A Letter of Guarantee expresses the commitment of a bank to oversee the delivery of goods or services by a supplier and the payment of the specified amount by the buyer.

The document assures the buyer or seller in the transaction agreement that the other party will not forfeit the contract terms. Letters of guarantee help reduce risk in large financial transactions by ensuring that the interests of both parties are protected.

Letter of Guarantee Samples

Issuance of Letter of Guarantee in Business

Individuals seeking letters of guarantee will usually approach their bank and make an application for it. The bank will evaluate the risk associated with the transaction, and, if manageable, the customer will be required to pay a given sum to obtain the document.

EXAMPLE

For companies in the call or option business, the bank can give a letter to guarantee that the business will provide an underlying asset if the other party exercises their call option.

It is important to state that the guarantee letter may specify that the bank will pay only a portion of the funds and not all of it.

Letters of guarantee also apply to technology trade, leases of large equipment, goods import-export declaration, contracting, and construction, as well as funding from financial institutions.

Letter of Credit Vs Letter of Guarantee

Despite a letter of credit (also termed documentary credit) and a letter of guarantee enabling smooth operations in high-value transactions, they have several key differences.

These differences are:

- First, letters of credit protect the financial interests of the seller; letters of guarantee ensure that both parties meet their contractual obligations. As a result, the guarantee letter may be more expensive than the credit letter.

- Secondly, letters of guarantee are more versatile and can be used for more purposes than a letter of credit.

- The third difference is that while a letter of credit is meant to instill confidence so that a business agreement is finalized, a bank guarantee minimizes the risk of loss if one party defaults on the contract.

- Fourthly, a letter of credit is a form of promissory note from a bank or any other financial institution showing commitment by the bank to facilitate the transfer of funds after certain requirements are met. Once the given terms are met and validated, funds are transferred to the supplier. In comparison, a letter of guarantee is executed if either the buyer or the seller fails to fulfill the terms of the transaction. For instance, if a buyer had requested this letter from the supplier before shipment and the supplier failed to deliver the goods paid for, the buyer could demand to be compensated by the issuing bank.

How does a Letter of Guarantee Work?

Letters of guarantee become a necessity in cases where one party in a transaction is not certain whether the other party will meet the financial obligation. This mainly applies when purchasing costly equipment and other assets.

Nevertheless, the entire amount of debt is not covered by this but only a portion of the amount in question is paid, such as the principal amount or interest. The bank decides the amount of money it will compensate its client. A bank annual charge fee is attached to the service. This represents a percentage of the money the bank owes the client in case of default.

Use the example of a letter of guarantee

To illustrate how this works, let’s imagine a case where ABC has contracted a company, XYZ, to provide expensive agricultural machinery. ABC is a relatively new company, and XYZ doubts that the other party can pay for the goods. In such a situation, ABC will approach its bank and obtain a guarantee letter, which will assure XYZ that it will be paid once the goods have been delivered. Once the letter has been given, the supplier is assured that the buyer will pay for the goods, and the buyer knows that the seller is committed to delivering the goods to them.

When is It Required?

A letter of guarantee assures the surety that the other party will fulfill the obligations set in a contract of sale. However, various situations may lead one party to doubt that the other will deliver as promised.

Here, we discuss three circumstances where a buyer or supplier may need assurance through a letter of guarantee:

New supplier

Conducting transactions with a new partner requires some level of certainty that the other party will not be in default. Some sellers may also be unwilling to provide expensive goods or services on credit to a new buyer. In such a case, the seller may request a letter of guarantee because the other party does not have a track record that can be used to evaluate financial capacity.

Start-up company

Doing business with start-up companies is difficult because you may not be sure about their going concern, and you are also uncertain about their creditworthiness. For such businesses, getting guarantee letters helps them secure contracts worth large sums of money because the bank can assure their suppliers that they will be paid. Start-ups in the construction industry can also secure tenders with prospective clients if they produce letters that guarantee their performance in the planned construction.

Dealing with a supplier outside the usual trading area

Letters of guarantee are primarily relevant in international transactions because of the numerous risks involved in such engagements. For example, in transportation across national boundaries, an exporter will want a guarantee letter that the associated levies, duties, and payments will be made once the goods have been received. A supplier will also want to be assured that, in case of any exchange rate fluctuations, the buyer will compensate for the additional costs incurred. If the buyer fails to meet such obligations after agreeing to the contract terms, the seller will be free to recover the compensation from the bank.

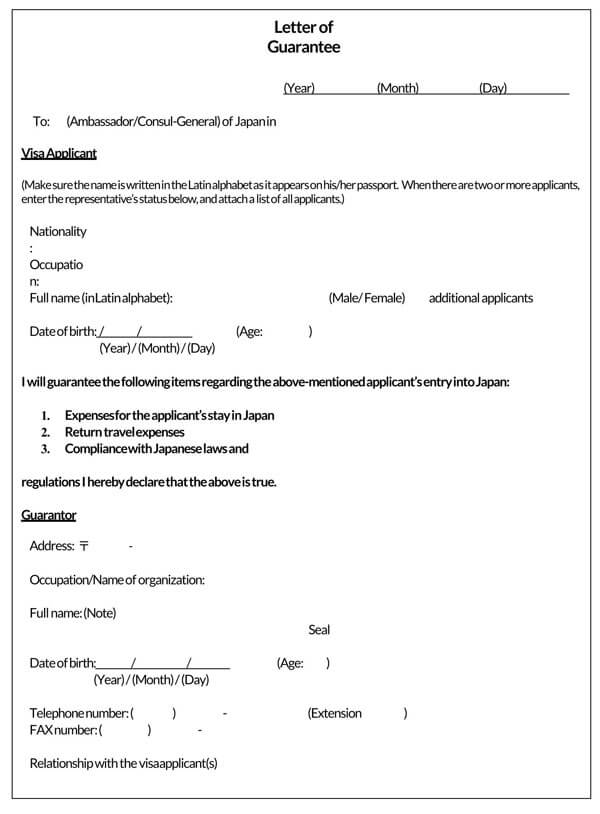

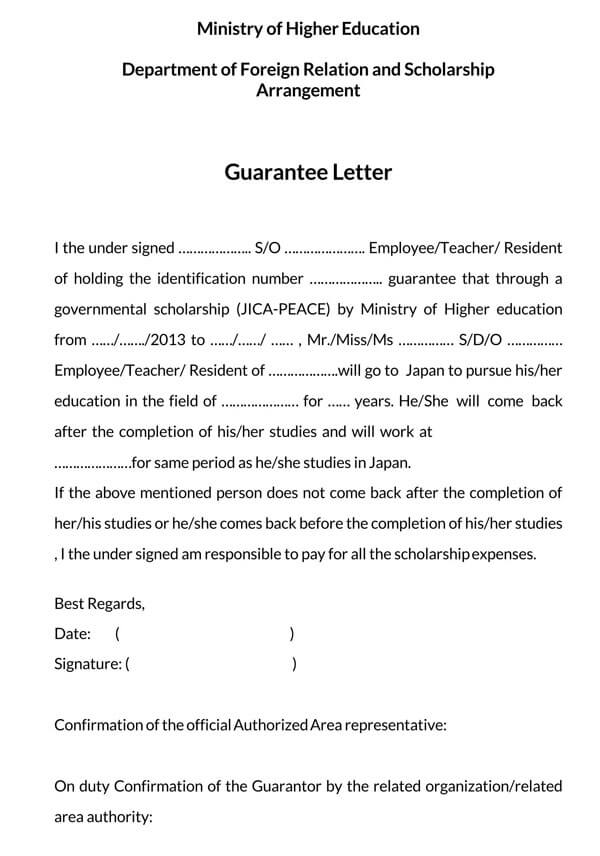

Some other uses of this letter, along with the relevant template, are given:

