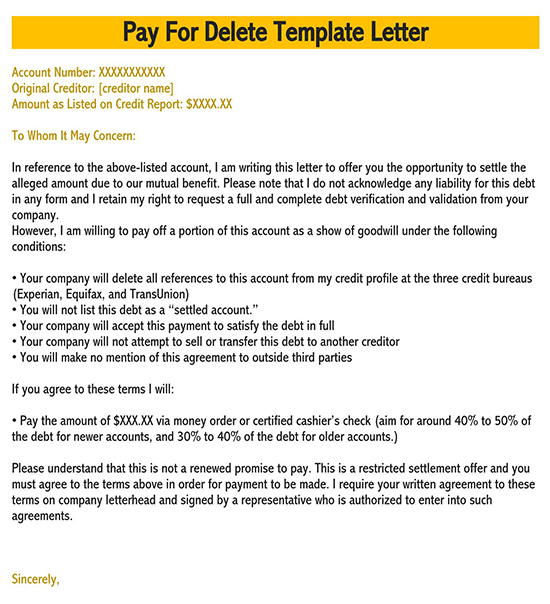

Negative credit information is never encouraging. The information contained therein may jeopardize your chances of ever receiving loans or being trusted by other financial institutions when seeking financial assistance. Luckily, there is a way out of all this. This is the ‘pay for deleting’ avenue.

Under this arrangement, you pay up a specified portion of the debt, usually 40% of the whole amount, after which you draft a letter to that effect. Upon meeting these two preconditions, the agency concerned will normally go ahead and delete the negative records. Our discussion below centers on this letter and how to draft it.

