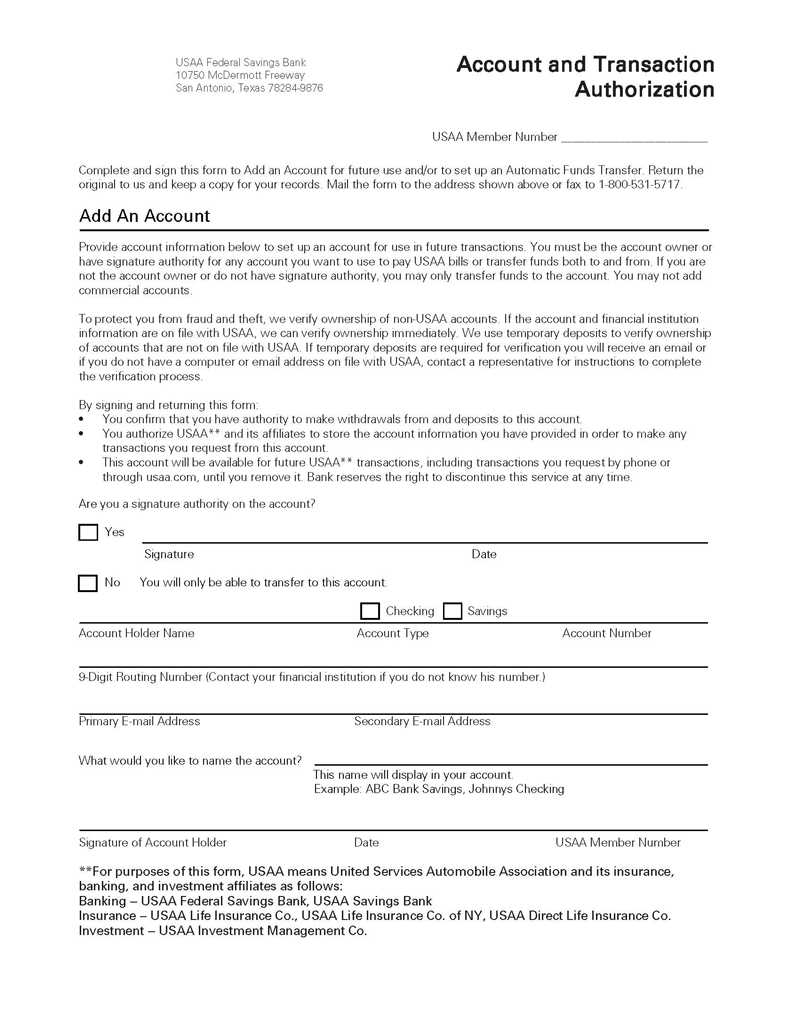

Direct Deposit Authorization Form Templates

Using direct deposit is very simple. Before a payer can transfer money into your account, you, the payee, will need to give them permission for it. Your employer will provide you with this form when you are hired. Then, you will be required to add your information to that form, which the payer will use to directly deposit funds through their bank.

What is the Procedure for Authorizing Direct Deposits?

Using direct deposit is very simple. Before a payer can transfer money into your account, you, the payee, will need to give them permission for it. Your employer will provide you with a direct deposit authorization form when you are hired. Then, you will be required to add your information to that form, which the payer will use to directly deposit funds through their bank.

