A Bill of Sale is a legal document used to record a transaction in which a monetary payment is made to transfer ownership of a vehicle.

The BOS accompanies the title, which both parties sign upon completing and signing it. Once signed, it can be used to show that the sale/transfer of ownership of the vehicle was completed successfully. The new owner of the vehicle will have to present it and other relevant documents such as the certificate of title at a local DMV when registering the vehicle.

note

Both parties should only sign it after the agreed purchase price has been paid in full by the buyer and the seller has issued the certificate of title.

Other names that can be used to describe it include:

- Car bill of sale

- Automobile bill of sale

- Auto bill of sale

- Auto purchase agreement

- Car purchase agreement

- DMV bill of sale

- Vehicle sale receipt

Free Templates

By state

Standard templates

Understanding the (Vehicle) Car Bill of Sale

Before drafting it, it is essential first to understand how the document should be used. Below is an in-depth description of how it should be used:

Usage of DMV bill of sale

It is usually a requirement in most states when selling a vehicle. It is significant when selling a used vehicle as it records the transaction details and can be used as proof of purchase (can be considered the receipt). Once the document is completed and signed by both the buyer and seller, both parties should be furnished with a copy for their records.

Below are the usages of this form:

- It is needed when purchasing or selling a vehicle privately to prove that the owner of the vehicle agreed to the transfer of ownership;

- The document is considered more of a receipt and is often required for various purposes such as; getting insurance covers, registering the vehicle at the DMV, and tax purposes;

- It can be used to protect the buyer and seller from any disagreements that may arise with regards to the ownership of the vehicle;

- Since the BOS details the vehicle’s condition at the time of the sale, the buyer cannot dispute or demand a refund for damages made to the vehicle after the sale is completed;

- The document also clarifies the change of ownership of the vehicle. It establishes that the new owner’s responsibility is to cater to any accidents or speeding tickets after the sale is complete.

note

As it can be used as a receipt to prove that a transaction took place, it is not always considered proof of ownership. Only the certificate of title establishes the legal owner of the vehicle.

Bill of Sale Vs. Title Transfer

Although it is a crucial part of the selling process, it doesn’t prove ownership of the vehicle in any way. However, a title transfer proves ownership of a car and finalizes the whole transaction. Therefore, to complete the sale process, you should transfer the title right away. A legally binding bill of sale makes the lives of the sellers and buyers pretty easier.

How a Car Bill of Sale Works

The buying or selling of a vehicle through it is done as a step-by-step process. This process applies to the private sale of most if not all types of vehicles. Getting the procedure right can prove crucial if it should be referenced in the future.

Below is the procedure to follow when using it in a transaction:

Discuss the terms of the agreement

Firstly, the buyer and the seller need to negotiate the applicable terms of the transaction and write them down. The aspects being negotiated are the amount of purchase, due date, method of payment, and condition of the vehicle. Normally, with cash transactions, money will usually exchange hands at the time of sale, whereas if creditors provide financing, the purchase will have to be discussed with the financier. Third parties will occasionally have to do a valuation of the vehicle.

Obtain the vehicle identification number (VIN)

Every automobile has a unique 17 character number known as Verification Identification Number used for identification purposes. Where can the VIN be obtained from?

There are several places where a buyer can get the VIN; they include:

- Driver’s side interior dash

- Driver’s side interior door jam

- Front of the vehicle’s engine block under the hood

- The driver’s side windshield

On the other hand, the VIN can be found on the car’s title or registration. Next, use the VIN to determine the vehicle’s history. This can be done through various sites that are used for VIN searches at a fee. Information obtained from VIN searches includes ownership history, previous repairs, car accidents, and water damage.

Once the VIN search is completed, a third party should be brought in to conduct a private inspection of the vehicle. This is because VIN searches only capture damages or information reported to the insurance company. A private inspection ensures the vehicle’s condition is verified in case it has damages that might not be determined from the VIN search.