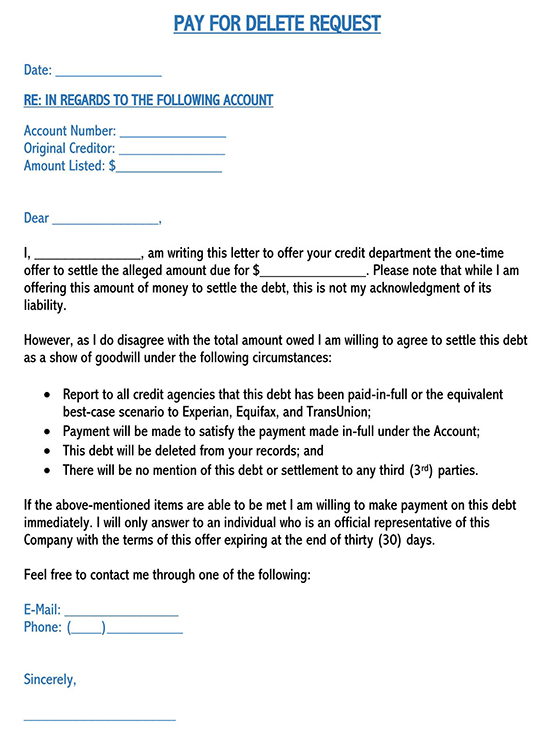

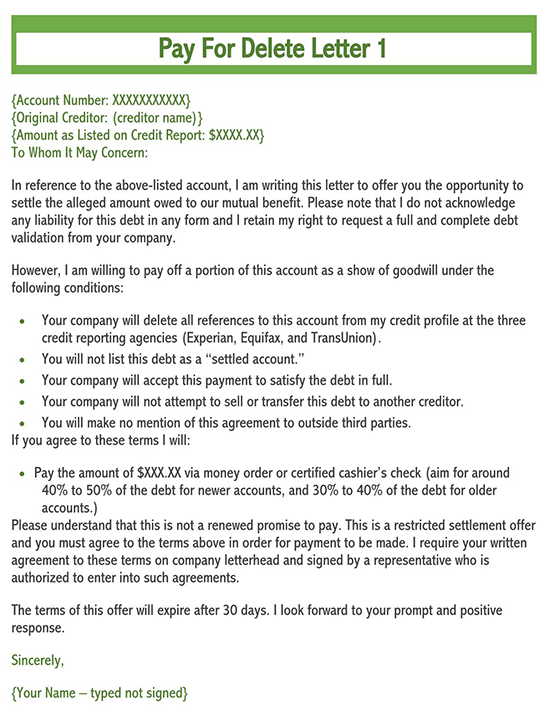

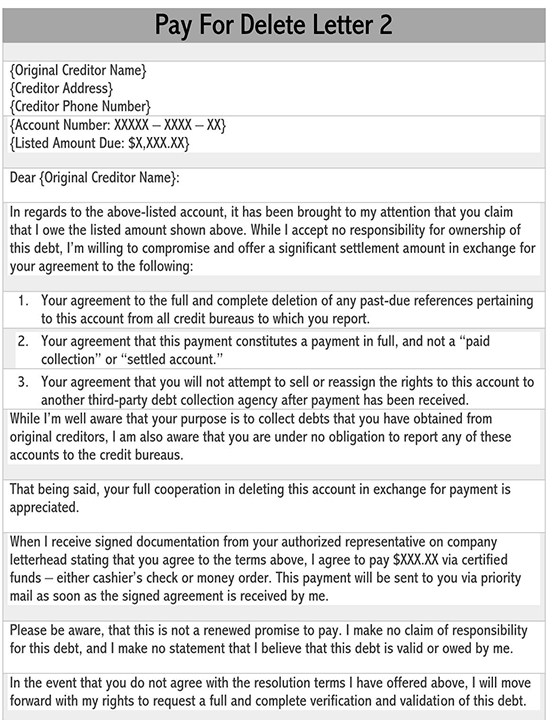

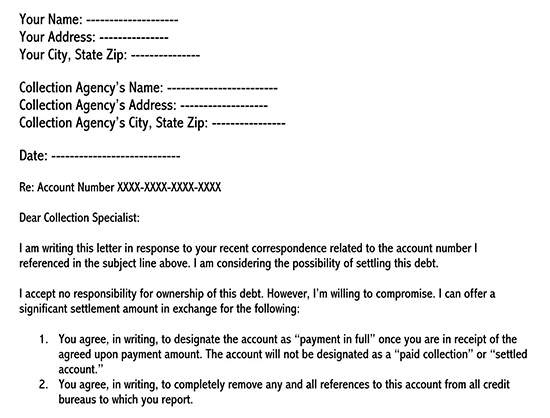

Free Templates

How a “Pay for Delete Letter” Works

It is a communique that you draft and send out to a credit reference bureau either directly or via a debt collection agency. Its purpose is to ask the agency to delete the record of bad debt from your account under the settlement of no less than 40% of that debt.

Under this arrangement, a debtor approaches a debt collection firm and strikes a deal with it. The purpose of the deal is to have derogatory contents or records purged from his account. Typically, it is followed by settling a portion of the debt, during which time this letter is drafted.

A debtor drafts this letter and sends it to the agency concerned. That agency will launch an investigation that typically entails seeking information from the creditors to vouch for the accuracy of the details therein. It proceeds to delete the records after confirming them. All these happen within 30 days.

When a “Pay for Delete Letter” Doesn’t Work, Dispute it

This mode of having your records purged by a debt collection agency does not always work these days. That is due to the existence of credit reference bureaus that are government-owned and mandated to follow up on the records of debtors.

If you draft such a letter but do not receive the necessary outcomes, you have the leeway to dispute the same using the laid down structures or mechanisms. You have the leeway to dispute the provisions of the letter as many times as you wish. Use the laid down structures extensively.

What Should You do if the ‘Pay for Delete Letter’ is Rejected?

It may not always be a given that this letter will be successful. In the unlikely event that it is rejected, you should consider these options:

Draft a method of verification letter

You may consider drafting a ‘method of verification letter.’ This letter asks the agency concerned to verify your own debt. That way, it will shed light on why the agency is reluctant to delete the erroneous content. Also, the agency is obligated by the ‘Fair Credit Reporting Act credit laws’ to purge the record in the event that it is incapable of verifying the debt.