Types of direct deposit authorization forms

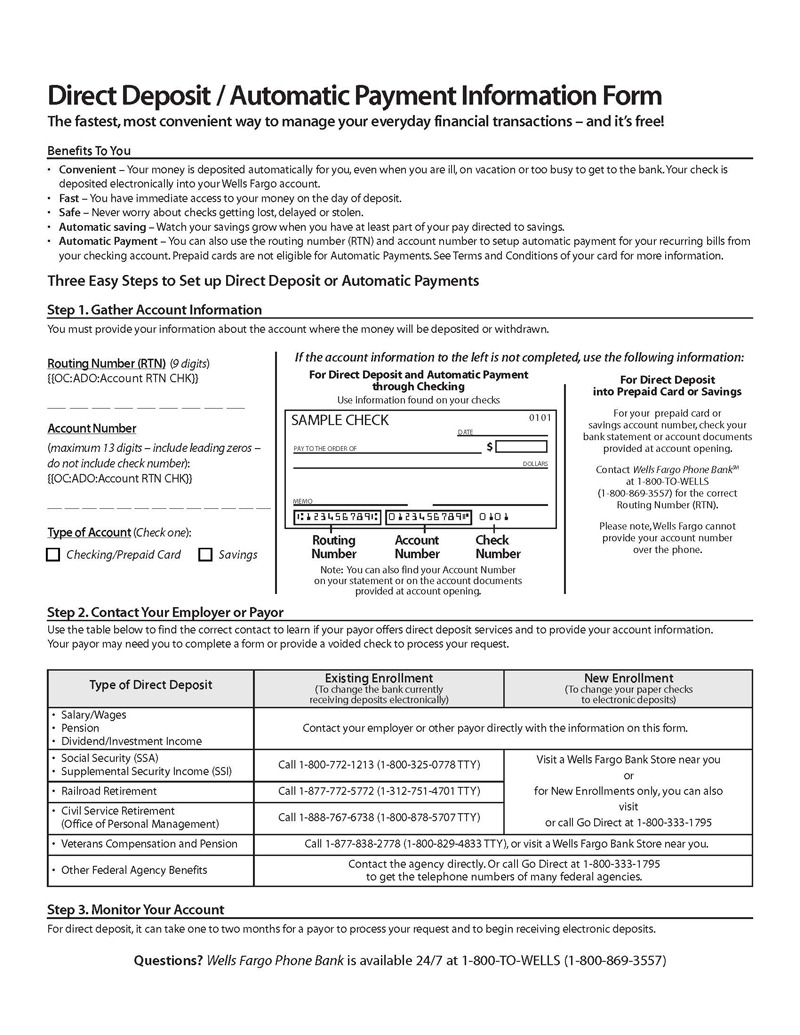

Banks and some government organizations also provide the forms. It contains vital information, such as bank details and the amount, that allow the payer to make a direct deposit to your account.

Primary direct deposit forms are listed below:

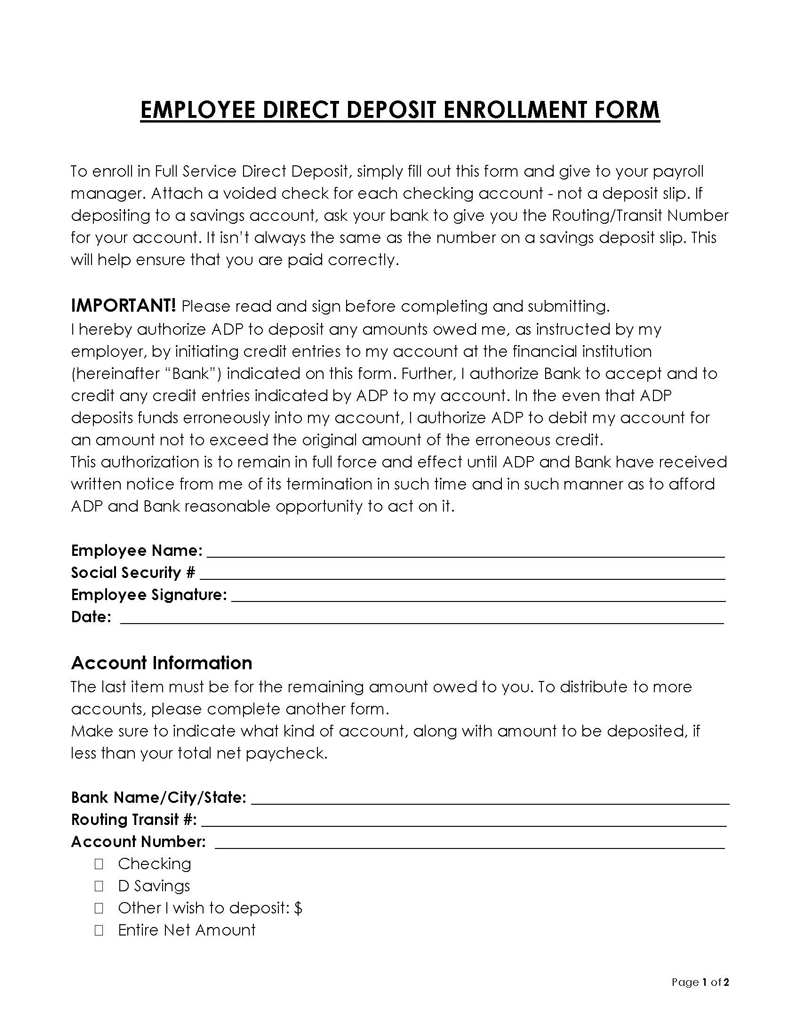

- ADP

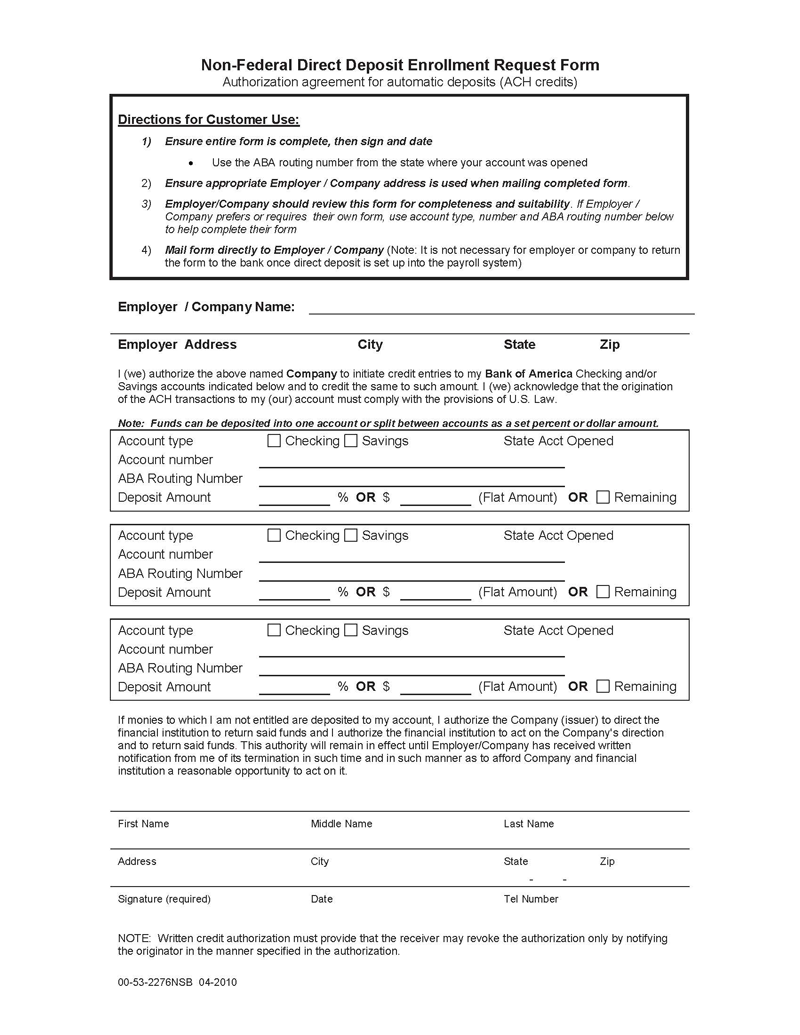

- Bank of America