Complete car bill of sale form

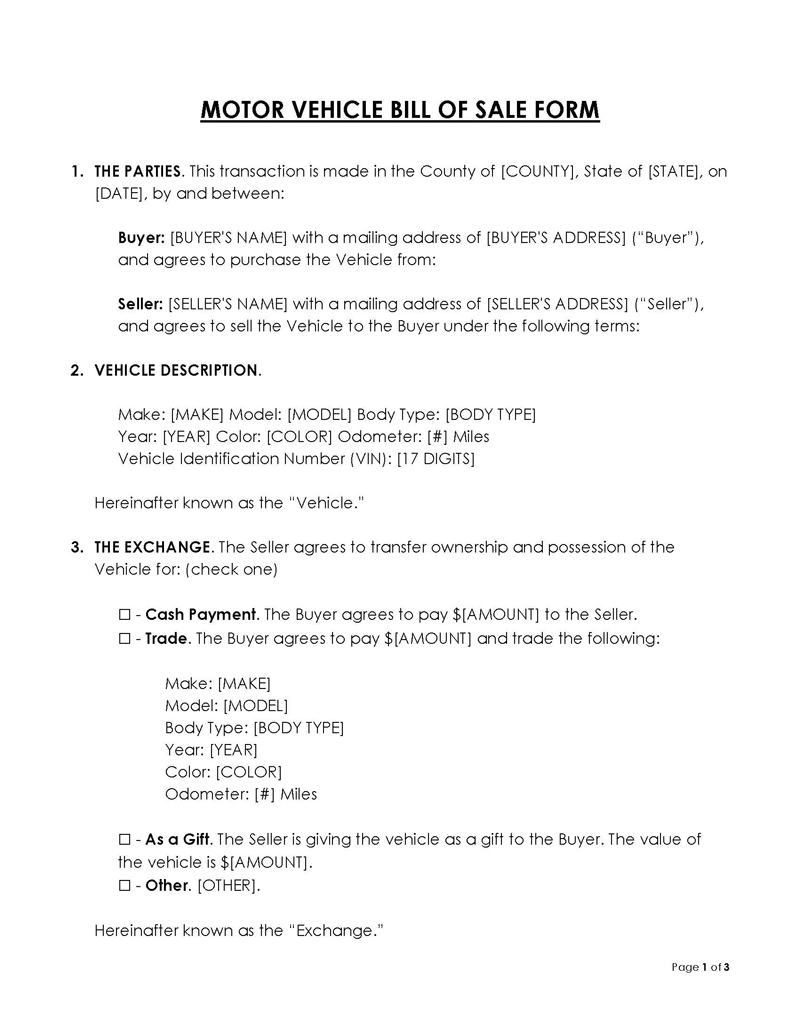

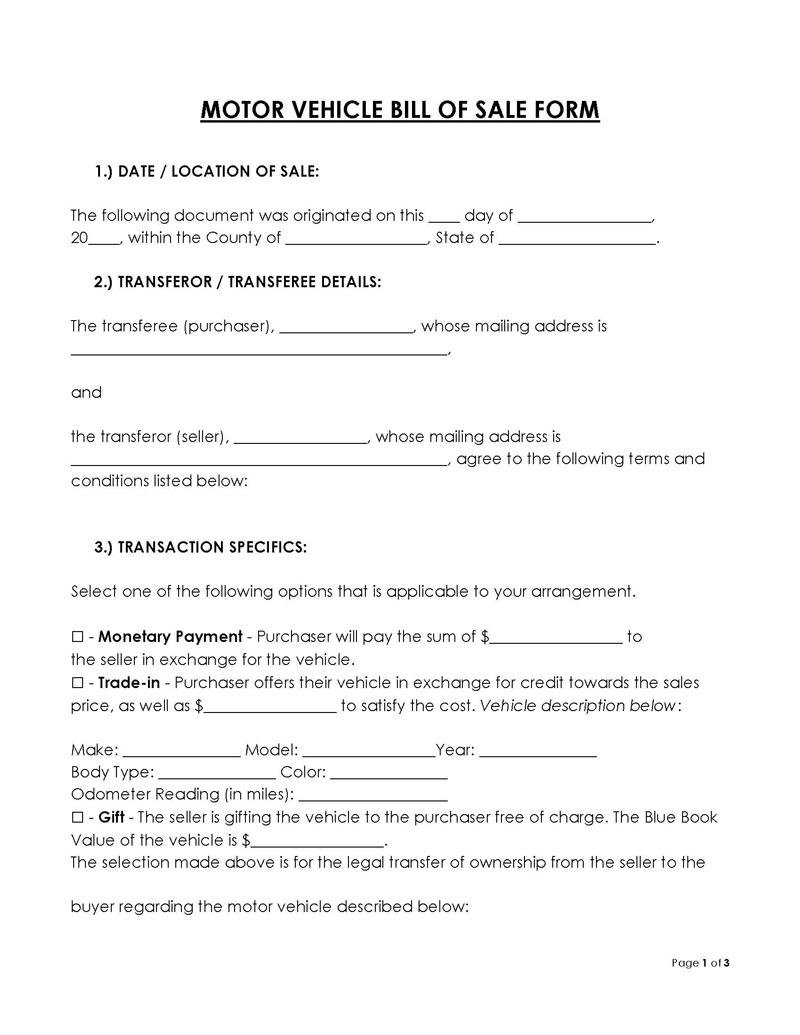

The next step is to fill it up. Download a form suited for the specific vehicle. Even though different states will have state-specific forms, certain elements of the transaction are fundamentally captured in it.

The components of the form will represent different aspects of the transaction. Remember, these documents are governed by state laws, and incomplete forms can be deemed ineffective should the document fail to present crucial information.

The following details should be filled before the buyer and the seller signs the document:

Date of sale

It should be dated. State the date when the document was created, which will often be the date of the transaction. Indicate the day, month, and year precisely.

Location of sale

Next, indicate the region where the transaction was held. Write down the county and state details. The state identifies the applicable jurisdiction of the document.

Details of parties

The details of the involved parties (buyer and seller) should then follow. Each party should provide their name and physical address. This information is necessary for identifying who was involved in the transaction. Each party ought to be clearly identified accordingly, either as the seller or the buyer.

Transaction details

The form should then capture the key details of the transaction. This section should represent how the buyer is expected to compensate the seller, in other words, the terms of sale. The key points to be addressed in this section are cash payments, trade-ins, and gifts applicable to the sale.

If the car will be bought by paying a specified amount to the seller, the form should indicate how much money will be exchanged as the sale price. The purchase price should be stated in the appropriate monetary unit and exact figures.

Trade-ins are another method used in buying and selling vehicles. A trade-in involves the buyer submitting their vehicle in exchange for the seller’s vehicle. In most cases, a trade-in vehicle will not be enough to cover the seller’s asking price; the buyer will therefore be required to make an additional payment to cover the difference. The trade-in vehicle should be described by providing the following information; model, body type, make, year, color, and odometer reading (in miles).