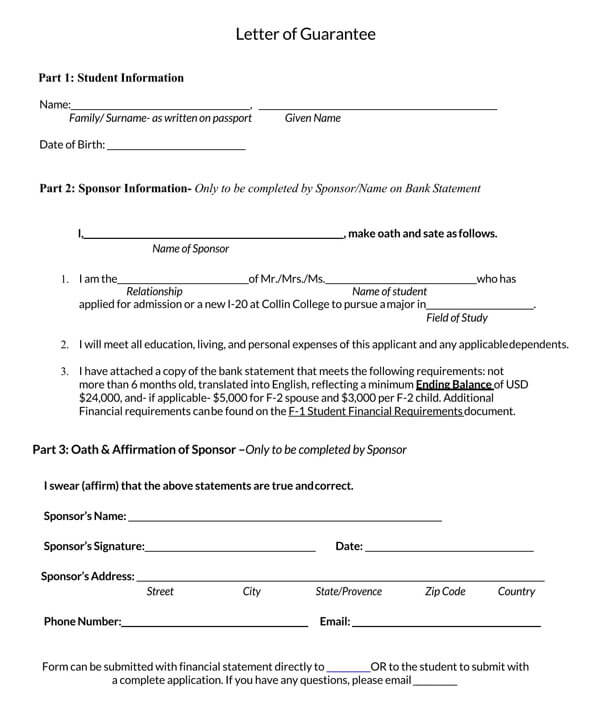

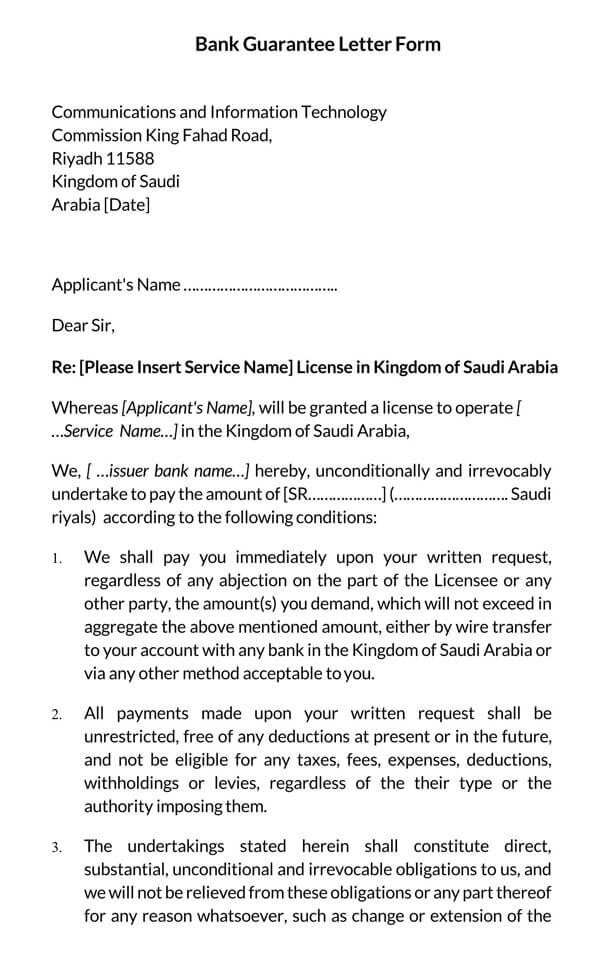

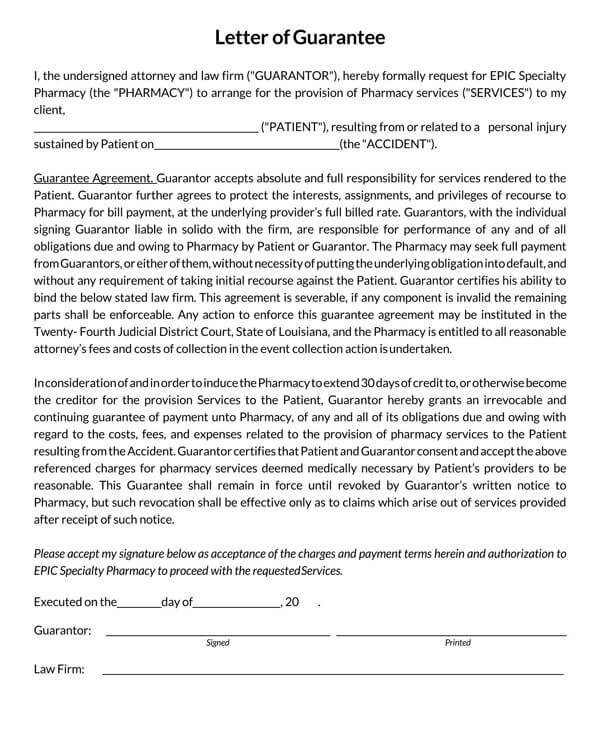

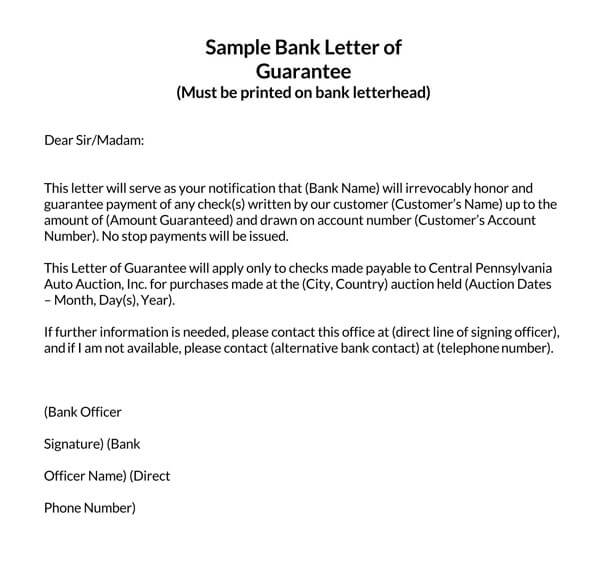

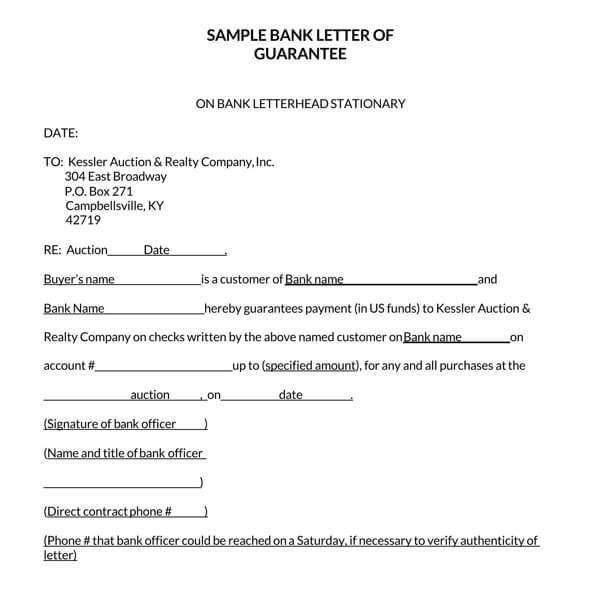

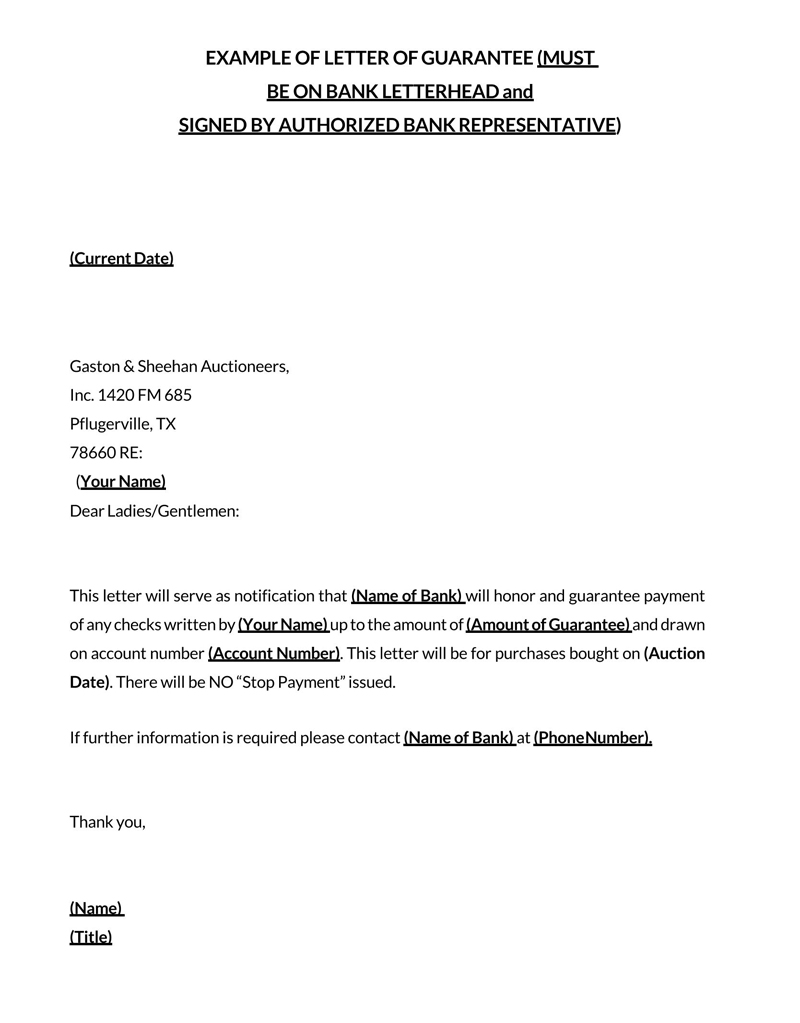

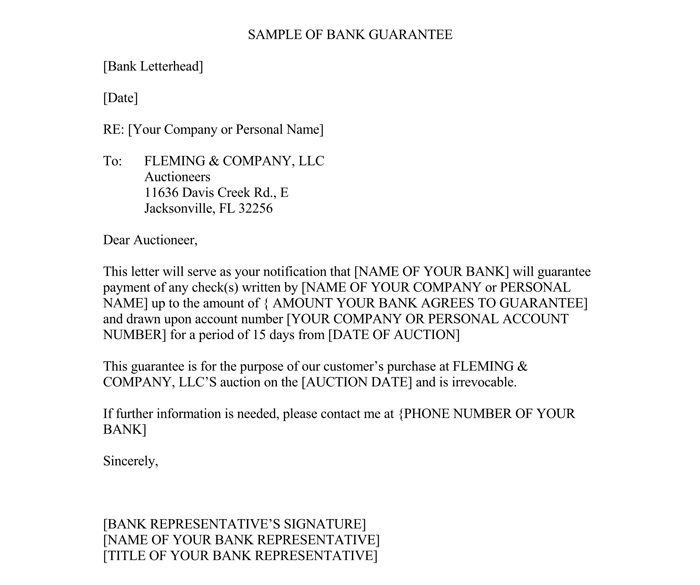

Guarantee Letter Template

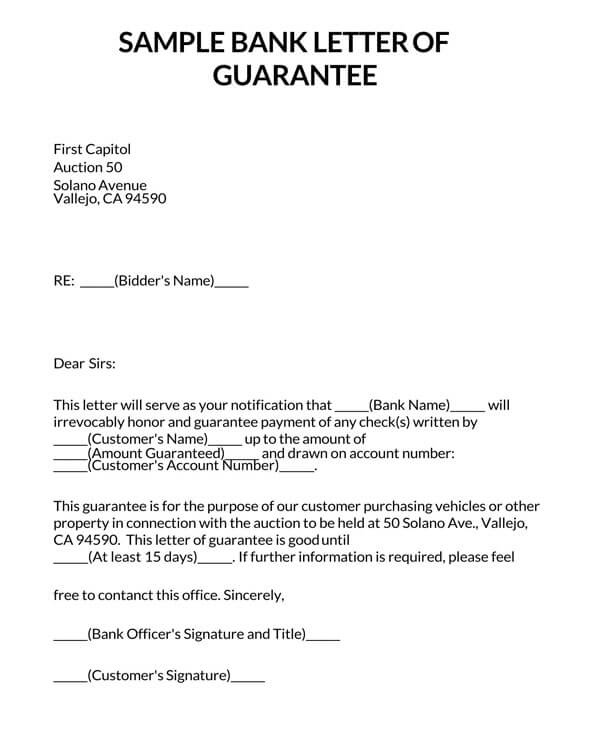

This particular template represents a sample of bank guarantee, which can assist to formulate a formal guarantee letter. It shows the pattern, which is suitable for such a letter along with the relevant content.

Download: Microsoft Word (.docx)

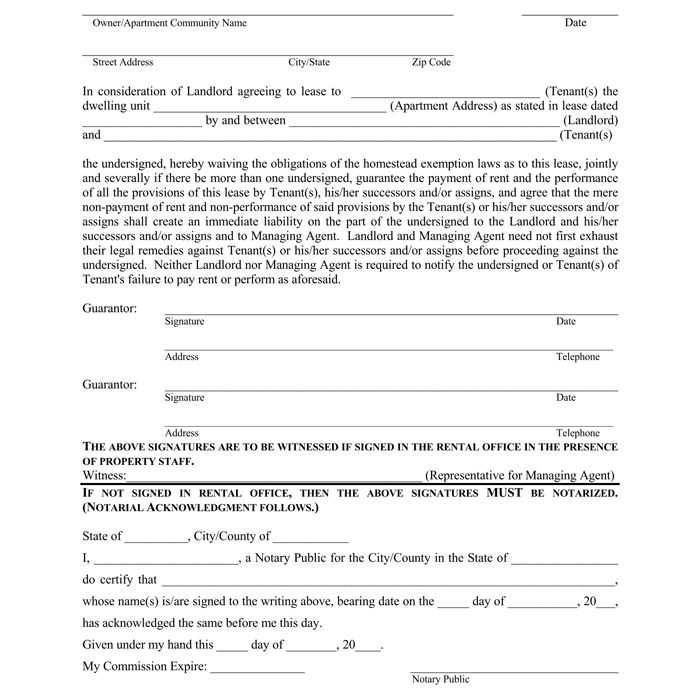

Guarantee Letter For Rent Payment

This particular template as the name suggests is a guarantee letter for the rent payment, which provides the relevant content and the template for what information to include in this kind of letter. It is important to follow a certain format since it can give an idea of all the relevant and required information.

Download: Microsoft Word (.docx)

Rent Guarantee Letter

This particular template as the name suggests is a guarantee letter for the rent payment, which provides the relevant content and the template for what information to include in this kind of letter. It is important to follow a certain format since it can give an idea of all the relevant and required information.