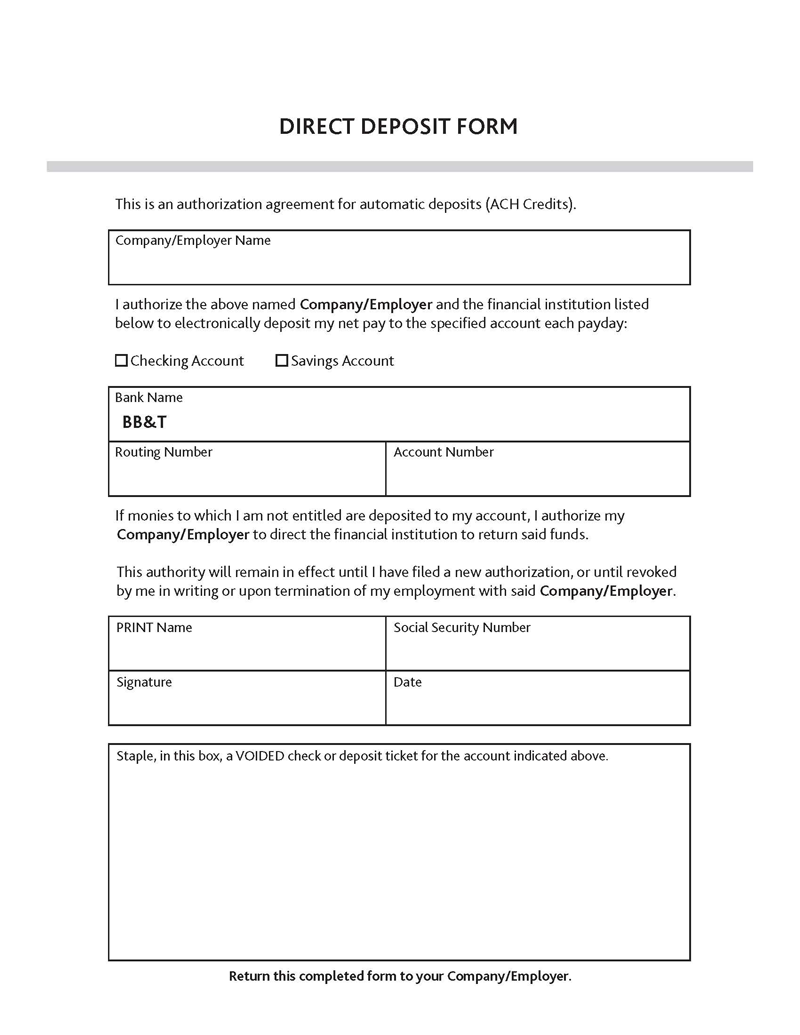

- BB&T

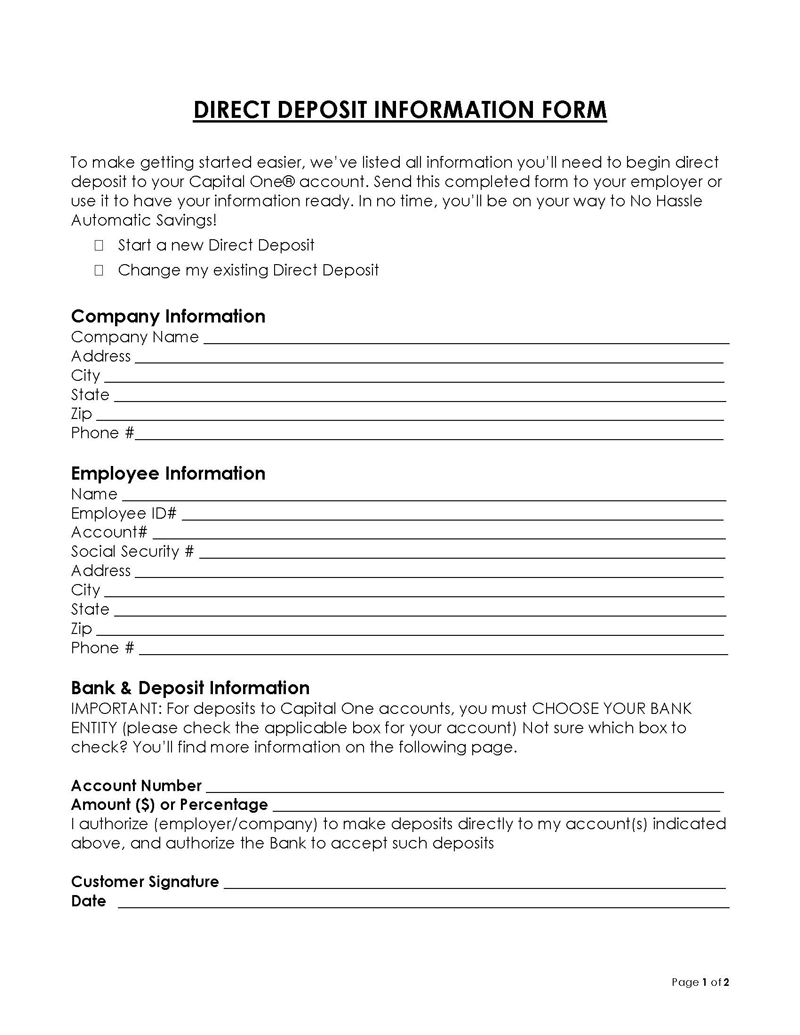

- Capital One (360)