Alternatively, the seller can be transferring possession of the car to the buyer without being compensated. If this is the case, the car bill of sale form should clearly indicate the vehicle was a gift. Additionally, the value of the vehicle should be stated in figures and monetary units.

Vehicle description

After the transaction details, the vehicle in question should be identified through a conclusive description. Ensure the form states the vehicle’s make, model, and body type. The make is defined by the manufacturer’s name, while the model can be found at the back of the car or from the seller’s manual or title.

Other details that can be added as part of the description are the type of car (sedan, van, lorry, etc.), color, odometer reading at the time of sale, and VIN.

Taxes

Next, the form should address how applicable municipal, county, and state taxes will be handled. There are fundamentally two approaches in covering taxes in a vehicle sale; it can be included or be paid as a separate payment by the buyer. The form should made it clear which method was used in the transaction.

Authorization

For it to be valid, it must be signed by the seller and the buyer. Signatures indicate that the party has read and agrees to the stipulations of the BOS. Each party should provide a signature, name, and date of signing. The buyer’s details should appear before the seller’s.

Odometer disclosure statement

It then requires an odometer disclosure statement to be added in order to be complete. The disclosure should identify the seller as the inspector and the odometer reading in miles. The disclosure should then declare the odometer status. There are three scenarios that can define the odometer accuracy or status of a vehicle; the odometer could be reading more than the actual mileage, less than the actual mileage, or the exact mileage traveled by the vehicle. The form should explicitly declare the appropriate status. The buyer should provide their signature, name, and date of signing on the disclosure.