Download: Microsoft Word (.docx)

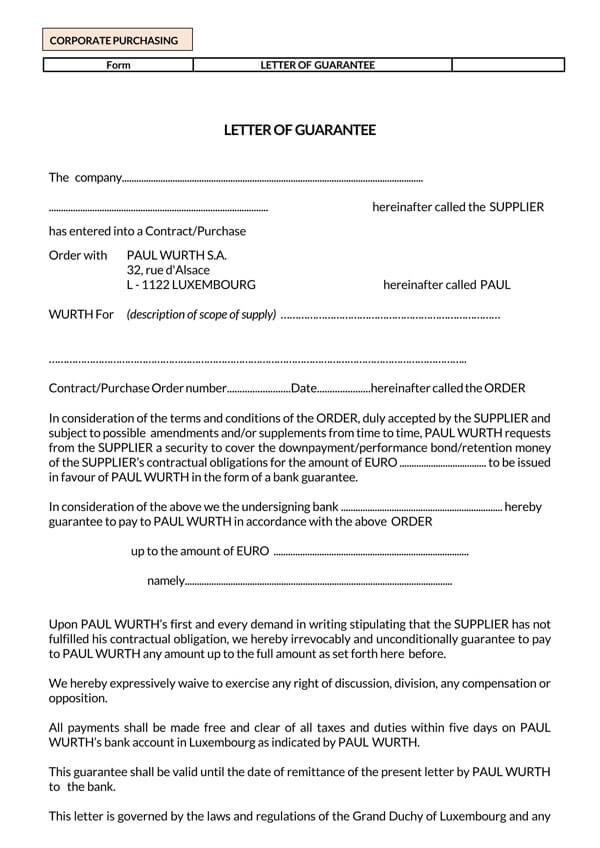

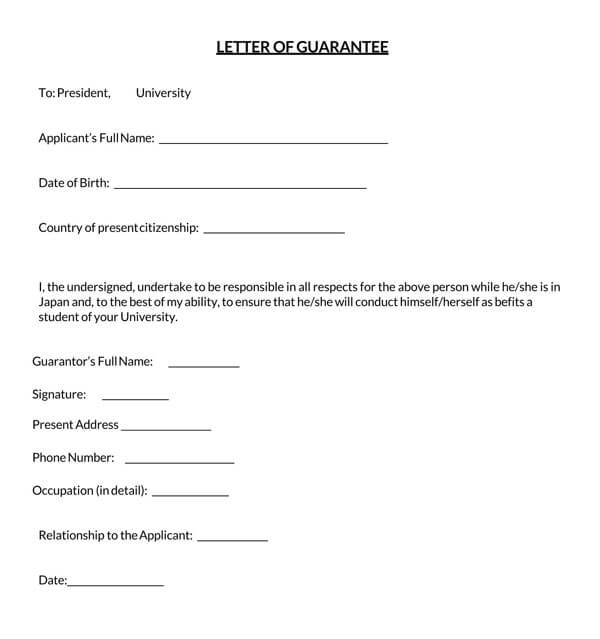

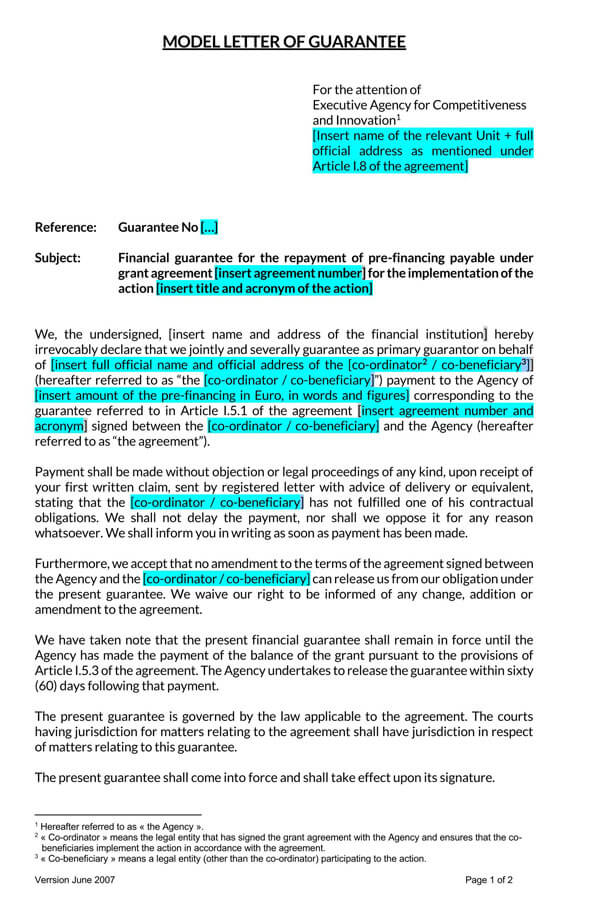

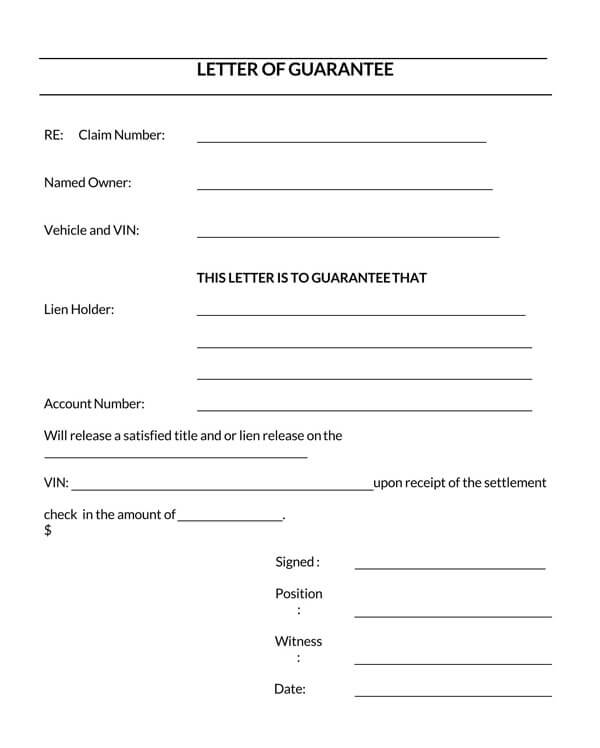

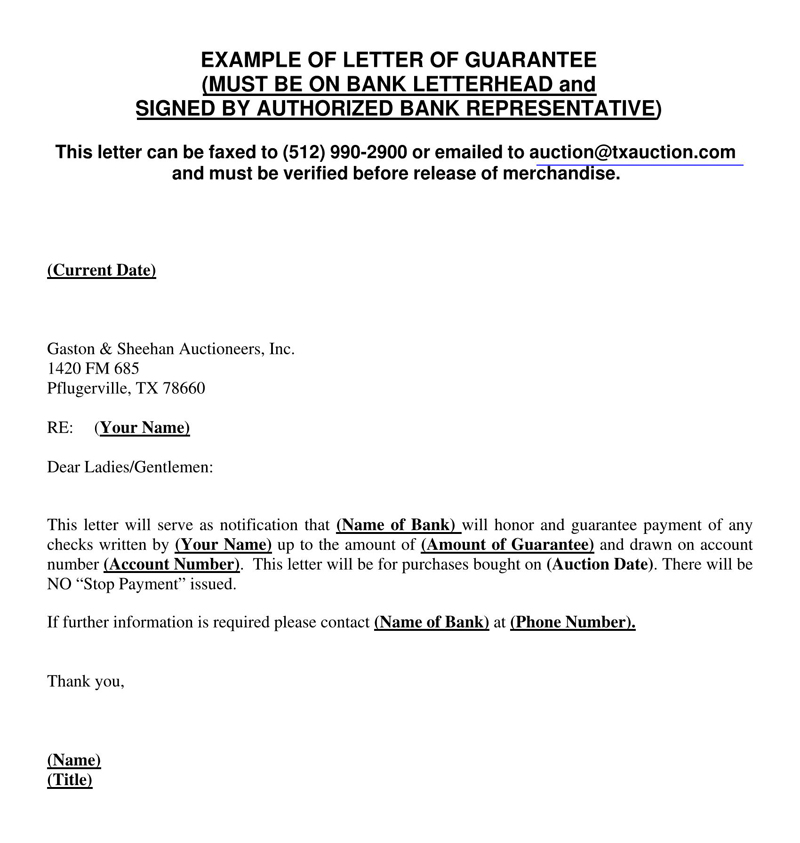

Standby Letter of Guarantee

This particular letter is basically a template, which contains blank spaces against the titles, which could be filled for information. It shows the basic pattern and the information, which should be a part of this kind of letter.