- Chase

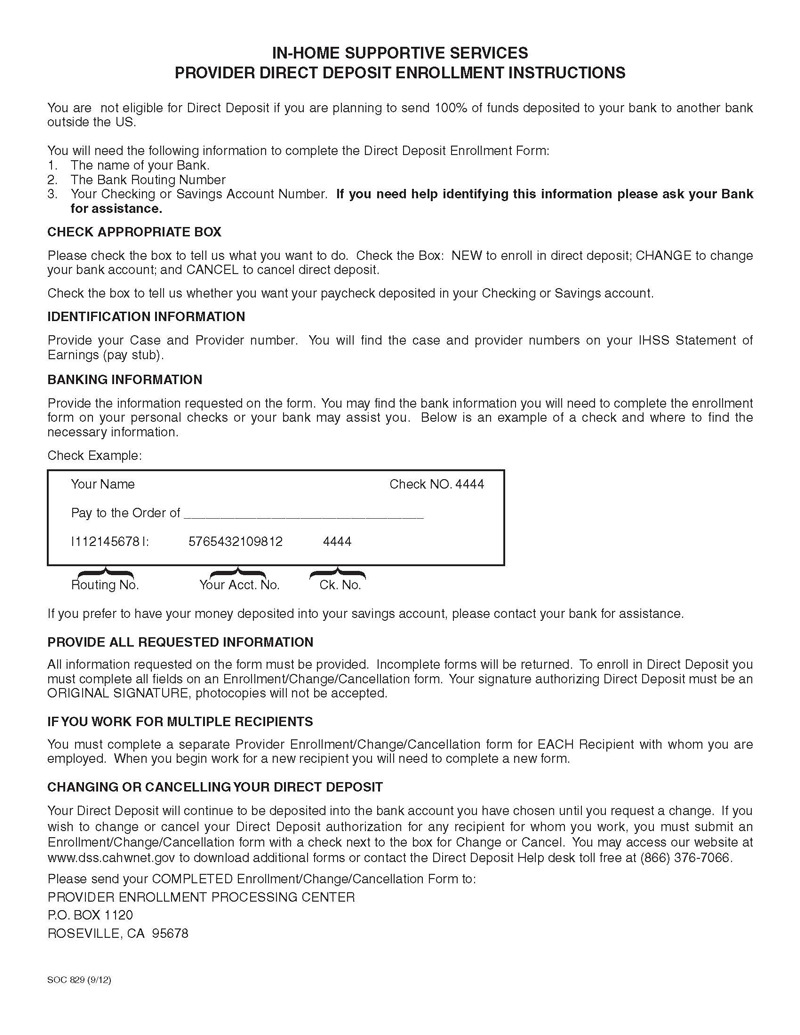

- IHSS

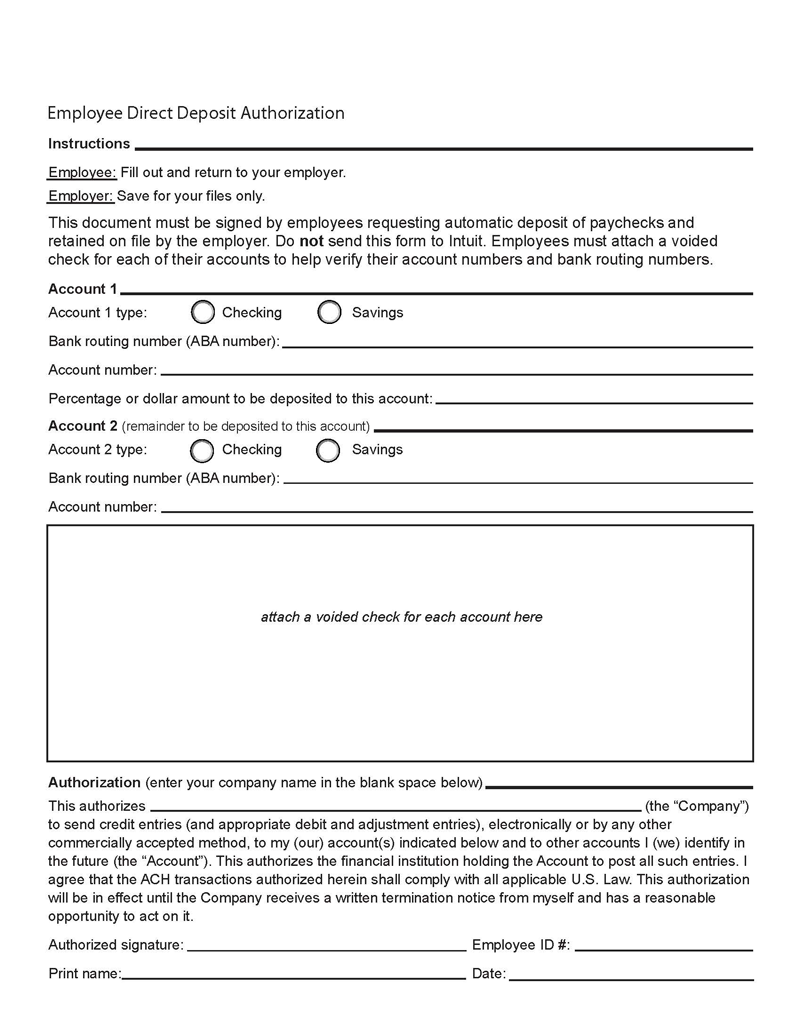

- Intuit/QuickBooks

- Key Bank

- Navy Federal Credit Union (NFCU)

- NetSpend

- Paychex

- PNC Bank

- RushCard

- Social Security Administration

- Standard (Form 1199a)

- SunTrust

- TD Bank

- US Bank

- USAA

- Wells Fargo

What to Include in the Direct Deposit Authorization Form?

The form includes essential information about the account holder and is considered a confidential document.

Here is a list of essentials that should be included in this form:

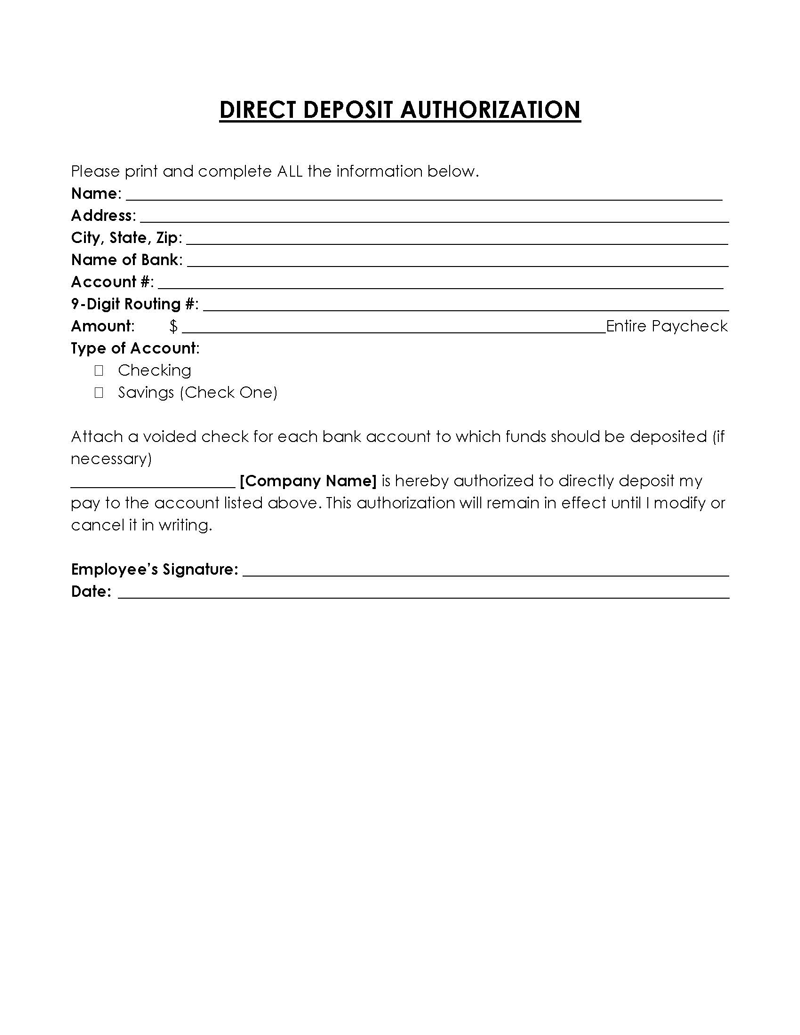

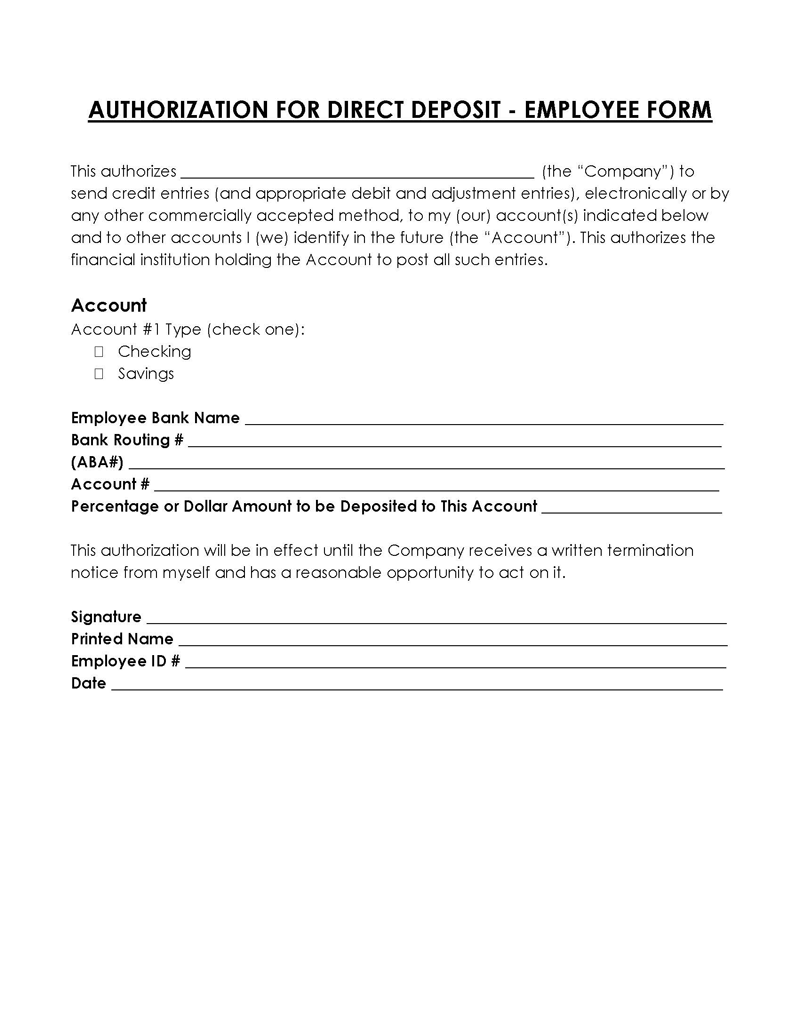

Account holder’s information

The form should include the payee’s name and contact information. In addition, you should have your employee add their full name and a valid mailing address when completing the form.

Bank information

The details of the employee’s bank or other institution and related information should be included.

Account number

The employee’s valid account number must be entered in the outlined space when filling out the form.

Routing number

You should include the bank’s routing number, which is a nine-digit number. You can find a bank’s routing number on a physical check or on the bank’s website.

Account type

Indicate the account type that your employee uses. For example, if they are using a savings account, specify it. It should be specified if they are using any account type.

Percentage

The amount of the employee’s paycheck that they want to deposit into the account; if they don’t want to divide it among several accounts, they should enter “100%” instead.

Authorizing statement including authorized company’s information

An authorizing statement should also be added to the form. The “I hereby authorize…” statement indicates that the employee has given their permission that their salary may be deposited directly into their bank account.

Employee’s signature and date

The employee must sign the form. The date the form was signed should also be added.

Sample DDA Form

NAME

____________________________________________

MAILING ADDRESS ____________________________________________

BANK INFORMATION ________________________

NAME OF BANK ________________________

BRANCH ADDRESS ____________________________________________

ACCOUNT #

____________________________________________

ROUTING NO.

____________________________________________

PAYMENT DOLLAR VALUE __

PERCENTAGE OF SALARY __% or __ Entire. (check one.)

TYPE OF ACCOUNT __ Savings __ Checkings

EMPLOYEE SIGNATURE _______________________

DATE _________

Additional Forms

How to Process It?