Notary acknowledgment

Lastly, the notary’s public details should be written in the form. It needs to be notarized. The notary public is expected to oversee the signing of the form when an automobile transaction is taking place. The notary public should provide a declaration that they witnessed the form’s signing. Their jurisdiction should also be clearly apparent in the document. An official seal is then provided, and the document now becomes binding.

Collect vehicle documents

Once it is completed, other documents associated with the sale should be presented. These documents will typically have to be submitted by the seller to the buyer.

The basic vehicle documentation to be presented are:

Certificate of title

A certificate of title to a vehicle is an official document that proves the seller’s ownership which should be transferred to the buyer after the transaction. Since a BOS in most states is used to only transfer possession, a certificate of title becomes necessary to close the sale. A certificate of title will contain specific details of the vehicle and the seller and state they have the authority to transfer their right of ownership to third parties.

Registration

Any vehicle meant to operate on public roads needs to be registered with the owner’s state of residence. The seller should therefore provide the buyer with a registration document issued by the state DMV.

Bill of sale

A completed and signed form should be presented. It is not required by law in some states; however, it is recommended to fill it in any vehicle transaction. It will act as a receipt of the sale.

Odometer disclosure statement

A signed odometer disclosure statement should be presented for the transaction to be complete. Note that mileage will, in most cases, influence the valuation and maintenance of a car and hence the significance of the odometer disclosure.

Identity proof

The seller then provides proof of identity to verify that indeed they are who they say they are. Various documents can be used as proof of identity—for example, a state-issued ID, driver’s license, or a passport photo. Match the details on the identification to those in the title and registration. Verifying identity reduces cases of fraud and scams when purchasing vehicles.

Execute the transaction

The next step in using it is to complete the transaction. This step involves signing all the relevant paperwork in order for ownership to be legally transferred to the buyer. In most cases, the seller will bring the vehicle to the location of signing while the buyer brings the money.

Once the buyer presents the agreed-upon amount, the seller submits the keys to the car. Each party receives a copy of the BOS. If any tax obligations are yet to be fulfilled, the payment should be made to the DMV. If the seller is liable for the sales tax, it is recommended that this payment be finalized at the time of sale. If the buyer is responsible for the sales tax, they can make payments at the time of registration.

Vehicle registration

The buyer is normally obligated to finalize the last step of the transaction, which is registering the vehicle at the DMV. They must present the bill of sale, title, proof of car insurance, identification, odometer disclosure statement, emissions test report, and a payment fee. Confirm with the state’s vehicle registration requirements as the requirements will vary from one state to another.

Bill of State Forms and State DMV Locations

Frequently Asked Questions

In some states, it is mandatory, whereas, in other states, it is not a requirement for the sale of a vehicle to be legal. However, it is advised that it should always be used when buying or selling a car regardless of the state’s stipulations as it is a receipt that the transaction took place.

Either party – buyer or seller, can present it during the transaction. More often than not, the seller is expected to provide it; however, there is no limitation prohibiting a buyer from bringing a copy of the same.

Most states will require that both parties sign the form. However, the signing requirements are governed by state laws, and in some states, only the seller is required to sign the document. It is advised that both parties sign it, but it is always wise to consult local state laws.

Depending on the state where the sale is being carried out, it may need to be notarized or not. It is recommended even if the state laws do not require it to be notarized, consider notarizing it as it increases the legality of the document.

Utilizing a bill of sale goes a long way in preventing any disputes after selling a vehicle. Adding as many details as possible is another way of enhancing the effectiveness of the form. Additionally, adding a Certificate of Acknowledgement further enhances the capacity of it to prevent disagreements.

A sales agreement is a contract that outlines pertinent details about the sale or purchase of goods and services. Conversely, it is proof (receipt) of a transaction and bears no contractual obligations to either party involved in the transaction.

Ordinarily, both parties are expected to sign it if the local laws require the document to be signed. This is, however, not the case in all states. Always refer to the state’s laws to determine if signing is required and which party is required to sign.

Preferably, it should be issued to the buyer immediately after collecting payment and at the time of sale. Remember, it is a receipt, and receipts are given after payment has been made.

A promissory note is only used when the buyer does not have the full amount being asked by the seller during the time of the purchase. The buyer thus promises to pay the balance at a later date after the date of sale. The promissory note outlines how this payment should be covered and the period within which it should be fully paid.