Download: Microsoft Word (.docx)

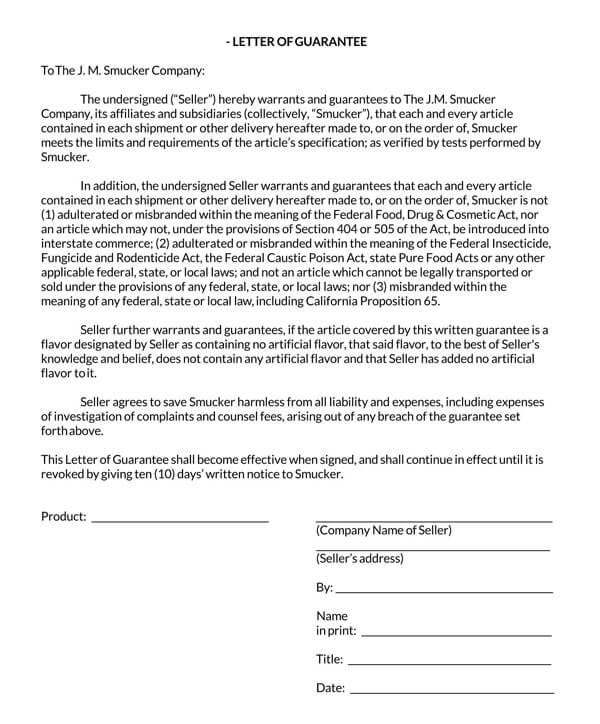

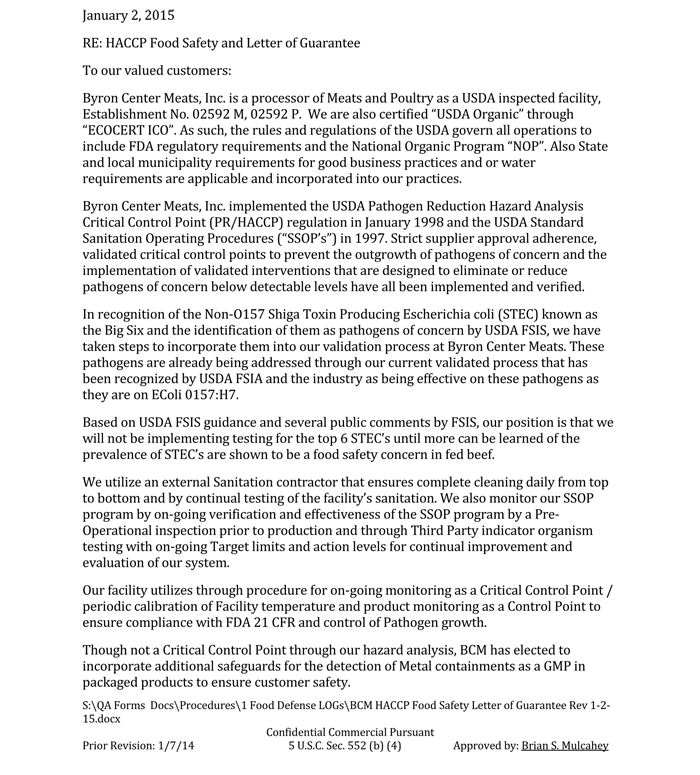

Letter of Guarantee for Food Safety

This particular letter is a sample, which gives information on the relevant content serving as a letter of guarantee for food safety. It shows a format and the type of information, which is important to include in this kind of letter. It shows how to address the customers and where to put the date and other important information.

Download: Microsoft Word (.docx)