Re-negotiate settlement

Next, you may also try to re-negotiate the debt settlement. This means changing the metrics of the debt portfolio appropriately. These could include altering the repayment period, rate of interest, penalties levied for late payments, and the other terms of reference that govern the repayment exercise altogether.

Change the collateral

All loans are backed and secured using collateral. If the one that is held in lien by the creditor is too expensive, think about changing it to a lesser and more affordable option. That will free it up and let you use the more expensive one for better tasks.

Alter the payment options

You may also think of altering the payment options. These are the avenues via which you repay the debt. Some modes of payment are often too expensive or rigid. In lieu of this, we recommend that you attempt the option that is cheaper and less stressful to undertake.

What Should be Included In the ‘Pay for Delete Letter’?

It has to comprise all the details of the loan or debt instrument concerned.

Below is a breakdown of the vital pieces of information that the letter has to comprise:

Dates

Two dates have to be incorporated in this letter. The first is the date when the debt obligation was entered into. The second, on the other hand, is the date when this letter is drafted. They provide the benchmarks against which any future references are made.

Relevant addresses

This letter has to contain the relevant addresses of the debtor and the creditor. These ideally ought to be the addresses that were used when entering the debt obligation in the first place. They also make it possible for any references to be made with absolute ease.

Account number

Each debt instrument is usually assigned a unique account number that is further used to reference it in any future negotiations. You have to supply this account number, as it is the one that uniquely distinguishes this specific debt instrument from the others.

Turnaround times

The turnaround time is the amount of time that is used to fulfill a request or complete a task. This is the core of the bone of contention of this letter. Be sure to spell it out for all to see clearly. Then accompany this by stating exactly how much time you would want the creditor to give you to complete the payment.

Payment amounts

As part of the necessary negotiations, you may also work on the payment options. Ask the creditor to consider other options that are more flexible and easier to undertake overall. These should work alongside any other key negotiation points.

Tips for Drafting the Letter

To draft a letter of this kind well, you have to adhere to certain tips.

Identified and explained hereunder are some of the top tips you may have to adhere to to do a better job:

Keep the letter concise

Only supply those vital pieces of information that are necessary to drive the point home. Leave out that superfluous information that is not in any way attached to the complaint at hand.

Carry out some background check

Before you even contemplate drafting this letter, you must carry out proper background checks. Be sure to draft this letter if and only if this debt portfolio warrants it. You do not have to draft it if the debt in question is not listed on the credit report.

Keep duplicates

It is always important that you keep a duplicate of the letter for the sake of easier future reference. This letter may be used as the basis for arguing cases in a court of law and dispelling any ambiguities too!

Send the letter via ‘certified mail return receipt requested

When sending out this letter, you should use ‘Certified Mail Return Receipt Requested.’ This avenue is safer and more convenient, as it lets you know whether the letter has indeed reached the recipient. Moreover, it allows for returns to the sender if the targeted recipient does not receive it.

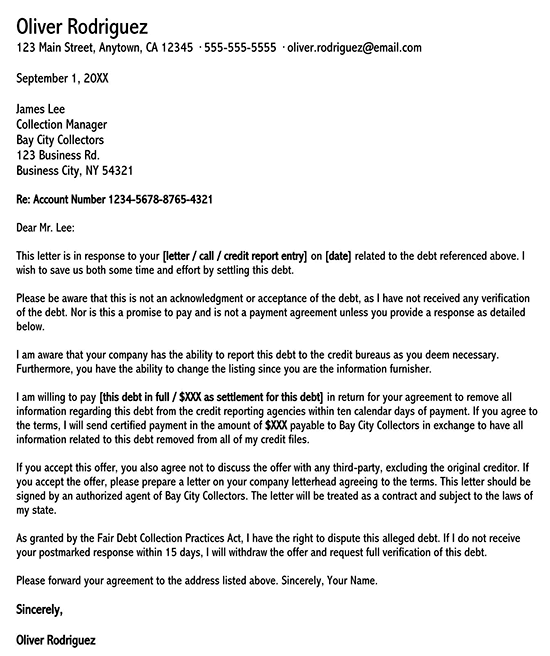

Sample Letters

In the interest of providing practical solutions, a sample pay-for-delete letter is in this section. You can leverage this sample to communicate with creditors and explore options for improving their credit profile.