Processing the authorization form is simple. However, it is a professional document, so the following necessary steps should be followed:

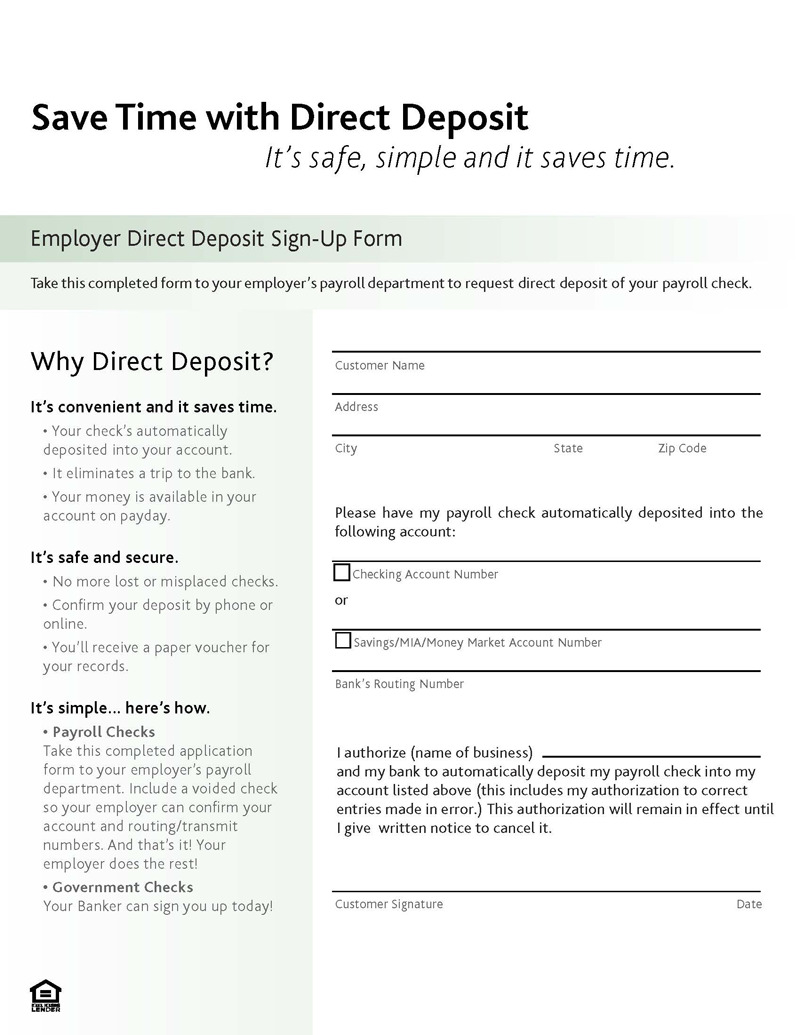

Obtain a direct deposit form

You should request this form from your employer or whichever bank you are using. It can be written or online. Some of the financial institutions from which you can request the form include Capital One, Bank of America, NerdWallet, etc.

Provide the required details

Provide your account information, bank details, account number, routing number, account type, signature, and date. Any other relevant information requested in the form should also be provided.

Confirm the deposit amount

You should state if you would like to split your deposit into two accounts and the amount you want to be deposited. State it if you want to keep some percentage in a high-yield savings account.

Submit the form

You can submit the form to your employer once you have completed it and provided all the required information. However, this process will have to take weeks to complete.

TIP FOR YOU

Submit the voided cheque or deposit slip. You should submit the voided check or deposit slip to your employer. First, however, you need to specify that the check is void and cannot be reused before submitting it. Void checks or deposit slips are required because some employers may need them to confirm that they are connected to the right bank.

Alternatives of Direct Deposit Method

You can use other payment methods if you do not want to pay your employees using direct deposit. They include the following:

Physical paycheck

A physical paycheck remains a standard payment method. While it is not as efficient as direct deposit, it is commonly used to pay employees. This particular type of payment requires that a proper record of the transaction be kept.

Cash

You can also choose to pay your employees in cash. Ensure that you keep records of every cash payment to avoid any confusion or mistakes later. Cash payments are stressful and not advisable.

Payroll card

A payroll card is a type of prepaid debit card for employees. On payday, your organization would deposit an employee’s wages on their card. The employee can use the card to make cash withdrawals from ATMs and to make purchases, just like a debit card from a bank account. However, it does not go directly into a personal account, and it has more fees than direct deposit.

Virtual wallet

There are several virtual wallets, like Venmo or Apple Pay, that are easily accessible and can be used to pay employees. For this method, the employees will have to create an account on one of these platforms.

Frequently Asked Questions

Providing a direct deposit authorization is not complicated. An employee will be provided with one by their employer when they are hired. Employers can create these forms using free downloadable templates to create a simple and straightforward form.

Direct deposits are faster compared to other payment methods. This transaction may take up to five business days.

You can change your account information by submitting a new direct deposit authorization form. After making the necessary changes, you can submit it to your employer or the HR department.