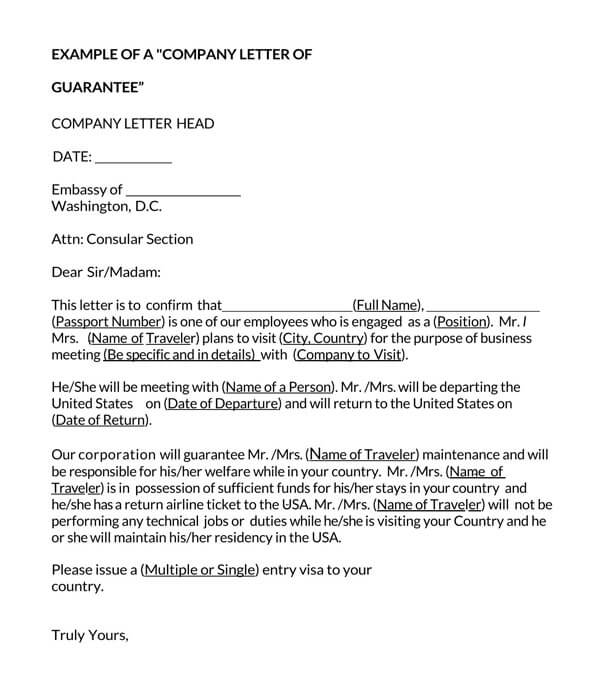

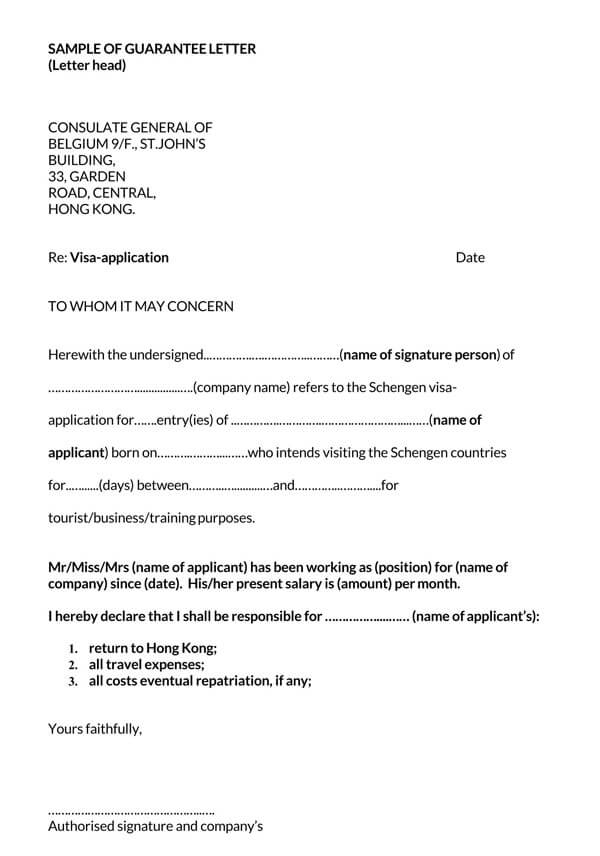

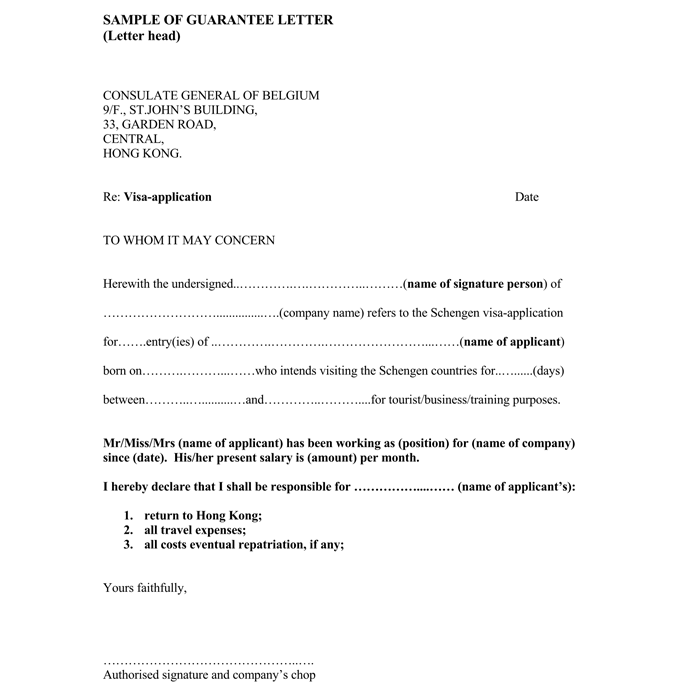

Guarantee Letter From The Company

This particular letter provides a sample of the guarantee letter. It shows where to include the letterhead and the relevant address. It shows that the letter starts by addressing “to whom it may concern”, which is usually used when the relevant person is unknown. It shows the relevant content and where to include the name of the signature person and the name of the applicant on the letter.

Download: Microsoft Word (.docx)

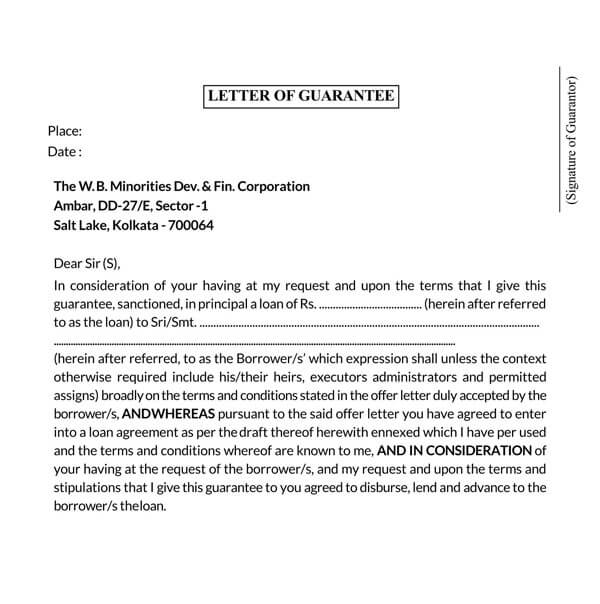

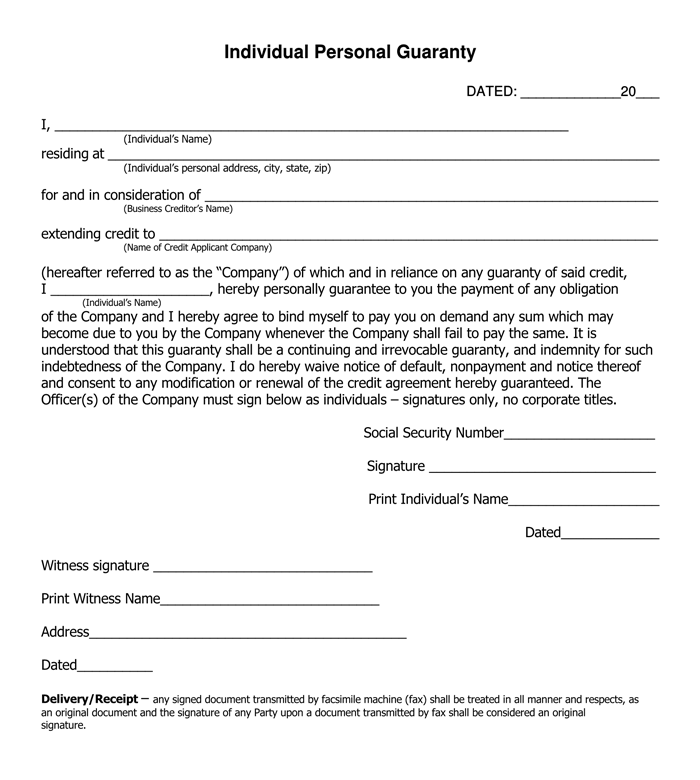

Personal Letter of Guarantee for Loan

This particular letter shows the individual personal guaranty. It shows the template and there are blank spaces to fill the relevant information like where to insert the name of the individual, personal address, city, and zip code. It provides a blank space in the content to fill up the name of the credit applicant company. It provides a format on where to include what information like a signature and much more.

Download: Microsoft Word (.docx)

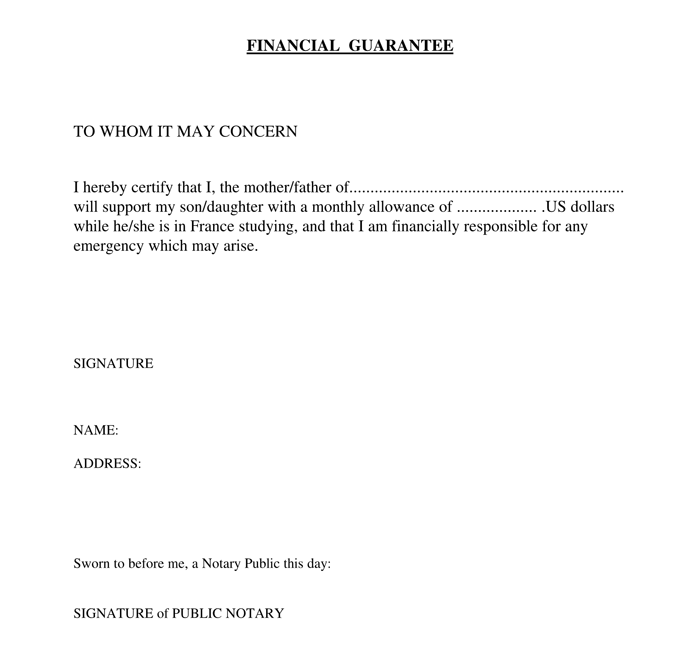

Financial Guarantee Letter

This particular letter depicts a financial guarantee on behalf of parents for their son or daughter. It provides a template along with the relevant content. Using the templates and sample is a good idea to finalize a formal letter as these templates and samples give a lot of information about the relevant content.