sample

Re: Settlement Offer for Account Number 987654321

Dear XYZ Collections Department,

I am reaching out regarding the matter of the debt on account number 987654321, which I incurred on March 15, 20XX. I am fully aware of this debt and am eager to resolve it.

After a careful assessment of my current financial condition, I propose a settlement that I believe will be mutually beneficial. This offer involves a pay-for-delete arrangement, wherein I agree to pay a part of the outstanding balance in exchange for the removal of this entry from my credit reports.

I propose a payment of $2,000 as a full and final settlement. This amount represents the maximum I can afford given my financial constraints. Should you accept this offer, I am prepared to make the payment within 30 days of receiving your written confirmation.

In return for this payment, I kindly request that you delete any reporting of this debt from my credit history with all major credit reporting agencies. This action is crucial for me to rebuild my credit score and take a step towards financial stability.

Please understand that this letter is neither an acknowledgment of the legitimacy of the debt nor a commitment to pay outside of this settlement offer. My offer is strictly conditional on receiving a written agreement from your office that confirms the terms, including the removal of all references to this debt from my credit files.

I believe this settlement proposal is fair and advantageous for both parties involved. I kindly request a response to this letter by January 5, 20XX, to confirm acceptance of this offer or to discuss a possible counteroffer.

I appreciate your consideration of this matter and am hopeful for a positive and prompt resolution.

Sincerely,

Stephanie Doris

Key Takeaways

This pay-for-delete letter serves as a useful guide for someone looking to write a similar letter due to several key aspects:

- The letter is clear and concise, stating its purpose right from the beginning. It identifies the account in question and directly addresses the intent of the communication.

- The letter includes specific details such as the account number, the proposed settlement amount, and the turnaround time for payment. This level of detail shows preparedness and seriousness about the offer.

- The writer acknowledges their financial constraints, which helps in setting the context for the settlement offer. This can be important for the creditor to understand the borrower’s situation.

- The conditions for the settlement are laid out, particularly the request for deletion of the debt from credit reports. This specificity is vital to ensure both parties understand what is being agreed upon.

- The letter carefully states that it is neither an acknowledgment of the debt’s legitimacy nor a commitment to pay outside of this settlement. This is a strategic move to protect the writer’s legal position.

- Setting a deadline for a response creates a sense of urgency and prompts a timely reply from the creditor.

- The closing of the letter is polite and expresses hope for a positive resolution, which is good practice in maintaining a positive relationship with the creditor.

For someone in a similar situation, this letter provides a solid template that can be adapted to their specific circumstances.

Frequently Asked Questions

Let’s take a look at some of the frequently asked questions surrounding this topic of discussion now:

Yes, it does! The margin of this increase nonetheless depends on the amount of money you pay to cover some of the debt obligation and your negotiation power. It is imperative, therefore, to negotiate well for the best possible rates and margins.

Yes, it is perfectly legal. Nonetheless, there are some hurdles and limitations that tend to curtail its overall reach and efficacy. Chief among these is the existence of credit reference bureaus that have largely taken over the role of overseeing debts.

The standard duration of time that the process takes is roughly 30 days. It may take longer or shorter, depending mostly on the cooperation between the various parties and the kind of seriousness that the parties treat the entire exercise with.

Conclusion

Deleting a negative report is a very critical thing to do if you want to boost your chances of ever getting loans at a later date. You can never gamble with this procedure hence. Take your time to read the explanations we have delivered above. Best of luck in your subsequent attempt to reverse your negative credit score.