Download: Microsoft Word (.docx)

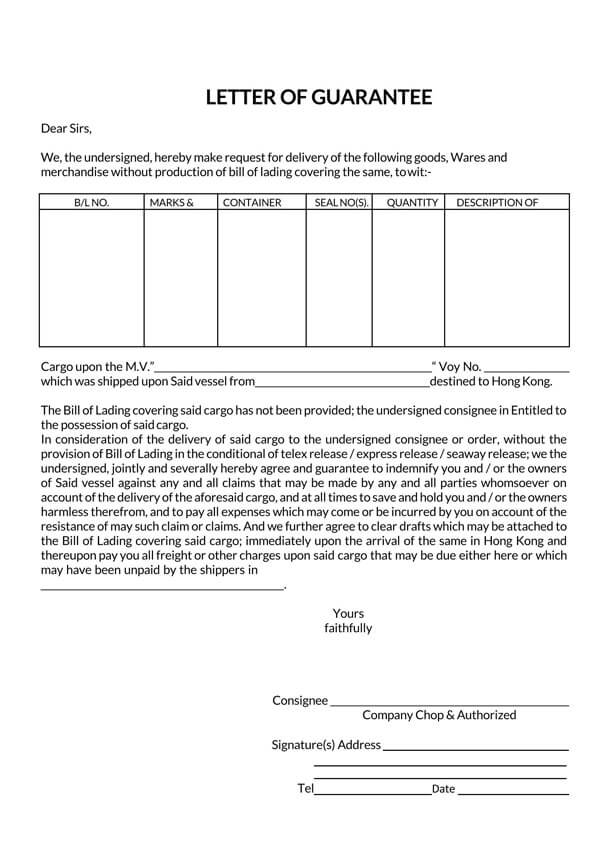

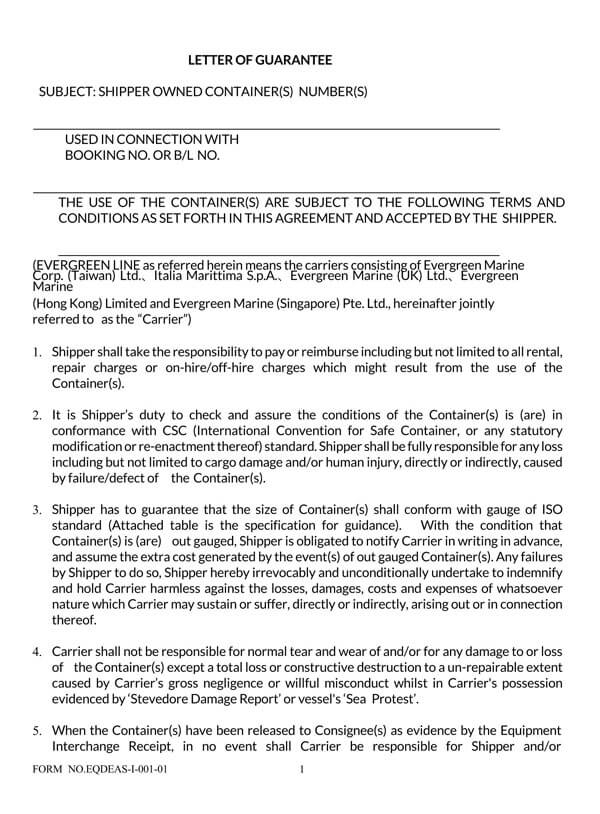

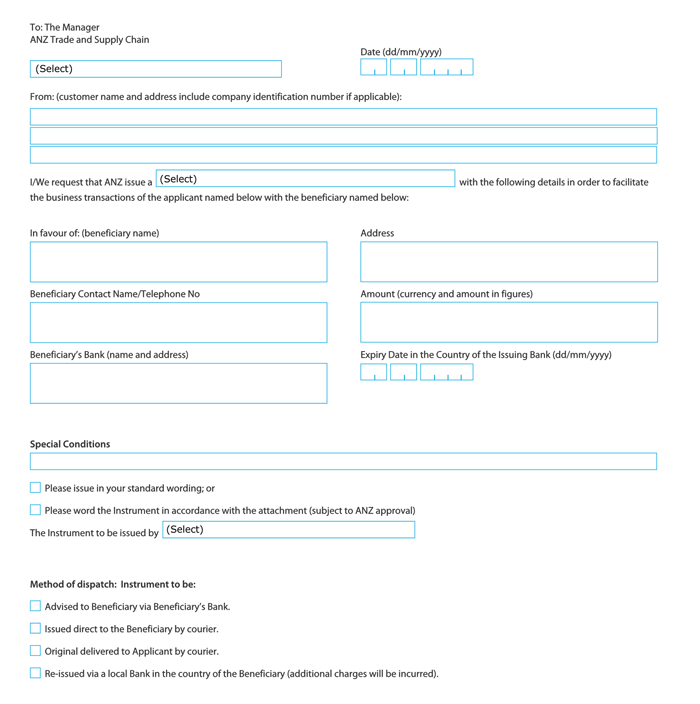

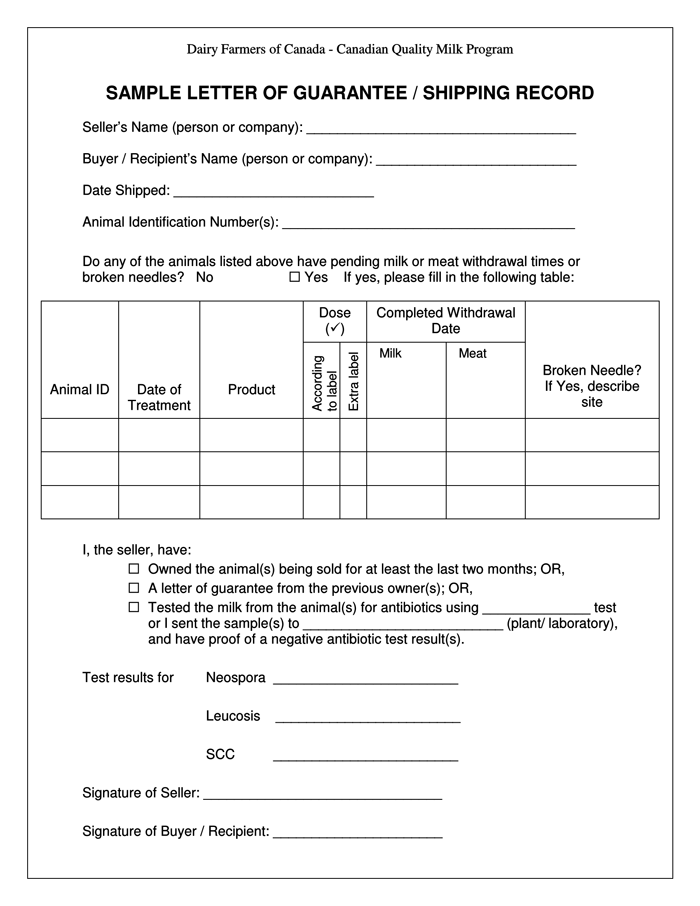

Shipping Guarantee Letter

This particular letter provides a template for the sample letter of guarantee for the shipping record. It includes a variety of information with blank spaces. It is wise to follow the patterns and templates as it gives valuable information and insight, which otherwise one might forget including in a typical letter.

Download: Microsoft Word (.docx)

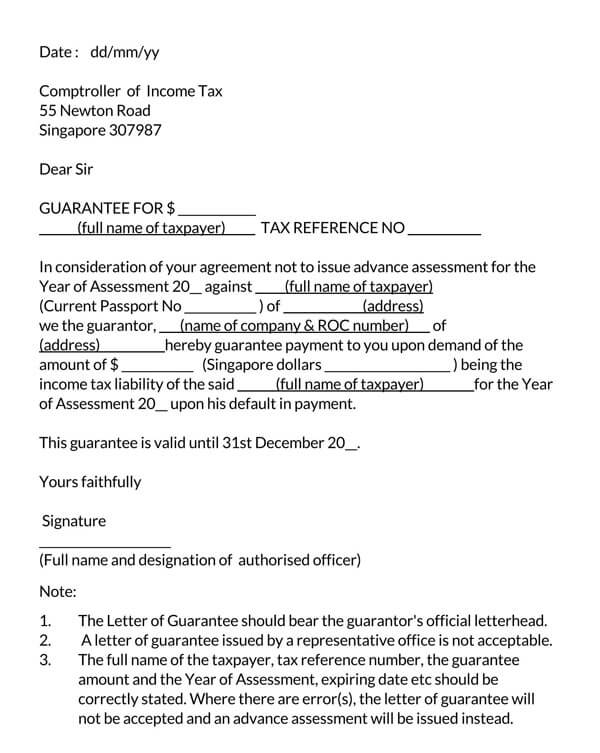

Clearing Letter of Guarantee

This particular template gives information on the clearing letter of guarantee. It shows what type of content to include and where to insert the relevant information in the letter. It provides a systematic format, which is important for this kind of letter.

Download: Microsoft Word (.docx)

How to Issue a Letter of Guarantee

Letters of guarantee involve transactions with very high stakes, and stringent procedures must be followed in their issuance.

Here are some of the common steps that are followed when such documents are given:

Examining/issuing a letter of guarantee

To determine whether to provide this letter or not, a bank will often evaluate the riskiness of such action. The applicant will be required to provide proof that the contract will be executed using documents such as transaction history and bank statements, among others. The letter is issued once the bank is satisfied that there is minimal risk of liability arising from non-payment for the goods.

Fee

Different banks will charge fees depending on the riskiness of the transaction, the principal amount of money, and the standard rates of the issuing bank. Therefore, considering such factors will enable the bank to calculate an annual fee for such a letter.

Amendment /modification in letter or guarantee

Some parties may not be satisfied with the agreement made on aspects such as the date of delivery of goods and overall cost, among others. Therefore, the letter of guarantee can be adjusted to reflect the wishes of both parties before its issuance.

Compensation against the letter of guarantee

Such a letter requires that payment be made accordingly once both parties have fulfilled their responsibilities as agreed.

EXAMPLE

If a contractor has finished a construction project as agreed upon, a notice is made to the bank to allow for compensation.

Before payment can be released, the bank will usually require evidence that the party has completed the work or delivered the agreed goods.

Post-guarantee management

Execution of the guarantee may lead to three possible scenarios. First, if the amount requested by the seller exceeds the buyer’s account balance, the bank will extend a loan to the buyer’s account with the excess amount and pay the seller. Second, if the amount paid to the seller is less than what had been agreed upon, the remaining balance after payment will be transferred to the client’s account. The third scenario is where the bank transfers enough money from the client’s account to the seller as per the agreement and adjusts its accounts in line with the transaction.

How do I Write a Letter of Guarantee?

When writing such a letter, there are important elements to be included in the template. These elements are discussed in this section:

Date

It is important to provide a date to a letter of guarantee to show the recency of the document and for record-keeping.

Your name and contact information

Specific details of the person, company, or bank extending the letter of guarantee need to be provided. In addition, both parties must know the intermediary in the agreement, who will mediate any proceedings in case of non-fulfillment.

Company’s name and contact information

The name of the applicant along with their contact information must be stated in the document because it should be clear who has requested it. In addition, details of the other party to the transaction should also be given.

Salutation

Letters of the guarantee are official documents that should have a polite and professional salutation served as a greeting to the letter’s recipient.

Body of the letter

The body is where all the important details of the letter are addressed. You must identify yourself, clearly indicate what is being guaranteed, and specify the circumstances for writing the letter.

- Identify your relationship to the person: The guarantor should stipulate association with the applicant of the letter. If the client is a business partner or customer, such a relationship needs to be stated. Anyone reading the agreement will understand why you are willing to assure that the said party will fulfil the contract terms.

- What you are guaranteeing: Letters of the guarantee are specified in the business deal, item, service, or sum of interest involved. By indicating the subject of the agreement, you provide limits for which you are responsible for the other party’s actions. Therefore, ensure that you are brief but precise in what you have agreed to guarantee.

- Specific circumstances for writing this letter: You may decide to write the reason for providing the letter of guarantee or not. If you feel that the document’s situation is unusual, a brief explanation can be included.

Conclusion

A brief overview of the letter is given at the end of the document. You may include your details and that of your client at this point. The relevant details that should be included in the conclusion section include your name, the name of the person you are signing for, and the transaction to be guaranteed. Additional information may also be requested by the company such as bank account number, annual income, social security number, home address, and date of birth.

Professional sign-off

Write a polite and respectful sign-off tag at the end of the letter.

Letter of Guarantee Sample

Subject: Letter of Guarantee for Jane Smith

Dear Bank Manager,

I am writing to provide a formal guarantee concerning the obligations of Jane Smith in relation to her business loan application with the Bank of Springfield. As Jane’s long-term business partner at Doe & Smith Enterprises, I have a comprehensive understanding of her financial responsibility and business acumen.

I hereby guarantee that should Jane Smith fail to fulfill her financial obligations concerning the business loan of $50,000 for the purpose of expanding our joint venture, Doe & Smith Enterprises, I will assume responsibility for the debt. This guarantee is backed by my knowledge of Jane’s character and our shared business’s financial stability.

The decision to extend this guarantee is based on our recent opportunity to embark on a significant project that requires immediate funding, which is why Jane is seeking this loan. We believe this project will substantially benefit our business and is worth investing in.

I am providing this guarantee solely for the loan application in question, specifically for the expansion project of Doe & Smith Enterprises, and this does not extend to any future financial obligations that Jane might incur.

For your reference, I have attached my financial statements and proof of income, substantiating my ability to fulfill this guarantee if necessary.

I trust that this letter will meet your requirements for Jane Smith’s loan application. Please feel free to contact me if further information or clarification is required.

Thank you for considering this guarantee as part of Jane Smith’s loan application. We are optimistic about a favorable decision from your bank.

Sincerely,

John Doe

Key takeaways

The provided letter is a comprehensive and useful sample for several reasons:

- The letter identifies the relationship between the guarantor and the applicant, stating that they are business partners. This context is crucial, as it helps the bank understand why the guarantor is willing to assume financial responsibility for the applicant.

- It explicitly states what the guarantor is assuring—the repayment of a $50,000 business loan. By specifying the exact amount and purpose (business expansion), the letter sets clear boundaries for the guarantor’s responsibility.

- The letter provides the specific circumstances prompting its writing—the opportunity for a significant project requiring immediate funding. This gives the bank insight into the business decision behind the loan application, enhancing the credibility of both the applicant and the guarantor.

- The inclusion of financial statements and proof of income by the guarantor is a vital component. It assures the bank of the guarantor’s ability to fulfill the financial commitment, should the need arise.

- The letter states that the guarantee is valid only for the specific loan in question and does not extend to any future obligations. This is important for protecting the guarantor’s interests.

- The letter is professionally formatted and written, which is crucial in formal business communications. This professionalism helps establish credibility and seriousness in the commitment being made.

Conclusion

A letter of guarantee is a good way for individuals or companies to reduce their risk of non-payment or non-performance in transactions. Any supplier wants to be assured that compensation will be made without the need for lengthy litigation to recover the funds. Compared to the letter of credit, the guarantee letter protects the buyer and the seller in the transaction.

Keep in mind that letters of guarantee can be applied to any business situation involving large sums of money. From the construction of buildings to the importation/exportation of machinery, such documents can be customized for nearly any industry or dealing. A business can also issue this letter, accepting liability if another party does not pay a loan or debt. Therefore, it is crucial to ensure that the letter of guarantee is correctly written to avoid unnecessary liabilities if a party defaults on the agreements.